Global Automated Guided Vehicle Agv Software Market

Market Size in USD Billion

CAGR :

%

USD

4.82 Billion

USD

15.74 Billion

2024

2032

USD

4.82 Billion

USD

15.74 Billion

2024

2032

| 2025 –2032 | |

| USD 4.82 Billion | |

| USD 15.74 Billion | |

|

|

|

|

Global Automated Guided Vehicle (AGV) Software Market Size

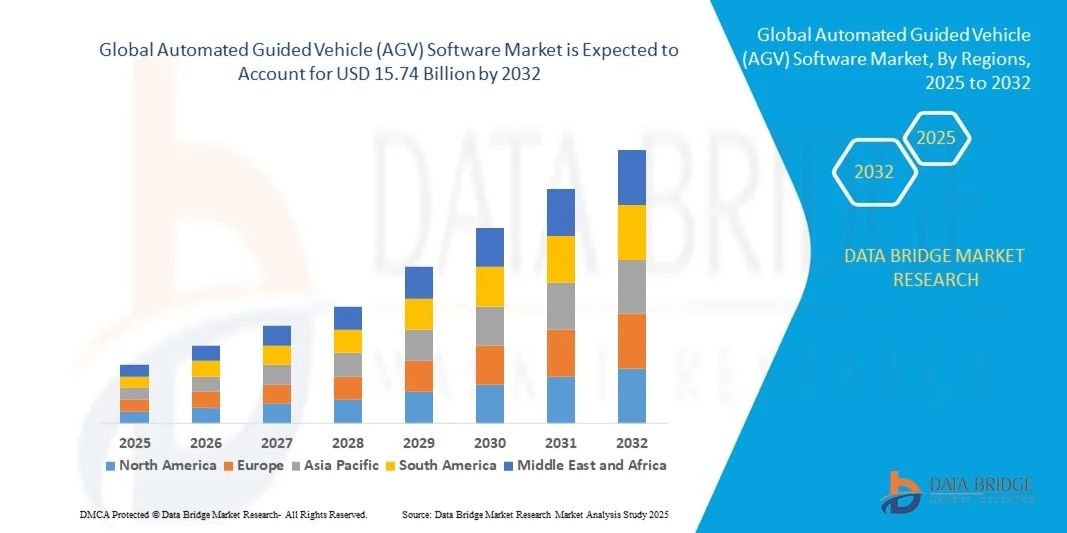

- The global Automated Guided Vehicle (AGV) Software Market size was valued at USD 4.82 billion in 2024 and is projected to reach USD 15.74 billion by 2032, growing at a CAGR of 15.95% during the forecast period.

- Market expansion is primarily driven by increasing automation in logistics, manufacturing, and warehousing sectors, alongside advancements in AI and robotics enhancing AGV capabilities and efficiency.

- Additionally, the rising need for operational cost reduction, improved safety, and optimized material handling solutions in industries is accelerating the adoption of AGV software, significantly propelling the market’s growth.

Global Automated Guided Vehicle (AGV) Software Market Analysis

- Automated Guided Vehicles (AGVs), providing autonomous material handling and transportation solutions, are increasingly essential in modern manufacturing, warehousing, and logistics operations due to their efficiency, precision, and integration with Industry 4.0 technologies.

- The rising demand for AGV software is primarily driven by the need for automation to reduce labor costs, improve operational safety, and enhance supply chain efficiency across various industries.

- Europe dominated the Global Automated Guided Vehicle (AGV) Software Market with the largest revenue share of 34.4% in 2024, supported by early adoption of automation technologies, significant investments in smart manufacturing, and the presence of leading AGV software providers, with the U.S. market seeing strong growth fueled by advancements in AI and IoT integration.

- Asia-Pacific is expected to be the fastest-growing region in the Global Automated Guided Vehicle (AGV) Software Market during the forecast period, attributed to rapid industrialization, expanding e-commerce sectors, and increasing focus on warehouse automation in countries like China, Japan, and India.

- The Integrated Software segment dominated the market with the largest market revenue share of 61.4% in 2024, attributed to its ability to manage, monitor, and optimize entire AGV fleets from a centralized platform

Report Scope and Global Automated Guided Vehicle (AGV) Software Market Segmentation

|

Attributes |

Automated Guided Vehicle (AGV) Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Global Automated Guided Vehicle (AGV) Software Market Trends

Enhanced Efficiency Through AI and Voice Integration

- A significant and accelerating trend in the global Automated Guided Vehicle (AGV) Software Market is the deepening integration with artificial intelligence (AI) and popular voice-controlled ecosystems such as Amazon Alexa, Google Assistant, and Apple HomeKit. This fusion of technologies is significantly enhancing operational efficiency and ease of use in automated material handling systems.

- For instance, advanced AGV software platforms now enable voice-activated commands to control vehicle movements, route adjustments, and task prioritization, allowing operators to manage fleets more intuitively and hands-free. Similarly, some systems offer integration with digital assistants to provide real-time status updates and operational alerts via voice notifications.

- AI integration in AGV software enables features such as adaptive route planning based on real-time warehouse conditions, predictive maintenance alerts, and intelligent fleet coordination to optimize throughput. For example, some AGV systems use machine learning algorithms to analyze traffic patterns within facilities, dynamically rerouting vehicles to avoid congestion and reduce downtime. Voice control capabilities add an additional layer of user-friendly interaction, allowing operators to initiate or modify tasks remotely using simple voice commands.

- The seamless integration of AGV software with broader smart factory and IoT platforms facilitates centralized control over various aspects of the automated environment. Through a single interface, users can manage AGV fleets alongside robotic arms, conveyor systems, and inventory management tools, creating a unified and highly efficient industrial ecosystem.

- This trend towards more intelligent, intuitive, and interconnected AGV systems is fundamentally reshaping expectations for automation in logistics and manufacturing. Consequently, companies such as Geek+ and Mobile Industrial Robots (MiR) are developing AI-enabled AGV solutions with features like automatic task allocation, real-time fleet monitoring, and voice command compatibility with popular digital assistants.

- The demand for AGV software that offers seamless AI and voice control integration is growing rapidly across industries such as e-commerce, automotive, and pharmaceuticals, as businesses increasingly prioritize operational efficiency, flexibility, and comprehensive smart factory functionality.

Global Automated Guided Vehicle (AGV) Software Market Dynamics

Driver

Growing Need Due to Rising Demand for Automation and Operational Efficiency

- The increasing demand for automation across industries such as e-commerce, automotive, and manufacturing, combined with the need for operational efficiency and labor optimization, is significantly driving the adoption of AGV software globally.

- For instance, in March 2024, Toyota Industries Corporation announced the expansion of its AGV software capabilities to enhance real-time fleet management and integration with smart factory platforms, reflecting the industry's strategic shift toward fully connected, intelligent automation systems.

- As companies face pressure to meet faster delivery times, manage labor shortages, and optimize intralogistics, AGV software offers advanced features like real-time fleet tracking, intelligent task allocation, and predictive maintenance—all of which help improve throughput and reduce downtime.

- Additionally, the integration of AGV software with warehouse management systems (WMS), enterprise resource planning (ERP) tools, and IoT devices is making AGVs a vital component of Industry 4.0 environments. This enables centralized control, data-driven operations, and seamless connectivity across automated facilities.

- The flexibility of modern AGV software allows for the management of mixed fleets (AGVs, AMRs, forklifts), scalable deployments, and remote operation. These capabilities are driving adoption not only in large-scale facilities but also in mid-sized enterprises seeking to modernize their operations without significant infrastructure overhauls.

Restraint/Challenge

High Implementation Costs and Integration Complexities

- One of the primary challenges limiting the widespread adoption of AGV software is the high initial investment required for implementation, including hardware (AGVs), infrastructure upgrades, and software licensing. These costs can be a barrier, especially for small- to mid-sized enterprises with limited automation budgets.

- Additionally, integrating AGV software into existing warehouse and factory systems can be complex, often requiring custom configurations, skilled IT support, and downtime for installation—factors that deter some companies from transitioning to automation.

- For Instance, legacy systems may not be compatible with advanced AGV software platforms, necessitating costly upgrades or full system replacements to achieve seamless integration. Moreover, the need for employee training and technical support further adds to the total cost of ownership.

- Concerns around system interoperability, cybersecurity, and long-term maintenance also play a role. As AGV software relies heavily on network connectivity and data exchange, any security vulnerabilities or connectivity failures can disrupt entire operations.

- To overcome these challenges, vendors are focusing on modular software designs, plug-and-play solutions, cloud-based platforms, and enhanced support services to simplify integration. The development of subscription-based pricing models and scalable deployment options is also helping lower entry barriers for smaller organizations.

Global Automated Guided Vehicle (AGV) Software Market Scope

Automated guided vehicle (AGV) software market is segmented on the basis of offering and end user.

- By Offering

On the basis of offering, the Global Automated Guided Vehicle (AGV) Software Market is segmented into In-Built Vehicle Software and Integrated Software. The Integrated Software segment dominated the market with the largest market revenue share of 61.4% in 2024, attributed to its ability to manage, monitor, and optimize entire AGV fleets from a centralized platform. Integrated software allows seamless communication with warehouse management systems (WMS), enterprise resource planning (ERP) systems, and IoT-enabled devices, making it ideal for large-scale operations across manufacturing, logistics, and retail. Its compatibility with multiple vehicle types and systems makes it essential for enterprises looking to scale automation.

The In-Built Vehicle Software segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the growing trend of compact AGVs and autonomous mobile robots (AMRs). These pre-configured systems reduce the need for complex integration, offering a plug-and-play solution for smaller warehouses or specialized applications where simplicity, low cost, and rapid deployment are prioritized.

- By End User

On the basis of end user, the Global Automated Guided Vehicle (AGV) Software Market is segmented into Automotive, Manufacturing, Food and Beverages, Aerospace, Healthcare, Logistics, Retail, and Others. The Logistics segment held the largest market revenue share of 29.8% in 2024, driven by a surge in warehouse automation fueled by e-commerce growth and increasing demand for real-time order fulfillment. AGV software plays a crucial role in enhancing logistics operations by optimizing inventory movement, reducing human error, and providing data-driven insights for continuous process improvement. Large-scale distribution centers and third-party logistics (3PL) providers are key adopters in this segment.

The Healthcare segment is anticipated to register the fastest CAGR from 2025 to 2032, propelled by the rising need for safe, hygienic, and efficient transportation of medical supplies, lab samples, and pharmaceuticals. AGV software in healthcare facilities enables autonomous delivery and route optimization while ensuring strict adherence to safety protocols. The post-pandemic focus on automation in critical environments further drives growth in this segment.

Global Automated Guided Vehicle (AGV) Software Market Regional Analysis

- Europe dominated the Global Automated Guided Vehicle (AGV) Software Market with the largest revenue share of 34.4% in 2024, driven by rapid industrial automation, a strong presence of key market players, and high adoption of advanced logistics technologies across manufacturing and warehousing sectors.

- Companies in the region prioritize operational efficiency, labor optimization, and digital transformation, leading to widespread deployment of AGVs powered by sophisticated software systems. The growing presence of e-commerce giants, such as Amazon and Walmart, further boosts demand for intelligent intralogistics solutions.

- This leadership position is supported by well-established infrastructure, significant investment in Industry 4.0 technologies, and increasing emphasis on real-time data analytics and fleet management. The region’s innovation-driven economy and preference for integrated automation platforms have firmly positioned AGV software as a critical enabler of productivity in both commercial and industrial applications.

U.S. AGV Software Market Insight

The U.S. AGV software market captured the largest revenue share of 78% in 2024 within North America, fueled by the rapid automation of warehouses and manufacturing facilities. The country’s leadership in e-commerce, automotive, and logistics sectors drives strong demand for AGV systems, supported by advanced software capabilities. The adoption of AI, IoT, and cloud-based fleet management tools enhances the performance and scalability of AGV operations. Additionally, the presence of leading AGV software providers and continuous investment in Industry 4.0 infrastructure position the U.S. as a dominant market. Labor shortages and the push for contactless material handling further amplify demand for intelligent AGV solutions.

Europe AGV Software Market Insight

The Europe AGV software market is projected to grow at a substantial CAGR throughout the forecast period, driven by stringent workplace safety regulations and increased focus on operational efficiency. Countries like Germany, France, and the Netherlands are investing heavily in smart factories and digital logistics infrastructure. The need to streamline internal logistics in automotive, food and beverage, and pharmaceuticals is prompting businesses to adopt intelligent AGV software solutions. Additionally, the growing demand for electric and sustainable transport within warehouses aligns with the shift towards autonomous guided vehicles managed via integrated, energy-efficient software systems.

U.K. AGV Software Market Insight

The U.K. AGV software market is expected to witness a significant CAGR during the forecast period, supported by the growing emphasis on supply chain automation and industrial digitization. The country’s logistics and warehousing sectors are rapidly modernizing, with AGV systems being adopted to enhance order fulfillment and reduce labor dependency. Post-Brexit economic realignments have also spurred interest in boosting domestic manufacturing productivity, where AGV software plays a crucial role. Increasing investment in AI-powered automation and real-time data monitoring contributes to a favorable market environment for AGV software providers in the U.K.

Germany AGV Software Market Insight

The Germany AGV software market is forecast to expand at a robust CAGR, backed by its leading position in industrial automation and engineering innovation. As a hub for automotive and manufacturing excellence, Germany is driving the adoption of AGVs to support lean production, precision logistics, and smart factory operations. Strong government support for Industry 4.0 initiatives, combined with a skilled workforce and high R&D investment, accelerates the integration of intelligent AGV software solutions. The demand for efficient, data-driven material handling across various sectors ensures sustained market growth.

Asia-Pacific AGV Software Market Insight

The Asia-Pacific AGV software market is poised to grow at the fastest CAGR of 25.6% from 2025 to 2032, driven by rapid industrialization, increasing labor costs, and growing demand for supply chain automation in key economies such as China, Japan, and India. The region is emerging as both a consumer and manufacturer of AGVs and related software systems, benefiting from economies of scale and technological innovation. Government-led digitalization initiatives, expanding e-commerce operations, and the development of smart logistics parks are further accelerating the deployment of AGV software across diverse industries.

Japan AGV Software Market Insight

The Japan AGV software market is gaining strong momentum, driven by its mature manufacturing base and culture of technological innovation. The rise of smart factories, particularly in the automotive and electronics sectors, is fueling the need for advanced AGV fleet management solutions. Japanese firms prioritize precision, automation, and long-term reliability, leading to demand for highly adaptive and AI-integrated AGV software platforms. The aging workforce and a national focus on labor-saving technologies also support increased AGV adoption in logistics and healthcare environments.

China AGV Software Market Insight

The China AGV software market accounted for the largest revenue share in Asia-Pacific in 2024, thanks to its booming manufacturing sector, massive e-commerce growth, and strong support for industrial automation. Government initiatives like “Made in China 2025” are propelling the adoption of smart logistics solutions, including AGVs powered by intelligent software. With a vast number of domestic AGV manufacturers and competitive pricing, China is both a major producer and consumer of AGV systems. The demand for efficiency, safety, and scalability in warehouses and production facilities is a major driver of market expansion.

Global Automated Guided Vehicle (AGV) Software Market Share

The Automated Guided Vehicle (AGV) Software industry is primarily led by well-established companies, including:

• Daifuku Co., Ltd. (Japan)

• KUKA AG (Germany)

• Dematic (U.S.)

• Toyota Industries Corporation (Japan)

• JBT Corporation (U.S.)

• Seegrid Corporation (U.S.)

• Egemin Automation (Belgium)

• Honeywell Intelligrated (U.S.)

• Swisslog Holding AG (Switzerland)

• Murata Machinery, Ltd. (Japan)

• Geek+ (China)

• Mobile Industrial Robots (MiR) (Denmark)

• Northrop Grumman Corporation (U.S.)

• SSI Schäfer (Germany)

• Autostore (Norway)

What are the Recent Developments in Global Automated Guided Vehicle (AGV) Software Market?

- In May 2023, KUKA AG, a leading German automation company, launched a next-generation AGV software suite aimed at improving real-time fleet coordination in high-density industrial environments. The software integrates advanced AI algorithms to enable predictive routing, dynamic task assignment, and obstacle avoidance across multiple AGVs. This launch reinforces KUKA's position as a pioneer in smart factory automation and showcases its commitment to enhancing operational efficiency through intelligent software solutions tailored to complex manufacturing ecosystems.

- In April 2023, Toyota Industries Corporation unveiled an upgraded version of its T-Hive fleet management system, designed to optimize AGV operations in large-scale warehouses and logistics centers. The system provides cloud-based control, real-time diagnostics, and advanced analytics to reduce downtime and boost throughput. By integrating with warehouse management systems (WMS), the software ensures seamless material handling workflows. This move underscores Toyota's ongoing investment in digital transformation and end-to-end automation capabilities.

- In March 2023, Daifuku Co., Ltd. expanded its software offerings with the launch of “Sym3,” a digital twin simulation platform for AGV operations. This innovative tool enables users to model, test, and validate AGV movement and performance in virtual environments before deployment. Designed to reduce operational risk and implementation time, Sym3 highlights Daifuku’s focus on innovation and customer-centric automation solutions, strengthening its role in driving smart manufacturing initiatives globally.

- In February 2023, Geek+, a leading Chinese robotics and automation company, partnered with a major European retailer to deploy its RoboShuttle system powered by proprietary AGV software. This collaboration aims to enhance intralogistics efficiency and improve order accuracy across distribution centers. The software enables intelligent traffic control and inventory tracking, highlighting Geek+’s ability to deliver scalable automation solutions for fast-paced retail environments and its growing influence in the European market.

- In January 2023, Seegrid Corporation introduced its “Fleet Central” software platform, an AI-powered solution for real-time AGV fleet monitoring and analytics. Designed for industrial environments such as manufacturing plants and fulfillment centers, the platform allows operators to visualize workflows, optimize traffic patterns, and perform predictive maintenance. The launch marks a strategic move to position Seegrid as a leader in software-first AGV solutions, focusing on data-driven performance and user-friendly operational control.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Automated Guided Vehicle Agv Software Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automated Guided Vehicle Agv Software Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automated Guided Vehicle Agv Software Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.