Global Audio Amplifier Market

Market Size in USD Billion

CAGR :

%

USD

4.44 Billion

USD

6.76 Billion

2024

2032

USD

4.44 Billion

USD

6.76 Billion

2024

2032

| 2025 –2032 | |

| USD 4.44 Billion | |

| USD 6.76 Billion | |

|

|

|

|

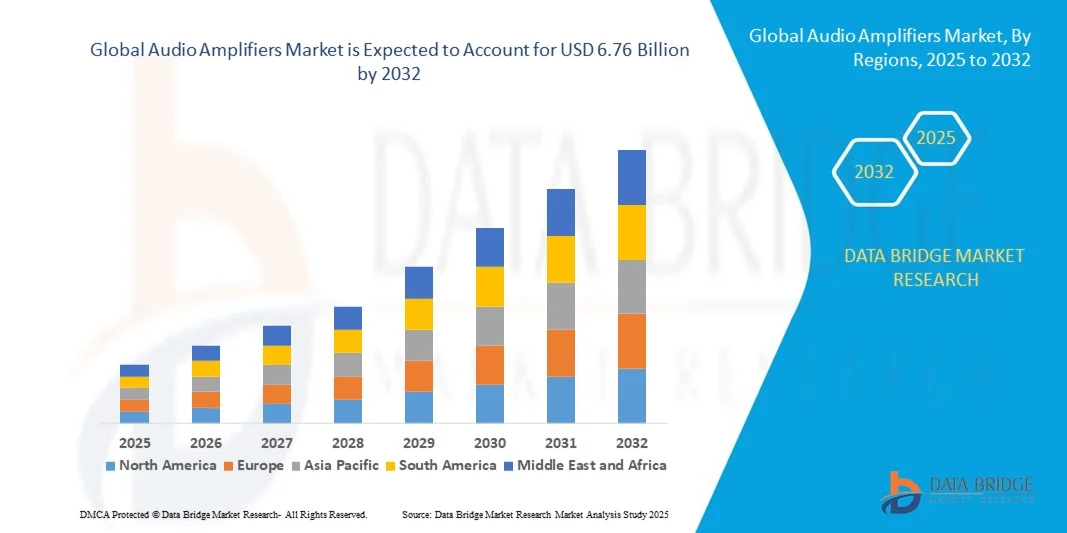

What is the Global Audio Amplifiers Market Size and Growth Rate?

- The global audio amplifiers market size was valued at USD 4.44 billion in 2024 and is expected to reach USD 6.76 billion by 2032, at a CAGR of 5.40% during the forecast period

- The rise in popularity of consumer electronic devices across the globe acts as one of the major factors driving the growth of audio amplifiers market. The increase in demand for high-quality audio output among population, and rise in adoption of the amplifier owning to the features such as improved stereo imaging and clarity, and working with a pair of 3.5mm wired headphones with +12 dB of zero distortion volume gain accelerate the market growth

What are the Major Takeaways of Audio Amplifiers Market?

- The increase in developments across advanced and power-efficient electronic products leading automotive applications for driving class D audio amplifier performance, and rise in demand for traction of in-vehicle infotainment systems further influence the market

- In addition, increase in government incentives, urbanization and digitization, and increase in demand for energy-efficient technologies in portable audio devices positively affect the audio amplifiers market. Furthermore, Penetration of the Internet of Things (Iot) and integration of increased number of functionalities with audio systems of vehicles extend profitable opportunities to the market players

- North America dominated the audio amplifiers market with the largest revenue share of 37.56% in 2024, driven by strong demand for consumer electronics, premium audio devices, and smart home entertainment systems

- The Asia-Pacific audio amplifiers market is projected to grow at the fastest CAGR of 8.21% from 2025 to 2032, driven by rising disposable incomes, rapid urbanization, and booming consumer electronics demand in China, Japan, and India

- The Two Channel segment dominated the market with the largest revenue share of 38.6% in 2024, driven by its widespread use in home audio systems, TVs, and entry-level hi-fi setups

Report Scope and Audio Amplifiers Market Segmentation

|

Attributes |

Audio Amplifiers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Audio Amplifiers Market?

Enhanced Convenience Through AI and Voice Integration

- A significant and accelerating trend in the global audio amplifiers market is the integration with artificial intelligence (AI) and popular voice-controlled ecosystems such as Amazon Alexa, Google Assistant, and Apple HomeKit. This fusion of technologies enhances user convenience and delivers a smarter listening experience

- For instance, Yamaha’s MusicCast amplifiers seamlessly integrate with voice assistants, allowing users to control volume, input selection, and playback with simple voice commands. Similarly, Sonos Amp can be controlled through Alexa and Google Assistant, offering hands-free audio management

- AI-enabled audio amplifiers can analyze listening patterns, optimize sound output, and provide intelligent recommendations for improved audio quality. Voice assistants further allow hands-free operation, creating an effortless home entertainment environment

- The seamless integration with smart home platforms enables users to control amplifiers alongside lighting, climate, and other connected devices through a unified interface, enhancing the connected lifestyle experience

- This trend toward AI-powered, voice-enabled, and interconnected amplifiers is reshaping user expectations for audio devices, encouraging companies to design smarter solutions for home, automotive, and professional applications

What are the Key Drivers of Audio Amplifiers Market?

- The rising demand for high-quality sound systems across consumer electronics, automobiles, and professional audio setups is a key driver fueling the growth of the audio amplifiers market

- For instance, in March 2024, STMicroelectronics launched a new line of Class-D audio amplifiers designed for automotive infotainment systems, supporting high efficiency and low distortion. Such innovations highlight the growing need for advanced amplification solutions

- Growing popularity of smart devices, streaming services, and home theaters is driving demand for amplifiers that deliver superior sound quality while offering seamless connectivity with other gadgets

- The automotive sector is increasingly adopting advanced amplifiers for premium in-car audio systems, as consumers seek immersive experiences during travel

- Moreover, the rise of wireless and portable devices has accelerated the adoption of compact, energy-efficient amplifiers, appealing to both tech-savvy consumers and professional audio system providers

Which Factor is Challenging the Growth of the Audio Amplifiers Market?

- Concerns over design complexity, heat dissipation, and energy efficiency present challenges to broader adoption of advanced audio amplifiers. High-performance amplifiers often generate significant heat, requiring additional cooling solutions that increase costs and design complexity

- For instance, several manufacturers of high-wattage Class-A amplifiers face difficulties in balancing sound quality with energy efficiency, which can limit adoption in mainstream consumer devices

- In addition, the higher cost of premium amplifiers compared to conventional models can act as a barrier for price-sensitive consumers, particularly in emerging markets where affordability remains a major purchasing factor

- The miniaturization trend also puts pressure on manufacturers to deliver compact designs without compromising sound performance, which adds to R&D expenses

- Overcoming these challenges will require innovations in energy-efficient amplifier architectures, cost reduction strategies, and consumer education on the value of high-quality audio solutions for sustained market growth

How is the Audio Amplifiers Market Segmented?

The market is segmented on the basis of channel type, device, and end-user industry.

- By Channel Type

On the basis of channel type, the audio amplifiers market is segmented into Mono Channel, Two Channel, Four Channel, Six Channel, and Others. The Two Channel segment dominated the market with the largest revenue share of 38.6% in 2024, driven by its widespread use in home audio systems, TVs, and entry-level hi-fi setups. Two-channel amplifiers remain popular for their balance of sound quality, affordability, and compact design. They are particularly favored in residential applications, providing reliable stereo sound for music and entertainment.

The Four Channel segment is projected to witness the fastest CAGR of 20.9% from 2025 to 2032, supported by its increasing adoption in automotive infotainment systems and home theater applications. Four-channel amplifiers offer multi-speaker connectivity, enabling immersive surround sound experiences. Their rising use in gaming, professional audio setups, and high-performance vehicles further drives their growth trajectory, making them a preferred choice for modern users.

- By Device

On the basis of device, the audio amplifiers market is segmented into Smartphones, Television Sets, Tablets, Desktops & Laptops, Home Audio Systems, Automotive Infotainment Systems, and Professional Audio Systems. The Smartphones segment held the largest market revenue share of 34.7% in 2024, attributed to the growing global penetration of mobile devices and the demand for superior sound quality in compact form factors. Leading smartphone brands are increasingly embedding advanced audio amplifier ICs to enhance music, gaming, and video streaming experiences.

The Automotive Infotainment Systems segment is expected to register the fastest CAGR of 22.3% from 2025 to 2032, fueled by rising consumer preference for immersive in-car audio experiences. With the growing demand for connected vehicles and premium car audio systems, automakers are increasingly integrating high-performance amplifiers. In addition, the expansion of electric vehicles and autonomous cars is boosting innovation in amplifier technologies designed for low power consumption and space efficiency.

- By End-User Industry

On the basis of end-user industry, the audio amplifiers market is segmented into Consumer Electronics, Automotive, and Entertainment. The Consumer Electronics segment accounted for the largest revenue share of 46.1% in 2024, driven by the massive demand for audio amplifiers in smartphones, laptops, TVs, and home audio systems. The rising consumption of digital content, video streaming, and music services has significantly pushed manufacturers to enhance sound performance across consumer devices.

The Automotive segment is projected to witness the fastest CAGR of 21.4% from 2025 to 2032, supported by the integration of advanced infotainment systems and the rising consumer appetite for luxury in-car entertainment. Premium vehicles are increasingly equipped with multi-channel amplifiers for high-fidelity sound output. Furthermore, partnerships between automakers and audio brands such as Harman, Bose, and Bang & Olufsen are strengthening amplifier adoption in the automotive sector, making it a key growth contributor.

Which Region Holds the Largest Share of the Audio Amplifiers Market?

- North America dominated the audio amplifiers market with the largest revenue share of 37.56% in 2024, driven by strong demand for consumer electronics, premium audio devices, and smart home entertainment systems

- Consumers in the region prioritize high-quality sound, seamless device integration, and wireless connectivity, making amplifiers an essential part of home theaters, personal audio setups, and automotive infotainment

- High disposable incomes, a tech-savvy population, and rapid adoption of advanced streaming services further support demand, establishing North America as the leading regional market for both residential and commercial audio applications

U.S. Audio Amplifiers Market Insight

The U.S. audio amplifiers market captured the largest revenue share of 81% in 2024 within North America, fueled by the widespread use of smartphones, smart TVs, and portable devices requiring advanced amplification. Consumers are increasingly investing in home theaters, soundbars, and multi-room audio systems, creating strong demand for amplifiers. The rising popularity of DIY home setups, coupled with integration of voice assistants such as Alexa and Google Assistant into amplifiers, further drives market growth. In addition, the U.S. automotive sector’s focus on premium infotainment systems significantly boosts adoption of multi-channel audio amplifiers.

Europe Audio Amplifiers Market Insight

The Europe audio amplifiers market is projected to grow at a substantial CAGR throughout the forecast period, supported by strong demand in consumer electronics, automotive, and entertainment sectors. Rising urbanization and the popularity of streaming services are fueling demand for high-quality sound systems across residential and commercial applications. European consumers also value energy efficiency, compact amplifier designs, and eco-friendly technologies, pushing manufacturers to innovate. Increasing adoption in multi-family housing projects, smart homes, and premium vehicles further drives amplifier usage.

U.K. Audio Amplifiers Market Insight

The U.K. audio amplifiers market is expected to witness a noteworthy CAGR during the forecast period, driven by rising interest in home automation and smart entertainment systems. The country’s strong music culture and high demand for wireless audio devices are boosting amplifier adoption. Concerns over sound quality, convenience, and design flexibility are motivating consumers to upgrade from basic audio systems to advanced amplifiers integrated with connected devices. In addition, the U.K.’s growing e-commerce ecosystem is facilitating easy access to premium amplifiers, accelerating market expansion.

Germany Audio Amplifiers Market Insight

The Germany audio amplifiers market is projected to expand at a considerable CAGR, fueled by strong demand for high-fidelity sound systems and the country’s focus on advanced engineering. Germany’s large automotive sector is a major contributor, as luxury car manufacturers increasingly integrate premium multi-channel amplifiers into infotainment systems. In the residential space, consumers are adopting eco-conscious, compact, and high-performance amplifiers, aligning with sustainability preferences. Integration with smart home platforms and connected devices is becoming more common, strengthening amplifier penetration across modern households and offices.

Which Region is the Fastest Growing Region in the Audio Amplifiers Market?

The Asia-Pacific audio amplifiers market is projected to grow at the fastest CAGR of 8.21% from 2025 to 2032, driven by rising disposable incomes, rapid urbanization, and booming consumer electronics demand in China, Japan, and India. The growing popularity of smart homes and connected entertainment systems, supported by government-led digitalization initiatives, is boosting adoption. In addition, Asia-Pacific’s position as a global manufacturing hub for audio devices ensures affordability and accessibility, expanding amplifier adoption across both mass-market and premium segments.

Japan Audio Amplifiers Market Insight

The Japan audio amplifiers market is witnessing strong growth, supported by the country’s tech-driven consumer base and high penetration of smart homes. Demand is fueled by premium audio experiences in both residential and commercial setups, alongside a focus on compact, space-efficient designs. Japan’s aging population is also contributing, as user-friendly, voice-controlled amplifiers are increasingly preferred. Integration of amplifiers with IoT devices such as smart TVs, security systems, and lighting further supports adoption.

China Audio Amplifiers Market Insight

The China audio amplifiers market accounted for the largest revenue share in Asia-Pacific in 2024, backed by the country’s expanding middle class, rapid urbanization, and booming smart home ecosystem. Consumers in China are heavily investing in smart speakers, home theaters, and wireless sound systems, creating significant demand for amplifiers. Strong domestic production, competitive pricing, and the government’s push toward smart city initiatives are further fueling adoption. China’s growing automotive industry, with an increasing focus on in-car entertainment, also drives demand for advanced multi-channel audio amplifiers.

Which are the Top Companies in Audio Amplifiers Market?

The audio amplifiers industry is primarily led by well-established companies, including:

- Infineon Technologies AG (Germany)

- Maxim Integrated (U.S.)

- Cirrus Logic, Inc. (U.S.)

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION (Japan)

- Semiconductor Components Industries, LLC (Onsemi) (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- ROHM CO., LTD. (Japan)

- Monolithic Power Systems, Inc. (U.S.)

- Biamp Systems (U.S.)

- STMicroelectronics (Switzerland/France)

- LEA Professional (U.S.)

- Texas Instruments Incorporated (U.S.)

- NXP Semiconductors (Netherlands)

- Analog Devices, Inc. (U.S.)

- Silicon Laboratories (U.S.)

- ICEpower (Denmark)

- Nuvoton Technology Corporation (Taiwan)

- Renesas Electronics Corporation (Japan)

- Dialog Semiconductor (U.K.)

- Integrated Silicon Solution Inc. (U.S.)

What are the Recent Developments in Global Audio Amplifiers Market?

- In May 2025, HARMAN International completed its USD 350 million acquisition of Sound United’s consumer-audio division, bringing renowned brands such as Bowers & Wilkins, Denon, Marantz, and Polk under its portfolio. This move significantly strengthens HARMAN’s position in the global premium audio market

- In May 2025, Yamaha rolled out a firmware update that officially certified its AVENTAGE AVRs, including models RX-A8A, RX-A6A, RX-A4A, and RX-A2A, with Works with Sonos interoperability. This update enhances seamless multi-room audio experiences for consumers

- In April 2025, BMW introduced the HypersonX 43-signal acoustic concept as part of its Neue Klasse electric vehicles, integrated within the Operating System X platform. This innovation highlights BMW’s commitment to delivering next-generation in-car soundscapes

- In January 2025, Texas Instruments launched the TAS6754-Q1 class-D amplifier and AM275x-Q1 MCU line at CES 2025, featuring one-inductor modulation and advanced spatial-audio processing. This debut underscores TI’s focus on advancing high-performance automotive audio solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Audio Amplifier Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Audio Amplifier Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Audio Amplifier Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.