Global Automatic Labeling Machine Market

Market Size in USD Billion

CAGR :

%

USD

8.50 Billion

USD

13.96 Billion

2024

2032

USD

8.50 Billion

USD

13.96 Billion

2024

2032

| 2025 –2032 | |

| USD 8.50 Billion | |

| USD 13.96 Billion | |

|

|

|

|

Automatic Labelling Machine Market Size

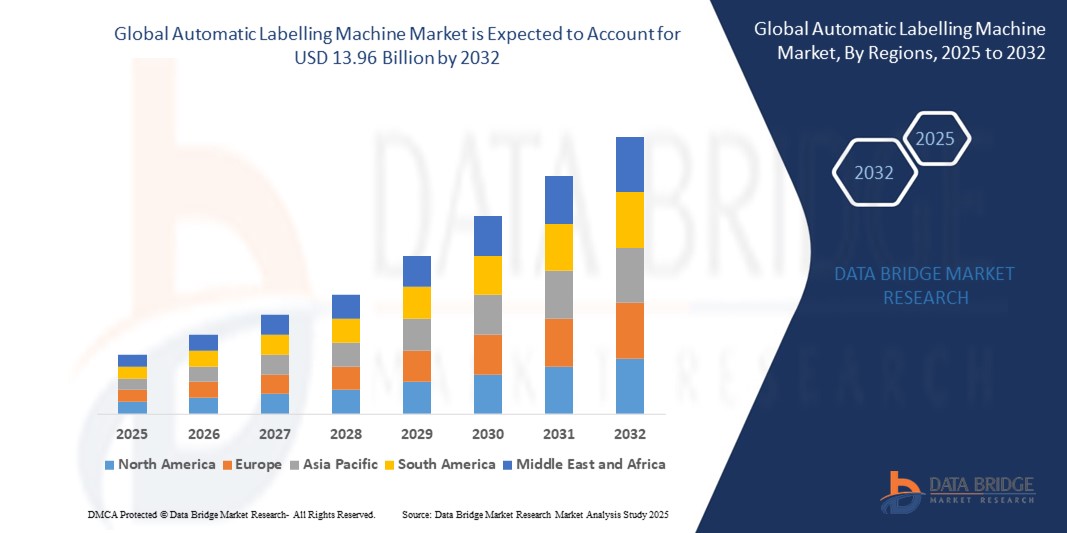

- The global automatic labelling machine market size was valued at USD 8.50 billion in 2024 and is expected to reach USD 13.96 billion by 2032, at a CAGR of 6.40% during the forecast period

- The market growth is primarily driven by the increasing demand for efficient and accurate labelling solutions across various industries, particularly in food and beverage, pharmaceuticals, and cosmetics, due to rising consumer preferences for packaged and ready-to-use products

- Growing awareness of automation benefits, such as enhanced productivity, reduced labor costs, and compliance with stringent regulatory standards, is further boosting demand for automatic labelling machines in both OEM and aftermarket channels

Automatic Labelling Machine Market Analysis

- The automatic labelling machine market is experiencing robust growth as industries prioritize automation to enhance operational efficiency, reduce errors, and meet regulatory labelling requirements

- The rising demand for high-speed, precise, and versatile labelling solutions across both high-volume and niche production segments is encouraging manufacturers to innovate with advanced technologies, such as AI-driven analytics and IoT integration

- North America dominates the automatic labelling machine market with the largest revenue share of 33.9% in 2024, driven by its advanced manufacturing infrastructure and widespread adoption of automation technologies in key industries such as food and beverage, pharmaceuticals, and consumer goods

- Europe is expected to be the fastest-growing region during the forecast period, propelled by its strong engineering expertise, focus on innovation, and increasing demand for advanced packaging technologies in countries such as Germany and Italy

- The Wrap-Around Labelling Machines segment held the largest market revenue share of 38.2% in 2024, driven by its versatility in applying seamless, high-quality labels across diverse industries such as food and beverage, pharmaceuticals, and cosmetics

Report Scope and Automatic Labelling Machine Market Segmentation

|

Attributes |

Automatic Labelling Machine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automatic Labelling Machine Market Trends

Increasing Integration of Smart Technologies and IoT

- The global automatic labelling machine market is experiencing a notable trend toward the integration of smart technologies and Internet of Things (IoT) solutions

- These technologies enable real-time monitoring, predictive maintenance, and enhanced operational efficiency by providing insights into machine performance and label application accuracy

- IoT-enabled labelling machines can connect with production line systems, allowing for seamless data exchange and automation of labelling processes

- For instances, companies are developing smart labelling systems that adjust label placement based on real-time product dimensions or integrate with supply chain management systems to ensure compliance with labelling regulations

- This trend enhances the appeal of automatic labelling machines for industries seeking to improve productivity, reduce errors, and align with Industry 4.0 initiatives

- Advanced analytics from IoT systems can monitor parameters such as label adhesion quality, machine downtime, and production speed, optimizing overall performance

Automatic Labelling Machine Market Dynamics

Driver

Rising Demand for Automation and Regulatory Compliance

- The growing need for automation in industries such as food and beverage, pharmaceuticals, and cosmetics is a key driver for the global automatic labelling machine market

- Automatic labelling machines enhance production efficiency by providing high-speed, accurate label application, meeting the demand for streamlined packaging processes

- Stringent government regulations, particularly in regions such as Europe and North America, mandating accurate labelling for product safety, traceability, and consumer information, are boosting market adoption

- The expansion of e-commerce and the need for efficient logistics and inventory management further drive demand for advanced labelling solutions that ensure accurate product identification

- Manufacturers are increasingly integrating labelling machines as standard equipment in production lines to meet consumer expectations for high-quality, compliant packaging

Restraint/Challenge

High Initial Costs and Data Integration Complexities

- The high initial investment required for purchasing, installing, and integrating automatic labelling machines can be a significant barrier, particularly for small and medium-sized enterprises in emerging markets

- Retrofitting existing production lines with advanced labelling systems can be complex and costly, requiring specialized expertise

- In addition, integrating smart labelling machines with existing IoT or enterprise systems poses challenges related to compatibility and data management

- Concerns about maintaining consistent label quality across diverse product types and packaging materials can also hinder adoption, as machines must be adaptable to various surfaces and formats

- These factors may limit market growth in cost-sensitive regions or industries with fragmented production processes

Automatic Labelling Machine market Scope

The market is segmented on the basis of Type, Technology, End-Use, and Operation Mode.

- By Type

On the basis of type, the global automatic labelling machine market is segmented into Front and Back Labelling Machines, Wrap-Around Labelling Machines, Sleeve Labelling Machines, Carton Labelling Machines, and Others. The Wrap-Around Labelling Machines segment held the largest market revenue share of 38.2% in 2024, driven by its versatility in applying seamless, high-quality labels across diverse industries such as food and beverage, pharmaceuticals, and cosmetics. These machines enhance product aesthetics and provide ample space for branding and regulatory compliance.

The Sleeve Labelling Machines segment is expected to witness the fastest growth rate of 7.8% from 2025 to 2032, fueled by rising demand for 360-degree branding and tamper-evident packaging. Sleeve labels, particularly shrink sleeves, offer enhanced visual appeal and compatibility with complex container shapes, driving adoption in beverage, cosmetics, and household product sectors.

- By Technology

On the basis of technology, the global automatic labelling machine market is segmented into Pressure-Sensitive Labelling, Heat-Shrink Labelling, In-Mold Labelling, and Glue-Based Labelling. The Pressure-Sensitive Labelling segment dominated with a market revenue share of 42.3% in 2024, owing to its ease of use, versatility, and ability to adhere to various materials such as glass, plastic, and metal. Its compatibility with high-speed production lines and diverse packaging types makes it ideal for industries such as food and beverage and pharmaceuticals.

The Heat-Shrink Labelling segment is anticipated to experience the fastest growth rate of 8.1% from 2025 to 2032, driven by increasing demand for shrink sleeve labels that provide full-body coverage and enhanced shelf appeal. Advancements in heat-shrink technology and sustainability-focused innovations, such as linerless labels, further accelerate adoption.

- By End-Use

On the basis of end use, the global automatic labelling machine market is segmented into Food and Beverage, Pharmaceuticals, Cosmetics and Personal Care, Chemicals, Logistics and Retail, and Others. The Food and Beverage segment accounted for the largest market revenue share of 43.5% in 2024, driven by stringent regulatory requirements for labeling, high production volumes, and growing consumer demand for transparency in product information, such as nutritional facts and traceability.

The Pharmaceuticals segment is expected to witness the fastest growth rate of 7.5% from 2025 to 2032, fueled by increasing regulatory standards for precise and compliant labeling, particularly for serialization and traceability. The adoption of smart labeling technologies, such as RFID, further supports growth in this sector.

Automatic Labelling Machine Market Regional Analysis

- North America dominates the automatic labelling machine market with the largest revenue share of 33.9% in 2024, driven by its advanced manufacturing infrastructure and widespread adoption of automation technologies in key industries such as food and beverage, pharmaceuticals, and consumer goods

- Consumers prioritize labelling machines for enhancing production efficiency, ensuring regulatory compliance, and improving brand visibility, particularly in regions with stringent labelling standards

- Growth is supported by advancements in labelling technology, including pressure-sensitive and smart labelling systems, alongside rising adoption in both OEM and aftermarket segments

U.S. Automatic Labelling Machine Market Insight

The U.S. automatic labelling machine market captured the largest revenue share of 71.3% in 2024 within North America, fueled by strong demand in the food and beverage and pharmaceutical sectors, coupled with growing adoption of automation. The trend towards high-speed, precise labelling solutions and increasing regulations for product traceability and safety further boost market expansion. Automakers’ integration of advanced labelling systems in production lines complements aftermarket sales, creating a dynamic product ecosystem.

Europe Automatic Labelling Machine Market Insight

The Europe automatic labelling machine market is expected to witness the fastest growth rate, supported by a strong regulatory emphasis on product safety and traceability. Consumers seek labelling machines that ensure compliance with stringent standards while offering high-speed and versatile solutions. The growth is prominent in both new installations and retrofit projects, with countries such as Germany and France showing significant uptake due to advanced manufacturing capabilities and environmental concerns.

U.K. Automatic Labelling Machine Market Insight

The U.K. market for automatic labelling machines is expected to witness significant growth, driven by demand for efficient labelling solutions in food and beverage and cosmetics industries. Increased focus on brand differentiation and rising awareness of regulatory compliance encourage adoption. Evolving labelling regulations influence consumer choices, balancing precision with operational efficiency.

Germany Automatic Labelling Machine Market Insight

Germany is expected to witness rapid growth in the automatic labelling machine market, attributed to its advanced manufacturing sector and high consumer focus on production efficiency and regulatory compliance. German industries prefer technologically advanced labelling machines, such as pressure-sensitive and in-mold systems, that enhance automation and reduce operational costs. The integration of these machines in premium manufacturing lines and aftermarket solutions supports sustained market growth.

Asia-Pacific Automatic Labelling Machine Market Insight

The Asia-Pacific region is expected to witness significant growth, driven by expanding industrial production and rising disposable incomes in countries such as China, India, and Japan. Increasing demand for packaged goods, regulatory compliance, and brand visibility is boosting the adoption of automatic labelling machines. Government initiatives promoting automation and product safety further encourage the use of advanced labelling technologies.

Japan Automatic Labelling Machine Market Insight

Japan’s automatic labelling machine market is expected to experience rapid growth due to strong consumer preference for high-quality, technologically advanced labelling solutions that enhance production efficiency and compliance. The presence of major manufacturers and the integration of labelling machines in OEM production lines accelerate market penetration. Rising interest in aftermarket automation solutions also contributes to growth.

China Automatic Labelling Machine Market Insight

China holds the largest share of the Asia-Pacific automatic labelling machine market, propelled by rapid industrialization, rising product packaging needs, and increasing demand for efficient labelling solutions. The country’s growing consumer base and focus on automation support the adoption of advanced labelling technologies. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Automatic Labelling Machine Market Share

The automatic labelling machine industry is primarily led by well-established companies, including:

- ProMach Inc. (U.S.)

- Krones AG (Germany)

- CVC Technologies, Inc. (U.S.)

- SATO Holdings Corporation (Japan)

- LABELMATE (U.S.)

- Videojet Technologies Pvt. Ltd. (U.S.)

- Herma (Germany)

- Epson America, Inc. (U.S.)

- Avery Dennison Corporation (U.S.)

- Wihuri Group (Finland)

- Marchesini Group S.p.A. (Italy)

- AutomateIT (Germany)

- Sidel (France)

- UPM Global (U.S.)

- PAC Machinery (U.S.)

What are the Recent Developments in Global Automatic Labelling Machine Market?

- In July 2024, Domino Printing Sciences plc launched a suite of automated solutions for product printing and label verification, leveraging AI-driven software and machine vision to enable real-time data analysis and error detection. These innovations are designed to help manufacturers minimize costly labeling mistakes, especially those related to undeclared allergens, and improve operational efficiency across high-speed production lines. The new system eliminates manual intervention, integrates seamlessly with existing workflows, and supports compliance with increasingly strict labeling regulations. Domino’s closed-loop approach simplifies automation adoption while reducing complexity and cost

- In June 2024, Sacmi Imola S.C. introduced an upgraded version of its Labelling Machine CFS, designed to meet the increasing demand for precision and speed in high-volume production environments. The new model features enhanced digital controls and an advanced inspection system, significantly improving labeling accuracy and operational efficiency. These upgrades allow for better integration with automated production lines and ensure consistent quality across diverse container types. This innovation reflects Sacmi’s commitment to smart manufacturing, offering flexible, high-performance solutions tailored to the evolving needs of the food and beverage industry

- In May 2024, Krones AG unveiled its latest innovation—the Krones Varioline labeling machine, designed to meet the evolving needs of the food and beverage industry. Featuring advanced modular technology, the Varioline can handle a wide variety of container sizes and shapes, offering unmatched flexibility and efficiency. Its modular design allows producers to switch between packaging formats with minimal downtime, supporting up to 20+ packaging combinations in a single machine. This launch addresses the rising demand for customizable, high-speed labeling solutions, helping manufacturers streamline operations and respond to diverse market requirements

- In January 2024, Weber Packaging Solutions launched the TQS-I integrated print & apply system, a cutting-edge solution that combines a high-resolution inkjet printer with a labeling head in a single unit. This system enables on-demand variable data printing and precise label application in one seamless step, significantly improving efficiency and accuracy on production lines. Designed for industries requiring high-speed, flexible labeling—such as food, beverage, and pharmaceuticals—the TQS-I helps reduce downtime and streamline operations. Its modular design and digital controls make it ideal for modern packaging environments focused on traceability and compliance

- In February 2023, Sidel Group, a global leader in packaging solutions, announced the acquisition of Makro Labelling Srl, an Italian company renowned for its modular labeling machines. This strategic move strengthens Sidel’s position in the labeling technology market, expanding its capabilities across low- and medium-speed modular systems and enhancing its reach in dynamic sectors such as food, beverage, wine, spirits, and personal care. Makro will continue to operate independently from its headquarters in Mantova, Italy, while benefiting from Sidel’s global infrastructure and expertise. The acquisition marks a new phase of international growth and innovation for both companies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.