Global Auto Catalyst Market

Market Size in USD Million

CAGR :

%

USD

140.39 Million

USD

195.12 Million

2025

2033

USD

140.39 Million

USD

195.12 Million

2025

2033

| 2026 –2033 | |

| USD 140.39 Million | |

| USD 195.12 Million | |

|

|

|

|

Auto Catalyst Market Size

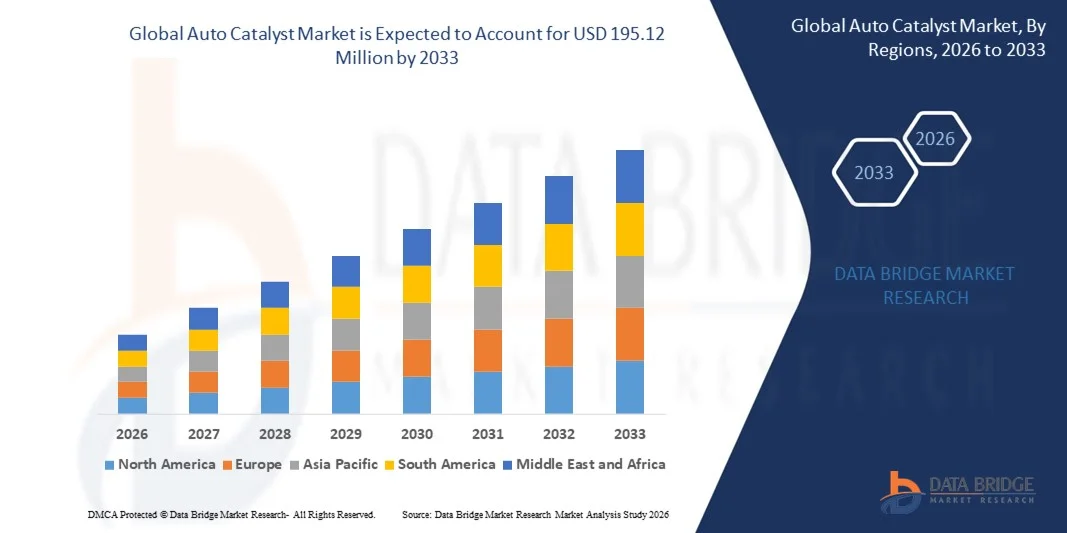

- The global auto catalyst market size was valued at USD 140.39 million in 2025 and is expected to reach USD 195.12 million by 2033, at a CAGR of 4.20% during the forecast period

- The market growth is largely fueled by the increasing adoption of emission control technologies and stringent global regulations on vehicle emissions, which are driving automakers to integrate advanced catalytic converters across gasoline, diesel, and hybrid vehicles

- Furthermore, rising demand for fuel-efficient, low-emission vehicles and the expansion of automotive production in emerging markets are establishing advanced catalysts as essential components for regulatory compliance and environmental sustainability. These converging factors are accelerating the adoption of automotive catalysts, thereby significantly boosting the industry’s growth

Auto Catalyst Market Analysis

- Auto catalysts are critical components in vehicles that convert harmful exhaust gases such as carbon monoxide, hydrocarbons, and nitrogen oxides into less harmful emissions through chemical reactions. These systems are widely used in passenger cars, light-duty vehicles, heavy-duty vehicles, and hybrid models to meet environmental standards

- The escalating demand for auto catalysts is primarily fueled by strict emission regulations in North America, Europe, and Asia-Pacific, growing awareness of environmental impact, and the increasing production of hybrid and fuel-efficient vehicles. In addition, technological advancements in platinum group metal-based catalysts and recycling solutions are supporting market expansion and sustainability initiatives

- Asia-Pacific dominated the auto catalyst market with a share of 52.45% in 2025, due to rapid growth in automotive production, increasing adoption of emission control technologies, and stringent environmental regulations in the region

- North America is expected to be the fastest growing region in the auto catalyst market during the forecast period due to stringent EPA emission standards, rising demand for hybrid and gasoline vehicles, and technological advancements in catalytic converters

- Light-duty vehicle segment dominated the market with a market share of 52.8% in 2025, due to the high volume of LDV production globally and the need to comply with stringent emission standards in urban regions. LDVs, including passenger cars and small commercial vehicles, account for a significant portion of on-road emissions, making catalytic converter integration essential

Report Scope and Auto Catalyst Market Segmentation

|

Attributes |

Auto Catalyst Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Auto Catalyst Market Trends

Rising Adoption of Hybrid and Low-Emission Vehicles

- A significant trend in the auto catalyst market is the growing integration of advanced catalytic converters in hybrid, gasoline, and diesel vehicles, driven by the increasing focus on reducing vehicular emissions and improving fuel efficiency. This adoption is positioning auto catalysts as essential components for compliance with global emission standards and for supporting the transition to greener mobility

- For instance, Cataler Corporation supplies next-generation hybrid vehicle catalysts to Toyota, enabling the automaker to meet stringent emission regulations across key markets. Such developments highlight the increasing reliance on high-performance catalysts to maintain engine efficiency while minimizing environmental impact

- The trend is further reinforced by the expansion of hybrid and low-emission vehicle production in regions such as North America, Europe, and Asia-Pacific, where regulatory mandates encourage automakers to incorporate advanced catalysts. The rising consumer preference for environmentally friendly vehicles and growing awareness of carbon footprint reduction are accelerating catalyst adoption across vehicle segments

- Manufacturers are also investing in the development of platinum group metal (PGM)-based catalysts with improved durability and conversion efficiency, ensuring optimal performance under varying operating conditions. This technological progress strengthens the role of catalysts in emerging mobility solutions, including mild-hybrid and plug-in hybrid vehicles

- The aftermarket segment is seeing increased adoption as vehicle owners retrofit older vehicles with emission-compliant catalytic converters, further supporting overall market growth. The demand for replacement and upgraded catalysts is driven by stricter inspection and emission testing requirements, enhancing the market opportunity for both OEM and aftermarket players

- Overall, the rising adoption of hybrid and low-emission vehicles is reinforcing the critical role of auto catalysts in global efforts toward cleaner transportation and sustainable automotive production

Auto Catalyst Market Dynamics

Driver

Stringent Global Vehicle Emission Regulations

- The growing emphasis on reducing vehicular emissions across regions such as North America, Europe, and Asia-Pacific is a key driver for the auto catalyst market. Governments are implementing stringent standards such as the U.S. EPA Tier 3 norms, Euro 6/7 regulations, and India’s BS6 emission norms, compelling automakers to integrate efficient catalytic converters in new vehicles

- For instance, Johnson Matthey develops platinum and palladium-based catalysts that help automakers comply with Euro 6d emission standards, ensuring vehicles meet CO, NOx, and hydrocarbon limits. These catalysts enable manufacturers to deliver low-emission vehicles without compromising engine performance

- The rising demand for hybrid, gasoline, and diesel vehicles equipped with advanced emission control systems is boosting market expansion. Catalysts are increasingly used in both light-duty and heavy-duty vehicles to maintain compliance with evolving emission norms while enhancing fuel efficiency

- Automakers are investing in research to improve catalyst performance under low-temperature and high-load conditions, addressing regulatory requirements in diverse operating environments. Advanced formulations and integration of PGM metals ensure stable and reliable conversion of exhaust gases

- The emphasis on emission compliance is also driving collaboration between catalyst producers and automotive OEMs, leading to innovation in next-generation catalytic converters designed for future mobility solutions. Regulatory pressure continues to ensure that catalyst adoption remains a critical factor in vehicle design and manufacturing strategies

Restraint/Challenge

High Cost and Volatility of Platinum Group Metals (PGMs)

- The auto catalyst market faces challenges due to the high cost and fluctuating availability of PGMs such as platinum, palladium, and rhodium, which are critical for catalyst efficiency. Price volatility directly impacts manufacturing costs and limits profit margins for catalyst producers and automakers

- For instance, Umicore’s investments in PGM recycling facilities in the U.S. reflect efforts to mitigate supply constraints and reduce dependence on volatile raw material markets. Recovering PGMs from spent catalysts helps stabilize supply, but initial capital requirements are substantial

- The reliance on limited PGM mining sources, primarily in South Africa and Russia, exposes manufacturers to geopolitical risks and supply disruptions, further complicating cost management

- High raw material expenses also make it challenging to balance performance requirements with economic feasibility, particularly for low-cost vehicles in emerging markets. Manufacturers must optimize PGM loading and enhance catalytic efficiency to control costs without compromising regulatory compliance

- Overall, the volatility and expense of PGMs remain a major constraint, influencing market strategies, investment decisions, and pricing structures across the global auto catalyst industry

Auto Catalyst Market Scope

The market is segmented on the basis of type, vehicle type, and engine type.

- By Type

On the basis of type, the auto catalyst market is segmented into platinum catalysts, palladium catalysts, and rhodium catalysts. The platinum catalyst segment dominated the largest market revenue share in 2025, driven by its high efficiency in converting harmful exhaust gases such as carbon monoxide and nitrogen oxides into less harmful emissions. Automakers prefer platinum catalysts due to their long-term durability, excellent thermal stability, and compatibility with both gasoline and diesel engines. The segment’s strong presence is also supported by stringent emission regulations in regions such as North America and Europe, which require reliable catalytic performance. Platinum catalysts are widely adopted in passenger cars and light-duty vehicles, reinforcing their market leadership. In addition, ongoing technological improvements in catalyst formulations enhance conversion efficiency and reduce platinum loading, further driving adoption.

The palladium catalyst segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for gasoline vehicles and stricter emission norms in emerging markets. For instance, Toyota has increasingly adopted palladium-based catalysts in its gasoline models to meet Euro 6 emission standards while maintaining engine performance. Palladium catalysts offer cost advantages over platinum and high catalytic activity for hydrocarbon and carbon monoxide oxidation. The growing shift toward hybrid and fuel-efficient vehicles also supports the adoption of palladium catalysts due to their favorable performance in low-temperature exhaust conditions. Expanding automotive production in Asia-Pacific and Latin America contributes to the rising demand for palladium-based catalytic converters.

- By Vehicle Type

On the basis of vehicle type, the auto catalyst market is segmented into light-duty vehicles, heavy-duty vehicles, motorcycles, and passenger cars. The light-duty vehicle segment dominated the largest market revenue share of 52.8% in 2025, driven by the high volume of LDV production globally and the need to comply with stringent emission standards in urban regions. LDVs, including passenger cars and small commercial vehicles, account for a significant portion of on-road emissions, making catalytic converter integration essential. Manufacturers increasingly prefer advanced catalyst systems in LDVs to enhance fuel efficiency, reduce emissions, and maintain engine performance. In addition, growing consumer awareness of environmental impact and government incentives for low-emission vehicles further strengthen this segment. The presence of major automakers in North America, Europe, and Asia-Pacific ensures a consistent demand for catalysts in this vehicle type.

The passenger car segment is expected to witness the fastest CAGR from 2026 to 2033, driven by rising passenger car production and modernization of older fleets with advanced emission control technologies. For instance, Honda has introduced passenger car models equipped with next-generation catalytic converters to meet stringent global emission norms. Passenger cars benefit from compact catalyst designs that integrate easily with gasoline and hybrid engines, making them a preferred segment for technology adoption. The trend toward eco-friendly and fuel-efficient vehicles supports the growth of catalytic converter demand in passenger cars. Rapid urbanization and increasing disposable income in emerging markets further propel passenger car production, driving catalyst consumption.

- By Engine Type

On the basis of engine type, the auto catalyst market is segmented into LDV-gasoline, LDV-diesel, and HDV. The LDV-gasoline segment dominated the largest market revenue share in 2025, driven by the widespread use of gasoline engines in passenger cars and light-duty vehicles. Gasoline engines produce higher hydrocarbon and carbon monoxide emissions, which necessitate efficient catalytic converters for regulatory compliance. The segment benefits from the adaptability of platinum and palladium catalysts, offering superior conversion efficiency and low-temperature performance. Governments in North America, Europe, and Asia-Pacific continue to enforce stringent emission standards for gasoline vehicles, reinforcing catalyst adoption. In addition, increasing hybrid and mild-hybrid vehicle production further supports demand for gasoline-compatible catalysts.

The LDV-diesel segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the adoption of diesel vehicles in commercial and light-duty transport. For instance, Ford has implemented advanced diesel catalysts in its EcoBlue engine lineup to meet Euro 6d emission standards. Diesel catalysts, particularly those integrated with diesel particulate filters (DPFs), effectively reduce nitrogen oxides and particulate matter, meeting environmental regulations. The segment benefits from growing demand in emerging markets, where diesel engines remain popular due to fuel efficiency and torque advantages. Continuous innovations in catalyst formulations for diesel engines improve durability and performance, driving market expansion in this segment.

Auto Catalyst Market Regional Analysis

- Asia-Pacific dominated the auto catalyst market with the largest revenue share of 52.45% in 2025, driven by rapid growth in automotive production, increasing adoption of emission control technologies, and stringent environmental regulations in the region

- The presence of major automobile manufacturing hubs in China, Japan, and South Korea, coupled with rising demand for fuel-efficient and low-emission vehicles, is accelerating market expansion

- The region’s cost-effective manufacturing landscape, favorable government incentives for clean vehicle technologies, and growing exports of automotive components are contributing to increased adoption of catalysts across light-duty and heavy-duty vehicles

China Auto Catalyst Market Insight

China held the largest share in the Asia-Pacific auto catalyst market in 2025, owing to its position as the world’s largest automotive producer and strong government mandates on emission standards. Investments in new vehicle technologies, including hybrid and electric-gasoline vehicles with advanced catalytic converters, are major growth drivers. Demand is further supported by extensive R&D in catalyst efficiency, partnerships with global automakers, and strong domestic vehicle sales across passenger cars and light commercial vehicles.

India Auto Catalyst Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising vehicle production, increasing adoption of BS6-compliant engines, and government incentives for emission reduction technologies. Policies promoting cleaner fuels, expansion of the automotive manufacturing sector, and investments in emission control technologies are strengthening catalyst demand. In addition, growing exports of vehicles and components from India to global markets are contributing to rapid market expansion.

Europe Auto Catalyst Market Insight

The Europe auto catalyst market is expanding steadily, supported by stringent Euro 6 and Euro 7 emission regulations, high demand for low-emission vehicles, and strong R&D capabilities in automotive technologies. The region emphasizes environmental compliance, high-quality materials, and technological advancements in catalytic converters, particularly for passenger cars and commercial vehicles. Adoption of hybrid and gasoline vehicles integrated with advanced catalysts is further enhancing market growth.

Germany Auto Catalyst Market Insight

Germany’s auto catalyst market is driven by its leadership in automotive manufacturing, engineering excellence, and export-oriented vehicle production. The country has a strong network of automotive OEMs and suppliers, fostering continuous innovation in emission control technologies. Demand is particularly strong for catalysts used in high-performance passenger cars, commercial vehicles, and hybrid engines.

U.K. Auto Catalyst Market Insight

The U.K. market is supported by a mature automotive industry, focus on reducing vehicle emissions, and government policies promoting cleaner transport technologies. Investments in R&D, collaborations between automotive manufacturers and research institutions, and increasing adoption of hybrid vehicles are contributing to strong catalyst demand. The country continues to play a significant role in the production of emission control systems for both domestic and export markets.

North America Auto Catalyst Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by stringent EPA emission standards, rising demand for hybrid and gasoline vehicles, and technological advancements in catalytic converters. Strong automotive production in the U.S., Canada, and Mexico, coupled with growing emphasis on fuel efficiency and emission reduction, is boosting catalyst adoption. Increasing reshoring of automotive manufacturing and collaborations between automakers and catalyst producers are supporting market expansion.

U.S. Auto Catalyst Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its well-established automotive industry, advanced R&D infrastructure, and significant investment in emission control technologies. Focus on sustainability, regulatory compliance, and adoption of hybrid and fuel-efficient vehicles is encouraging the use of high-performance catalytic converters. Presence of key players and a mature supply chain further solidify the U.S.'s leading position in the region.

Auto Catalyst Market Share

The auto catalyst industry is primarily led by well-established companies, including:

- Umicore (Belgium)

- BASF SE (Germany)

- Johnson Matthey (U.K.)

- CATALER CORPORATION (Japan)

- Clariant (Switzerland)

- CDTi Advanced Materials, Inc. (U.S.)

- Cummins Inc. (U.S.)

- Heraeus Holding (Germany)

- INTERKAT Catalyst GmbH (Germany)

- Tenneco Inc. (U.S.)

- IBIDEN (Japan)

- N.E. CHEMCAT (South Korea)

- Magneti Marelli S.p.A (Italy)

- BOSAL (Netherlands)

- CRI Catalyst Company LP (U.S.)

- Ecocat India Pvt. Ltd. (India)

- Eberspächer (Germany)

- Klarius Products Ltd. (U.K.)

- Sinocat Environmental Technology Co., Ltd. (China)

Latest Developments in Global Auto Catalyst Market

- In August 2024, Cataler Corporation secured a major multi-year supply contract with Toyota to provide next-generation hybrid vehicle catalysts. This partnership strengthens Cataler’s position in the automotive catalyst market, particularly in the growing hybrid and low-emission vehicle segment, and reinforces Toyota’s strategy to expand its lineup of environmentally friendly vehicles. The deal highlights increasing demand for advanced catalysts capable of meeting stringent emission standards, creating growth opportunities for specialized suppliers

- In July 2024, Heraeus acquired a 20% minority stake in E-Convert, an Indian startup focused on low-cost automotive catalysts. This strategic investment enhances Heraeus’s presence in the rapidly expanding Indian market, enabling access to cost-efficient production technologies for emission control solutions. The move also supports market growth in emerging regions, where rising vehicle production and tightening emission regulations are driving demand for affordable yet effective catalyst technologies

- In June 2024, Umicore announced a $500 million investment to establish an auto catalyst recycling facility in Texas, U.S. The plant aims to recover platinum group metals (PGMs) from spent catalysts, promoting a circular economy and ensuring sustainable supply of precious metals for North American automakers. This initiative strengthens Umicore’s market leadership in PGM recycling, reduces dependence on raw material imports, and addresses the growing need for sustainable catalyst solutions amid stricter emission regulations

- In May 2024, BASF inaugurated a new state-of-the-art automotive catalyst manufacturing plant in Shanghai, China. The facility expands BASF’s production capacity to meet the rising demand from Asian automakers for advanced emission control technologies. This expansion positions BASF as a key supplier in the fast-growing Asia-Pacific market, where stringent emission norms and increasing vehicle production are driving the adoption of high-performance catalytic converters

- In April 2024, Johnson Matthey entered a multi-year strategic partnership with Sibanye-Stillwater to secure a stable supply of platinum group metals (PGMs) for automotive catalysts. This agreement ensures continuity in raw material supply, supporting Johnson Matthey’s production of high-performance catalysts amid rising demand for emission-compliant vehicles. The deal reinforces the company’s market position globally, mitigates PGM price volatility, and strengthens resilience in the highly competitive catalyst industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.