Global Autism Therapy Market

Market Size in USD Billion

CAGR :

%

USD

2.33 Billion

USD

3.89 Billion

2024

2032

USD

2.33 Billion

USD

3.89 Billion

2024

2032

| 2025 –2032 | |

| USD 2.33 Billion | |

| USD 3.89 Billion | |

|

|

|

|

Autism Therapy Market Size

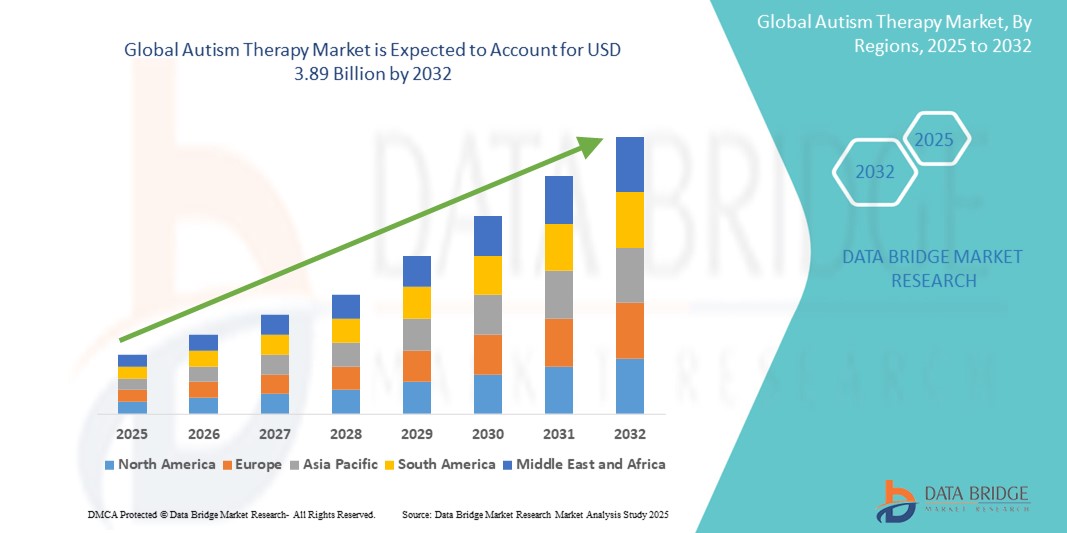

- The global autism therapy market size was valued at USD 2.33 billion in 2024 and is expected to reach USD 3.89 billion by 2032, at a CAGR of 6.60% during the forecast period

- The market growth is largely fuelled by the increasing prevalence of autism spectrum disorders, growing awareness among parents and caregivers, and rising demand for early intervention and personalized therapeutic solutions

- Technological advancements in digital therapeutics and the integration of artificial intelligence in therapy tools are further accelerating innovation and expanding access to effective treatment options

Autism Therapy Market Analysis

- The autism therapy market is experiencing steady growth with increasing demand for evidence-based therapies that support behavioural, communication, and social development in individuals with autism

- Rising adoption of advanced therapeutic approaches, including virtual platforms and interactive tools, is enhancing treatment accessibility and personalizing patient care across different age groups

- North America dominates the global autism therapy market with the largest revenue share of 57.5% in 2024. This is driven by high awareness of autism spectrum disorder (ASD) and established diagnostic pathways, along with significant healthcare expenditure and robust government and private funding for autism research and support services.

- Asia-Pacific is expected to be the fastest growing region in the autism therapy market during the forecast period due to increasing urbanization, rising disposable incomes, and technological advancements across key countries. This growth is also propelled by increasing awareness of ASD and improving healthcare infrastructure in the region.

- The child segment holds the largest share in the autism therapy market, primarily because autism spectrum disorder typically manifests during early childhood. Growing awareness among parents and healthcare providers has led to increased screening and diagnosis at younger ages, prompting earlier therapeutic intervention. Government-led initiatives, school-based programs, and awareness campaigns are further encouraging families to seek early support. Research continues to highlight the effectiveness of early therapy in improving communication, behaviour, and cognitive outcomes in children. As a result, there is rising demand for specialized child-focused therapies, including speech, occupational, and behavioural interventions. This segment continues to grow as both public and private sectors expand services tailored to young individuals.

Report Scope and Autism Therapy Market Segmentation

|

Attributes |

Autism Therapy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Autism Therapy Market Trends

“Integration of Digital Therapeutics and Telehealth in Autism Therapy”

- Digital therapy apps are being widely used to support behavior management and skill development in children with autism

- For instance, Mightier uses biofeedback video games to help children learn emotional regulation, while Cognoa offers early intervention tools through an AI-powered platform

- Telehealth platforms are bridging the gap for families in remote or underserved areas who lack access to in-person therapy

- These technologies offer flexibility by reducing travel and scheduling burdens, allowing families to receive consistent therapy from home

- Therapists can monitor progress and adjust treatment plans in real time, improving engagement and long-term outcomes

- As awareness and acceptance of virtual care increase, digital solutions are becoming essential components of autism therapy delivery

Autism Therapy Market Dynamics

Driver

“Rising Awareness and Early Diagnosis”

- Growing awareness of autism spectrum disorder is leading to earlier diagnosis and intervention, as more parents, educators, and healthcare providers recognize early signs and seek timely therapy

- For instance, global awareness campaigns by organizations such as Autism Speaks and the World Health Organization have emphasized early developmental screenings and reduced stigma

- Government and health programs are promoting routine childhood screenings, making early detection a standard part of pediatric care in many countries

- Advancements in diagnostic tools such as eye-tracking systems and artificial intelligence-powered applications are enabling faster, more accurate identification of autism

- For instance, tools such as the Cognoa early autism diagnostic app help identify developmental concerns in children before traditional clinical signs become clear

- The rise in early diagnoses is fueling demand for behavioral, occupational, and speech therapies, with schools and healthcare providers expanding their support services to match needs

- Families are increasingly investing in long-term personalized care, including private therapy centers and digital programs, contributing to a robust and growing autism therapy market

Restraint/Challenge

“High Cost of Therapy and Limited Access”

- One of the main challenges in the autism therapy market is the high cost of long-term treatment, which includes behavioural, speech, and occupational therapies delivered over several years

- Insurance coverage is inconsistent across countries and providers, often forcing families to pay out of pocket, which can delay or interrupt therapy due to financial constraints

- For instance, in the U.S., many private insurance plans do not fully cover autism therapies, leading families to spend thousands annually

- Access to therapy remains limited in rural and low-income regions where there is a shortage of trained professionals and specialized centres

- For instance, in parts of Africa and Southeast Asia, families may have to travel hours or even days to access basic autism services

- Even in developed countries, services are concentrated in urban centres, resulting in long wait times and underserved rural populations

- While digital platforms and telehealth offer alternative solutions, they rely on stable internet access and digital literacy, which are not always available, especially in marginalized communities

Autism Therapy Market Scope

The global autism therapy market is segmented on the basis of age group, type, treatment type, drug, and distribution channel.

- By Age Group

On the basis of age group, the autism therapy market is segmented into child and adult. The child segment holds the largest share in the autism therapy market, primarily because autism spectrum disorder typically manifests during early childhood. Growing awareness among parents and healthcare providers has led to increased screening and diagnosis at younger ages, prompting earlier therapeutic intervention. Government-led initiatives, school-based programs, and awareness campaigns are further encouraging families to seek early support. Research continues to highlight the effectiveness of early therapy in improving communication, behaviour, and cognitive outcomes in children. As a result, there is rising demand for specialized child-focused therapies, including speech, occupational, and behavioural interventions. This segment continues to grow as both public and private sectors expand services tailored to young individuals.

The adult segment is gaining momentum as more individuals with autism transition into adulthood and seek continued support. Service providers are increasingly offering therapies that address adult-specific needs such as employment readiness, social integration, and independent living. While historically underserved, adults with autism are now benefiting from growing awareness and policy shifts that promote lifelong support. A variety of cost-effective therapy models, including vocational training and behavioural counselling, are being introduced by community centers, healthcare institutions, and private providers. This segment's growth is supported by improved diagnosis in late teens and adults and a broader societal recognition of the importance of adult autism care.

- By Type

On the basis of type, the autism therapy market is segmented into asperger syndrome, pervasive developmental disorder, and autistic disorder. The autistic disorder segment accounted for the largest market share in the autism therapy market, driven by its higher global prevalence compared to other types of autism spectrum disorder. This segment benefits from increased focus by researchers and healthcare providers, resulting in a broader range of therapy options and diagnostic tools tailored specifically for classic autism symptoms. Government programs and private initiatives are also channelling resources into early identification and treatment of autistic disorder, further solidifying its market dominance. The segment continues to lead due to the availability of well-established treatment protocols and a stronger infrastructure supporting early intervention and ongoing care. With more children being diagnosed under this classification, therapy centres and educational institutions have prioritized services targeting this group.

The pervasive developmental disorder and Asperger syndrome segments are among the fastest growing in the autism therapy market, as awareness and clinical understanding of these milder or atypical forms of ASD improve. Advances in diagnostic criteria and growing recognition of the diverse presentation of symptoms have led to higher diagnosis rates in these categories. This has created a growing demand for specialized therapies that address unique social, behavioural, and communication challenges seen in these conditions. Increased advocacy, educational resources, and inclusion efforts are also driving this segment’s growth. While these segments currently hold a smaller share compared to autistic disorder, they are expanding rapidly due to better screening tools, especially for older children and adults who may have previously gone undiagnosed.

- By Treatment Type

On the basis of treatment type, the autism therapy market is segmented into ABA (Applied Behaviour Analysis), hyperbaric oxygen therapy, chelation therapy, oxytocin therapy, communication and behavioural therapy, and others. Behavioural and Communication Therapies, particularly ABA, are widely considered the gold standard and hold a significant market share. This is driven by their proven effectiveness in improving social, communication, and behavioural skills in individuals with ASD. The segment is also experiencing growth due to increasing awareness and adoption globally.

The Oxytocin Therapy segment is anticipated to witness the fastest growth rate from 2023 to 2030. This projected growth is driven by ongoing advancements in clinical research exploring oxytocin's potential to improve social communication and repetitive behaviours in individuals with ASD. As more studies yield positive results and understanding of its mechanisms deepens, there is increasing interest and potential for broader clinical application, particularly for specific symptom management, positioning it for rapid expansion from a relatively smaller current market base.

- By Drug

On the basis of drug, the autism therapy market is segmented into anticonvulsants, antipsychotics, insomnia drugs, SSRIs (Selective Serotonin Reuptake Inhibitors), stimulants, and others. The stimulants segment held a significant share in the autism therapy market due to the widespread use of medications such as Adderall and Ritalin to manage symptoms such as hyperactivity, inattention, and impulsivity commonly seen in individuals with autism spectrum disorder. These medications are well-known, easily accessible, and often prescribed as part of a broader treatment plan, especially for children with overlapping symptoms of attention-deficit disorders. Their established safety profiles and quick action make them a preferred choice among healthcare providers and caregivers. The availability of both brand-name and generic versions also contributes to their widespread use. As a result, stimulants remain a dominant segment in the pharmacological treatment landscape for autism-related behavioural challenges.

The antipsychotics and selective serotonin reuptake inhibitors (SSRIs) segments are expected to witness substantial growth in the autism therapy market. Antipsychotic drugs such as risperidone and aripiprazole are among the few medications approved specifically for treating irritability and aggression in individuals with autism, making them increasingly adopted by clinicians. SSRIs, on the other hand, are frequently prescribed to address co-occurring conditions such as anxiety, obsessive-compulsive behaviours, and depression, which are common in individuals with autism. As the understanding of these associated mental health conditions improves, the demand for these medications is rising. The continued development of new-generation drugs with improved safety and efficacy profiles is also expected to boost growth in these segments over the coming years.

- By Distribution Channel

On the basis of distribution channel, the autism therapy market is segmented into hospital and clinics, retail pharmacies, and online pharmacies.

The retail pharmacies segment held the largest market share in the autism therapy market, largely due to the widespread distribution networks and ease of access for prescribed medications such as stimulants, antipsychotics, and antidepressants. Individuals and caregivers often rely on retail pharmacies for regular medication refills and consultations, especially in urban and semi-urban areas. This segment also benefits from pharmaceutical marketing campaigns and physician referrals, which direct patients to nearby retail outlets. The convenience of walk-in purchases, insurance processing, and pharmacist support contributes to its dominance. With the growing number of autism diagnoses and ongoing treatment plans, retail pharmacies continue to be the primary source for obtaining essential therapies.

The hospital and clinics segment accounts for a significant portion of the market, driven by the availability of comprehensive care models and specialized autism treatment centres. Patients receiving multidimensional care, including behavioural therapy, medication, and assessments, often get prescriptions filled directly within hospital systems or affiliated clinics. Meanwhile, the online pharmacies segment is emerging as the fastest growing, as digital healthcare platforms become more widely adopted. The convenience of doorstep delivery, privacy, and expanded access in remote regions has made online pharmacies an attractive option. In addition, rising comfort with e-prescriptions and telemedicine is accelerating this trend, particularly among tech-savvy and younger caregivers. Together, these segments are reshaping how autism therapies are accessed and delivered.

Autism Therapy Market Regional Analysis

- North America dominates the global autism therapy market, holding the largest revenue share of 57.5%, driven by high awareness of autism spectrum disorder (ASD), established diagnostic pathways, significant healthcare expenditure, and robust government and private funding for autism research and support services

- The region also benefits from a high concentration of specialized autism treatment centres and a strong emphasis on early intervention programs

- Further supported by favourable reimbursement policies for autism-related therapies across various states and provinces.

U.S. Autism Therapy Market Insight

The U.S. autism therapy market accounts for the largest revenue share of 81.5% within North America, fuelled by comprehensive insurance coverage mandates for autism therapies, increasing prevalence of ASD diagnoses, and a well-developed infrastructure for behavioural and developmental therapies. The strong presence of research institutions and advocacy groups further propels market growth, along with a high adoption rate of evidence-based interventions such as Applied Behaviour Analysis (ABA).

Europe Autism Therapy Market Insight

The Europe autism therapy market is expected to grow at a substantial growth rate throughout the forecast period. This growth is driven by increasing public awareness, improved diagnostic capabilities, and growing government initiatives to support individuals with ASD and their families. Expanding access to therapeutic services, the implementation of national autism strategies, and a focus on integrating autism care into mainstream healthcare systems are key factors contributing to market expansion across the region.

U.K. Autism Therapy Market Insight

The U.K. autism therapy market is expected to grow at a substantial growth rate during the forecast period, driven by rising autism prevalence rates, increasing awareness among parents and educators, and expanding access to diagnostic services. Government funding and initiatives aimed at improving support for individuals with ASD, coupled with the growing availability of specialized therapy providers, are significant contributors to market growth in the UK.

Germany Autism Therapy Market Insight

The German autism therapy market is expected to grow at a substantial growth rate during the forecast period, fuelled by a strong healthcare system, increasing early diagnosis rates, and growing parental demand for effective interventions. Emphasis on patient-centric care, coupled with advancements in therapeutic approaches and the increasing recognition of the long-term benefits of early intervention, are propelling the adoption of autism therapies in Germany.

Asia-Pacific Autism Therapy Market Insight

The Asia-Pacific autism therapy market is expected to grow at a substantial growth rate during the forecast period. This rapid growth is driven by increasing awareness of ASD, improving diagnostic capabilities, rising disposable incomes allowing access to private therapies, and growing government support for autism-related initiatives in countries such as China, India, and Australia. The expanding population and the development of healthcare infrastructure are also key factors contributing to the accelerated adoption of autism therapies in the region.

Japan Autism Therapy Market Insight

The Japan autism therapy market is expected to grow at a substantial growth rate due to increasing awareness and understanding of ASD, a focus on early diagnosis, and the development of specialized support services. The country's advanced healthcare system and a societal emphasis on well-being are contributing to the growing demand for comprehensive autism interventions, including educational support and behavioural therapies.

China Autism Therapy Market Insight

The China autism therapy market is expected to grow at a substantial growth rate in Asia Pacific, attributed to its vast population, increasing prevalence of ASD diagnoses, and a rapidly developing healthcare sector. Growing parental awareness, coupled with the emergence of specialized autism therapy centres and increasing government and private investment in autism care infrastructure, are key factors propelling the market in China.

Autism Therapy Market Share

The autism therapy industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- The Lily Center (U.S.)

- Abbvie, Inc (U.S.)

- Merck & Co., Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Novartis AG (Switzerland)

- Johnson & Johnson Services, Inc. (U.S.)

- Hopebridge, LLC. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Otsuka America Pharmaceutical, Inc (Japan)

- Curemark, LLC (U.S.)

- Sun Pharmaceutical Industries Ltd. (India)

- Mylan N.V. (U.S.)

- Endo, Inc. (Ireland)

- F. Hoffmann-La Roche Ltd (Switzerland)

Latest Developments in Global Autism Therapy Market

- In September 2022, Bened Life launched Neuralli, a groundbreaking development marking the introduction of the first gut-brain medical probiotic. Designed to support neurological conditions such as Parkinson’s disease and autism spectrum disorder, this innovation aims to enhance mental health care through the gut-brain connection. By offering a novel, non-invasive therapeutic option, Neuralli has the potential to complement existing treatments and promote broader acceptance of microbiome-based interventions in the autism therapy market

- In December 2022, STALICLA, a Swiss clinical-stage biotech company, completed Phase 1b trials for its lead drug candidate STP1, focused on treating neurodevelopmental disorders. This advancement demonstrates the company’s progress in precision medicine, using omics-based approaches to target specific biological subtypes. The success of STP1’s early trials signal promising therapeutic potential and could pave the way for more tailored and effective treatments, contributing to the expansion and scientific credibility of the autism therapy market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL AUTISM THERAPY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL AUTISM THERAPY MARKETSIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VOLUME DATA

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL AUTISM THERAPY MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 INSTALLED BASE DATA

15 VALUE CHAIN ANALYSIS

16 HEALTHCARE ECONOMY

16.1 HEALTHCARE EXPENDITURE

16.2 CAPITAL EXPENDITURE

16.3 CAPEX TRENDS

16.4 CAPEX ALLOCATION

16.5 FUNDING SOURCES

16.6 INDUSTRY BENCHMARKS

16.7 GDP RATION IN OVERALL GDP

16.8 HEALTHCARE SYSTEM STRUCTURE

16.9 GOVERNMENT POLICIES

16.1 ECONOMIC DEVELOPMENT

17 GLOBAL AUTISM THERAPY MARKET, BY TYPE

17.1 OVERVIEW

17.2 BEHAVIORAL THERAPY

17.2.1 APPLIED BEHAVIOR ANALYSIS (ABA)

17.2.2 COGNITIVE BEHAVIORAL THERAPY (CBT)

17.2.3 PIVOTAL RESPONSE TREATMENT (PRT)

17.2.4 EARLY INTENSIVE BEHAVIORAL INTERVENTION (EIBI)

17.3 OCCUPATIONAL THERAPY

17.3.1 SENSORY INTEGRATION THERAPY

17.3.2 FINE MOTOR SKILLS TRAINING

17.3.3 ACTIVITIES OF DAILY LIVING (ADLS) TRAINING

17.3.4 PLAY-BASED THERAPY

17.4 SPEECH THERAPY

17.4.1 LANGUAGE DEVELOPMENT

17.4.2 SOCIAL COMMUNICATION INTERVENTIONS

17.4.3 PICTURE EXCHANGE COMMUNICATION SYSTEM (PECS)

17.4.4 ASSISTIVE COMMUNICATION DEVICES (E.G., AAC DEVICES)

17.5 PHYSICAL THERAPY

17.5.1 GROSS MOTOR SKILL DEVELOPMENT

17.5.2 BALANCE AND COORDINATION TRAINING

17.5.3 MUSCLE STRENGTHENING

17.5.4 POSTURAL TRAINING

17.6 SOCIAL SKILLS TRAINING

17.6.1 GROUP SOCIAL SKILLS PROGRAMS

17.6.2 PEER INTERACTION PROGRAMS

17.6.3 EMOTIONAL REGULATION TRAINING

17.7 SENSORY INTEGRATION THERAPY

17.7.1 AUDITORY INTEGRATION THERAPY

17.7.2 VISUAL INTEGRATION THERAPY

17.7.3 TACTILE STIMULATION PROGRAMS

17.8 COGNITIVE THERAPY

17.8.1 COGNITIVE DEVELOPMENT INTERVENTIONS

17.8.2 MINDFULNESS-BASED COGNITIVE THERAPY (MBCT)

17.8.3 EXECUTIVE FUNCTION TRAINING

17.9 DEVELOPMENTAL THERAPY

17.9.1 DEVELOPMENTAL, INDIVIDUAL DIFFERENCES, RELATIONSHIP-BASED MODEL (DIR)

17.9.2 FLOORTIME THERAPY

17.9.3 RELATIONSHIP DEVELOPMENT INTERVENTION (RDI)

17.1 MEDICATIONS

17.10.1 ANTIPSYCHOTIC MEDICATIONS

17.10.1.1. RISPERIDONE

17.10.1.2. ARIPIPRAZOLE

17.10.2 ANTIDEPRESSANTS

17.10.2.1. SELECTIVE SEROTONIN REUPTAKE INHIBITORS (SSRIS)

17.10.2.2. TRICYCLIC ANTIDEPRESSANTS (TCAS)

17.10.3 STIMULANTS

17.10.3.1. METHYLPHENIDATE

17.10.3.2. AMPHETAMINE-BASED MEDICATIONS

17.10.4 ANTI-ANXIETY MEDICATIONS

17.10.5 ANTICONVULSANTS

18 GLOBAL AUTISM THERAPY MARKET, BY DELIVERY MODE

18.1 OVERVIEW

18.2 IN-PERSON THERAPY

18.2.1 ONE-ON-ONE SESSIONS

18.2.2 GROUP THERAPY

18.3 HOME-BASED THERAPY

18.3.1 PARENT-LED PROGRAMS

18.3.2 HOME VISITING SPECIALISTS

18.4 TELEHEALTH THERAPY

18.4.1 VIRTUAL BEHAVIORAL THERAPY

18.4.2 ONLINE SPEECH THERAPY

18.4.3 REMOTE SOCIAL SKILLS TRAINING

18.5 SCHOOL-BASED THERAPY

18.5.1 INDIVIDUALIZED EDUCATION PROGRAM (IEP) SUPPORT

18.5.2 CLASSROOM-BASED SUPPORT SERVICES

18.6 COMMUNITY-BASED THERAPY

18.6.1 RECREATIONAL THERAPY PROGRAMS

18.6.2 AFTER-SCHOOL SOCIAL PROGRAMS

19 GLOBAL AUTISM THERAPY MARKET, BY AGE GROUP

19.1 OVERVIEW

19.2 CHILDREN

19.3 ADOLESCENTS

19.4 ADULTS

20 GLOBAL AUTISM THERAPY MARKET, BY END USER

20.1 OVERVIEW

20.2 THERAPY CENTERS

20.3 HOSPITALS

20.4 HOME CARE SETTINGS

20.5 SCHOOLS AND EDUCATIONAL INSTITUTIONS

20.6 RESEARCH INSTITUTES

20.7 REHABILITATION CENTERS

20.8 COMMUNITY CENTERS

21 GLOBAL AUTISM THERAPY MARKET, BY REGION

21.1 GLOBAL AUTISM THERAPY MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

21.1.1 NORTH AMERICA

21.1.1.1. U.S.

21.1.1.2. CANADA

21.1.1.3. MEXICO

21.1.2 EUROPE

21.1.2.1. GERMANY

21.1.2.2. FRANCE

21.1.2.3. U.K.

21.1.2.4. NORWAY

21.1.2.5. POLAND

21.1.2.6. ITALY

21.1.2.7. SPAIN

21.1.2.8. RUSSIA

21.1.2.9. TURKEY

21.1.2.10. NETHERLANDS

21.1.2.11. SWITZERLAND

21.1.2.12. REST OF EUROPE

21.1.3 ASIA-PACIFIC

21.1.3.1. JAPAN

21.1.3.2. CHINA

21.1.3.3. SOUTH KOREA

21.1.3.4. INDIA

21.1.3.5. AUSTRALIA

21.1.3.6. SINGAPORE

21.1.3.7. THAILAND

21.1.3.8. MALAYSIA

21.1.3.9. INDONESIA

21.1.3.10. PHILIPPINES

21.1.3.11. VIETNAM

21.1.3.12. REST OF ASIA-PACIFIC

21.1.4 SOUTH AMERICA

21.1.4.1. BRAZIL

21.1.4.2. ARGENTINA

21.1.4.3. PERU

21.1.4.4. REST OF SOUTH AMERICA

21.1.5 MIDDLE EAST AND AFRICA

21.1.5.1. SOUTH AFRICA

21.1.5.2. SAUDI ARABIA

21.1.5.3. UAE

21.1.5.4. EGYPT

21.1.5.5. KUWAIT

21.1.5.6. ISRAEL

21.1.5.7. REST OF MIDDLE EAST AND AFRICA

21.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

22 GLOBAL AUTISM THERAPY MARKET, SWOT AND DBMR ANALYSIS

23 GLOBAL AUTISM THERAPY MARKET, COMPANY LANDSCAPE

23.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

23.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

23.3 COMPANY SHARE ANALYSIS: EUROPE

23.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

23.5 MERGERS & ACQUISITIONS

23.6 NEW PRODUCT DEVELOPMENT & APPROVALS

23.7 EXPANSIONS

23.8 REGULATORY CHANGES

23.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

24 GLOBAL AUTISM THERAPY MARKET, COMPANY PROFILE

24.1 CENTRIA HEALTHCARE

24.1.1 COMPANY OVERVIEW

24.1.2 REVENUE ANALYSIS

24.1.3 GEOGRAPHIC PRESENCE

24.1.4 PRODUCT PORTFOLIO

24.1.5 RECENT DEVELOPMENTS

24.2 THE AUTISM COMMUNITY NETWORK (ACN)

24.2.1 COMPANY OVERVIEW

24.2.2 REVENUE ANALYSIS

24.2.3 GEOGRAPHIC PRESENCE

24.2.4 PRODUCT PORTFOLIO

24.2.5 RECENT DEVELOPMENTS

24.3 AUTISM LEARNING PARTNERS

24.3.1 COMPANY OVERVIEW

24.3.2 REVENUE ANALYSIS

24.3.3 GEOGRAPHIC PRESENCE

24.3.4 PRODUCT PORTFOLIO

24.3.5 RECENT DEVELOPMENTS

24.4 THE CENTER FOR AUTISM AND RELATED DISORDERS (CARD)

24.4.1 COMPANY OVERVIEW

24.4.2 REVENUE ANALYSIS

24.4.3 GEOGRAPHIC PRESENCE

24.4.4 PRODUCT PORTFOLIO

24.4.5 RECENT DEVELOPMENTS

24.5 HOPEBRIDGE AUTISM THERAPY CENTERS

24.5.1 COMPANY OVERVIEW

24.5.2 REVENUE ANALYSIS

24.5.3 GEOGRAPHIC PRESENCE

24.5.4 PRODUCT PORTFOLIO

24.5.5 RECENT DEVELOPMENTS

24.6 EASTERSEALS

24.6.1 COMPANY OVERVIEW

24.6.2 REVENUE ANALYSIS

24.6.3 GEOGRAPHIC PRESENCE

24.6.4 PRODUCT PORTFOLIO

24.6.5 RECENT DEVELOPMENTS

24.7 AUTISM SPEAKS

24.7.1 COMPANY OVERVIEW

24.7.2 REVENUE ANALYSIS

24.7.3 GEOGRAPHIC PRESENCE

24.7.4 PRODUCT PORTFOLIO

24.7.5 RECENT DEVELOPMENTS

24.8 TRUMPET BEHAVIORAL HEALTH

24.8.1 COMPANY OVERVIEW

24.8.2 REVENUE ANALYSIS

24.8.3 GEOGRAPHIC PRESENCE

24.8.4 PRODUCT PORTFOLIO

24.8.5 RECENT DEVELOPMENTS

24.9 BLUESPRIG PEDIATRICS

24.9.1 COMPANY OVERVIEW

24.9.2 REVENUE ANALYSIS

24.9.3 GEOGRAPHIC PRESENCE

24.9.4 PRODUCT PORTFOLIO

24.9.5 RECENT DEVELOPMENTS

24.1 AVEANNA HEALTHCARE

24.10.1 COMPANY OVERVIEW

24.10.2 REVENUE ANALYSIS

24.10.3 GEOGRAPHIC PRESENCE

24.10.4 PRODUCT PORTFOLIO

24.10.5 RECENT DEVELOPMENTS

24.11 BEHAVIOR FRONTIERS

24.11.1 COMPANY OVERVIEW

24.11.2 REVENUE ANALYSIS

24.11.3 GEOGRAPHIC PRESENCE

24.11.4 PRODUCT PORTFOLIO

24.11.5 RECENT DEVELOPMENTS

24.12 MAGELLAN HEALTH

24.12.1 COMPANY OVERVIEW

24.12.2 REVENUE ANALYSIS

24.12.3 GEOGRAPHIC PRESENCE

24.12.4 PRODUCT PORTFOLIO

24.12.5 RECENT DEVELOPMENTS

24.13 THERAPLAY, INC.

24.13.1 COMPANY OVERVIEW

24.13.2 REVENUE ANALYSIS

24.13.3 GEOGRAPHIC PRESENCE

24.13.4 PRODUCT PORTFOLIO

24.13.5 RECENT DEVELOPMENTS

24.14 ACHIEVE BEYOND

24.14.1 COMPANY OVERVIEW

24.14.2 REVENUE ANALYSIS

24.14.3 GEOGRAPHIC PRESENCE

24.14.4 PRODUCT PORTFOLIO

24.14.5 RECENT DEVELOPMENTS

24.15 LITTLE LEAVES BEHAVIORAL SERVICES

24.15.1 COMPANY OVERVIEW

24.15.2 REVENUE ANALYSIS

24.15.3 GEOGRAPHIC PRESENCE

24.15.4 PRODUCT PORTFOLIO

24.15.5 RECENT DEVELOPMENTS

24.16 NEW ENGLAND ABA

24.16.1 COMPANY OVERVIEW

24.16.2 REVENUE ANALYSIS

24.16.3 GEOGRAPHIC PRESENCE

24.16.4 PRODUCT PORTFOLIO

24.16.5 RECENT DEVELOPMENTS

24.17 MELMARK

24.17.1 COMPANY OVERVIEW

24.17.2 REVENUE ANALYSIS

24.17.3 GEOGRAPHIC PRESENCE

24.17.4 PRODUCT PORTFOLIO

24.17.5 RECENT DEVELOPMENTS

24.18 THE LOVAAS INSTITUTE

24.18.1 COMPANY OVERVIEW

24.18.2 REVENUE ANALYSIS

24.18.3 GEOGRAPHIC PRESENCE

24.18.4 PRODUCT PORTFOLIO

24.18.5 RECENT DEVELOPMENTS

24.19 AUTISM CARE PARTNERS

24.19.1 COMPANY OVERVIEW

24.19.2 REVENUE ANALYSIS

24.19.3 GEOGRAPHIC PRESENCE

24.19.4 PRODUCT PORTFOLIO

24.19.5 RECENT DEVELOPMENTS

24.2 THERAPIES 4 KIDS

24.20.1 COMPANY OVERVIEW

24.20.2 REVENUE ANALYSIS

24.20.3 GEOGRAPHIC PRESENCE

24.20.4 PRODUCT PORTFOLIO

24.20.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

25 RELATED REPORTS

26 CONCLUSION

27 QUESTIONNAIRE

28 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.