Global Automotive Closure Market

Market Size in USD Billion

CAGR :

%

USD

26.79 Billion

USD

45.35 Billion

2024

2032

USD

26.79 Billion

USD

45.35 Billion

2024

2032

| 2025 –2032 | |

| USD 26.79 Billion | |

| USD 45.35 Billion | |

|

|

|

|

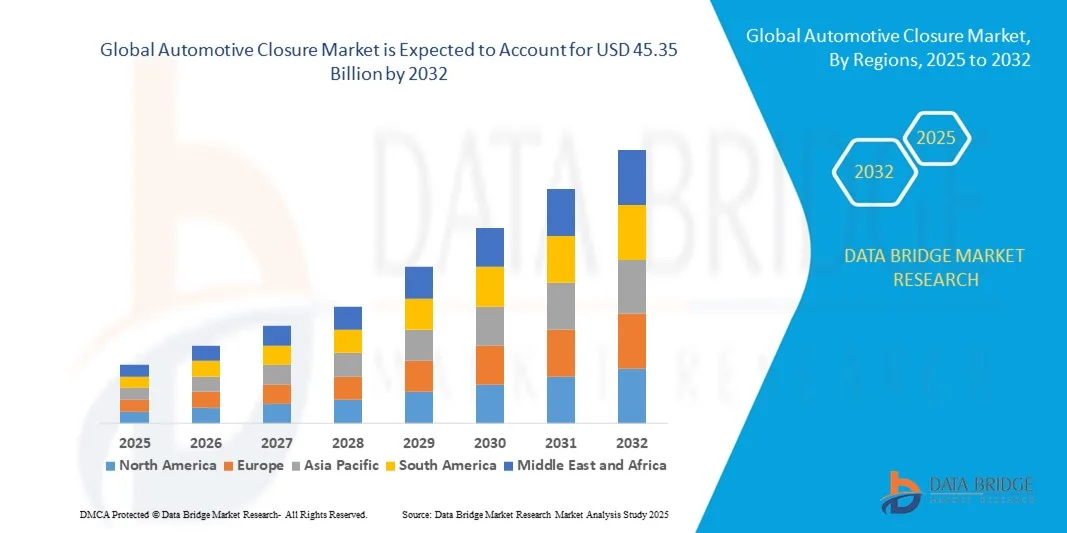

What is the Global Automotive Closure Market Size and Growth Rate?

- The global automotive closure market size was valued at USD 26.79 billion in 2024 and is expected to reach USD 45.35 billion by 2032, at a CAGR of 6.80% during the forecast period

- Increasing demand for comfort and luxury among the consumers, growth in hybrid electric vehicles (HEV) and plug-in hybrid electric vehicles (PHEV) sales, rising focus toward safety/hands-free operations, prevalence of better overall efficiency due to the improved aerodynamics associated with the product implementation, focus of closure manufacturers on the development of lightweight materials, development of an integrated closure system to meet safety standards are some of the major as well as vital factors which will such asly to augment the growth of the automotive closure market

What are the Major Takeaways of Automotive Closure Market?

- Increasing number of research and development activities along with advancement on closure technology such as LED latches, collision avoidance closure system, and integration of electronics into closure systems which will further contribute by generating massive opportunities that will lead to the growth of the automotive closure market in the above-mentioned projected timeframe

- North America dominated the automotive closure market with the largest revenue share of 34.16% in 2024, driven by a growing demand for vehicle automation, smart vehicle features, and advanced security systems

- The Asia-Pacific automotive closure market is poised to grow at the fastest CAGR of 9.5% during the forecast period of 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and rapid technological adoption in countries such as China, Japan, and India

- The powered segment dominated the market with the largest revenue share of 57.6% in 2024, driven by rising adoption of electric and automated vehicle systems that enhance convenience, safety, and ease of use

Report Scope and Automotive Closure Market Segmentation

|

Attributes |

Automotive Closure Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Automotive Closure Market?

Integration of AI and Smart Connectivity for Enhanced Vehicle Access

- A key trend in the global automotive closure market is the increasing adoption of artificial intelligence (AI) and smart connectivity features, enabling advanced functionality in vehicle access systems. This trend is driving more intelligent, user-friendly solutions for keyless entry, remote locking, and enhanced vehicle security

- For instance, AI-enabled automotive closures now allow predictive locking/unlocking based on user behavior, and smart key systems can integrate with digital assistants such as Amazon Alexa and Google Assistant, enabling voice-activated vehicle access

- AI-powered automotive closures also provide adaptive alerts and activity monitoring, detecting unusual access patterns or attempted breaches. Systems such as Ultraloq smart locks now improve over time through machine learning, offering enhanced recognition and proactive notifications

- Integration with connected car ecosystems allows centralized control of vehicle functions, such as access, climate preconditioning, and telematics, through a unified interface

- This trend is reshaping consumer expectations, leading companies such as WELOCK and other OEMs to develop AI-driven automotive closures with seamless connectivity and predictive capabilities

- The rising demand for intelligent, convenient, and secure vehicle access is fueling rapid adoption in both personal and commercial automotive segments

What are the Key Drivers of Automotive Closure Market?

- Increasing awareness of vehicle security threats and rising adoption of smart car systems are major drivers for the automotive closure market

- In April 2024, Onity, Inc. (Honeywell International, Inc.) introduced IoT-enabled vehicle access sensors for secure fleet management, illustrating how innovations are shaping market growth

- Consumers are seeking solutions with features such as remote locking/unlocking, access logs, tamper alerts, and keyless operation, offering superior protection over traditional mechanical locks

- The expansion of connected car ecosystems and integrated telematics encourages the adoption of Automotive Closures with seamless smartphone app or digital assistant integration

- The convenience of remote access, control for family members or service personnel, and mobile application management are accelerating uptake in personal vehicles and commercial fleets. The growing trend of DIY connected vehicle solutions and user-friendly options further stimulates market growth

Which Factor is Challenging the Growth of the Automotive Closure Market?

- Cybersecurity concerns around connected automotive closures pose a significant challenge to widespread adoption. These systems rely on network connectivity and software, making them vulnerable to hacking and data breaches

- High-profile IoT vulnerabilities have created hesitation among potential users regarding vehicle security solutions

- Robust encryption, secure authentication protocols, and continuous software updates are critical to building consumer trust. Companies such as August and Level Home emphasize these features in their marketing to reassure users

- High initial costs of advanced Automotive Closure systems, compared to traditional locks, can be a barrier for price-sensitive buyers, especially in developing markets. While basic models from brands such as Wyze are more affordable, premium features such as integrated cameras or advanced biometric recognition often come at a higher price point

- The perceived premium for smart vehicle access technology can still limit adoption among consumers who do not see immediate value

- Overcoming these challenges through enhanced cybersecurity, consumer education, and more affordable solutions will be essential for long-term market expansion

How is the Automotive Closure Market Segmented?

The market is segmented on the basis of type, product type, component, sales channel, and vehicle type.

- By Type

On the basis of type, the automotive closure market is segmented into manual and powered closures. The powered segment dominated the market with the largest revenue share of 57.6% in 2024, driven by rising adoption of electric and automated vehicle systems that enhance convenience, safety, and ease of use. Powered closures are increasingly preferred in premium and mid-segment vehicles for doors, tailgates, and hoods, providing effortless operation and integration with keyless entry systems. The market sees strong demand for powered closures due to their compatibility with modern vehicle safety systems and advanced features such as auto-close, remote operation, and anti-pinch mechanisms.

The manual segment is expected to witness the fastest CAGR of 19.8% from 2025 to 2032, primarily in entry-level vehicles and cost-sensitive markets, where affordability and simplicity remain key priorities. Growing consumer interest in hybrid manual-powered configurations is further contributing to market growth.

- By Product Type

On the basis of product type, the automotive closure market is segmented into bonnet, roof, windows, doors, rear hatch, and fuel doors. Doors dominated the market in 2024 with a revenue share of 46.3%, driven by their critical role in vehicle access and safety compliance, as well as integration with advanced locking and keyless entry systems. Rear hatches and windows are also witnessing steady adoption due to convenience and automation features in SUVs, hatchbacks, and luxury vehicles.

The roof segment is expected to witness the fastest CAGR of 21.2% from 2025 to 2032, fueled by rising demand for sunroofs, panoramic roofs, and automated retractable systems. Technological advancements in lightweight materials and motorized actuation are further supporting the growth of innovative closure solutions across vehicle types.

- By Component

On the basis of component, the automotive closure market is segmented into electronic control unit (ECU), switch, latch, motor and actuator, and relay. Motors and actuators dominated the market with a revenue share of 41.5% in 2024, driven by their essential role in automated closure operation and the integration of smart locking mechanisms. Latches and switches also contribute significantly due to their importance in vehicle safety and ergonomics.

The ECU segment is expected to witness the fastest CAGR of 22.5% from 2025 to 2032, as vehicle manufacturers increasingly integrate intelligent control units to enable centralized, software-driven closure management and compatibility with connected vehicle systems. This trend aligns with the growing adoption of electric vehicles and advanced driver-assistance systems (ADAS).

- By Sales Channel

On the basis of sales channel, the automotive closure market is segmented into original equipment manufacturer (OEM) and aftermarket. The OEM segment dominated with the largest revenue share of 63.2% in 2024, driven by increasing vehicle production, adoption of integrated closures in new models, and the emphasis on advanced safety standards.

The aftermarket segment is expected to witness the fastest CAGR of 20.4% from 2025 to 2032, fueled by replacement demand, retrofitting of smart closures, and rising consumer preference for customization in existing vehicles. The growth in e-commerce and online automotive parts platforms is also accelerating aftermarket adoption.

- By Vehicle Type

On the basis of vehicle type, the automotive closure market is segmented into electric vehicles (EVs), passenger vehicles, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs). Passenger vehicles dominated the market with a revenue share of 49.7% in 2024, owing to their sheer volume, focus on comfort, and widespread integration of power-operated closure systems.

The EV segment is expected to witness the fastest CAGR of 23.1% from 2025 to 2032, driven by global EV adoption, government incentives, and the integration of high-tech, energy-efficient closure systems in electric and hybrid vehicles. The growth of connected and autonomous vehicle technologies further reinforces this trend, positioning EVs as a key driver for innovative closure solutions.

Which Region Holds the Largest Share of the Automotive Closure Market?

- North America dominated the automotive closure market with the largest revenue share of 34.16% in 2024, driven by a growing demand for vehicle automation, smart vehicle features, and advanced security systems

- Consumers in the region highly value the convenience, safety, and seamless integration offered by automotive closures with keyless entry, smart sensors, and connected vehicle platforms

- This widespread adoption is further supported by high disposable incomes, strong automotive infrastructure, and technological awareness, establishing automotive closures as a preferred solution for passenger and commercial vehicles

U.S. Automotive Closure Market Insight

The U.S. automotive closure market captured the largest revenue share in 2024 within North America, fueled by rapid adoption of connected vehicle technologies and advanced driver-assistance systems (ADAS). Consumers increasingly prefer vehicles with automated doors, tailgates, and hatches for enhanced convenience and safety. The integration of keyless systems, smartphone-enabled access, and voice-assisted features is significantly driving market growth. Moreover, growing interest in electric vehicles (EVs) and luxury vehicle features continues to expand Automotive Closure adoption across both passenger and commercial vehicle segments.

Europe Automotive Closure Market Insight

The Europe automotive closure market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent vehicle safety regulations, urbanization, and rising demand for technologically advanced closures. Adoption is growing across passenger vehicles, light commercial vehicles, and electric vehicles. Consumers are increasingly seeking closures that enhance convenience, security, and energy efficiency. Automotive Closures are being incorporated into new vehicle models as well as retrofitted in premium and mid-segment vehicles, contributing to overall market growth.

U.K. Automotive Closure Market Insight

The U.K. automotive closure market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the increasing trend of vehicle automation and consumer preference for enhanced safety. Rising awareness of keyless entry systems, coupled with the popularity of connected vehicles, is driving adoption. In addition, strong automotive manufacturing, retail infrastructure, and e-commerce availability of replacement parts are expected to further support market growth in the region.

Germany Automotive Closure Market Insight

The Germany automotive closure market is expected to expand at a considerable CAGR during the forecast period, driven by growing awareness of vehicle security, technological advancement, and eco-conscious mobility solutions. Germany’s well-established automotive industry and emphasis on innovation and quality support adoption of advanced Automotive Closures. Integration with electric and hybrid vehicles, along with preference for secure, automated closure systems in passenger and commercial vehicles, is fueling market growth.

Which Region is the Fastest Growing Region in the Automotive Closure Market?

The Asia-Pacific automotive closure market is poised to grow at the fastest CAGR of 9.5% during the forecast period of 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and rapid technological adoption in countries such as China, Japan, and India. The region’s inclination towards connected vehicles, EVs, and advanced vehicle features is driving Automotive Closure adoption. Government initiatives promoting smart transportation and local manufacturing of closure components are making advanced Automotive Closures more affordable and accessible to a wider consumer base.

Japan Automotive Closure Market Insight

The Japan automotive closure market is gaining momentum due to the country’s high-tech automotive culture, rapid urbanization, and demand for convenience and safety. Adoption is driven by the growing number of connected and electric vehicles. Integration with vehicle IoT systems, smart sensors, and automated features is accelerating market growth. Moreover, Japan’s aging population is such asly to spur demand for easier-to-use, secure closure systems in passenger and commercial vehicles.

China Automotive Closure Market Insight

The China automotive closure market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, increasing vehicle ownership, and high adoption of electric and connected vehicles. China is a leading hub for automotive manufacturing and smart vehicle component production, making Automotive Closures widely accessible and affordable. The push towards smart mobility, EV adoption, and vehicle automation are key factors propelling market growth in China across passenger, commercial, and electric vehicle segments.

Which are the Top Companies in Automotive Closure Market?

The automotive closure industry is primarily led by well-established companies, including:

- TOYOTA MOTOR CORPORATION (Japan)

- Magna International Inc. (Canada)

- Honda Motor Co., Ltd. (Japan)

- Continental AG (Germany)

- BMW AG (Germany)

- AISIN SEIKI Co., Ltd. (Japan)

- DENSO CORPORATION (Japan)

- Robert Bosch GmbH (Germany)

- Daimler AG (Germany)

- The Ford Motor Company (U.S.)

- Johnson Electric Holdings Limited (Hong Kong)

- OMRON Corporation (Japan)

- Panasonic Corporation of North America (U.S.)

- Aptiv (Ireland)

- Mitsuba Corp. (Japan)

- HELLA GmbH & Co. KGaA (Germany)

- VALEO (France)

- General Motors (U.S.)

- Volkswagen AG (Germany)

- thyssenkrupp System Engineering GmbH (Germany)

What are the Recent Developments in Global Automotive Closure Market?

- In March 2024, Continental AG announced the launch of its next-generation automated closure systems to improve vehicle efficiency and safety. The innovation integrates advanced sensor technology to enhance power closing responsiveness and employs artificial intelligence to predict user behavior for smoother operation. By optimizing aerodynamics while the vehicle is in motion, this system enhances the driving experience and boosts overall energy efficiency. This development is expected to significantly advance smart vehicle closures in the automotive market

- In September 2023, DENSO CORPORATION introduced "Everycool," an innovative cooling system aimed at improving energy efficiency and driver comfort in commercial vehicles during engine-off periods. The system efficiently cools truck cabins while the engine is inactive, reducing environmental impact and cutting power consumption by approximately 57%. This launch highlights DENSO’s commitment to enhancing driver comfort and sustainable automotive solutions

- In January 2022, Aptiv PLC entered into a definitive agreement to acquire Wind River Systems, Inc., a global leader in intelligent edge software, to leverage connected intelligent systems, strengthen software-defined mobility capabilities, and enable advanced smart vehicle architectures. This acquisition builds on a strategic collaboration formed in 2021 to develop a software toolchain for diverse automotive applications, underscoring Aptiv’s focus on innovation and intelligent vehicle systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Automotive Closure Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automotive Closure Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automotive Closure Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.