Global Atherectomy And Intravascular Lithotripsy Ivl Devices Market

Market Size in USD Million

CAGR :

%

USD

900.76 Million

USD

1,434.60 Million

2024

2032

USD

900.76 Million

USD

1,434.60 Million

2024

2032

| 2025 –2032 | |

| USD 900.76 Million | |

| USD 1,434.60 Million | |

|

|

|

|

Atherectomy and Intravascular Lithotripsy (IVL) Devices Market Size

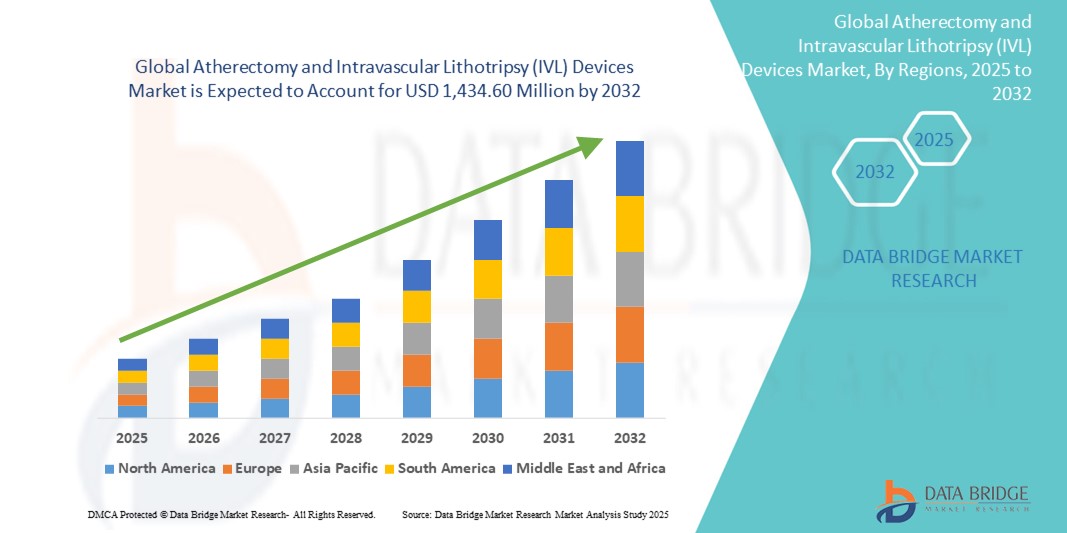

- The global atherectomy and intravascular lithotripsy (IVL) devices market size was valued at USD 900.76 million in 2024 and is expected to reach USD 1,434.60 million by 2032, at a CAGR of 5.99% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress in minimally invasive vascular procedures, particularly driven by the need for safer and more effective treatment of complex arterial calcifications. As the global burden of peripheral and coronary artery diseases increases, healthcare providers are increasingly turning to advanced atherectomy and IVL devices that allow for precise plaque modification and improved stent deployment outcomes

- Furthermore, rising demand for patient-centric, catheter-based solutions that offer reduced procedure times, lower complication risks, and quicker recovery is accelerating the uptake of atherectomy and intravascular lithotripsy (IVL) devices. These converging factors—especially the aging population, higher prevalence of diabetes and obesity, and expanding reimbursement coverage—are significantly boosting the industry's growth across both hospital and outpatient settings

Atherectomy and Intravascular Lithotripsy (IVL) Devices Market Analysis

- Atherectomy and intravascular lithotripsy (IVL) Devices are increasingly vital in modern vascular and endovascular procedures due to their minimally invasive approach to treating calcified arterial blockages. These devices are essential for improving luminal gain, vessel compliance, and preparing calcified plaques for optimal stent placement or drug delivery

- The escalating demand for atherectomy and IVL devices is primarily driven by the rising global prevalence of peripheral artery disease (PAD), coronary artery disease (CAD), and the growing aging population with comorbidities such as diabetes and hypertension that increase the risk of arterial calcification

- North America dominated the atherectomy and intravascular lithotripsy (IVL) devices market with the largest revenue share of 41.6% in 2024, attributed to the high burden of cardiovascular diseases, favorable reimbursement policies, strong presence of leading medical device companies, and rapid adoption of advanced vascular intervention technologies across the U.S. and Canada

- Asia-Pacific is expected to be the fastest growing region in the atherectomy and intravascular lithotripsy (IVL) devices market during the forecast period (2025–2032), owing to increasing healthcare expenditure, improving access to cardiovascular care, and rising incidence of PAD and CAD across aging populations in countries such as China, India, and Japan

- The atherectomy devices segment dominated the atherectomy and intravascular lithotripsy (IVL) devices market, with a revenue share of 58.6% in 2024, attributed to their widespread use in treating peripheral and coronary artery diseases involving plaque and calcification. Their versatility across various lesion morphologies and compatibility with existing interventional tools have boosted adoption among interventional cardiologists and vascular surgeons

Report Scope and Atherectomy and Intravascular Lithotripsy (IVL) Devices Market Segmentation

|

Attributes |

Atherectomy and Intravascular Lithotripsy (IVL) Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Atherectomy and Intravascular Lithotripsy (IVL) Devices Market Trends

“Growing Demand Driven by Procedural Precision and Minimally Invasive Interventions”

- A significant and accelerating trend in the global atherectomy and intravascular lithotripsy (IVL) devices market is the increasing demand for precision-guided, minimally invasive vascular interventions aimed at treating complex calcified arterial lesions

- For instance, Shockwave Medical Inc. has expanded its intravascular lithotripsy technology portfolio to treat severe arterial calcification in both coronary and peripheral arteries. The company’s IVL catheter systems utilize sonic pressure waves to fracture calcium deposits with minimal trauma to surrounding soft tissue, a key benefit for patients with fragile vasculature or comorbidities

- The rise of image-guided atherectomy systems, such as those offered by Boston Scientific and Cardiovascular Systems Inc., supports procedural safety and improved clinical outcomes. These systems are becoming increasingly favored for complex cases, including in-stent restenosis and long chronic total occlusions (CTOs)

- Atherectomy systems now offer greater lesion modification capabilities with a lower risk of vessel dissection or perforation compared to traditional balloon angioplasty, making them the preferred choice in PAD and CAD cases with significant calcification

- Technological advancements, including the integration of real-time feedback, improved catheter designs, and physician-friendly console interfaces, are boosting adoption across both hospitals and outpatient settings

- The demand for Atherectomy and IVL devices is growing rapidly across North America, Europe, and Asia-Pacific, as interventional cardiologists and vascular surgeons increasingly prioritize tools that reduce procedural complexity while enhancing patient outcomes. The trend toward outpatient-based interventions and value-based care further fuels the market’s expansion

Atherectomy and Intravascular Lithotripsy (IVL) Devices Market Dynamics

Driver

“Rising Prevalence of Vascular Diseases and Demand for Minimally Invasive Procedures”

- The increasing global burden of peripheral artery disease (PAD) and coronary artery disease (CAD), especially among the aging population, is significantly driving the demand for atherectomy and IVL devices. These devices play a critical role in treating calcified lesions and arterial blockages that cannot be addressed by conventional angioplasty or stenting alone

- For instance, according to the World Health Organization (WHO), cardiovascular diseases are the leading cause of death globally, accounting for nearly 17.9 million deaths annually. This escalating prevalence is boosting the adoption of advanced interventional solutions such as IVL and atherectomy systems

- Atherectomy and IVL offer a minimally invasive alternative to traditional surgical approaches, allowing for faster recovery times, reduced hospital stays, and fewer complications, which is appealing to both physicians and patients

- Moreover, advancements in device technology—such as the introduction of laser and orbital atherectomy systems and new-generation IVL catheters—are increasing procedural success rates and expanding usage across diverse patient populations

- Growing awareness among healthcare professionals and expanding reimbursement coverage for PAD treatment in regions such as North America and Europe further stimulate market expansion. These innovations are also being increasingly adopted in outpatient and ambulatory settings, broadening their clinical reach

Restraint/Challenge

“High Device Costs and Limited Access in Developing Regions”

- One of the primary restraints facing the atherectomy and intravascular lithotripsy (IVL) devices market is the high cost associated with these technologies. Both capital and procedural costs—especially for advanced systems such as IVL catheters—can be prohibitive for smaller healthcare settings and budget-constrained institutions

- In developing countries, the lack of access to specialized vascular intervention facilities, coupled with limited healthcare funding and reimbursement limitations, further restricts adoption

- In addition, these procedures often require trained interventional specialists and catheterization labs with fluoroscopic capabilities, which may not be readily available in rural or under-resourced healthcare systems

- While manufacturers are investing in R&D to lower production costs and expand affordability, widespread adoption in emerging markets remains a challenge

- Overcoming this barrier will depend on greater physician training, inclusion in public health policies, and partnerships with local governments and health providers to ensure accessibility and affordability in underserved areas

Atherectomy and Intravascular Lithotripsy (IVL) Devices Market Scope

The market is segmented on the basis of device type, end user, and distribution channel.

- By Device Type

On the basis of device type, the atherectomy and intravascular lithotripsy (IVL) devices market is segmented into atherectomy devices and intravascular lithotripsy (IVL) devices. The atherectomy devices segment dominated the largest market revenue share of 58.6% in 2024, attributed to their widespread use in treating peripheral and coronary artery diseases involving plaque and calcification. Their versatility across various lesion morphologies and compatibility with existing interventional tools have boosted adoption among interventional cardiologists and vascular surgeons.

The intravascular lithotripsy (IVL) devices segment is expected to witness the fastest CAGR of 10.9% from 2025 to 2032, driven by the rising demand for minimally invasive techniques to manage heavily calcified lesions with improved safety and outcomes, especially among elderly and comorbid patients.

- By End User

On the basis of end user, the atherectomy and intravascular lithotripsy (IVL) devices market is segmented into hospitals, specialty clinics, ambulatory surgical centers, and others. The hospitals segment accounted for the largest market revenue share of 48.3% in 2024, due to the availability of advanced interventional infrastructure, skilled personnel, and reimbursement support for vascular procedures. Hospitals remain the primary setting for complex cardiovascular interventions, including those requiring IVL and atherectomy devices.

The ambulatory surgical centers (ASCs) segment is projected to grow at the fastest CAGR of 11.4% from 2025 to 2032, fueled by the shift toward outpatient procedures and the rising preference for cost-effective care settings. ASCs offer quicker turnaround, reduced hospitalization time, and growing insurance coverage for vascular interventions.

- By Distribution Channel

On the basis of distribution channel, the atherectomy and intravascular lithotripsy (IVL) devices market is segmented into direct tenders, retail sales, and others. The direct tenders segment held the largest market revenue share of 61.2% in 2024, driven by bulk purchasing by large hospital chains and government-run healthcare institutions. Long-term procurement contracts and favorable pricing structures offered by manufacturers further support this channel’s dominance.

The retail sales segment is anticipated to register the fastest growth during the forecast period due to the expansion of online B2B platforms, increasing presence of third-party distributors, and ease of access for smaller clinics and standalone ASCs.

Atherectomy and Intravascular Lithotripsy (IVL) Devices Market Regional Analysis

- North America dominated the atherectomy and intravascular lithotripsy (IVL) devices market with the largest revenue share of 41.6% in 2024, driven by the rising prevalence of peripheral and coronary artery diseases, a strong presence of key medical device companies, and advanced healthcare infrastructure

- The region’s growing elderly population, favorable reimbursement policies, and increasing adoption of minimally invasive procedures further contribute to market expansion

- Moreover, continuous technological advancements and the availability of skilled interventional cardiologists are bolstering the demand for atherectomy and IVL procedures in the region

U.S. Atherectomy and Intravascular Lithotripsy (IVL) Devices Market Insight

The U.S. atherectomy and intravascular lithotripsy (IVL) devices market captured the largest revenue share of 61% within North America in 2024, owing to early adoption of novel vascular interventions, strong investment in R&D, and the widespread use of catheter-based procedures. Supportive regulatory approvals from the FDA and rising incidences of PAD among the aging population are pushing the adoption of atherectomy and IVL devices. Additionally, the rise in outpatient cardiovascular procedures is fueling demand in ambulatory surgical centers across the country.

Europe Atherectomy and Intravascular Lithotripsy (IVL) Devices Market Insight

The Europe atherectomy and intravascular lithotripsy (IVL) devices market is projected to expand at a substantial CAGR throughout the forecast period, fueled by rising healthcare spending, an aging demographic, and increasing rates of atherosclerosis. Germany, the U.K., and France are key contributors, with their robust healthcare systems and growing emphasis on minimally invasive vascular treatments. The increasing adoption of IVL devices due to their lower risk profile is also supporting market growth.

U.K. Atherectomy and Intravascular Lithotripsy (IVL) Devices Market Insight

The U.K. atherectomy and intravascular lithotripsy (IVL) devices market is expected to grow at a noteworthy CAGR throughout the forecast period, driven by increased awareness of PAD, improved diagnostic capabilities, and the National Health Service (NHS) encouraging minimally invasive procedures. The demand for IVL is rising due to its effectiveness in managing calcified lesions, especially in high-risk patients where conventional angioplasty is insufficient.

Germany Atherectomy and Intravascular Lithotripsy (IVL) Devices Market Insight

The Germany atherectomy and intravascular lithotripsy (IVL) devices market is set to expand at a significant pace throughout the forecast period, due to its strong emphasis on innovation and precision medical technology. With an increase in cardiovascular disease prevalence and aging population, German hospitals are adopting advanced devices such as orbital atherectomy and IVL systems. The country’s focus on data-driven and value-based healthcare is also facilitating faster integration of these technologies into clinical practice.

Asia-Pacific Atherectomy and Intravascular Lithotripsy (IVL) Devices Market Insight

The Asia-Pacific atherectomy and intravascular lithotripsy (IVL) devices market is projected to grow at the fastest CAGR of 24% from 2025 to 2032, propelled by rapidly growing populations, increased healthcare access, and higher investments in modern medical infrastructure. Countries such as China, India, and Japan are witnessing a surge in PAD and diabetes cases, driving the need for effective vascular interventions. Government-backed initiatives for improving cardiovascular care and local manufacturing of cost-effective devices are expected to further accelerate market growth.

Japan Atherectomy and Intravascular Lithotripsy (IVL) Devices Market Insight

The Japan atherectomy and intravascular lithotripsy (IVL) devices market is advancing steadily, driven by its technologically mature healthcare system, rising elderly population, and preference for precision-based, less invasive therapies. Japanese interventional cardiologists are increasingly using IVL for complex lesions due to its favorable safety profile. Ongoing innovation and collaborations between global and local manufacturers are also enhancing market penetration.

China Atherectomy and Intravascular Lithotripsy (IVL) Devices Market Insight

The China atherectomy and intravascular lithotripsy (IVL) devices market held the largest share in the Asia-Pacific region in 2024, attributed to a large patient pool, expanding urbanization, and strong domestic production capabilities. With government efforts toward improving cardiovascular health and the rise of smart hospitals, the use of advanced interventional tools such as atherectomy and IVL is growing rapidly. Affordability, growing awareness, and public-private partnerships in healthcare infrastructure are key drivers behind China’s market dominance.

Atherectomy and Intravascular Lithotripsy (IVL) Devices Market Share

The atherectomy and intravascular lithotripsy (IVL) devices industry is primarily led by well-established companies, including:

- Straub Medical AG (Switzerland)

- Biotronik (Germany)

- C.R. Bard, Inc. (U.S.)

- Avinger (U.S.)

- Medtronic (Ireland)

- Koninklijke Philips N.V. (Netherlands)

- Boston Scientific Corporation (U.S.)

- Cardiovascular Systems (U.S.)

- EDAP TMS (France)

- Olympus Corporation (Japan)

- Dornier MedTech (Germany)

- BD (U.S.)

- Storz Medical AG (Germany)

- DirexGroup (Germany)

- Elmed Medical Systems (Turkey)

- Siemens Healthineers AG (Germany)

Latest Developments in Global Atherectomy and Intravascular Lithotripsy (IVL) Devices Market

- In May 2025, Shockwave Medical, a Johnson & Johnson MedTech company, presented late-breaking clinical results from the EMPOWER CAD trial at EuroPCR 2025. This trial evaluated the safety and effectiveness of intravascular lithotripsy (IVL) in treating calcified coronary artery disease in women. Results showed a high procedural success rate of 86.9%, low complication rates, and significant quality-of-life improvements at 30 days. This study underscores the expanding use of IVL in diverse patient populations and reinforces Shockwave’s leadership in the IVL market

- In April 2025, Shockwave Medical initiated the FORWARD CAD pivotal IDE study to evaluate its novel Javelin Coronary IVL Catheter, a forward-delivering IVL platform designed for patients with heavily calcified coronary lesions. This innovative catheter aims to simplify lesion crossing and expand treatment to more complex anatomies. The study launch marks a significant milestone in next-generation IVL device development and reflects continued R&D investment in coronary plaque modification technologies

- In March 2025, Elixir Medical received CE mark approval in Europe for its LithiX Hertz Intravascular Lithotripsy System, marking the company’s entry into the European IVL market. The device uses ultra-short electrical pulses to fracture vascular calcium and is positioned as a competitor to Shockwave’s legacy platform. This regulatory milestone supports Elixir's geographic expansion and highlights the growing competitive landscape of the IVL segment

- In April 2025, the U.S. FDA granted 510(k) clearance to Bolt Medical’s Intravascular Lithotripsy platform, enabling Boston Scientific to proceed with commercialization following its acquisition of Bolt. This new entry enhances treatment options for interventional cardiologists and reflects a broader trend toward diversification in the U.S. IVL device space

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.