Global Automotive Aluminum Alloy Oe Market

Market Size in USD Billion

CAGR :

%

USD

7.91 Billion

USD

10.66 Billion

2025

2033

USD

7.91 Billion

USD

10.66 Billion

2025

2033

| 2026 –2033 | |

| USD 7.91 Billion | |

| USD 10.66 Billion | |

|

|

|

|

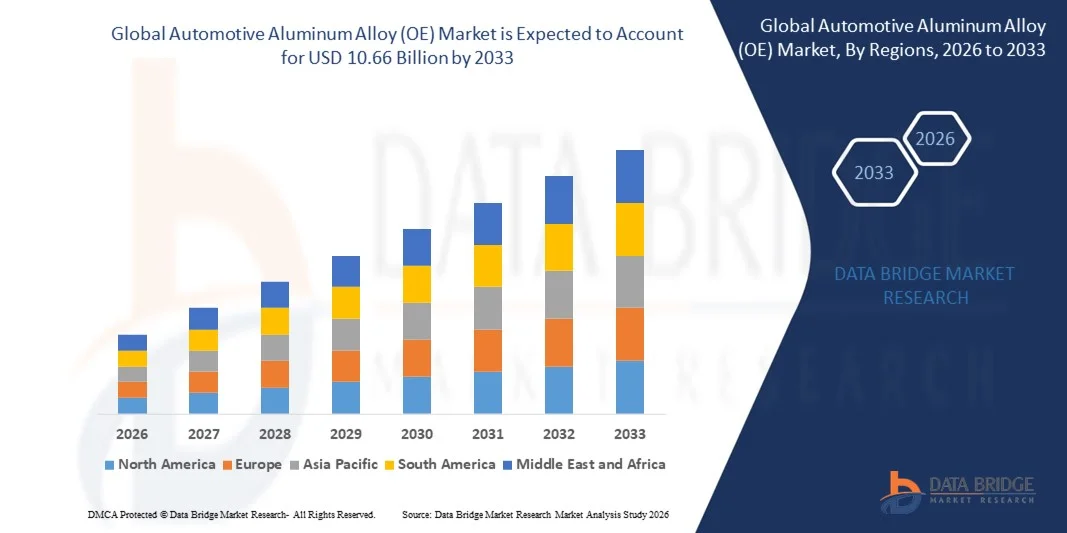

What is the Global Automotive Aluminum Alloy (OE) Market Size and Growth Rate?

- The global automotive aluminum alloy (OE) market size was valued at USD 7.91 billion in 2025 and is expected to reach USD 10.66 billion by 2033, at a CAGR of3.80% during the forecast period

- The developments and advancements in the transportation sector, high utilization of aluminum in vehicle manufacturing application and technological advancements in aluminum manufacturing technologies and processing equipment are the major factors driving the automotive aluminum alloy (OE) market

- The high adoption of aluminum alloy because of its ability reducing the load on the vehicle, the limited power is required by the engine to drive the vehicle and the increasing need for fuel efficiency across the globe accelerate the automotive aluminum alloy (OE) market growth

What are the Major Takeaways of Automotive Aluminum Alloy (OE) Market?

- The increasing production of lightweight vehicles with aluminum alloys by automobile manufacturers, the reduction in vehicle’s weight enables OEMs to reduce emissions, improve fuel efficiency and driving dynamics for the end users and growing pollution globally influence the automotive aluminum alloy (OE) market

- In addition, changing regulatory requirements, rapid urbanization, rise in the disposable income of people and rising demand for fuel-efficient vehicles positively affect the automotive aluminum alloy (OE) market. Furthermore, technological advancement in the application extends profitable opportunities to the automotive aluminum alloy (OE) market players

- Asia-Pacific dominated the automotive aluminum alloy (OE) market with a 42.8% revenue share in 2025, driven by massive automotive production volumes, strong EV manufacturing capabilities, and rapid expansion of lightweight vehicle programs across China, Japan, India, and South Korea

- Europe is projected to register the fastest CAGR of 11.02% from 2026 to 2033, driven by stringent CO₂ emission targets, rapid electrification, and strong focus on sustainable lightweighting across Germany, France, Italy, and the U.K.

- The Body segment dominated the market with a 34.7% share in 2025, driven by rapid adoption of lightweighting strategies in passenger cars, premium vehicles, and EVs

Report Scope and Automotive Aluminum Alloy (OE) Market Segmentation

|

Attributes |

Automotive Aluminum Alloy (OE) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Automotive Aluminum Alloy (OE) Market?

Rising Transition Toward Lightweight, High-Strength, and High-Performance Automotive Aluminum Alloys

- The automotive aluminum alloy (OE) market is experiencing a strong shift toward lightweight, corrosion-resistant, and high-strength alloys that support next-generation vehicle architectures, including EVs, hybrids, and advanced ICE platforms

- Manufacturers are developing high-formability, heat-treatable, and multi-grade aluminum alloys that enhance crash resistance, improve structural rigidity, and reduce overall vehicle mass to meet global emission and fuel-efficiency targets

- Growing demand for cost-efficient, durable, and multi-application aluminum materials is boosting their adoption in body structures, chassis components, closures, and powertrain systems across major automotive OEMs

- For instance, companies such as Novelis, Alcoa, Constellium, and Arconic have introduced upgraded alloy families with improved tensile strength, recyclability, and compatibility with modern forming and joining technologies

- Increasing need for lightweighting, energy efficiency, and improved vehicle performance is accelerating the use of high-grade aluminum alloys across all vehicle categories

- As vehicles become more electrified and safety regulations tighten, Automotive Aluminum Alloys (OE) will remain essential for next-gen vehicle design, performance optimization, and sustainability goals

What are the Key Drivers of Automotive Aluminum Alloy (OE) Market?

- Rising demand for lightweight materials to reduce vehicle weight, improve fuel economy, and meet stringent global emission norms is accelerating the use of high-grade aluminum alloys across automotive OEMs

- For instance, in 2025, companies such as Novelis, Norsk Hydro, and Constellium expanded their automotive alloy portfolios to support higher strength grades, improved recyclability, and enhanced battery enclosure solutions

- Growing adoption of EVs, hybrid vehicles, ADAS systems, and modern chassis architectures is driving large-scale use of aluminum alloys in body-in-white, closures, and structural components across the U.S., Europe, and Asia-Pacific

- Advancements in alloy processing, extrusion technology, rolling mills, and heat-treatment innovations have improved performance, durability, crashworthiness, and forming flexibility

- Rising use of battery housings, EV frames, lightweight wheels, and structural components is creating strong demand for high-strength aluminum alloys with better thermal and electrical properties

- Supported by continuous investments in automotive R&D, sustainability programs, and lightweight materials innovation, the Automotive Aluminum Alloy (OE) market is expected to witness robust long-term growth

Which Factor is Challenging the Growth of the Automotive Aluminum Alloy (OE) Market?

- High production costs associated with premium automotive-grade aluminum alloys and energy-intensive manufacturing processes restrict adoption among cost-sensitive OEMs and Tier-2 suppliers

- For instance, during 2024–2025, fluctuations in aluminum ingot prices, raw material shortages, and higher smelting costs increased production expenses for several global alloy manufacturers

- Complexity in forming, joining, and welding advanced aluminum grades requires specialized manufacturing infrastructure, skilled labor, and process optimization, increasing operational challenges

- Limited awareness and slow adoption in emerging markets regarding advanced lightweighting materials and alloy-specific performance benefits hinder faster market penetration

- Competition from advanced high-strength steel (AHSS), carbon fiber composites, and magnesium alloys creates pricing pressure and limits differentiation among aluminum suppliers

- To address these challenges, companies are focusing on cost-efficient alloy development, recycling-based production, energy-efficient smelting, and improved forming technologies to enhance global adoption of automotive aluminum alloys (OE)

How is the Automotive Aluminum Alloy (OE) Market Segmented?

The market is segmented on the basis of application, electric vehicle, vehicle type, and sales channel.

- By Application

On the basis of application, the automotive aluminum alloy (OE) market is segmented into Engine Component, Wheels, Driveline, Heat Exchanger, Body, and Others. The Body segment dominated the market with a 34.7% share in 2025, driven by rapid adoption of lightweighting strategies in passenger cars, premium vehicles, and EVs. Automakers are increasingly using aluminum body panels, closures, crash structures, and frames to improve fuel efficiency, enhance crash performance, and reduce overall vehicle weight by up to 40%. Increasing penetration of multi-material architectures and growing demand for corrosion-resistant, high-strength alloys further boost segment growth.

The Wheels segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising production of alloy wheels, growing preference for high-aesthetic rims, and increasing usage of forged aluminum wheels in EVs and luxury vehicles. Lightweight wheel adoption improves dynamics, reduces unsprung mass, and enhances energy efficiency—key trends driving future demand.

- By Electric Vehicle

On the basis of electric vehicle type, the market is segmented into Battery Electric Vehicles (BEV), Hybrid Electric Vehicles (HEV), and Plug-in Hybrid Electric Vehicles (PHEV). The Battery Electric Vehicle (BEV) segment dominated the market with a 52.1% share in 2025, driven by global electrification mandates, declining battery prices, and aggressive investments by automakers in aluminum-intensive EV platforms. BEVs require significantly higher aluminum content—up to 30–40% more—due to lightweight body structures, thermal management systems, battery enclosures, and chassis components.

The Plug-in Hybrid Electric Vehicle (PHEV) segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand in Europe and China, increasing consumer preference for dual-powertrain flexibility, and stringent emission norms pushing OEMs toward lightweight solutions. Aluminum’s ability to offset the additional weight of hybrid systems will continue to drive strong adoption across global PHEV platforms.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicles, and Electric Vehicles. The Passenger Vehicles segment dominated the market with a 57.4% share in 2025, attributed to large production volumes, rising use of aluminum in body-in-white structures, and growing demand for high-performance, fuel-efficient vehicles. Automakers are increasingly adopting aluminum alloys for doors, hoods, frames, crash structures, and powertrain components to meet stringent global emission and safety norms.

The Electric Vehicle segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rapid EV manufacturing expansion, OEM investments in aluminum-intensive platforms, and the need to reduce EV curb weight to enhance driving range. The high thermal conductivity and corrosion resistance of aluminum alloys make them essential for battery housings, thermal systems, and EV chassis components—driving strong future penetration.

- By Sales Channel

On the basis of sales channel, the automotive aluminum alloy (OE) market is segmented into OEM Market and After-OEM Market. The OEM Market dominated the segment with a 76.8% share in 2025, supported by large-scale adoption of aluminum alloys across new vehicle platforms, rising integration of lightweight structures in EVs, and continuous R&D into high-strength and heat-treatable alloys. OEMs are increasingly using aluminum to meet tightening fuel economy standards, reduce lifecycle emissions, and enhance vehicle structural performance.

The After-OEM Market is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising replacement demand for wheels, body panels, radiators, and driveline components, along with growing customization trends. Increasing vehicle age, growth in collision repairs, and expanding aftermarket distribution networks in Asia–Pacific and Latin America further support segment expansion.

Which Region Holds the Largest Share of the Automotive Aluminum Alloy (OE) Market?

- Asia-Pacific dominated the automotive aluminum alloy (OE) market with a 42.8% revenue share in 2025, driven by massive automotive production volumes, strong EV manufacturing capabilities, and rapid expansion of lightweight vehicle programs across China, Japan, India, and South Korea

- Rising adoption of aluminum-intensive architectures in passenger vehicles, commercial fleets, and EV platforms continues to fuel demand for high-strength and heat-treatable alloys. Automakers in the region are increasingly integrating aluminum in body structures, wheels, engine components, and thermal systems to meet stringent emission norms

- Growing investments in battery manufacturing, EV chassis development, and next-generation vehicle platforms further accelerate regional leadership. Strong supply chain ecosystems, large smelting capacities, and continuous innovation in alloy processing technologies reinforce Asia-Pacific’s dominance in the global market

China Automotive Aluminum Alloy (OE) Market Insight

China is the largest contributor in Asia-Pacific, supported by world-leading vehicle production, rapid electrification, and strong government support for lightweight mobility. High adoption of aluminum body structures, EV battery enclosures, and chassis components drives robust demand. The presence of major aluminum producers and expanding EV exports further strengthen market growth.

Japan Automotive Aluminum Alloy (OE) Market Insight

Japan shows significant market share driven by precision manufacturing, strong hybrid vehicle production, and high adoption of aluminum in engine components, heat exchangers, and structural parts. Automotive OEMs prioritize weight reduction and material efficiency, supporting sustained demand for premium alloys.

India Automotive Aluminum Alloy (OE) Market Insight

India is emerging as a major growth center due to rising passenger vehicle production, increasing EV adoption, and government incentives for lightweight manufacturing. Growing use of aluminum wheels, body panels, and thermal components boosts market penetration across domestic and export vehicle programs.

Europe Automotive Aluminum Alloy (OE) Market – Fastest-Growing Region (CAGR 2026–2033)

Europe is projected to register the fastest CAGR of 11.02% from 2026 to 2033, driven by stringent CO₂ emission targets, rapid electrification, and strong focus on sustainable lightweighting across Germany, France, Italy, and the U.K. Automakers are aggressively adopting aluminum-intensive architectures in EV chassis, frames, crash structures, and battery housings to meet regulatory requirements. Extensive expansion in EV gigafactories, strong presence of leading aluminum producers, and rising adoption of recycled aluminum alloys further accelerate market growth. Increasing investments in hydrogen vehicles, premium automotive manufacturing, and high-performance mobility platforms reinforce Europe’s position as the fastest-growing regional market.

Which are the Top Companies in Automotive Aluminum Alloy (OE) Market?

The automotive aluminum alloy (OE) industry is primarily led by well-established companies, including:

- Norsk Hydro ASA (Norway)

- thyssenkrupp AG (Germany)

- KOBE STEEL, LTD. (Japan)

- AMG Advanced Metallurgical Group N.V. (Netherlands)

- Constellium (France)

- NIPPON STEEL CORPORATION (Japan)

- AGCO Corporation (U.S.)

- ArcelorMittal (Luxembourg)

- Alcoa Corporation (U.S.)

- Novelis Deutschland GmbH (Germany)

- UACJ Corporation (Japan)

- Arconic (U.S.)

- AUSTEM COMPANY LTD. (South Korea)

- Bharat Forge (India)

- FLEX-N-GATE CORPORATION (U.S.)

- GORDON (U.S.)

- KIRCHHOFF Automotive GmbH (Germany)

- Magna International Inc. (Canada)

What are the Recent Developments in Global Automotive Aluminum Alloy (OE) Market?

- In October 2024, Norsk Hydro ASA introduced a new aluminum alloy engineered specifically for electric vehicles, offering enhanced energy absorption, greater durability, and reduced weight to support next-generation EV designs, further strengthening the company’s position in advanced lightweight materials

- In August 2024, Alcoa Corporation launched its latest high-performance aluminum alloy for aerospace applications, delivering improved strength and superior fatigue resistance to meet modern aircraft manufacturing demands, marking a significant advancement in aerospace-grade alloy solutions

- In March 2021, Ronal Group rolled out its Ronal R67 wheel, featuring five slim spokes paired with five bold double spokes integrated with colorful aero-style design elements in Tornado Red or Track Grey, ensuring optimal airflow and a sporty visual appeal, reinforcing the brand’s commitment to stylish and functional wheel innovations

- In December 2020, Ronal Group unveiled the Ronal R70-blue, the world’s first carbon-neutral recycled wheel made from pre-consumer, post-consumer, and primary aluminum sourced from renewable energy, delivering a 100% recyclable solution that highlights the company’s dedication to sustainability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.