Global At Home Cervical Cancer Screening Devices Market

Market Size in USD Million

CAGR :

%

USD

297.00 Million

USD

1,373.76 Million

2024

2032

USD

297.00 Million

USD

1,373.76 Million

2024

2032

| 2025 –2032 | |

| USD 297.00 Million | |

| USD 1,373.76 Million | |

|

|

|

|

At-Home Cervical Cancer Screening Devices Market Size

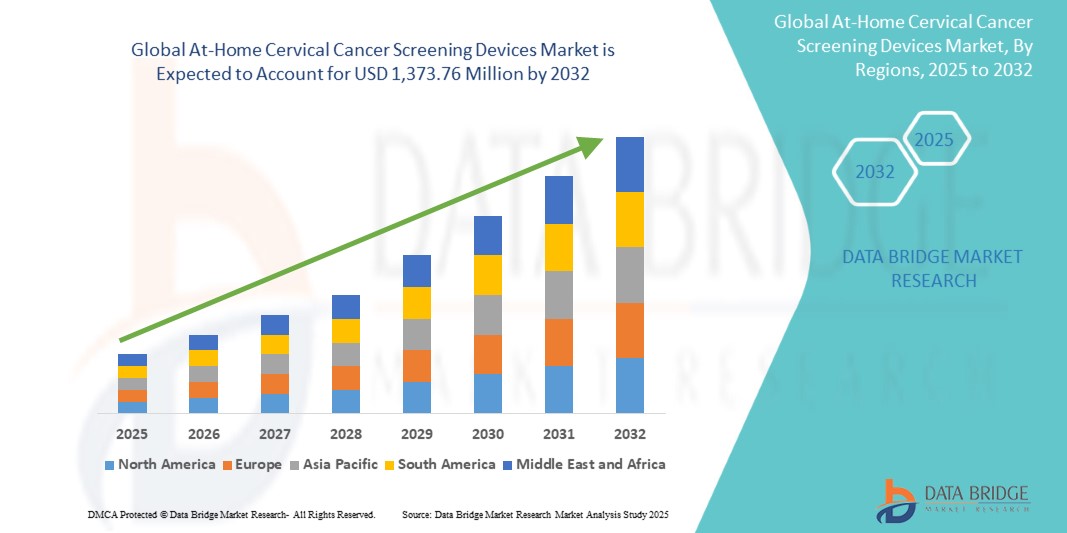

- The global At-home cervical cancer screening devices market size was valued at USD 297.0 million in 2024 and is expected to reach USD 1,373.76 million by 2032, at a CAGR of 21.10% during the forecast period

- The market growth is largely fueled by the increasing awareness of cervical cancer and the need for early detection, which has driven demand for convenient and reliable at-home testing solutions

- Furthermore, technological advancements in self-sampling kits, molecular diagnostics, and integration with telehealth platforms are enabling users to collect samples safely and accurately from home

At-Home Cervical Cancer Screening Devices Market Analysis

- At-Home Cervical Cancer Screening Devices, offering convenient and privacy-focused options for early cervical cancer detection, are increasingly vital components of women’s healthcare, enabling safe and accurate screening from home

- The escalating demand for At-Home Cervical Cancer Screening Devices is primarily fueled by growing awareness of women’s health, rising prevalence of cervical disorders, and a preference for convenient, private, and timely screening solutions

- North America dominated the at-home cervical cancer screening devices market with the largest revenue share of 42.5% in 2024, characterized by advanced healthcare infrastructure, high awareness of preventive healthcare, and a strong presence of key market players, with the U.S. experiencing substantial growth in at-home screening adoption, particularly in urban and suburban populations, driven by technological innovations and supportive healthcare policies

- Asia-Pacific is expected to be the fastest-growing region in the at-home cervical cancer screening devices market during the forecast period, registering a CAGR of 12.3%, due to increasing urbanization, rising disposable incomes, expanding healthcare access, and growing awareness of early cervical cancer detection in countries such as China and India

- The 25–65 years segment dominated the at-home cervical cancer screening devices market with the largest market revenue share of 82.6% in 2024, as this age group falls within the globally recognized high-risk category for cervical cancer. Most national and international cervical cancer screening programs focus on women within this range, ensuring widespread adoption

Report Scope and At-Home Cervical Cancer Screening Devices Market Segmentation

|

Attributes |

At-Home Cervical Cancer Screening Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

At-Home Cervical Cancer Screening Devices Market Trends

Enhanced Convenience Through Digital Health Platforms and Remote Monitoring

- A significant and accelerating trend in the global at-home cervical cancer screening devices market is the integration of advanced digital health platforms and remote monitoring technologies. These solutions enhance user convenience by providing clear instructions, real-time guidance, and automated result reporting, allowing users to complete screening tests accurately at home

- For instance, certain at-home cervical cancer screening kits now come with companion mobile applications that guide users step-by-step through sample collection, provide reminders for testing schedules, and deliver results securely via encrypted channels

- Integration with telehealth services enables users to consult healthcare professionals remotely if test results indicate abnormalities, improving timely medical intervention and follow-up care

- The development of automated sample processing and digital analysis platforms is improving test accuracy and reducing the risk of human error, making at-home testing more reliable and clinically acceptable

- This trend toward user-friendly, connected, and digitally supported screening devices is reshaping expectations for preventive healthcare, particularly in women’s health

- Consequently, companies are investing in intuitive interfaces, mobile connectivity, and data security features to increase adoption rates and enhance patient engagement

- The growing emphasis on patient autonomy, privacy, and accessibility is driving the demand for at-home cervical cancer screening solutions in both urban and remote populations

At-Home Cervical Cancer Screening Devices Market Dynamics

Driver

Growing Need Due to Rising Awareness and Accessibility of At-Home Screening

- The increasing prevalence of cervical disorders and rising awareness of women’s health issues, coupled with the demand for convenient and private healthcare solutions, is a significant driver for the heightened adoption of At-Home Cervical Cancer Screening Devices

- For instance, a 2024 U.K. study found that 69% of women would prefer at-home self-sampling for cervical cancer screening if given the option, citing greater privacy and convenience compared to clinic visits. This highlights how growing awareness of women’s health and the need for discreet solutions drive adoption of at-home screening devices

- As consumers become more aware of the importance of early detection, At-Home Cervical Cancer Screening Devices provide reliable and easy-to-use options, enabling timely identification of HPV and other cervical abnormalities. These devices reduce the need for frequent clinical visits, making screening more convenient and accessible

- Furthermore, the growing focus on preventive healthcare and the desire for private, comfortable screening options are making At-Home Cervical Cancer Screening Devices increasingly popular. Integration with telehealth services and mobile applications allows users to receive guidance, track results, and consult healthcare professionals remotely

- The convenience of self-sampling, affordability compared to regular hospital visits, and the ability to monitor personal health at home are key factors propelling the adoption of At-Home Cervical Cancer Screening Devices in both developed and emerging markets. The trend towards consumer-driven healthcare and expanding product availability further contributes to market growth

Restraint/Challenge

Concerns Regarding Accuracy and Initial Costs

- Concerns surrounding the accuracy of self-sampling kits and initial costs of advanced At-Home Cervical Cancer Screening Devices pose a challenge to broader market penetration. Some consumers may hesitate to adopt at-home testing due to doubts about reliability compared to clinical testing

- Reports highlighting improper sample collection or delayed results have occasionally made consumers cautious about fully relying on at-home screening solutions

- Addressing these concerns through improved kit design, clear instructions, regulatory approvals, and robust laboratory support is crucial for building consumer confidence. Companies are focusing on enhancing device accuracy, providing comprehensive guidance, and offering teleconsultation services to reassure users

- In addition, the relatively high price of premium kits, including advanced molecular tests or integrated digital tracking, can be a barrier to adoption for price-sensitive consumers, particularly in developing regions or among first-time users. Basic kits are becoming more affordable, but advanced options still carry a higher cost

- While prices are gradually decreasing and insurance coverage is expanding, the perceived premium for reliable and validated at-home tests can still limit widespread adoption

- Overcoming these challenges through product innovation, consumer education on proper usage, and the development of cost-effective yet accurate At-Home Cervical Cancer Screening Devices will be vital for sustained market growth

At-Home Cervical Cancer Screening Devices Market Scope

The market is segmented on the basis of test type, age group, and technology.

• By Test Type

On the basis of test type, the at-home cervical cancer screening devices market is segmented into self-administered HPV tests and Pap smear alternatives. The self-administered HPV tests segment dominated the largest market revenue share of 68.5% in 2024, primarily due to their superior sensitivity and ability to detect high-risk HPV strains that are strongly linked to cervical cancer. Their widespread adoption across developed and emerging regions is supported by growing awareness campaigns and recommendations from organizations like the WHO. Self-administered kits offer unmatched convenience and privacy, making them highly suitable for women reluctant to visit clinics. In addition, the cost-effectiveness of these kits compared to traditional screening methods has encouraged adoption in low- and middle-income countries. Collaborations between diagnostic firms, NGOs, and governments are further expanding availability and affordability. Increasing digital health integration for test result reporting and follow-up consultations is also strengthening their dominance globally.

The Pap smear alternatives segment is anticipated to witness the fastest CAGR of 14.8% from 2025 to 2032, fueled by the need for more comfortable and non-invasive testing solutions. Unlike traditional Pap smears, these alternatives rely on simpler sample collection and advanced biomarker detection technologies, making them more user-friendly. Rising demand among women who prefer less invasive options is a major growth driver. Telemedicine platforms are increasingly incorporating these solutions, offering users direct access to testing and consultation. In addition, these methods are gaining acceptance in regions with limited healthcare infrastructure as they reduce dependency on clinical setups. Growing research validating their accuracy and reliability is further encouraging adoption. Continuous product innovations by startups and established firms are expected to boost market penetration, especially in younger and tech-savvy populations.

• By Age Group

On the basis of age group, the at-home cervical cancer screening devices market is segmented into 25–65 years and under 25 years. The 25–65 years segment accounted for the largest market revenue share of 82.6% in 2024, as this age group falls within the globally recognized high-risk category for cervical cancer. Most national and international cervical cancer screening programs focus on women within this range, ensuring widespread adoption. Rising incidence of HPV infections in this demographic has increased the urgency for regular and accessible screening. At-home screening kits are particularly valued for providing a convenient option for working women and those living in remote areas. Growing trust in the clinical accuracy of at-home tests has improved compliance rates compared to traditional clinic-based screenings. Partnerships between healthcare providers and governments have expanded distribution channels, ensuring better reach. Digital health apps are also playing a key role in guiding this age group through the screening process and follow-up care. Overall, strong public health emphasis and user acceptance cement the dominance of this segment.

The under 25 years segment is projected to witness the fastest CAGR of 13.9% from 2025 to 2032, driven by heightened awareness of HPV and cervical cancer risks among younger women. Educational initiatives in schools, universities, and through social media are encouraging early screening adoption. This younger demographic is highly receptive to digital-first healthcare solutions, making app-connected and telemedicine-integrated kits particularly attractive. Advances in non-invasive collection devices are reducing barriers to testing, making it more acceptable for first-time users. Rising cultural emphasis on preventive healthcare is also contributing to growth in this age group. Startups and innovators are increasingly targeting younger women with campaigns focused on empowerment, privacy, and proactive health monitoring. Expanding healthcare access through e-commerce platforms further boosts adoption. Over time, the early introduction of testing habits in this demographic is expected to create a long-term positive impact on overall screening compliance.

• By Technology

On the basis of technology, the at-home cervical cancer screening devices market is segmented into dry swab collection devices and tampon-like collection devices. The dry swab collection devices segment held the largest revenue share of 61.4% in 2024, largely because of their simplicity, affordability, and compatibility with laboratory analysis. These devices are widely distributed in public health initiatives, especially in low- and middle-income countries where access to clinical screening is limited. Their minimal training requirements and ease of use make them a preferred option for large-scale deployment. The ability to collect accurate HPV samples reliably has led to strong clinical acceptance. NGOs and governments often favor dry swabs due to their scalability and cost-effectiveness in national screening programs. Growing awareness campaigns highlighting their reliability and convenience have improved adoption among women across different socioeconomic groups. In addition, partnerships with telehealth platforms enable quick follow-ups, further enhancing their utility and dominance in the market.

The tampon-like collection devices segment is expected to register the fastest CAGR of 15.2% from 2025 to 2032, supported by innovations in comfort and sample accuracy. These devices offer a more discreet and familiar method of collection, which resonates with women seeking privacy and ease of use. Clinical studies have shown improved sample quality for HPV DNA detection, which enhances diagnostic confidence. Growing investment by device manufacturers in refining design and functionality is accelerating commercialization. Consumer feedback has also highlighted higher satisfaction compared to traditional swabs, driving demand. Successful pilot projects in Europe and North America have demonstrated strong acceptance and potential scalability. In addition, these devices are increasingly promoted through e-commerce and digital health campaigns, broadening access. The combination of technological advancement, comfort, and clinical validation is expected to solidify their rapid growth trajectory in the coming years.

At-Home Cervical Cancer Screening Devices Market Regional Analysis

- North America dominated the at-home cervical cancer screening devices market with the largest revenue share of 42.5% in 2024

- Characterized by advanced healthcare infrastructure, high awareness of preventive healthcare, and a strong presence of key market players

- While experiencing substantial growth in at-home screening adoption, particularly in urban and suburban populations, driven by technological innovations and supportive healthcare policies

U.S. At-Home Cervical Cancer Screening Devices Market Insight

The U.S. at-home cervical cancer screening devices market captured the largest revenue share in 2024 within North America, fueled by widespread awareness campaigns, rising prevalence of HPV-related disorders, and growing preference for private, convenient at-home screening options. Increasing collaborations between healthcare providers and digital health platforms are also propelling adoption, alongside favorable reimbursement frameworks and strong consumer trust in FDA-approved screening solutions.

Europe At-Home Cervical Cancer Screening Devices Market Insight

The Europe at-home cervical cancer screening devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by government-led cancer prevention initiatives, increasing emphasis on women’s health, and rising acceptance of self-sampling kits. European healthcare systems are increasingly integrating at-home screening with centralized laboratories, enabling early detection and reducing hospital burdens. The region is also witnessing growth in both public health programs and private sector innovations.

U.K. At-Home Cervical Cancer Screening Devices Market Insight

The U.K. At- at-home cervical cancer screening devices market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by strong NHS-led awareness campaigns, growing consumer comfort with self-testing, and rising demand for accessible early detection solutions. The country’s emphasis on preventive healthcare and expansion of digital health services is expected to further stimulate adoption across both rural and urban populations.

Germany At-Home Cervical Cancer Screening Devices Market Insight

The Germany at-home cervical cancer screening devices market is expected to expand at a considerable CAGR during the forecast period, driven by a strong focus on preventive diagnostics, technological innovation, and sustainability in healthcare. Germany’s advanced laboratory network and emphasis on accuracy and reliability support greater trust in at-home kits. Increasing partnerships between medical device companies and research institutions are fostering innovation, further accelerating adoption.

Asia-Pacific At-Home Cervical Cancer Screening Devices Market Insight

The Asia-Pacific at-home cervical cancer screening devices market is poised to grow at the fastest CAGR of 12.3% from 2025 to 2032, driven by rising urbanization, improving healthcare access, and growing awareness of early cervical cancer detection. Countries such as China and India are experiencing strong demand due to large at-risk populations, government health initiatives, and the rising affordability of self-sampling kits. Increasing investments by local manufacturers are also making these devices more accessible across diverse income groups.

Japan At-Home Cervical Cancer Screening Devices Market Insight

The Japan at-home cervical cancer screening devices market is gaining momentum due to the country’s strong public health infrastructure, high technological adoption, and emphasis on early detection. Growing consumer preference for discreet and reliable at-home solutions, supported by partnerships with telehealth providers, is fueling market growth. Japan’s aging population and government focus on reducing cancer mortality rates further strengthen the adoption of self-screening devices.

China At-Home Cervical Cancer Screening Devices Market Insight

The China at-home cervical cancer screening devices market accounted for the largest revenue share in Asia-Pacific in 2024, supported by rapid urbanization, an expanding middle class, and rising healthcare awareness. The country is witnessing widespread adoption of affordable at-home screening kits due to strong domestic production and government programs encouraging early cancer detection. Digital health integration and rising online sales channels are also propelling growth, making China a central hub for regional market expansion.

At-Home Cervical Cancer Screening Devices Market Share

The at-home cervical cancer screening devices industry is primarily led by well-established companies, including:

- Teal Health, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Georgia Institute of Technology (U.S.)

- BD (U.S.)

- QIAGEN (Germany)

- Hologic, Inc. (U.S.)

- MobileODT (Israel)

- NURX Inc. (U.S.)

- PrivaPath Diagnostics (U.S.)

- Everlywell (U.S.)

Latest Developments in At-Home Cervical Cancer Screening Devices Market

- In April 2023, the World Health Organization (WHO) published updated guidance endorsing HPV self-sampling as an effective option to expand cervical cancer screening coverage, noting that self-collected vaginal samples can be used for HPV DNA testing and recommending self-sampling as a route to reach WHO’s 70% screening coverage target by 2030; the guidance strengthened the policy case for at-home/self-collection programmes worldwide

- In May 2024, Roche announced U.S. Food and Drug Administration (FDA) approval of its HPV self-collection solution for use with Roche’s cobas HPV test, marking one of the first regulatory clearances enabling self-collection pathways (sample mailed/processed by lab) in the U.S. and accelerating access to at-home/self-sampling screening options

- In August 2024, Becton, Dickinson and Company (BD) saw expanded regulatory recognition for its Onclarity HPV assay (and related approvals) that supported use of self-collected vaginal samples in health-care settings, reinforcing lab workflows and test validation needed to scale self-sampling programs and enabling broader implementation of at-home sample collection models routed through clinical labs

- In May 2025, Teal Health announced FDA approval of the Teal Wand, the first FDA-cleared at-home vaginal self-collection device specifically marketed for at-home cervical cancer screening; the clearance (and immediate rollout in California) represents a milestone enabling prescription-based home sample collection and lab testing for high-risk HPV as a direct consumer option

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.