Global Automotive Brake Shoe Market

Market Size in USD Billion

CAGR :

%

USD

9.78 Billion

USD

17.05 Billion

2024

2032

USD

9.78 Billion

USD

17.05 Billion

2024

2032

| 2025 –2032 | |

| USD 9.78 Billion | |

| USD 17.05 Billion | |

|

|

|

|

Automotive Brake Shoe Market Size

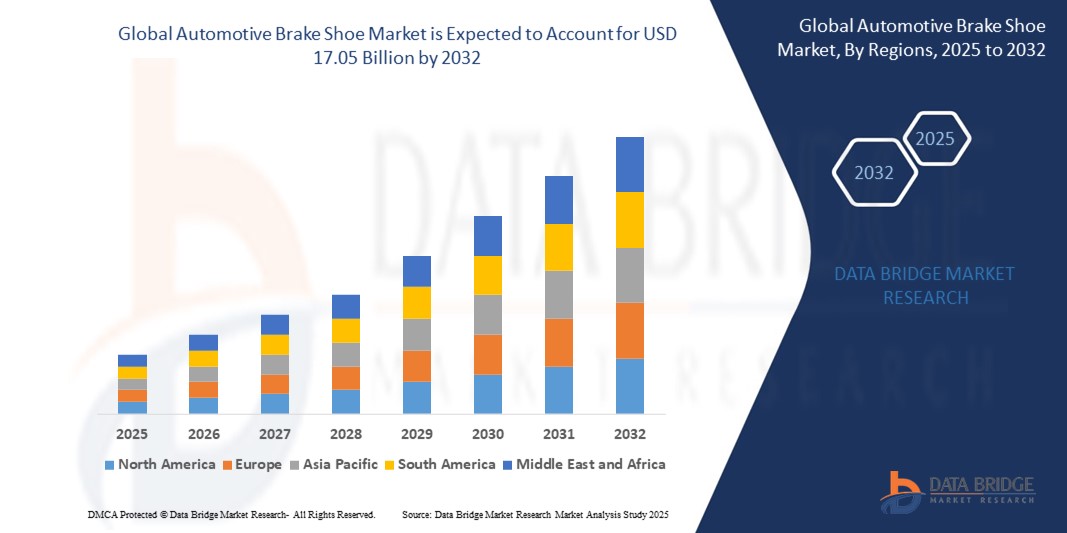

- The global automotive brake shoe market size was valued at USD 9.78 billion in 2024 and is expected to reach USD 17.05 billion by 2032, at a CAGR of 7.20% during the forecast period

- The market growth is primarily driven by increasing vehicle production, rising demand for enhanced braking systems, and growing emphasis on vehicle safety standards across both developed and emerging markets.

- The surge in demand for lightweight and durable brake shoes, coupled with advancements in material technologies, is further propelling market expansion, particularly in the aftermarket segment.

Automotive Brake Shoe Market Analysis

- Automotive brake shoes, critical components of drum brake systems, are essential for ensuring vehicle safety by providing reliable stopping power in various vehicle types, including passenger cars, commercial vehicles, and two-wheelers

- The market is fueled by stringent global safety regulations, increasing vehicle parc, and growing consumer awareness of the importance of regular brake system maintenance

- Asia-Pacific dominated the automotive brake shoe market with the largest revenue share of 42.5% in 2024, driven by high vehicle production rates, particularly in countries such as China and India, coupled with a robust automotive manufacturing ecosystem and increasing aftermarket demand

- North America is expected to be the fastest-growing region during the forecast period, propelled by advancements in braking technologies, rising adoption of electric vehicles, and strong aftermarket sales driven by a large vehicle parc and high consumer spending on vehicle maintenance

- The passenger vehicles segment dominated the largest market revenue share of 42.0% in 2024, driven by the global surge in SUV and sedan demand, coupled with consumer emphasis on safety and performance

Report Scope and Automotive Brake Shoe Market Segmentation

|

Attributes |

Automotive Brake Shoe Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Brake Shoe Market Trends

“Integration of Advanced Materials and Smart Technologies”

- The Global Automotive Brake Shoe Market is experiencing a notable trend toward the integration of advanced materials and smart technologies

- Innovations in materials, such as ceramic and non-asbestos organic (NAO), are enhancing brake shoe performance by improving durability, heat dissipation, and environmental sustainability

- Smart technologies, including sensors that monitor brake shoe wear and tear, are being incorporated to enable predictive maintenance and enhance safety

- For instance, companies are developing brake shoes with embedded sensors that provide real-time data on wear levels, allowing fleet operators and consumers to schedule maintenance proactively, reducing downtime and repair costs

- This trend is increasing the appeal of brake shoes for both OEMs and aftermarket buyers, particularly in high-performance vehicles and heavy commercial vehicles

- Advanced materials such as low-metallic NAO are gaining traction for their ability to balance performance and cost, catering to a wide range of vehicle types, including passenger vehicles and two-wheelers

Automotive Brake Shoe Market Dynamics

Driver

“Growing Demand for Vehicle Safety and Regulatory Compliance”

- Rising consumer and regulatory demand for enhanced vehicle safety is a key driver for the Global Automotive Brake Shoe Market

- Brake shoes are critical for ensuring reliable braking performance in vehicles, particularly in heavy commercial vehicles and two-wheelers, where safety is paramount

- Government regulations, such as the ECE R90 standards in Europe, Asia-Pacific, and Africa, mandate strict performance and safety requirements for brake components, boosting the adoption of high-quality brake shoes

- The increasing production of passenger vehicles and light commercial vehicles, especially in Asia-Pacific, is driving demand for brake shoes in both OEM and aftermarket channels

- The rise of electric vehicles (EVs) and hybrid vehicles is also fueling demand for specialized brake shoes designed to handle unique braking requirements, such as regenerative braking systems

Restraint/Challenge

“High Costs and Shift toward Disc Brakes”

- The high cost of advanced brake shoe materials, such as ceramic and low-metallic NAO, and the integration of smart technologies can be a significant barrier to adoption, particularly in cost-sensitive markets such as two-wheelers and light commercial vehicles

- The complexity and cost of retrofitting brake shoes into older vehicles further limit market growth in the aftermarket segment

- A major challenge is the increasing shift toward disc brakes, especially in passenger vehicles and high-performance applications, which reduces demand for traditional drum brake systems and brake shoes

- Environmental concerns related to brake dust emissions and strict regulations on materials, such as the phasing out of asbestos, require manufacturers to invest in costly R&D to develop eco-friendly alternatives

- These factors may restrain market growth, particularly in regions with high adoption of disc brakes, such as North America, which is the fastest-growing region, and in cost-conscious markets within Asia-Pacific, the dominating region

Automotive Brake Shoe market Scope

The market is segmented on the basis of vehicle type, type, material, sales channel, and position.

- By Vehicle Type

On the basis of vehicle type, the global automotive brake shoe market is segmented into passenger vehicles, light commercial vehicles, heavy commercial vehicles, and two-wheelers. The passenger vehicles segment dominated the largest market revenue share of 42.0% in 2024, driven by the global surge in SUV and sedan demand, coupled with consumer emphasis on safety and performance. Manufacturers are increasingly integrating advanced brake shoe technologies to meet regulatory standards and enhance vehicle safety.

The two-wheelers segment is expected to witness the fastest growth rate of 5.2% from 2025 to 2032, fueled by their affordability and popularity in urban mobility, particularly in developing countries such as India and China. The rising demand for reliable braking systems in congested urban environments further accelerates adoption.

- By Type

On the basis of type, the global automotive brake shoe market is segmented into leading/trailing, twin leading, and duo-servo type. The leading/trailing segment dominated with a 48.5% market revenue share in 2024, primarily due to its widespread use in passenger vehicles and cost-effectiveness for rear-wheel applications. Its consistent braking force makes it ideal for standard driving conditions.

The twin leading segment is anticipated to experience the fastest growth rate of 6.8% from 2025 to 2032, driven by its high efficiency in forward braking and suitability for heavy-duty applications in commercial vehicles, which require robust stopping power without a power brake booster.

- By Material

On the basis of material, the global automotive brake shoe market is segmented into semi-metallic, non-asbestos organic (NAO), low-metallic nao, and ceramic. The semi-metallic segment held the largest market revenue share of 40.0% in 2024, attributed to its durability, heat dissipation capabilities, and suitability for high-performance vehicles. Its composition, including 30-60% metallic materials, ensures high thermal stability.

The ceramic segment is expected to grow at the fastest rate of 7.5% from 2025 to 2032, driven by its eco-friendly attributes, low dust production, and superior durability. Increasing environmental regulations and consumer demand for sustainable braking solutions are key growth drivers.

- By Sales Channel

On the basis of sales channel, the global automotive brake shoe market is segmented into OEM and aftermarket. The aftermarket segment accounted for the largest market revenue share of 55.0% in 2024, driven by the accessibility of parts, lower costs, and availability of professional service stations. The need for frequent brake shoe replacements in aging vehicle fleets further boosts this segment.

The OEM segment is projected to grow at a robust rate of 5.9% from 2025 to 2032, fueled by the integration of advanced brake shoe technologies by manufacturers during vehicle production to comply with stringent safety and performance standards.

- By Position

On the basis of position, the global automotive brake shoe market is segmented into front and front and rear. The front and rear segment dominated with a 60.5% market revenue share in 2024, as most modern vehicles, particularly passenger cars and commercial vehicles, utilize brake shoes in both positions to optimize braking performance and safety.

The front segment is expected to witness significant growth at a CAGR of 4.5% from 2025 to 2032, driven by the increasing adoption of drum brakes in the front wheels of budget-friendly and older vehicle models, particularly in emerging markets.

Automotive Brake Shoe Market Regional Analysis

- Asia-Pacific dominated the automotive brake shoe market with the largest revenue share of 42.5% in 2024, driven by high vehicle production rates, particularly in countries such as China and India, coupled with a robust automotive manufacturing ecosystem and increasing aftermarket demand

- Consumers prioritize brake shoes for enhanced vehicle safety, durability, and performance, particularly in regions with heavy traffic and diverse road conditions

- Growth is supported by advancements in brake shoe materials, such as ceramic and semi-metallic compounds, alongside rising adoption in both OEM and aftermarket segments

U.S. Automotive Brake Shoe Market Insight

The U.S. automotive brake shoe is expected to witness significant growth, fueled by strong aftermarket demand and growing consumer awareness of vehicle safety and braking efficiency. The trend towards vehicle customization and stricter safety regulations further boosts market expansion. Automakers’ increasing integration of advanced brake shoes in new vehicles complements aftermarket sales, creating a diverse product ecosystem.

Europe Automotive Brake Shoe Market Insight

The Europe automotive brake shoe market is expected to witness steady growth, supported by regulatory emphasis on vehicle safety and performance. Consumers seek brake shoes that enhance braking efficiency while offering durability. The growth is notable in both OEM installations and aftermarket replacements, with countries such as Germany and France showing significant uptake due to advanced automotive industries and stringent safety standards.

U.K. Automotive Brake Shoe Market Insight

The U.K. market for automotive brake shoes is expected to witness notable growth, driven by demand for improved vehicle safety and performance in urban and rural settings. Increased focus on vehicle maintenance and rising awareness of braking system reliability encourage adoption. Evolving safety regulations influence consumer choices, balancing performance with compliance.

Germany Automotive Brake Shoe Market Insight

Germany is expected to witness strong growth in the automotive brake shoe market, attributed to its advanced automotive manufacturing sector and high consumer focus on vehicle safety and efficiency. German consumers prefer technologically advanced brake shoes, such as ceramic and low-metallic NAO, that enhance braking performance and contribute to fuel efficiency. The integration of these brake shoes in premium vehicles and aftermarket options supports sustained market growth.

Asia-Pacific Automotive Brake Shoe Market Insight

The Asia-Pacific region dominates the global automotive brake shoe market and is expected to maintain its lead through 2032, driven by expanding automotive production and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of vehicle safety, braking performance, and cost-effectiveness is boosting demand. Government initiatives promoting road safety and vehicle efficiency further encourage the use of advanced brake shoes.

Japan Automotive Brake Shoe Market Insight

Japan’s automotive brake shoe market is expected to witness significant growth due to strong consumer preference for high-quality, technologically advanced brake shoes that enhance vehicle safety and performance. The presence of major automotive manufacturers and integration of brake shoes in OEM vehicles accelerate market penetration. Rising interest in aftermarket replacements also contributes to growth.

China Automotive Brake Shoe Market Insight

China holds the largest share of the Asia-Pacific automotive brake shoe market, propelled by rapid urbanization, rising vehicle ownership, and increasing demand for reliable braking solutions. The country’s growing middle class and focus on vehicle safety support the adoption of advanced brake shoes. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Automotive Brake Shoe Market Share

The automotive brake shoe industry is primarily led by well-established companies, including:

- Bosch Auto Parts (Germany)

- BNA Automotive India Pvt Ltd. (India)

- Meritor, Inc. (U.S.)

- Tribo. (Brazil)

- Brake Parts Inc. LLC. (U.S.)

- MAT Holding, Inc. (U.S.)

- ASK Automotive Pvt. Ltd. (India)

- ZF Friedrichshafen AG (Germany)

- Continental AG (Germany)

- EBC Brakes. (U.K.)

- ICER BRAKES (Spain)

- Nisshinbo Brake Inc. (Japan)

- Showa Denko Materials Co., Ltd. (Japan)

- Hawk Performance (U.S.)

- SANGSIN BRAKE. (South Korea)

- KFE Brake Systems (U.S.)

What are the Recent Developments in Global Automotive Brake Shoe Market?

- In April 2025, Tenneco unveiled its Low Emission Brake technology, featuring advanced friction formulations and brake disc coatings engineered to reduce PM10 and PM2.5 particulate emissions from braking systems. Developed to meet upcoming Euro 7 and China 7 standards, the technology integrates renewable and recycled materials, enabling a 15–35% reduction in CO₂ emissions during manufacturing. This innovation reflects the automotive industry’s growing commitment to sustainability, offering improved brake performance, durability, and environmental compliance. Tenneco’s solution has already been selected by major European automakers, underscoring its real-world impact

- In April 2025, Nisshinbo, via its subsidiary TMD Friction, launched the Strong Ceramic (SC) friction material, a next-generation brake pad formulation tailored for light commercial vehicles and heavy SUVs. Designed to meet the demands of heavier loads, frequent braking, and high-mileage usage, SC material delivers enhanced wear resistance, superior thermal stability, and consistent braking performance—even under extreme conditions such as downhill driving where disc temperatures can reach up to 800°C. This innovation ensures longer service life and reduced downtime, making it ideal for business fleets and utility vehicles

- In June 2024, Brakes India, a TSF Group company, and ADVICS, a premium brake system supplier from Japan and part of the AISIN Group, announced a strategic joint venture to co-develop and manufacture advanced braking systems for the Indian light vehicle market. The collaboration will focus on technologies such as Electronic Stability Control (ESC) and other next-generation braking solutions, addressing the growing demand for hybrid, electric, and autonomous vehicles in India. The greenfield project, based in southern India, will be backed by an investment of over INR 500 crores, with Brakes India holding a 51% stake and ADVICS 49%. The venture is expected to employ over 300 people and will leverage both companies’ strengths in R&D, localization, and global technology integration to accelerate the adoption of safe and sustainable mobility solutions

- In February 2024, Allied Nippon launched its EV+ brake pad range, specifically engineered for the unique demands of electric vehicles (EVs). The EV+ line features a new friction compound and the proprietary BRAKEBOOST Instant Friction layer, designed to deliver enhanced stopping power, stable performance, and ultra-low noise—a key consideration for the quieter operation of EVs. These AA-rated pads also incorporate copper-free materials to reduce environmental impact. With 37 initial references covering popular EV models such as the Tesla Model 3, Renault Zoe, and Kia Niro, the EV+ range reflects the industry’s shift toward sustainable, high-performance braking solutions

- In October 2023, Brembo introduced its Copper Free XTRA line of aftermarket brake pads at the AAPEX and SEMA shows in Las Vegas. This new range includes Low Met and Ceramic NAO formulations, engineered to deliver high-performance braking while significantly reducing copper content, aligning with global environmental regulations. The XTRA Low Met pads focus on sporty performance and stopping power, while the XTRA Ceramic pads prioritize comfort, cleaner wheels, and low dust emissions. This launch reflects Brembo’s commitment to safety, sustainability, and innovation in the aftermarket sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.