Global Atomic Spectroscopy Market

Market Size in USD Million

CAGR :

%

USD

4.56 Million

USD

18.56 Million

2024

2032

USD

4.56 Million

USD

18.56 Million

2024

2032

| 2025 –2032 | |

| USD 4.56 Million | |

| USD 18.56 Million | |

|

|

|

|

Atomic Spectroscopy Market Size

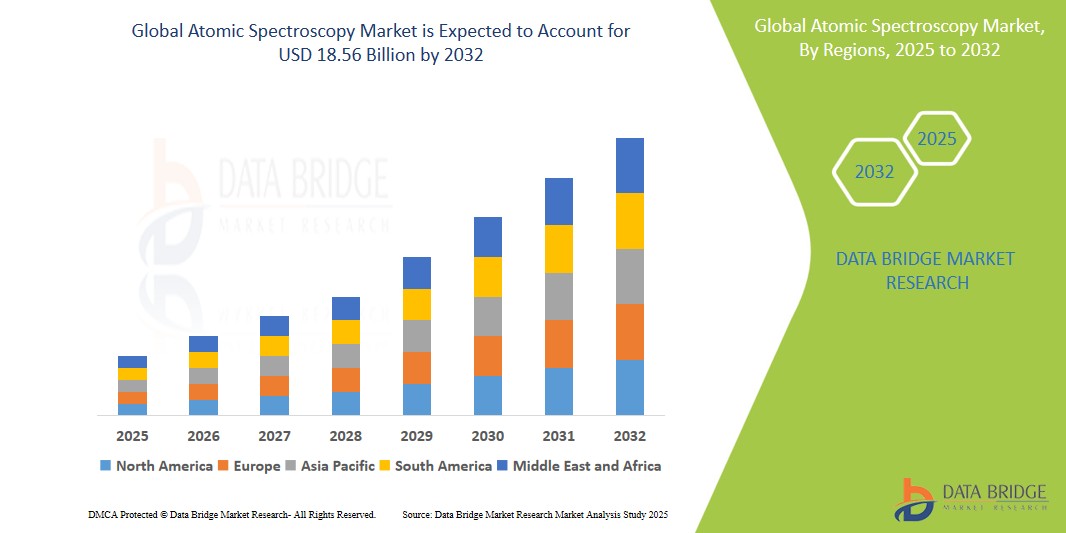

- The global Atomic Spectroscopy market size was valued at USD 4.56 billion in 2024 and is expected to reach USD 18.56 billion by 2034, at a CAGR of 10.5% during the forecast period of 2025-2034.

- The market growth is primarily driven by the increasing demand for advanced analytical techniques in various industries, including pharmaceuticals, biotechnology, environmental testing, and food & beverage safety.

- Furthermore, stringent government regulations regarding environmental monitoring and product quality are fueling the adoption of atomic spectroscopy methods for accurate and reliable elemental analysis. Technological advancements in atomic spectroscopy instruments, such as enhanced sensitivity and automation, are also contributing to the market's expansion by offering more efficient and precise analytical solutions.

Atomic Spectroscopy Market Analysis

- The increasing demand for precise elemental analysis across various sectors, including pharmaceuticals, environmental monitoring, and food safety, is a significant driver for the atomic spectroscopy market.

- The Asia-Pacific region is anticipated to be the fastest-growing market for atomic spectroscopy due to increasing industrialization, rising government investments in research and development, and growing awareness regarding food safety and environmental regulations, particularly in countries like China and India.

- Technological advancements in atomic spectroscopy instruments, such as enhanced sensitivity, portability, and automation, are expanding their applicability and driving market growth by offering more efficient and cost-effective analytical solutions.

- Asia-Pacific dominates the Atomic Spectroscopy market with the largest revenue share of 42.80% in 2025, driven by increasing industrialization, growing government investments in research and development, rising environmental concerns, and the expanding application of atomic spectroscopy in various industries across the region.

- The Atomic Absorption Spectroscopy (AAS) segment is expected to dominate the Atomic Spectroscopy market with a market share of 43.2% in 2025, driven by its well-established applications in various industries for cost-effective and reliable elemental analysis, particularly in environmental monitoring, food safety, and chemical analysis.

Report Scope and Atomic Spectroscopy Market Segmentation

|

Attributes |

Atomic Spectroscopy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Atomic Spectroscopy Market Trends

“Stringent Regulatory Standards”

- ICP-MS sensitivity gains enable better trace analysis in pharmaceuticals and environment. AAS automation and detection limits improve routine elemental analysis versatility.

- Modern AAS features improve detection limits and automation, making it more versatile for routine elemental analysis. Portable XRF offers real-time, non-destructive field analysis with enhanced accuracy.

- For Instance, The US FDA and European Union have set maximum allowable levels for lead, cadmium, and arsenic in various food items. Atomic Absorption Spectroscopy (AAS) and Inductively Coupled Plasma-Mass Spectrometry (ICP-MS) are crucial techniques employed by food manufacturers to comply with these regulations by accurately quantifying trace levels of these toxic elements in raw materials and finished goods, preventing potentially harmful products from reaching the market.

- The atomic spectroscopy market is poised for continued growth, driven by stringent regulations and technological advancements. Increasing demand for precise elemental analysis across diverse sectors like food safety and environmental monitoring, coupled with user-friendly innovations, will fuel its expansion in the coming years.

Atomic Spectroscopy Market Dynamics

Driver

“Technological Advancements in Instrumentation”

- Sensitivity gains enable ultra-trace detection in pharmaceuticals and environmental monitoring. Miniaturization creates portable systems for on-site elemental analysis in field studies.

- Improved light sources lower detection limits for food safety and diagnostics. Automation and software enhance efficiency in routine lab analyses.

- For Instance, Pharmaceutical companies utilize advanced ICP-MS to detect trace elemental impurities in drug formulations with high sensitivity, ensuring compliance with stringent regulatory limits for patient safety. For instance, it precisely quantifies heavy metals like arsenic and mercury in active pharmaceutical ingredients, crucial for meeting USP 232 and 233 standards.

- Enhanced portable units improve light element detection in mining and environment. Advanced software enables real-time on-site elemental mapping.

Restraint/Challenge

“High Cost of Advanced Instrumentation”

- The sophisticated nature of some advanced atomic spectroscopy instruments, particularly techniques like ICP-MS and high-resolution ICP-OES, can result in significant upfront investment and maintenance costs. This can be a challenge, especially for smaller laboratories and organizations with limited budgets, potentially hindering broader adoption of these advanced technologies.

- For Instance, A state-of-the-art ICP-MS used for ultra-trace analysis of pollutants in water samples can cost upwards of $150,000, excluding the ongoing expenses for consumables like high-purity argon gas and specialized sample introduction components, making it financially challenging for widespread adoption in resource-limited settings.

- Advanced instruments like ICP-MS require substantial initial investment and ongoing operational costs, including consumables and specialized training. This financial hurdle can limit accessibility for smaller labs and research institutions with constrained budgets.

Atomic Spectroscopy Market Scope

The market is segmented on the basis Technology, application and end user.

By Technology

On the basis of technology, the global Atomic Spectroscopy market is segmented into Atomic Absorption Spectroscopy (AAS), X-Ray Fluorescence (XRF), X-Ray Diffraction (XRD), Inductively Coupled Plasma-Optical Emission Spectroscopy (ICP-OES), Inductively Coupled Plasma-Mass Spectrometry (ICP-MS), Elemental Analyzers, and Others. The Atomic Absorption Spectroscopy (AAS) segment dominates the largest market revenue share of 65.18% in 2025, due to its well-established applications, cost-effectiveness for many elemental analyses, and widespread use in routine quality control and environmental monitoring across various industries globally.

The X-Ray Fluorescence (XRF) product segment is anticipated to witness the fastest growth rate of 34.82% from 2025 to 2032, driven by growing demand for rapid, non-destructive elemental analysis across diverse sectors like mining for on-site ore analysis, environmental testing for quick pollution screening, and quality control in manufacturing for real-time material verification. Advancements in portable XRF technology are enhancing its accessibility and application scope.

By Application

On the basis of application, the global Atomic Spectroscopy market is segmented into Food & Beverage Testing, Pharmaceuticals & Biotechnology, Industrial Chemistry, Environmental Testing, Geochemical/Mining, Petrochemical, and Others. The Pharmaceuticals & Biotechnology segment is expected to hold the largest market share revenue share of 63.45% in 2025, driven by stringent quality control regulations, the need for precise elemental analysis in drug development and manufacturing, and the increasing focus on trace metal analysis in biological samples for safety and efficacy.

The Food & Beverage Testing segment is anticipated to witness the fastest growth rate of 54.56% from 2025 to 2032, fueled by increasing consumer awareness regarding food safety, stricter government regulations on food quality and labeling, and the rising need for advanced analytical techniques to detect contaminants and ensure nutritional content across the global food supply chain.

By End user

On the basis of end user, the global Atomic Spectroscopy market is segmented into Laboratories, Universities, Manufacturing Facilities, and Government Agencies. The Laboratories segment currently holds the largest market share revenue share of 61.34 % in 2025, driven by the widespread use of atomic spectroscopy techniques in analytical service providers, research institutions, and quality control labs across various industries for routine and specialized elemental analysis.

The Universities segment is anticipated to witness the fastest growth rate of 56.41% from 2025 to 2032, propelled by increasing investments in research and development activities, a growing focus on advanced analytical techniques in scientific education, and rising adoption of atomic spectroscopy in various academic disciplines.

Atomic Spectroscopy Market Regional Analysis

- Asia-Pacific dominates the Atomic Spectroscopy market with the largest revenue share of 42.80% in 2024, driven by a increasing industrialization, growing environmental concerns, and rising demand for advanced analytical techniques in rapidly developing economies like China and India, which are significantly investing in research and manufacturing sectors.

- This growth is further supported by increasing government emphasis on stringent environmental monitoring and the escalating demand for sophisticated analytical solutions across diverse industries within these rapidly developing economies.

Australia Atomic Spectroscopy Market Insight

The Australia Atomic Spectroscopy market captured the largest revenue share of 35.34% within Asia-Pacific in 2025, driven by stringent quality control in its robust mining sector, demanding precise elemental analysis for resource assessment and processing. Furthermore, increasing environmental regulations necessitate sophisticated monitoring of soil, water, and air quality, boosting the adoption of these technologies for accurate contaminant detection and management across the country.

Japan Atomic Spectroscopy Market Insight

The Japan Atomic Spectroscopy market captured the largest revenue share of 15.01% within Asia-Pacific in 2025, due to the country's strong focus on technological innovation and high investments in research and development across various sectors, including electronics, pharmaceuticals, and environmental monitoring. Japanese manufacturers are key players in developing advanced and reliable atomic spectroscopy instrumentation, contributing substantially to the global market's technological progress and application advancements.

North America Atomic Spectroscopy Market Insight

The U.S Atomic Spectroscopy market captured the largest revenue share of 16.75% within North America in 2025, due to stringent environmental regulations and a strong emphasis on quality control across industries like pharmaceuticals and food & beverage. Furthermore, significant investments in research and development, coupled with the presence of leading analytical instrument manufacturers in the region, contribute substantially to market growth.

Mexico Atomic Spectroscopy Market Insight

The Mexico Atomic Spectroscopy market captured the largest revenue share of 24.71% within North America in 2025, due to stringent environmental regulations, particularly concerning water and soil quality, which drive the demand for precise heavy metal analysis. Additionally, the presence of a strong pharmaceutical industry and significant investments in research and development activities within the Mexico contribute substantially to the high adoption of advanced atomic spectroscopy techniques for quality control and drug development.

Canada Atomic Spectroscopy Market Insight

The Germany Atomic Spectroscopy market captured the largest revenue share of 25.71% within North America in 2025, driven by growing awareness of mental well-being and the increasing integration of Atomic Spectroscopy into corporate wellness programs and healthcare practices. Rising stress levels and demand for non-pharmacological mental health solutions have fueled interest in mindfulness. Additionally, the availability of digital Atomic Spectroscopy platforms and a tech-savvy population have supported widespread adoption across various age groups and professional settings.

Europe Atomic Spectroscopy Market Insight

The Europe Atomic Spectroscopy market captured the largest revenue share of 18.75% within Europe in 2025, driven by the region’s rich cultural heritage in meditative practices and rising modern-day mental health concerns. Countries like India and China have seen strong adoption due to traditional roots, while urban populations increasingly turn to digital platforms. Government wellness initiatives, increased smartphone usage, and awareness campaigns have further boosted demand for accessible, self-guided Atomic Spectroscopy solutions.

U.K. Atomic Spectroscopy Market Insight

The U.K. Atomic Spectroscopy market captured the largest revenue share of 25.71% within Europe in 2025, driven by increasing awareness of mental health issues and a strong shift toward preventive wellness practices. The integration of mindfulness in public healthcare, education, and corporate wellness programs has supported widespread adoption. Additionally, high smartphone penetration and the popularity of Atomic Spectroscopy apps have made digital mindfulness tools easily accessible, appealing to a broad demographic seeking stress relief and emotional balance.

Germany Atomic Spectroscopy Market Insight

The Germany Atomic Spectroscopy market captured the largest revenue share of 12.12% within Europe in 2025, driven by increasing stringent environmental regulations across its robust industrial sectors, including chemicals, pharmaceuticals, and automotive. These regulations necessitate precise and reliable elemental analysis for quality control, environmental monitoring, and compliance, fostering a strong demand for advanced atomic spectroscopy techniques and instrumentation within the country.

Atomic Spectroscopy Market Share

The Atomic Spectroscopy industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific (United States)

- Agilent Technologies (United States)

- PerkinElmer (United States)

- Bruker Corporation (United States)

- Shimadzu Corporation (Japan)

- Hitachi High-Technologies Corporation (Japan)

- JEOL Ltd. (Japan)

- Analytik Jena GmbH+Co. KG (Germany)

- HORIBA (Japan)

- Oxford Instruments (United Kingdom)

- Rigaku Corporation (Japan)

- GBC Scientific Equipment Pty Ltd (Australia)

- Skyray Instrument Inc. (China)

- Edinburgh Instruments Ltd (United Kingdom)

Latest Developments in Global Atomic Spectroscopy Market

- In March 2024, Thermo Fisher Scientific introduced the new iCAP™ TQ3 ICP-MS system, featuring enhanced sensitivity and matrix tolerance. This development allows laboratories to achieve more accurate and reliable trace element analysis in complex samples, expanding its application in environmental monitoring and food safety testing.

- In January 2025, Agilent Technologies launched the 5977B GC/MSD system with enhanced sensitivity and faster acquisition speeds. This new gas chromatography-mass spectrometry detector improves the efficiency and throughput of analytical laboratories in various applications, including environmental analysis and forensic toxicology.

- In June 2024, PerkinElmer released the Avio® 560 Max ICP-OES, designed for high-performance elemental analysis with a reduced footprint. This new inductively coupled plasma optical emission spectrometer offers improved plasma stability and detection limits, catering to the needs of environmental, food, and chemical analysis laboratories.

- In November 2023, Shimadzu Corporation introduced the EDX-7000/8000 series of Energy Dispersive X-ray Fluorescence (EDXRF) spectrometers with advanced software for more intuitive operation and data analysis. These new models offer enhanced sensitivity and resolution, expanding their utility in quality control and material identification across various industries.

- In April 2024, Bruker Corporation launched the G8 GALILEO ONH-pE analyzer for simultaneous determination of oxygen, nitrogen, and hydrogen in inorganic materials. This new elemental analyzer offers rapid and precise measurements, catering to the growing demand for accurate material characterization in the automotive, aerospace, and steel industries.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.