Global Automotive Chromium Finishing Market

Market Size in USD Billion

CAGR :

%

USD

4.52 Billion

USD

5.77 Billion

2025

2033

USD

4.52 Billion

USD

5.77 Billion

2025

2033

| 2026 –2033 | |

| USD 4.52 Billion | |

| USD 5.77 Billion | |

|

|

|

|

Automotive Chromium Finishing Market Size

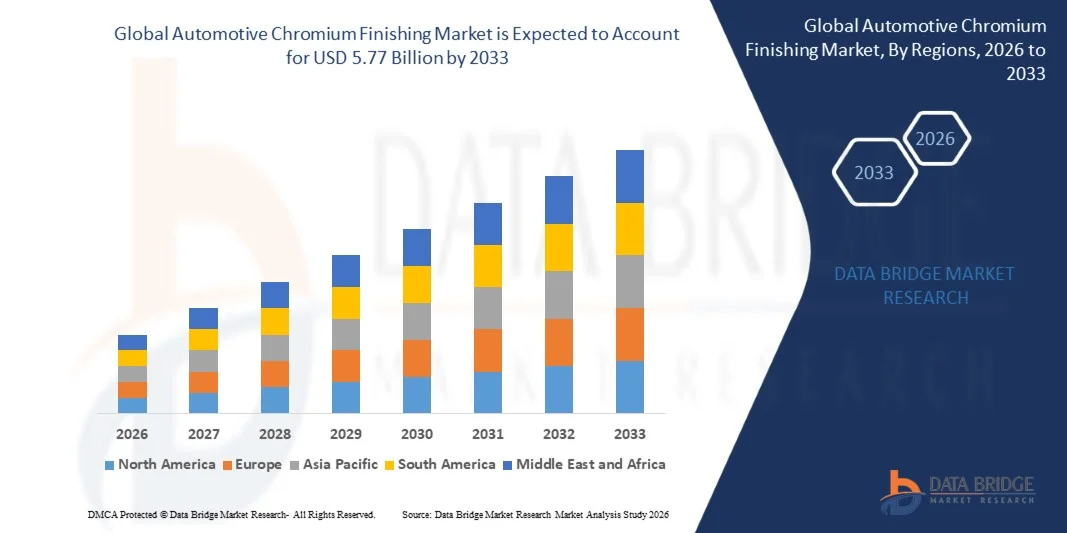

- The global automotive chromium finishing market size was valued at USD 4.52 billion in 2025 and is expected to reach USD 5.77 billion by 2033, at a CAGR of 3.10% during the forecast period

- The market growth is largely fueled by the rising production of passenger cars, commercial vehicles, and two-wheelers, coupled with increasing demand for premium vehicle aesthetics and durable corrosion-resistant components. Growing emphasis on electric and hybrid vehicles is further driving the need for lightweight, chrome-finished automotive parts, accelerating market expansion

- Furthermore, technological advancements in chromium plating processes, including low-emission, trivalent, and automation-integrated finishing solutions, are enhancing production efficiency, surface quality, and environmental compliance. These converging factors are boosting adoption among OEMs and aftermarket providers, thereby significantly supporting the growth of the automotive chromium finishing industry

Automotive Chromium Finishing Market Analysis

- Automotive chromium finishing, providing decorative and functional surface treatments for metal and plastic components, is increasingly essential in vehicle manufacturing for improving durability, corrosion resistance, and visual appeal. The rising preference for chrome-finished trims, bumpers, grilles, and wheel rims in both passenger and commercial vehicles is strengthening its market relevance

- The escalating demand for automotive chromium finishing is primarily fueled by the expansion of global automotive production, stringent regulatory standards for component longevity and safety, and increasing consumer preference for premium and aesthetically enhanced vehicles. In addition, OEMs’ focus on sustainable and efficient plating technologies is further driving market adoption across regions

- Asia-Pacific dominated the automotive chromium finishing market with a share of over 50% in 2025, due to increasing vehicle production, growing demand for premium passenger cars, and a strong presence of automotive component manufacturers

- North America is expected to be the fastest growing region in the automotive chromium finishing market during the forecast period due to rising demand for decorative and hard chrome finishes in passenger cars, light commercial vehicles, and luxury vehicles

- Metal segment dominated the market with a market share of 65.5% in 2025, due to high demand for chrome plating on metal components such as bumpers, grilles, and wheel rims due to their durability and corrosion resistance. Automakers prioritize metal substrates for chrome finishing because they enhance vehicle aesthetics while providing mechanical strength. In addition, the established supply chain and proven performance of metal chrome finishes contribute to their continued dominance in the market

Report Scope and Automotive Chromium Finishing Market Segmentation

|

Attributes |

Automotive Chromium Finishing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Chromium Finishing Market Trends

“Growing Adoption of Lightweight and Chrome-Finished Automotive Components”

- A significant trend in the automotive chromium finishing market is the increasing adoption of lightweight metal and plastic components with chrome finishes, driven by rising demand for premium aesthetics, corrosion resistance, and durability across passenger cars, commercial vehicles, and two-wheelers. This trend is elevating chromium finishing as a critical element for vehicle design, safety, and performance

- For instance, BASF and Atotech supply advanced decorative and hard chrome solutions to automotive OEMs such as BMW and Mercedes-Benz, enhancing the visual appeal and longevity of bumpers, grilles, wheel trims, and interior components. Such finishes strengthen brand perception and support high-quality, long-lasting vehicle surfaces

- The growing production of electric and hybrid vehicles is accelerating the use of lightweight chrome-plated components, as manufacturers seek to reduce overall vehicle weight without compromising strength or aesthetics. This is positioning chromium finishing as a key enabler of sustainable automotive manufacturing

- Commercial vehicle manufacturers are increasingly integrating chrome-finished components in heavy-duty trucks and LCVs to ensure durability under extreme operating conditions, expanding market relevance across the transportation sector

- Rising aftermarket customization is also driving demand, with chrome plating used on replacement parts, trims, and accessories to meet consumer preferences for style and corrosion-resistant finishes. This is enhancing the overall adoption of chromium finishing services beyond OEM production

- The market is witnessing strong growth in regions such as Asia-Pacific, where automotive production is rapidly expanding, and consumers are increasingly demanding vehicles with premium design features. This trend is reinforcing the transition toward higher-quality, visually appealing, and corrosion-resistant automotive components

Automotive Chromium Finishing Market Dynamics

Driver

“Rising Demand for Premium Vehicle Aesthetics and Corrosion-Resistant Parts”

- The growing preference for premium vehicle finishes, combined with the need for durable, corrosion-resistant surfaces, is driving the demand for automotive chromium finishing. Manufacturers are increasingly incorporating chrome-plated trims, bumpers, grilles, and wheel rims to enhance both vehicle aesthetics and longevity

- For instance, Atotech and MacDermid supply decorative and functional chrome plating solutions to global OEMs such as Ford and Hyundai, supporting high-quality, durable surface finishes. These solutions enable manufacturers to meet consumer expectations for premium design and long-lasting components

- The expansion of electric and hybrid vehicle production is further increasing the adoption of lightweight chrome-plated components, as OEMs focus on maintaining strength while reducing overall weight

- Automotive OEMs and aftermarket providers are leveraging these solutions to differentiate products and meet stringent safety and durability standards, positioning chromium finishing as an essential part of modern vehicle manufacturing

- The increasing emphasis on vehicle brand perception, coupled with consumer demand for stylish, long-lasting finishes, continues to strengthen this driver and reinforces market growth

Restraint/Challenge

“Stringent Environmental and Safety Regulations for Chrome Plating”

- The automotive chromium finishing market faces challenges due to strict environmental and safety regulations governing the use of hexavalent chromium and other hazardous chemicals in plating processes. Compliance requires costly process modifications, specialized equipment, and adherence to emission and wastewater treatment standards

- For instance, companies such as Technic Inc. and BASF are investing in trivalent chromium plating technologies to meet global regulatory requirements while maintaining surface quality and performance. These transitions increase production complexity and operational costs

- Manufacturers must balance regulatory compliance with production efficiency, which can limit scalability and slow adoption of certain chrome finishing processes

- Strict occupational health and safety guidelines also require additional training, protective equipment, and monitoring, adding to operational burdens for plating facilities

- The market continues to encounter constraints related to high costs, complex process implementation, and environmental compliance, which collectively challenge manufacturers to optimize operations while meeting growing demand for high-quality chrome finishes

Automotive Chromium Finishing Market Scope

The market is segmented on the basis of base material, process, vehicle, and end-user.

• By Base Material

On the basis of base material, the automotive chromium finishing market is segmented into metal and plastics. The metal segment dominated the market with the largest revenue share of 65.5% in 2025, driven by the high demand for chrome plating on metal components such as bumpers, grilles, and wheel rims due to their durability and corrosion resistance. Automakers prioritize metal substrates for chrome finishing because they enhance vehicle aesthetics while providing mechanical strength. In addition, the established supply chain and proven performance of metal chrome finishes contribute to their continued dominance in the market.

The plastics segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising adoption of lightweight automotive components and eco-friendly designs. Plastic parts such as bumpers, trims, and mirror housings are increasingly being chrome-finished to mimic metallic aesthetics without adding excessive weight. The growth is supported by advancements in pre-treatment technologies and improved adhesion methods that allow high-quality finishes on plastic surfaces. In addition, the push toward fuel efficiency encourages manufacturers to replace heavier metal components with plastic alternatives.

• By Process

On the basis of process, the automotive chromium finishing market is segmented into decorative chrome and hard chrome. The decorative chrome segment dominated the market in 2025, driven by its extensive use for enhancing the visual appeal of automotive components such as bumpers, door handles, grilles, and wheel trims. Rising popularity of chrome-plated interiors and exterior trims further strengthens the segment’s market share.

The hard chrome segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by increasing demand for wear-resistant and corrosion-resistant components such as shafts, piston rods, and suspension parts. For instance, Technic Inc. and SurTec supply hard chrome solutions for heavy commercial vehicles and LCVs. Hard chrome plating enhances mechanical durability and extends service life of parts subjected to friction and heavy loads. Technological advancements in low-emission and trivalent chromium processes are promoting environmentally compliant solutions.

• By Vehicle

On the basis of vehicle type, the automotive chromium finishing market is segmented into passenger cars, LCVs, HCVs, and two-wheelers. The passenger car segment dominated the market in 2025, driven by rising demand for premium designs, luxury trims, and aesthetic chrome accents. For instance, BMW and Mercedes-Benz incorporate extensive decorative chrome elements in their high-end models. Chrome components on passenger cars enhance vehicle appearance and brand perception. In addition, passenger cars represent the largest vehicle population globally, ensuring high demand for both decorative and functional chrome finishes.

The two-wheeler segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising adoption in emerging markets and increasing consumer interest in stylish, chrome-accented motorcycles and scooters. For instance, TVS Motor and Hero MotoCorp employ chrome plating on premium motorcycles to attract urban consumers. Chrome finishing on exhaust pipes, handlebars, and wheel rims enhances visual appeal while offering corrosion protection. The combination of rising demand for personal mobility and fashionable vehicle design accelerates adoption in this segment.

• By End-User

On the basis of end-user, the automotive chromium finishing market is segmented into automotive OEM and automotive aftermarket. The automotive OEM segment dominated the market in 2025, driven by the high demand for factory-fitted chrome finishes on new vehicles, ensuring consistency, durability, and compliance with quality standards. In addition, increasing production of passenger cars and commercial vehicles globally strengthens the OEM segment’s market share.

The automotive aftermarket segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by growing vehicle ownership, aging fleets, and consumer preference for customizing or refurbishing chrome parts. For instance, Magna International and Plastek Group provide aftermarket chrome plating services for replacement and upgraded components. Rising DIY culture and vehicle modification trends in regions such as North America and Asia-Pacific drive market growth. The availability of cost-effective and environmentally compliant aftermarket solutions encourages wider adoption.

Automotive Chromium Finishing Market Regional Analysis

- Asia-Pacific dominated the automotive chromium finishing market with the largest revenue share of over 50% in 2025, driven by increasing vehicle production, growing demand for premium passenger cars, and a strong presence of automotive component manufacturers

- The region’s cost-effective manufacturing landscape, rising investments in automotive component production, and expanding electric and hybrid vehicle adoption are accelerating market expansion

- The availability of skilled labor, favorable government policies, and rapid industrialization across developing economies are contributing to increased consumption of chromium finishing for both decorative and functional automotive parts

China Automotive Chromium Finishing Market Insight

China held the largest share in the Asia-Pacific automotive chromium finishing market in 2025, owing to its position as the world’s largest automotive manufacturer and a hub for high-quality component production. The country’s strong industrial base, government incentives supporting automotive sector expansion, and advanced export capabilities for finished vehicles and components are major growth drivers. Demand is also bolstered by increasing production of electric and hybrid vehicles and rising consumer preference for premium vehicle aesthetics.

India Automotive Chromium Finishing Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by expanding passenger car production, rising two-wheeler ownership, and increasing adoption of chrome-finished vehicle components. Government initiatives supporting Make in India and automotive localization are strengthening the demand for chromium finishing. In addition, rising exports of automotive components, growing urbanization, and increasing disposable incomes are contributing to robust market expansion.

Europe Automotive Chromium Finishing Market Insight

The Europe automotive chromium finishing market is expanding steadily, supported by strong demand for high-quality decorative and functional finishes, stringent environmental regulations, and investments in advanced plating technologies. The region emphasizes premium vehicle design, corrosion resistance, and sustainable manufacturing practices, particularly in passenger cars and commercial vehicles. Increasing adoption of electric vehicles and advanced coatings for lightweight components is further enhancing market growth.

Germany Automotive Chromium Finishing Market Insight

Germany’s market is driven by its leadership in premium vehicle manufacturing, extensive R&D capabilities, and export-oriented automotive industry. The country has well-established partnerships between OEMs and plating solution providers, fostering innovation in decorative and hard chrome finishes. Demand is particularly strong for high-end passenger cars, commercial vehicles, and precision components requiring long-lasting corrosion resistance.

U.K. Automotive Chromium Finishing Market Insight

The U.K. market is supported by a mature automotive sector, growing efforts to localize supply chains post-Brexit, and rising demand for premium finishes on passenger and commercial vehicles. With increasing focus on R&D, advanced plating processes, and environmental compliance, the U.K. continues to play a significant role in high-quality automotive component production.

North America Automotive Chromium Finishing Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for decorative and hard chrome finishes in passenger cars, light commercial vehicles, and luxury vehicles. Strong focus on electric vehicles, lightweight components, and advanced corrosion-resistant coatings is boosting demand. In addition, increasing reshoring of automotive component manufacturing and collaboration between OEMs and plating solution providers are supporting market expansion.

U.S. Automotive Chromium Finishing Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its extensive passenger car and commercial vehicle production, advanced R&D infrastructure, and adoption of premium decorative and hard chrome finishes. The country’s focus on innovation, regulatory compliance, and environmental sustainability is encouraging the use of advanced chromium finishing in vehicle components. Presence of key players and a mature supply chain further solidify the U.S.’s leading position in the region.

Automotive Chromium Finishing Market Share

The automotive chromium finishing industry is primarily led by well-established companies, including:

- Atotech (Germany)

- MacDermid, Inc. (U.S.)

- U.S. Chrome Corporation (U.S.)

- Borough (U.S.)

- Taiyo Technology of America Ltd (U.S.)

- COLLINI GRUPPE (Germany)

- Valley Chrome Plating INC. (U.S.)

- F.H. Lambert Limited (U.K.)

- SYNERGIES CASTINGS Ltd (U.K.)

- Eakas Corporation (U.S.)

- American Electroplating Company (U.S.)

- Rotorua Electroplaters (New Zealand)

- OGAWA ASIA COMPANY LIMITED (Japan)

- MVC Holdings, LLC (U.S.)

- Micro Metal Finishing, LLC (U.S.)

- Kakihara Industries Co., Ltd. (Japan)

- Chromium Inc. (U.S.)

- Chem Processing Inc (U.S.)

- Allied Finishing (U.S.)

Latest Developments in Global Automotive Chromium Finishing Market

- In January 2025, Atotech announced a strategic partnership with General Motors to co‑develop chromium‑free plating processes for automotive components, aimed at reducing environmental impact and meeting evolving regulatory standards. This collaboration is expected to accelerate the adoption of sustainable alternatives to traditional chrome plating in vehicle production, helping OEMs comply with stricter surface‑treatment regulations while maintaining aesthetic and corrosion‑resistant properties for trims and exterior parts

- In December 2024, Technic Inc. formed a strategic partnership with Aqua Metallurgy to co‑develop low‑emission chrome plating processes, supporting accelerated compliance with stringent global environmental and safety standards. This development fosters greener production methods and enhances competitiveness by offering plating solutions that reduce hazardous emissions, aligning with industry and regulatory demand for eco‑friendly surface finishes

- In June 2024, BASF collaborated with Harland Simon to integrate automation and digital controls into chrome plating lines for automotive components, enabling more efficient plating operations and reduced waste. This initiative is poised to improve production efficiency and quality in the automotive chromium finishing market, allowing manufacturers to scale up output while reducing operational costs and environmental footprint

- In July 2023, S.J.S. Enterprises Limited, an India-based provider of decorative aesthetics solutions for the automotive industry, acquired 90.1% stake in Walter Pack Automotive Products India Private Limited (WPI) for $28.46 million. As a result, Walter Pack became a subsidiary of S.J.S. Enterprises. This acquisition is expected to strengthen S.J.S.’s capabilities in the automotive sector and significantly boost its earnings per share while expanding its presence in the chromium finishing market

- In May 2022, Atotech and Schweitzer Engineering Laboratories established a partnership at a cutting-edge plant under development in the United States, aimed at advancing automotive plating technologies. This collaboration is expected to drive innovation in chromium finishing processes, enhance operational efficiency, and support the production of high-quality, corrosion-resistant automotive components

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.