Global Augmented Analytics Market

Market Size in USD Billion

CAGR :

%

USD

23.37 Billion

USD

193.00 Billion

2024

2032

USD

23.37 Billion

USD

193.00 Billion

2024

2032

| 2025 –2032 | |

| USD 23.37 Billion | |

| USD 193.00 Billion | |

|

|

|

|

Augmented Analytics Market Size

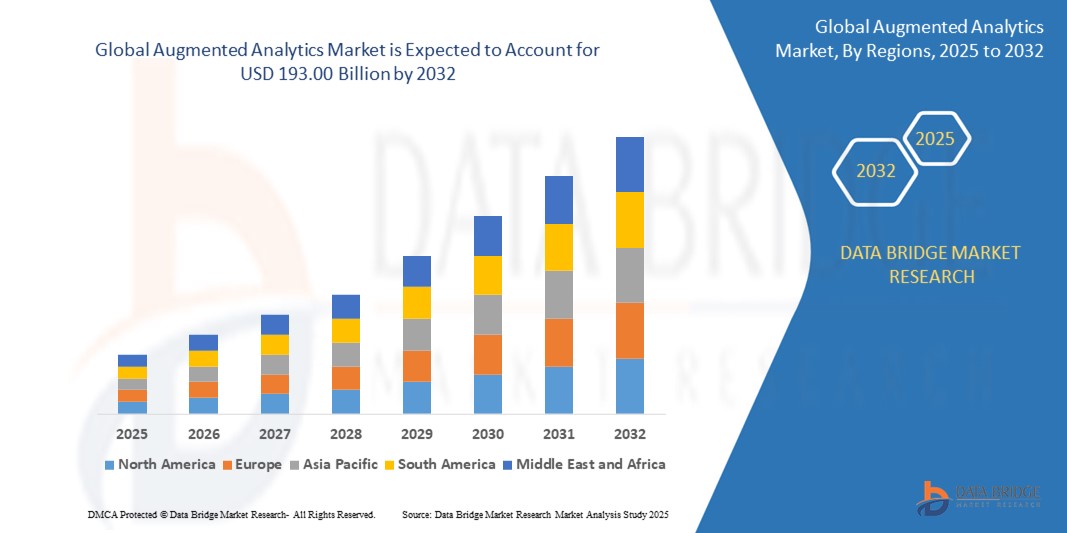

- The global augmented analytics market size was valued at USD 23.37 billion in 2024 and is expected to reach USD 193.00 billion by 2032, at a CAGR of 30.20% during the forecast period

- The market growth is driven by the increasing adoption of artificial intelligence (AI) and machine learning (ML) technologies, growing demand for data-driven decision-making, and the rising need for automated and accessible analytics solutions across industries

- In addition, the surge in big data generation and the need for simplified, natural language processing (NLP)-enabled analytics tools are accelerating the integration of augmented analytics into business intelligence (BI) systems, significantly propelling market growth

Augmented Analytics Market Analysis

- Augmented analytics leverages AI, ML, and NLP to enhance data preparation, insight generation, and data visualization, enabling organizations to derive actionable insights with minimal technical expertise

- The growing emphasis on digital transformation, coupled with the need for real-time analytics and enhanced data accessibility, is fueling the demand for augmented analytics solutions across diverse verticals

- North America dominated the augmented analytics market with a revenue share of 42.3% in 2024, driven by early adoption of AI technologies, robust technological infrastructure, and the presence of leading market players

- Asia-Pacific is anticipated to be the fastest-growing region during the forecast period, attributed to rapid digitalization, increasing investments in AI infrastructure, and rising adoption of analytics solutions in emerging economies such as China and India

- The software segment dominated the largest market revenue share of 68.2% in 2024, driven by its ability to automate data cleansing, integration, and transformation processes, enabling organizations to derive actionable insights efficiently

Report Scope and Augmented Analytics Market Segmentation

|

Attributes |

Augmented Analytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Augmented Analytics Market Trends

“Increasing Integration of Artificial Intelligence and Big Data Analytics”

- The global augmented analytics market is experiencing a significant trend of integrating Artificial Intelligence (AI) and Big Data analytics, enabling advanced data processing and actionable insights across various industries

- These technologies facilitate automated data preparation, predictive analytics, and natural language processing, allowing organizations to derive deeper insights from complex datasets without relying heavily on data scientists

- AI-powered augmented analytics platforms can proactively identify trends, patterns, and anomalies, enabling faster and more informed decision-making for businesses

- For instance, companies such as Qlik and Salesforce are developing AI-driven solutions that provide automated insights, such as predictive sales forecasting or customer behavior analysis, tailored to specific industry needs

- This trend enhances the value proposition of augmented analytics, making it increasingly attractive to both large enterprises and small to medium-sized enterprises (SMEs) seeking to optimize operations and improve strategic outcomes

- AI algorithms analyze vast datasets, including customer interactions, operational metrics, and market trends, to offer personalized recommendations and optimize processes such as supply chain management or marketing campaigns

Augmented Analytics Market Dynamics

Driver

“Rising Demand for Data-Driven Decision-Making and Self-Service Analytics”

- The increasing need for data-driven decision-making across industries, such as Banking, Financial Services, and Insurance (BFSI), retail, and healthcare, is a major driver for the global augmented analytics market

- Augmented analytics systems enhance business intelligence by providing features such as automated data preparation, natural language querying, and predictive analytics, enabling non-technical users to access insights easily

- Government initiatives promoting digital transformation, particularly in North America and Asia-Pacific, are contributing to the widespread adoption of augmented analytics solutions

- The proliferation of cloud computing and advancements in AI and machine learning technologies are further enabling the expansion of augmented analytics applications, offering scalability and real-time insights for sophisticated business needs

- Enterprises are increasingly adopting augmented analytics as standard or optional tools to meet stakeholder expectations and enhance operational efficiency

Restraint/Challenge

“High Implementation Costs and Data Security Concerns”

- The substantial initial investment required for software, services, and integration of augmented analytics systems can be a significant barrier to adoption, particularly for SMEs in emerging markets

- Integrating augmented analytics platforms into existing IT infrastructure can be complex and costly, requiring specialized expertise and resources

- Data security and privacy concerns pose a major challenge, as augmented analytics systems collect and process vast amounts of sensitive business and customer data, raising risks of breaches or misuse

- The fragmented regulatory landscape across countries regarding data privacy and compliance, such as GDPR in Europe, further complicates operations for global vendors and service providers

- These factors can deter potential adopters and limit market expansion, especially in regions with high cost sensitivity or stringent data protection regulations

Augmented Analytics market Scope

The market is segmented on the basis of component, organization size, deployment type, and vertical

- By Component

On the basis of component, the global augmented analytics market is segmented into software and services. The software segment held the largest market revenue share of 68.2% in 2024, driven by its ability to automate data cleansing, integration, and transformation processes, enabling organizations to derive actionable insights efficiently. Software solutions leverage AI and machine learning to provide advanced analytics, predictive modeling, and data visualization, reducing reliance on specialized data scientists.

The services segment is expected to witness the fastest growth rate of 31.2% from 2025 to 2032, driven by the increasing demand for training, consulting, deployment, integration, and support services. These services ensure effective implementation and ongoing support, helping organizations maximize the value of augmented analytics solutions in a cost-efficient manner.

- By Organization Size

On the basis of organization size, the global augmented analytics market is segmented into large enterprises and small and medium-sized enterprises (SMEs). The large enterprises segment dominated the market with a revenue share of 76.8% in 2024, owing to their significant investments in advanced analytics tools to manage complex operations and vast datasets. Large enterprises benefit from customized solutions that address sophisticated business needs across various departments.

The SMEs segment is anticipated to experience the fastest growth rate of 32.5% from 2025 to 2032. The affordability and user-friendly nature of augmented analytics platforms enable SMEs to integrate these tools seamlessly, empowering them to compete with larger players by leveraging data-driven insights for decision-making, particularly in retail, healthcare, and finance sectors.

- By Deployment Type

On the basis of deployment type, the global augmented analytics market is segmented into cloud and on-premise. The on-premise segment held the largest market revenue share of 62.3% in 2024, driven by organizations in regulated industries such as banking and healthcare prioritizing data security, compliance, and control over their analytics infrastructure. On-premise solutions offer robust customization and integration with existing systems.

The cloud segment is expected to witness the fastest growth rate of 33.7% from 2025 to 2032, owing to its scalability, cost-effectiveness, and ease of integration. Cloud-based solutions enable global collaboration and real-time data access, making them ideal for organizations with fluctuating data demands and those seeking flexible analytics platforms.

- By Vertical

On the basis of vertical, the global augmented analytics market is segmented into banking, financial services, and insurance (BFSI), telecom and it, retail and consumer goods, healthcare and life sciences, manufacturing, government and defense, energy and utilities, transportation and logistics, media and entertainment, and others. The banking, financial services, and insurance segment held the largest market revenue share of 25.4% in 2024, driven by its increasing reliance on augmented analytics for real-time decision-making, fraud detection, risk assessment, and regulatory compliance. Financial institutions leverage AI-driven insights to streamline processes such as credit scoring and market analysis.

The healthcare and life Sciences segment is anticipated to experience the fastest growth rate of 30.2% from 2025 to 2032. This growth is fueled by the rising adoption of augmented analytics to improve patient outcomes, streamline drug discovery, and enhance diagnostics through predictive analytics and data-driven insights, addressing the sector’s need for optimized care and operational efficiency.

Augmented Analytics Market Regional Analysis

- North America dominated the augmented analytics market with a revenue share of 42.3% in 2024, driven by early adoption of AI technologies, robust technological infrastructure, and the presence of leading market players

- Consumers and businesses prioritize augmented analytics for enhancing data-driven decision-making, improving operational efficiency, and uncovering actionable insights, particularly in regions with advanced digital ecosystems

- Growth is supported by advancements in machine learning, natural language processing, and automated data preparation technologies, alongside rising adoption in both large enterprises and small to medium-sized enterprises (SMEs) across cloud and on-premise deployments

U.S. Augmented Analytics Market Insight

The U.S. augmented analytics market captured the largest revenue share of 88.6% in 2024 within North America, fueled by strong demand for AI-driven analytics solutions and growing awareness of their benefits in real-time decision-making and operational efficiency. The trend towards self-service analytics and increasing regulations promoting data privacy and security further boost market expansion. Businesses’ growing incorporation of augmented analytics in business intelligence platforms complements adoption across industries such as banking, financial services, and insurance (BFSI), healthcare, and retail, creating a diverse product ecosystem.

Europe Augmented Analytics Market Insight

The Europe augmented analytics market is expected to witness significant growth, supported by regulatory emphasis on digital transformation and ethical AI adoption. Businesses seek analytics solutions that enhance decision-making while ensuring compliance with data privacy regulations. The growth is prominent in both large enterprises and SMEs, with countries such as Germany and the U.K. showing significant uptake due to rising investments in AI and increasing urban digitalization.

U.K. Augmented Analytics Market Insight

The U.K. market for augmented analytics is expected to witness rapid growth, driven by demand for improved operational efficiency and data-driven insights in urban and industrial settings. Increased interest in self-service analytics and rising awareness of predictive analytics benefits encourage adoption. Evolving data protection regulations, such as those aligned with the EU Digital Strategy, influence business choices, balancing analytics capabilities with compliance.

Germany Augmented Analytics Market Insight

Germany is expected to witness a high growth rate in augmented analytics, attributed to its advanced technological infrastructure and strong focus on data-driven efficiency in industries such as manufacturing, BFSI, and healthcare. German businesses prefer AI-powered analytics solutions that enhance decision-making and contribute to operational optimization. The integration of these solutions in enterprise systems and aftermarket analytics tools supports sustained market growth

Asia-Pacific Augmented Analytics Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding digital transformation, rising investments in AI, and increasing data volumes in countries such as China, India, and Japan. Growing awareness of predictive analytics, automated insights, and data visualization is boosting demand. Government initiatives promoting AI adoption and data-driven governance further encourage the use of advanced analytics solutions across cloud and on-premise deployments.

Japan Augmented Analytics Market Insight

Japan’s augmented analytics market is expected to witness rapid growth due to strong consumer and business preference for high-quality, AI-driven analytics solutions that enhance decision-making and operational efficiency. The presence of major technology providers and integration of analytics in enterprise systems accelerate market penetration. Rising interest in self-service analytics and cloud-based solutions also contributes to growth.

China Augmented Analytics Market Insight

China holds the largest share of the Asia-Pacific augmented analytics market, propelled by rapid digitalization, increasing enterprise data volumes, and growing demand for AI-driven insights. The country’s expanding tech-savvy population and focus on smart business solutions support the adoption of advanced analytics. Strong domestic technological capabilities and competitive pricing enhance market accessibility across industries such as retail, telecom, and manufacturing.

Augmented Analytics Market Share

The augmented analytics industry is primarily led by well-established companies, including:

- Salesforce (U.S.)

- SAP SE (Germany)

- IBM Corporation (U.S.)

- Microsoft (U.S.)

- Oracle (U.S.)

- Tableau Software (U.S.)

- MicroStrategy Incorporated (U.S.)

- SAS Institute Inc. (U.S.)

- QlikTech (Qlik) (Sweden)

- TIBCO Software Inc. (U.S.)

- Sisense Inc. (U.S.)

- Yellowfin International (Australia)

- ThoughtSpot Inc. (U.S.)

- Domo, Inc. (U.S.)

What are the Recent Developments in Global Augmented Analytics Market?

- In July 2024, Qlik introduced Qlik Talend Cloud, a powerful integrated solution designed to enhance AI adoption at scale. This platform combines advanced AI capabilities with trusted data foundations, ensuring seamless and secure implementation for enterprises. By integrating AI-augmented data pipelines, Qlik Talend Cloud sets a new standard in data quality and reliability, helping businesses transform raw data into strategic assets. The solution supports flexible deployment and caters to various user profiles, making it a valuable tool for modern enterprises

- In May 2024, Oracle and Accenture announced a strategic partnership to accelerate the adoption of generative AI, focusing on financial transformation. This collaboration aims to equip Chief Financial Officers (CFOs) with AI-powered financial planning and analysis tools, enhancing decision-making and operational efficiency. Leveraging Oracle Cloud Infrastructure (OCI) Generative AI, the initiative enables real-time data analysis, dynamic scenario planning, and procurement spend optimization. By integrating AI-driven insights, the partnership supports businesses in achieving sustainable growth and innovation

- In May 2024, IBM introduced major updates to its Watson X platform, enhancing AI development and data analytics. The company released a family of Granite models as open-source, making advanced AI more accessible and customizable. Additionally, new generative AI-powered data products were unveiled to optimize enterprise workflows and improve decision-making. These innovations reflect IBM’s commitment to fostering open AI ecosystems and driving efficiency in business applications

- In April 2024, Cloud Software Group, Inc. and Microsoft announced an eight-year strategic partnership, committing USD 1.65 billion to advance cloud and AI solutions. This collaboration strengthens Microsoft's cloud infrastructure and generative AI capabilities, aiming to deliver transformative technologies to over 100 million users. The alliance enhances Citrix’s role as a preferred Microsoft Azure partner, supporting enterprise desktop services and AI-driven innovations. By integrating cutting-edge data analytics and AI tools, the partnership accelerates digital transformation across industries

- In September 2023, Oracle introduced advanced AI-powered enhancements to its Oracle Analytics Cloud, revolutionizing data-driven decision-making. These updates include augmented analytics and generative-AI assistants, enabling organizations to interact with data more intuitively. Leveraging Oracle Cloud Infrastructure (OCI) Generative AI, the new capabilities help users conduct sophisticated analysis efficiently, without relying on data scientists or IT teams. Features such as AI-powered document understanding and contextual insights further streamline analytics workflows. This innovation aligns with Oracle’s vision for accessible and intelligent data solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.