Global Automatic Edge Banding Machine Market

Market Size in USD Billion

CAGR :

%

USD

6.73 Billion

USD

7.61 Billion

2024

2032

USD

6.73 Billion

USD

7.61 Billion

2024

2032

| 2025 –2032 | |

| USD 6.73 Billion | |

| USD 7.61 Billion | |

|

|

|

|

Automatic Edge Banding Machine Market Size

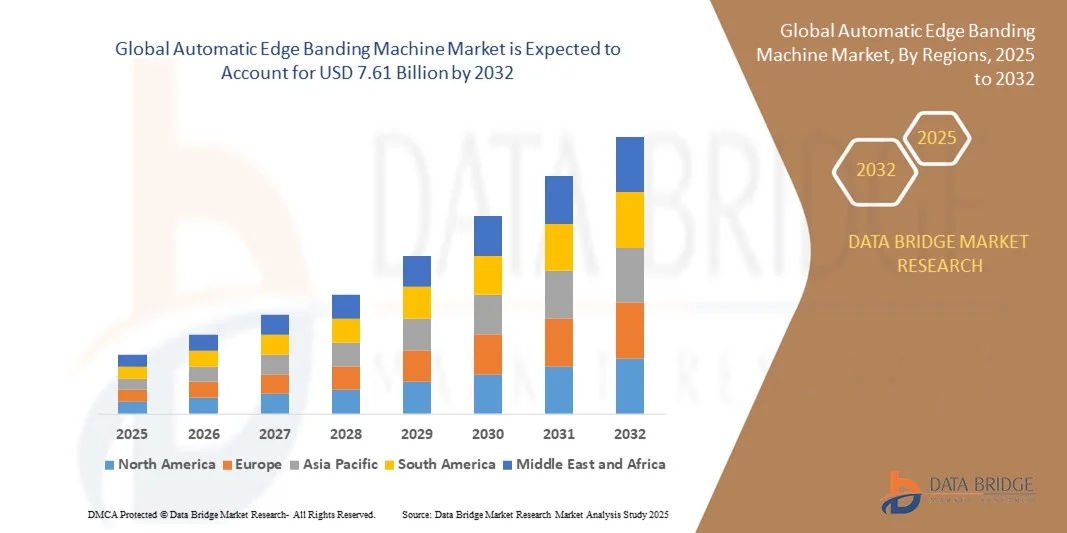

- The global automatic edge banding machine market size was valued at USD 6.73 billion in 2024 and is expected to reach USD 7.61 billion by 2032, at a CAGR of 2.5% during the forecast period

- The market growth is largely fuelled by increasing demand for automated wood processing equipment, rising adoption of advanced manufacturing technologies, and the need for high-quality finished furniture products

- Growing investments in the furniture and interior design industry, along with technological advancements in edge banding machines, are further supporting market expansion

Automatic Edge Banding Machine Market Analysis

- The market is witnessing increased adoption of CNC-controlled machines and multi-functional edge banding systems, enabling manufacturers to reduce labor costs and improve productivity

- Rising awareness of precision finishing, durability, and aesthetic appeal in furniture and cabinetry is encouraging the shift toward automated edge banding machines

- North America dominated the automatic edge banding machine market with the largest revenue share of 41.8% in 2024, driven by the growing furniture manufacturing industry, increasing adoption of automated woodworking solutions, and technological advancements in CNC and robotic systems

- Asia-Pacific region is expected to witness the highest growth rate in the global automatic edge banding machine market, driven by increasing urbanization, rising disposable incomes, and large-scale investments in infrastructure and residential housing projects across emerging economies

- The Full-Automatic segment held the largest market revenue share in 2024, driven by its high efficiency, faster production speed, and ability to handle multi-step edge finishing processes with minimal human intervention. Full-automatic machines are widely preferred in large-scale furniture and panel manufacturing operations for consistent quality and reduced labor costs

Report Scope and Automatic Edge Banding Machine Market Segmentation

|

Attributes |

Automatic Edge Banding Machine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automatic Edge Banding Machine Market Trends

Increasing Adoption of Automated Woodworking Solutions

- The growing shift toward automated edge banding machines is transforming the woodworking and furniture manufacturing landscape by enabling precise, high-speed edge finishing. The integration of robotics and CNC technology allows for consistent quality, reduced manual labor, and lower material wastage, ultimately improving productivity and reducing production costs. These machines also minimize human error, support multi-shift operations, and contribute to standardized output across high-volume production lines

- Rising demand from large-scale furniture manufacturers and custom woodworking shops is accelerating the adoption of advanced edge banding systems with multi-function capabilities, including trimming, gluing, and buffing. These machines enhance operational efficiency while maintaining high-quality finishes. In addition, manufacturers benefit from reduced setup times, better resource utilization, and the ability to handle diverse materials and panel sizes with minimal adjustments

- The affordability and versatility of modern edge banding machines are making them attractive for both small workshops and large manufacturing facilities, enabling scalability and customization without compromising output quality. Smaller operations can now compete with industrial-scale manufacturers, while large enterprises can implement modular systems to expand capacity or introduce new product lines efficiently

- For instance, in 2023, several European furniture manufacturers implemented fully automated edge banding systems, leading to faster production cycles, reduced labor dependency, and improved finish consistency across mass-produced components. The adoption also enabled smoother integration with CAD/CAM systems, resulting in reduced waste, faster prototyping, and more efficient maintenance schedules

- While automated edge banding solutions are gaining traction, their effectiveness depends on ongoing technological upgrades, proper operator training, and integration with existing production workflows. Manufacturers are focusing on user-friendly interfaces, modular designs, and remote monitoring to maximize adoption. Continuous software improvements, predictive maintenance capabilities, and IoT-enabled monitoring are further enhancing operational reliability and long-term performance

Automatic Edge Banding Machine Market Dynamics

Driver

Rising Demand for High-Precision and Efficient Edge Finishing in Furniture Manufacturing

- Increasing requirements for precise, uniform, and durable edge finishes in furniture, cabinetry, and panel processing are driving investment in automated edge banding machines. These systems reduce errors, improve aesthetics, and ensure product consistency. Enhanced finishing quality is also helping manufacturers meet stricter industry standards and customer expectations for premium furniture

- Manufacturers are adopting automated solutions to optimize production speed, reduce manual labor, and minimize material wastage, providing cost advantages and shorter lead times. Machines capable of multi-step processing further reduce downtime, streamline operations, and enable flexible production scheduling to meet growing demand for customized furniture

- Government initiatives and industry programs promoting modern manufacturing practices and automation are further supporting adoption, encouraging companies to upgrade to high-performance edge banding equipment. Incentives for smart manufacturing, energy-efficient machines, and workforce skill development are facilitating wider adoption across emerging and mature markets

- For instance, in 2022, a leading North American furniture manufacturer integrated CNC-based edge banding machines, boosting production efficiency and reducing overall operational costs. This implementation also allowed better tracking of material usage, predictive maintenance, and reduced scrap rates, contributing to more sustainable manufacturing processes

- While demand is strong, further market expansion depends on machine affordability, energy efficiency, and technical support to ensure seamless integration into existing manufacturing lines. Investments in after-sales service, operator training, and modular machine upgrades are critical to ensuring consistent performance and long-term adoption

Restraint/Challenge

High Capital Investment and Technical Expertise Requirements

- Advanced automatic edge banding machines require significant upfront investment, making them less accessible for small workshops or budget-conscious manufacturers. High costs can delay return on investment and adoption. The complexity of modern systems also necessitates ongoing maintenance contracts and software updates, which can add to total ownership costs

- Many facilities lack trained personnel capable of operating, programming, and maintaining complex edge banding systems, which can lead to operational inefficiencies and inconsistent output quality. Training programs, certifications, and workforce upskilling are essential to address these gaps and fully leverage the technology’s potential

- Supply chain challenges, including the availability of spare parts, adhesives, and specialized tooling, can further restrict seamless machine operation and maintenance in remote locations. Dependency on international suppliers for components can lead to production delays, increased lead times, and additional logistics costs

- For instance, in 2023, several furniture workshops in Southeast Asia reported production delays due to difficulties in sourcing replacement parts and lack of skilled operators, impacting delivery timelines. These delays also affected customer satisfaction, contract fulfillment, and overall competitiveness in fast-paced markets

- While automated edge banding technology continues to evolve, addressing high capital costs, skill gaps, and supply chain reliability is critical. Manufacturers are focusing on modular machines, affordable packages, and operator training programs to drive wider adoption and long-term growth. Integration with IoT, predictive maintenance, and cloud-based monitoring is expected to further reduce operational challenges and improve ROI

Automatic Edge Banding Machine Market Scope

The market is segmented on the basis of product type and end user.

- By Product Type

On the basis of product type, the automatic edge banding machine market is segmented into Full-Automatic and Semi-Automatic. The Full-Automatic segment held the largest market revenue share in 2024, driven by its high efficiency, faster production speed, and ability to handle multi-step edge finishing processes with minimal human intervention. Full-automatic machines are widely preferred in large-scale furniture and panel manufacturing operations for consistent quality and reduced labor costs.

The Semi-Automatic segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its lower initial investment, ease of operation, and suitability for small to mid-sized workshops. Semi-automatic machines offer flexibility, moderate automation, and cost-effectiveness, making them attractive for custom woodworking shops and growing manufacturers seeking automation without full-scale infrastructure changes.

- By End User

On the basis of end user, the market is segmented into Furniture Industry, Building Material Industry, and Others. The Furniture Industry segment accounted for the largest market share in 2024, driven by increasing demand for high-quality, durable, and aesthetically finished furniture. Automated edge banding machines enable faster production cycles, minimize material wastage, and ensure uniform finishes, supporting large-scale furniture manufacturers in maintaining product consistency.

The Building Material Industry segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising construction activity, increasing use of laminated panels, and demand for precision edge finishing in modular interiors. Automation helps improve productivity, reduce labor dependency, and ensure uniformity in panel products for commercial and residential projects.

Automatic Edge Banding Machine Market Regional Analysis

- North America dominated the automatic edge banding machine market with the largest revenue share of 41.8% in 2024, driven by the growing furniture manufacturing industry, increasing adoption of automated woodworking solutions, and technological advancements in CNC and robotic systems

- Manufacturers in the region highly value precision, speed, and reduced labor dependency offered by advanced edge banding machines, enabling consistent product quality and shorter production cycles

- This widespread adoption is further supported by high disposable incomes, robust industrial infrastructure, and government initiatives promoting automation and smart manufacturing, establishing automatic edge banding machines as a preferred solution for both small workshops and large-scale manufacturers

U.S. Automatic Edge Banding Machine Market Insight

The U.S. market captured the largest revenue share in North America in 2024, fueled by the rising demand for high-precision, automated furniture production. Manufacturers are increasingly integrating full-automatic and semi-automatic edge banding machines to optimize production workflows, reduce labor costs, and ensure uniform finishes. The adoption of energy-efficient and IoT-enabled systems is also driving growth, enabling real-time monitoring, predictive maintenance, and scalable production solutions.

Europe Automatic Edge Banding Machine Market Insight

Europe is expected to witness the fastest growth rate from 2025 to 2032, driven by precision requirements, energy-efficient manufacturing, and sustainable production practices in furniture and panel processing. Countries such as Germany, Italy, and France are witnessing higher adoption of automated edge banding systems to reduce manual labor, enhance productivity, and maintain high-quality finishes. Integration with CNC and robotic systems, along with eco-friendly adhesives, is further promoting market growth across residential, commercial, and industrial sectors.

Germany Automatic Edge Banding Machine Market Insight

Germany is expected to witness the fastest growth rate from 2025 to 2032 due to its strong industrial base, emphasis on precision manufacturing, and adoption of automated solutions. Full-automatic and semi-automatic edge banding machines are being implemented to improve efficiency, reduce labor dependency, and achieve consistent high-quality finishes. The demand is further supported by the country’s focus on sustainability, energy-efficient equipment, and technological innovation in furniture manufacturing.

Asia-Pacific Automatic Edge Banding Machine Market Insight

The Asia-Pacific market is expected to witness the fastest growth rate from 2025 to 2032, driven by the expanding furniture manufacturing industry, increasing urbanization, and adoption of automated woodworking solutions in countries such as China, Japan, and India. Rising investments in smart factories, government initiatives promoting industrial automation, and a growing preference for efficient production are fueling market growth. In addition, the affordability of advanced edge banding machines in the region is enabling wider adoption across small and medium-sized workshops.

China Automatic Edge Banding Machine Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid industrialization, the booming furniture and building materials industry, and increasing adoption of CNC-based edge banding machines. Manufacturers are prioritizing automation to reduce labor costs, improve finish quality, and achieve high production efficiency. Government support for smart manufacturing and digitalized production further accelerates market growth.

Japan Automatic Edge Banding Machine Market Insight

The Japan market is expected to witness the fastest growth rate from 2025 to 2032 due to high-tech manufacturing culture, precision requirements in furniture production, and rising automation adoption. Manufacturers are integrating advanced edge banding machines with CNC and robotic systems to enhance operational efficiency, reduce waste, and maintain consistent finishes. Demand is also supported by customized furniture trends and eco-friendly production practices in both residential and commercial segments.

Automatic Edge Banding Machine Market Share

The Automatic Edge Banding Machine industry is primarily led by well-established companies, including:

- Arkema (France)

- BASF SE (Germany)

- Atlas Molded Products (U.S.)

- ARMACELL LLC (Germany)

- Sealed Air (U.S.)

- KANEKA CORPORATION (Japan)

- Borealis AG (Austria)

- Recticel NV/SA (Belgium)

- Rogers Corporation (U.S.)

- Synthos (Poland)

- Total (France)

- Zotefoams plc (U.K.)

- Foamcraft, Inc. (U.S.)

- Hanwha Advanced Materials America (U.S.)

- BEWiSynbra Group (Norway)

- Tosoh Corporation (Japan)

- UFP Technologies, Inc. (U.S.)

- Dow (U.S.)

- RAJAPACK Ltd (U.K.)

- JSP (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Automatic Edge Banding Machine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automatic Edge Banding Machine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automatic Edge Banding Machine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.