Global Automatic Coffee Machines Market

Market Size in USD Billion

CAGR :

%

USD

5.20 Billion

USD

7.71 Billion

2025

2033

USD

5.20 Billion

USD

7.71 Billion

2025

2033

| 2026 –2033 | |

| USD 5.20 Billion | |

| USD 7.71 Billion | |

|

|

|

|

Automatic Coffee Machines Market Size

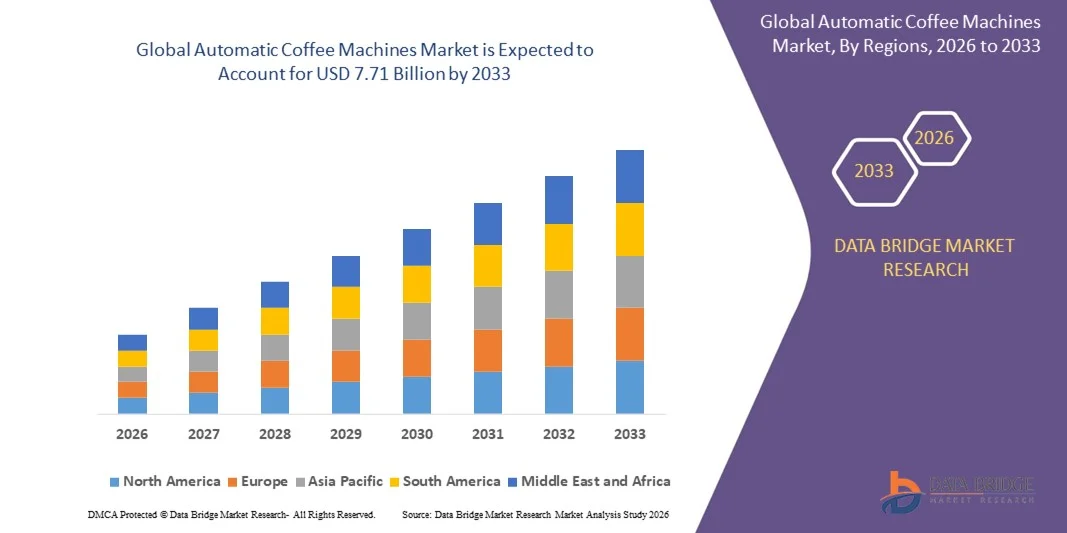

- The global automatic coffee machines market size was valued at USD 5.2 billion in 2025 and is expected to reach USD 7.71 billion by 2033, at a CAGR of 5.06% during the forecast period

- The market growth is largely fueled by the growing consumer preference for premium, convenient, and automated coffee preparation, leading to increased adoption of fully automatic and bean-to-cup machines in both residential and commercial settings

- Furthermore, rising demand for consistent, high-quality beverages, coupled with advancements in smart and connected coffee machine technologies, is establishing automatic coffee machines as the preferred solution for homes, offices, cafés, and hospitality businesses. These converging factors are accelerating market adoption, thereby significantly boosting the industry’s growth

Automatic Coffee Machines Market Analysis

- Automatic coffee machines, providing fully or partially automated brewing from grinding to dispensing, are increasingly vital for modern households, offices, and commercial establishments due to their ability to deliver consistent flavor, ease of use, and reduced manual effort

- The escalating demand for automatic coffee machines is primarily driven by rising coffee consumption, the growing café and specialty coffee culture, and increasing awareness of smart kitchen appliances, as well as consumer preference for convenience, customization, and time efficiency in beverage preparation

- North America dominated automatic coffee machines market with a share of 43.61% in 2025, due to the region’s strong coffee consumption culture, widespread preference for premium brewing solutions, and rapid adoption of automated kitchen appliances. Consumers increasingly seek café-quality beverages at home and the convenience of one-touch brewing systems that deliver consistent results

- Asia-Pacific is expected to be the fastest growing region in the automatic coffee machines market during the forecast period due to rising urbanization, increasing disposable incomes, and expanding awareness of premium coffee consumption across countries such as China, Japan, India, and South Korea

- Fully automatic coffee machine segment dominated the market with a market share of 47.8% in 2025, due to its balanced combination of automation and user control, making it suitable for both home and commercial applications. These machines grind, tamp, brew, and self-clean, reducing the need for manual involvement while maintaining high beverage consistency. Their popularity is fueled by expanding smart home integration and touch-panel interfaces. Growing availability of mid-range fully automatic models also attracts consumers transitioning from manual brewing. The segment’s strong presence in office environments reinforces its leading market share

Report Scope and Automatic Coffee Machines Market Segmentation

|

Attributes |

Automatic Coffee Machines Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automatic Coffee Machines Market Trends

Rising Adoption of Fully Automatic and Bean-To-Cup Machines

- A significant trend in the automatic coffee machines market is the increasing adoption of fully automatic and bean-to-cup machines, driven by consumer preference for convenient, café-quality coffee at home or in workplaces. This trend is enhancing the overall user experience by combining brewing precision, grinding, and milk frothing in a single machine

- For instance, De’Longhi and Jura offer advanced bean-to-cup machines that allow users to customize coffee strength, temperature, and texture. Such innovations are elevating the popularity of premium home and office coffee solutions that deliver consistency and convenience

- The demand for smart and connected coffee machines is growing as features such as app-based brewing, programmable schedules, and automatic cleaning enhance user interaction. This is positioning automatic coffee machines as integral elements of modern smart kitchens and workplace break areas

- Cafés and small commercial establishments are increasingly investing in fully automatic machines to ensure quick service and high-quality beverages while reducing barista dependency. This trend is promoting operational efficiency and consistent taste across customer-facing outlets

- The home appliance industry is witnessing a shift toward compact, multifunctional machines that save space without compromising performance. Consumers are prioritizing seamless integration of coffee preparation into daily routines, driving further adoption

- The market is seeing strong growth in premium and specialty coffee offerings where machines equipped with precision grinders, temperature control, and milk frothing technology are essential. This rising incorporation of automation and smart features is reinforcing the transition toward convenient, high-quality coffee experiences

Automatic Coffee Machines Market Dynamics

Driver

Growing Demand for Convenient, High-Quality Coffee

- The rising consumer preference for ready-to-brew, café-style coffee at home and workplaces is driving the demand for automatic coffee machines. These machines offer consistent taste, reduced preparation time, and user-friendly operation, fulfilling the need for convenience and quality

- For instance, Nespresso and Breville supply fully automatic and capsule-based coffee machines that cater to busy households and office environments. These products provide controlled brewing parameters and reliable performance, supporting lifestyle convenience

- Increasing awareness of specialty coffee and the desire for personalized beverages is boosting demand for machines with advanced customization features such as grind size, milk frothing, and temperature adjustment. Consumers are seeking machines that deliver professional-grade results with minimal effort

- The expansion of urban lifestyles and busier work schedules is fueling the need for quick coffee preparation solutions that require minimal maintenance. Automatic coffee machines meet this requirement while enhancing the overall coffee experience

- The growing penetration of smart kitchen appliances and connected devices is encouraging manufacturers to integrate IoT-enabled features, allowing remote operation, maintenance alerts, and recipe customization. This integration is strengthening the value proposition of automatic coffee machines

Restraint/Challenge

High Cost and Maintenance of Premium Machines

- The automatic coffee machines market faces challenges due to the high upfront cost of premium fully automatic models, which can limit adoption among price-sensitive consumers. Maintenance requirements, including descaling, cleaning, and replacement of parts, further add to operational costs

- For instance, Jura and De’Longhi machines require regular servicing and specialized components to maintain performance and longevity. These additional expenses can deter potential buyers and slow market penetration in emerging regions

- Complexity of operation and troubleshooting in advanced machines may also discourage some consumers, particularly those seeking simpler, low-maintenance solutions. Users may require guidance or professional support for optimal usage

- Availability of spare parts and technical support varies across regions, which can impact user satisfaction and machine longevity. Manufacturers face the challenge of ensuring reliable service networks while controlling cost implications

- The market continues to navigate the balance between offering premium features and maintaining affordability. These challenges collectively compel manufacturers to innovate cost-effective solutions while sustaining high-quality performance

Automatic Coffee Machines Market Scope

The market is segmented on the basis of product type, type, component, price, and end user.

- By Product Type

On the basis of product type, the automatic coffee machines market is segmented into automatic espresso coffee machines, automatic capsule coffee machines, automatic bean-to-cup coffee machines, automatic instant coffee machines, and others. The automatic espresso coffee machines segment dominated the market in 2025 due to its strong adoption across households and commercial outlets seeking consistent brewing quality. Consumers prefer these machines because they deliver rich coffee extraction and offer programmable settings that replicate café-style beverages. Their durability and ability to support various coffee recipes make them a staple for premium coffee preparation. The segment also benefits from increasing demand for compact models suited for modern kitchens. Manufacturers continuously introduce advanced espresso machines with improved frothing systems, enhancing user appeal and maintaining segment leadership.

The automatic bean-to-cup coffee machines segment is expected to witness the fastest growth from 2026 to 2033 driven by rising consumer preference for fresh bean grinding and premium customized beverages. This segment is expanding rapidly as offices, cafés, and households shift toward machines offering barista-level quality with minimal manual intervention. Bean-to-cup machines integrate grinding, brewing, and cleaning functions, making them ideal for users seeking convenience and freshness. Increasing awareness of specialty coffee culture also supports their adoption among urban consumers. Enhanced touchscreen controls, automated milk systems, and aroma optimization technologies further accelerate this segment’s growth.

- By Type

On the basis of type, the automatic coffee machines market is segmented into fully automatic coffee machines, super-automatic coffee machines, and semi-automatic coffee machines. The fully automatic segment dominated the market with the largest share of 47.8% in 2025 due to its balanced combination of automation and user control, making it suitable for both home and commercial applications. These machines grind, tamp, brew, and self-clean, reducing the need for manual involvement while maintaining high beverage consistency. Their popularity is fueled by expanding smart home integration and touch-panel interfaces. Growing availability of mid-range fully automatic models also attracts consumers transitioning from manual brewing. The segment’s strong presence in office environments reinforces its leading market share.

The super-automatic coffee machine segment is projected to record the fastest growth from 2026 to 2033 owing to its advanced automation features that require virtually no user effort. These machines handle grinding, brewing, milk frothing, and cleaning with precision, appealing to high-traffic cafés and corporate cafeterias. Increasing demand for personalized beverages with adjustable aroma, strength, and temperature supports their rapid uptake. Their integration with digital controls, app connectivity, and cloud-based maintenance alerts enhances operational efficiency. Businesses prefer super-automatic machines to reduce training requirements and maintain consistent service quality. This rising shift toward ultra-convenient professional-grade solutions is driving the segment’s accelerating expansion.

- By Component

On the basis of component, the market is segmented into pump, boiler, coffee bean grinder, and piston. The boiler segment dominated the market in 2025 as it functions as the core heating system responsible for maintaining stable brewing temperatures. Consistent heat distribution directly impacts extraction quality, making boilers critical for achieving optimal flavor profiles. Manufacturers continue to innovate through dual-boiler and thermoblock technologies that improve energy efficiency and reduce warm-up time. The segment benefits from widespread adoption across both commercial and household machines. Its importance in ensuring reliable performance supports its strong market share. Demand for premium models with temperature precision further strengthens this segment.

The coffee bean grinder segment is anticipated to witness the fastest growth from 2026 to 2033 due to rising consumer preference for freshly ground coffee, which significantly enhances aroma and taste. Increasing interest in specialty coffee encourages users to choose machines with integrated high-performance grinders. Advanced grinders with multiple grind settings support customized brewing styles for espresso, drip, and specialty drinks. Commercial outlets increasingly adopt grinder-equipped machines to maintain beverage consistency during peak hours. Innovations in burr grinding systems that minimize heat generation improve coffee quality, boosting market expansion. Growing demand for bean-to-cup coffee culture accelerates this segment’s rapid growth trajectory.

- By Price

On the basis of price, the market is segmented into low, medium, and high. The medium-priced segment dominated the market in 2025 due to its balance of affordability and advanced features that appeal to a wide consumer base. These machines provide reliable brewing performance, user-friendly controls, and sufficient automation for daily use. Households and small offices prefer medium-range models as they offer essential functions without the high cost of premium machines. Manufacturers increasingly introduce models with improved grinders, milk frothers, and digital displays within this price range. The segment benefits from strong retail availability and brand competition. Its versatility makes it the most widely adopted category.

The high-priced segment is expected to register the fastest growth from 2026 to 2033 driven by rising demand for luxury, technologically enhanced coffee machines. Consumers seeking café-grade brewing, advanced automation, and aesthetic designs increasingly invest in premium models. High-end machines often include dual boilers, integrated milk systems, aroma-optimization technologies, and app-based customization. The surge in premium café culture and home barista trends supports this segment’s expansion. Commercial spaces also adopt high-range models to improve service quality and operational convenience. Increasing disposable income and demand for upscale kitchen appliances further accelerate growth.

- By End User

On the basis of end user, the market is segmented into office use, commercial use, home use, coffee café, and others. The commercial use segment dominated the market in 2025 due to extensive demand across restaurants, hotels, resorts, and institutional food services. These facilities require high-capacity machines capable of continuous operation, which drives preference for automatic systems. Commercial users benefit from consistent beverage quality, reduced preparation time, and lower dependency on skilled baristas. Growth in hospitality and food service sectors further strengthens this segment. Increasing adoption of premium machines with customizable drink menus enhances operational efficiency. The rising number of quick-service outlets supports segment dominance.

The coffee café segment is expected to experience the fastest growth from 2026 to 2033 fueled by the rising global café culture and expansion of specialty coffee chains. Coffee cafés increasingly adopt automatic machines to handle high customer volumes while delivering consistent beverage quality. These machines support advanced brewing options, enabling cafés to offer varied and customizable drinks. Automated frothing, bean-to-cup grinding, and rapid brewing systems reduce service time and improve productivity. New café startups and franchise expansions contribute to demand for professional-grade automatic machines. The increasing consumer inclination toward premium coffee experiences accelerates segment growth.

Automatic Coffee Machines Market Regional Analysis

- North America dominated the automatic coffee machines market with the largest revenue share of 43.61% in 2025, driven by the region’s strong coffee consumption culture, widespread preference for premium brewing solutions, and rapid adoption of automated kitchen appliances. Consumers increasingly seek café-quality beverages at home and the convenience of one-touch brewing systems that deliver consistent results

- The rising trend of at-home coffee brewing, supported by high purchasing power and a lifestyle shift toward personalized beverage preparation, is boosting demand for automatic espresso and bean-to-cup machines

- Growing awareness of specialty coffee and the integration of digital features such as app control, beverage customization, and maintenance alerts are further fueling regional adoption, establishing automatic coffee machines as a preferred choice across residential and commercial environments

U.S. Automatic Coffee Machines Market Insight

The U.S. automatic coffee machines market captured the largest revenue share in 2025 within North America, fueled by increasing investment in premium kitchen appliances and rising demand for barista-style coffee at home. Consumers are prioritizing machines that offer programmable brewing, consistent beverage quality, and automated milk frothing. The thriving café culture encourages households and offices to adopt automatic machines to replicate specialty beverages. Smart features such as app-based controls, Wi-Fi connectivity, and voice-assistant integration further propel market growth. The demand for durable, high-capacity machines in commercial establishments also supports the U.S. market expansion.

Europe Automatic Coffee Machines Market Insight

The Europe automatic coffee machines market is projected to expand at a substantial CAGR during the forecast period, primarily driven by strong coffee traditions, rising preference for premium automated brewing, and stringent appliance quality standards. Urbanization and increasing adoption of connected kitchen devices are fostering demand across households and commercial outlets. Consumers are drawn to energy-efficient, customizable machines that deliver consistent beverage quality. The region is witnessing growth in cafés, boutique hotels, offices, and multi-family residential projects, with automatic coffee machines being integrated into both new installations and renovation projects.

U.K. Automatic Coffee Machines Market Insight

The U.K. automatic coffee machines market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand for convenient, automated coffee-brewing solutions at home and in commercial establishments. Concerns over time efficiency, beverage consistency, and convenience are encouraging households, offices, and cafés to choose fully automatic and bean-to-cup machines. The U.K.’s strong retail and e-commerce infrastructure, alongside growing adoption of smart kitchen appliances, is expected to continue stimulating market growth.

Germany Automatic Coffee Machines Market Insight

The Germany automatic coffee machines market is expected to expand at a considerable CAGR during the forecast period, fueled by high consumer emphasis on engineering quality, sustainability, and precision brewing technologies. German consumers increasingly prefer machines with adjustable grind levels, precise temperature control, and automated milk frothing. Adoption is rising across households, offices, and high-end hotels. Integration with smart home systems and eco-conscious appliance designs further encourages market expansion.

Asia-Pacific Automatic Coffee Machines Market Insight

The Asia-Pacific automatic coffee machines market is poised to grow at the fastest CAGR during 2026 to 2033, driven by rising urbanization, increasing disposable incomes, and expanding awareness of premium coffee consumption across countries such as China, Japan, India, and South Korea. The region is witnessing a rapid shift toward smart kitchens and automated beverage solutions. Government initiatives promoting digitalization, modern retail expansion, and affordable machine availability from regional manufacturers are accelerating adoption. APAC’s role as a manufacturing hub for automated coffee appliances further expands accessibility to a wider consumer base.

Japan Automatic Coffee Machines Market Insight

The Japan automatic coffee machines market is gaining momentum due to the country’s high-tech culture, compact living environments, and rising demand for efficient, automated beverage systems. Japanese consumers prioritize precision, convenience, and hygiene, which are well addressed by machines offering one-touch brewing and self-cleaning functions. Increasing numbers of smart homes and connected buildings are further supporting adoption. The aging population also drives demand for easy-to-operate, secure, and reliable coffee machines in both residential and commercial sectors.

China Automatic Coffee Machines Market Insight

The China automatic coffee machines market accounted for the largest revenue share in Asia-Pacific in 2025, driven by a rapidly expanding middle class, growing interest in Western-style coffee culture, and the rise of premium café chains. Households, offices, and commercial spaces are increasingly adopting automatic machines. The push toward smart cities, availability of cost-effective machines from domestic manufacturers, and strong e-commerce growth are key factors propelling market expansion.

Automatic Coffee Machines Market Share

The automatic coffee machines industry is primarily led by well-established companies, including:

- Melitta Professional Coffee Solutions GmbH & Co. KG (Germany)

- BSH Home Appliances Group (Germany)

- Siemens (Germany)

- WMF Group (Germany)

- Koninklijke Philips N.V. (Netherlands)

- JURA Vertrieb (Schweiz) AG (Switzerland)

- De’Longhi Appliances S.r.l. (Italy)

- Keurig Green Mountain, Inc. (U.S.)

- NESTLE NESPRESSO S.A. (Switzerland)

- Home Connect GmbH (Germany)

- Bunn-O-Matic Corporation (U.S.)

- Bravilor Bonamat (Netherlands)

- Animo B.V. (Netherlands)

- Panasonic Corporation (Japan)

- Behmor, Inc. (U.S.)

- Electrolux (Sweden)

- Concordia Beverage Systems (U.S.)

- Morphy Richards India (India)

- Hamilton Beach Brands, Inc. (U.S.)

Latest Developments in Global Automatic Coffee Machines Market

- In February 2024, KitchenAid announced plans to enter the at-home espresso segment with new automatic machines priced between USD 1,199 and USD 1,999, aiming to compete with established brands such as Starbucks. This initiative is expected to significantly strengthen KitchenAid’s presence in the premium home coffee market by offering fully automated, barista-style coffee experiences. The launch enhances convenience for consumers seeking high-quality espresso without professional skills and is likely to stimulate demand for premium espresso machines in North America and Europe, fostering competition among top-tier home appliance brands

- In January 2024, Bosch unveiled the 800 Series fully automatic espresso machine, featuring the Aroma Max System, a ceramic grinder, and a 5-inch touchscreen interface. This launch is anticipated to boost Bosch’s market share by catering to consumers seeking consistent coffee quality combined with ease of use. The advanced automation and intuitive controls support both residential and professional applications, while innovations such as the ceramic grinder extend durability and flavor precision, reinforcing Bosch’s positioning in the premium coffee appliance segment

- In January 2024, Groupe SEB announced plans to establish a USD 65 million R&D hub in China, scheduled to be operational by 2025, focusing on professional coffee machines. This investment is expected to strengthen the company’s foothold in the rapidly expanding Asian market, accelerate region-specific product innovation, and address local commercial and professional needs. The hub reflects Groupe SEB’s long-term strategy to capture market share in high-growth regions while reinforcing its competitive advantage in advanced coffee machine solutions

- In October 2023, WMF Professional Coffee Machines introduced the WMF 1500 F bean-to-cup machine featuring pressure-brew technology, rapid brewing capabilities, and large output capacity. This development is poised to enhance WMF’s market position in the commercial segment by meeting high-volume demand in cafés, offices, and hospitality settings. The machine’s user-friendly maintenance, consistent beverage quality, and efficiency improvements make it attractive to commercial operators seeking reliable and scalable coffee solutions

- In September 2023, Nespresso launched the Vertuo Next Pro machine targeting small offices and co-working spaces, offering app connectivity, high-speed brewing, and barcode-based cup customization. This product is expected to drive growth in the professional and SMB segment by delivering automated, personalized coffee experiences with minimal operational effort. By integrating convenience, speed, and precision, Nespresso strengthens its B2B presence and encourages wider adoption of automatic coffee machines in corporate and shared office environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.