Global At Home Gel Nail Kits Market

Market Size in USD Million

CAGR :

%

USD

758.67 Million

USD

1,265.06 Million

2024

2032

USD

758.67 Million

USD

1,265.06 Million

2024

2032

| 2025 –2032 | |

| USD 758.67 Million | |

| USD 1,265.06 Million | |

|

|

|

|

At–Home Gel Nail Kits Market Size

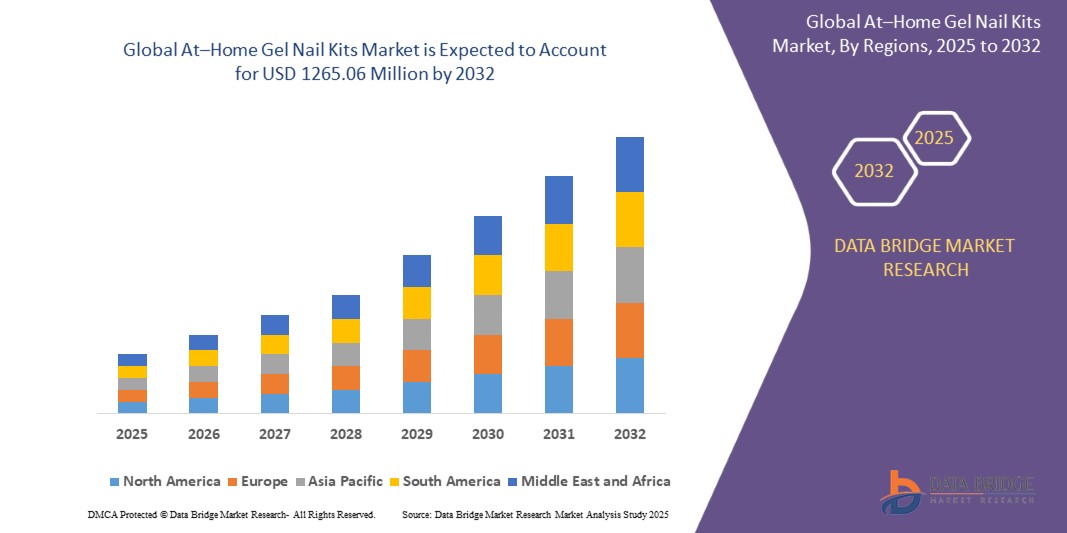

- The global at–home gel nail kits market size was valued at USD 758.67 million in 2024 and is expected to reach USD 1265.06 million by 2032, at a CAGR of 6.6% during the forecast period

- The market growth is largely fueled by the rising popularity of DIY beauty care solutions and the increasing influence of social media trends, which have positioned at-home gel nail kits as a cost-effective alternative to professional salons. Growing consumer preference for convenience, coupled with expanding product availability through online retail, is propelling demand across global markets

- Furthermore, the increasing adoption of starter kits by beginners and the premiumization of gel nail polish kits with long-lasting formulations are expanding consumer bases across different income groups. These converging factors are accelerating the uptake of at-home gel nail kits, thereby significantly boosting the industry’s growth

At–Home Gel Nail Kits Market Analysis

- At-home gel nail kits are beauty products that enable users to perform salon-quality manicures at home, typically including gel polishes, UV/LED lamps, base and top coats, and nail care tools. They cater to consumers seeking affordability, convenience, and personalization while reducing dependence on professional salons

- The escalating demand for these kits is primarily fueled by rising disposable incomes, the growing culture of self-care and DIY grooming, and consumer interest in safe, easy-to-use, and long-lasting nail care solutions. Expanding product innovation and distribution through both online and offline channels are further reinforcing the steady growth of this market

- North America dominated at–home gel nail kits market with a share of 37.5% in 2024, due to the strong preference for DIY beauty solutions and the rising popularity of at-home self-care routines

- Asia-Pacific is expected to be the fastest growing region in the at–home gel nail kits market during the forecast period due to rapid urbanization, increasing disposable incomes, and a rising trend of fashion-conscious consumers

- Gel nail polish kits segment dominated the market with a market share of 42% in 2024, due to their strong consumer preference for salon-such as results at home and the convenience of achieving long-lasting manicures without recurring salon visits. Their affordability compared to professional services and the wide availability of shades and finishes further boosted their adoption among women seeking customization and style. The segment also benefits from social media trends and influencer promotions, which significantly enhance product visibility and consumer engagement. In addition, the easy application process and compatibility with compact UV/LED lamps make gel nail polish kits a practical choice for both beginners and regular users, reinforcing their market leadership

Report Scope and At–Home Gel Nail Kits Market Segmentation

|

Attributes |

At–Home Gel Nail Kits Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

At–Home Gel Nail Kits Market Trends

Rising Social Media Influence on DIY Nail Care

- The at–home gel nail kits market is rapidly expanding as influencers on TikTok, Instagram, and YouTube popularize DIY nail care routines. Social media plays a defining role in creating demand for creative designs and self-care trends

- For instance, Sally Hansen has leveraged influencer campaigns showcasing at–home gel nail kits that deliver salon-such as finishes. These campaigns boosted product visibility across digital platforms and strengthened consumer adoption among beauty-conscious millennials and Gen Z users

- The endorsement of DIY beauty routines during and after the pandemic reinforced consumer preference for home-based nail care. Increased availability of tutorials and product reviews empowers users to achieve professional results without salon visits

- In addition, the rise of personalization in nail art is fueling demand. Consumers increasingly experiment with colors, glitters, and seasonal themes using at–home kits, enhancing creativity and driving new product launches across beauty categories

- Subscription boxes and e-commerce platforms are offering curated gel nail kits, expanding accessibility. Bundled kits with UV lamps, gels, and accessories provide value-driven solutions, encouraging repeat sales and boosting engagement with young beauty enthusiasts

- Technology advancements such as LED curing lamps with faster dry times and long-lasting gels are reshaping customer expectations. This innovation-driven product development delivers higher convenience, quality assurance, and improved user satisfaction in the DIY nail space

At–Home Gel Nail Kits Market Dynamics

Driver

Growing Demand for Affordable Salon-Quality at Home

- Consumers are increasingly choosing at-home gel nail kits as cost-effective alternatives to expensive salon visits. These kits provide durability, shine, and professional results, contributing to disruptive growth across the personal care and beauty accessories market

- For instance, SensatioNail has expanded its range of at-home gel nail kits that deliver high-quality finishes. By offering affordable packaged solutions, the company caters to consumers seeking salon-level experiences at lower recurring costs

- Affordability is a key driver for students, young professionals, and budget-conscious households. These consumers view DIY gel kits as practical solutions that save money and reduce frequency of professional salon appointments over time

- In addition, growing product availability across mass-market retailers, beauty stores, and e-commerce channels is driving accessibility. Attractive bundle pricing and seasonal discounts make gel nail kits appealing for first-time users and repeat customers alike

- Time savings further support adoption since at-home kits allow users to achieve manicures at their convenience. This flexibility has become increasingly important as busy lifestyles demand convenient beauty care solutions paired with professional outcomes

Restraint/Challenge

Counterfeit Products Affecting Trust

- Counterfeit gel nail kits are a serious challenge in the market. Poor-quality replicas lead to damaged nails, skin reactions, and reduced durability, undermining consumer trust and negatively impacting the credibility of established beauty brands

- For instance, OPI has addressed counterfeiting concerns by strengthening product authentication measures and educating consumers about authorized purchase channels. The company emphasized risks associated with low-quality fakes, helping reinforce consumer confidence in original professional kits

- E-commerce marketplaces often struggle with counterfeit listings, making it harder to control authenticity. Consumers encountering unsafe or ineffective fake products may hesitate to repurchase at-home gel kits despite growing popularity of DIY nail care

- In addition, counterfeit products intensify price competition pressures. By undercutting branded offerings with cheaper alternatives, they erode pricing power of genuine brands, affecting revenues and creating uneven competitive landscapes in the nail care ecosystem

- Overcoming this challenge requires transparent supply chains, tamper-proof packaging, QR-based authentication, and consumer awareness campaigns. Trust restoration strategies are critical to sustaining long-term adoption while driving consistent demand in a globally expanding DIY nail category

At–Home Gel Nail Kits Market Scope

The market is segmented on the basis of product type, price range, end user, and distribution channel.

• By Product Type

On the basis of product type, the at-home gel nail kits market is segmented into gel nail polish kits, nail art kits, starter kits, and professional kits. The gel nail polish kits segment dominated the largest market revenue share of 42% in 2024, driven by their strong consumer preference for salon-such as results at home and the convenience of achieving long-lasting manicures without recurring salon visits. Their affordability compared to professional services and the wide availability of shades and finishes further boosted their adoption among women seeking customization and style. The segment also benefits from social media trends and influencer promotions, which significantly enhance product visibility and consumer engagement. In addition, the easy application process and compatibility with compact UV/LED lamps make gel nail polish kits a practical choice for both beginners and regular users, reinforcing their market leadership.

The starter kits segment is expected to witness the fastest growth rate from 2025 to 2032, as these kits cater to beginners and first-time users entering the at-home nail care space. Starter kits typically include UV/LED lamps, base coats, top coats, and a small range of gel polishes, providing an all-in-one solution. Their affordability compared to professional kits and their appeal to new users looking for a convenient entry into gel nail applications make them highly attractive. The growing culture of DIY beauty care and the trend of learning nail art through online tutorials are further boosting the demand for starter kits in both developed and emerging markets.

• By Price Range

On the basis of price range, the at-home gel nail kits market is segmented into premium kits, mid-range kits, and budget-friendly kits. The premium kits segment held the largest market share in 2024, supported by strong demand from consumers willing to invest in high-quality tools and long-lasting formulations. These kits often include advanced UV/LED lamps, multiple polish shades, and durable nail care accessories, making them highly valued for professional-such as results. Premium buyers are typically motivated by performance, durability, and brand reputation, driving steady sales in this category.

The budget-friendly kits segment is anticipated to grow at the fastest pace from 2025 to 2032, driven by rising demand among price-sensitive consumers, particularly in emerging economies. Affordable kits allow wider accessibility, appealing to students, young professionals, and casual users experimenting with at-home nail care. The increasing presence of affordable options on e-commerce platforms, coupled with frequent promotional offers and discounts, further boosts sales. The availability of easy-to-use, compact kits at competitive prices also aligns with the growing DIY trend in beauty care, encouraging adoption among first-time users.

• By End User

On the basis of end user, the at-home gel nail kits market is segmented into women, teens and young adults, and men. The women segment dominated the market revenue share in 2024, as women continue to represent the largest consumer base for nail care products. High frequency of use, coupled with the rising influence of fashion and beauty trends, drives consistent demand. The preference for salon-quality results without the high recurring costs of professional services further strengthens women’s reliance on at-home kits.

The teens and young adults segment is projected to grow at the fastest rate from 2025 to 2032, driven by their growing inclination toward self-expression through creative nail art. Social media platforms such as Instagram, TikTok, and YouTube play a central role in popularizing DIY nail styling among this demographic. Their strong engagement with beauty influencers and willingness to experiment with new trends are fueling rapid adoption of gel nail kits. Affordability and the appeal of customizing nail designs at home also resonate well with this segment, driving its accelerated growth trajectory.

• By Distribution Channel

On the basis of distribution channel, the at-home gel nail kits market is segmented into online and offline. The online segment dominated the market share in 2024, supported by the growing penetration of e-commerce and the convenience of browsing a wide variety of brands and price ranges. Online retail platforms offer detailed product descriptions, customer reviews, and video tutorials, which assist buyers in making informed purchasing decisions. Discounts, subscription services, and exclusive online bundles also contribute to higher consumer engagement in this segment.

The offline segment is expected to register the fastest growth from 2025 to 2032, particularly through specialty beauty stores, supermarkets, and pharmacies. Many consumers still prefer offline purchases for the tactile experience of evaluating product quality and shades before buying. Offline channels also enable impulse buying, driven by attractive in-store displays and promotions. Expansion of beauty retail chains and the rising popularity of pop-up stores and exclusive brand outlets further support growth in this segment during the forecast period.

At–Home Gel Nail Kits Market Regional Analysis

- North America dominated the at–home gel nail kits market with the largest revenue share of 37.5% in 2024, driven by the strong preference for DIY beauty solutions and the rising popularity of at-home self-care routines

- Consumers in the region are highly influenced by social media trends and beauty influencers, which continuously boost awareness and adoption of gel nail kits. This demand is further supported by higher disposable incomes, a mature beauty and personal care industry, and the convenience of accessing a wide variety of premium kits through e-commerce platforms

- The region’s growing inclination toward affordable, salon-quality results at home firmly establishes it as the leading market for at-home gel nail kits

U.S. At–Home Gel Nail Kits Market Insight

The U.S. at-home gel nail kits market captured the largest revenue share in 2024 within North America, fueled by a strong culture of DIY beauty care and the rising influence of beauty influencers. Consumers increasingly prefer at-home gel nail kits as a cost-effective alternative to professional salons, especially with the convenience of online tutorials and subscription-based product offerings. The rapid expansion of e-commerce channels, coupled with frequent promotional campaigns, is further boosting adoption. In addition, the demand for personalized beauty experiences and the integration of innovative starter kits tailored for beginners are propelling steady market growth in the U.S.

Europe At–Home Gel Nail Kits Market Insight

The Europe at-home gel nail kits market is projected to expand at a substantial CAGR throughout the forecast period, supported by the rising popularity of DIY nail art and the growing trend of at-home beauty routines. Increasing urbanization, a strong culture of personal grooming, and high awareness of global beauty trends are driving demand for gel nail kits across the region. Consumers are also drawn to the affordability and convenience of achieving salon-quality results at home. The expansion of specialty beauty stores and online platforms offering diverse kit options is further fostering growth in both Western and Eastern Europe.

U.K. At–Home Gel Nail Kits Market Insight

The U.K. at-home gel nail kits market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the growing preference for self-care routines and heightened awareness of affordable beauty solutions. Concerns regarding high salon costs are encouraging consumers to switch to DIY gel nail kits. The strong penetration of online beauty retail and the increasing popularity of influencer-driven marketing are also boosting demand. Moreover, the country’s fashion-forward culture and emphasis on style and personalization are expected to sustain market momentum.

Germany At–Home Gel Nail Kits Market Insight

The Germany at-home gel nail kits market is expected to expand at a considerable CAGR during the forecast period, fueled by a strong inclination toward high-quality, durable beauty solutions. German consumers emphasize product safety, long wear time, and eco-friendly formulations, which are increasingly being incorporated into premium gel nail kits. The growing availability of professional-grade kits in retail outlets and online stores, coupled with the rise of DIY beauty tutorials, is encouraging adoption. This preference for reliable, performance-oriented kits aligns with local consumer expectations and supports market growth in Germany.

Asia-Pacific At–Home Gel Nail Kits Market Insight

The Asia-Pacific at-home gel nail kits market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rapid urbanization, increasing disposable incomes, and a rising trend of fashion-conscious consumers. Countries such as China, Japan, and India are witnessing strong demand, with social media platforms and beauty influencers playing a central role in spreading awareness. Government support for digitalization and the widespread presence of e-commerce channels are making at-home gel nail kits more affordable and accessible. The region’s strong manufacturing base also enhances product availability at competitive prices, strengthening adoption across both premium and budget-friendly segments.

Japan At–Home Gel Nail Kits Market Insight

The Japan at-home gel nail kits market is gaining momentum due to the country’s strong beauty culture, advanced technology adoption, and preference for convenience. Japanese consumers are drawn to premium-quality kits that emphasize precision, durability, and aesthetic appeal. The popularity of DIY beauty routines among younger consumers, combined with a demand for easy-to-use starter kits, is propelling growth. In addition, Japan’s aging population is driving demand for simplified, user-friendly kits that allow older consumers to maintain personal grooming at home.

China At–Home Gel Nail Kits Market Insight

The China at-home gel nail kits market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the expanding middle class, rapid urbanization, and high adoption of beauty products among young consumers. China’s strong e-commerce ecosystem, supported by platforms such as Tmall and JD.com, is fueling widespread accessibility of at-home gel nail kits. Domestic manufacturers are increasingly offering affordable yet innovative kits, further stimulating adoption. The growing emphasis on fashion trends, influencer-led marketing, and the rising culture of personalized grooming solutions are key factors propelling market expansion in China.

At–Home Gel Nail Kits Market Share

The at–home gel nail kits industry is primarily led by well-established companies, including:

- Coty, Inc. (U.S.)

- Revlon Consumer Products Corporation (U.S.)

- OPI Products Inc. (U.S.)

- CND (Creative Nail Design, Inc.) (U.S.)

- Orly International, Inc. (U.S)

- OPALLAC PTY LTD (Australia)

- Alessandro International GmbH (Germany)

- Sally Hansen (U.S.)

- Le Mini Macaron (France)

- Mylee (U.K.)

Latest Developments in Global At–Home Gel Nail Kits Market

- In 2024, Coty Inc. collaborated with Lena Gercke to integrate her fashion brand LeGer into the beauty segment, aiming to merge fashion and personal care innovation. This collaboration is expected to strengthen Coty’s positioning in the European beauty market by appealing to young, style-conscious consumers and expanding its reach into Germany, where LeGer has established a strong following. The partnership enhances Coty’s brand image by blending fashion-driven creativity with beauty products, creating new growth opportunities in the at-home gel nail kits space

- In January 2024, KISS Products Inc., a manufacturer and distributor of professional nail and lash products, launched the Salon X-tend LED Soft Gel System. This product introduces a cost-effective and long-lasting solution for achieving salon-quality gel nails at home. The launch is expected to boost KISS’s market competitiveness by catering to consumers seeking affordable alternatives to salon treatments, while also driving wider adoption of DIY gel nail kits through innovative product design and accessibility

- In October 2023, Modelones introduced its Vegan Gel Nail Kit Collection, highlighting sustainability and cruelty-free formulations. The launch aligns with increasing consumer demand for eco-conscious beauty solutions and is expected to strengthen the brand’s market share among environmentally aware consumers. This development reflects the growing shift in the market toward clean beauty and adds differentiation in a competitive landscape

- In August 2023, Beetles Gel Polish expanded its product portfolio by launching a multifunctional starter kit designed for beginners. The kit includes LED lamps, base and top coats, and a curated selection of polishes to simplify the DIY process. This move supports the rising trend of first-time users entering the market and reinforces Beetles’ reputation as an accessible and consumer-friendly brand

- In May 2023, OPI, a leading nail care brand under Wella Company, announced its partnership with Amazon to expand direct-to-consumer sales of gel nail kits. The collaboration enhances OPI’s online distribution network, leveraging Amazon’s vast e-commerce reach to improve product accessibility. This initiative accelerates OPI’s global visibility and also strengthens the role of e-commerce in driving growth for at-home gel nail kits

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.