Global Automotive Active Suspension System Market

Market Size in USD Billion

CAGR :

%

USD

43.07 Billion

USD

55.85 Billion

2024

2032

USD

43.07 Billion

USD

55.85 Billion

2024

2032

| 2025 –2032 | |

| USD 43.07 Billion | |

| USD 55.85 Billion | |

|

|

|

|

Automotive Active Suspension System Market Size

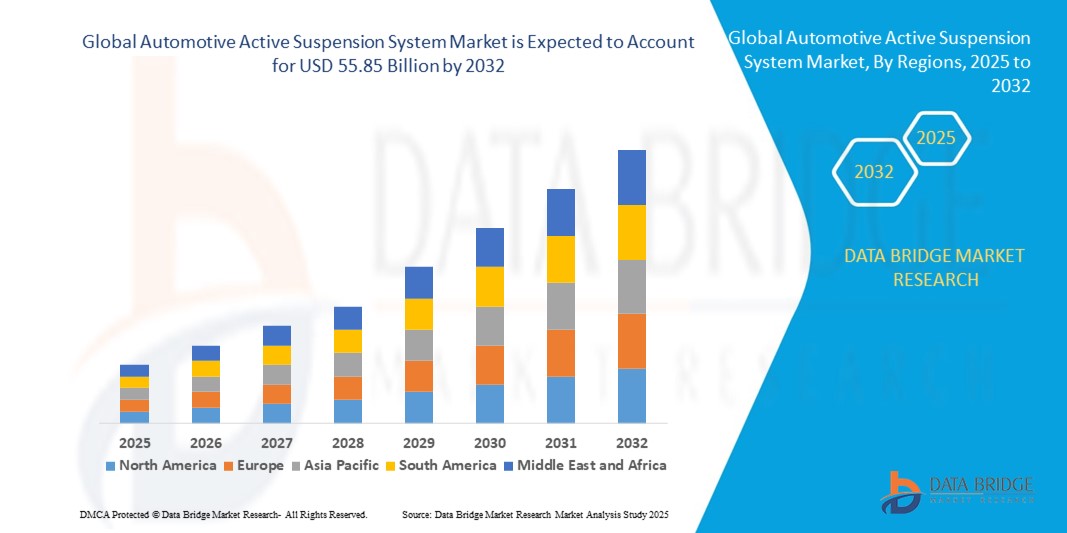

- The global automotive active suspension system market size was valued at USD 43.07 billion in 2024 and is expected to reach USD 55.85 billion by 2032, at a CAGR of 3.3% during the forecast period

- The market growth is largely driven by the increasing integration of advanced suspension technologies in vehicles to enhance ride comfort, handling precision, and overall driving dynamics across both luxury and mass-market segments

- Furthermore, rising demand for electric and hybrid vehicles, which require lighter and more responsive suspension systems, is accelerating the adoption of semi-active and active suspension solutions. The push for vehicle safety, emission efficiency, and smoother driving experiences is further propelling market expansion

Automotive Active Suspension System Market Analysis

- Automotive active suspension systems use sensors, actuators, and electronic control units to adjust the suspension in real time, improving vehicle stability, ride quality, and traction based on changing road conditions

- The growing focus on intelligent mobility solutions, combined with rising expectations for comfort and performance, is fueling demand across passenger cars, SUVs, and high-performance vehicles. These systems are increasingly integrated into electric and premium models, reflecting a shift toward smarter, software-driven vehicle dynamics

- North America dominated the automotive active suspension system market with a share of 35.5% in 2024, due to the strong presence of premium vehicle manufacturers and increasing demand for advanced ride control technologies

- Asia-Pacific is expected to be the fastest growing region in the automotive active suspension system market during the forecast period due to rapid urbanization, expanding automotive production, and rising income levels across countries such as China, Japan, and India

- Passenger vehicles segment dominated the market with a market share of 52.8% in 2024, due to high production volumes, increasing consumer demand for ride comfort, and rising integration of semi-active systems in mid- to high-end vehicles. As urbanization and disposable income levels rise, consumers are prioritizing smoother, more controlled driving experiences, which supports steady adoption across this segment

Report Scope and Automotive Active Suspension System Market Segmentation

|

Attributes |

Automotive Active Suspension System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Automotive Active Suspension System Market Trends

Rising Number of Connected Vehicles

- The market for automotive active suspension systems is growing significantly due to the increasing number of connected vehicles equipped with advanced sensors and communication technologies, enabling real-time adjustment of suspension settings for enhanced ride comfort and safety

- For instance, major suppliers such as Continental and ZF are integrating active suspension systems with vehicle-to-everything (V2X) communication platforms, allowing the suspension to anticipate road conditions and traffic inputs for smoother handling and improved safety

- Advances in sensor technology and control algorithms allow active suspensions to dynamically adapt damping forces based on road profiles and driving behavior, improving vehicle stability and passenger comfort

- The rising adoption of electric and autonomous vehicles drives demand for sophisticated suspension solutions that optimize battery weight distribution and maintain ride quality under varying operational scenarios

- Integration with advanced driver-assistance systems (ADAS) such as adaptive cruise control and lane keeping increases the functional synergy between suspension and other safety systems, fostering a holistic vehicle control approach

- Expanding presence of connected vehicle infrastructure in key regions such as North America, Europe, and Asia-Pacific supports growth by enabling more sophisticated active suspension functionalities linked to cloud and edge data analytics

Automotive Active Suspension System Market Dynamics

Driver

Rise in Adoption of ADAS Features in Automobiles

- The growing adoption of advanced driver-assistance systems (ADAS) significantly drives the active suspension system market by requiring adaptable suspension solutions that enhance vehicle stability, safety, and passenger comfort in complex driving environments

- For instance, Tenneco has collaborated with automotive OEMs to supply electro-hydraulic active suspension systems compatible with ADAS technologies such as automated emergency braking and adaptive steering, improving overall vehicle responsiveness

- Increasing consumer demand for enhanced driving dynamics, coupled with government safety regulations, fuels investments toward active suspension systems that integrate with ADAS for predictive control and accident avoidance

- The trend toward electrification of vehicles raises demand for active suspensions that manage the added battery pack weight and improve energy efficiency by optimizing vehicle dynamics

- Expanding use of connected car technologies and sensor fusion enables real-time performance monitoring and remote diagnostics of active suspension systems, encouraging OEMs to adopt these advanced solutions

Restraint/Challenge

Lack of Connectivity Infrastructures

- Insufficient connectivity infrastructure, particularly in emerging and rural markets, limits the effectiveness and adoption of connected active suspension systems which rely on real-time data from vehicle-to-infrastructure (V2I) and vehicle-to-cloud communications

- For instance, despite innovations by Hitachi Automotive Systems in network-enabled active suspensions, their full capabilities remain underutilized in regions with poor connectivity such as parts of Southeast Asia and Africa

- High implementation complexity and the need for robust, low-latency communication networks pose challenges to integrating suspension systems with broader connected vehicle ecosystems

- Infrastructure gaps delay standardization of communication protocols and data-sharing frameworks essential for integrating active suspensions with ADAS and autonomous driving technologies

- Security vulnerabilities and latency issues in connectivity networks raise concerns over system reliability and consumer trust, impacting willingness to fully embrace connected active suspension solutions

Automotive Active Suspension System Market Scope

The market is segmented on the basis of system, component, suspension type, and vehicle type.

- By System

On the basis of system, the automotive active suspension system market is segmented into passive, active, and semi-active. The passive segment accounted for the largest revenue share in 2024 due to its widespread use across low-cost and mid-range vehicles and its minimal maintenance requirements. Passive systems are mechanically simple, cost-effective, and durable, making them a staple in conventional automotive suspensions. Their reliability and well-established manufacturing infrastructure continue to drive their market dominance across emerging and price-sensitive markets.

The active segment is expected to witness the fastest growth rate from 2025 to 2032 owing to its superior ride quality, dynamic response to road conditions, and increasing integration in premium and electric vehicles. Active systems utilize sensors and actuators to adapt suspension stiffness in real-time, enhancing safety, comfort, and vehicle handling. Growing demand for advanced driver assistance systems (ADAS) and luxury driving experiences is accelerating adoption in both personal and fleet-based mobility segments.

- By Component

On the basis of component, the market is segmented into shock dampener, leaf spring, struts, control arm, spring, ball joint, air compressor, and others. The shock dampener segment held the largest share in 2024, attributed to its central role in energy dissipation and ride comfort across nearly all vehicle classes. Shock dampeners are critical for controlling rebound and compression, helping maintain tire-road contact and reducing vibrations. Their integration in both conventional and semi-active suspension systems ensures consistent demand across OEM and aftermarket applications.

The air compressor segment is projected to grow at the fastest rate from 2025 to 2032 due to rising adoption of air suspension systems in high-end SUVs, luxury vehicles, and electric vehicles. Air compressors enable real-time suspension height adjustment and load balancing, which enhances driving comfort and stability. Increasing consumer preference for customizable ride quality and the expanding market for performance-oriented vehicles support segment growth.

- By Suspension Type

On the basis of suspension type, the market is segmented into hydraulic suspension, air suspension, and leaf spring. The leaf spring segment dominated the market in 2024, largely driven by its extensive use in commercial and heavy-duty vehicles due to its durability, load-bearing capacity, and low cost. Leaf springs are robust and simple, making them ideal for vehicles that operate in harsh environments or transport heavy loads. Their long-established manufacturing base further solidifies their position in utility and transport applications.

The air suspension segment is expected to register the highest growth rate during the forecast period, supported by growing adoption in premium vehicles and electric models. Air suspension systems offer adjustable ride height, smoother handling, and enhanced passenger comfort, which appeals to luxury car buyers and long-distance transport operators. OEMs are increasingly integrating air suspensions to meet customer demand for adaptive ride experiences and to complement EV performance characteristics.

- By Vehicle Type

On the basis of vehicle type, the market is categorized into two wheelers, passenger vehicles, commercial vehicles, and others. The passenger vehicles segment accounted for the largest revenue share of 52.8% in 2024, fueled by high production volumes, increasing consumer demand for ride comfort, and rising integration of semi-active systems in mid- to high-end vehicles. As urbanization and disposable income levels rise, consumers are prioritizing smoother, more controlled driving experiences, which supports steady adoption across this segment.

The commercial vehicles segment is poised to grow at the fastest CAGR from 2025 to 2032 due to the need for robust suspension solutions that ensure stability, cargo protection, and driver comfort over long hauls. Fleet operators are increasingly investing in active and semi-active systems to reduce vehicle wear, enhance operational safety, and meet regulatory standards. The rapid expansion of logistics and transportation industries globally further boosts the demand for advanced suspension systems in this category.

Automotive Active Suspension System Market Regional Analysis

- North America dominated the automotive active suspension system market with the largest revenue share of 35.5% in 2024, driven by the strong presence of premium vehicle manufacturers and increasing demand for advanced ride control technologies

- The region benefits from early adoption of vehicle innovation, a strong aftermarket for suspension upgrades, and high consumer preference for comfort and handling in passenger vehicles

- Demand is further fueled by the proliferation of SUVs and luxury cars, along with favorable government policies supporting vehicle safety and emission reduction technologies

U.S. Automotive Active Suspension System Market Insight

The U.S. automotive active suspension system market accounted for largest share of North America in 2024, reflecting a strong presence of leading automakers and robust R&D infrastructure. The growing penetration of electric and luxury vehicles has led to increased integration of advanced suspension technologies to improve ride dynamics and passenger comfort. U.S. consumers are particularly focused on performance, which is driving OEMs to include active and semi-active suspension as standard or optional features. In addition, the aftermarket segment is also seeing demand for performance upgrades, enhancing overall system adoption. Rising awareness of road safety and comfort is expected to further propel market growth in the coming years.

Europe Automotive Active Suspension System Market Insight

The Europe automotive active suspension system market is projected to register steady growth over the forecast period, supported by the region’s focus on automotive innovation and regulatory emphasis on safety and sustainability. With a strong concentration of luxury and performance vehicle manufacturers in countries such as Germany, France, and Italy, the market benefits from continuous advancements in vehicle dynamics and chassis technologies. European consumers demand comfort and also energy efficiency and driving stability, which is encouraging wider adoption of electronically controlled suspension systems. The transition toward electric mobility is also expected to drive the integration of active suspensions into a broader range of vehicle models.

Germany Automotive Active Suspension System Market Insight

Germany leads the European market for active suspension systems, owing to its position as a global automotive innovation hub. With some of the world’s most prestigious automotive brands headquartered in the country, there is a consistent demand for next-generation ride control technologies that deliver optimal comfort and high performance. German OEMs are heavily investing in intelligent suspension systems that integrate seamlessly with ADAS and EV platforms. The market is also supported by strong government incentives for research and sustainability, further enabling the advancement and deployment of smart suspension systems. High consumer expectations for precision engineering and ride quality continue to shape the market trajectory in Germany.

Asia-Pacific Automotive Active Suspension System Market Insight

The Asia-Pacific region is expected to witness the fastest CAGR from 2025 to 2032, driven by rapid urbanization, expanding automotive production, and rising income levels across countries such as China, Japan, and India. The surge in demand for passenger vehicles, especially mid-range and premium models, is fueling the adoption of semi-active and active suspension systems. As the region becomes a key manufacturing and export hub for automotive components, OEMs are leveraging cost advantages to integrate advanced technologies in a broader vehicle range. Government initiatives promoting EVs and vehicle safety are also accelerating the adoption of electronically controlled suspension systems in the region.

China Automotive Active Suspension System Market Insight

China held the largest market revenue share in Asia-Pacific in 2024, propelled by its position as the world’s largest automotive market and a growing emphasis on vehicle comfort and technology. The country's expanding middle class and increasing preference for premium and electric vehicles are encouraging OEMs to offer intelligent suspension systems even in mid-segment models. Local manufacturers are investing heavily in R&D to meet evolving consumer expectations, while government policies supporting smart mobility and safety innovation are driving product adoption. China's fast-paced urban development and strong EV infrastructure also enhance the market landscape for active suspension systems.

Japan Automotive Active Suspension System Market Insight

Japan is emerging as a key market for active suspension systems in Asia-Pacific, backed by its technologically advanced automotive ecosystem and emphasis on innovation. Japanese automakers are integrating intelligent ride control systems in both traditional and electric vehicles to meet rising consumer expectations for safety, comfort, and adaptive performance. With a high level of urbanization and demand for smooth driving in dense traffic environments, active suspension systems are gaining favor. In additionally, Japan’s aging population is influencing demand for vehicles that offer minimal vibration and improved stability, especially in passenger and mobility-assist vehicles, further reinforcing market growth.

Automotive Active Suspension System Market Share

The automotive active suspension system industry is primarily led by well-established companies, including:

- ThyssenKrupp AG (Germany)

- Fox Factory Inc. (U.S.)

- Gabriel India Limited (India)

- Hendrickson L.L.C. (U.S.)

- KYB Corporation (Japan)

- ZF Friedrichshafen AG (Germany)

- Tenneco Inc. (U.S.)

- Continental AG (Germany)

- NHK Springs Co., Ltd. (Japan)

- Benteler International AG (Germany)

- HL Mando Corp. (South Korea)

- Sogefi Group (Italy)

- Marelli Corporation (Japan)

Latest Developments in Global Automotive Active Suspension System Market

- In November 2023, Porsche launched the updated Panamera featuring a new hybrid V8 engine combined with an advanced active suspension system. This development strengthens Porsche's position in the performance luxury segment by offering enhanced power and fuel efficiency without compromising driving comfort. The inclusion of active suspension underlines the growing trend of integrating intelligent chassis systems in high-performance hybrid vehicles, setting a benchmark for competitors in the premium automotive sector

- In June 2023, ClearMotion, a San Francisco-based tech firm, committed USD 32 million towards the development of its next-generation active chassis systems. This move positions ClearMotion as a disruptive player in the suspension technology landscape by replacing traditional shock absorbers with software-driven, high-speed actuators capable of real-time wheel adjustments. The company also secured a substantial order from a major EV manufacturer, indicating strong market validation and paving the way for the commercial rollout of its ClearMotion1 system within a year, especially in the EV segment where comfort and control are key differentiators

- In December 2022, FleetPride announced the acquisition of Keystone Spring Service, a specialized provider of suspension, wheel-end, driveline, and hydraulic services. With operations based in Pittsburgh and Portersville, this acquisition expands FleetPride’s capabilities and service footprint in the heavy-duty truck and aftermarket suspension domain. It reinforces FleetPride’s strategic focus on strengthening its position in the commercial vehicle maintenance and repair ecosystem

- In December 2022, MagnaFlow Group acquired Camburg Engineering, a recognized name in off-road and aftermarket suspension components. Known for designing race-tested parts, Camburg’s integration into MagnaFlow’s portfolio enhances the latter’s presence in the performance and motorsports suspension market. This move is set to boost MagnaFlow’s competitive edge in high-performance applications and diversify its offerings across off-road and enthusiast-driven segments

- In October 2021, Continental AG expanded its active suspension product portfolio and conducted collaborative workshops with multiple suppliers and vehicle manufacturers. This strategic initiative aimed to promote its latest offerings and strengthen its market influence through industry partnerships. The expansion of its product line reflects Continental’s commitment to innovation and its proactive approach to engaging stakeholders

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Automotive Active Suspension System Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automotive Active Suspension System Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automotive Active Suspension System Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.