Global Automatic Carton Erector Market

Market Size in USD Billion

CAGR :

%

USD

1.16 Billion

USD

1.69 Billion

2024

2032

USD

1.16 Billion

USD

1.69 Billion

2024

2032

| 2025 –2032 | |

| USD 1.16 Billion | |

| USD 1.69 Billion | |

|

|

|

|

Automatic Carton Erector Market Size

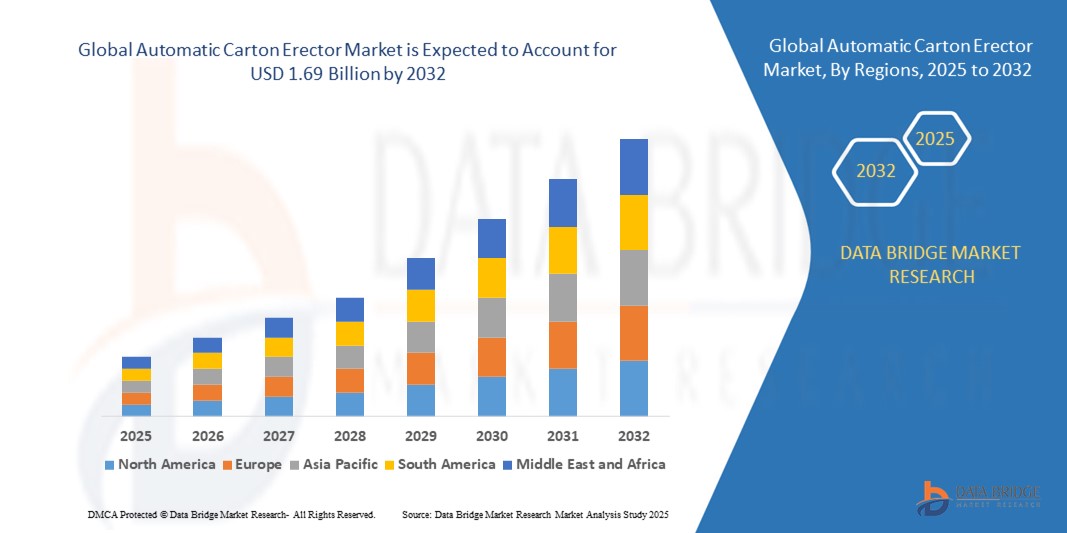

- The global automatic carton erector market size was valued at USD 1.16 billion in 2024 and is expected to reach USD 1.69 billion by 2032, at a CAGR of 8.7% during the forecast period

- The market growth is largely fueled by the increasing adoption of automated packaging solutions and technological advancements in end-of-line packaging systems, leading to enhanced operational efficiency and reduced labor dependency across manufacturing and e-commerce sectors

- Furthermore, rising demand for high-speed, reliable, and customizable carton forming solutions is establishing automatic carton erectors as a critical component in modern packaging lines. These converging factors are accelerating the deployment of automatic carton erectors, thereby significantly boosting the industry's growth

Automatic Carton Erector Market Analysis

- Automatic carton erectors are machinery systems designed to form, fold, and seal corrugated cartons efficiently, minimizing manual intervention. They integrate with conveyors, robotic systems, and other end-of-line equipment to streamline packaging operations in industries such as food and beverage, e-commerce, pharmaceuticals, and automotive

- The escalating demand for automatic carton erectors is primarily driven by the need to improve packaging speed, accuracy, and consistency, reduce labor costs, and meet the growing requirements of high-volume production and e-commerce fulfillment centers

- North America dominated the automatic carton erector market with a share of 37.7% in 2024, due to the high adoption of automated packaging solutions across food and beverage, e-commerce, and manufacturing industries

- Asia-Pacific is expected to be the fastest growing region in the automatic carton erector market during the forecast period due to increasing industrialization, e-commerce expansion, and rising adoption of automated packaging solutions in countries such as China, Japan, and India

- Automatic segment dominated the market with a market share of 58.5% in 2024, due to its ability to provide end-to-end carton forming with minimal human intervention. Automatic systems are widely adopted in high-volume manufacturing environments, where consistent speed, accuracy, and reduced labor costs are critical. Their compatibility with other automated packaging lines and advanced control systems enhances operational efficiency, making them the preferred choice for large-scale production. Furthermore, automatic carton erectors contribute to improved workplace safety by minimizing manual handling of cartons

Report Scope and Automatic Carton Erector Market Segmentation

|

Attributes |

Automatic Carton Erector Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automatic Carton Erector Market Trends

Rising Adoption of Smart Packaging Solutions

- The automatic carton erector market is rapidly evolving with widespread adoption of smart packaging technologies. Integration of IoT, robotics, and predictive analytics is enabling manufacturers to enhance operational efficiency and reduce error rates for diverse packaging applications

- For instance, Infinity Automated Solutions has introduced advanced carton erectors featuring real-time monitoring and cloud connectivity for e-commerce and consumer goods. Such innovations are accelerating packaging speed and facilitating seamless automation across complex supply chains

- The focus on modular, flexible designs is fueling growth as companies look for systems that accommodate high-mix, low-volume packaging formats. Manufacturers now offer customizable machines adaptable to changing product types and seasonal demands in multiple industries

- AI-enabled systems are setting new benchmarks in packaging optimization. Smart carton erectors can forecast demand patterns, reduce material waste, and support dynamic production schedules, helping companies to meet faster fulfillment expectations and stringent quality standards

- Industry 4.0 transformations are driving investments in sustainable and energy-efficient carton erecting machines. Companies are prioritizing eco-friendly designs, lightweight materials, and recyclable packaging solutions to align with global sustainability mandates and environmental regulations

- Warehouse automation is expanding with autonomous mobile robots handling material logistics and carton assembly. This trend supports greater speed, safety, and scalability, especially for direct-to-consumer brands seeking efficient, personalized packaging for growing order volumes

Automatic Carton Erector Market Dynamics

Driver

Growing E-commerce Industry

- The surge in e-commerce is a primary driver, increasing demand for efficient carton erecting solutions to cope with higher order volumes, rapid fulfillment timelines, and rising consumer expectations for error-free packaging and delivery

- For instance, major online retailers have invested in fully automated carton erecting lines to boost productivity and minimize labor dependency, enabling faster order processing during peak seasons and improving overall warehouse performance

- Labor cost escalation is motivating companies to automate packaging processes. Automatic carton erectors reduce human error and also help businesses streamline costs and maintain competitiveness in increasingly dynamic supply chains

- Continuous innovation in automation and robotics is broadening market appeal, with new erector systems offering remote monitoring and predictive maintenance. These upgrades improve machine uptime and operational transparency for logistics managers

- Emerging economies in Asia-Pacific are witnessing significant adoption spurred by rapid manufacturing growth, urbanization, and consumer spending. Expanding production capacities are triggering demand for scalable, cost-effective packaging automation solutions

Restraint/Challenge

High Initial Investment Cost

- High upfront investment remains a major challenge for automatic carton erector adoption, with many SMEs deterred by costs of installation, integration, and skilled labor requirements for advanced packaging technologies

- For instance, nearly 70% of manufacturers surveyed by the National Association of Manufacturers reported cost barriers as the key reason for slow automation adoption, especially in regions with low capital access and limited automation readiness

- The complexity of integrating new carton erectors with legacy production lines and compliance requirements increases deployment expenses. Technical incompatibility and regulatory hurdles can lead to downtime and added costs for businesses upgrading equipment

- Maintenance and frequent servicing of high-speed machines further escalate total ownership costs over time. Downtime risk and reliance on skilled operators mean smaller companies often struggle with scalability and operational continuity

- Space constraints in existing facilities can limit carton erector installation. Manufacturers must carefully assess layout, workflow integration, and future expansion plans to maximize returns and minimize disruption from large-scale automated systems

Automatic Carton Erector Market Scope

The market is segmented on the basis of product type, automation type, and end-use industry.

- By Product Type

On the basis of product type, the automatic carton erector market is segmented into horizontal carton erector and vertical carton erector. The horizontal carton erector segment dominated the largest market revenue share in 2024, driven by its ability to handle high-speed operations and large-volume production lines efficiently. Manufacturers in the food and beverage and e-commerce sectors often prefer horizontal carton erectors for their robust construction and capacity to manage a wide variety of carton sizes. The segment’s widespread adoption is further supported by its seamless integration with upstream filling and packaging systems, reducing downtime and improving overall productivity. In addition, horizontal carton erectors offer advanced features such as automatic flap folding and gluing, enhancing operational precision and reducing manual labor requirements.

The vertical carton erector segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its compact footprint and adaptability in space-constrained facilities. Vertical systems are increasingly adopted in small and medium-sized enterprises seeking cost-effective solutions for moderate production volumes. Their flexibility in handling different carton dimensions and easy maintenance further drives market expansion in emerging regions.

- By Automation Type

On the basis of automation type, the market is segmented into semi-automatic and automatic carton erectors. The automatic segment dominated the largest market revenue share of 58.5% in 2024 due to its ability to provide end-to-end carton forming with minimal human intervention. Automatic systems are widely adopted in high-volume manufacturing environments, where consistent speed, accuracy, and reduced labor costs are critical. Their compatibility with other automated packaging lines and advanced control systems enhances operational efficiency, making them the preferred choice for large-scale production. Furthermore, automatic carton erectors contribute to improved workplace safety by minimizing manual handling of cartons.

The semi-automatic segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand from small and medium-sized businesses. Semi-automatic systems provide a cost-effective entry point into automation, offering a balance between manual control and mechanized efficiency. Their ease of setup, lower capital investment, and suitability for moderate production volumes are fueling growth in developing markets.

- By End-Use Industry

On the basis of end-use industry, the market is segmented into food and beverage, e-commerce and retail, pharmaceuticals and healthcare, automotive, and others. The e-commerce and retail segment dominated the largest market revenue share in 2024, driven by the rapid growth of online shopping and the resulting need for efficient, high-speed packaging solutions. Companies are increasingly investing in carton erectors to ensure faster order fulfillment and minimize product damage during transit. The rising adoption of automated packaging solutions in fulfillment centers is further accelerating market demand, while integration with warehouse management systems enhances operational transparency and efficiency.

The pharmaceuticals and healthcare segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by stringent regulations for packaging integrity and the need for precise, reliable carton forming. Pharmaceutical companies are adopting automated carton erectors to ensure compliance, reduce human error, and improve productivity in handling sensitive products. The increasing complexity of pharmaceutical packaging and growing production volumes in emerging markets further support expansion in this segment.

Automatic Carton Erector Market Regional Analysis

- North America dominated the automatic carton erector market with the largest revenue share of 37.7% in 2024, driven by the high adoption of automated packaging solutions across food and beverage, e-commerce, and manufacturing industries

- Companies in the region prioritize operational efficiency, high-speed production, and integration of carton erectors with existing packaging lines, enabling reduced labor costs and faster throughput

- This widespread adoption is further supported by advanced manufacturing infrastructure, technological expertise, and strong capital investments, establishing automatic carton erectors as a key solution for both large-scale and mid-sized production facilities

U.S. Automatic Carton Erector Market Insight

The U.S. market captured the largest revenue share in North America in 2024, driven by increasing demand for automation in packaging operations to enhance productivity and reduce manual errors. Manufacturers are investing in high-speed, fully automated carton erectors to meet the growing requirements of the e-commerce and retail sectors. In addition, the integration of smart sensors and IoT-enabled systems for real-time monitoring is further propelling market growth. Rising labor costs and the need for consistent, high-quality carton forming are also encouraging the adoption of automated solutions.

Europe Automatic Carton Erector Market Insight

The Europe market is projected to expand at a substantial CAGR throughout the forecast period, fueled by the demand for automation in the food, pharmaceutical, and retail industries. Strict regulatory standards for packaging accuracy and efficiency are encouraging manufacturers to deploy automatic carton erectors. Growing urbanization, increasing labor costs, and the push for Industry 4.0 adoption are also driving the demand. The region sees notable growth in both small-scale production units and large industrial packaging lines.

U.K. Automatic Carton Erector Market Insight

The U.K. market is anticipated to grow at a significant CAGR during the forecast period, driven by the need for efficient packaging solutions in e-commerce, pharmaceuticals, and retail sectors. Businesses are increasingly adopting automated carton erecting systems to streamline packaging operations, reduce operational downtime, and improve throughput. The country’s strong e-commerce infrastructure and technological adoption support the rapid integration of automated packaging systems.

Germany Automatic Carton Erector Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, driven by rising industrial automation and smart manufacturing adoption. The focus on precision, quality control, and sustainability in packaging processes is encouraging the use of automatic carton erectors. Integration with robotic packaging lines and monitoring systems ensures improved efficiency and reduced labor dependence. Germany’s strong manufacturing base and emphasis on innovation contribute to widespread adoption across industries.

Asia-Pacific Automatic Carton Erector Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during 2025–2032, driven by increasing industrialization, e-commerce expansion, and rising adoption of automated packaging solutions in countries such as China, Japan, and India. The region benefits from cost-effective manufacturing, growing demand for high-speed packaging systems, and government initiatives promoting industrial automation. Emerging small- and medium-sized enterprises are also adopting automatic carton erectors to improve production efficiency and compete with large-scale manufacturers.

Japan Automatic Carton Erector Market Insight

The Japan market is growing steadily due to high technological adoption, labor efficiency requirements, and the need for compact, space-saving packaging systems. The integration of automated carton erectors with IoT-enabled packaging lines is increasing operational precision and reducing human errors. Japan’s aging workforce further encourages automation to maintain productivity and reliability in production facilities.

China Automatic Carton Erector Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, fueled by rapid industrialization, expanding e-commerce and retail sectors, and increasing manufacturing automation. The country’s cost-effective production environment, strong domestic machinery manufacturers, and growing adoption of smart manufacturing solutions support market growth. High demand from food and beverage, e-commerce, and pharmaceutical sectors is accelerating deployment of automatic carton erectors across the region.

Automatic Carton Erector Market Share

The automatic carton erector industry is primarily led by well-established companies, including:

- Schneider Packaging Equipment Company, Inc. (U.S.)

- LOVESHAW (U.S.)

- Combi Packaging Systems, LLC (U.S.)

- Tetra Pak International S.A. (Sweden)

- KHS Group (Germany)

- MARCHESINI GROUP S.p.A. (Italy)

- OMAG SpA (Italy)

- YANGZHOU MEIDA FILLING MACHINERY CO., LTD. (China)

- Wayne Automation (U.S.)

- Gurki Pack (China)

- Cyklop (Germany)

- BestPack (U.S.)

- Lantech (U.S.)

- Shorr Packaging (U.S.)

- Sneed Coding (U.S.)

- Ranpak (U.S.)

- Robopac USA (U.S.)

- Continental Companies (U.S.)

- Impak Packaging Systems (Canada)

- Autoboxup (China)

- Accio (China)

- Gebo Machinery (China)

Latest Developments in Global Automatic Carton Erector Market

- In October 2024, Pacteon Group showcased its latest innovations in packaging automation at Pack Expo International. The company introduced a Collaborative Case Erector-Palletizer, an integrated Single-Lane Empty Can Vacuum Transfer with Laser Coding, and various robotic case packing and palletizing systems. These solutions are designed to enhance productivity and reduce labor costs in end-of-line packaging operations. The integration of robotic systems and advanced coding technologies underscores the industry’s shift towards more efficient, fully automated packaging processes, helping manufacturers achieve higher throughput and operational precision

- In September 2024, Pacteon Group expanded its automation portfolio by adding Descon Conveyor Systems alongside Schneider Packaging Equipment, ESS Technologies, and Phoenix Stretch Wrappers. This expansion allows Pacteon to offer a more complete range of end-of-line solutions, integrating conveyors with case erecting and palletizing technologies. The addition of Descon’s products enhances operational efficiency, reduces manual handling, and provides manufacturers with seamless automation solutions, improving overall packaging productivity

- In December 2023, Combi Packaging Systems, a U.S.-based packaging solution provider, collaborated with 3M Company. This partnership has positioned Combi as a leading North American manufacturer of filling and sealing corrugated boxes, providing customers with a single source for all packaging line needs. The collaboration enables Combi to expand its range of end-of-line packaging solutions by integrating 3M’s sealing technologies with Combi’s case erecting systems. This synergy improves operational efficiency and offers more comprehensive packaging solutions, strengthening Combi’s market position

- In September 2023, IIMT launched its Programmable Fully Automatic Robotic Carton Erector, designed to automate the erection of corrugated boxes. This system addresses ergonomic challenges by minimizing manual labor while enhancing operational speed and accuracy. The adoption of collaborative robotics in carton erection reflects the industry’s focus on improving worker safety and streamlining end-of-line packaging, particularly for high-volume manufacturing environments

- In October 2022, Paxiom showcased its latest automated packaging machine technology at Pack Expo International in Chicago. The company featured the VF 1200 high-speed bagging machine, WeightCheQ 0-250 check weigher, PKR Delta robotic cell, and a bulk bagging system. These innovations demonstrate Paxiom’s commitment to improving packaging efficiency, accuracy, and throughput, catering to the increasing demand for automated solutions in food, e-commerce, and industrial packaging sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.