Global Automotive Connecting Rod Market

Market Size in USD Billion

CAGR :

%

USD

14.29 Billion

USD

17.82 Billion

2024

2032

USD

14.29 Billion

USD

17.82 Billion

2024

2032

| 2025 –2032 | |

| USD 14.29 Billion | |

| USD 17.82 Billion | |

|

|

|

|

Automotive Connecting Rod Market Size

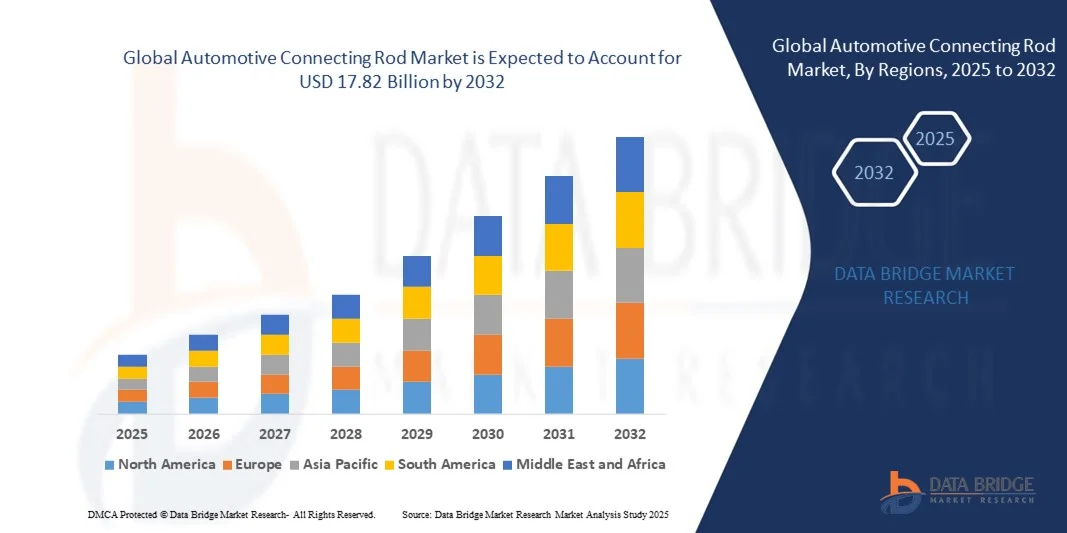

- The global automotive connecting rod market size was valued at USD 14.29 billion in 2024 and is expected to reach USD 17.82 billion by 2032, at a CAGR of 2.8% during the forecast period

- The market growth is largely fueled by the increasing production of vehicles, advancements in engine design, and the rising demand for lightweight, high-performance automotive components that enhance fuel efficiency and reduce emissions

- Furthermore, growing emphasis on precision engineering, technological advancements in forging and casting processes, and the expanding adoption of hybrid and electric vehicles are driving continuous innovation in connecting rod materials and manufacturing methods, significantly boosting market expansion

Automotive Connecting Rod Market Analysis

- Automotive connecting rods are critical engine components that connect the piston to the crankshaft, converting linear motion into rotational motion to drive the vehicle. These rods must withstand high stress, pressure, and temperature, making material strength and design precision key performance factors

- The rising demand for durable, lightweight connecting rods made from steel and aluminum alloys is driven by automakers’ focus on improving engine efficiency and meeting stringent emission norms. Increasing integration of advanced forging, casting, and powder metallurgy techniques is further transforming the market by enabling stronger, more efficient connecting rod solutions for modern combustion and hybrid engines

- Asia-Pacific dominated the automotive connecting rod market with a share of 43.5% in 2024, due to the region’s strong automobile production base, rapid industrialization, and rising demand for lightweight vehicle components

- North America is expected to be the fastest growing region in the automotive connecting rod market during the forecast period due to the region’s increasing production of high-performance vehicles and growing demand for fuel-efficient engines

- Steel segment dominated the market with a market share of 63.5% in 2024, due to its high tensile strength, durability, and cost-effectiveness. Steel connecting rods are widely preferred by OEMs for their ability to withstand high combustion pressures and temperature variations in internal combustion engines. Their long-established reliability in performance-oriented and heavy-duty vehicles further solidifies their dominance. In addition, advancements in alloy compositions and surface treatment processes have enhanced the fatigue resistance and longevity of steel rods, maintaining their leadership position in the market

Report Scope and Automotive Connecting Rod Market Segmentation

|

Attributes |

Automotive Connecting Rod Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Connecting Rod Market Trends

Rising Use of Lightweight Materials in Connecting Rods

- The automotive connecting rod market is witnessing a strong trend toward the use of lightweight materials such as aluminum alloys, titanium, and high-strength steel composites to improve engine performance and fuel efficiency. This shift from conventional forged steel rods is driven by the industry's overarching goal to reduce overall vehicle weight and enhance power-to-weight ratio

- For instance, MAHLE GmbH has introduced lightweight aluminum connecting rods that significantly reduce reciprocating mass while maintaining high fatigue strength. Similarly, CP-Carrillo is developing titanium connecting rods for high-performance and racing applications, ensuring improved engine responsiveness and durability under extreme stress conditions

- The adoption of these advanced materials contributes to lower inertia in the engine, leading to enhanced efficiency and smoother operation. As automotive manufacturers focus on meeting stringent emission regulations, lightweight connecting rods are playing a key role in achieving better fuel economy and lower carbon footprints

- In addition, technological innovations in surface coating and heat treatment processes are enabling manufacturers to improve wear resistance and extend the lifespan of lightweight connecting rods. These treatments help overcome traditional concerns regarding aluminum and titanium's lower rigidity compared to steel

- Manufacturers are collaborating closely with OEMs to develop customized connecting rod designs optimized for specific engine types such as hybrid and turbocharged units. This collaboration is strengthening the integration of lightweight materials with innovative design techniques ensuring consistent performance and reliability

- As the global automotive industry transitions toward electrification and energy-efficient combustion systems, the demand for lightweight connecting rods continues to grow. The long-term trend points toward a future where material optimization and precision manufacturing will define the next generation of connecting rod technologies for both conventional and hybrid vehicles

Automotive Connecting Rod Market Dynamics

Driver

Growing Demand for Fuel-Efficient Engines

- The continuous rise in demand for fuel-efficient vehicles is a major factor driving advancements in connecting rod design and material selection. Manufacturers are prioritizing components that minimize friction, reduce overall engine weight, and enhance combustion efficiency to meet evolving fuel economy regulations

- For instance, Thyssenkrupp AG has developed precision-forged steel connecting rods that help reduce oil film friction within the engine assembly, improving overall vehicle fuel efficiency. Similarly, companies such as Sunnen Products Company are providing honing solutions that ensure tighter dimensional tolerances, optimizing the structural balance of rods for efficient performance

- As consumers become more aware of the benefits of reduced fuel consumption, automakers are focusing on introducing engine components that enhance power output while promoting energy conservation. The connecting rod, being a critical link between pistons and crankshafts, plays a unique role in balancing strength and lightweight attributes

- The global emphasis on sustainability and reduced emissions has also encouraged manufacturers to adopt eco-efficient production techniques for connecting rods. Advances in forged and powdered metal processes are helping to achieve desired strength characteristics while minimizing waste material

- With increasing demand for engines that deliver superior mileage without compromising power, the role of connecting rods designed to optimize fuel combustion is becoming increasingly crucial. The ongoing innovation in this field is expected to continue aligning with the automotive industry's collective pursuit of higher efficiency and compliance with environmental standards

Restraint/Challenge

High Manufacturing Costs of Advanced Materials

- The use of premium lightweight materials such as titanium and high-strength aluminum alloys in connecting rods presents a major cost challenge for manufacturers. The high cost of raw materials and complex machining requirements contribute to elevated production expenses, particularly for mass-market vehicles

- For instance, the titanium connecting rods produced by Pauter Machine Engineering demonstrate superior strength-to-weight ratios but entail extensive forging, machining, and heat treatment processes that significantly increase manufacturing costs compared to conventional steel rods

- In many cases, the oxidative nature and limited recyclability of certain lightweight materials require additional surface treatments to ensure corrosion resistance, further increasing expenditures. These costs make it difficult for some automakers to adopt advanced materials on a larger scale

- The integration of precision design technologies such as CNC machining and 3D forging adds to capital investment requirements. This restrains smaller manufacturers from competing with companies that possess advanced manufacturing infrastructure and financial capabilities

- Although technological progress and automation are gradually reducing production costs, the affordability gap between traditional and high-performance connecting rods remains substantial. The challenge lies in achieving a balance between performance improvement and cost efficiency to maintain market competitiveness

- Ultimately, overcoming these cost-related barriers will depend on scaling up material innovations, improving manufacturing efficiency, and developing cost-effective production methods that allow the benefits of lightweight connecting rods to reach mainstream automotive applications

Automotive Connecting Rod Market Scope

The market is segmented on the basis of material, process type, and vehicle type.

- By Material

On the basis of material, the automotive connecting rod market is segmented into steel, aluminum, and others. The steel segment dominated the largest market revenue share of 63.5% in 2024, attributed to its high tensile strength, durability, and cost-effectiveness. Steel connecting rods are widely preferred by OEMs for their ability to withstand high combustion pressures and temperature variations in internal combustion engines. Their long-established reliability in performance-oriented and heavy-duty vehicles further solidifies their dominance. In addition, advancements in alloy compositions and surface treatment processes have enhanced the fatigue resistance and longevity of steel rods, maintaining their leadership position in the market.

The aluminum segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the growing emphasis on lightweight vehicle design and improved fuel efficiency. Aluminum connecting rods are increasingly adopted in sports and high-performance vehicles for their reduced mass, which enhances engine response and reduces overall vehicle weight. With automakers focusing on meeting stringent emission standards, the use of aluminum in engine components supports better thermal conductivity and energy efficiency. Moreover, innovations in manufacturing processes, such as precision forging and heat treatment, are improving the strength-to-weight ratio of aluminum rods, fueling their rapid adoption.

- By Process Type

On the basis of process type, the market is segmented into forged, cast rods, and powder metals. The forged segment accounted for the largest market share in 2024, driven by its superior mechanical properties and high fatigue strength. Forged connecting rods offer excellent resistance to impact and stress, making them suitable for heavy-duty and high-performance engines. Automakers prefer forging due to the enhanced grain structure and durability it provides, which ensures longer service life even under extreme operating conditions. The increasing demand for reliable and performance-oriented components across both passenger and commercial vehicles further boosts the dominance of the forged segment.

The powder metals segment is projected to grow at the fastest CAGR during 2025–2032, propelled by technological advancements in powder metallurgy that enable high precision and material efficiency. Powder metal connecting rods are gaining traction for their lightweight structure, cost savings in production, and consistency in dimensional accuracy. The ability to customize compositions and reduce machining needs makes them ideal for mass production. In addition, their environmental advantage—stemming from minimal material wastage—aligns with the automotive industry's sustainability goals, encouraging wider adoption in the coming years.

- By Vehicle Type

Based on vehicle type, the market is segmented into passenger cars and commercial vehicles. The passenger cars segment dominated the largest market revenue share in 2024 due to the high production volumes and rising consumer demand for fuel-efficient and lightweight vehicles. The integration of advanced connecting rods designed to enhance engine performance and reduce vibration supports the popularity of this segment. Growth in electric and hybrid passenger cars also drives demand for connecting rods with optimized weight and strength characteristics. The continuous evolution of small, high-output engines in passenger cars sustains strong demand for durable connecting rod materials and designs.

The commercial vehicles segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the expanding logistics, transportation, and construction industries worldwide. Commercial vehicles require robust and heavy-duty connecting rods capable of handling extended operational hours and high torque loads. As fleet operators increasingly prioritize engine efficiency and reduced maintenance costs, manufacturers are developing enhanced forged and composite connecting rods to meet these needs. In addition, the adoption of advanced diesel and alternative-fuel engines in commercial fleets further accelerates the growth of this segment.

Automotive Connecting Rod Market Regional Analysis

- Asia-Pacific dominated the automotive connecting rod market with the largest revenue share of 43.5% in 2024, driven by the region’s strong automobile production base, rapid industrialization, and rising demand for lightweight vehicle components

- The growing presence of major automotive OEMs and favorable government initiatives promoting electric and fuel-efficient vehicles further support market expansion

- Increasing investments in manufacturing infrastructure, coupled with technological advancements in metal forging and casting, are accelerating market growth across the region

China Automotive Connecting Rod Market Insight

China held the largest share in the Asia-Pacific automotive connecting rod market in 2024, supported by its position as the world’s largest automobile producer and exporter. The country’s well-established automotive supply chain, extensive use of steel and aluminum alloys, and continuous innovation in engine component design are key growth drivers. Growing domestic demand for passenger and commercial vehicles, alongside strong government support for local manufacturing and electric mobility, reinforces China’s market dominance.

India Automotive Connecting Rod Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising vehicle production, expanding commercial fleet operations, and government programs encouraging domestic manufacturing. The Make in India initiative and increasing investments in automotive R&D are enhancing the country’s capability to produce high-performance, lightweight connecting rods. In addition, rapid urbanization, growing disposable incomes, and demand for fuel-efficient vehicles are boosting the adoption of advanced connecting rod technologies.

Europe Automotive Connecting Rod Market Insight

The Europe automotive connecting rod market is growing steadily, driven by the region’s emphasis on emission reduction, lightweight engine design, and high-quality manufacturing standards. Automakers in Europe are increasingly adopting advanced materials such as aluminum and powder metals to enhance efficiency and reduce CO₂ emissions. Strict regulatory standards, coupled with the strong presence of luxury and performance car manufacturers, are shaping continuous innovation in connecting rod production across the continent.

Germany Automotive Connecting Rod Market Insight

Germany leads the European market owing to its robust automotive engineering capabilities and advanced manufacturing infrastructure. The country’s focus on precision forging, high-performance alloys, and hybrid engine technology strengthens its market position. Strong R&D activities, partnerships between OEMs and suppliers, and growing demand for high-efficiency internal combustion engines in premium vehicles contribute significantly to Germany’s market dominance.

U.K. Automotive Connecting Rod Market Insight

The U.K. market is supported by its growing focus on sustainable mobility, engine innovation, and expanding local automotive supply chain post-Brexit. Increasing investments in lightweight material development and hybrid vehicle components are driving demand for advanced connecting rods. The country’s engineering excellence, combined with collaborative research between industry and academia, continues to foster innovation and strengthen its role in Europe’s automotive component landscape.

North America Automotive Connecting Rod Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by the region’s increasing production of high-performance vehicles and growing demand for fuel-efficient engines. Continuous advancements in forging and powder metallurgy technologies are enhancing product quality and design efficiency. The presence of major automotive manufacturers, strong focus on sustainability, and adoption of hybrid and alternative-fuel vehicles further propel market expansion.

U.S. Automotive Connecting Rod Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its strong automotive sector, extensive R&D ecosystem, and high adoption of advanced materials. The country’s leadership in developing lightweight and high-strength engine components supports its competitive edge. In addition, increasing production of electric and hybrid vehicles, coupled with steady replacement demand for internal combustion engines, ensures sustained growth of the connecting rod market in the U.S.

Automotive Connecting Rod Market Share

The automotive connecting rod industry is primarily led by well-established companies, including:

- Tianrun Crankshaft Co., Ltd. (China)

- Arrow Precision Ltd. (U.K.)

- Albon Engineering & Manufacturing plc. (U.K.)

- JD Norman Industries (U.S.)

- CP Carrillo. (U.S.)

- Wossner Pistons (Germany)

- Wiseco Piston Company Inc. (U.S.)

- Pauter Machine Co. (U.S.)

- POWER INDUSTRIES. (U.S.)

- Mahle GmbH (Germany)

- Cummins Inc. (U.S.)

- Honda Motor Co. Ltd. (Japan)

- Dover Corporation (U.S.)

- IT Forging (Thailand) Co. Ltd. (Thailand)

- Linamar (Canada)

- YASUNAGA CORPORATION. (Japan)

Latest Developments in Global Automotive Connecting Rod Market

- In April 2024, Linamar Corporation integrated advanced forging techniques into its manufacturing operations to produce lighter and stronger automotive connecting rods. This development enhances product durability and performance while supporting the industry’s transition toward fuel-efficient and electric vehicles. The company’s focus on forging innovation positions it to cater to OEMs seeking high-strength components that reduce engine weight and improve efficiency, thereby strengthening Linamar’s competitive stance in the global connecting rod market

- In March 2024, Linamar Corporation expanded its production capabilities for high-performance automotive components, including connecting rods, to meet rising demand from electric and hybrid vehicle manufacturers. This strategic move reinforces the company’s ability to deliver durable and precision-engineered parts tailored for next-generation powertrains. The expansion underscores Linamar’s commitment to innovation and its proactive adaptation to evolving automotive trends favoring lightweight and sustainable engine components

- In March 2024, MGP Connecting Rods collaborated with a major automotive manufacturer to design and develop custom connecting rods for electric vehicles. This partnership highlights the growing need for specialized components optimized for EV performance and efficiency. By co-developing tailored solutions, MGP is strengthening its position in the emerging electric vehicle components market and demonstrating its engineering expertise in advanced connecting rod technologies

- In March 2024, MGP Connecting Rods also announced the launch of a new lightweight connecting rod designed for high-performance applications. This product introduction supports the company’s strategic goal to provide enhanced engine performance through weight reduction and improved strength. The new design targets both motorsport and premium automotive segments, aligning with market trends emphasizing power optimization and mechanical efficiency

- In February 2024, Pauter Machine Co. unveiled a new series of titanium connecting rods aimed at motorsports applications, combining superior strength with reduced mass. This innovation addresses the performance demands of high-speed racing engines and underscores the company’s focus on precision engineering. The introduction of titanium rods enhances Pauter’s product portfolio and solidifies its reputation as a key supplier in the high-performance automotive components sector.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.