Global Automatic Brewing Equipment Market

Market Size in USD Billion

CAGR :

%

USD

8.19 Billion

USD

13.15 Billion

2024

2032

USD

8.19 Billion

USD

13.15 Billion

2024

2032

| 2025 –2032 | |

| USD 8.19 Billion | |

| USD 13.15 Billion | |

|

|

|

|

Automatic Brewing Equipment Market Size

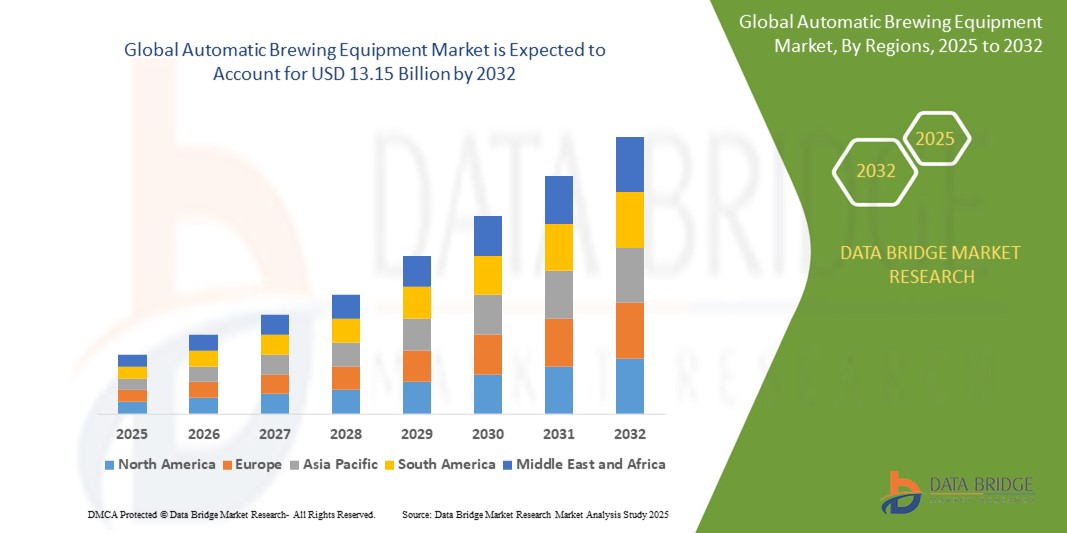

- The global automatic brewing equipment market size was valued at USD 8.19 billion in 2024 and is expected to reach USD 13.15 billion by 2032, at a CAGR of 6.10% during the forecast period

- The market growth is primarily driven by the increasing popularity of craft beer, advancements in brewing automation technologies, and the rising demand for efficient, scalable brewing solutions in both macro and craft breweries

- Growing consumer preference for premium and artisanal beer, coupled with the need for consistent quality and production efficiency, is positioning automatic brewing equipment as a critical component in modern brewing operations

Automatic Brewing Equipment Market Analysis

- Automatic brewing equipment, encompassing systems for automated brewing processes, is becoming increasingly essential in both macrobreweries and craft breweries due to its ability to enhance production efficiency, ensure consistent quality, and reduce labor costs

- The surge in demand for automatic brewing equipment is fueled by the global rise in craft beer consumption, increasing adoption of automation in brewing processes, and the need for sustainable and energy-efficient brewing solutions

- Europe dominated the automatic brewing equipment market with the largest revenue share of 42.5% in 2024, driven by a strong brewing heritage, high demand for premium beers, and the presence of leading equipment manufacturers

- Asia-Pacific is expected to be the fastest-growing region in the automatic brewing equipment market during the forecast period, propelled by rapid urbanization, rising disposable incomes, and growing consumer interest in craft beer, particularly in countries such as China and India

- The macrobrewery segment dominated the largest market revenue share of 82.0% in 2024, driven by the high demand for mass-produced beers and the need for sophisticated, high-capacity brewing equipment to meet international distribution requirements. Large-scale breweries rely on automated systems to ensure efficiency, consistency, and scalability in production

Report Scope and Automatic Brewing Equipment Market Segmentation

|

Attributes |

Automatic Brewing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automatic Brewing Equipment Market Trends

“Increasing Integration of AI and IoT Technologies”

- The global automatic brewing equipment market is experiencing a significant trend toward the integration of Artificial Intelligence (AI) and Internet of Things (IoT) technologies

- These technologies enable advanced process automation, real-time monitoring, and data analytics, providing deeper insights into brewing performance, ingredient usage, and equipment maintenance needs

- AI-powered brewing systems allow for proactive optimization, identifying potential issues such as fermentation inconsistencies or equipment malfunctions before they lead to costly downtime or product defects

- For instance, companies are developing AI-driven platforms that analyze brewing parameters to optimize recipes, adjust fermentation temperatures, or predict maintenance schedules based on real-time equipment data

- IoT-enabled brewing systems allow remote control via smartphones or cloud platforms, enhancing operational efficiency and enabling brewers to monitor and adjust processes in real time

- This trend is increasing the appeal of automatic brewing equipment for both macrobreweries and craft breweries, offering scalability, precision, and consistency in beer production

Automatic Brewing Equipment Market Dynamics

Driver

“Rising Demand for Craft Beer and Automated Brewing Solutions”

- Growing consumer preference for craft beer and artisanal beverages, characterized by unique flavors and high-quality ingredients, is a major driver for the automatic brewing equipment market

- Automatic brewing systems enhance production efficiency by offering features such as precise temperature control, automated ingredient addition, and real-time fermentation monitoring, which ensure consistent quality for both macrobreweries and craft breweries

- Government support, particularly in regions such as Asia-Pacific with relaxed regulations in countries such as China and India, is encouraging the establishment of new breweries, further boosting demand for automated equipment

- The proliferation of IoT and advancements in automation technologies are enabling faster data processing and seamless integration of brewing systems, supporting sophisticated applications such as recipe customization and energy-efficient production

- Breweries are increasingly adopting fully automated systems as standard or optional features to meet consumer expectations for premium and diverse beer offerings, enhancing market competitiveness

Restraint/Challenge

“High Initial Costs and Data Security Concerns”

- The significant upfront investment required for purchasing, installing, and integrating automatic brewing equipment, including hardware and software, can be a barrier for smaller craft breweries and new market entrants, particularly in emerging markets

- Retrofitting existing brewing facilities with advanced automated systems can be complex and costly, limiting adoption in cost-sensitive regions

- Data security and privacy concerns pose a major challenge, as IoT-enabled brewing systems collect and transmit sensitive production data, raising risks of breaches or misuse of information related to proprietary recipes or operational processes

- The fragmented regulatory landscape across countries regarding data collection, storage, and usage complicates compliance for international manufacturers and service providers, potentially deterring adoption

- These factors may limit market expansion, particularly in regions with high cost sensitivity or stringent data protection regulations

Automatic Brewing Equipment market Scope

The market is segmented on the basis of brewery type, equipment type, and material type.

- By Brewery Type

On the basis of brewery type, the global automatic brewing equipment market is segmented into macrobrewery and craft brewery. The macrobrewery segment dominated the largest market revenue share of 82.0% in 2024, driven by the high demand for mass-produced beers and the need for sophisticated, high-capacity brewing equipment to meet international distribution requirements. Large-scale breweries rely on automated systems to ensure efficiency, consistency, and scalability in production.

The craft brewery segment is expected to witness the fastest growth rate of 6.84% from 2025 to 2032. This growth is fueled by rising consumer preference for unique, artisanal beers with diverse flavors and natural ingredients. The increasing number of microbreweries and brewpubs globally, particularly in North America and Europe, further drives demand for specialized, small-scale automated brewing equipment.

- By Equipment Type

On the basis of equipment type, the global automatic brewing equipment market is segmented into macrobrewery equipment and craft brewery equipment. The macrobrewery equipment segment dominated the market with a revenue share of 75% in 2023, attributed to the global proliferation of microbreweries and the rising popularity of craft beer. This segment includes high-capacity systems such as milling equipment, brewhouses, and fermentation tanks, essential for large-scale production.

The craft brewery equipment segment is anticipated to experience robust growth from 2025 to 2032, driven by the surge in demand for small-scale, customizable brewing systems. These systems cater to craft breweries’ need for flexibility in producing diverse beer styles, supported by innovations such as automated multi-vessel systems and IoT-integrated brewing technologies.

- By Material Type

On the basis of material type, the global automatic brewing equipment market is segmented into brass, copper, aluminum, stainless steel, and mild steel. The stainless steel segment held the largest market revenue share of 56.5% in 2024, owing to its durability, resistance to corrosion, and sanitary benefits, making it the preferred material for brewing vessels and fermenters. Its reliability ensures long-term performance under harsh brewing conditions.

The copper segment is expected to witness significant growth from 2025 to 2032, driven by its traditional aesthetic appeal and excellent thermal conductivity, which are valued in craft brewing for enhancing brewing precision and product quality. The increasing adoption of copper in specialty brewing applications supports this segment’s growth.

Automatic Brewing Equipment Market Regional Analysis

- Europe dominated the automatic brewing equipment market with the largest revenue share of 42.5% in 2024, driven by a strong brewing heritage, high demand for premium beers, and the presence of leading equipment manufacturers

- Consumers prioritize automatic brewing equipment for enhanced efficiency, consistency in beer quality, and scalability, particularly in regions with established brewing traditions and growing craft beer trends

- Growth is supported by technological advancements, such as IoT-enabled smart brewing systems and AI-based fermentation controls, alongside rising adoption in both macrobrewery and craft brewery segments

U.S. Automatic Brewing Equipment Market Insight

The U.S. automatic brewing equipment market is expected to witness significant growth, fueled strong demand for craft beer and increasing consumer preference for automated brewing solutions. The trend toward microbreweries and brewpubs, coupled with growing awareness of energy-efficient and high-capacity equipment, boosts market expansion. The integration of automated systems in both OEM and aftermarket segments creates a diverse product ecosystem.

Europe Automatic Brewing Equipment Market Insight

The Europe leads the global automatic brewing equipment market, supported by its rich brewing heritage and stringent quality standards. Consumers demand equipment that enhances production efficiency while maintaining beer quality. The market sees significant growth in both macrobrewery and craft brewery installations, with countries such as Germany and Belgium driving demand due to their established beer industries and focus on automation.

U.K. Automatic Brewing Equipment Market Insight

The U.K. market for automatic brewing equipment is expected to witness robust growth, driven by increasing demand for craft beer and automated brewing systems in urban and suburban settings. Rising consumer interest in premium and artisanal beers, coupled with regulatory support for energy-efficient technologies, encourages adoption. The balance between automation and compliance with safety standards further supports market growth.

Germany Automatic Brewing Equipment Market Insight

Germany is expected to exhibit strong growth in the automatic brewing equipment market, attributed to its advanced brewing industry and high consumer focus on quality and efficiency. German breweries prefer technologically advanced equipment, such as automated brewhouses and fermentation systems, to optimize production and reduce energy consumption. The integration of these systems in both large-scale and craft breweries supports sustained market growth.

Asia-Pacific Automatic Brewing Equipment Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate in the automatic brewing equipment market, driven by rising beer consumption and expanding brewery infrastructure in countries such as China, India, and Japan. Increasing disposable incomes and growing awareness of craft beer and innovative brewing technologies boost demand. Government initiatives promoting relaxed regulations for brewery establishments further encourage market growth.

Japan Automatic Brewing Equipment Market Insight

Japan’s automatic brewing equipment market is expected to experience rapid growth due to strong consumer preference for high-quality, automated brewing systems that enhance production efficiency and consistency. The presence of major brewery manufacturers and the integration of automated equipment in OEM setups accelerate market penetration. Growing interest in craft beer and aftermarket customization also contributes to market expansion.

China Automatic Brewing Equipment Market Insight

China holds the largest share of the Asia-Pacific automatic brewing equipment market, propelled by rapid urbanization, increasing beer consumption, and growing demand for automated brewing solutions. The country’s expanding middle class and focus on modern brewing technologies support the adoption of advanced equipment. Strong domestic manufacturing capabilities and competitive pricing further enhance market accessibility.

Automatic Brewing Equipment Market Share

The automatic brewing equipment industry is primarily led by well-established companies, including:

- Alfa Laval (Sweden)

- GEA Group Aktiengesellschaft (Germany)

- Krones AG (Germany)

- Paul Mueller Company (U.S.)

- Praj Industries (India)

- MEURA (Belgium)

- Della Toffola SpA (Italy)

- Criveller Group (U.S.)

- Hypro (India)

- MiniBrew B.V. (Netherlands)

- BrewBilt Manufacturing (U.S.)

- Portland Kettle Works (U.S.)

- DME Brewing Solutions (Canada)

- Specific Mechanical Systems (Canada)

- XIMO Brewing Equipment (China)

- Lehui Craft (China)

- JVNW Inc. (U.S.)

- Ss Brewtech (U.S.)

What are the Recent Developments in Global Automatic Brewing Equipment Market?

- In October 2024, Core Equipment announced a strategic partnership with Bucher Denwel, a member of Bucher Unipektin, to deliver advanced cold block technologies to craft breweries and contract packaging facilities. Traditionally reserved for large-scale brewers, this specialized equipment—covering processes such as filtration, flash pasteurization, dealcoholisation, carbonation, and yeast management—will now be more accessible to smaller producers. The collaboration enables customized, scalable solutions for both new installations and upgrades, enhancing brewing precision, efficiency, and product quality. This move reflects a broader industry trend toward democratizing high-end brewing technology for the craft segment

- In June 2024, Versuni North America launched a new lineup of semi-automatic and fully automatic espresso and coffee machines, including the Philips Barista Brew Semi-Automatic Espresso Machine and the Philips Espresso 4400 and 5500 LatteGo models. These machines are designed to bring barista-style coffee experiences into the home, combining advanced features with user-friendly interfaces. Key innovations include SilentBrew Technology, which reduces brewing noise by up to 40%, and the LatteGo milk system, known for its easy cleaning and one-touch latte preparation. The 5500 model offers up to 20 hot and iced recipes, while the 4400 provides 12, catering to a wide range of preferences

- In November 2023, Ziemann Holvrieka strategically expanded its brewing technology portfolio by acquiring Künzel Maschinenbau GmbH, a German company renowned for its expertise in malt handling and grist mills. Founded in 1922, Künzel has long been a trusted name in the early stages of beer production, delivering tailored systems for raw material handling. This acquisition strengthens Ziemann Holvrieka’s ability to provide end-to-end brewery solutions, from grain intake to final product, and creates synergies in product development, market expansion, and customer service. Künzel will continue operating under its own name, preserving its legacy and technical leadership

- In January 2023, Alfa Laval partnered with the Rhea Group to deliver integrated brewing solutions tailored for the craft beer industry. This collaboration combines Alfa Laval’s expertise in advanced brewing equipment with Rhea Group’s capabilities in automation and process integration, aiming to support small and mid-sized breweries in scaling operations efficiently. The partnership addresses the rising global demand for high-quality craft beer by offering modular, energy-efficient systems that enhance yield, reduce water and energy consumption, and ensure consistent product quality. Together, they empower brewers to innovate while maintaining control over cost and sustainability

- In November 2022, SABCO BrewMagic unveiled the BrewMagic Presto, a compact and affordable electric brewing system tailored for home brewers seeking professional-grade performance. As the most accessible model in the BrewMagic lineup, Presto features a three-vessel setup—hot liquor tank, mash tun, and boil kettle—along with a 7-inch touchscreen, RIMS control system, and food-grade high-temperature pump. Designed for portability and ease of use, it supports batch sizes from 5 to 17 gallons and operates on 240V power, making it ideal for brewing in kitchens, garages, or even with friends. This launch reflects a broader trend of democratizing advanced brewing technology for enthusiasts

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Automatic Brewing Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automatic Brewing Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automatic Brewing Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.