Global Automatic Tray Sealing Machines Market

Market Size in USD Billion

CAGR :

%

USD

5.35 Billion

USD

10.20 Billion

2024

2032

USD

5.35 Billion

USD

10.20 Billion

2024

2032

| 2025 –2032 | |

| USD 5.35 Billion | |

| USD 10.20 Billion | |

|

|

|

|

Automatic Tray Sealing Machines Market Size

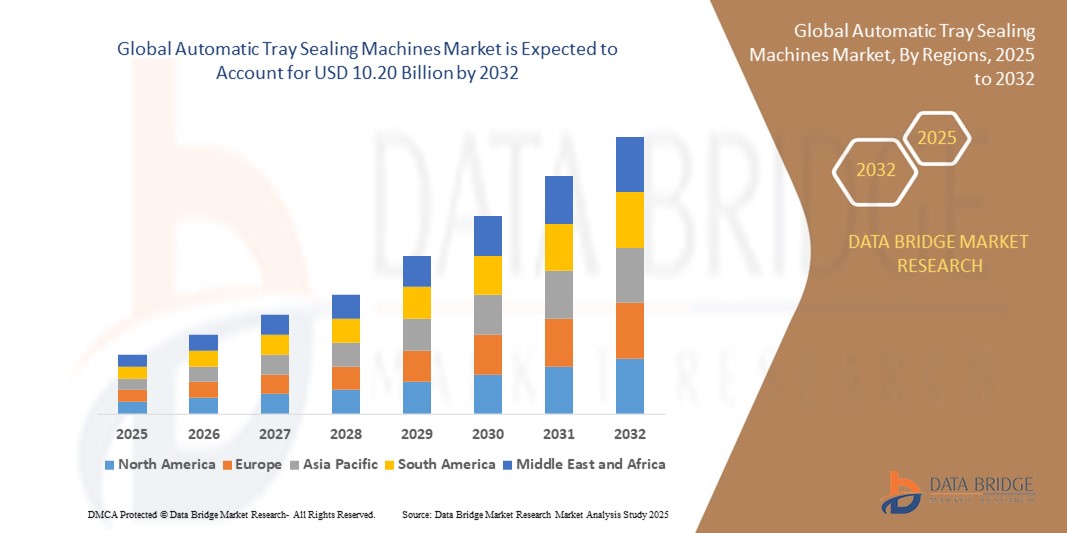

- The global automatic tray sealing machines market size was valued at USD 5.35 billion in 2024 and is expected to reach USD 10.20 billion by 2032, at a CAGR of 8.40% during the forecast period

- The market growth is largely fueled by the increasing demand for hygienic, efficient, and automated food packaging solutions, driven by rising consumption of ready-to-eat meals, processed foods, and fresh produce across global markets

- Furthermore, growing adoption of modified atmosphere and vacuum skin packaging to enhance shelf life and reduce food waste is accelerating the uptake of automatic tray sealing machines. These factors, along with the push for sustainability and automation in food processing, are significantly boosting the industry’s growth

Automatic Tray Sealing Machines Market Analysis

- Automatic tray sealing machines are packaging systems designed to seal food trays using heat and pressure, often in combination with MAP or vacuum sealing technologies to maintain freshness and extend shelf life. These machines are widely used in meat, poultry, seafood, bakery, and ready meal applications for their speed, consistency, and reduced labor dependence

- The growing demand for safe, tamper-evident, and visually appealing packaging, coupled with the expansion of food retail chains and cold chain logistics, is driving rapid adoption of these machines across both industrial-scale and mid-sized food production units

- Asia-Pacific dominated the automatic tray sealing machines market with a share of 37.3% in 2024, due to the region’s rapidly growing food processing industry, rising demand for packaged and convenience foods, and expansion of cold chain logistics in densely populated economies

- North America is expected to be the fastest growing region in the automatic tray sealing machines market during the forecast period due to the high demand for pre-packaged food, growing investments in food automation, and stringent regulatory standards for food safety and packaging integrity

- Modified Atmospheric Packaging (MAP) segment dominated the market with a market share of 48% in 2024, due to its ability to significantly extend shelf life by altering the internal atmosphere of the package. This method is highly favored by food processors aiming to reduce spoilage and waste while preserving product freshness, color, and taste. MAP’s adaptability to various food categories, including fresh produce, meats, and bakery items, and its compatibility with automation solutions have made it the top choice for high-throughput packaging lines

Report Scope and Automatic Tray Sealing Machines Market Segmentation

|

Attributes |

Automatic Tray Sealing Machines Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automatic Tray Sealing Machines Market Trends

Increasing Investments in Food Processing Technology

- The automatic tray sealing machines market is experiencing strong growth driven by substantial investments in advanced food processing technologies aimed at improving packaging speed, efficiency, and product safety

- For instance, companies such as Sealed Air Corporation and Multivac are integrating state-of-the-art automation, robotics, and smart sensors into their tray sealing solutions to boost productivity and compliance with stricter hygiene standards in food packaging

- Rising consumer demand for convenience foods such as ready-to-eat and ready-to-cook meals is encouraging manufacturers to adopt faster, flexible tray sealing systems that handle diverse tray sizes and materials with minimal changeover time

- Growing emphasis on sustainability leads to innovations in tray sealing technology that support recyclable and biodegradable films while minimizing material usage without compromising seal integrity

- Expansion of e-commerce food delivery platforms is driving demand for durable and tamper-evident tray sealing solutions capable of preserving product freshness over longer supply chains

- Industry 4.0 adoption encourages integration of IoT-enabled tray sealing machines connected with cloud platforms for real-time monitoring, predictive maintenance, and remote operation, enhancing operational agility

Automatic Tray Sealing Machines Market Dynamics

Driver

Increasing Demand for Convenient Food Packaging

- Consumer lifestyles characterized by busy schedules and a preference for quick meal solutions are driving rapid growth in demand for convenient, hygienically packaged food products, increasing the need for automatic tray sealing machines

- For instance, major food manufacturers such as Nestlé and Kraft Heinz utilize tray sealing technologies extensively to package ready meals and fresh produce that appeal to on-the-go consumers seeking quality and extended shelf life

- Increasing penetration of processed, frozen, and ready-to-eat meals across both developed and emerging markets fuels demand for tray sealing machines capable of high throughput and consistent sealing performance

- Rising retail expansion, including supermarkets and online grocery platforms, pushes manufacturers to improve packaging aesthetics, shelf visibility, and tamper evidence—all enabled by advanced tray sealing equipment

- Regulatory requirements enforcing food safety, contamination prevention, and traceability further incentivize food processors to invest in automatic tray sealing solutions that ensure hygienic and secure packaging

Restraint/Challenge

High Initial Investment Costs

- The substantial capital expenditure required to acquire, install, and integrate automatic tray sealing machines, especially advanced models with automation and IoT capabilities, inhibits adoption by small and medium-scale food processors

- For instance, companies such as Multivac and Proseal face challenges making their high-performance tray sealers affordable to lower-tier market segments, resulting in slower penetration in price-sensitive regions

- Maintenance costs, requirement for skilled operators, and the complexity of integrating new machines within existing production lines further add to the upfront financial burden

- Limited access to financing and leasing options in developing economies constrains the ability of many manufacturers to invest in state-of-the-art tray sealing technologies, delaying modernization efforts

- Price competition from manual or semi-automatic sealing solutions and alternative packaging formats affects market growth despite the long-term benefits of full automation

Automatic Tray Sealing Machines Market Scope

The market is segmented on the basis of packaging type and application.

- By Packaging Type

On the basis of packaging type, the automatic tray sealing machines market is segmented into Modified Atmospheric Packaging (MAP), Vacuum Skin Packaging (VSP), and General Sealing. The Modified Atmospheric Packaging (MAP) segment dominated the largest market revenue share of 48% in 2024, attributed to its ability to significantly extend shelf life by altering the internal atmosphere of the package. This method is highly favored by food processors aiming to reduce spoilage and waste while preserving product freshness, color, and taste. MAP’s adaptability to various food categories, including fresh produce, meats, and bakery items, and its compatibility with automation solutions have made it the top choice for high-throughput packaging lines.

The Vacuum Skin Packaging (VSP) segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its growing application in premium meat, seafood, and ready meal segments. VSP enhances product visibility while ensuring minimal movement inside the tray, improving aesthetics and reducing risk of contamination. Its excellent sealing integrity and oxygen barrier properties appeal to manufacturers aiming to maintain texture, flavor, and safety of high-value perishables. Moreover, the increasing consumer preference for visually appealing and hygienically packaged food is further accelerating the adoption of VSP systems across food retail chains.

- By Application

On the basis of application, the automatic tray sealing machines market is segmented into Meat, Poultry and Seafood, Bakery and Confectionary, Fresh Produce, Ready Meals, Sweets and Dry Fruits, and Others. The Meat, Poultry and Seafood segment held the largest market revenue share in 2024, owing to the high perishability of these products and the growing demand for extended shelf life without compromising quality. Tray sealing systems in this segment enable advanced packaging methods such as MAP and VSP, which are essential in preserving texture, moisture, and flavor during storage and transit. The increasing global consumption of animal proteins and the expansion of cold chain logistics have further bolstered demand for automated and hygienic sealing solutions in this category.

The Ready Meals segment is anticipated to register the fastest growth rate from 2025 to 2032, fueled by rising urbanization, busy lifestyles, and the increasing reliance on convenience foods. Automatic tray sealing machines are particularly advantageous in ready meal packaging as they support high-speed operations, leak-proof seals, and microwave/oven compatibility. The surge in demand for pre-packaged, single-serve, and health-conscious meal solutions is prompting food manufacturers to invest in efficient tray sealing technologies that maintain freshness while meeting evolving consumer expectations.

Automatic Tray Sealing Machines Market Regional Analysis

- Asia-Pacific dominated the automatic tray sealing machines market with the largest revenue share of 37.3% in 2024, driven by the region’s rapidly growing food processing industry, rising demand for packaged and convenience foods, and expansion of cold chain logistics in densely populated economies

- Increasing investments in modern food packaging infrastructure, combined with the surge in retail-ready meal consumption, are accelerating the deployment of advanced sealing equipment

- Furthermore, the presence of key packaging machinery manufacturers, adoption of automation across large-scale food production units, and government support for food safety and export enhancement are driving regional market growth

China Automatic Tray Sealing Machines Market Insight

China held the largest share in the Asia-Pacific automatic tray sealing machines market in 2024, propelled by its dominant position in food manufacturing, strong export orientation, and rapid automation in packaging operations. The growing demand for hygienic, leak-proof, and shelf-stable food packaging is further driving the need for high-performance sealing machines.

India Automatic Tray Sealing Machines Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, supported by the expanding ready-to-eat and processed food sectors, growth of organized retail, and rising adoption of smart packaging technologies. Government initiatives promoting food safety and cold chain modernization are also contributing to market momentum.

Europe Automatic Tray Sealing Machines Market Insight

The Europe automatic tray sealing machines market is expected to grow steadily, driven by increasing emphasis on sustainable packaging, food quality, and compliance with stringent safety regulations. The region is also experiencing rising demand for advanced sealing systems in processed meat, seafood, and bakery segments.

Germany Automatic Tray Sealing Machines Market Insight

Germany’s market is expanding due to its highly developed food packaging industry, technological innovation in sealing systems, and focus on energy efficiency and recyclability. Manufacturers are investing in automation to meet consumer and regulatory demands for quality, traceability, and minimal food waste.

U.K. Automatic Tray Sealing Machines Market Insight

The U.K. market is driven by growing consumption of convenience foods, premium ready meals, and high-end protein products. Packaging innovation, sustainability goals, and modernization of food processing facilities are boosting the adoption of advanced sealing technologies.

North America Automatic Tray Sealing Machines Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, fueled by the high demand for pre-packaged food, growing investments in food automation, and stringent regulatory standards for food safety and packaging integrity. The integration of IoT-enabled sealing systems and demand for extended shelf-life packaging are shaping market dynamics.

U.S. Automatic Tray Sealing Machines Market Insight

The U.S. accounted for the largest share in the North America market in 2024, supported by its robust food processing sector, consumer preference for packaged fresh and frozen meals, and continuous innovation in packaging technology. Adoption of high-speed, versatile sealing machines is rising among large-scale processors focused on operational efficiency and product differentiation.

Automatic Tray Sealing Machines Market Share

The automatic tray sealing machines industry is primarily led by well-established companies, including:

- Proseal (U.K.)

- MULTIVAC (Germany)

- G. Mondini S.p.A. (Italy)

- ILPRA S.p.A. (Italy)

- SEALPAC (Taiwan)

- ULMA Group (Spain)

- Italianpack S.p.A. (Italy)

- Orved S.p.A. (Italy)

- Cima-Pak Corporation (U.S.)

- The Platinum Package Group (U.S.)

- Ossid LLC (U.S.)

Latest Developments in Global Automatic Tray Sealing Machines Market

- In January 2025, JBT Proseal achieved a significant operational milestone by installing its 8000th tray sealing machine at Bakkavor Group. This accomplishment underscores the company's leadership in sealing technology and highlights the growing demand for high-efficiency, automated packaging solutions. The installation is expected to enhance Bakkavor’s production scalability, reduce packaging waste, and improve overall sustainability—reinforcing Proseal’s role in shaping the future of automated food packaging

- In February 2024, ProMach expanded its global footprint and product portfolio by acquiring Zanichelli Meccanica S.p.A., an Italy-based specialist in food processing equipment. This strategic move strengthens ProMach’s capabilities in integrated processing and packaging solutions, allowing it to better serve European markets and address the rising demand for flexible, end-to-end food packaging technologies

- In August 2023, JBT’s Proseal launched the CP4 case packing machine, the latest model in its CP series, designed to maximize throughput and efficiency for food producers worldwide. This innovation reflects the company’s commitment to enhancing packaging line automation. By offering greater flexibility, speed, and profitability, the CP4 supports the industry’s shift toward streamlined, labor-saving systems and reinforces JBT’s competitive positioning in secondary packaging solutions

- In July 2022, John Bean Technologies Corporation (JBT) reinforced its presence in the food machinery segment by acquiring Alco-food-machines GmbH & Co. KG, a German-based manufacturer known for its advanced food processing equipment. This acquisition enhances JBT’s product offering across the food processing value chain and supports its goal of delivering comprehensive automation solutions—benefiting food producers seeking integrated packaging and processing capabilities

- In June 2022, Pro Mach Inc., a leading packaging machinery company based in the U.S., completed the acquisition of Reepack, an Italy-based manufacturer specializing in premium flexible packaging machinery. The details of the acquisition were not disclosed, but it significantly strengthens ProMach's position in the food packaging sector, particularly in protein packaging automation. Known for its expertise in vacuum chambers, thermoformers, tray sealers, and flow wrappers, Reepack’s integration enhances ProMach’s reputation as a top supplier in the food packaging automation industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Automatic Tray Sealing Machines Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automatic Tray Sealing Machines Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automatic Tray Sealing Machines Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.