Global Automated Sample Storage Systems Market

Market Size in USD Billion

CAGR :

%

USD

1.81 Billion

USD

7.22 Billion

2025

2033

USD

1.81 Billion

USD

7.22 Billion

2025

2033

| 2026 –2033 | |

| USD 1.81 Billion | |

| USD 7.22 Billion | |

|

|

|

|

Automated Sample Storage Systems Market Size

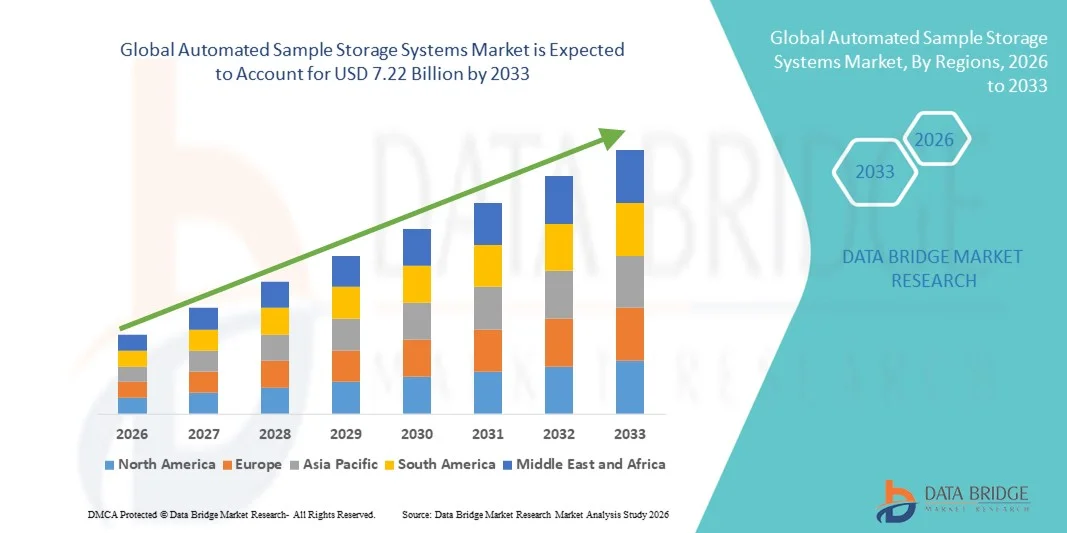

- The global automated sample storage systems market size was valued at USD 1.81 billion in 2025 and is expected to reach USD 7.22 billion by 2033, at a CAGR of 18.90% during the forecast period

- The market growth for automated sample storage systems is primarily driven by the increasing need for efficient sample management, improved laboratory workflow, and enhanced data accuracy across research, clinical, and diagnostic settings

- Rising adoption of advanced automation technologies in laboratories, coupled with the demand for high-throughput sample handling, is fueling the growth of automated storage solutions

Automated Sample Storage Systems Market Analysis

- Automated Sample Storage Systems, offering precise and high-throughput storage solutions for biological and chemical samples, are increasingly vital components of modern laboratories, biobanks, and clinical research facilities due to their enhanced efficiency, sample integrity, and streamlined workflow management

- The escalating demand for automated sample storage is primarily fueled by the growing adoption of laboratory automation technologies, increasing sample volumes in research and diagnostics, and a rising preference for error-free, temperature-controlled storage systems

- North America dominated the automated sample storage systems market with the largest revenue share of 42.5% in 2025, driven by advanced laboratory infrastructure, high investment in research and development, and a strong presence of key industry players. The U.S. experienced substantial growth in installations, particularly in clinical, pharmaceutical, and research laboratories, fueled by innovations from both established and emerging automation solution providers

- Asia-Pacific is expected to be the fastest-growing region in the automated sample storage systems market during the forecast period, registering a CAGR of 9.2% from 2026 to 2033. Growth is supported by increasing urbanization, rising R&D expenditure, expanding pharmaceutical and biotech industries, and government initiatives promoting laboratory automation in countries such as China, India, and Japan

- The Biological Sample Storage segment dominated the market with a revenue share of 52.1% in 2025, owing to the surge in biobanking, clinical trials, and molecular diagnostics research

Report Scope and Automated Sample Storage Systems Market Segmentation

|

Attributes |

Automated Sample Storage Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Automated Sample Storage Systems Market Trends

Enhanced Laboratory Efficiency and Workflow Automation

- A significant and accelerating trend in the global automated sample storage systems market is the adoption of advanced laboratory automation and workflow optimization solutions. This trend is enabling research facilities, biobanks, and clinical laboratories to streamline sample management, reduce errors, and enhance operational efficiency

- For instance, high-throughput automated sample storage units are increasingly being integrated with laboratory information management systems (LIMS), allowing for seamless tracking, retrieval, and documentation of samples

- Automation trends also include modular and scalable storage solutions that can accommodate varying sample volumes, offering flexibility for research expansion and facility upgrades

- Temperature-controlled storage with precise monitoring systems is becoming standard, ensuring sample integrity for long-term preservation

- The focus on reducing manual handling, improving reproducibility, and maintaining sample quality is driving laboratories to increasingly adopt automated storage systems. Companies are also introducing solutions that enable remote monitoring and predictive maintenance, supporting continuous workflow efficiency

- This trend towards more efficient, scalable, and reliable sample storage solutions is reshaping expectations across research, clinical, and pharmaceutical sectors, leading to higher adoption rates globally

Automated Sample Storage Systems Market Dynamics

Driver

Growing Need Due to Efficient Sample Management and Laboratory Automation

- The increasing demand for precise and efficient sample handling in laboratories, research institutions, and pharmaceutical facilities is a significant driver for the growing adoption of Automated Sample Storage Systems

- For instance, in April 2025, Thermo Fisher Scientific announced the expansion of its sample storage portfolio with enhanced automation features aimed at optimizing workflow efficiency. Such strategies by key companies are expected to drive the Automated Sample Storage Systems industry growth in the forecast period

- As laboratories handle increasing volumes of samples, the need for reliable storage systems that ensure sample integrity, reduce human error, and save time is becoming more critical. Automated systems provide controlled environments with consistent temperature and humidity conditions, supporting research accuracy

- Furthermore, the rising focus on high-throughput screening, biobanking, and long-term sample preservation is driving adoption, as these systems enable centralized, organized, and secure sample management

- The convenience of automated monitoring, tracking, and retrieval of samples, along with the reduction of manual labor, are key factors propelling the adoption of Automated Sample Storage Systems across research and clinical laboratories. The trend toward laboratory automation and efficiency, coupled with increasing availability of user-friendly solutions, further contributes to market growth

Restraint/Challenge

Concerns Regarding High Initial Costs and Maintenance Requirements

- The relatively high initial investment required for advanced automated sample storage systems can pose a significant challenge for budget-constrained laboratories or smaller research facilities

- For instance, high-capacity ultra-low temperature storage units with integrated automation can cost several tens of thousands of dollars, making procurement a considerable financial commitment

- Addressing these challenges through leasing models, modular systems, and flexible financing options is crucial for expanding adoption

- In addition, ongoing maintenance, calibration, and energy requirements may add to the total cost of ownership, which can limit uptake among cost-sensitive users

- While prices are gradually decreasing with technological advancements and increased competition, the perceived premium for automated systems can still hinder widespread adoption in certain regions or smaller facilities

- Overcoming these challenges through cost-effective solutions, training programs for lab personnel, and optimized energy-efficient systems will be vital for sustained market growth

Automated Sample Storage Systems Market Scope

The market is segmented on the basis of product type, application, capacity, and end user.

- By Product Type

On the basis of product type, the Automated Sample Storage Systems market is segmented into System Units, Reagents, and Consumables. The System Units segment dominated the market with the largest revenue share of 46.3% in 2025, driven by increasing demand for high-throughput, automated sample storage solutions in pharmaceutical, biotechnology, and clinical research settings. System units offer precise temperature control, high reliability, and integration with laboratory information management systems (LIMS), ensuring sample integrity and reducing human error. Their adoption is particularly strong in large-scale biobanks and clinical research organizations managing millions of samples. The segment’s dominance is further reinforced by ongoing R&D investments and product innovations enhancing storage capacity, energy efficiency, and automation features. System units with modular configurations and remote monitoring capabilities are increasingly preferred by end users for scalability. Leading vendors are expanding portfolios to include ultra-low temperature and cryogenic storage solutions. Stringent regulatory compliance requirements in clinical and pharma settings drive the use of validated system units. Growing adoption of personalized medicine and high-throughput genomics research boosts demand. The market is further supported by the replacement cycle of older, manual storage systems. Integration with automated retrieval and tracking systems enhances efficiency and accuracy. The segment’s leadership is also strengthened by strong after-sales support and service contracts.

The Reagents and Consumables segment is expected to witness the fastest CAGR of 14.2% from 2026 to 2033, fueled by the rising consumption of consumables such as vials, tubes, and sample plates in automated storage workflows. Growth is supported by increasing sample volumes in genomics, proteomics, and drug discovery pipelines. Consumables are essential for maintaining sample integrity and compatibility with storage systems. Expanding use in high-throughput screening, biobanking, and clinical trials drives adoption. Vendors are introducing specialized consumables for cryogenic, ultra-low temperature, and room temperature storage conditions. Rising research funding and expansion of academic and industrial laboratories boost demand. Growth is also supported by the need for single-use consumables to reduce contamination risks. The segment benefits from repeat purchases due to limited lifespan of consumables. Increasing demand from emerging markets for affordable and standardized consumables contributes to growth. Partnerships between system providers and consumable manufacturers strengthen supply chains. Innovations such as barcoded and pre-labeled consumables enhance traceability and operational efficiency. Growing adoption of automated liquid handling integrated with consumables further drives the segment.

- By Application

On the basis of application, the Automated Sample Storage Systems market is segmented into Biological Sample Storage and Compound Storage. The Biological Sample Storage segment dominated the market with a revenue share of 52.1% in 2025, owing to the surge in biobanking, clinical trials, and molecular diagnostics research. This segment covers the storage of blood, plasma, tissue, and DNA/RNA samples under controlled conditions. High reliability, automated monitoring, and integration with laboratory workflows are key factors driving adoption. The increasing focus on personalized medicine and large-scale genomic studies fuels demand. Regulatory requirements for sample traceability and long-term stability further strengthen this segment. Leading academic and pharmaceutical institutions invest heavily in biological sample storage systems. Advanced storage solutions offering ultra-low temperatures and cryogenic capabilities are becoming standard. Automated retrieval and sample tracking reduce errors and enhance efficiency. The demand is particularly strong in North America and Europe due to mature research infrastructure. Multi-functional storage systems compatible with various sample types are widely adopted. Continuous innovation in system design and energy efficiency boosts market preference. Integration with LIMS and cloud-based data monitoring enhances operational control.

The Compound Storage segment is projected to witness the fastest CAGR of 13.8% from 2026 to 2033, driven by the rising number of small-molecule and biologics libraries in pharmaceutical and biotech companies. Growth is supported by high-throughput screening programs, preclinical compound management, and drug discovery pipelines. Automated storage reduces manual handling errors and ensures compound stability over extended periods. Expansion of contract research organizations (CROs) and private biobanks increases adoption. Systems compatible with microplates, vials, and multi-well plates further support compound storage needs. Increasing focus on combinatorial chemistry and high-throughput assay development accelerates demand. Regulatory requirements for secure compound storage ensure continued investment in automated systems. Scalability, energy efficiency, and integration with lab automation software enhance adoption. Emerging markets are witnessing growing interest in affordable and standardized compound storage solutions. Technological innovations, such as automated retrieval and tracking, drive operational efficiency. Collaborations between storage system providers and pharma companies boost adoption. Cloud-based monitoring and analytics are further propelling market growth.

- By Capacity

On the basis of capacity, the market is segmented into Less Than 100K Samples, 100K - 500K Samples, 500K - 2M Samples, and More Than 2M Samples. The 100K – 500K Samples segment dominated with a revenue share of 44.7% in 2025, favored by mid-sized laboratories, academic research centers, and private biobanks that require a balance between storage volume and cost efficiency. Automated systems in this capacity range provide scalability, reliable temperature control, and integration with inventory management systems. These systems are widely adopted in clinical research and molecular biology studies. The segment benefits from high reliability, modular designs, and ease of maintenance. Repeatable sample retrieval, minimal human intervention, and operational efficiency are key drivers. Growing awareness of biosample preservation standards boosts adoption. Integration with laboratory automation and cryogenic storage solutions enhances performance. Vendors offer custom configurations to meet specific lab requirements. High adoption is observed in North America and Europe due to established research infrastructure. Continuous product innovation and energy-efficient designs maintain the segment’s competitive edge. Multi-functional systems support diverse sample types. Strong after-sales support ensures ongoing reliability and client retention.

The More Than 2M Samples segment is expected to witness the fastest CAGR of 12.9% from 2026 to 2033, driven by large biopharmaceutical companies and national biobanks requiring ultra-high-capacity storage. The surge in population-scale genomics, COVID-19 biobanking, and multi-site clinical trials fuels demand. Systems in this category offer advanced automation, multi-chamber designs, and remote monitoring. High sample volume capacity enables efficient workflow management and long-term preservation. Cloud-based inventory management and AI-enabled monitoring systems are increasingly integrated. Expanding infrastructure in Asia-Pacific and emerging regions drives market growth. Growing outsourcing of sample storage to private biobanks further propels adoption. Technological advancements ensure temperature uniformity and energy efficiency. Vendors offer predictive maintenance and automated error detection. Integration with laboratory robotics enhances throughput. Rising investments in precision medicine and drug discovery initiatives support growth.

- By End User

On the basis of end user, the market is segmented into Pharma and Biotech Companies, Academic Research Labs, and Private Biobanks. The Pharma and Biotech Companies segment dominated with a revenue share of 50.4% in 2025, due to extensive use of automated storage systems in drug discovery, high-throughput screening, and clinical research. Companies prioritize sample integrity, traceability, and regulatory compliance. The segment benefits from large-scale investments in research infrastructure and R&D expansion. High sample throughput requirements drive demand for automation and robotics integration. Multi-site studies and global trials reinforce the need for centralized storage systems. Continuous innovation in storage technology ensures reliable long-term preservation. Strong adoption in North America and Europe reflects mature pharmaceutical ecosystems. Advanced analytics and remote monitoring features improve operational efficiency. Integration with LIMS and AI enhances workflow optimization. Repeatable sample handling reduces error rates and operational costs. The segment remains highly attractive due to recurring revenue from consumables and system upgrades.

The Academic Research Labs segment is expected to witness the fastest CAGR of 13.6% from 2026 to 2033, fueled by increasing research activities in genomics, proteomics, and clinical diagnostics. Growth is driven by expanding government funding, collaborative research programs, and the rise of precision medicine initiatives. Small to mid-sized labs increasingly adopt automated systems to improve efficiency and reduce human error. Demand for mid-capacity and modular systems is growing. Integration with cloud-based monitoring and data management software enhances research capabilities. Repeatable workflows and scalable solutions enable labs to meet evolving project demands. Rising adoption in Asia-Pacific and emerging markets provides additional growth opportunities. Technological innovations such as automated retrieval, temperature uniformity, and sample tracking increase adoption. Expansion of university-affiliated biobanks also fuels growth. Funding and grants for cutting-edge research accelerate adoption rates. Increasing focus on academic-industry collaborations strengthens the segment’s market presence.

Automated Sample Storage Systems Market Regional Analysis

- North America dominated the automated sample storage systems market with the largest revenue share of 42.5% in 2025

- Driven by advanced laboratory infrastructure, high investment in research and development, and a strong presence of key industry players. The region has seen substantial adoption across clinical, pharmaceutical, and research laboratories, fueled by innovations from both established and emerging automation solution providers

- The market growth in North America is further supported by the increasing demand for efficient sample storage, workflow optimization, and compliance with stringent regulatory standards, making automated systems an essential part of laboratory modernization

U.S. Automated Sample Storage Systems Market Insight

The U.S. automated sample storage systems market captured the largest revenue share within North America in 2025, driven by a well-established healthcare and research ecosystem, strong pharmaceutical and biotechnology sectors, and rapid adoption of laboratory automation solutions. Substantial growth has been observed in clinical, pharmaceutical, and research laboratories, fueled by the introduction of innovative automated storage systems that enhance operational efficiency, sample tracking, and space utilization. Both established companies and new entrants are actively launching advanced systems to meet the growing need for high-throughput, reliable, and compliant sample management solutions.

Europe Automated Sample Storage Systems Market Insight

The Europe automated sample storage systems market is projected to expand at a substantial CAGR throughout the forecast period, supported by well-developed research infrastructure, regulatory compliance requirements, and increasing adoption of laboratory automation. Countries such as Germany, the U.K., and France are driving growth with increasing investments in pharmaceutical R&D, biotechnology, and academic research institutes. The demand for systems that improve accuracy, reduce manual errors, and enhance workflow efficiency across clinical and research applications is significantly contributing to market expansion.

U.K. Automated Sample Storage Systems Market Insight

The U.K. automated sample storage systems market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by investments in laboratory modernization, the increasing number of clinical and research laboratories, and growing government support for life science initiatives. The trend toward automation in academic and pharmaceutical research, alongside robust infrastructure and strong digital adoption, is further propelling growth.

Germany Automated Sample Storage Systems Market Insight

Germany automated sample storage systems market is expected to expand at a considerable CAGR during the forecast period, driven by high awareness of laboratory efficiency, digitalization of research processes, and the demand for technologically advanced and eco-conscious solutions. Germany’s well-established research ecosystem and emphasis on innovation promote the adoption of automated storage systems across clinical, pharmaceutical, and research facilities.

Asia-Pacific Automated Sample Storage Systems Market Insight

Asia-Pacific automated sample storage systems market is poised to grow at the fastest CAGR of 9.2% from 2026 to 2033, supported by increasing urbanization, rising R&D expenditure, and expansion of pharmaceutical, biotechnology, and academic research sectors across countries such as China, India, and Japan. Government initiatives promoting laboratory automation and investment in life sciences infrastructure are key factors driving growth.

Japan Automated Sample Storage Systems Market Insight

Japan automated sample storage systems market is gaining momentum due to its high-tech research culture, increasing demand for laboratory efficiency, and the growing number of clinical, pharmaceutical, and academic laboratories. Rising investments in life science research and automation solutions are fueling adoption, alongside efforts to optimize workflow and enhance sample management in both clinical and research settings.

China Automated Sample Storage Systems Market Insight

China automated sample storage systems market accounted for the largest revenue share in Asia-Pacific in 2025, driven by a rapidly expanding middle class, increased investment in pharmaceutical and biotech R&D, and growing adoption of automated laboratory solutions. The push for laboratory modernization, coupled with government initiatives supporting scientific research and life sciences, is significantly contributing to market growth.

Automated Sample Storage Systems Market Share

The Automated Sample Storage Systems industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific (U.S.)

- Sigma-Aldrich (U.S.)

- Sartorius AG (Germany)

- Agilent Technologies (U.S.)

- BD Biosciences (U.S.)

- GN Gachon (South Korea)

- Helmer Scientific (U.S.)

- Cole-Parmer (U.S.)

- Hamilton Company (Switzerland)

- PHC Holdings Corporation (Japan)

- Brooks Life Sciences (U.S.)

- BioStorage Technologies (U.S.)

- SSI – Sample Storage International (Germany)

- VOXIS BioStorage (France)

Latest Developments in Global Automated Sample Storage Systems Market

- In January 2022, Hamilton Company introduced its new Verso Q50 and Verso Q75 automated sample storage systems, offering high‑density benchtop sample storage configurations with capacity for up to 152,000 vials or microplates and designed to streamline lab workflows in compact laboratory footprints

- In February 2024, Azenta, Inc. launched the BioArc Ultra, a next‑generation automated ultracold (‑80 °C) sample storage system that uses eco‑friendly refrigeration with zero ozone‑depletion potential and up to 70% lower power consumption compared to traditional systems—targeted at large‑scale biorepositories

- In January 2025, the UK Biocentre selected Azenta’s BioArc Ultra for deployment within its Milton Keynes facility, enabling high‑density, fully automated ‑80 °C storage with projected capacity to handle over 35 million samples and up to 9 million retrievals annually

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.