Global Automotive Blind Spot Detection System Market

Market Size in USD Billion

CAGR :

%

USD

3.63 Billion

USD

7.84 Billion

2024

2032

USD

3.63 Billion

USD

7.84 Billion

2024

2032

| 2025 –2032 | |

| USD 3.63 Billion | |

| USD 7.84 Billion | |

|

|

|

|

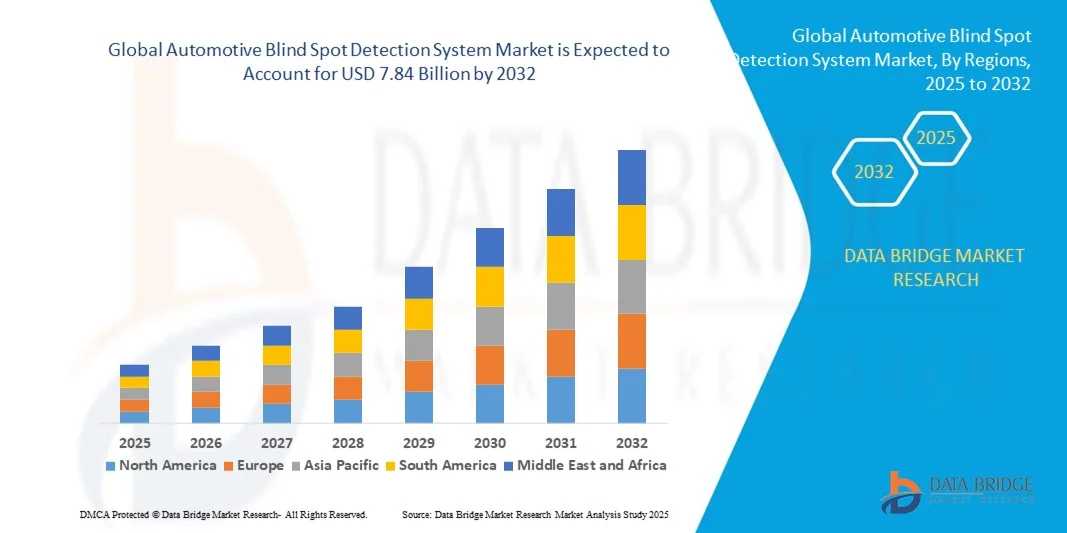

What is the Global Automotive Blind Spot Detection System Market Size and Growth Rate?

- The global automotive blind spot detection system market size was valued at USD 3.63 billion in 2024 and is expected to reach USD 7.84 billion by 2032, at a CAGR of 10.1% during the forecast period

- The rise in demand for premium vehicles across the globe acts as one of the major factor driving the growth of the automotive blind spot detection system market. The introduction of stringent government programs pertaining to vehicle safety, and advent of various solutions such as at-home test drive, review videos, and digital showrooms accelerate the market growth

- The high usage of safety services and technologies because of the stringent regulations provided by the governments to avoid collisions and accidents, and focus of manufacturers of vehicles to meet the standards set by different authorities regarding safety of vehicles further influence the market

What are the Major Takeaways of Automotive Blind Spot Detection System Market?

- Expansion of automotive sector, rise in demand for passenger cars, rapid urbanization and increase in need for personal mode of transportation positively affect the automotive blind spot detection system market

- Furthermore, advent of autonomous vehicles and increasing demand for semi-autonomous vehicle extend profitable opportunities to the market players

- Asia-Pacific dominated the automotive blind spot detection system market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, rising disposable incomes, and increased adoption of advanced vehicle safety technologies

- The Europe automotive blind spot detection system market is poised to grow at the fastest CAGR of 8.65% during 2025 to 2032, fueled by stringent vehicle safety regulations, increasing consumer awareness, and the rapid adoption of connected vehicle technologies

- The radar sensor segment dominated the market with the largest revenue share of 45.3% in 2024, driven by its robust performance under diverse weather and lighting conditions, and its ability to detect vehicles in adjacent lanes at high speed

Report Scope and Automotive Blind Spot Detection System Market Segmentation

|

Attributes |

Automotive Blind Spot Detection System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Automotive Blind Spot Detection System Market?

Advanced Driver Assistance Through AI and Sensor Fusion

- A significant and accelerating trend in the global automotive blind spot detection system market is the integration of artificial intelligence (AI) with advanced sensor fusion technologies, including radar, LiDAR, and cameras. This combination enhances vehicle safety by providing more accurate and predictive detection of vehicles or obstacles in blind spots

- For instance, modern systems such as ZF’s Active Blind Spot Assist leverage AI algorithms to detect vehicles approaching at high speed, providing early warnings and corrective steering assistance. Similarly, Continental’s Side Assist system uses radar sensors and predictive algorithms to alert drivers, reducing lane-change collisions

- AI-enabled detection systems can learn driver behavior patterns and adjust alert thresholds for different driving conditions, providing personalized safety feedback. Integration with vehicle infotainment and voice commands allows drivers to monitor blind spot alerts hands-free

- The seamless connectivity of Automotive Blind Spot Detection Systems with other advanced driver-assistance systems (ADAS) enables centralized vehicle safety management, coordinating lane-keeping, adaptive cruise control, and parking assist features

- This trend towards more intelligent, predictive, and interconnected safety systems is reshaping consumer expectations for vehicle safety. Companies such as Aptiv and Autoliv are actively developing AI-enabled systems with predictive collision alerts and adaptive response functionalities

- The demand for AI-driven, sensor-integrated Automotive Blind Spot Detection Systems is rapidly increasing across passenger cars, commercial vehicles, and luxury segments, as consumers prioritize proactive safety features

What are the Key Drivers of Automotive Blind Spot Detection System Market?

- The rising prevalence of road accidents, coupled with regulatory mandates for vehicle safety, is a significant driver for the increased adoption of automotive blind spot detection systems

- For instance, in 2024, the European Union mandated the inclusion of blind spot detection and lane-change assist systems in all new vehicles, encouraging manufacturers to integrate advanced ADAS features

- Growing consumer awareness about road safety, coupled with the availability of affordable, sensor-driven detection systems, is propelling adoption in both emerging and mature markets

- Integration of these systems with ADAS platforms provides additional benefits, such as lane-keeping assist, adaptive cruise control, and automated parking, offering drivers a comprehensive safety solution

- The convenience of real-time alerts, automated corrective action, and voice or dashboard notifications is increasing the preference for vehicles equipped with blind spot detection, particularly among fleet operators and tech-savvy consumers

- Moreover, automotive manufacturers are offering modular, upgradeable systems compatible with a variety of vehicle models, further boosting market penetration

Which Factor is Challenging the Growth of the Automotive Blind Spot Detection System Market?

- Concerns regarding system reliability in adverse weather conditions and sensor interference remain significant challenges for wider market adoption. Fog, rain, or snow can impair radar and camera functionality, affecting system accuracy

- High initial costs of vehicles equipped with advanced blind spot detection systems can deter price-sensitive buyers, particularly in developing regions. While mid-range vehicles are increasingly adopting these systems, premium features such as 360-degree camera integration or predictive AI remain expensive

- Cybersecurity vulnerabilities in connected vehicles, including ADAS and blind spot detection modules, pose potential risks of hacking and unauthorized system manipulation, which may affect consumer confidence

- Some drivers may over-rely on these systems, potentially creating safety concerns if alerts are ignored or misinterpreted, requiring continuous driver education and system improvements

- Addressing these challenges through enhanced sensor calibration, improved AI algorithms, cost optimization, and cybersecurity measures will be vital for sustained growth in the automotive blind spot detection system market

How is the Automotive Blind Spot Detection System Market Segmented?

The market is segmented on the basis of technology, vehicle class, and vehicle type.

- By Technology

On the basis of technology, the automotive blind spot detection system market is segmented into radar sensor, ultrasonic sensor, LiDAR sensor, and others. The radar sensor segment dominated the market with the largest revenue share of 45.3% in 2024, driven by its robust performance under diverse weather and lighting conditions, and its ability to detect vehicles in adjacent lanes at high speed. Radar sensors are widely preferred by OEMs due to their cost-effectiveness, reliability, and compatibility with existing ADAS platforms.

The LiDAR sensor segment is anticipated to witness the fastest CAGR of 22.1% from 2025 to 2032, fueled by advancements in high-resolution 3D mapping, autonomous vehicle applications, and increasing demand for precise object detection. LiDAR-enabled systems are gaining traction in premium and autonomous vehicle segments for their superior detection accuracy, particularly in complex urban traffic scenarios, positioning them as a key growth driver for next-generation blind spot detection solutions.

- By Vehicle Class

On the basis of vehicle class, the automotive blind spot detection system market is segmented into entry-level, mid-market, and luxury vehicles. The mid-market segment accounted for the largest market revenue share of 52% in 2024, driven by the increasing adoption of safety features in mainstream vehicles and stricter regulatory mandates for collision prevention systems. Mid-market vehicles provide a balance of affordability and advanced safety technology, making blind spot detection systems accessible to a wider consumer base.

The luxury vehicle segment is projected to witness the fastest CAGR of 21.5% from 2025 to 2032, driven by premium carmakers integrating AI-assisted radar, LiDAR, and sensor fusion technologies for comprehensive driver assistance and enhanced safety. Luxury buyers increasingly demand advanced ADAS features, including predictive blind spot alerts and lane-change assistance, supporting rapid market growth for high-end, feature-rich detection systems.

- By Vehicle Type

On the basis of vehicle type, the automotive blind spot detection system market is segmented into passenger cars, LCVs (light commercial vehicles), and M&HCVs (medium & heavy commercial vehicles). The passenger car segment dominated the market with the largest revenue share of 57.6% in 2024, driven by rising consumer awareness of road safety, government mandates, and increasing integration of ADAS in personal vehicles. Passenger cars benefit from a combination of affordability, design flexibility, and ease of sensor integration, making them the primary target for blind spot detection systems.

The M&HCV segment is expected to witness the fastest CAGR of 23% from 2025 to 2032, fueled by fleet operators adopting advanced safety technologies to reduce accidents, improve driver monitoring, and comply with transportation safety regulations. Increasing awareness of operational safety and insurance benefits further accelerates adoption in commercial heavy vehicles.

Which Region Holds the Largest Share of the Automotive Blind Spot Detection System Market?

- Asia-Pacific dominated the automotive blind spot detection system market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, rising disposable incomes, and increased adoption of advanced vehicle safety technologies

- Consumers and fleet operators in the region highly value enhanced vehicle safety, convenience, and integration of advanced driver-assistance systems (ADAS), including blind spot detection, lane departure warning, and collision avoidance technologies

- This widespread adoption is further supported by government safety regulations, growing automotive production in countries such as China, Japan, and India, and the expanding preference for connected and semi-autonomous vehicles, establishing Automotive Blind Spot Detection Systems as a standard safety feature

China Automotive Blind Spot Detection System Market Insight

China accounted for the largest share in APAC due to its expanding automotive industry, growing middle class, and high demand for safety features in vehicles. Government initiatives to improve road safety and regulations encouraging the use of ADAS systems are driving adoption in passenger cars, LCVs, and commercial fleets. Domestic manufacturers are increasingly integrating radar, ultrasonic, and LiDAR-based blind spot detection systems to meet consumer demand for safer vehicles. In addition, the growth of smart cities and connected vehicle infrastructure facilitates the implementation of intelligent vehicle safety systems, further supporting market expansion across multiple vehicle segments.

Japan Automotive Blind Spot Detection System Market Insight

The Japanese market is growing steadily, propelled by a high-tech automotive ecosystem, urban traffic complexities, and aging demographics that increase demand for driver assistance technologies. Consumers favor vehicles equipped with ADAS features, including radar-based blind spot detection, to enhance safety and convenience. OEMs are increasingly integrating semi-autonomous systems and connected vehicle technologies, complementing government initiatives focused on reducing road accidents. The combination of technological innovation, regulatory support, and consumer preference for advanced safety features is driving the adoption of Automotive Blind Spot Detection Systems in passenger cars, light commercial vehicles, and specialized transportation solutions.

Which Region is the Fastest Growing Region in the Automotive Blind Spot Detection System Market?

The Europe automotive blind spot detection system market is poised to grow at the fastest CAGR of 8.65% during 2025 to 2032, fueled by stringent vehicle safety regulations, increasing consumer awareness, and the rapid adoption of connected vehicle technologies. Countries such as Germany, the U.K., and France are witnessing significant growth due to regulatory mandates on vehicle safety, combined with OEMs integrating advanced ADAS features into mid-market and luxury vehicles. The region’s focus on reducing road accidents, coupled with growing demand for driver assistance and semi-autonomous features, is accelerating the adoption of Automotive Blind Spot Detection Systems across passenger cars and commercial vehicles. European consumers are increasingly prioritizing intelligent vehicle technologies, such as radar and LiDAR-based systems, to enhance safety, efficiency, and convenience, driving sustained market expansion.

Germany Automotive Blind Spot Detection System Market Insight

Germany leads Europe’s market due to its robust automotive industry, early adoption of advanced safety technologies, and consumer preference for premium vehicles. OEMs are actively equipping passenger cars and commercial vehicles with ADAS systems, including radar and LiDAR-based blind spot detection. Strong government safety regulations, innovation in semi-autonomous vehicle technologies, and high consumer awareness of road safety are driving growth. The country’s focus on sustainable and smart transportation further accelerates adoption. In addition, collaborations between OEMs and technology providers are expanding the availability of connected safety features, positioning Germany as a central hub for Automotive Blind Spot Detection System innovation.

U.K. Automotive Blind Spot Detection System Market Insight

The U.K. market is expanding rapidly, fueled by rising consumer demand for safer vehicles, increased adoption of ADAS features, and government-mandated vehicle safety standards. OEMs are integrating radar, ultrasonic, and LiDAR-based blind spot detection systems across passenger cars and commercial fleets. Consumer awareness campaigns highlighting the benefits of collision prevention and lane departure alerts further support market growth. The U.K.’s strong automotive retail network and adoption of connected vehicle technologies enhance accessibility to advanced safety solutions. Increasing urban traffic and rising adoption of semi-autonomous driving features are also contributing to the market’s rapid expansion during the forecast period.

Which are the Top Companies in Automotive Blind Spot Detection System Market?

The automotive blind spot detection system industry is primarily led by well-established companies, including:

- Continental AG (Germany)

- DENSO CORPORATION (Japan)

- Robert Bosch GmbH (Germany)

- Aptiv (U.S.)

- Autoliv Inc. (U.S.)

- ZF Friedrichshafen AG (Germany)

- Xiamen Australia Shida Electronics Co., Ltd. (China)

- Analog Devices, Inc. (U.S.)

- Auto-i (South Korea)

- Valeo (France)

- Ficosa Internacional SA (Spain)

- PRECO Electronics (U.S.)

- Siemens (Germany)

- Mobileye (Israel)

- s.m.s, smart microwave sensors GmbH (smartmicro) (Austria)

- HYUNDAI MOBIS (South Korea)

- Magna International Inc. (Canada)

- Mando Corp. (South Korea)

- HARMAN International (U.S.)

- HELLA GmbH & Co. KGaA (Germany)

- Samvardhana Motherson Group (India)

What are the Recent Developments in Global Automotive Blind Spot Detection System Market?

- In May 2023, Porsche announced a partnership with Israel-based company Mobileye to integrate advanced driver assistance technology, including Mobileye's SuperVision system in future models. The technology enables hands-off operation in certain situations, supporting functions such as auto lane changing, collision avoidance, and blind spot detection. This collaboration is expected to enhance vehicle safety and driver convenience significantly

- In February 2023, Tata Motors launched the latest dark edition of compact SUVs, Harrier and Safari, in the Indian market. These SUVs are equipped with an Advanced Driver Assistance System (ADAS) featuring blind spot detection, forward collision warning, lane departure warning, and emergency braking. This launch strengthens Tata Motors’ focus on safety and premium features in its SUV lineup

- In January 2023, NXP Semiconductors released an advanced automotive 28nm RFCMOS radar-on-chip family for next-generation ADAS and autonomous driving systems. The radar supports safety-critical applications, including automatic emergency braking and blind spot detection. This innovation is poised to accelerate the adoption of next-gen ADAS technologies in vehicles globally

- In January 2022, GILLIG LLC and RR.AI entered into an agreement to develop next-generation ADAS and SAE Level 4 Autonomous Vehicle technology for GILLIG transit buses in North America. The partnership focuses on safety features such as automatic emergency braking, precise docking, blind spot detection, and pedestrian avoidance. This initiative marks a significant step toward safer and more autonomous public transportation solutions

- In November 2021, MG introduced its advanced 2022 MG ZS EV in the U.K., offered in three trim levels. All variants feature ADAS capabilities including cross traffic alert, blind spot detection, lane change assist, and intelligent speed limit assist. This launch underscores MG’s commitment to integrating advanced safety technologies into electric vehicles

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Automotive Blind Spot Detection System Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automotive Blind Spot Detection System Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automotive Blind Spot Detection System Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.