Global Automotive Crankshaft Market

Market Size in USD Billion

CAGR :

%

USD

5.90 Billion

USD

8.19 Billion

2024

2032

USD

5.90 Billion

USD

8.19 Billion

2024

2032

| 2025 –2032 | |

| USD 5.90 Billion | |

| USD 8.19 Billion | |

|

|

|

|

Automotive Crankshaft Market Size

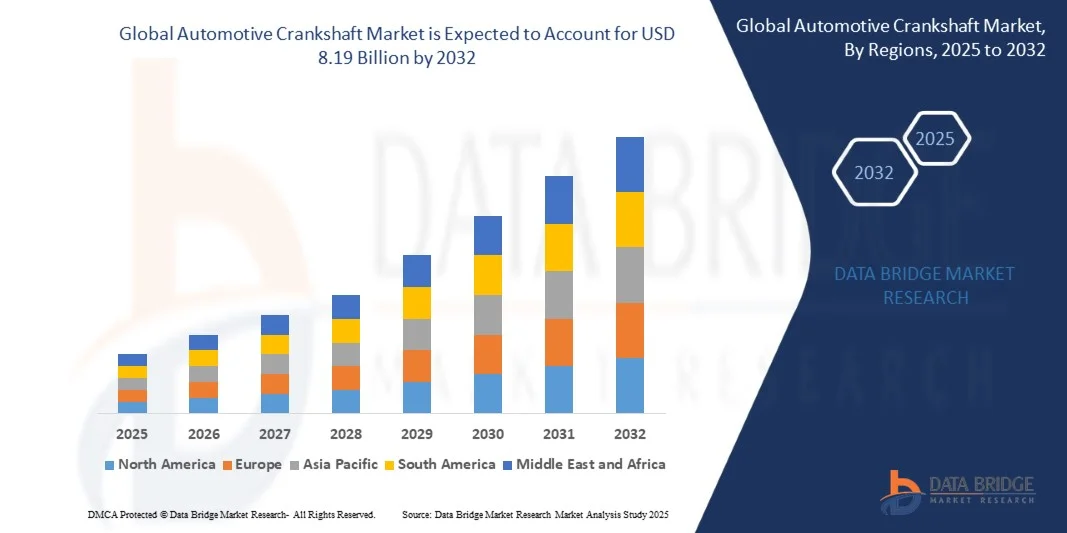

- The global Automotive Crankshaft Market size was valued at USD 5.90 billion in 2024 and is projected to reach USD 8.19 billion by 2032, growing at a CAGR of 4.20% during the forecast period.

- Market expansion is being driven by rising vehicle production, the increasing popularity of high-performance and fuel-efficient engines, and advancements in forging and casting technologies for crankshaft manufacturing.

- Additionally, growing demand for lightweight, durable crankshafts in hybrid and electric vehicles is encouraging innovation across OEMs and suppliers. These trends are collectively propelling the market forward, ensuring sustained long-term growth.

Automotive Crankshaft Market Analysis

- Automotive crankshafts, essential components responsible for converting linear piston motion into rotational motion, are critical to internal combustion engine performance across both passenger and commercial vehicles, with rising demand due to increasing engine efficiency requirements and vehicle production.

- The growing demand for automotive crankshafts is primarily driven by expanding automotive manufacturing in emerging markets, the push for fuel-efficient engines, and technological advancements in material strength and precision engineering.

- Asia Pacific dominated the Global Automotive Crankshaft Market with the largest revenue share of 31.2% in 2024, supported by a strong automotive aftermarket, robust presence of major automakers, and continued investment in engine innovation and performance enhancement, especially in the U.S. where high-performance and hybrid vehicles are gaining popularity.

- North America is expected to be the fastest growing region in the Global Automotive Crankshaft Market during the forecast period due to rapid industrialization, growing vehicle ownership, and the expansion of local manufacturing hubs in countries such as China, India, and South Korea.

- The magnetic sensor segment dominated the market with the largest revenue share of approximately 38.5% in 2024. Magnetic sensors are widely preferred due to their robustness, high accuracy in harsh automotive environments, and cost-effectiveness.

Report Scope and Automotive Crankshaft Market Segmentation

|

Attributes |

Automotive Crankshaft Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Crankshaft Market Trends

“Advanced Manufacturing and Material Technologies Reshaping Crankshaft Design”

- A significant and accelerating trend in the global Automotive Crankshaft Market is the widespread adoption of advanced manufacturing techniques and high-performance materials, leading to stronger, lighter, and more durable crankshafts. Technologies such as precision forging, isothermal die forging, and 3D modeling are transforming traditional production processes, resulting in components with enhanced fatigue resistance and dimensional accuracy.

- For instance, companies such as Bharat Forge and Thyssenkrupp AG are investing in next-generation forging lines that offer improved consistency and microstructure control, allowing for the production of crankshafts that meet the demanding performance requirements of modern combustion engines and hybrid systems.

- The incorporation of lightweight materials such as micro-alloyed steel and, in some high-performance applications, titanium alloys, is enabling significant weight reduction without compromising structural integrity. This directly contributes to fuel efficiency and lower emissions—key priorities for automotive OEMs worldwide.

- Moreover, advanced CNC machining and non-destructive testing technologies are improving crankshaft precision and reliability. Companies like American Axle & Manufacturing (AAM) are leveraging automated quality control systems to detect micro-cracks and stress points early in the manufacturing process, enhancing engine safety and longevity.

- The increasing shift towards hybrid and electric vehicles is also influencing crankshaft development. While fully electric powertrains do not require crankshafts, many hybrid engines still do. As a result, suppliers are developing hybrid-optimized crankshafts that meet the compact and high-efficiency demands of electrified powertrains.

- This trend toward more advanced, lightweight, and high-precision crankshaft solutions is redefining industry standards and expectations. The market is seeing growing demand from OEMs seeking components that support performance, regulatory compliance, and cost-efficiency in next-gen vehicle platforms across both developed and emerging markets.

Automotive Crankshaft Market Dynamics

Driver

“Growing Demand Driven by Increasing Automotive Production and Emission Regulations”

- The rising global automotive production, particularly in emerging markets, alongside stringent emission and fuel efficiency regulations, is a significant driver boosting demand for advanced automotive crankshafts. As manufacturers focus on improving engine performance and reducing weight, crankshaft innovation becomes critical.

- For instance, governments in regions such as Asia-Pacific and Europe continue to enforce stricter emission norms such as Euro 7 and China 6 standards, compelling OEMs to adopt lightweight, high-strength crankshafts to enhance engine efficiency and lower emissions.

- Increasing production of passenger vehicles, commercial vehicles, and the gradual rise of hybrid powertrains also contribute to the growing market for crankshafts designed to meet diverse performance requirements.

- Furthermore, the expansion of the automotive industry in countries like India, China, and Brazil, supported by urbanization and rising disposable incomes, is fueling demand for durable and precision-engineered crankshafts.

- The focus on fuel economy, engine downsizing, and the use of advanced materials and manufacturing techniques such as forging and machining are key factors driving market growth. OEMs and suppliers are investing heavily in research and development to produce crankshafts that can withstand higher loads while reducing weight.

Restraint/Challenge

“Material Costs and Manufacturing Complexity Limit Market Growth”

- High costs associated with premium raw materials such as alloy steels and titanium, coupled with the complexity of advanced manufacturing processes, pose significant challenges to the automotive crankshaft market. These factors increase production expenses, impacting the overall cost of vehicles.

- For Instance, the fluctuating prices of steel and rare metals can disrupt supply chains and increase crankshaft manufacturing costs, making it difficult for manufacturers to maintain competitive pricing.

- Additionally, precision forging, CNC machining, and rigorous quality control add complexity and time to production cycles, sometimes limiting scalability for smaller manufacturers.

- The demand for lightweight yet highly durable crankshafts necessitates advanced materials and sophisticated fabrication techniques, which can require substantial capital investment and technical expertise.

- While innovations in manufacturing efficiency and alternative materials are gradually reducing costs, the perceived expense remains a barrier, particularly for entry-level and mid-segment vehicles in developing markets.

- Overcoming these challenges will require continued advances in cost-effective materials, process automation, and supply chain optimization to enable broader market penetration and support sustainable growth.

Automotive Crankshaft Market Scope

The market is segmented on the basis of sensor type, application, Vehicle Type, distribution channel.

• By Sensor Type

On the basis of sensor type, the Global Automotive Crankshaft Market is segmented into magnetic sensor, hall effect sensor, variable reluctance sensor, and optical sensor. The magnetic sensor segment dominated the market with the largest revenue share of approximately 38.5% in 2024. Magnetic sensors are widely preferred due to their robustness, high accuracy in harsh automotive environments, and cost-effectiveness. These sensors provide reliable detection of crankshaft position and speed, essential for engine control units (ECUs).

The hall effect sensor segment is expected to witness the fastest growth rate of 22.4% from 2025 to 2032, driven by increasing adoption in advanced engine management systems and electric vehicles. Hall effect sensors offer high precision and immunity to environmental interference, making them ideal for modern automotive applications that require real-time feedback and improved fuel efficiency.

• By Application

On the basis of application, the Global Automotive Crankshaft Market is segmented into engine timing, speed detection, and position detection. The engine timing segment held the largest market revenue share of 45.7% in 2024, as precise crankshaft timing is critical for optimal combustion efficiency, emissions control, and engine performance. Accurate engine timing sensors ensure proper synchronization of fuel injection and ignition systems, which is vital for meeting stringent emission regulations globally.

Speed detection is anticipated to be the fastest growing segment with a CAGR of 20.9% from 2025 to 2032, driven by the increasing integration of advanced driver-assistance systems (ADAS) and electronic stability control, both of which require accurate speed sensing for improved vehicle safety and control.

• By Vehicle Type

On the basis of vehicle type, the Global Automotive Crankshaft Market is segmented into passenger vehicles, commercial vehicles, and two-wheelers. The passenger vehicle segment dominated the market with a revenue share of 52.3% in 2024, attributed to the large global production and sales volume of cars, SUVs, and light-duty vehicles. Increasing consumer demand for fuel-efficient and low-emission passenger vehicles is propelling innovations in crankshaft design and sensor technologies.

The commercial vehicles segment is expected to witness the fastest CAGR of 18.6% during the forecast period, supported by the expansion of logistics, transportation, and construction sectors globally. Heavy-duty commercial vehicles require durable and high-performance crankshafts that can withstand rigorous operating conditions, further driving market growth.

• By Distribution Channel

On the basis of distribution channel, the Global Automotive Crankshaft Market is segmented into OEM and aftermarket. The OEM segment accounted for the largest market revenue share of 57.8% in 2024, driven by the strong demand from vehicle manufacturers for high-quality, integrated crankshaft solutions designed to meet original equipment specifications and stringent regulatory standards.

The aftermarket segment is projected to register the fastest growth rate of 19.7% from 2025 to 2032, fueled by increasing vehicle age, rising maintenance needs, and growing consumer preference for cost-effective replacement parts. Aftermarket crankshafts are often chosen for repairs and upgrades, especially in regions with a large fleet of aging vehicles, supporting steady market expansion.

Automotive Crankshaft Market Regional Analysis

- Asia-Pacific dominated the Global Automotive Crankshaft Market with the largest revenue share of 31.2% in 2024, driven by strong automotive manufacturing activities and advanced technological adoption in engine components.

- The region benefits from a well-established automotive industry, high demand for fuel-efficient and high-performance vehicles, and stringent emission regulations pushing for innovative crankshaft designs and materials.

- Additionally, significant investments by key OEMs and suppliers in research and development, coupled with robust infrastructure and skilled workforce, support the production of advanced crankshafts. The U.S. market, in particular, experiences steady growth due to rising passenger vehicle production and the gradual adoption of hybrid powertrains.

U.S. Automotive Crankshaft Market Insight

The U.S. automotive crankshaft market captured the largest revenue share of 81% in North America in 2024, driven by a robust automotive manufacturing sector and increasing demand for high-performance, fuel-efficient engines. The country’s strong emphasis on emission regulations and engine optimization is accelerating the adoption of advanced crankshaft technologies. Furthermore, the rise in hybrid and turbocharged engine production is boosting demand for lightweight, durable crankshafts. The presence of key OEMs and aftermarket suppliers, combined with technological advancements in manufacturing processes, supports sustained market growth.

Europe Automotive Crankshaft Market Insight

The Europe automotive crankshaft market is projected to expand at a substantial CAGR throughout the forecast period, fueled by stringent emission norms such as Euro 7 and rising investments in clean engine technologies. The region’s automotive industry is focused on enhancing engine efficiency and durability, driving the demand for advanced crankshaft designs. Increasing production of electric and hybrid vehicles, coupled with growing urbanization and industrialization, is further promoting crankshaft market growth across Germany, France, and Italy. OEMs’ preference for precision-engineered components to meet environmental standards continues to be a major growth driver.

U.K. Automotive Crankshaft Market Insight

The U.K. automotive crankshaft market is expected to grow at a noteworthy CAGR during the forecast period, supported by the country’s strong automotive manufacturing base and innovation in engine technologies. The push towards electrification and hybrid vehicle adoption is creating opportunities for advanced crankshaft solutions tailored for next-generation powertrains. The U.K.’s focus on reducing carbon emissions and improving fuel economy is stimulating demand for lightweight, high-performance crankshafts in both passenger and commercial vehicles.

Germany Automotive Crankshaft Market Insight

The Germany automotive crankshaft market is anticipated to expand at a considerable CAGR during the forecast period, driven by the country’s leadership in automotive engineering and precision manufacturing. Germany’s stringent emission regulations and commitment to sustainability are encouraging OEMs to invest in crankshaft innovations that enhance engine efficiency and durability. The presence of major automotive OEMs and suppliers promotes continuous development of advanced materials and manufacturing technologies, with increasing integration in both internal combustion and hybrid engines.

Asia-Pacific Automotive Crankshaft Market Insight

The Asia-Pacific automotive crankshaft market is poised to grow at the fastest CAGR of 24% during the forecast period, propelled by rapid urbanization, rising disposable incomes, and expanding automotive production in countries like China, India, and Japan. The region is witnessing growing demand for fuel-efficient and lightweight crankshafts, supported by government initiatives focused on emission reduction and sustainable transportation. Asia-Pacific’s role as a manufacturing hub for automotive components also lowers production costs and improves accessibility, driving market expansion in passenger vehicles, commercial vehicles, and two-wheelers.

Japan Automotive Crankshaft Market Insight

The Japan automotive crankshaft market is gaining momentum due to the country’s technological innovation, stringent emission standards, and strong automotive sector. The demand for compact, lightweight, and durable crankshafts is increasing, especially with the rise of hybrid and fuel-efficient vehicles. Integration of advanced sensor technologies for enhanced engine management is also propelling growth. Japan’s focus on precision engineering and quality manufacturing continues to drive the development of next-generation crankshaft components tailored for evolving powertrains

China Automotive Crankshaft Market Insight

The China automotive crankshaft market accounted for the largest revenue share in Asia-Pacific in 2024, supported by the country’s booming automotive industry and rapid urbanization. China’s expanding middle class and increasing vehicle ownership are fueling demand for efficient and durable crankshafts across passenger, commercial, and electric vehicles. Government policies encouraging emission reductions and electric vehicle adoption are pushing OEMs to innovate crankshaft designs. Additionally, strong domestic manufacturing capabilities and competitive pricing contribute to China’s leading position in the regional crankshaft market.

Global Automotive Crankshaft Market Share

The Automotive Crankshaft industry is primarily led by well-established companies, including:

- Thyssenkrupp AG (Germany)

- Mahle Group (Germany)

- Bharat Forge Limited (India)

- Nippon Steel Integrated Crankshaft LLC (Japan/U.S.)

- Hitachi Metals, Ltd. (Japan)

- American Axle & Manufacturing (AAM) (U.S.)

- Sichuan Goldstone Orient New Material Co., Ltd. (China)

- Maschinenfabrik Alfing Kessler GmbH (MAF) (Germany)

- Safran S.A. (France)

- Trelleborg Sealing Solutions (Sweden)

- Cummins Inc. (U.S.)

- Arrow Precision Ltd. (U.K.)

- Callies Performance Products (U.S.)

- SCAT Enterprises (U.S.)

- KingTec Racing (China)

- Shandong Wina Industrial Co., Ltd. (China)

- Happy Forgings Ltd. (India)

- Kalyani Techno Forge Ltd. (India)

- Sansera Engineering Limited (India)

- Fukoku India Pvt Ltd. (India)

What are the Recent Developments in Global Automotive Crankshaft Market?

- In April 2023, Thyssenkrupp AG, a global leader in automotive components, announced a major investment to expand its crankshaft manufacturing capacity in Germany. This initiative aims to meet the rising demand for lightweight and high-performance crankshafts driven by stricter emission standards and the growing shift towards hybrid powertrains. By leveraging advanced forging and machining technologies, Thyssenkrupp is enhancing its production efficiency and product quality, reinforcing its position in the competitive global automotive crankshaft market.

- In March 2023, Bharat Forge Limited, one of India’s leading automotive component manufacturers, launched a new line of forged crankshafts tailored for electric and hybrid vehicles. The innovative crankshafts are engineered to withstand high torque loads and offer superior durability, addressing the evolving needs of the automotive industry. This product introduction reflects Bharat Forge’s commitment to innovation and sustainability, supporting the rapid electrification trend in emerging markets.

- In March 2023, American Axle & Manufacturing (AAM) successfully secured a multi-year contract with a major U.S. OEM to supply advanced crankshafts for next-generation internal combustion engines. This collaboration underscores AAM’s expertise in precision manufacturing and its ability to deliver high-quality components that improve engine efficiency and performance. The contract highlights the sustained importance of optimized crankshafts in improving fuel economy and reducing emissions amid the transition to hybrid vehicles.

- In February 2023, Mahle Group, a global supplier of automotive systems, announced a strategic partnership with a leading automotive manufacturer in Europe to co-develop lightweight crankshafts utilizing novel materials and manufacturing processes. This initiative is aimed at reducing engine weight while maintaining structural integrity, helping OEMs meet increasingly stringent environmental regulations. The partnership reflects Mahle’s focus on innovation and sustainability within the global automotive crankshaft market.

- In January 2023, Hitachi Metals, Ltd., a key player in advanced automotive materials, introduced a new line of high-strength crankshafts designed for commercial vehicles. Showcased at a major automotive industry event, these crankshafts feature enhanced fatigue resistance and wear performance, meeting the rigorous demands of heavy-duty engines. Hitachi’s product launch emphasizes its commitment to supporting the growing commercial vehicle segment with durable, high-performance engine components.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.