Global Automotive Ai Market

Market Size in USD Billion

CAGR :

%

USD

19.33 Billion

USD

89.73 Billion

2025

2033

USD

19.33 Billion

USD

89.73 Billion

2025

2033

| 2026 –2033 | |

| USD 19.33 Billion | |

| USD 89.73 Billion | |

|

|

|

|

Automotive AI Market Size

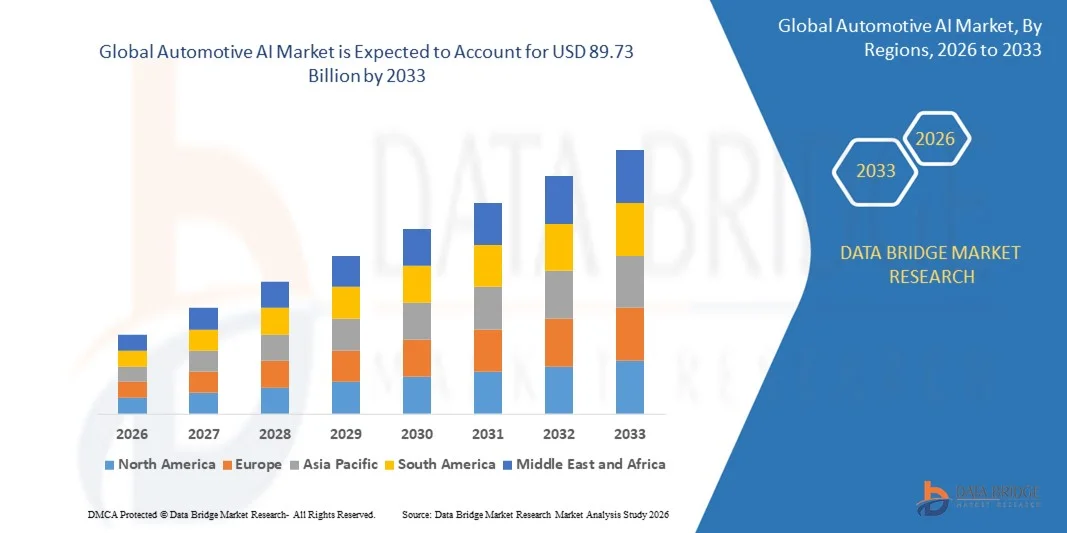

- The global automotive AI market size was valued at USD 19.33 billion in 2025 and is expected to reach USD 89.73 billion by 2033, at a CAGR of 21.15% during the forecast period

- The market growth is largely fueled by the increasing adoption of connected and autonomous vehicle technologies, supported by rapid advancements in artificial intelligence, machine learning, and sensor integration, which are driving digital transformation across passenger and commercial vehicles

- Furthermore, rising demand for enhanced vehicle safety, real-time decision-making, and intelligent in-vehicle experiences is positioning Automotive AI as a core enabler of next-generation mobility, with these converging factors significantly accelerating market expansion

Automotive AI Market Analysis

- Automotive AI, enabling intelligent perception, decision-making, and automation in vehicles, has become a critical component of modern mobility systems, supporting applications such as advanced driver assistance, autonomous driving, predictive maintenance, and smart infotainment across diverse vehicle categories

- The growing demand for Automotive AI is primarily driven by stricter safety regulations, increasing investments by automakers in autonomous technologies, and strong consumer preference for connected, efficient, and technology-driven driving experiences

- North America dominated the automotive AI market with a share of 35.5% in 2025, due to high adoption of connected vehicles, increasing investments in autonomous driving technologies, and a strong presence of leading automotive and AI technology companies

- Asia-Pacific is expected to be the fastest growing region in the automotive AI market during the forecast period due to rising urbanization, technological adoption, and government support for autonomous mobility in countries such as China, Japan, and India

- Hardware segment dominated the market with a market share of 75.5% in 2025, due to the increasing adoption of advanced sensors, cameras, LiDAR, and computing units essential for autonomous driving systems. Hardware forms the backbone of AI-enabled vehicles, ensuring real-time processing, accurate object detection, and reliable decision-making on the road

Report Scope and Automotive AI Market Segmentation

|

Attributes |

Automotive AI Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive AI Market Trends

Integration of AI-Driven Autonomous and Connected Vehicle Technologies

- A major trend in the Automotive AI market is the deep integration of artificial intelligence into autonomous and connected vehicle platforms, driven by the automotive industry’s transition toward software-defined and data-driven mobility solutions. AI technologies are increasingly embedded into vehicle architectures to support real-time perception, decision-making, and continuous learning, enhancing both driving automation and connectivity features

- For instance, Tesla Inc. integrates AI-driven neural networks across its Autopilot and Full Self-Driving systems to enable lane detection, traffic recognition, and adaptive driving behavior using real-world vehicle data. This approach highlights how AI is becoming central to vehicle intelligence and continuous performance improvement

- The adoption of AI in connected vehicles is expanding as automakers leverage cloud connectivity and edge computing to process large volumes of sensor and driver data. This trend enables features such as predictive maintenance, over-the-air software updates, and personalized in-vehicle experiences

- Autonomous vehicle developers are increasingly relying on AI-powered perception systems that combine computer vision, sensor fusion, and deep learning to interpret complex road environments. These capabilities are strengthening the reliability of autonomous navigation and accelerating the development of higher autonomy levels

- AI integration is also reshaping vehicle-to-everything communication by enabling intelligent interaction between vehicles, infrastructure, and mobility platforms. This is supporting the development of smart transportation ecosystems that improve traffic efficiency and road safety

- The growing emphasis on connected and autonomous mobility is reinforcing AI as a foundational technology within modern vehicles. This trend is positioning Automotive AI as a critical enabler of long-term innovation across passenger and commercial vehicle segments

Automotive AI Market Dynamics

Driver

Rising Demand for Advanced Driver Assistance and Vehicle Safety Systems

- The rising focus on vehicle safety and accident prevention is a key driver for the Automotive AI market, as automakers increasingly deploy AI-based driver assistance systems to enhance road safety and compliance with regulatory standards. AI enables real-time monitoring, hazard detection, and automated responses that reduce driver workload and human error

- For instance, Robert Bosch GmbH supplies AI-enabled ADAS solutions such as automatic emergency braking, lane-keeping assistance, and adaptive cruise control, which are widely adopted by global automotive manufacturers. These systems demonstrate how AI directly contributes to improved vehicle safety performance

- Governments and regulatory bodies worldwide are mandating advanced safety features in new vehicles, encouraging OEMs to integrate AI-driven assistance technologies as standard offerings. This regulatory push is accelerating the adoption of AI across mass-market and premium vehicles

- Fleet operators and commercial vehicle users are also adopting AI-based safety systems to reduce accidents, minimize downtime, and lower insurance costs. This broad-based demand across vehicle categories is strengthening the role of AI as a core safety enabler

- The sustained emphasis on reducing road fatalities and improving driving safety continues to reinforce this driver. As safety expectations rise, Automotive AI adoption is expanding steadily across global markets

Restraint/Challenge

High Development Costs and Complexity of Automotive AI Integration

- The Automotive AI market faces significant challenges due to the high costs and technical complexity associated with developing and integrating AI systems into vehicles. Building reliable AI models requires extensive data collection, high-performance computing infrastructure, and rigorous testing to meet automotive safety standards

- For instance, Waymo LLC invests heavily in AI training, simulation, and validation to ensure the safety and reliability of its autonomous driving systems. These extensive development efforts highlight the substantial financial and technical resources required to deploy Automotive AI at scale

- Integrating AI into vehicles involves complex coordination between hardware, software, sensors, and vehicle control systems. This increases development timelines and creates challenges in achieving seamless system interoperability

- Automotive AI systems must comply with strict functional safety and cybersecurity requirements, adding further layers of complexity to design and validation processes. Ensuring reliability under diverse driving conditions remains a major hurdle for manufacturers

- These challenges collectively restrain rapid market expansion by increasing barriers to entry and slowing deployment cycles. Overcoming cost and integration complexities remains a critical focus area for sustained growth in the Automotive AI market

Automotive AI Market Scope

The market is segmented on the basis of component, level of autonomy, technology, and vehicle type.

- By Component

On the basis of component, the Automotive AI market is segmented into hardware and software. The hardware segment dominated the market with the largest revenue share of 75.5% in 2025, driven by the increasing adoption of advanced sensors, cameras, LiDAR, and computing units essential for autonomous driving systems. Hardware forms the backbone of AI-enabled vehicles, ensuring real-time processing, accurate object detection, and reliable decision-making on the road. Automotive manufacturers prioritize robust and durable hardware to meet stringent safety standards and support integration with multiple AI technologies. The growth is further supported by partnerships between automakers and semiconductor companies to develop specialized automotive-grade chips.

The software segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by the rising demand for advanced AI algorithms, predictive analytics, and vehicle control systems. Software enables machine learning models, computer vision, and context-aware computing to operate seamlessly within vehicles, offering features such as adaptive cruise control, collision avoidance, and driver monitoring. Increasing investments in over-the-air software updates and AI-driven mobility services further drive adoption. The flexibility to upgrade functionalities and integrate with connected vehicle ecosystems makes software a critical growth area.

- By Level of Autonomy

On the basis of level of autonomy, the Automotive AI market is segmented into Level 1, Level 2, Level 3, and Level 4. The Level 2 segment dominated the market with the largest revenue share in 2025, supported by its widespread adoption in passenger vehicles for semi-automated driving features such as lane-keeping, adaptive cruise control, and automated parking. Level 2 systems balance safety, convenience, and cost, making them attractive to both OEMs and consumers transitioning from traditional vehicles to partially autonomous systems. Regulatory acceptance and consumer familiarity with assisted driving technologies further support market dominance.

Level 3 is expected to witness the fastest growth from 2026 to 2033, driven by advancements in AI perception, sensor fusion, and real-time decision-making capabilities. For instance, companies such as Waymo are testing Level 3 systems for urban mobility, allowing vehicles to handle certain driving tasks without human intervention under defined conditions. Increasing investments in autonomous fleets and regulatory progress in key markets contribute to rapid adoption of Level 3 systems.

- By Technology

On the basis of technology, the Automotive AI market is segmented into machine learning, natural language processing, computer vision, context-aware computing, and others. The computer vision segment dominated the market with the largest revenue share in 2025, driven by its critical role in real-time object detection, lane tracking, pedestrian recognition, and traffic sign interpretation. Automotive OEMs integrate advanced cameras and vision algorithms to enhance safety and support higher levels of autonomy. The technology’s ability to operate in diverse lighting and weather conditions makes it indispensable for autonomous navigation and ADAS applications.

Machine learning is expected to witness the fastest CAGR from 2026 to 2033, fueled by the growing demand for predictive analytics, adaptive driving models, and personalized in-vehicle experiences. For instance, Tesla leverages machine learning to continuously improve autopilot capabilities based on real-world driving data. Increasing investments in AI model training, simulation environments, and fleet learning further drive software adoption in AI-powered vehicles.

- By Vehicle Type

On the basis of vehicle type, the Automotive AI market is segmented into passenger vehicles and commercial vehicles. Passenger vehicles dominated the market with the largest revenue share in 2025, driven by the high adoption of AI-based driver assistance systems and connected car technologies in private transportation. OEMs focus on integrating semi- and fully autonomous features in passenger cars to meet rising consumer demand for convenience, safety, and enhanced driving experiences. Government incentives and smart city initiatives supporting connected mobility also bolster market penetration.

Commercial vehicles are expected to witness the fastest growth from 2026 to 2033, driven by the increasing deployment of AI solutions for logistics, fleet management, and last-mile delivery. For instance, Daimler Truck is investing in autonomous truck pilots and AI-driven telematics to optimize operations and reduce operational costs. The growing need for fuel efficiency, route optimization, and safety in long-haul and urban delivery vehicles further supports rapid adoption in the commercial segment.

Automotive AI Market Regional Analysis

- North America dominated the automotive AI market with the largest revenue share of 35.5% in 2025, driven by high adoption of connected vehicles, increasing investments in autonomous driving technologies, and a strong presence of leading automotive and AI technology companies

- Consumers in the region prioritize enhanced safety, driver assistance features, and in-vehicle convenience, encouraging widespread adoption of AI-enabled systems across passenger and commercial vehicles

- This growth is further supported by advanced automotive infrastructure, high disposable incomes, and favorable government initiatives promoting intelligent transportation systems, establishing North America as a key market for Automotive AI solutions

U.S. Automotive AI Market Insight

The U.S. Automotive AI market captured the largest revenue share in 2025 within North America, fueled by rapid adoption of AI-based driver assistance systems and autonomous vehicle technologies. Automakers are increasingly integrating AI for predictive maintenance, navigation, and safety features. The growing preference for connected car ecosystems, mobile applications, and real-time vehicle analytics further propels market expansion. Moreover, the U.S. market benefits from strong R&D investments and collaborations between technology firms and OEMs, supporting advancements in autonomous driving and AI-enabled fleet management.

Europe Automotive AI Market Insight

The Europe Automotive AI market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent safety and emissions regulations and growing demand for autonomous and semi-autonomous vehicles. Urbanization, government incentives, and consumer interest in connected cars are fostering adoption of AI technologies. European OEMs are increasingly leveraging AI for driver assistance, predictive analytics, and traffic management. The market is witnessing strong growth in Germany, France, and Italy across passenger and commercial vehicle applications.

U.K. Automotive AI Market Insight

The U.K. Automotive AI market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing adoption of connected vehicles and autonomous driving trials. Concerns over road safety, urban traffic management, and emission reduction are encouraging the integration of AI in vehicles. The U.K.’s focus on smart mobility, coupled with supportive regulatory frameworks and investments in AI R&D, is expected to continue stimulating market growth.

Germany Automotive AI Market Insight

The Germany Automotive AI market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s strong automotive manufacturing base and technological innovation. German consumers and fleet operators increasingly demand AI-enabled safety, navigation, and efficiency features in vehicles. Integration of AI with connected infrastructure and smart transportation initiatives is promoting widespread adoption, with emphasis on sustainability, reliability, and high-performance autonomous systems.

Asia-Pacific Automotive AI Market Insight

The Asia-Pacific Automotive AI market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising urbanization, technological adoption, and government support for autonomous mobility in countries such as China, Japan, and India. Growing consumer awareness, increasing investments by domestic and global automakers, and the emergence of smart city projects are driving AI adoption in both passenger and commercial vehicles. The region also benefits from a strong automotive manufacturing ecosystem, enabling cost-effective deployment of AI solutions and accelerating market penetration.

Japan Automotive AI Market Insight

The Japan Automotive AI market is gaining momentum due to the country’s advanced automotive technology ecosystem, rapid urbanization, and focus on autonomous driving innovation. Japanese consumers value safety, convenience, and smart mobility solutions, driving adoption of AI-enabled vehicles. Integration with connected infrastructure, in-vehicle AI assistants, and predictive maintenance systems is fueling growth, while the aging population encourages demand for easy-to-use autonomous vehicle features.

China Automotive AI Market Insight

The China Automotive AI market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to rapid urbanization, expanding middle-class population, and high technological adoption in vehicles. China is a leading market for connected cars and autonomous vehicle trials, and AI-enabled systems are increasingly adopted in passenger, commercial, and fleet vehicles. Government initiatives for smart cities, supportive regulations, and strong domestic automotive AI technology companies are key factors driving market expansion.

Automotive AI Market Share

The automotive AI industry is primarily led by well-established companies, including:

- BMW AG (Germany)

- Huawei Technologies Co. (China)

- Magna International Inc. (Canada)

- Qualcomm Incorporated (U.S.)

- Hyundai Mobis Co. Ltd. (South Korea)

- Intel Corporation / Mobileye (U.S.)

- Mercedes-Benz Group AG (Germany)

- Horizon Robotics Inc. (China)

- Amazon Web Services Inc. (U.S.)

- Continental AG (Germany)

- Toyota Motor Corporation (Japan)

- Aptiv PLC (Ireland)

- Microsoft Corporation (U.S.)

- ZF Friedrichshafen AG (Germany)

- Tesla Inc. (U.S.)

- Uber Technologies Inc. (U.S.)

- Hyundai Motor Company (South Korea)

- Robert Bosch GmbH (Germany)

- NVIDIA Corporation (U.S.)

- Waymo LLC (U.S.)

Latest Developments in Global Automotive AI Market

- In June 2025, Helm.ai, backed by Honda, introduced a new vision system for autonomous vehicles, significantly strengthening perception capabilities in Automotive AI solutions. This development highlights the growing importance of camera-based AI perception systems in enabling safer and more scalable autonomous driving. The collaboration reflects a broader market trend where OEMs increasingly partner with specialized AI startups to accelerate innovation while reducing development timelines and costs

- In April 2025, BMW announced the integration of DeepSeek AI into its future vehicles for the China market, emphasizing the rising demand for localized, AI-driven intelligent cabin experiences. This move demonstrates how automakers are tailoring Automotive AI solutions to regional consumer preferences, particularly in voice interaction, personalization, and infotainment. The development reinforces the strategic role of AI in enhancing in-vehicle user experience and strengthening competitiveness in high-growth markets

- In August 2024, Intel Corporation launched its first discrete GPU, Intel Arc Graphics, specifically designed for the automotive industry, marking a major advancement in AI computing capabilities for software-defined vehicles. By integrating automotive-grade GPUs into its AI-focused SoC portfolio, Intel enabled automakers to deliver high-fidelity graphics, advanced visualization, and next-generation in-vehicle experiences. This launch supports the growing market demand for scalable, open, and high-performance AI platforms in connected and autonomous vehicles

- In June 2024, MORAI Inc. partnered with Automotive Artificial Intelligence (AAI) GmbH to enhance autonomous vehicle development through advanced simulation and AI software integration. This collaboration accelerates the testing and validation of autonomous driving systems, reducing development risks and time to market. The partnership reflects the increasing reliance on simulation-driven AI tools to improve safety, efficiency, and scalability in the Automotive AI ecosystem

- In March 2024, Arm Limited introduced Armv9-based automotive technologies, including new Arm Automotive Enhanced processors, strengthening AI, security, and virtualization capabilities for next-generation vehicles. These server-class processors enable higher-performance AI workloads while meeting automotive reliability standards. The launch supports the market’s shift toward centralized computing architectures and reinforces Arm’s role in powering AI-driven automotive applications across autonomous and connected vehicle platforms

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.