Global Automotive Bicycle Chain Market

Market Size in USD Billion

CAGR :

%

USD

8.69 Billion

USD

12.35 Billion

2024

2032

USD

8.69 Billion

USD

12.35 Billion

2024

2032

| 2025 –2032 | |

| USD 8.69 Billion | |

| USD 12.35 Billion | |

|

|

|

|

Automotive Bicycle Chain Market Size

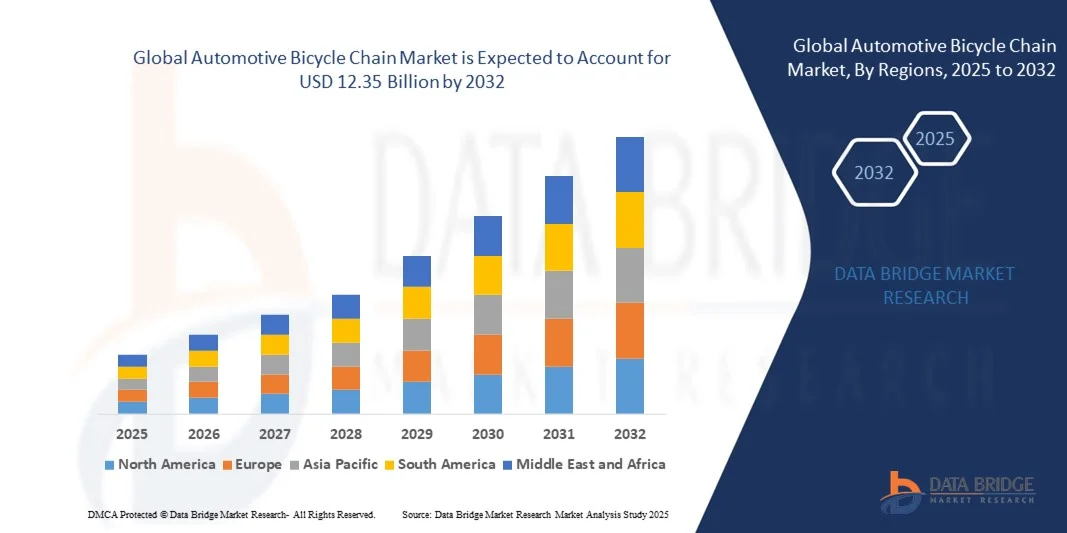

- The global automotive bicycle chain market size was valued at USD 8.69 billion in 2024 and is expected to reach USD 12.35 billion by 2032, at a CAGR of 4.50% during the forecast period

- The market growth is largely fuelled by the rising demand for lightweight and fuel-efficient vehicles, increasing adoption of bicycles in urban mobility solutions, and the expansion of the automotive and electric bike sectors

- Growing awareness regarding sustainable transportation and stringent government regulations to reduce carbon emissions are also driving the demand for high-performance bicycle chains in automotive and e-bike applications

Automotive Bicycle Chain Market Analysis

- The market is influenced by increasing investments in electric bicycles, hybrid vehicles, and high-performance automotive components, which require robust and efficient chain systems

- Rising consumer preference for low-maintenance and corrosion-resistant chains, coupled with developments in lightweight and high-strength alloys, is shaping product innovation and adoption globally

- North America dominated the automotive bicycle chain market with the largest revenue share of 38.50% in 2024, driven by the growing adoption of electric bicycles, hybrid vehicles, and increasing urban mobility solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global automotive bicycle chain market, driven by rising demand for bicycles in China, Japan, and Southeast Asia, expanding manufacturing capabilities, and growing awareness of health and environmental benefits associated with cycling

- The Mountain Bike segment held the largest market revenue share in 2024, driven by the rising popularity of off-road cycling and adventure sports. Mountain bike chains are designed to withstand high stress and rough terrain, providing durability and reliable performance for both recreational and professional cyclists

Report Scope and Automotive Bicycle Chain Market Segmentation

|

Attributes |

Automotive Bicycle Chain Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Bicycle Chain Market Trends

Increasing Demand For High-Performance And Durable Bicycle Chains

- The rising demand for high-performance bicycle chains in automotive and e-bike applications is reshaping the market by enabling efficient power transmission and long-lasting operation. Lightweight yet durable chains enhance fuel efficiency and reduce maintenance costs, particularly in urban mobility and sports vehicles. Moreover, chains with advanced coatings are reducing friction and extending service life, making them highly desirable for premium applications

- Growing adoption of electric bicycles, hybrid vehicles, and eco-friendly transportation solutions is accelerating the need for advanced chains capable of handling higher torque and repetitive motion. This trend is further driven by increasing consumer preference for smooth and reliable drivetrain performance. In addition, regulatory push toward low-emission vehicles is stimulating the adoption of optimized drivetrain components

- Technological advancements in chain materials, coatings, and precision manufacturing are enhancing strength, corrosion resistance, and wear performance. These innovations help meet stringent automotive standards and improve overall operational reliability. Furthermore, research in lightweight alloys and polymer-coated links is enabling quieter, smoother operation under varying environmental conditions

- For instance, in 2023, a leading European e-bike manufacturer upgraded its drivetrain systems with nickel-plated high-strength chains, improving durability and reducing maintenance intervals for urban commuters. This implementation also demonstrated higher load capacity and resistance to wear in harsh weather conditions, boosting overall product quality

- While high-performance and sustainable transportation solutions drive demand, continuous R&D, material innovation, and quality control are essential for long-term market growth. Collaboration with component suppliers and ongoing field testing are also key strategies to maintain competitive advantage in the evolving market

Automotive Bicycle Chain Market Dynamics

Driver

Increasing Adoption Of Electric Vehicles And Sustainable Transportation

- Rising demand for electric vehicles, hybrid cars, and e-bikes is pushing manufacturers to prioritize high-performance automotive bicycle chains. Their ability to transmit power efficiently while withstanding heavy loads makes them critical in modern drivetrain systems. The growing popularity of e-mobility solutions in urban and suburban areas is further boosting this trend

- Growing consumer awareness regarding eco-friendly transportation and government incentives for low-emission vehicles are boosting the adoption of advanced chain systems across automotive and bicycle applications. In addition, fleet operators and delivery services are increasingly investing in durable, low-maintenance chains to enhance operational efficiency

- Continuous innovations in alloy materials, surface coatings, and precision engineering enhance chain performance, durability, and energy efficiency, attracting widespread adoption in urban mobility and sports vehicles. Moreover, integration of advanced manufacturing techniques ensures consistent quality, even for mass-produced chains

- For instance, in 2022, a leading North American e-bike manufacturer integrated high-strength coated chains into its product lineup, improving energy efficiency and reducing wear under high-torque conditions. The adoption also led to higher user satisfaction and reduced warranty claims related to drivetrain failures

- While market growth is driven by EV adoption and sustainability trends, ongoing development in materials, design, and production processes is critical to meet evolving automotive and bicycle drivetrain requirements. Investment in R&D, partnerships with raw material suppliers, and performance testing under extreme conditions are necessary for continued adoption

Restraint/Challenge

High Cost Of Advanced Chains And Limited Availability In Emerging Markets

- Premium automotive bicycle chains, particularly high-strength and coated variants, are expensive, limiting adoption among small-scale manufacturers and budget-conscious consumers. Low-cost alternatives often compromise on durability and performance, restricting widespread use. In addition, fluctuating raw material costs can further increase end-product pricing, creating financial constraints for buyers

- In emerging and rural markets, availability of advanced chains is limited, causing delays in procurement and maintenance. Supply chain constraints, logistical challenges, and import costs further impede market penetration. The lack of specialized distributors and maintenance service centers in these regions also hinders seamless product deployment

- Operators and consumers often require technical knowledge to install, maintain, and optimize advanced chain systems, creating a skills gap in some regions. This can result in underperformance or accelerated wear, reducing operational efficiency. Training programs and technical support networks are critical to address these challenges effectively

- For instance, in 2023, several e-bike manufacturers in Southeast Asia reported supply delays and limited availability of coated high-strength chains, impacting production schedules and product quality. These bottlenecks also increased operational costs and extended lead times for end-users, slowing market expansion

- While chain technology continues to advance, addressing cost, accessibility, and technical knowledge gaps is crucial. Manufacturers are focusing on localized production, distribution networks, and user training programs to expand market adoption and ensure long-term growth. Strategic alliances with logistics providers and aftermarket support services are also emerging as key solutions to overcome regional challenges

Automotive Bicycle Chain Market Scope

The market is segmented on the basis of bicycle type, material, width, chain type, and sales channel.

- By Bicycle Type

On the basis of bicycle type, the automotive bicycle chain market is segmented into Mountain Bike, Hybrid/Cross Bike, and Road Bike. The Mountain Bike segment held the largest market revenue share in 2024, driven by the rising popularity of off-road cycling and adventure sports. Mountain bike chains are designed to withstand high stress and rough terrain, providing durability and reliable performance for both recreational and professional cyclists.

The Hybrid/Cross Bike segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing adoption of multi-purpose bicycles suitable for urban commuting and leisure riding. Hybrid chains offer a balance of strength, flexibility, and efficiency, making them ideal for riders seeking versatility across varying terrains.

- By Material

On the basis of material, the market is segmented into Carbon Steel, Alloy Steel, and Nickel Plated. The Carbon Steel segment accounted for the largest market revenue share in 2024 due to its cost-effectiveness, high strength, and wear resistance. Carbon steel chains are widely used in standard bicycles and commuter e-bikes for their durability and ease of maintenance.

The Nickel Plated segment is projected to witness the fastest growth from 2025 to 2032, owing to its superior corrosion resistance, smooth operation, and aesthetic appeal. Nickel-plated chains are increasingly preferred for premium bicycles and e-bike applications, where long-term reliability and minimal maintenance are critical.

- By Width

On the basis of width, the market is segmented into 1/8, 3/16, and 3/32. The 1/8-inch width segment dominated the market in 2024 due to its widespread use in heavy-duty bicycles, e-bikes, and urban commuting models. Wider chains can handle higher loads and provide enhanced torque transmission for demanding cycling conditions.

The 3/32-inch segment is projected to witness the fastest growth from 2025 to 2032, driven by its compatibility with multi-speed bicycles and performance bikes. Its precise engagement with sprockets ensures smoother pedaling efficiency and reduced wear, making it popular among professional riders.

- By Chain Type

On the basis of chain type, the market is segmented into Single Speed Chains, Multiple Speed Chains, and 5 Speed Chains. The Multiple Speed Chains segment captured the largest market share in 2024, attributed to the growing popularity of geared bicycles that offer better performance across varying terrains. Multiple speed chains provide enhanced drivetrain efficiency, flexibility, and durability, meeting the demands of both casual and competitive cyclists.

The Single Speed Chains segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising adoption of urban bikes and fixed-gear bicycles. Single speed chains are easier to maintain, lightweight, and cost-effective, appealing to commuters and cycling enthusiasts alike.

- By Sales Channel

On the basis of sales channel, the market is segmented into First Fit and Replacement. The First Fit segment held the largest revenue share in 2024, driven by OEM partnerships with bicycle manufacturers and e-bike producers. First fit chains are integrated into new bicycles during production, ensuring quality, compatibility, and optimal performance.

The Replacement segment is projected to grow at the fastest rate from 2025 to 2032, driven by increasing awareness of bicycle maintenance, growing e-bike adoption, and the need to replace worn-out chains. Aftermarket chains are preferred by individual users seeking performance upgrades or cost-effective alternatives for maintenance.

Automotive Bicycle Chain Market Regional Analysis

- North America dominated the automotive bicycle chain market with the largest revenue share of 38.50% in 2024, driven by the growing adoption of electric bicycles, hybrid vehicles, and increasing urban mobility solutions

- Consumers and manufacturers in the region highly value high-performance, durable, and corrosion-resistant chains that ensure smooth power transmission and reduce maintenance costs

- This widespread adoption is further supported by favorable government initiatives promoting sustainable transportation, rising disposable incomes, and a technologically inclined population, establishing advanced bicycle chains as a preferred solution for both automotive and e-bike applications

U.S. Automotive Bicycle Chain Market Insight

The U.S. automotive bicycle chain market captured the largest revenue share in 2024 within North America, fueled by the rapid growth of e-bikes, hybrid vehicles, and urban mobility initiatives. Manufacturers are prioritizing durable and high-efficiency chains to enhance drivetrain performance and extend product lifespan. In addition, the integration of precision-engineered chains in both electric and conventional bicycles is driving market expansion, supported by increasing consumer awareness of low-maintenance and sustainable transportation solutions.

Europe Automotive Bicycle Chain Market Insight

The Europe automotive bicycle chain market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent quality and safety standards, along with the rising demand for e-bikes and eco-friendly mobility solutions. Urbanization, cycling infrastructure development, and government incentives are fostering adoption of advanced chain systems. European consumers also value lightweight, durable, and low-maintenance chains for both personal and commercial bicycle applications, with strong growth expected across new vehicle manufacturing and aftermarket segments.

U.K. Automotive Bicycle Chain Market Insight

The U.K. automotive bicycle chain market is expected to witness significant growth from 2025 to 2032, fueled by the increasing popularity of e-bikes and hybrid bicycles in urban areas. Rising concerns regarding sustainability, traffic congestion, and the adoption of eco-friendly transportation solutions are encouraging both consumers and manufacturers to prioritize high-performance bicycle chains. The country’s well-developed cycling infrastructure and online retail channels further support market expansion.

Germany Automotive Bicycle Chain Market Insight

The Germany automotive bicycle chain market is expected to witness robust growth from 2025 to 2032, driven by technological advancements in chain materials, precision engineering, and coating processes. German consumers and manufacturers increasingly demand high-strength, corrosion-resistant chains for electric, hybrid, and conventional bicycles. In addition, the focus on sustainable urban transport, combined with local production capabilities and stringent quality requirements, promotes widespread adoption of advanced bicycle chain solutions.

Asia-Pacific Automotive Bicycle Chain Market Insight

The Asia-Pacific automotive bicycle chain market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for bicycles in urban commuting, rapid e-bike adoption, and rising disposable incomes in countries such as China, Japan, and India. Technological advancements in chain manufacturing, coupled with government initiatives supporting sustainable transport and cycling infrastructure, are propelling market growth. Furthermore, APAC’s strong manufacturing base enables the production of affordable, high-quality bicycle chains for both domestic and export markets.

Japan Automotive Bicycle Chain Market Insight

The Japan automotive bicycle chain market is expected to witness substantial growth from 2025 to 2032 due to the country’s high-tech culture, increasing e-bike adoption, and focus on efficient urban mobility. Consumers highly value precision-engineered, durable, and low-maintenance chains for both personal and commercial bicycle applications. In addition, Japan’s aging population and increasing preference for eco-friendly commuting options are likely to spur demand for easier-to-use, reliable chain solutions in the automotive and bicycle sectors.

China Automotive Bicycle Chain Market Insight

The China automotive bicycle chain market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the rapid adoption of e-bikes, hybrid bicycles, and high levels of urban cycling infrastructure development. The availability of cost-effective, high-quality chain products, along with strong domestic manufacturing capabilities, supports widespread adoption across residential, commercial, and rental bicycle segments. Government initiatives promoting cycling and sustainable transportation further bolster market growth in China.

Automotive Bicycle Chain Market Share

The Automotive Bicycle Chain industry is primarily led by well-established companies, including:

- Campagnolo S.r.l. (Italy)

- SRAM LLC (U.S.)

- Wippermann (Germany)

- TAYA CHAIN (Taiwan)

- Park Tool Co. (U.S.)

- Renold Plc. (U.K.)

- Jenson USA (U.S.)

- Odyssey BMX (U.S.)

- Zhejiang Dong Mei Chain Co., Ltd. (China)

- KMC (Taiwan)

- RKSA (India)

- TIEN YUEN MACHINERY MFG. CO. LTD. (Taiwan)

- Metro Group (India)

- ZUMI CHAIN MFG. CO. LTD. (China)

- Rohloff AG (Germany)

- ASR OVERSEAS (India)

- ORIENTAL CHAIN MFG. CO. LTD. (Taiwan)

- Avon Cycles Ltd. (India)

- SHIMANO INC (Japan)

- Giant Bicycles (Taiwan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.