Global Automotive Active Roll Control System Arc Market

Market Size in USD Billion

CAGR :

%

USD

4.10 Billion

USD

5.40 Billion

2025

2033

USD

4.10 Billion

USD

5.40 Billion

2025

2033

| 2026 –2033 | |

| USD 4.10 Billion | |

| USD 5.40 Billion | |

|

|

|

|

Automotive Active Roll Control System (ARC) Market Size

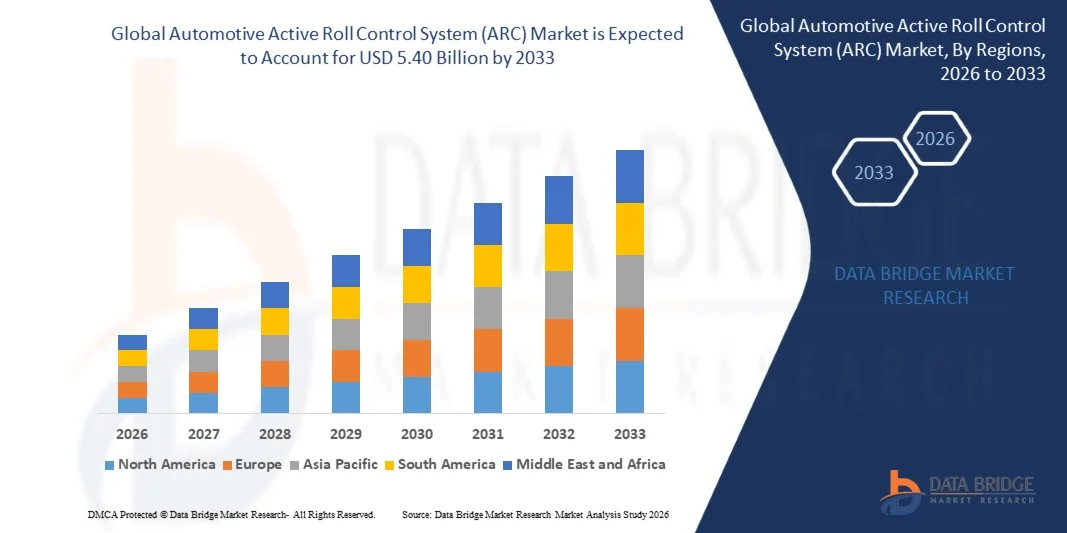

- The global automotive active roll control system (ARC) market size was valued at USD 4.10 billion in 2025 and is expected to reach USD 5.40 billion by 2033, at a CAGR of 3.50% during the forecast period

- The market growth is largely fuelled by the increasing demand for enhanced vehicle stability, passenger safety, and improved handling performance in passenger cars, commercial vehicles, and luxury automobiles

- Growing adoption of electric and hybrid vehicles, coupled with advancements in automotive suspension technologies and integration with advanced driver-assistance systems (ADAS), is further propelling market expansion

Automotive Active Roll Control System (ARC) Market Analysis

- The market is witnessing steady growth due to the focus on reducing body roll during cornering, improving driving comfort, and enhancing vehicle safety, particularly in SUVs, luxury cars, and commercial vehicles

- Technological innovations, such as electronically controlled hydraulic actuators, adaptive suspension systems, and integration with vehicle dynamics control systems, are boosting market adoption across both mature and emerging automotive markets

- North America dominated the automotive active roll control (ARC) system market with the largest revenue share of 35.20% in 2025, driven by increasing demand for vehicle safety technologies and advanced driving comfort features

- Asia-Pacific region is expected to witness the highest growth rate in the global automotive active roll control system (ARC) market, driven by rapid urbanization, growing automotive manufacturing hubs, and increasing penetration of technologically advanced vehicle stability systems across China, India, Japan, and South Korea

- The rotary actuator segment held the largest market revenue share in 2025, driven by its compact design, precise control, and compatibility with a wide range of vehicle suspension systems. Rotary actuators are widely adopted in luxury and high-performance vehicles for enhanced ride comfort and stability during cornering and sudden maneuvers

Report Scope and Automotive Active Roll Control System (ARC) Market Segmentation

|

Attributes |

Automotive Active Roll Control System (ARC) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Active Roll Control System (ARC) Market Trends

“Increasing Adoption of Active Roll Control Systems in Vehicles”

• The growing implementation of active roll control (ARC) systems is transforming vehicle dynamics by enhancing stability and reducing body roll during cornering and sudden maneuvers. This improves passenger comfort, vehicle safety, and overall driving experience, particularly in luxury and high-performance vehicles. In addition, ARC systems help in minimizing wear on suspension components and improving tire longevity, contributing to overall vehicle efficiency

• The rising demand for superior handling and ride quality in SUVs, sedans, and sports cars is accelerating the adoption of ARC systems. Manufacturers are integrating these systems with advanced suspension technologies to offer better stability in varying road conditions, including uneven terrains and high-speed scenarios. This trend is further reinforced by consumer expectations for smoother rides and enhanced driving confidence across diverse road networks

• The scalability and adaptability of modern ARC systems are making them suitable for integration across multiple vehicle segments. OEMs benefit from enhanced safety ratings, regulatory compliance, and consumer appeal without significant redesign costs. Furthermore, ARC systems support integration with autonomous driving and advanced driver-assistance systems (ADAS), creating a pathway for future vehicle innovations

• For instance, in 2023, several European and North American automotive brands implemented next-generation ARC systems in premium SUVs, resulting in reduced vehicle sway, improved cornering response, and increased consumer satisfaction. The adoption also contributed to higher safety scores in crash tests and improved market competitiveness for these models

• While ARC systems are advancing vehicle safety and comfort, their impact depends on continued technological innovation, cost optimization, and integration with other vehicle dynamics control systems. Manufacturers must focus on lightweight, energy-efficient, and electronically controlled solutions to fully capitalize on growing demand. Continued R&D in sensor technology and electronic controls will further enhance the effectiveness of ARC systems

Automotive Active Roll Control System (ARC) Market Dynamics

Driver

“Growing Focus on Vehicle Safety and Enhanced Driving Experience”

• Increasing emphasis on passenger safety and stricter vehicle stability regulations are pushing automakers to adopt ARC systems as a standard feature in modern vehicles. Safety-conscious consumers are demanding technologies that reduce the risk of rollovers and accidents. Enhanced safety features are also helping brands differentiate in competitive automotive markets

• The rise in high-performance and luxury vehicle production is driving the integration of ARC systems to offer superior handling, precise steering response, and reduced body tilt during sharp turns. Consumers increasingly associate advanced suspension systems with brand prestige and safety assurance. Manufacturers are leveraging ARC systems as key selling points for safety-conscious and performance-driven buyers

• Government regulations in regions such as North America and Europe are encouraging the implementation of advanced vehicle stability technologies, including ARC systems, to meet crash safety and rollover standards. These regulations often include incentives or penalties linked to vehicle safety ratings, which in turn boosts adoption among OEMs seeking compliance

• For instance, in 2022, several automotive OEMs in Germany and the U.S. included ARC systems as part of safety packages in mid-to-high-end SUVs, improving driving stability and safety ratings. The inclusion of ARC systems also strengthened consumer confidence and contributed to higher sales in safety-focused vehicle segments

• While safety regulations and consumer preference are propelling market growth, manufacturers must continue enhancing system reliability, integration with other electronic stability systems, and cost efficiency to maintain adoption. Focus on modular designs and predictive maintenance capabilities will further expand ARC adoption across vehicle segments

Restraint/Challenge

“High Cost and Complexity of Integration in Vehicles”

• The high cost of ARC systems, including hydraulic, electronic, and sensor components, limits adoption in mass-market and budget vehicles. Cost-sensitive manufacturers often prefer conventional suspension solutions over advanced ARC systems. In addition, high initial investment for R&D and calibration increases production overheads for smaller OEMs

• Integration of ARC systems with existing vehicle dynamics, braking, and suspension architecture can be technically complex, requiring advanced engineering and testing. This complexity may delay deployment and increase production costs. The need for software calibration and compatibility with multiple vehicle models further complicates system integration

• Maintenance and repair of ARC-equipped vehicles can be more expensive than standard suspension systems, reducing appeal among small and mid-size vehicle owners. Specialized service requirements, component replacement, and diagnostic equipment costs can deter aftermarket adoption and limit consumer willingness for retrofitting older models

• For instance, in 2023, several emerging automotive markets in Asia-Pacific reported slower adoption of ARC systems due to integration challenges and higher component costs in locally produced vehicles. Delays in technical training and availability of skilled personnel further constrained system rollout in these regions

• While ARC technologies continue to evolve, addressing cost, complexity, and serviceability challenges remains crucial. OEMs must focus on modular, scalable, and lightweight solutions to enhance adoption across different vehicle segments. Investment in training, simplified maintenance protocols, and cost-effective sensor solutions will also help accelerate market penetration

Automotive Active Roll Control System (ARC) Market Scope

The market is segmented on the basis of actuator type, vehicle type, and distribution channel.

• By Actuator Type

On the basis of actuator type, the automotive active roll control (ARC) system market is segmented into rotary actuator and linear actuator. The rotary actuator segment held the largest market revenue share in 2025, driven by its compact design, precise control, and compatibility with a wide range of vehicle suspension systems. Rotary actuators are widely adopted in luxury and high-performance vehicles for enhanced ride comfort and stability during cornering and sudden maneuvers.

The linear actuator segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its high force output, smooth operation, and suitability for integration with electronically controlled suspension systems. Linear actuators are increasingly preferred in SUVs, sedans, and commercial vehicles where improved vehicle handling and reduced body roll are critical for passenger safety and driving experience.

• By Vehicle Type

On the basis of vehicle type, the ARC system market is segmented into passenger vehicles, light commercial vehicles (LCV), and heavy commercial vehicles (HCV). The passenger vehicle segment held the largest market share in 2025, driven by growing consumer demand for enhanced safety, comfort, and driving performance in personal vehicles. Manufacturers are integrating ARC systems in SUVs, sedans, and sports cars to meet expectations for stability and ride quality.

The LCV segment is expected to witness the fastest growth from 2026 to 2033, fueled by the increasing need for improved stability, cargo protection, and passenger safety in delivery vans and light trucks. OEMs are focusing on lightweight, cost-effective ARC solutions suitable for commercial vehicle applications without compromising performance.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into original equipment manufacturer (OEM) and aftermarket. The OEM segment held the largest market revenue share in 2025, driven by the trend of factory-fitted ARC systems in new vehicles for better integration, safety compliance, and enhanced consumer appeal. OEM-installed systems ensure optimal performance and alignment with vehicle dynamics.

The aftermarket segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising retrofitting demand in existing vehicles to improve handling, stability, and passenger safety. Growth in the aftermarket is supported by specialized service providers, availability of modular ARC kits, and increasing awareness among vehicle owners regarding safety and performance upgrade.

Automotive Active Roll Control System (ARC) Market Regional Analysis

• North America dominated the automotive active roll control (ARC) system market with the largest revenue share of 35.20% in 2025, driven by increasing demand for vehicle safety technologies and advanced driving comfort features

• Consumers in the region highly value enhanced handling, stability, and reduced body roll offered by ARC systems, particularly in SUVs, sedans, and high-performance vehicles

• This widespread adoption is further supported by stringent vehicle safety regulations, high disposable incomes, and the growing preference for technologically advanced vehicles, establishing ARC systems as a favored solution among both OEMs and aftermarket suppliers

U.S. Automotive Active Roll Control System (ARC) Market Insight

The U.S. ARC system market captured the largest revenue share in 2025 within North America, fueled by the rapid adoption of advanced vehicle safety and stability technologies. Vehicle manufacturers are increasingly integrating ARC systems to improve handling, ride comfort, and rollover prevention. The growing preference for luxury and high-performance vehicles, combined with stringent safety standards, further propels the ARC system industry. Moreover, increasing integration with electronic stability control and suspension systems is significantly contributing to market expansion.

Europe Automotive Active Roll Control System (ARC) Market Insight

The Europe ARC system market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent vehicle safety and emission regulations and the demand for improved ride quality. The increase in premium vehicle production, coupled with rising consumer expectations for comfort and performance, is fostering the adoption of ARC systems. The region is experiencing significant growth across passenger and commercial vehicle segments, with manufacturers incorporating ARC systems into both new models and upgrades

U.K. Automotive Active Roll Control System (ARC) Market Insight

The U.K. ARC system market is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing focus on vehicle safety, handling performance, and consumer demand for high-end features. Concerns regarding road safety, particularly in urban and high-traffic areas, are encouraging automakers to adopt ARC systems in passenger vehicles and SUVs. The U.K.’s automotive innovation ecosystem, along with robust OEM and aftermarket networks, is expected to further stimulate market growth.

Germany Automotive Active Roll Control System (ARC) Market Insight

The Germany ARC system market is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising awareness of vehicle dynamics technologies and the demand for high-performance, safe, and fuel-efficient vehicles. Germany’s well-established automotive manufacturing infrastructure and emphasis on innovation promote the adoption of ARC systems across passenger and commercial vehicles. Integration with electronic stability and active suspension systems is also becoming increasingly prevalent, aligning with local safety and performance standards.

Asia-Pacific Automotive Active Roll Control System (ARC) Market Insight

The Asia-Pacific ARC system market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising vehicle production, urbanization, and increasing disposable incomes in countries such as China, Japan, and India. The region's growing automotive industry, supported by government safety regulations and increasing consumer awareness, is driving the adoption of ARC systems. Furthermore, as APAC emerges as a manufacturing hub for vehicle components, the affordability and accessibility of ARC systems are expanding to a wider range of passenger and commercial vehicles.

Japan Automotive Active Roll Control System (ARC) Market Insight

The Japan ARC system market is expected to witness significant growth from 2026 to 2033 due to the country’s focus on advanced automotive technologies, high-performance vehicle production, and demand for driving comfort. Japanese consumers prioritize safety and handling performance, encouraging automakers to integrate ARC systems in both domestic and export vehicles. Integration with electronic suspension and stability control systems is further fueling growth, while the aging population drives demand for vehicles offering improved ride stability and comfort.

China Automotive Active Roll Control System (ARC) Market Insight

The China ARC system market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid vehicle production, expanding middle-class demand, and strong automotive manufacturing capabilities. China stands as one of the largest markets for passenger and commercial vehicles, and ARC systems are increasingly being adopted in SUVs, sedans, and premium vehicles. Government safety regulations, rising urban traffic density, and the push towards technologically advanced vehicles are key factors propelling the market in China.

Automotive Active Roll Control System (ARC) Market Share

The Automotive Active Roll Control System (ARC) industry is primarily led by well-established companies, including:

- Schaeffler Group (Germany)

- Robert Bosch GmbH (Germany)

- BWI Group (China)

- Continental AG (Germany)

- Ford Motor Company (U.S.)

- WABCO Vehicle Control Systems (U.S.)

- Volvo Car Corporation (Sweden)

- Volkswagen (Germany)

- Mercedes-Benz AG (Germany)

- Dr. Ing. h.c. F. Porsche AG (Germany)

- BMW AG (Germany)

- Hitachi Automotive Systems, Ltd (Japan)

Latest Developments in Global Automotive Active Roll Control System (ARC) Market

- In August 2025, Bosch (DE) introduced a new ARC system equipped with advanced sensor integration, designed to enhance vehicle stability, responsiveness, and overall handling. This development strengthens Bosch’s leadership in automotive safety technologies and supports its commitment to delivering superior driving experiences. The upgraded system is expected to raise industry standards, prompting other manufacturers to accelerate innovations and intensifying competition within the ARC market

- In July 2025, Continental (DE) entered a strategic partnership with a major electric vehicle manufacturer to co-develop an ARC system specifically engineered for EV platforms. The collaboration enables Continental to align its solutions with the rising demand for electric mobility, offering improved stability and safety tailored to EV dynamics. This move positions the company to capitalize on the rapidly growing EV segment and strengthens its market presence

- In September 2025, ZF Friedrichshafen (DE) completed the acquisition of an AI-focused vehicle dynamics startup, aiming to integrate artificial intelligence into its ARC technologies. The addition of AI capabilities allows ZF to enhance system adaptability, predictive control, and real-time responsiveness across diverse driving conditions. This strategic acquisition is expected to give ZF a competitive technological edge while supporting the broader industry transition toward intelligent and autonomous driving systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.