Global Audit Software Market

Market Size in USD Billion

CAGR :

%

USD

2.06 Billion

USD

5.97 Billion

2024

2032

USD

2.06 Billion

USD

5.97 Billion

2024

2032

| 2025 –2032 | |

| USD 2.06 Billion | |

| USD 5.97 Billion | |

|

|

|

|

Audit Software Market Size

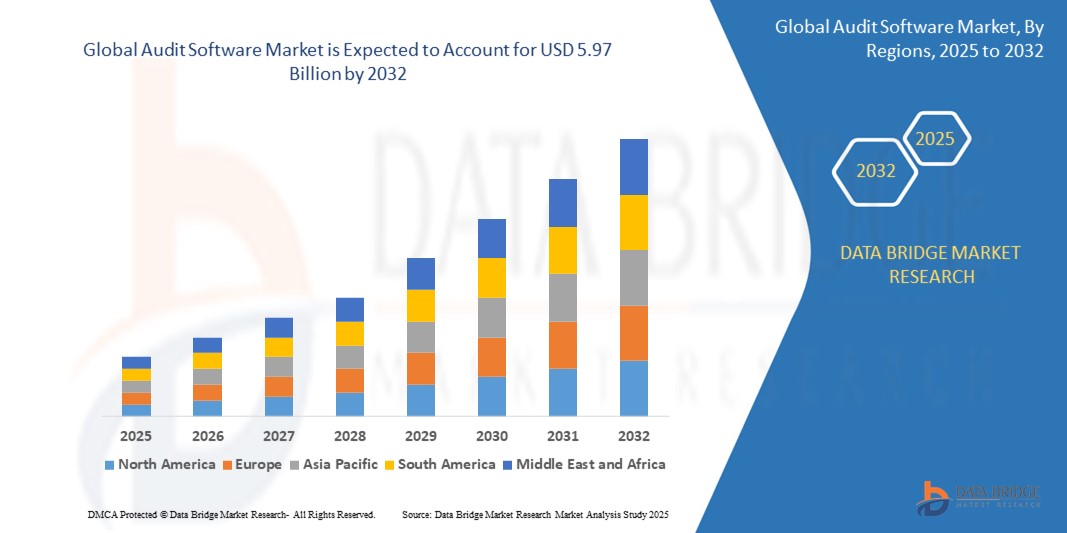

- The global audit software market size was valued at USD 2.06 billion in 2024 and is expected to reach USD 5.97 billion by 2032, at a CAGR of 14.20% during the forecast period

- The market growth is largely fueled by the increasing need for automated and accurate auditing processes across industries, driven by the rise in regulatory compliance requirements and digital transformation initiatives within organizations

- Furthermore, the growing demand for cloud-based audit tools offering real-time analytics, improved risk management, and streamlined reporting is prompting companies to adopt integrated audit software solutions. These converging factors are accelerating the shift from manual audits to digital platforms, thereby significantly boosting the audit software market's growth

Audit Software Market Analysis

- Audit software refers to technology solutions designed to streamline internal audit processes, manage compliance requirements, and enhance the transparency and accuracy of financial and operational reporting. These tools automate key tasks such as risk assessment, workflow tracking, control testing, and documentation across various enterprise functions

- The increasing adoption of audit software is driven by a heightened focus on corporate governance, regulatory pressure across sectors such as BFSI and healthcare, and the growing preference for real-time monitoring and cloud-enabled auditing systems

- North America dominated the audit software market with a share of 47.5% in 2024, due to strict regulatory compliance standards, widespread digitization across enterprises, and strong presence of key audit software providers

- Asia-Pacific is expected to be the fastest growing region in the audit software market during the forecast period due to a rapid digital shift across industries and growing awareness of corporate accountability

- Solution segment dominated the market with a market share of 64.8% in 2024, due to growing demand for automated auditing tools that enhance accuracy, ensure regulatory compliance, and reduce manual intervention. Organizations increasingly adopt comprehensive audit software solutions to streamline internal audit workflows, mitigate financial and operational risks, and centralize audit data for better oversight and reporting. The scalability and integration capabilities of these solutions with enterprise systems such as ERP and GRC platforms further fuel their dominance

Report Scope and Audit Software Market Segmentation

|

Attributes |

Audit Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Audit Software Market Trends

““Integration with Enterprise Applications”

- The audit software market is rapidly evolving as organizations increasingly demand solutions that seamlessly integrate with core enterprise applications, including ERP, CRM, and HR management systems. This integration streamlines audit workflows, enables real-time data sharing, and enhances visibility throughout complex business processes

- For instance, industry leaders such as SAP, Oracle, and Microsoft are embedding audit functionalities directly within their enterprise software suites, enabling clients to unify compliance, risk management, and financial controls within a single ecosystem

- The shift toward platform-based, interoperable solutions is driven by the growing complexity of reporting requirements and the need for more agile, data-driven auditing across industries such as BFSI, healthcare, manufacturing, and energy

- Integration with enterprise applications is further advanced by the use of open APIs, allowing audit software vendors to foster collaboration with a wide array of business intelligence and analytics tools, enhancing the scope of automated audit evidence collection and risk insights

- As remote and hybrid work models proliferate, integrated systems ensure all audit stakeholders, regardless of location, can access, review, and act on audit findings securely in real time—a crucial advantage for global teams and multi-site operations

- The focus on end-to-end integration is also accelerating adoption of AI, data analytics, and process automation within audit software, resulting in faster, smarter, and more accurate auditing capabilities

Audit Software Market Dynamics

Driver

“Growing Demand for Cloud-Based Solutions”

- The surge in demand for cloud-based audit software is a key driver, as organizations of all sizes seek scalability, flexibility, and rapid deployment without the infrastructure requirements of on-premise solutions

- For instance, leading vendors such as IBM, SAP, and Oracle are significantly expanding their cloud audit offerings to deliver continuous monitoring, automated updates, and seamless access from any device or location—features especially prized by globally distributed teams and regulated industries

- Cloud-based platforms offer cost efficiency through subscription models and reduced maintenance, making them attractive for both large enterprises and SMEs seeking to modernize their audit functions

- Enhanced security, real-time collaboration, and integration with other cloud services contribute to streamlined audit processes, proactive compliance management, and faster response to regulatory changes

- The growing need for remote and hybrid audit processes, coupled with rising digital transformation initiatives across sectors, is making cloud-based audit software the preferred choice for organizations seeking resilience and operational agility

Restraint/Challenge

“High Implementation Costs”

- Despite their benefits, audit software solutions—especially those with advanced integration and cloud capabilities—can entail significant upfront costs for customization, deployment, and training, posing challenges for smaller organizations with limited IT budgets

- For instance, organizations adopting enterprise-level solutions from vendors such as SAP or Oracle often face high expenses related to data migration, user training, and ongoing support, slowing the pace of adoption among cost-sensitive segments

- Integrating audit platforms with legacy business applications and ensuring full interoperability may require additional development and consulting resources, raising total cost of ownership

- Complex regulatory environments and frequent changes in compliance standards can lead to further investment in software updates and staff re-training, making robust cost management a necessity for sustained use

- Smaller firms and non-profit organizations may seek alternative low-cost or modular solutions, but these typically offer fewer features and limited scalability, putting them at a disadvantage compared to fully integrated enterprise offerings

Audit Software Market Scope

The market is segmented on the basis of component, deployment mode, organization size, and industry vertical.

- By Component

On the basis of component, the audit software market is segmented into solution and services. The solution segment accounted for the largest market revenue share of 64.8% in 2024, driven by growing demand for automated auditing tools that enhance accuracy, ensure regulatory compliance, and reduce manual intervention. Organizations increasingly adopt comprehensive audit software solutions to streamline internal audit workflows, mitigate financial and operational risks, and centralize audit data for better oversight and reporting. The scalability and integration capabilities of these solutions with enterprise systems such as ERP and GRC platforms further fuel their dominance.

The services segment is anticipated to witness the fastest growth rate from 2025 to 2032, owing to the rising need for implementation, training, and support services associated with complex audit environments. As companies adopt more sophisticated audit tools, service providers play a critical role in ensuring seamless integration, customization, and ongoing technical support, particularly in highly regulated industries where audit precision is essential.

- By Deployment Mode

On the basis of deployment mode, the audit software market is categorized into on-premise and cloud. The on-premise segment held the largest market revenue share in 2024, primarily due to its appeal among large enterprises with strict data security policies and infrastructure investments. On-premise deployments offer direct control over sensitive audit data and systems, which is a key consideration for financial institutions, government agencies, and healthcare providers dealing with confidential records.

The cloud segment is projected to exhibit the highest CAGR from 2025 to 2032, propelled by its scalability, lower upfront costs, and remote accessibility. Cloud-based audit software enables real-time collaboration, easier updates, and integration with cloud-based business suites, which is particularly beneficial for organizations seeking agile, cost-efficient auditing processes. The rising trend of digital transformation and increasing trust in cloud security frameworks contribute to the growing preference for cloud deployment.

- By Organization Size

On the basis of organization size, the audit software market is segmented into large enterprises and small & medium enterprises (SMEs). The large enterprises segment dominated the market in 2024, owing to their complex auditing needs, high regulatory exposure, and large-scale operations across multiple geographies. These organizations often invest in enterprise-grade audit tools to standardize processes, ensure compliance, and perform comprehensive internal audits with enhanced transparency.

The small & medium enterprises (SMEs) segment is expected to grow at the fastest rate from 2025 to 2032, driven by the increasing awareness of compliance and risk management requirements among smaller firms. Cloud-based and modular audit software offerings tailored to SME budgets have made adoption more accessible. In addition, the rise in regulatory scrutiny and the need for streamlined financial management are prompting SMEs to invest in affordable yet effective auditing solutions.

- By Industry Vertical

On the basis of industry vertical, the audit software market is segmented into BFSI, retail & e-commerce, manufacturing, government & defence, energy & utilities, IT & telecom, education, healthcare, and others. The BFSI segment captured the largest revenue share in 2024, supported by stringent regulatory mandates, frequent internal audits, and high volumes of transactional data requiring close scrutiny. Financial institutions are early adopters of advanced audit solutions for risk mitigation, fraud detection, and compliance reporting.

The healthcare segment is poised to record the fastest growth rate from 2025 to 2032 due to increasing data privacy regulations, such as HIPAA, and the need for secure auditing of patient records, billing, and insurance claims. The rising adoption of electronic health records (EHRs) and medical software systems necessitates robust audit trails and compliance tools. Audit software in healthcare enhances transparency, reduces compliance costs, and supports secure operational governance.

Audit Software Market Regional Analysis

- North America dominated the audit software market with the largest revenue share of 47.5% in 2024, driven by strict regulatory compliance standards, widespread digitization across enterprises, and strong presence of key audit software providers

- Businesses in the region prioritize risk management and regulatory adherence, prompting large-scale adoption of advanced audit solutions for financial and operational transparency

- The region benefits from mature IT infrastructure, high awareness of cybersecurity threats, and increased integration of cloud-based tools, positioning audit software as a vital component in enterprise governance frameworks

U.S. Audit Software Market Insight

The U.S. audit software market captured a dominant share of North America’s total revenue in 2024, owing to the country's advanced enterprise IT infrastructure and proactive regulatory enforcement. Large enterprises are at the forefront of audit software adoption, deploying solutions that streamline internal control testing, automate reporting, and enhance audit accuracy. A growing trend in real-time auditing, coupled with the integration of AI and analytics for fraud detection and performance monitoring, is reshaping the market. The demand for SaaS-based models and remote auditing capabilities continues to rise, especially within sectors such as banking, insurance, and pharmaceuticals.

Europe Audit Software Market Insight

The Europe audit software market is projected to grow at a steady pace throughout the forecast period, supported by stringent compliance requirements such as GDPR, IFRS, and sustainability regulations. Businesses across the region are adopting digital audit platforms to manage growing volumes of financial and operational data while ensuring accuracy, transparency, and regulatory compliance. The demand is particularly strong among government institutions, energy providers, and large manufacturing firms that must meet both industry-specific and cross-border regulatory obligations. Emphasis on ESG audits and digital assurance services is further accelerating market expansion in Europe.

U.K. Audit Software Market Insight

The U.K. audit software market is expected to grow at a notable CAGR, fueled by increasing demand for automation in audit trails, financial control, and tax reporting. Businesses are seeking efficient and scalable solutions to comply with evolving post-Brexit financial regulations and internal governance standards. The country’s robust financial sector, expanding fintech ecosystem, and early adoption of cloud and analytics technologies are encouraging widespread use of audit software among both large enterprises and SMEs. The trend toward remote work and digital-first compliance strategies is also amplifying software deployment across the professional services and e-commerce sectors.

Germany Audit Software Market Insight

The Germany audit software market is anticipated to expand steadily over the forecast period, driven by its industrial backbone, commitment to compliance, and high standards for operational transparency. German organizations across manufacturing, automotive, and utilities are increasingly implementing audit software to manage complex internal control systems and meet both national and EU regulations. The rising preference for localized, multilingual platforms and the need for end-to-end audit process visibility are creating strong demand for advanced digital solutions. Integration with ERP systems and support for sustainability-related audit modules are further boosting adoption rates in the country.

Asia-Pacific Audit Software Market Insight

The Asia-Pacific audit software market is expected to grow at the fastest CAGR from 2025 to 2032, owing to a rapid digital shift across industries and growing awareness of corporate accountability. Countries such as China, India, and Japan are witnessing increased investment in governance, risk, and compliance tools as regulatory scrutiny intensifies and businesses scale operations regionally. The adoption of cloud-based platforms is particularly high among mid-sized enterprises seeking affordable, secure, and scalable solutions. Government-led digitalization initiatives and the growing need for transparent business practices are further driving audit software penetration in this dynamic region.

Japan Audit Software Market Insight

Japan’s audit software market is gaining momentum, driven by its technology-first approach, strict corporate governance mandates, and rising demand for operational efficiency. Organizations in sectors such as electronics, healthcare, and financial services are prioritizing digital audit solutions to ensure real-time compliance, minimize risk, and optimize process integrity. The integration of audit software with IoT and business analytics tools is becoming common, especially as Japanese firms invest in digital transformation to stay globally competitive. The country's aging workforce is also prompting adoption of intuitive, automated systems that reduce reliance on manual audit tasks.

China Audit Software Market Insight

China accounted for the largest share of the Asia-Pacific audit software market in 2024, supported by rapid industrialization, regulatory tightening, and government-led efforts to promote digital governance. Chinese enterprises are adopting audit platforms to manage complex financial systems, meet domestic compliance requirements, and ensure data traceability across decentralized operations. A growing ecosystem of domestic software vendors, coupled with rising adoption in sectors such as retail, real estate, and logistics, is expanding the market reach. The push toward smart city development and data security is also encouraging the integration of advanced, cloud-native audit tools.

Audit Software Market Share

The audit software industry is primarily led by well-established companies, including:

- IBM (U.S.)

- SAP SE (Germany)

- Protiviti Inc. (U.S.)

- ACL Services Ltd (Canada)

- Ideagen Plc (U.K.)

- NAVEX Global, Inc. (U.S.)

- Wolters Kluwer Corporate & Financial Services (Netherlands)

- Workiva (U.S.)

- MasterControl, Inc. (U.S.)

- Xactium Limited (U.K.)

Latest Developments in Global Audit Software Market

- In May 2025, Workiva Inc. secured USD 120 million in funding, led by BlackRock, to scale its audit software offerings and strengthen its cloud-based platform. This substantial investment is expected to accelerate Workiva’s innovation and market expansion, reinforcing its position as a key player in the growing audit software landscape

- In March 2025, SAP SE and Deloitte announced a strategic partnership to integrate SAP GRC Audit Center with Deloitte’s audit services. This collaboration is anticipated to significantly boost market competitiveness by merging SAP’s audit technology with Deloitte’s domain expertise, thereby enhancing audit accuracy, efficiency, and value delivery across client organizations

- In January 2024, Intuit Inc. launched Intuit Audit, a new audit software solution tailored for small and medium-sized accounting firms. By automating routine tasks and delivering real-time analytics, the solution aims to reduce manual errors and operational friction, helping Intuit gain traction in the SME audit software segment.

- In January 2024, MetricStream, a significant player in the audit software market, acquired Intelex Technologies, known for its environmental, health, and safety (EHS) management systems. This acquisition aims to enhance MetricStream’s audit management product offerings and broaden its market presence

- In January 2024, Netwrix Corporation, a leading provider of audit software, unveiled its newest audit management solution, Netwrix Auditor 11.5. This updated version features enhanced data analytics capabilities, a revamped user interface, and seamless integration with popular enterprise applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.