Global Automated Container Terminal Market

Market Size in USD Billion

CAGR :

%

USD

10.84 Billion

USD

19.16 Billion

2025

2033

USD

10.84 Billion

USD

19.16 Billion

2025

2033

| 2026 –2033 | |

| USD 10.84 Billion | |

| USD 19.16 Billion | |

|

|

|

|

Automated Container Terminal Market Size

- The global automated container terminal market was valued at USD 10.84 Billion in 2025 and is expected to reach USD 19.16 Billion by 2033

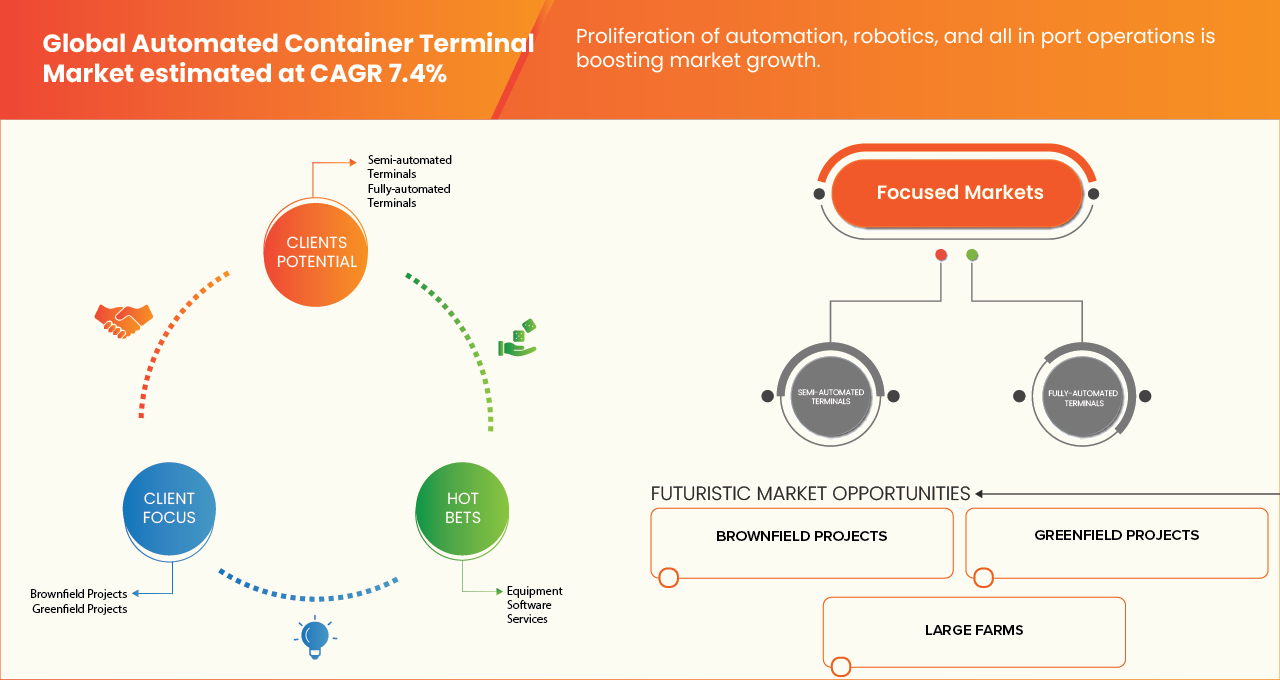

- During the forecast period of 2026 to 2033 the market is likely to grow at a CAGR of 7.4%, primarily driven by the need for enhanced operational efficiency and port capacity.

- The growth of the automated container terminal market is driven by factors such as increasing global trade volumes, rising demand for high-performance container handling equipment, technological advancements in automation and artificial intelligence, and the expansion of manufacturing and transportation sectors worldwide.

Automated Container Terminal Market Analysis

- Automated container terminals are advanced port facilities that use automated technology and software to operate container handling equipment, minimizing manual labor, maximizing throughput, and enhancing the safety and predictability of cargo operations. They play a crucial role in the global supply chain, serving shipping lines, port authorities, and logistics networks by enabling faster vessel turnarounds and optimized yard management.

- One of the primary technologies in automated container terminals is the use of Automated Stacking Cranes (ASCs), which autonomously store and retrieve containers in the yard, optimizing space utilization and reducing handling times. The growing shift towards larger container vessels is also driving the development of specialized software and automated guided vehicles (AGVs) designed to coordinate the complex movement of containers between the quay and the stack. In terminal operations, this automation is essential for gate processing, ship planning, and equipment maintenance, ensuring consistent performance and reduced operational costs.

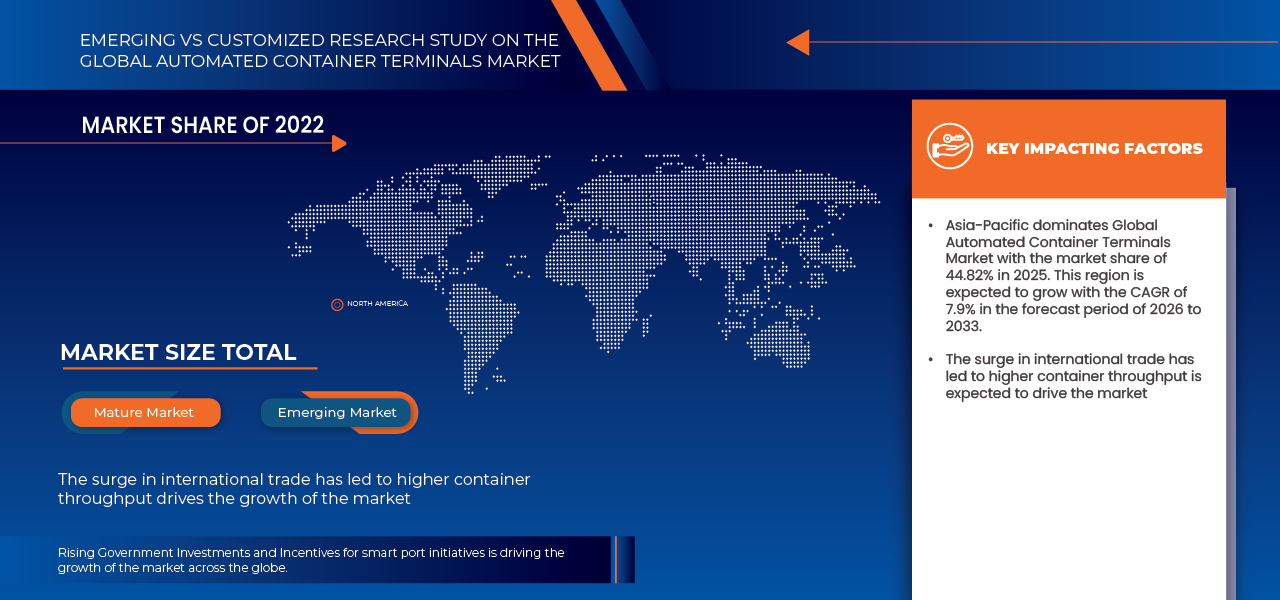

- Asia-Pacific is expected to dominate the automated container terminal market with the largest revenue share of 45.02% in 2026, supported by rapid port infrastructure modernization, strong government investments in smart port initiatives, and increasing containerized trade volumes in key economies such as China, Japan, South Korea, and Singapore. Additionally, the region’s focus on automation, digitization, and sustainability—through technologies like AI-driven terminal operations, autonomous cranes, and IoT-based tracking systems—further strengthens its leadership in the global market.

- Asia-Pacific is expected to be the fastest-growing region in the Automated Container Terminal market during the forecast period with a CAGR of 7.9%, fueled by expanding maritime trade, rapid adoption of automation technologies, and large-scale investments in smart port development projects across China, India, South Korea, and Southeast Asia. The region’s growing focus on enhancing port efficiency, reducing turnaround time, and minimizing labor costs—alongside strategic initiatives like China’s Belt and Road Initiative and India’s Sagarmala Program is driving the accelerated deployment of automated container handling systems.

- In 2026, the semi-automated terminals segment is expected to dominate the market with a 53.93% market share due to their optimal balance between capital investment and operational benefits, offering a lower-risk transition path for existing ports, significant productivity gains, and greater operational flexibility compared to fully automated systems.

Report Scope and Automated Container Terminal Market Segmentation

|

Attributes |

Automated Container Terminal Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automated Container Terminal Market Trends

“Expansion of automated terminals in emerging markets”

- The rapid growth in trade volumes and the increasing demand for efficient port operations in emerging markets are creating a significant opportunity for ACT market players. By developing greenfield and brownfield automated container terminals, these regions can enhance port efficiency, accommodate larger vessels, and strengthen their integration into global supply chains.

- Expansion into emerging markets enables equipment manufacturers, software vendors, and service integrators to leverage first-mover advantages, deploy modern automation technologies, and achieve greater operational scalability. Investments in advanced cranes, Automated Guided Vehicles (AGVs), Terminal Operating Systems (TOS), and digital logistics platforms are transforming ports into modern, efficient hubs capable of handling surging container traffic while reducing costs and dwell times.

- In July 2025, according to the Times of India, Vizhinjam International Seaport (India) commenced operations using AI-based port operations and automated cranes, trained India’s first female automated crane operators, and handled over 830,000 containers in its first year

- In September 2025, Reuters reported that the Colombo West International Terminal (Sri Lanka), operated by a consortium led by Adani Group, expanded its fully automated terminal capacity to handle up to 3.2 million containers annually, ahead of schedule, strengthening regional logistics capabilities

- Thus, the expansion of automated terminals in emerging markets is establishing these regions as key growth drivers for the ACT market. By implementing advanced automation technologies, emerging-market ports are modernizing infrastructure, reducing operational bottlenecks, and improving global competitiveness, paving the way for sustained industry growth.

Automated Container Terminal Market Dynamics

Driver

“The surge in international trade has led to higher container throughput”

- The continuous expansion of global trade has significantly increased the volume of containerized cargo moving across international borders, thereby driving demand for efficient, automated container-handling solutions. As seaborne trade remains the backbone of global commerce, ports worldwide are under growing pressure to enhance throughput capacity, reduce vessel turnaround time, and improve overall terminal efficiency. Automated Container Terminals (ACTs) have emerged as a vital solution to address these operational demands by leveraging robotics, AI, and advanced logistics technologies.

- Rising globalization, coupled with the growth of e-commerce and cross-border supply chains, is further accelerating the need for automation in port operations. Automated cranes, driverless vehicles, and digital port management systems are increasingly being deployed to handle large container volumes with precision and minimal human intervention.

- In October 2024, according to the United Nations Conference on Trade and Development (UNCTAD, 2024), global maritime trade volumes grew by 2.4% in 2023, with containerized trade accounting for over 60% of seaborne cargo, emphasizing the critical need for automated port infrastructure

- In November 2024, A report by Hamburg Port Consulting highlights that automation and digitalisation are becoming essential to modern port operations, as rising cargo volumes demand higher efficiency

- In addition, the increasing complexity of global logistics networks and the expansion of free trade zones are compelling ports to adopt next-generation automated systems to remain competitive. Automation not only supports higher container throughput but also ensures greater operational accuracy, sustainability, and adaptability to fluctuating trade demands. As international maritime trade continues to surge, automation technologies such as AGVs, automated stacking cranes, and digital twin-based monitoring systems are becoming indispensable for optimizing performance and reducing operational bottlenecks.

- Thus, the surge in international trade volumes and the growing need for efficient container handling are propelling the adoption of automated container terminals globally, solidifying automation as a key pillar for future-ready, resilient, and high-performing port operations.

Restraint/Challenge

“High upfront investment and installation costs”

Despite the growing adoption of automation technologies across global ports, the high upfront investment and installation costs remain a significant restraining factor in the automated container terminal market. Developing fully or semi-automated terminals requires substantial capital for advanced machinery, such as Automated Guided Vehicles (AGVs), Automated Stacking Cranes (ASCs), and sophisticated Terminal Operating Systems (TOS), as well as for integrating supporting digital infrastructure and energy systems. These expenses often exceed hundreds of millions of dollars, posing a major restraint, particularly for medium- and small-scale ports with limited budgets or uncertain cargo throughput.

- Moreover, automation projects typically involve complex retrofitting and long installation timelines, which can disrupt ongoing operations and extend Return-On-Investment (ROI) periods. While automation promises long-term operational efficiency and labor savings, the high initial Capital Expenditure (CAPEX) and integration risks often deter terminal operators from adopting full-scale automation solutions. Consequently, many ports opt for phased or hybrid automation models instead of complete overhauls.

- In January 2024, Port Technology International reported that 62% of terminal professionals identified high initial investment requirements as the primary barrier to automation deployment in container terminals

- In June 2023, PortEconomics highlighted that automation retrofits in existing terminals often face complex integration issues, further increasing project costs and limiting flexibility post-installation.

- Thus, while terminal automation promises long-term benefits such as enhanced productivity, labor optimization, and sustainability, the significant upfront financial burden and complex installation processes remain key restraints for market growth. Overcoming these challenges will depend on adopting innovative financing mechanisms, phased automation models, and increased public–private collaboration to make automation financially viable for ports of all sizes in the coming years.

Automated Container Terminal Market Scope

The market is segmented on the basis of degree of automation, project type, offering, end user, and distribution channel.

- By Degree of Automation

On the basis of degree of automation, the market is segmented into semi-automated terminals and fully automated terminals. In 2026, the semi-automated terminals segment is expected to dominate the market with a 53.93% market share, driven by their cost-effectiveness, operational flexibility, gradual integration of automation with manual oversight, and the growing adoption of automated stacking cranes (ASCs) and remote-controlled yard equipment, which enhance efficiency, safety, and productivity while minimizing transition risks and implementation costs.

Moreover, this segment is further projected to register the higher CAGR during the forecast period of 2026 to 2033, owing to the rising preference among port operators for phased automation strategies, lower upfront capital requirements, ease of retrofitting existing terminals, reduced labor resistance, faster return on investment, and increasing deployment of intelligent control systems across brownfield port projects.

- By Project Type

On the basis of project type, the market is segmented into brownfield and greenfield. In 2026, the brownfield segment is expected to dominate with a 64.59% market share, driven by the upgrading and modernization of existing port infrastructure, integration of advanced automation technologies into operational terminals, cost-effectiveness compared to building new terminals, and the need to enhance efficiency, reduce vessel turnaround times, and meet growing container throughput demands.

The Greenfield segment is the fastest-growing segment in the market, with a CAGR of 7.9%, driven by the development of new, state-of-the-art terminals equipped with advanced automation technologies, increasing international trade volumes, strong government support for port infrastructure expansion, and the need for efficient, scalable, and sustainable terminal operations.

- By Offering

On the basis of offering, the global automated container terminal market is segmented into equipment, software, services. In 2026, the equipment segment is expected to dominate the market with 54.58% market share, driven by the growing deployment of automated stacking cranes (ASCs), automated guided vehicles (AGVs), remote-controlled yard equipment, and quay cranes, as well as increasing investments in port modernization, rising container volumes, and the demand for higher operational efficiency and safety in terminal operations.

Software is the fastest-growing segment with a CAGR of 8.3% in the market driven by rising adoption of advanced terminal operating systems (TOS), real-time data analytics, AI and IoT-enabled solutions, and the growing need for efficient cargo management, predictive maintenance, and seamless port community integration.

- By End User

On the basis of end user, the market is segmented into public and private. In 2026, the public segment is expected to dominate the market with 56.28% market share, driven by the government-led port authorities, large-scale infrastructure investments, national trade facilitation initiatives, modernization of strategic ports, adoption of automation to improve efficiency and safety, long-term funding stability, and policy support aimed at enhancing global connectivity and economic growth.

Private is the fastest-growing segment with CAGR of 7.6% in the market driven by rising private terminal concessions, public–private partnerships, demand for operational efficiency, faster decision-making, return-on-investment focus, adoption of advanced automation technologies, competitive pressure to reduce costs, improve throughput, and deliver higher service reliability.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct channel and indirect channel. In 2026, the direct channel segment is expected to dominate the market with 68.65% market share, driven by the strong relationships between terminal operators and automation solution providers, customized system integration requirements, reduced procurement costs, direct technical support, long-term service contracts, and the need for seamless implementation of complex, high-value automation solutions.

Automated Container Terminal Market Regional Analysis

- Asia-Pacific is expected to dominate the automated container terminal Market with the largest revenue share of 45.02% in 2026, supported by the region’s strong trade growth, extensive port expansion projects, and rising adoption of advanced automation and digital technologies. Key economies such as China, Japan, South Korea, and Singapore are leading in the integration of AI-based terminal management systems, automated guided vehicles (AGVs), and remote-controlled cranes to enhance operational efficiency. Furthermore, government-backed smart port initiatives, coupled with increasing investments from global port operators like PSA International, Hutchison Ports, and DP World, continue to reinforce Asia-Pacific’s dominance in the global market

- Asia-Pacific is expected to be the fastest-growing region in the automated container terminal market during the forecast period with a CAGR of 7.9%, fueled by by expanding maritime trade, rapid adoption of automation technologies, and large-scale investments in smart port development projects across China, India, South Korea, and Southeast Asia. The region’s growing focus on enhancing port efficiency, reducing turnaround time, and minimizing labor costs—alongside strategic initiatives like China’s Belt and Road Initiative and India’s Sagarmala Program is driving the accelerated deployment of automated container handling systems.

Europe Automated Container Terminal Market Insight

The Europe automated container terminal market fueled by early adoption of terminal automation technologies, well-established port infrastructure, and strong presence of leading automation solution providers such as Konecranes, ABB, and Kalmar. European ports including Rotterdam (Netherlands), Hamburg (Germany), and Antwerp (Belgium) have been pioneers in deploying fully automated terminal operations, driven by a focus on enhancing operational efficiency, reducing emissions, and optimizing labor costs. Additionally, the region’s stringent environmental regulations and growing emphasis on sustainable, digitalized logistics systems further bolstered its leadership in the global market.

Germany Automated Container Terminal Market Insight

Germany automated container terminal market captured the largest revenue share in 2026 within Europe Region, fueled by country’s advanced port infrastructure, strong focus on Industry 4.0 integration, and early adoption of automation and digitalization technologies in maritime logistics. Major ports such as Hamburg and Bremerhaven have implemented automated cranes, terminal operating systems (TOS), and autonomous transport vehicles to improve efficiency and reduce operational costs. Furthermore, government initiatives supporting smart logistics, coupled with investments by major operators like HHLA (Hamburger Hafen und Logistik AG) and Eurogate, have accelerated Germany’s leadership in the European automated container terminal market.

North America Automated Container Terminal Market Insight

The North America automated container terminal market is fueled by rising containerized trade volumes, increasing investments in port modernization, and the growing need for operational efficiency and reduced turnaround times. Major ports such as Los Angeles, Long Beach, and Vancouver have been at the forefront of adopting semi- and fully automated terminal systems, supported by advanced AI-driven logistics, robotics, and data analytics. Additionally, the region’s emphasis on sustainability, labor optimization, and digital transformation—along with investments from key operators like SSA Marine, DP World, and APM Terminals further strengthened North America’s leading position in the global automated container terminal market.

U.S. Automated Container Terminal Market Insight

The U.S. automated container terminal market captured the largest revenue share in 2026 within North America Region, fueled by significant investments in port automation, digital infrastructure, and smart logistics systems. Major ports such as Los Angeles, Long Beach, and New York/New Jersey have adopted automated stacking cranes, automated guided vehicles (AGVs), and advanced terminal operating systems (TOS) to enhance productivity and reduce congestion. Additionally, strong support from federal and state initiatives aimed at improving supply chain resilience and sustainability, coupled with the presence of key global port operators like APM Terminals, SSA Marine, and DP World, has further strengthened the U.S. position as a leader in automated container terminal development across North America.

China Automated Container Terminal Market Insight

China automated container terminal market captured the largest revenue share in 2026 in Asia Pacific, fueled by massive investments in port automation, digital transformation, and smart logistics infrastructure. China is home to some of the world’s most advanced automated ports such as the Yangshan Deep-Water Port (Shanghai), Qingdao Port, and Tianjin Port which utilize AI-driven control systems, 5G connectivity, autonomous vehicles, and automated cranes to achieve high operational efficiency. Government initiatives under the Belt and Road Initiative (BRI) and the Made in China 2025 strategy have further accelerated automation adoption, promoting technological innovation, efficiency, and sustainability in port operations. Additionally, collaborations with leading technology providers like Huawei, ZPMC, and Shanghai International Port Group (SIPG) have reinforced China’s dominant position in the regional automated container terminal market.

Japan Automated Container Terminal Market Insight

Japan automated container terminal market fueled by country’s early adoption of automation technologies, strong government backing for smart port initiatives, and continuous modernization of maritime infrastructure. Leading ports such as Yokohama, Tokyo, and Kobe have integrated automated stacking cranes, intelligent terminal operating systems (TOS), and AI-based logistics platforms to enhance throughput and operational efficiency. Furthermore, Japan’s commitment to sustainability, labor efficiency, and digital transformation supported by initiatives from the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) and partnerships with technology providers like Mitsui O.S.K. Lines, NEC, and Hitachi has significantly strengthened its leadership in the regional automated container terminal market.

South Africa Automated Container Terminal Market Insight

South Africa automated container terminal market is projected to grow steadily, supported by ongoing modernization initiatives by Transnet Port Terminals (TPT), adoption of automated stacking cranes (ASCs) and remote-controlled quay cranes, implementation of smart port technologies and predictive maintenance solutions, investments in digital logistics infrastructure, and strategic partnerships with global automation providers such as Kalmar, ABB, and Siemens. Key ports including the Port of Durban, Port of Ngqura, and Cape Town Container Terminal are leading this transformation to enhance efficiency, reduce vessel turnaround times, and support the region’s growing trade volumes.

The Major Market Leaders Operating in the Market Are:

- TOTAL SOFT BANK LTD. (South Korea)

- INFORM SOFTWARE (Germany)

- Logstar ERP. (India)

- infyz.com (India)

- Tideworks (U.S.)

- Loginno Logistic Innovation ltd. (Israel)

- World Crane Services FZE (U.A.E.)

- STARCOMM SYSTEMS (U.K.)

- Kalmar Corporation (Finland)

- Cargotec Corporation (Finland)

- Konecranes Plc (Finland)

- Shanghai Zhenhua Heavy Industries Co., Ltd. (China)

- LIEBHERR Group (Switzerland)

- ABB Ltd. (Switzerland)

- HAPAG LLOYD (Germany)

- APM Terminals (Netherlands)

- BECKHOFF AUTOMATION GMBH & CO. KG (Germany)

- Künz GmbH (Austria)

- CyberLogitec Co., Ltd. (Korea)

- Camco Technologies NV (Belgium)

- IDENTEC SOLUTIONS AG (Austria)

- ORBCOMM Inc. (U.S.)

- ORBITA PORTS & TERMINALS acquired by TMEIC PORT TECHNOLOGIES, S.L. (Japan)

- PACECO Corp. (U.S.)

Latest Developments in Global Automated Container Terminal

- In October 2025, Hapag-Lloyd and DP World renewed their long-term partnership at the Port of Santos in Brazil. This extension secures collaboration for the next decade and includes a major expansion of the terminal, increasing quay length and annual handling capacity, which will allow Hapag-Lloyd to handle larger vessels and deliver new services for customers.

- In September 2025, Hiab Corporation signed a partnership with Forterra to accelerate the development of autonomous trucking and load handling solutions. This aims to elevate autonomous capabilities, enhancing sustainability and safety in logistics workflows.

- In September 2025, Liebherr and TPT entered into a 10-year strategic partnership agreement aimed at modernizing and enhancing efficiency across South Africa’s port operations. The agreement includes the supply of four large STS cranes for the Port of Durban and 48 rubber-tyred gantry (RTG) cranes for the Durban and Cape Town terminals, along with a 20-year asset management program to ensure long-term reliability of the equipment.

- In November 2024, Shanghai Zhenhua Heavy Industries Co., Ltd. (ZPMC) entered into a strategic cooperation agreement with Cavotec SA, marking a significant step toward advancing sustainability and innovation in port and terminal infrastructure globally. This partnership combines ZPMC’s expertise in manufacturing heavy-duty port equipment with Cavotec’s specialized technologies in automation and electrification. Together, they aim to develop cutting-edge solutions that improve the efficiency and environmental performance of ports, such as reducing emissions through electrified equipment and enhancing operational automation. By leveraging the strengths of both companies, the collaboration seeks to support the global maritime industry’s transition toward greener, smarter, and more sustainable port operations.

- In December 2024, Konecranes completed the acquisition of Rotterdam-based Peinemann Port Services BV and Peinemann Container Handling BV after receiving approval from the Dutch competition authority. The acquisition, valued at an undisclosed amount, added approximately 100 employees and strengthened Konecranes' position in the Netherlands, particularly in the Rotterdam area.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.3 COMPETITOR KEY PRICING STRATEGIES (PROMINENT PLAYERS)

4.4 TECHNOLOGY ANALYSIS – GLOBAL AUTOMATED CONTAINER TERMINAL MARKET

4.4.1 KEY TECHNOLOGIES

4.4.2 COMPLEMENTARY TECHNOLOGIES

4.4.3 ADJACENT TECHNOLOGIES

4.5 COMPANY PROFILING

4.5.1 HAPAG-LLOYD AG

4.5.1.1 LIST OF ACQUISITION

4.5.1.2 SHAREHOLDING PATTERN

4.5.1.3 COMPANY’S COMPETITORS AND ALTERNATIVES

4.5.1.4 BUSINESS MODEL

4.5.1.5 HOW THE COMPANY MAKES MONEY CANVAS

4.5.1.5.1 COMPANY CUSTOMER SEGMENTS

4.5.1.5.2 COMPANY VALUE PROPOSITIONS

4.5.1.5.3 COMPANY CHANNELS

4.5.1.5.4 COMPANY CUSTOMER RELATIONSHIPS

4.5.1.5.5 COMPANY REVENUE STREAMS

4.5.1.5.6 COMPANY KEY RESOURCES

4.5.1.5.7 COMPANY KEY ACTIVITIES

4.5.1.5.8 COMPANY KEY PARTNERS

4.5.1.5.9 COMPANY A COST STRUCTURE

4.5.1.5.10 COMPANY SWOT ANALYSIS

4.5.2 KONECRANES

4.5.2.1 LIST OF ACQUISITION

4.5.2.2 SHAREHOLDING PATTERN

4.5.2.3 COMPANY’S COMPETITORS AND ALTERNATIVES

4.5.2.4 BUSINESS MODEL

4.5.2.5 HOW THE COMPANY MAKES MONEY CANVAS

4.5.2.5.1 COMPANY CUSTOMER SEGMENTS

4.5.2.5.2 COMPANY VALUE PROPOSITIONS

4.5.2.5.3 COMPANY CHANNELS

4.5.2.5.4 COMPANY CUSTOMER RELATIONSHIPS

4.5.2.5.5 COMPANY REVENUE STREAMS

4.5.2.5.6 COMPANY KEY RESOURCES

4.5.2.5.7 COMPANY KEY ACTIVITIES

4.5.2.5.8 COMPANY KEY PARTNERS

4.5.2.5.9 COMPANY A COST STRUCTURE

4.5.2.5.10 COMPANY SWOT ANALYSIS

4.6 COMPETITIVE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 THE SURGE IN INTERNATIONAL TRADE HAS LED TO HIGHER CONTAINER THROUGHPUT

5.1.2 PROLIFERATION OF AUTOMATION, ROBOTICS, AND AI IN PORT OPERATIONS

5.1.3 SUSTAINABILITY INITIATIVES PROMOTING ENERGY-EFFICIENT AND LOW-EMISSION TERMINALS

5.1.4 RISING GOVERNMENT INVESTMENTS AND INCENTIVES FOR SMART PORT INITIATIVES

5.2 RESTRAINTS

5.2.1 HIGH UPFRONT INVESTMENT AND INSTALLATION COSTS

5.2.2 COMPLIANCE WITH STRINGENT REGIONAL REGULATIONS AND SAFETY STANDARDS

5.3 OPPORTUNITIES

5.3.1 EXPANSION OF AUTOMATED TERMINALS IN EMERGING MARKETS

5.3.2 INTEGRATION WITH SMART LOGISTICS SOLUTIONS AND PORT COMMUNITY SYSTEMS

5.3.3 GROWING ADOPTION OF ELECTRIC AND HYBRID AUTOMATED EQUIPMENT FOR SUSTAINABILITY

5.4 CHALLENGES

5.4.1 CYBERSECURITY RISKS ASSOCIATED WITH DIGITAL PORT INFRASTRUCTURE

5.4.2 SYSTEM INTEROPERABILITY WITH LEGACY EQUIPMENT AND MULTI-VENDOR SOLUTIONS

6 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION

6.1 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

6.1.1 SEMI-AUTOMATED TERMINALS

6.1.2 FULLY AUTOMATED TERMINALS

7 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE

7.1 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

7.1.1 BROWNFIELD PROJECTS

7.1.1.1 BROWNFIELD PROJECTS, BY TYPE

7.1.1.1.1 END-TO-END BROWNFIELD PROJECTS TERMINAL AUTOMATION

7.1.1.1.2 YARD-ONLY AUTOMATION RETROFITS

7.1.1.1.3 LANDSIDE / GATE AUTOMATION UPGRADES

7.1.1.1.4 QUAY CRANE AUTOMATION RETROFITS

7.1.2 GREENFIELD PROJECTS

7.1.2.1 GREENFIELD PROJECTS, BY TYPE

7.1.2.1.1 FULLY AUTOMATED GREENFIELD PROJECTS TERMINALS

7.1.2.1.2 SEMI-AUTOMATED GREENFIELD PROJECTS TERMINALS

7.1.2.1.3 PHASED GREENFIELD PROJECTS AUTOMATION

8 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING

8.1 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

8.1.1 EQUIPMENT

8.1.1.1 EQUIPMENT, BY TYPE

8.1.1.1.1 AUTOMATED & REMOTE-CONTROLLED CRANES

8.1.1.1.2 AUTOMATED HORIZONTAL TRANSPORT

8.1.1.1.3 GATE & LANDSIDE AUTOMATION EQUIPMENT

8.1.1.1.4 OTHERS

8.1.2 SOFTWARE

8.1.2.1 SOFTWARE, BY TYPE

8.1.2.1.1 EQUIPMENT CONTROL SYSTEMS (ECS) & FLEET MANAGEMENT

8.1.2.1.2 TERMINAL OPERATING SYSTEMS (TOS)

8.1.2.1.3 AUTOMATION & ORCHESTRATION PLATFORMS

8.1.2.1.4 DIGITAL TWIN & SIMULATION TOOLS

8.1.2.1.5 GATE & COMMUNITY PLATFORMS

8.1.2.1.6 OTHERS

8.1.3 SERVICES

8.1.3.1 SERVICE, BY TYPE

8.1.3.1.1 PROFESSIONAL SERVICES

8.1.3.1.2 MANAGED SERVICES

9 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY END USER

9.1 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

9.1.1 PUBLIC

9.1.1.1 PUBLIC, BY APPLICATION

9.1.1.1.1 PORT INFRASTRUCTURE MODERNIZATION

9.1.1.1.2 TRADE FACILITATION & CUSTOMS AUTOMATION

9.1.1.1.3 SAFETY & COMPLIANCE AUTOMATION

9.1.1.1.4 SMART NATIONAL LOGISTICS CORRIDORS

9.1.1.1.5 PUBLIC–PRIVATE PARTNERSHIP (PPP) CO-MANAGED TERMINALS

9.1.1.1.6 OTHERS

9.1.2 PRIVATE

9.1.2.1 PRIVATE, BY APPLICATION

9.1.2.1.1 HIGH-VOLUME AUTOMATED CONTAINER HANDLING

9.1.2.1.2 AUTOMATED LOGISTICS & INTERMODAL HUBS

9.1.2.1.3 CARRIER-OWNED SMART TERMINALS

9.1.2.1.4 SUBSCRIPTION & MANAGED TERMINAL AUTOMATION SERVICES

10 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL

10.1 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

10.1.1 DIRECT CHANNEL

10.1.2 INDIRECT CHANNEL

10.1.2.1 INDIRECT CHANNEL, BY TYPE

10.1.2.1.1 SYSTEM INTEGRATORS

10.1.2.1.2 VALUE-ADDED RESELLERS (VAR)

10.1.2.1.3 OTHERS

11 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY REGION

11.1 OVERVIEW

11.2 ASIA-PACIFIC

11.2.1 CHINA

11.2.2 SINGAPORE

11.2.3 SOUTH KOREA

11.2.4 JAPAN

11.2.5 INDIA

11.2.6 AUSTRALIA

11.2.7 MALAYSIA (

11.2.8 INDONESIA

11.2.9 THAILAND

11.2.10 PHILIPPINES (

11.2.11 REST OF ASIA PACIFIC

11.3 EUROPE

11.3.1 GERMANY

11.3.2 NETHERLANDS

11.3.3 BELGIUM

11.3.4 UNITED KINGDOM

11.3.5 FRANCE

11.3.6 ITALY

11.3.7 SPAIN

11.3.8 RUSSIA

11.3.9 TURKEY

11.3.10 SWITZERLAND

11.3.11 REST OF EUROPE

11.4 NORTH AMERICA

11.4.1 U.S.

11.4.2 CANADA

11.4.3 MEXICO

11.5 SOUTH AMERICA

11.5.1 BRAZIL

11.5.2 CHILE

11.5.3 COLOMBIA

11.5.4 PERU

11.5.5 ARGENTINA

11.5.6 REST OF SOUTH AMERICA

11.6 MIDDLE EAST AND AFRICA

11.6.1 U.A.E

11.6.2 SAUDI ARABIA

11.6.3 SOUTH AFRICA

11.6.4 EGYPT

11.6.5 ISRAEL

11.6.6 REST OF MIDDLE EAST & AFRICA

12 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LIEBHERR

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 BECKHOFF AUTOMATION

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 SHANGHAI ZHENHUA HEAVY INDUSTRIES CO., LTD.

14.3.1 COMPANY SNAPSHOTS

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 KONECRANES

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 KALMAR CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 ABB

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 APM TERMINALS

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 CAMCO TECHNOLOGIES

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 CLT

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 HIAB CORPORATION (SUBSIDIARY OF CARGOTEC)

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 HAPAG-LLOYD AG

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 INFYZ.COM.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 INFORM SOFTWARE

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 IDENTEC SOLUTIONS AG

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 KÜNZ GMBH

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 LOGSTAR ERP.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 LOGINNO LOGISTIC INNOVATION LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 ORBCOMM

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 PACECO CORP.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 STARCOM GPS GLOBAL SOLUTIONS

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 ECENT DEVELOPMENT

14.21 TMEIC

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 TIDEWORKS.

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENT

14.23 TOTAL SOFT BANK LTD.

14.23.1 COMPANY SNAPSHOT

14.23.2 REVENUE ANALYSIS

14.23.3 PRODUCT PORTFOLIO

14.24 WCS CONSULTANCY

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 INDUSTRY ANALYSIS AND FUTURISTIC SCENARIO OF THE GLOBAL AUTOMATED CONTAINER TERMINAL MARKET

TABLE 2 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 3 GLOBAL SEMI-AUTOMATED TERMINALS IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 4 GLOBAL FULLY AUTOMATED TERMINALS IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 5 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 6 GLOBAL BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 7 GLOBAL BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 8 GLOBAL GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 9 GLOBAL GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 10 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 11 GLOBAL EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 12 GLOBAL EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 13 GLOBAL SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 14 GLOBAL SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 15 GLOBAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 GLOBAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 17 GLOBAL PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 19 GLOBAL PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 20 GLOBAL PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 21 GLOBAL PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 GLOBAL PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 23 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 24 GLOBAL DIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 25 GLOBAL INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 GLOBAL INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 28 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 43 CHINA (USD THOUSAND)

TABLE 44 CHINA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 45 CHINA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 CHINA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 47 CHINA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 CHINA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 49 CHINA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 50 CHINA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 51 CHINA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 52 CHINA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 CHINA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 54 CHINA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 55 CHINA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 56 CHINA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 57 CHINA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 58 SINGAPORE (USD THOUSAND)

TABLE 59 SINGAPORE AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 60 SINGAPORE AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 SINGAPORE BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 62 SINGAPORE GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 63 SINGAPORE AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 64 SINGAPORE EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 SINGAPORE SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 SINGAPORE SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 SINGAPORE PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 68 SINGAPORE AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 69 SINGAPORE PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 70 SINGAPORE PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 71 SINGAPORE AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 72 SINGAPORE INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 SOUTH KOREA (USD THOUSAND)

TABLE 74 SOUTH KOREA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 75 SOUTH KOREA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 SOUTH KOREA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 SOUTH KOREA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 SOUTH KOREA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 79 SOUTH KOREA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 SOUTH KOREA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 SOUTH KOREA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 82 SOUTH KOREA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 83 SOUTH KOREA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 84 SOUTH KOREA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 85 SOUTH KOREA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 86 SOUTH KOREA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 87 SOUTH KOREA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 88 JAPAN (USD THOUSAND)

TABLE 89 JAPAN AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 90 JAPAN AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 JAPAN BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 JAPAN GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 93 JAPAN AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 94 JAPAN EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 JAPAN SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 JAPAN SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 JAPAN PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 JAPAN AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 99 JAPAN PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 100 JAPAN PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 101 JAPAN AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 102 JAPAN INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 INDIA (USD THOUSAND)

TABLE 104 INDIA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 105 INDIA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 INDIA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 INDIA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 INDIA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 109 INDIA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 INDIA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 111 INDIA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 112 INDIA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 113 INDIA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 114 INDIA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 115 INDIA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 116 INDIA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 117 INDIA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 118 AUSTRALIA (USD THOUSAND)

TABLE 119 AUSTRALIA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 120 AUSTRALIA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 121 AUSTRALIA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 122 AUSTRALIA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 AUSTRALIA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 124 AUSTRALIA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 AUSTRALIA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 AUSTRALIA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 127 AUSTRALIA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 AUSTRALIA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 129 AUSTRALIA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 130 AUSTRALIA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 131 AUSTRALIA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 132 AUSTRALIA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 MALAYSIA (USD THOUSAND)

TABLE 134 MALAYSIA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 135 MALAYSIA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 136 MALAYSIA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 MALAYSIA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 138 MALAYSIA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 139 MALAYSIA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 140 MALAYSIA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 MALAYSIA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 MALAYSIA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 143 MALAYSIA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 144 MALAYSIA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 145 MALAYSIA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 146 MALAYSIA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 147 MALAYSIA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 INDONESIA (USD THOUSAND)

TABLE 149 INDONESIA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 150 INDONESIA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 INDONESIA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 152 INDONESIA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 INDONESIA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 154 INDONESIA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 INDONESIA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 INDONESIA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 157 INDONESIA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 INDONESIA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 159 INDONESIA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 160 INDONESIA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 161 INDONESIA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 162 INDONESIA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 163 THAILAND (USD THOUSAND)

TABLE 164 THAILAND AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 165 THAILAND AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 166 THAILAND BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 THAILAND GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 168 THAILAND AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 169 THAILAND EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 THAILAND SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 THAILAND SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 THAILAND PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 173 THAILAND AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 174 THAILAND PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 175 THAILAND PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 176 THAILAND AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 177 THAILAND INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 PHILIPPINES (USD THOUSAND)

TABLE 179 PHILIPPINES AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 180 PHILIPPINES AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 PHILIPPINES BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 PHILIPPINES GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 PHILIPPINES AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 184 PHILIPPINES EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 185 PHILIPPINES SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 PHILIPPINES SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 PHILIPPINES PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 188 PHILIPPINES AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 189 PHILIPPINES PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 190 PHILIPPINES PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 191 PHILIPPINES AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 192 PHILIPPINES INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 193 REST OF ASIA PACIFIC (USD THOUSAND)

TABLE 194 REST OF ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 195 REST OF ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 196 REST OF ASIA-PACIFIC BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 197 REST OF ASIA-PACIFIC GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 REST OF ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 199 REST OF ASIA-PACIFIC EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 200 REST OF ASIA-PACIFIC SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 201 REST OF ASIA-PACIFIC SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 202 REST OF ASIA-PACIFIC PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 203 REST OF ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 204 REST OF ASIA-PACIFIC PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 205 REST OF ASIA-PACIFIC PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 206 REST OF ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 207 REST OF ASIA-PACIFIC INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 208 EUROPE AUTOMATED CONTAINER TERMINAL MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 209 EUROPE AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 210 EUROPE AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 211 EUROPE BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 212 EUROPE GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 EUROPE AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 214 EUROPE EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 215 EUROPE SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 EUROPE SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 217 EUROPE PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 218 EUROPE AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 219 EUROPE PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 220 EUROPE PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 221 EUROPE AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 222 EUROPE INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 223 GERMANY (USD THOUSAND)

TABLE 224 GERMANY AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 225 GERMANY AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 226 GERMANY BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 227 GERMANY GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 228 GERMANY AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 229 GERMANY EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 230 GERMANY SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 231 GERMANY SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 232 GERMANY PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 233 GERMANY AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 234 GERMANY PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 235 GERMANY PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 236 GERMANY AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 237 GERMANY INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 238 NETHERLANDS (USD THOUSAND)

TABLE 239 NETHERLANDS AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 240 NETHERLANDS AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 241 NETHERLANDS BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 242 NETHERLANDS GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 243 NETHERLANDS AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 244 NETHERLANDS EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 245 NETHERLANDS SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 246 NETHERLANDS SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 247 NETHERLANDS PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 248 NETHERLANDS AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 249 NETHERLANDS PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 250 NETHERLANDS PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 251 NETHERLANDS AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 252 NETHERLANDS INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 253 BELGIUM (USD THOUSAND)

TABLE 254 BELGIUM AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 255 BELGIUM AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 256 BELGIUM BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 257 BELGIUM GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 258 BELGIUM AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 259 BELGIUM EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 260 BELGIUM SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 261 BELGIUM SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 262 BELGIUM PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 263 BELGIUM AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 264 BELGIUM PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 265 BELGIUM PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 266 BELGIUM AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 267 BELGIUM INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 268 UNITED KINGDOM (USD THOUSAND)

TABLE 269 UNITED KINGDOM AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 270 UNITED KINGDOM AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 271 UNITED KINGDOM BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 272 UNITED KINGDOM GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 273 UNITED KINGDOM AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 274 UNITED KINGDOM EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 275 UNITED KINGDOM SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 276 UNITED KINGDOM SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 277 UNITED KINGDOM PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 278 UNITED KINGDOM AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 279 UNITED KINGDOM PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 280 UNITED KINGDOM PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 281 UNITED KINGDOM AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 282 UNITED KINGDOM INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 283 FRANCE (USD THOUSAND)

TABLE 284 FRANCE AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 285 FRANCE AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 286 FRANCE BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 287 FRANCE GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 288 FRANCE AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 289 FRANCE EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 290 FRANCE SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 291 FRANCE SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 292 FRANCE PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 293 FRANCE AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 294 FRANCE PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 295 FRANCE PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 296 FRANCE AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 297 FRANCE INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 298 ITALY (USD THOUSAND)

TABLE 299 ITALY AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 300 ITALY AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 301 ITALY BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 302 ITALY GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 303 ITALY AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 304 ITALY EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 305 ITALY SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 306 ITALY SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 307 ITALY PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 308 ITALY AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 309 ITALY PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 310 ITALY PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 311 ITALY AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 312 ITALY INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 313 SPAIN (USD THOUSAND)

TABLE 314 SPAIN AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 315 SPAIN AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 316 SPAIN BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 317 SPAIN GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 318 SPAIN AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 319 SPAIN EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 320 SPAIN SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 321 SPAIN SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 322 SPAIN PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 323 SPAIN AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 324 SPAIN PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 325 SPAIN PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 326 SPAIN AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 327 SPAIN INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 328 RUSSIA (USD THOUSAND)

TABLE 329 RUSSIA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 330 RUSSIA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 331 RUSSIA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 332 RUSSIA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 333 RUSSIA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 334 RUSSIA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 335 RUSSIA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 336 RUSSIA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 337 RUSSIA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 338 RUSSIA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 339 RUSSIA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 340 RUSSIA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 341 RUSSIA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 342 RUSSIA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 343 TURKEY (USD THOUSAND)

TABLE 344 TURKEY AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 345 TURKEY AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 346 TURKEY BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 347 TURKEY GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 348 TURKEY AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 349 TURKEY EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 350 TURKEY SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 351 TURKEY SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 352 TURKEY PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 353 TURKEY AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 354 TURKEY PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 355 TURKEY PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 356 TURKEY AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 357 TURKEY INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 358 SWITZERLAND (USD THOUSAND)

TABLE 359 SWITZERLAND AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 360 SWITZERLAND AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 361 SWITZERLAND BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 362 SWITZERLAND GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 363 SWITZERLAND AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 364 SWITZERLAND EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 365 SWITZERLAND SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 366 SWITZERLAND SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 367 SWITZERLAND PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 368 SWITZERLAND AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 369 SWITZERLAND PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 370 SWITZERLAND PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 371 SWITZERLAND AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 372 SWITZERLAND INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 373 REST OF EUROPE (USD THOUSAND)

TABLE 374 REST OF EUROPE AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 375 REST OF EUROPE AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 376 REST OF EUROPE BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 377 REST OF EUROPE GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 378 REST OF EUROPE AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 379 REST OF EUROPE EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 380 REST OF EUROPE SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 381 REST OF EUROPE SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 382 REST OF EUROPE PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 383 REST OF EUROPE AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 384 REST OF EUROPE PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 385 REST OF EUROPE PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 386 REST OF EUROPE AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 387 REST OF EUROPE INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 388 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 389 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 390 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)