Global Asset Management In Chemical Industry Market

Market Size in USD Billion

CAGR :

%

USD

7.60 Billion

USD

16.41 Billion

2024

2032

USD

7.60 Billion

USD

16.41 Billion

2024

2032

| 2025 –2032 | |

| USD 7.60 Billion | |

| USD 16.41 Billion | |

|

|

|

|

Asset Management in Chemical Industry Market Size

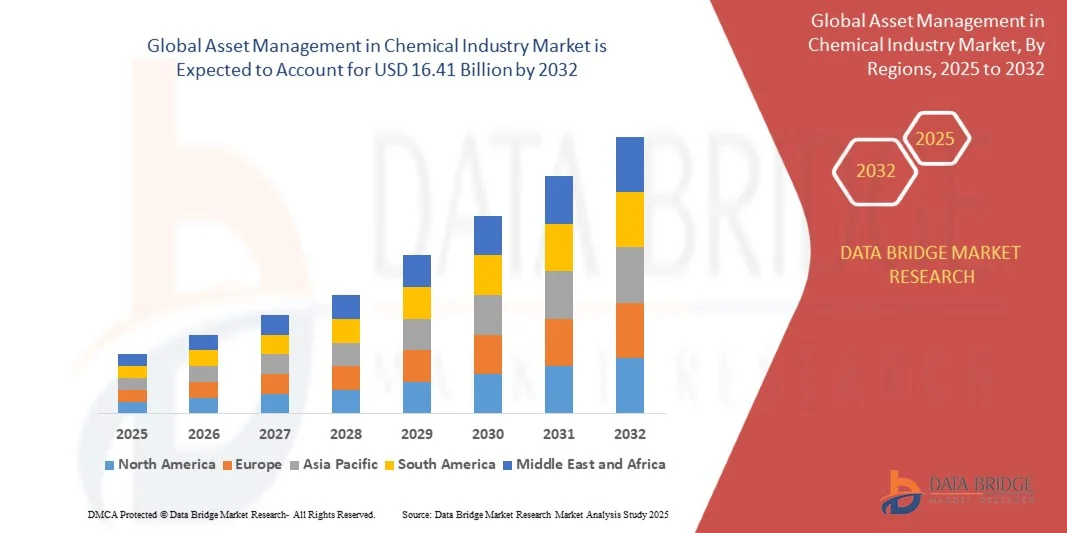

- The global asset management in chemical industry market size was valued at USD 7.6 billion in 2024 and is expected to reach USD 16.41 billion by 2032, at a CAGR of 10.10% during the forecast period

- The market growth is largely fueled by the increasing adoption of digital asset management solutions and advanced analytics within chemical manufacturing, leading to improved operational efficiency, predictive maintenance, and optimized asset utilization across production facilities

- Furthermore, rising demand for real-time monitoring, workflow automation, and regulatory compliance solutions is establishing asset management platforms as essential tools for chemical companies. These converging factors are accelerating the implementation of software and service-based solutions, thereby significantly boosting the industry's growth

Asset Management in Chemical Industry Market Analysis

- Asset management in the chemical industry involves the use of software and service solutions to monitor, maintain, and optimize physical and digital assets across chemical manufacturing plants. These platforms enable predictive maintenance, risk management, compliance reporting, and process optimization, enhancing both operational efficiency and safety

- The escalating demand for asset management solutions is primarily fueled by the increasing complexity of chemical operations, stringent regulatory standards, and the need to reduce unplanned downtime, improve resource utilization, and minimize operational costs. The shift toward digital transformation and Industry 4.0 initiatives is further propelling market adoption

- North America dominated the asset management in chemical industry market with a share of 35.2% in 2024, due to the rapid adoption of digital solutions and advanced analytics in chemical manufacturing

- Asia-Pacific is expected to be the fastest growing region in the asset management in chemical industry market during the forecast period due to rapid industrialization, rising chemical production, and adoption of digital transformation initiatives in countries such as China, Japan, and India

- Solutions segment dominated the market with a market share of 63% in 2024, due to the rising adoption of advanced digital platforms that streamline asset monitoring, predictive maintenance, and equipment performance analysis. Chemical manufacturers increasingly rely on integrated asset management software to minimize downtime, optimize equipment lifecycle, and improve plant safety. The ability of solutions to provide real-time data insights, regulatory compliance support, and integration with existing ERP systems has further strengthened their position as the preferred choice for large-scale chemical operations

Report Scope and Asset Management in Chemical Industry Market Segmentation

|

Attributes |

Asset Management in Chemical Industry Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asset Management in Chemical Industry Market Trends

Growth of Cloud-Based and IoT-Enabled Asset Management

- The asset management market within the chemical industry is rapidly evolving with the integration of cloud computing and IoT technologies that enable real-time monitoring, predictive analytics, and enhanced operational efficiency. These digital solutions provide chemical companies with improved visibility into asset health, enabling proactive maintenance and optimized performance across complex manufacturing environments

- For instance, Honeywell Process Solutions has launched cloud-enabled asset performance management platforms designed for chemical plants to reduce downtime and operation costs. Emerson Electric Co. offers IoT-integrated asset monitoring systems that allow for predictive maintenance and remote asset diagnostics, driving higher reliability and safety standards in chemical production

- Cloud-based asset management allows centralized data consolidation and advanced analytics, empowering managers with actionable insights and better decision-making capabilities. IoT sensors embedded in equipment provide continuous data flows critical for detecting anomalies, optimizing asset utilization, and extending equipment life cycles

- Strategic investments in digital twin technology, AI-driven analytics, and mobile access are shaping new asset management paradigms that prioritize agility and resilience. This digital transformation supports regulatory compliance, sustainability efforts, and cost reduction—key priorities for chemical industry operators

- Collaborations between industrial automation vendors, cloud service providers, and chemical manufacturers are accelerating the adoption of integrated digital asset management systems. This convergence is positioning asset management as a cornerstone of smart chemical manufacturing and Industry 4.0 deployment

- The ongoing growth of cloud and IoT-enabled asset management reflects a broader trend toward digitalization in the chemical industry, offering competitive advantages through enhanced efficiency, risk reduction, and operational intelligence

Asset Management in Chemical Industry Market Dynamics

Driver

Rising Demand for Predictive Maintenance and Efficiency

- Increasing emphasis on predictive maintenance to minimize unplanned downtime and extend equipment life is a primary driver for asset management solutions in the chemical sector. Predictive models use continuous data streams to forecast failures, enabling timely interventions and optimizing maintenance schedules to reduce operational costs

- For instance, BASF implements advanced asset management platforms that leverage sensor data analytics to predict equipment failures and optimize maintenance cycles across its global chemical production facilities. Dow Chemical utilizes predictive maintenance to enhance reliability and process uptime, thereby reducing production losses and safety risks

- Efficiency improvements through real-time asset monitoring and performance benchmarking enable chemical plants to fine-tune operations, improve resource utilization, and reduce energy consumption. These benefits align closely with industry targets for cost containment and sustainability

- The growing complexity of chemical manufacturing assets and increased regulatory focus on operational safety and environmental compliance create strong incentives to adopt predictive and condition-based maintenance strategies supported by modern asset management systems

- Integration of predictive maintenance within broader digital transformation frameworks encourages adoption of IoT, AI, and cloud technologies, positioning asset management as a critical enabler for operational excellence and competitive differentiation

Restraint/Challenge

High Costs and Complexity of Integrating with Legacy Systems

- The integration of advanced asset management technologies with existing legacy infrastructure presents significant challenges related to cost, technical complexity, and organizational readiness. Legacy assets and disparate systems often lack the connectivity standards required for seamless data exchange with modern cloud and IoT platforms

- For instance, many chemical plants, especially older facilities in Europe and North America, struggle to embed IoT sensors into legacy equipment, requiring costly retrofits or partial upgrades. Integration projects frequently involve extensive customization, system testing, and interoperability validation, which increase project timelines and expenses

- High upfront capital expenditure and ongoing operational costs for software licenses, cybersecurity, and specialized staff training add further barriers. Limited internal expertise and resistance to change may delay adoption, impacting the pace of digital asset management transformation

- Complex regulatory and safety standards in chemical manufacturing increase the necessity for rigorous testing and validation of integrated systems, further elevating costs and project risks. Achieving alignment between IT, OT (operational technology), and business units requires concerted effort and strategic planning

- In conclusion, despite the clear operational benefits, the cost and complexity of integrating advanced asset management solutions with legacy systems remain significant restraints. Successful adoption depends on effective change management, phased implementation strategies, and vendor partnerships that support scalable, secure integration in chemical industry environments

Asset Management in Chemical Industry Market Scope

The market is segmented on the basis of component, deployment type, organization size, and application.

• By Component

On the basis of component, the asset management in chemical industry market is segmented into solutions and services. The solutions segment dominated the largest market revenue share of 63% in 2024, driven by the rising adoption of advanced digital platforms that streamline asset monitoring, predictive maintenance, and equipment performance analysis. Chemical manufacturers increasingly rely on integrated asset management software to minimize downtime, optimize equipment lifecycle, and improve plant safety. The ability of solutions to provide real-time data insights, regulatory compliance support, and integration with existing ERP systems has further strengthened their position as the preferred choice for large-scale chemical operations.

The services segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by the increasing demand for consulting, training, and managed services that support chemical companies in implementing and scaling digital asset management platforms. As chemical facilities often face complex challenges in maintaining critical infrastructure, service providers offer expertise in system customization, predictive analytics, and process optimization. The rising shift toward outsourcing non-core operations, coupled with the need for ongoing technical support and system upgrades, will accelerate the demand for services in this market.

• By Deployment Type

On the basis of deployment type, the market is segmented into on-premises, cloud, and hybrid. The on-premises segment held the largest market revenue share in 2024, supported by its strong adoption among large chemical manufacturers seeking greater control, data security, and compliance with industry-specific regulations. On-premises deployment allows companies to maintain sensitive operational data within internal servers, which is critical for organizations with stringent confidentiality requirements. Its ability to provide higher customization and integration with legacy systems makes it a dominant choice in traditional chemical industry settings.

The cloud segment is projected to register the fastest growth rate from 2025 to 2032, driven by the rising trend of digital transformation and cost optimization strategies across the chemical sector. Cloud-based deployment offers chemical companies scalability, real-time collaboration, and flexibility to manage global operations seamlessly. With increasing adoption of IoT-enabled devices and smart sensors in chemical plants, cloud deployment supports predictive analytics and remote monitoring. Its lower upfront investment and ease of integration into modern digital ecosystems make it highly attractive for both SMEs and global chemical enterprises.

• By Organization Size

On the basis of organization size, the market is segmented into large enterprises and SMEs. The large enterprises segment dominated the largest market revenue share in 2024, largely due to the extensive need for managing complex asset portfolios, ensuring compliance, and optimizing large-scale production facilities. Multinational chemical companies often invest heavily in asset management systems to reduce downtime, improve safety compliance, and maximize return on investment across global operations. Their higher budgets and strategic focus on operational efficiency have supported strong adoption rates of advanced solutions.

The SMEs segment is forecasted to experience the fastest growth from 2025 to 2032, driven by growing awareness of digital asset management benefits such as reduced maintenance costs, enhanced resource utilization, and improved regulatory reporting. SMEs in the chemical industry are increasingly adopting cloud-based, affordable, and scalable asset management platforms to remain competitive against larger players. The rising availability of subscription-based services and cost-effective software tailored to mid-sized companies is making digital adoption more feasible, fueling rapid growth in this segment.

• By Application

On the basis of application, the market is segmented into portfolio management, compliance, risk management, client statements and reporting, trade order management, workflow automation, benchmarking, cash flow, and accounting. The compliance segment dominated the largest market revenue share in 2024, driven by stringent regulatory frameworks governing chemical production, safety, and environmental sustainability. Asset management solutions play a critical role in enabling chemical companies to meet international safety standards, maintain audit trails, and ensure adherence to government policies. With rising emphasis on ESG (environmental, social, and governance) reporting, compliance-driven asset management remains a top priority for large and mid-scale chemical manufacturers.

The workflow automation segment is expected to record the fastest growth rate from 2025 to 2032, propelled by the industry’s shift toward digitalization and Industry 4.0 adoption. Automated asset management workflows streamline repetitive tasks, enhance maintenance scheduling, and reduce operational inefficiencies in chemical plants. The increasing use of AI, IoT, and machine learning tools in predictive asset monitoring is further accelerating the adoption of automation. As chemical companies seek to boost productivity, lower labor costs, and reduce human error, workflow automation is emerging as a critical growth driver for asset management platforms.

Asset Management in Chemical Industry Market Regional Analysis

- North America dominated the asset management in chemical industry market with the largest revenue share of 35.2% in 2024, driven by the rapid adoption of digital solutions and advanced analytics in chemical manufacturing

- Companies in the region are increasingly investing in asset monitoring, predictive maintenance, and workflow optimization to improve operational efficiency and regulatory compliance

- The widespread adoption is further supported by high technological maturity, robust industrial infrastructure, and a growing focus on sustainability initiatives. The U.S., in particular, leads the market due to significant investments in automation and cloud-based solutions, enabling chemical firms to enhance real-time decision-making and streamline operations

U.S. Asset Management in Chemical Industry Market Insight

The U.S. market captured the largest revenue share in North America in 2024, fueled by increasing integration of digital asset management platforms with ERP systems and IoT-enabled devices. Chemical companies are prioritizing solutions that improve predictive maintenance, reduce downtime, and ensure regulatory compliance. The rising focus on operational efficiency, cost optimization, and risk mitigation is driving adoption across large enterprises and SMEs. In addition, the availability of advanced cloud and on-premises solutions, alongside professional services support, is further propelling market growth in the U.S.

Europe Asset Management in Chemical Industry Market Insight

The Europe market is projected to expand at a substantial CAGR during the forecast period, driven by stringent regulatory requirements, growing emphasis on process safety, and the increasing need for digital transformation in chemical manufacturing. Countries such as Germany, France, and the U.K. are witnessing strong adoption due to industrial modernization and rising awareness of asset lifecycle management benefits. European chemical firms are leveraging asset management solutions to enhance operational efficiency, compliance reporting, and cost-effectiveness across production plants.

U.K. Asset Management in Chemical Industry Market Insight

The U.K. market is expected to grow at a noteworthy CAGR, fueled by the rising adoption of cloud-based solutions, growing focus on compliance, and digitalization of chemical manufacturing operations. Businesses are investing in software and service-based solutions to optimize asset utilization, automate workflows, and ensure adherence to safety standards. In addition, the strong presence of SMEs alongside large enterprises adopting technology-driven asset management is encouraging market expansion.

Germany Asset Management in Chemical Industry Market Insight

The Germany market is projected to expand at a considerable CAGR, driven by increasing awareness of digital asset management benefits and rising demand for predictive maintenance, risk mitigation, and operational efficiency. Germany’s well-developed chemical industry, emphasis on sustainability, and focus on innovation are promoting adoption. Companies are integrating solutions with existing infrastructure to monitor assets, reduce downtime, and enhance regulatory compliance across production and distribution networks.

Asia-Pacific Asset Management in Chemical Industry Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid industrialization, rising chemical production, and adoption of digital transformation initiatives in countries such as China, Japan, and India. The region’s growing focus on operational efficiency, predictive maintenance, and cost reduction is propelling asset management solution adoption. Government initiatives supporting Industry 4.0, coupled with increasing investments in IoT, cloud, and automation technologies, are further accelerating market growth.

Japan Asset Management in Chemical Industry Market Insight

The Japan market is witnessing steady growth due to the country’s advanced industrial infrastructure, focus on high-tech manufacturing, and demand for asset optimization and regulatory compliance solutions. Japanese chemical companies are adopting digital platforms for real-time monitoring, predictive maintenance, and workflow automation. The integration of asset management solutions with IoT and smart factory initiatives is driving operational efficiency and supporting sustainable manufacturing practices.

China Asset Management in Chemical Industry Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid industrial expansion, technological adoption, and the government’s push for smart factories and digitalization in chemical manufacturing. Chemical firms are increasingly investing in software and service solutions to monitor assets, improve efficiency, and ensure compliance with safety and environmental standards. The presence of strong domestic solution providers, coupled with affordable and scalable platforms, is further propelling market growth across both large enterprises and SMEs.

Asset Management in Chemical Industry Market Share

The asset management in chemical industry industry is primarily led by well-established companies, including:

- FIS (U.S.)

- Broadridge Financial Solutions, Inc. (U.S.)

- SimCorp A/S (Denmark)

- CreditPoint Software (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- softTarget (U.K.)

- FundCount (U.S.)

- eFront (France)

- Scalable (Germany)

- Micro Focus (U.K.)

- Ivanti (U.S.)

- Snow Software (Sweden)

- Flexera (U.S.)

- Certero (U.K.)

- Broadcom (U.S.)

- Symantec Corporation (U.S.)

- Aspera Technologies Inc. (U.S.)

- IBM Corporation (U.S.)

- Microsoft (U.S.)

- ServiceNow (U.S.)

- Cherwell Software, LLC (U.S.)

Latest Developments in Asset Management in Chemical Industry Market

- In September 2025, Dow Inc. sold an additional 9% equity stake in Diamond Infrastructure Solutions to Macquarie Asset Management for $540 million, increasing Macquarie's total ownership to 49%. This strategic move brings Dow's total proceeds from the venture to approximately $3 billion. The partnership aims to enhance operational efficiencies and expand customer acquisition across U.S. Gulf Coast infrastructure assets, aligning with Dow's strategy to refocus on core business operations by divesting from non-core assets

- In June 2024, Hexagon introduced HxGN APM, an advanced asset performance management solution developed through the acquisition of Itus Digital in April 2024. HxGN APM integrates with Hexagon's HxGN EAM platform to optimize asset reliability, improve uptime, and reduce maintenance costs. This launch enhances Hexagon's capabilities in delivering comprehensive asset lifecycle intelligence solutions to the chemical industry

- In November 2024, Shrieve Chemical Company acquired Connection Chemical, a full-service distributor of industrial chemicals and fine ingredients based in Newtown, Pennsylvania. This acquisition expands Shrieve's product offerings and customer base, enhancing its position in the chemical distribution market. The move aims to strengthen Shrieve's capabilities in delivering value-added chemical solutions to clients across various industries

- In May 2024, Accenture announced the acquisition of Partners in Performance, a global strategy consulting firm specializing in performance improvement for asset-intensive industries. The acquisition added approximately 400 professionals to Accenture Strategy. This move strengthens Accenture's ability to support clients in the chemical sector with enhanced productivity, cost reduction, and energy transition initiatives

- In March 2024, Siemens launched its new Xcelerator Asset Management Suite for the chemical industry, offering real-time monitoring, predictive maintenance, and workflow automation across plant operations. This solution enables chemical manufacturers to reduce unplanned downtime, optimize asset utilization, and improve compliance with safety and environmental regulations, supporting the industry's shift toward digital transformation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Asset Management In Chemical Industry Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Asset Management In Chemical Industry Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Asset Management In Chemical Industry Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.