Global Australia And Us Microscopes Slides Market

Market Size in USD Billion

CAGR :

%

USD

1.11 Billion

USD

1.70 Billion

2024

2032

USD

1.11 Billion

USD

1.70 Billion

2024

2032

| 2025 –2032 | |

| USD 1.11 Billion | |

| USD 1.70 Billion | |

|

|

|

|

Microscope Slides Market Size

- The Global Microscope Slides Market, along with the Australia and U.S. Microscope Slides Markets, is projected to reach USD 1.70 billion, USD 28.20 million, and USD 468.05 million respectively by 2032, from USD 1.11 billion, USD 17.66 million, and USD 298.87 million in 2024, growing at a CAGR of 5.6%, 6.1%, and 5.9% respectively during the forecast period

- The growth is driven by the increasing adoption of microscope slides across industries such as healthcare, biotechnology, and research laboratories, fueled by the demand for advanced diagnostic tools, medical research, and quality control in clinical settings.

- The integration of advanced materials and coatings in microscope slides, along with innovations in slide design for enhanced clarity and durability, is further propelling market expansion, particularly in automated microscopy systems and high-throughput screening applications.

Microscope Slides Market Analysis

- Microscope slides are specialized tools designed to hold specimens for examination under microscopes, enabling precise observation and analysis in medical diagnostics, biological research, and quality control. These slides are critical in industries such as healthcare, biotechnology, pharmaceuticals, and academic research, ensuring accurate diagnostics, scientific discovery, and compliance with regulatory standards.

- The growing demand for microscope slides is driven by their ability to provide high-clarity and reliable platforms for sample analysis in advanced laboratory settings, supported by innovations in slide materials, such as low-autofluorescence glass and specialized coatings. The Global, Australia & U.S. push for automation in diagnostics, driven by advancements in digital pathology and high-throughput screening, coupled with increasing research activities in life sciences, is significantly boosting the adoption of microscope slides worldwide.

- North America dominated the Global, Australia & U.S. microscope slides market with a commanding revenue share of 35.26% in 2024, driven by its advanced healthcare infrastructure, significant investments in biomedical research, and high adoption rates in critical sectors like clinical diagnostics and biotechnology. The United States, in particular, has emerged as a leader due to its robust research ecosystem and supportive government initiatives promoting healthcare innovation and precision medicine.

- The Asia-Pacific region is anticipated to experience the fastest growth rate, with a projected CAGR of 6.3% from 2025 to 2032, propelled by rapid expansion in healthcare infrastructure, increasing research activities, and government-led initiatives to advance medical and biotechnology sectors in countries such as China, India, and Japan. The region’s focus on modernizing laboratories and expanding access to healthcare is further driving demand for microscope slides in diagnostic and research applications.

- Among product types, the standard glass microscope slides segment held the largest market share of 59.92% in 2024, valued at USD 0.66 billion, attributed to its widespread use in routine diagnostics and research due to its cost-effectiveness, durability, and compatibility with various staining and imaging techniques.

Report Scope and Microscope Slides Market Segmentation

|

Attributes |

Microscope Slides Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe Asia-Pacific

Middle East and Africa South America |

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Microscope Slides Market Trends

“Rising demand from precision medicine initiatives”

- The increasing focus on precision medicine is creating a substantial demand for advanced microscopic slides capable of supporting detailed cellular and molecular analysis. As healthcare providers move towards personalized treatment strategies, there is a growing need for high-resolution slides that can facilitate accurate identification of biomarkers, genetic mutations, and cellular abnormalities.

- These specialized slides enable more precise diagnostics, which are essential for developing targeted therapies and improving patient outcomes. Consequently, this trend is expected to drive innovation and growth within the microscopic slides market, as manufacturers develop new products to meet the evolving requirements of precision medicine.

For instance,

- In October 2020, NCBI stated that Advances in precision medicine manifest into tangible benefits, such as early detection of disease and designing personalized treatments are becoming more commonplace in health care. The power of precision medicine to personalize care is enabled by several data collection and analytics technologies

- In September 2024, according to the research published by International Journal of Pharmaceutical Investigation, Precision medicine is a strategy that offers tailored treatment to patients for particular diseases by considering their genetic, phenotypic, and psychological characteristics, ultimately significantly improving patient care. However, its implementation involves numerous ethical considerations, and it also necessitates the adoption of advanced methodologies to ensure its accurate and effective application.

- Moreover, the integration of innovative slide technologies with cutting-edge diagnostic methods such as immunohistochemistry, fluorescence in situ hybridization (FISH), and molecular profiling opens up new avenues for market expansion.

- These advanced slides allow clinicians and researchers to conduct comprehensive analyses at the cellular level, accelerating diagnosis and treatment decisions. As the healthcare industry continues to prioritize personalized medicine, the demand for sophisticated microscopic slides that support these advanced techniques will increase, acting as a key growth driver for the Global, Australia & U.S. market.

Microscope Slides Market Dynamics

Driver

“RISING BURDEN OF CHRONIC DISEASES ELEVATING DIAGNOSTIC NEEDS”

- Increasing incidence of chronic diseases has led to a higher demand for accurate and early diagnostic solutions, which directly impacts the growth of the microscopy slides market. Healthcare providers and laboratories rely heavily on microscopy slides to examine tissue samples, blood smears, and cellular specimens, enabling precise identification of abnormalities and aiding in timely diagnosis.

- As the number of patients affected by chronic conditions rises, there is a corresponding need for more diagnostic tests, thereby boosting the consumption of high-quality microscopy slides across hospitals, clinics, and diagnostic laboratories.

For Instance,

- In February 2024, National Center for Chronic Disease Prevention and Health Promotion stated that an increasing proportion of people in America are dealing with multiple chronic conditions; 42% have 2 or more, and 12% have at least 5. About 90% of the annual USD 4.1 trillion health care expenditure is attributed to managing and treating chronic diseases and mental health conditions. This heightened prevalence and the substantial healthcare expenditure on managing chronic diseases are expected to further accelerate demand for microscopy slides, reinforcing their critical role in diagnosis and research

- In March 2025, as per UCLA Health, the prevalence of chronic conditions has risen to unprecedented levels over the past twenty years, with nearly 1-in-3 young people estimated to now be living with pediatric onset conditions that significantly affect their lives. This alarming rise in chronic conditions, including pediatric-onset illnesses affecting a significant portion of the population, will further propel the demand for advanced microscopy slides to support diagnosis and research efforts worldwide

- Additionally, the surge in chronic disease cases encourages extensive research and development activities aimed at understanding disease mechanisms and developing targeted treatments. These research endeavors often depend on microscopy techniques that utilize specialized slides for sample preparation and analysis.

- Consequently, the growing burden of chronic health issues not only elevates diagnostic testing but also stimulates demand for advanced, disease-specific slides, further propelling market growth through increased adoption in healthcare and research settings.

Restraint/Challenge

“HIGH COST OF ADVANCED SLIDES AND IMAGING EQUIPMENT”

- The expensive nature of advanced microscopy slides and the sophisticated equipment required for their use can limit widespread adoption among laboratories, research institutions, and healthcare facilities, particularly in emerging markets or organizations with constrained budgets.

- This financial barrier may lead many laboratories to rely on traditional, less costly slides, thereby slowing the overall growth and technological advancement within the market. The high initial investment for cutting-edge slides and compatible systems can discourage smaller or resource-limited organizations from upgrading their microscopy setups, ultimately restricting market expansion.

For Instance

- In July 2022, as per John Wiley & Sons, Inc, the lab-based microscopes are expensive and unwieldy pieces of equipment, which are normally maintained in special areas for use. A decent microscope warrants special attention owing to its complexity and cost. These expensive and unwieldy instruments require specialized maintenance and storage, limiting widespread adoption and accessibility. Consequently, the high equipment costs may hinder the integration of microscopy slides in certain healthcare and research settings

- In January 2023, Motic Microscopes states that these 1.5H coverslips cost about $100\10,000 but prices from different companies can vary by more than tenfold. This significant price variation can limit adoption and accessibility, especially for smaller laboratories or institutions with budget constraints, thereby hindering market growth. Additionally, the overall expenses associated with high-quality coverslips could discourage widespread usage and investment in advanced microscopy solutions

- Additionally, the ongoing costs associated with maintenance, calibration, and the need for specialized training to operate advanced microscopy systems can further deter organizations from investing in these technologies. These recurring expenses increase the total cost of ownership, making it less feasible for some end-users to adopt the latest slide technologies.

- As a result, the high cost of advanced slides and equipment acts as a significant barrier, limiting the pace at which the market can grow and hindering the full integration of innovative microscopy solutions across diverse healthcare and research settings.

Microscope Slides Market Scope

The microscope slides market is segmented into categorized into six notable segments which are based on the product type, material, coating, application, end user and distribution channel.

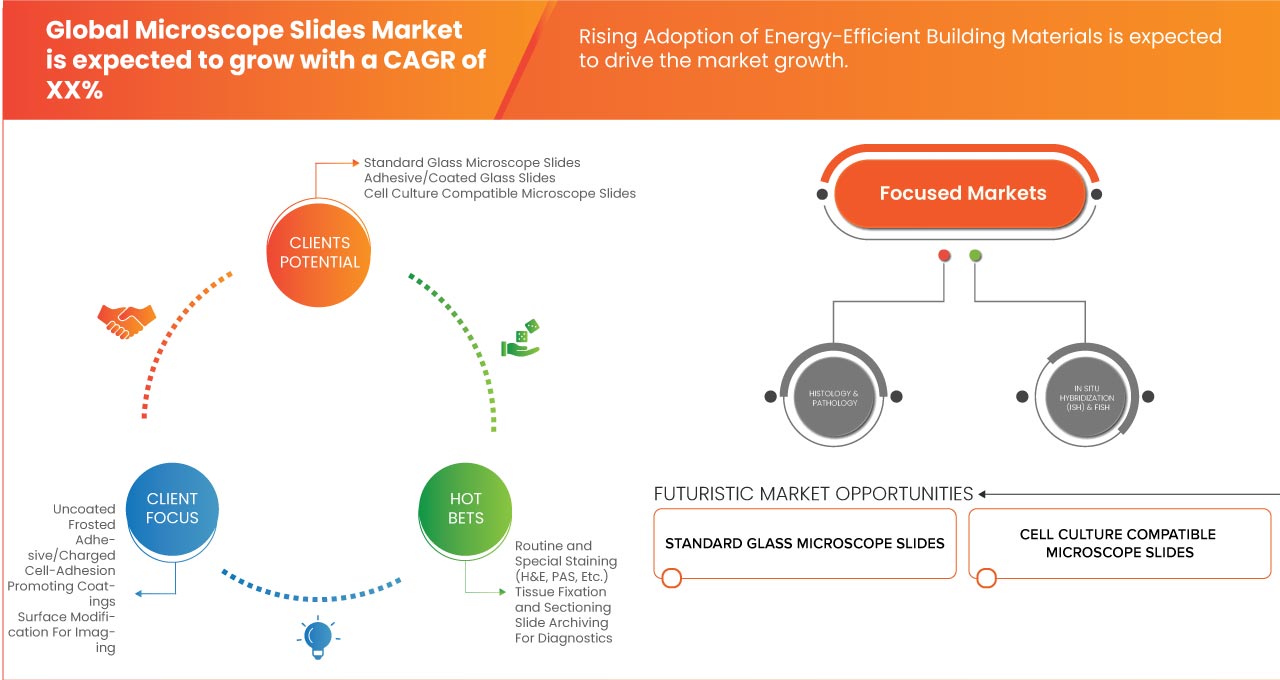

- By Product Type

On the basis of product type, the Microscope Slides market is segmented into Standard Glass Microscope Slides, Adhesive/Coated Glass Slides, Cell Culture Compatible Microscope Slides. The Standard Glass Microscope Slides segment dominates the market with a commanding revenue share of 59.92% in 2024, valued at USD 0.66 billion, driven by its their cost-effectiveness, reliability, and widespread use in research and clinical applications. Their proven performance and consistent quality make them the preferred choice across global, Australian, and U.S. markets.

The Cell Culture Compatible Microscope Slides segment is anticipated to witness the fastest CAGR of 6.3% from 2025 to 2032, This growth is primarily driven by the increasing demand for high-precision tools in applications requiring accurate observation and analysis of cell cultures, which are crucial in areas such as biopharmaceutical production, drug discovery, and regenerative medicine. The ability of these slides to provide an optimal environment for cell growth and imaging under microscopic conditions fuels their expanding adoption.

- By Material Type

By Material On the basis of material, the Global, Australia & U.S. microscope slides market is segmented into soda lime glass and borosilicate glass. The soda lime glass segment accounted for the largest market revenue share of 74.90% in 2024, driven by its affordability and widespread use in clinical diagnostics and educational settings.

The soda lime glass segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by its superior durability, thermal resistance, and increasing adoption in advanced research applications requiring high-clarity imaging.

- By Coating

On the basis of coating, the Global, Australia & U.S. microscope slides market is segmented into uncoated, frosted, adhesive/charged, cell-adhesion promoting coatings, and surface modification for imaging. The uncoated segment held the largest market share in 2024, driven by its cost-effectiveness and broad applicability in routine histology and pathology applications.

The Surface Modification for Imaging segment is expected to witness the fastest CAGR from 2025 to 2032, attributed to its growing use in immunohistochemistry and fluorescence microscopy, where enhanced sample adhesion and reduced background noise are critical for high-quality imaging.

- By Application

On the basis of application, the Global, Australia & U.S. microscope slides market is segmented into histology & pathology, immunohistochemistry (IHC), in situ hybridization (ISH) & FISH, cell culture & analysis, and fluorescence microscopy & confocal imaging. The histology & pathology segment dominated the market with a significant revenue share of 38.02% in 2024, driven by the high demand for microscope slides in clinical diagnostics and cancer research.

The fluorescence microscopy & confocal imaging segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by increasing investments in advanced imaging technologies and their growing adoption in life sciences research.

- By End-User

On the basis of end-user, the Global, Australia & U.S. microscope slides market is segmented into clinical pathology labs, hospitals & diagnostic centers, academic & research institutions, pharmaceutical & biotechnology companies, contract research organizations (CROs), and cell and tissue culture facilities. The clinical pathology labs segment held the largest market revenue share in 2024, driven by the critical role of microscope slides in diagnostic workflows and disease detection.

The Cell and Tissue Culture Facilities companies segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by the increasing focus on drug discovery and development, requiring advanced microscopy for cell-based assays and tissue analysis.

Microscope Slides Market Regional Analysis

North America

North America dominated the Global, Australia & U.S. microscope slides market with a revenue share of 35.26% in 2024, driven by its advanced healthcare infrastructure, stringent regulatory standards, and high adoption rates in key sectors such as clinical diagnostics, biotechnology, and academic research. The region’s robust research ecosystem, coupled with significant investments in medical innovation and digital pathology, supports the widespread use of microscope slides. The histology & pathology segment accounted for the largest application share of 38.02% in 2024, driven by the need for precise sample analysis in cancer diagnostics and medical research. The cell culture & analysis segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing investments in biotechnology and high-throughput screening initiatives across the region.

U.S. Microscope Slides Market Insight

The United States captured the largest revenue share of 76.11% within North America in 2024, driven by its leadership in medical diagnostics, biotechnology, and research infrastructure development. The U.S. benefits from a robust healthcare and research base, significant government funding for biomedical projects, and the presence of leading microscope slides manufacturers like Thermo Fisher Scientific and Corning Incorporated. The National Institutes of Health (NIH) projects continued growth in biomedical research funding, significantly boosting demand for microscope slides in applications like histology and cell culture. The growing adoption of advanced microscopy technologies, such as fluorescence and confocal imaging, for real-time analysis and drug discovery further propels market growth in the U.S.

Asia-Pacific Microscope Slides Market Insight

The Asia-Pacific microscope slides market is poised to grow at the fastest CAGR of approximately 6.3% during the forecast period of 2025 to 2032, driven by rapid expansion in healthcare infrastructure, urbanization, and government-led initiatives to advance medical and biotechnology research in countries such as China, India, and Japan. The region’s market, valued at USD 0.24 billion in 2024, is expected to reach USD 0.39 billion by 2032, propelled by the growing adoption of microscope slides in clinical diagnostics, academic research, and pharmaceutical development. Government initiatives like India’s National Health Mission and China’s 14th Five-Year Plan are driving investments in healthcare and research infrastructure, boosting demand for advanced microscope slides.

Australia Microscope Slides Market Insight

The Australia microscope slides market is gaining momentum due to the country’s advanced biotechnology and healthcare sectors, coupled with a strong focus on medical research and diagnostic innovation. The integration of advanced microscopy technologies in slides is enhancing their adoption in research institutions, clinical labs, and pharmaceutical applications. Australia’s focus on precision medicine and cancer research is driving demand for microscope slides in applications like immunohistochemistry and in situ hybridization. The presence of leading manufacturers like Nikon Corporation and Olympus Corporation further supports market growth.

Microscope Slides Market Share

- The Microscope Slides industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Leica Biosystems Nussloch GmbH (U.S.)

- Corning Incorporated (U.S.)

- Paul Marienfeld GmbH & Co. KG (Germany)

- Matsunami Glass Ind.,Ltd. (Japan)

- Globe Scientific Inc. (U.S.)

- DVK Life Sciences (Germany)

- Citotest Labware Manufacturing Co.,Ltd. (China)

- Avantor, Inc. (U.S.)

- Cardinal Health (U.S.)

- Valdemar Knittel Glasbearbeitungs GmbH (Germany)

- United Scientific Supplies, Inc. (U.S.)

- Chemglass. (U.S.)

- MUTO PURE CHEMICALS CO., LTD (Japan)

- Ted Pella, Inc. (U.S.)

- Heathrow Scientific (U.S.)

- Labcon North America (U.S.)

- Propper Manufacturing Co., Inc. (U.S.)

- C&A Scientific. (U.S.)

- Jiangsu Huida Medical Instruments Co., (China)

- Semadeni AG (Switzerland)

- Stellar Scientific (U.S.)

- Carolina Biological Supply Company (U.S.)

- SLMP, LLC. (U.S.)

- Thomas Scientific (U.S.)

- Chargen Life Sciences LLP (India)

Latest Developments in Global, Australia & U.S. Microscope Slides Market

- In June 2022, Recent medical advancements include the Abbott Volt PFA System, a new therapy for heart rhythm disorders like atrial fibrillation. It uses pulsed electrical fields for precise tissue targeting and improved catheter contact. Additionally, Falcon culture slides offer a simplified method for in situ cell analysis, allowing direct cell culture and staining on glass slides within a removable plastic chamber, preserving the cell monolayer.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL, AUSTRALIA & U.S. MICROSCOPE SLIDES MARKET

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 MICRO AND MACRO ECONOMIC FACTORS

4.4 PENETRATION AND GROWTH PROSPECT MAPPING

4.5 KEY PRICING STRATEGIES

4.6 COST ANALYSIS BREAKDOWN

4.7 TECHNOLOGY ROADMAP

4.8 TARIFFS & IMPACT ON THE MARKET OF GLOBAL MICROSCOPES SLIDES

4.9 REIMBURSEMENT FRAMEWORK

4.1 OPPUTUNITY MAP ANALYSIS

4.11 SUPPLY CHAIN ECOSYSTEM

4.12 HEALTHCARE ECONOMY

5 REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING BURDEN OF CHRONIC DISEASES ELEVATING DIAGNOSTIC NEEDS

6.1.2 EXPANSION OF MICROSCOPY IN EDUCATION AND ACADEMIC RESEARCH

6.1.3 INCREASING DEMAND FOR BIOMEDICAL AND CLINICAL RESEARCH

6.1.4 REGULATORY STANDARDS REINFORCING QUALITY AND ADOPTION

6.2 RESTRAINTS

6.2.1 HIGH COST OF ADVANCED SLIDES AND IMAGING EQUIPMENT

6.2.2 LIMITED INTEROPERABILITY AND COMPATIBILITY ISSUES WITH SLIDES

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL ADVANCEMENTS DRIVING INNOVATION

6.3.2 STRATEGIC COLLABORATIONS BETWEEN PLAYERS ENHANCING PRODUCT DEVELOPMENT

6.3.3 RISING DEMAND FROM PRECISION MEDICINE INITIATIVES

6.4 CHALLENGES

6.4.1 ENVIRONMENTAL AND WASTE DISPOSAL CONCERNS

6.4.2 COMPETITION FROM ALTERNATIVE TECHNOLOGIES

7 GLOBAL MICROSCOPE SLIDES MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 STANDARD GLASS MICROSCOPE SLIDES

7.2.1 PLAIN SLIDES

7.2.2 FROSTED END SLIDES

7.2.3 COLOR-CODED EDGE SLIDES

7.3 ADHESIVE/COATED GLASS SLIDES

7.3.1 POLY-L-LYSINE COATED SLIDES

7.3.2 CHARGED SLIDES

7.3.3 AMINO SILANE COATED SLIDES

7.3.4 HYDROPHILIC/HYDROPHOBIC COATED SLIDES

7.4 CELL CULTURE COMPATIBLE MICROSCOPE SLIDES

7.4.1 CHAMBER SLIDES

7.4.2 TISSUE CULTURE-TREATED SLIDES

7.4.3 ECM-COATED SLIDES

8 GLOBAL MICROSCOPE SLIDES MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 SODA LIME GLASS

8.3 BOROSILICATE GLASS

9 GLOBAL MICROSCOPE SLIDES MARKET, BY COATING

9.1 OVERVIEW

9.2 UNCOATED

9.3 FROSTED

9.4 ADHESIVE/CHARGED

9.4.1 POLY-L-LYSINE

9.4.2 AMINO SILANE

9.4.3 ORGAN SILANE

9.5 CELL-ADHESION PROMOTING COATINGS

9.5.1 COLLAGEN

9.5.2 FIBRONECTIN

9.5.3 LAMININ

9.5.4 OTHERS

9.6 SURFACE MODIFICATION FOR IMAGING

9.6.1 HYDROPHOBIC

9.6.2 HYDROPHILIC

10 GLOBAL MICROSCOPE SLIDES MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 HISTOLOGY & PATHOLOGY

10.2.1 ROUTINE AND SPECIAL STAINING (H&E, PAS, ETC.)

10.2.2 TISSUE FIXATION AND SECTIONING

10.2.3 SLIDE ARCHIVING FOR DIAGNOSTICS

10.3 IMMUNOHISTOCHEMISTRY (IHC)

10.4 IN SITU HYBRIDIZATION (ISH) & FISH

10.5 CELL CULTURE & ANALYSIS

10.5.1 2D CELL CULTURING ON SLIDE SURFACE

10.5.2 CELL IMAGING (LIVE/DEAD ASSAYS)

10.5.3 CELL PROLIFERATION, ADHESION, DIFFERENTIATION STUDIES

10.6 FLUORESCENCE MICROSCOPY & CONFOCAL IMAGING

11 GLOBAL MICROSCOPE SLIDES MARKET, BY END USER

11.1 OVERVIEW

11.2 CLINICAL PATHOLOGY LABS

11.3 HOSPITALS & DIAGNOSTIC CENTERS

11.4 ACADEMIC & RESEARCH INSTITUTIONS

11.5 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

11.6 CONTRACT RESEARCH ORGANIZATIONS (CROS)

11.7 CELL AND TISSUE CULTURE FACILITIES

12 GLOBAL MICROSCOPE SLIDES MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT SALES

12.3 LABORATORY SUPPLY DISTRIBUTORS

12.4 E-COMMERCE & ONLINE SCIENTIFIC RETAILERS

12.5 CONTRACTUAL PROCUREMENT CHANNELS

13 AUSTRALIA MICROSCOPE SLIDES MARKET, BY PRODUCT TYPE

13.1 OVERVIEW

13.2 STANDARD GLASS MICROSCOPE SLIDES

13.2.1 PLAIN SLIDES

13.2.2 FROSTED END SLIDES

13.2.3 COLOR-CODED EDGE SLIDES

13.3 ADHESIVE/COATED GLASS SLIDES

13.3.1 POLY-L-LYSINE COATED SLIDES

13.3.2 CHARGED SLIDES

13.3.3 AMINO SILANE COATED SLIDES

13.3.4 HYDROPHILIC/HYDROPHOBIC COATED SLIDES

13.4 CELL CULTURE COMPATIBLE MICROSCOPE SLIDES

13.4.1 CHAMBER SLIDES

13.4.2 TISSUE CULTURE-TREATED SLIDES

13.4.3 ECM-COATED SLIDES

14 AUSTRALIA MICROSCOPE SLIDES MARKET, BY MATERIAL

14.1 SODA LIME GLASS

14.2 BOROSILICATE GLASS

15 AUSTRALIA MICROSCOPE SLIDES MARKET, BY COATING

15.1 OVERVIEW

15.2 UNCOATED

15.3 FROSTED

15.4 ADHESIVE/CHARGED

15.4.1 POLY-L-LYSINE

15.4.2 AMINO SILANE

15.4.3 ORGAN SILANE

15.5 CELL-ADHESION PROMOTING COATINGS

15.5.1 COLLAGEN

15.5.2 FIBRONECTIN

15.5.3 LAMININ

15.5.4 OTHERS

15.6 SURFACE MODIFICATION FOR IMAGING

15.6.1 HYDROPHOBIC

15.6.2 HYDROPHILIC

16 AUSTRALIA MICROSCOPE SLIDES MARKET, BY APPLICATION

16.1 OVERVIEW

16.2 HISTOLOGY & PATHOLOGY

16.2.1 ROUTINE AND SPECIAL STAINING (H&E, PAS, ETC.)

16.2.2 TISSUE FIXATION AND SECTIONING

16.2.3 SLIDE ARCHIVING FOR DIAGNOSTICS

16.3 IMMUNOHISTOCHEMISTRY (IHC)

16.4 IN SITU HYBRIDIZATION (ISH) & FISH

16.5 CELL CULTURE & ANALYSIS

16.5.1 2D CELL CULTURING ON SLIDE SURFACE

16.5.2 CELL IMAGING (LIVE/DEAD ASSAYS)

16.5.3 CELL PROLIFERATION, ADHESION, DIFFERENTIATION STUDIES

16.6 FLUORESCENCE MICROSCOPY & CONFOCAL IMAGING

17 AUSTRALIA MICROSCOPE SLIDES MARKET, BY END USER

17.1 OVERVIEW

17.2 CLINICAL PATHOLOGY LABS

17.3 HOSPITALS & DIAGNOSTIC CENTERS

17.4 ACADEMIC & RESEARCH INSTITUTIONS

17.5 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

17.6 CONTRACT RESEARCH ORGANIZATIONS (CROS)

17.7 CELL AND TISSUE CULTURE FACILITIES

18 AUSTRALIA MICROSCOPE SLIDES MARKET, BY DISTRIBUTION CHANNEL

18.1 OVERVIEW

18.2 DIRECT SALES

18.3 LABORATORY SUPPLY DISTRIBUTORS

18.4 E-COMMERCE & ONLINE SCIENTIFIC RETAILERS

18.5 CONTRACTUAL PROCUREMENT CHANNELS

19 U.S. MICROSCOPE SLIDES MARKET, BY PRODUCT TYPE

19.1 OVERVIEW

19.2 STANDARD GLASS MICROSCOPE SLIDES

19.2.1 PLAIN SLIDES

19.2.2 FROSTED END SLIDES

19.2.3 COLOR-CODED EDGE SLIDES

19.3 ADHESIVE/COATED GLASS SLIDES

19.3.1 POLY-L-LYSINE COATED SLIDES

19.3.2 CHARGED SLIDES

19.3.3 AMINO SILANE COATED SLIDES

19.3.4 HYDROPHILIC/HYDROPHOBIC COATED SLIDES

19.3.5 CELL CULTURE COMPATIBLE MICROSCOPE SLIDES

19.3.6 CHAMBER SLIDES

19.3.7 TISSUE CULTURE-TREATED SLIDES

19.3.8 ECM-COATED SLIDES

20 U.S. MICROSCOPE SLIDES MARKET, BY MATERIAL

20.1 OVERVIEW

20.2 SODA LIME GLASS

20.3 BOROSILICATE GLASS

21 U.S. MICROSCOPE SLIDES MARKET, BY COATING

21.1 OVERVIEW

21.2 UNCOATED

21.3 FROSTED

21.4 ADHESIVE/CHARGED

21.4.1 POLY-L-LYSINE

21.4.2 AMINO SILANE

21.4.3 ORGAN SILANE

21.5 CELL-ADHESION PROMOTING COATINGS

21.5.1 COLLAGEN

21.5.2 FIBRONECTIN

21.5.3 LAMININ

21.5.4 OTHERS

21.6 SURFACE MODIFICATION FOR IMAGING

21.6.1 HYDROPHOBIC

21.6.2 HYDROPHILIC

22 U.S. MICROSCOPE SLIDES MARKET, BY APPLICATION

22.1 OVERVIEW

22.2 HISTOLOGY & PATHOLOGY

22.2.1 ROUTINE AND SPECIAL STAINING (H&E, PAS, ETC.)

22.2.2 TISSUE FIXATION AND SECTIONING

22.2.3 SLIDE ARCHIVING FOR DIAGNOSTICS

22.3 IMMUNOHISTOCHEMISTRY (IHC)

22.4 IN SITU HYBRIDIZATION (ISH) & FISH

22.5 CELL CULTURE & ANALYSIS

22.5.1 CELL CULTURING ON SLIDE SURFACE

22.5.2 CELL IMAGING (LIVE/DEAD ASSAYS)

22.5.3 CELL PROLIFERATION, ADHESION, DIFFERENTIATION STUDIES

22.6 FLUORESCENCE MICROSCOPY & CONFOCAL IMAGING

23 U.S. MICROSCOPE SLIDES MARKET, BY END USER

23.1 OVERVIEW

23.2 CLINICAL PATHOLOGY LABS

23.3 HOSPITALS & DIAGNOSTIC CENTERS

23.4 ACADEMIC & RESEARCH INSTITUTIONS

23.5 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

23.6 CONTRACT RESEARCH ORGANIZATIONS (CROS)

23.7 CELL AND TISSUE CULTURE FACILITIES

24 U.S. MICROSCOPE SLIDES MARKET, BY DISTRIBUTION CHANNEL

24.1 OVERVIEW

24.2 DIRECT SALES

24.3 LABORATORY SUPPLY DISTRIBUTORS

24.4 E-COMMERCE & ONLINE SCIENTIFIC RETAILERS

24.5 CONTRACTUAL PROCUREMENT CHANNELS

25 GLOBAL, AUSTRALIA & U.S. MICROSCOPE SLIDES MARKET BY REGION

26 GLOBAL MICROSCOPE SLIDES MARKET, COMPANY LANDSCAPE

26.1 COMPANY SHARE ANALYSIS: GLOBAL

26.2 COMPANY SHARE ANALYSIS: U.S.

26.3 COMPANY SHARE ANALYSIS: AUSTRALIA

27 SWOT ANALYSIS

28 COMPANY PROFILE

28.1 THERMO FISHER SCIENTIFIC INC.

28.1.1 COMPANY SNAPSHOT

28.1.2 REVENUE ANALYSIS

28.1.3 COMPANY SHARE ANALYSIS

28.1.4 PRODUCT PORTFOLIO

28.1.5 RECENT DEVELOPMENTS

28.2 LEICA BIOSYSTEMS NUSSLOCH GMBH

28.2.1 COMPANY SNAPSHOT

28.2.2 COMPANY SHARE ANALYSIS

28.2.3 PRODUCT PORTFOLIO

28.2.4 RECENT DEVELOPMENT

28.3 CORNING INCORPORATED

28.3.1 COMPANY SNAPSHOT

28.3.2 REVENUE ANALYSIS

28.3.3 COMPANY SHARE ANALYSIS

28.3.4 PRODUCT PORTFOLIO

28.3.5 RECENT NEWS

28.4 CARDINAL

28.4.1 COMPANY SNAPSHOT

28.4.2 REVENUE ANALYSIS

28.4.3 COMPANY SHARE ANALYSIS

28.4.4 PRODUCT PORTFOLIO

28.4.5 RECENT DEVELOPMENT

28.5 AVANTOR, INC.

28.5.1 COMPANY SNAPSHOT

28.5.2 REVENUE ANALYSIS

28.5.3 COMPANY SHARE ANALYSIS

28.5.4 PRODUCT PORTFOLIO

28.5.5 RECENT DEVELOPMENT

28.6 C&A SCIENTIFIC

28.6.1 COMPANY SNAPSHOT

28.6.2 PRODUCT PORTFOLIO

28.6.3 RECENT DEVELOPMENT

28.7 CAROLINA BIOLOGICAL SUPPLY COMPANY

28.7.1 COMPANY SNAPSHOT

28.7.2 PRODUCT PORTFOLIO

28.7.3 RECENT DEVELOPMENT

28.8 CHARGEN LIFE SCIENCES

28.8.1 COMPANY SNAPSHOT

28.8.2 PRODUCT PORTFOLIO

28.8.3 RECENT DEVELOPMENT

28.9 CHEMGLASS ,

28.9.1 COMPANY SNAPSHOT

28.9.2 PRODUCT PORTFOLIO

28.9.3 RECENT DEVELOPMENT

28.1 CITOTEST LABWARE MANUFACTURING CO., LTD.

28.10.1 COMPANY SNAPSHOT

28.10.2 PRODUCT PORTFOLIO

28.10.3 RECENT DEVELOPMENT

28.11 DWK LIFE SCIENCES

28.11.1 COMPANY SNAPSHOT

28.11.2 PRODUCT PORTFOLIO

28.11.3 RECENT DEVELOPMENT

28.12 GLOBE SCIENTIFIC INC.

28.12.1 COMPANY SNAPSHOT

28.12.2 PRODUCT PORTFOLIO

28.12.3 RECENT DEVELOPMENT

28.13 HEATHROW SCIENTIFIC

28.13.1 COMPANY SNAPSHOT

28.13.2 PRODUCT PORTFOLIO

28.13.3 RECENT DEVELOPMENT

28.14 JIANGSU HUIDA MEDICAL INSTRUMENTS CO.,LTD

28.14.1 COMPANY SNAPSHOT

28.14.2 PRODUCT PORTFOLIO

28.14.3 RECENT DEVELOPMENT

28.15 LABCON NORTH AMERICA

28.15.1 COMPANY SNAPSHOT

28.15.2 PRODUCT PORTFOLIO

28.15.3 RECENT DEVELOPMENT

28.16 MATSUNAMI GLASS IND., LTD.

28.16.1 COMPANY SNAPSHOT

28.16.2 PRODUCT PORTFOLIO

28.16.3 RECENT DEVELOPMENT

28.17 MUTO PURE CHEMICALS CO., LTD

28.17.1 COMPANY SNAPSHOT

28.17.2 PRODUCT PORTFOLIO

28.17.3 RECENT DEVELOPMENT

28.18 PAUL MARIENFELD GMBH & CO. KG

28.18.1 COMPANY SNAPSHOT

28.18.2 PRODUCT PORTFOLIO

28.18.3 RECENT DEVELOPMENT

28.19 PROPPER MANUFACTURING CO., INC.

28.19.1 COMPANY SNAPSHOT

28.19.2 PRODUCT PORTFOLIO

28.19.3 RECENT DEVELOPMENT

28.2 SEMADENI AG

28.20.1 COMPANY SNAPSHOT

28.20.2 PRODUCT PORTFOLIO

28.20.3 RECENT DEVELOPMENT

28.21 SLMP, LLC.

28.21.1 COMPANY SNAPSHOT

28.21.2 PRODUCT PORTFOLIO

28.21.3 RECENT DEVELOPMENT

28.22 STELLAR SCIENTIFIC

28.22.1 COMPANY SNAPSHOT

28.22.2 PRODUCT PORTFOLIO

28.22.3 RECENT DEVELOPMENT

28.23 TED PELLA, INC.

28.23.1 COMPANY SNAPSHOT

28.23.2 PRODUCT PORTFOLIO

28.23.3 RECENT DEVELOPMENT

28.24 THOMAS SCIENTIFIC

28.24.1 COMPANY SNAPSHOT

28.24.2 PRODUCT PORTFOLIO

28.24.3 RECENT DEVELOPMENT

28.25 UNITED SCIENTIFIC SUPPLIES, INC.

28.25.1 COMPANY SNAPSHOT

28.25.2 PRODUCT PORTFOLIO

28.25.3 RECENT DEVELOPMENT

28.26 WALDEMAR KNITTEL GLASBEARBEITUNGS GMBH

28.26.1 COMPANY SNAPSHOT

28.26.2 PRODUCT PORTFOLIO

28.26.3 RECENT DEVELOPMENT

29 QUESTIONNAIRE

30 RELATED REPORTS

List of Table

TABLE 1 GLOBAL MICROSCOPE SLIDES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 GLOBAL STANDARD GLASS MICROSCOPE SLIDES IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 GLOBAL STANDARD GLASS MICROSCOPE SLIDES IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 GLOBAL ADHESIVE/COATED GLASS SLIDES IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 GLOBAL ADHESIVE/COATED GLASS SLIDES IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 GLOBAL CELL CULTURE COMPATIBLE MICROSCOPE SLIDES IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 GLOBAL CELL CULTURE COMPATIBLE MICROSCOPE SLIDES IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 GLOBAL MICROSCOPE SLIDES MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 9 GLOBAL SODA LIME GLASS IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 GLOBAL BOROSILICATE GLASS IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 GLOBAL MICROSCOPE SLIDES MARKET, BY COATING, 2018-2032 (USD THOUSAND)

TABLE 12 GLOBAL UNCOATED IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 GLOBAL FROSTED IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 GLOBAL ADHESIVE/CHARGED IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 GLOBAL ADHESIVE/CHARGED IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 GLOBAL CELL-ADHESION PROMOTING COATINGS IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 GLOBAL CELL-ADHESION PROMOTING COATINGS IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 GLOBAL SURFACE MODIFICATION FOR IMAGING IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 GLOBAL SURFACE MODIFICATION FOR IMAGING IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 GLOBAL MICROSCOPE SLIDES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 21 GLOBAL HISTOLOGY & PATHOLOGY IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 GLOBAL HISTOLOGY & PATHOLOGY IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 GLOBAL IMMUNOHISTOCHEMISTRY (IHC) IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 GLOBAL IN SITU HYBRIDIZATION (ISH) & FISH IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 GLOBAL CELL CULTURE & ANALYSIS IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 GLOBAL CELL CULTURE & ANALYSIS IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 GLOBAL FLUORESCENCE MICROSCOPY & CONFOCAL IMAGING IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 GLOBAL MICROSCOPE SLIDES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 29 GLOBAL CLINICAL PATHOLOGY LABS IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 GLOBAL HOSPITALS & DIAGNOSTIC CENTERS IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 GLOBAL ACADEMIC & RESEARCH INSTITUTIONS IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 GLOBAL PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 GLOBAL CONTRACT RESEARCH ORGANIZATIONS (CROS) IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 GLOBAL CELL AND TISSUE CULTURE FACILITIES IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 GLOBAL MICROSCOPE SLIDES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 36 GLOBAL DIRECT SALES IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 GLOBAL LABORATORY SUPPLY DISTRIBUTORS IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 GLOBAL E-COMMERCE & ONLINE SCIENTIFIC RETAILERS IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 GLOBAL CONTRACTUAL PROCUREMENT CHANNELS IN MICROSCOPE SLIDES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 AUSTRALIA MICROSCOPE SLIDES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 AUSTRALIA STANDARD GLASS MICROSCOPE SLIDES IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 AUSTRALIA ADHESIVE/COATED GLASS SLIDES IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 AUSTRALIA CELL CULTURE COMPATIBLE MICROSCOPE SLIDES IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 AUSTRALIA MICROSCOPE SLIDES MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 45 AUSTRALIA MICROSCOPE SLIDES MARKET, BY COATING, 2018-2032 (USD THOUSAND)

TABLE 46 AUSTRALIA ADHESIVE/CHARGED IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 AUSTRALIA CELL-ADHESION PROMOTING COATINGS IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 AUSTRALIA SURFACE MODIFICATION FOR IMAGING IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 AUSTRALIA MICROSCOPE SLIDES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 50 AUSTRALIA HISTOLOGY & PATHOLOGY IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 AUSTRALIA CELL CULTURE & ANALYSIS IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 AUSTRALIA MICROSCOPE SLIDES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 53 AUSTRALIA MICROSCOPE SLIDES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 54 U.S. MICROSCOPE SLIDES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 U.S. STANDARD GLASS MICROSCOPE SLIDES IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 U.S. ADHESIVE/COATED GLASS SLIDES IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 U.S. CELL CULTURE COMPATIBLE MICROSCOPE SLIDES IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 U.S. MICROSCOPE SLIDES MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 59 U.S. MICROSCOPE SLIDES MARKET, BY COATING, 2018-2032 (USD THOUSAND)

TABLE 60 U.S. ADHESIVE/CHARGED IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 U.S. CELL-ADHESION PROMOTING COATINGS IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 U.S. SURFACE MODIFICATION FOR IMAGING IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 U.S. MICROSCOPE SLIDES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 64 U.S. HISTOLOGY & PATHOLOGY IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 U.S. CELL CULTURE & ANALYSIS IN MICROSCOPE SLIDES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 U.S. MICROSCOPE SLIDES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 67 U.S. MICROSCOPE SLIDES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 GLOBAL, AUSTRALIA & U.S. MICROSCOPE SLIDES MARKET: SEGMENTATION

FIGURE 2 GLOBAL, AUSTRALIA & U.S. MICROSCOPE SLIDES MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL, AUSTRALIA & U.S. MICROSCOPE SLIDES MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL, AUSTRALIA & U.S. MICROSCOPE SLIDES MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL, AUSTRALIA & U.S. MICROSCOPE SLIDES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL, AUSTRALIA & U.S. MICROSCOPE SLIDES MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL, AUSTRALIA & U.S. MICROSCOPE SLIDES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GLOBAL, AUSTRALIA & U.S. MICROSCOPE SLIDES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL, AUSTRALIA & U.S. MICROSCOPE SLIDES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL, AUSTRALIA & U.S. MICROSCOPE SLIDES MARKET: MARKET END USER COVERAGE GRID

FIGURE 11 LINE CHART, BY PRODUCT TYPE (2024)

FIGURE 12 GLOBAL, AUSTRALIA & U.S. MICROSCOPE SLIDES MARKET: SEGMENTATION

FIGURE 13 GLOBAL, AUSTRALIA & U.S. MICROSCOPE SLIDES MARKET: EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 COMPANY EVALUATION QUADRANT

FIGURE 16 THREE SEGMENTS COMPOSE THE GLOBAL, AUSTRALIA & U.S. MICROSCOPE SLIDES MARKET, BY PRODUCT TYPE (2024)

FIGURE 17 RISING BURDEN OF CHRONIC DISEASES ELEVATING DIAGNOSTIC NEEDS IS EXPECTED TO DRIVE THE GLOBAL, AUSTRALIA & U.S. MICROSCOPE SLIDES MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 18 STANDARD GLASS MICROSCOPE SLIDES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL, AUSTRALIA & U.S. MICROSCOPE SLIDES MARKET IN 2025 & 2032

FIGURE 19 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR THE GLOBAL, AUSTRALIA & U.S. MICROSCOPE SLIDES MARKET IN 2025 & 2032

FIGURE 20 DROC ANALYSIS

FIGURE 21 GLOBAL MICROSCOPE SLIDES MARKET: BY PRODUCT TYPE, 2024

FIGURE 22 GLOBAL MICROSCOPE SLIDES MARKET: BY PRODUCT TYPE, 2025-2032 (USD THOUSAND)

FIGURE 23 GLOBAL MICROSCOPE SLIDES MARKET: BY PRODUCT TYPE, CAGR (2025-2032)

FIGURE 24 GLOBAL MICROSCOPE SLIDES MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 25 GLOBAL MICROSCOPE SLIDES MARKET: BY MATERIAL, 2024

FIGURE 26 GLOBAL MICROSCOPE SLIDES MARKET: BY MATERIAL, 2025-2032 (USD THOUSAND)

FIGURE 27 GLOBAL MICROSCOPE SLIDES MARKET: BY MATERIAL, CAGR (2025-2032)

FIGURE 28 GLOBAL MICROSCOPE SLIDES MARKET: BY MATERIAL, LIFELINE CURVE

FIGURE 29 GLOBAL MICROSCOPE SLIDES MARKET: BY COATING, 2024

FIGURE 30 GLOBAL MICROSCOPE SLIDES MARKET: BY COATING, 2025-2032 (USD THOUSAND)

FIGURE 31 GLOBAL MICROSCOPE SLIDES MARKET: BY COATING, CAGR (2025-2032)

FIGURE 32 GLOBAL MICROSCOPE SLIDES MARKET: BY COATING, LIFELINE CURVE

FIGURE 33 GLOBAL MICROSCOPE SLIDES MARKET: BY APPLICATION, 2024

FIGURE 34 GLOBAL MICROSCOPE SLIDES MARKET: BY APPLICATION, 2025-2032 (USD THOUSAND)

FIGURE 35 GLOBAL MICROSCOPE SLIDES MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 36 GLOBAL MICROSCOPE SLIDES MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 37 GLOBAL MICROSCOPE SLIDES MARKET: BY END USER, 2024

FIGURE 38 GLOBAL MICROSCOPE SLIDES MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 39 GLOBAL MICROSCOPE SLIDES MARKET: BY END USER, CAGR (2025-2032)

FIGURE 40 GLOBAL MICROSCOPE SLIDES MARKET: BY END USER, LIFELINE CURVE

FIGURE 41 GLOBAL MICROSCOPE SLIDES MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 42 GLOBAL MICROSCOPE SLIDES MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 43 GLOBAL MICROSCOPE SLIDES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 44 GLOBAL MICROSCOPE SLIDES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 45 GLOBAL, AUSTRALIA & U.S. MICROSCOPE SLIDES MARKET BY SNAPSHOTS

FIGURE 46 GLOBAL MICROSCOPE SLIDES MARKET: COMPANY SHARE 2024 (%)

FIGURE 47 U.S. MICROSCOPE SLIDES MARKET: COMPANY SHARE 2024 (%)

FIGURE 48 AUSTRALIA MICROSCOPE SLIDES MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.