Global Automotive Data Logger Market

Market Size in USD Billion

CAGR :

%

USD

4.33 Billion

USD

7.50 Billion

2025

2033

USD

4.33 Billion

USD

7.50 Billion

2025

2033

| 2026 –2033 | |

| USD 4.33 Billion | |

| USD 7.50 Billion | |

|

|

|

|

Automotive Data Logger Market Size

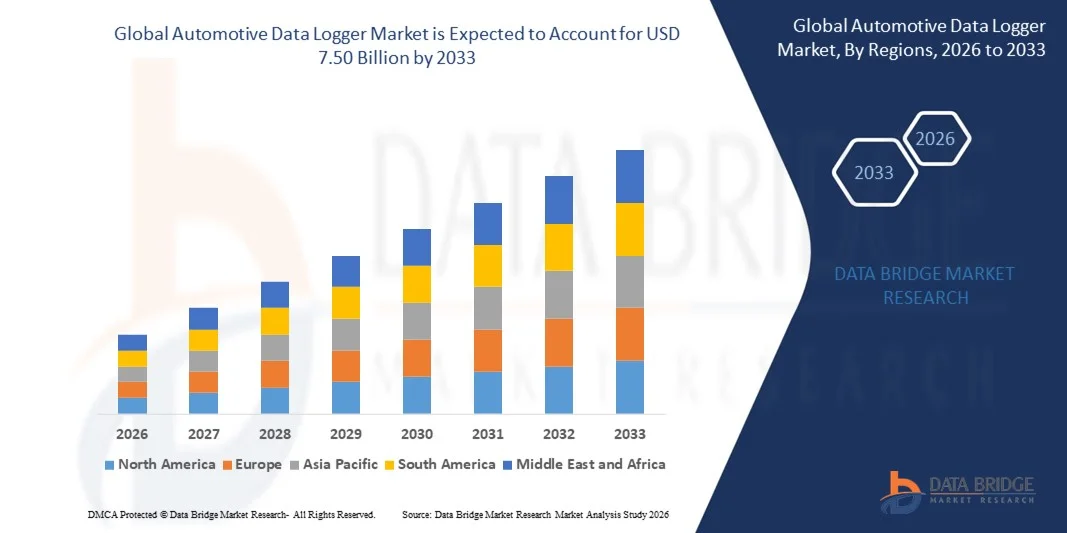

- The global automotive data logger market size was valued at USD 4.33 billion in 2025 and is expected to reach USD 7.50 billion by 2033, at a CAGR of 7.10% during the forecast period

- The market growth is largely fueled by the increasing integration of advanced electronics, telematics, and connectivity features in modern vehicles, which is driving the need for efficient data acquisition, monitoring, and diagnostics across automotive systems in real time

- Furthermore, the rising adoption of ADAS, autonomous driving prototypes, and electrification is elevating the demand for high-precision data logging tools, as automakers and suppliers require accurate performance insights to validate software, ensure safety, and streamline vehicle development cycles

Automotive Data Logger Market Analysis

- Automotive data loggers, used for capturing, recording, and analyzing vehicle data from sensors, ECUs, and communication networks, are rapidly becoming essential across vehicle testing, performance optimization, emissions monitoring, and regulatory compliance environments due to their ability to deliver high-speed insights and support complex automotive architectures

- The growing demand for automotive data loggers is primarily propelled by the expanding need for vehicle validation, the surge in connected and electric vehicle development, and the industry’s increasing reliance on data-driven decision-making to enhance reliability, safety, and operational efficiency

- North America dominated the automotive data logger market with a share of over 44% in 2025, due to strong adoption of advanced vehicle testing technologies and high investment in connected and autonomous vehicle development

- Asia-Pacific is expected to be the fastest growing region in the automotive data logger market during the forecast period due to rapid automotive production, increasing EV penetration, and strong technological advancements in countries such as China, Japan, South Korea, and India

- Hardware segment dominated the market with a market share of 69.4% in 2025, due to its critical role in capturing high-precision vehicle data across powertrain, ADAS, infotainment, and electrical systems. Automakers rely on advanced hardware modules that support multi-channel inputs, high-speed interfaces, and ruggedized designs suited for harsh automotive environments. Hardware-based loggers ensure real-time data acquisition essential for homologation, durability testing, and ECU validation workflows. Their widespread adoption in pre-production and prototype testing accelerates their dominance. Strong demand from OEM testing labs and engineering centers continues to support this segment’s leadership

Report Scope and Automotive Data Logger Market Segmentation

|

Attributes |

Automotive Data Logger Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Data Logger Market Trends

Increasing Use of Data Loggers in EV and Autonomous Vehicle Testing

- A significant trend in the automotive data logger market is the rising use of high-precision logging systems to support electric vehicle development and autonomous driving validation, driven by the growing complexity of vehicle electronics and the need for accurate performance insights. This trend is strengthening the role of data loggers as essential tools for capturing multi-channel data across sensors, ECUs, and communication networks during advanced testing cycles

- For instance, companies such as Continental AG and Vector Informatik provide automotive-grade data logging platforms that enable high-speed data acquisition and seamless integration with ADAS and EV architectures. These systems support real-time debugging and validation workflows for automakers developing next-generation vehicle technologies

- The adoption of data loggers in software-defined vehicles is accelerating as automakers rely on continuous data streams to refine algorithms, optimize control functions, and secure compliance with evolving safety standards. This is positioning data logging solutions as core enablers for future mobility development

- Growing EV adoption is further expanding the need for thermal, battery, and powertrain-specific data logging capabilities, strengthening the market’s shift toward more specialized and scalable solutions that meet diverse testing environments

- The integration of data logging with cloud connectivity is advancing continuous monitoring and remote diagnostics, enabling faster decision-making and reducing vehicle development timelines

- This trend continues to propel innovation as vehicle manufacturers and suppliers place greater emphasis on accurate data capture, real-time analysis, and robust system validation to support intelligent mobility ecosystems

Automotive Data Logger Market Dynamics

Driver

Rising Need for Real-Time Vehicle Diagnostics

- The automotive data logger market is driven by the growing requirement for real-time diagnostics to maintain vehicle reliability, optimize performance, and ensure efficient system validation across modern automotive architectures. Real-time insights allow engineers to identify faults quickly, accelerate development cycles, and improve overall system robustness

- For instance, companies such as Aptiv and National Instruments offer advanced diagnostic-oriented data loggers capable of capturing high-resolution signals from multiple automotive networks. These tools support rapid troubleshooting and help manufacturers meet stringent efficiency, safety, and emissions requirements

- The expansion of connected and software-defined vehicles is intensifying the need for continuous data visibility, driving demand for robust logging solutions that enhance operational transparency

- The push for predictive maintenance systems is elevating demand for data-driven insights, further supporting the use of automotive data loggers across commercial fleets and OEM testing environments

- Growing regulatory pressure for compliance-ready testing reinforces this driver as data loggers play a vital role in ensuring accuracy and traceability during certification processes

Restraint/Challenge

High Cost of Advanced Data Logging Systems

- The automotive data logger market faces challenges due to the high cost associated with deploying advanced multi-channel logging systems, which require sophisticated hardware, powerful processors, and specialized software to handle large volumes of vehicle data. These cost burdens limit adoption among smaller manufacturers and independent testing facilities

- For instance, premium data logging platforms from companies such as IPETRONIK and Dewesoft involve high-precision components and complex integration capabilities, resulting in elevated hardware and software expenses for end users

- The increasing requirement for high-speed interfaces, edge processing, and multi-network compatibility adds additional cost layers, making system customization and scalability financially demanding

- Manufacturers also face challenges with calibration, maintenance, and continuous software updates, which further increase ownership costs over time. As vehicle systems become more complex, the need for specialized personnel to manage and interpret logged data raises operational expenses for OEMs and testing centers

- This challenge continues to impact market penetration, compelling vendors to innovate toward cost-efficient, modular, and scalable data logging solutions to broaden adoption across the automotive ecosystem

Automotive Data Logger Market Scope

The market is segmented on the basis of component, connection, application, channels, and end market.

- By Component

On the basis of component, the automotive data logger market is segmented into hardware and software. The hardware segment dominated the market with the largest revenue share of 69.4% in 2025 due to its critical role in capturing high-precision vehicle data across powertrain, ADAS, infotainment, and electrical systems. Automakers rely on advanced hardware modules that support multi-channel inputs, high-speed interfaces, and ruggedized designs suited for harsh automotive environments. Hardware-based loggers ensure real-time data acquisition essential for homologation, durability testing, and ECU validation workflows. Their widespread adoption in pre-production and prototype testing accelerates their dominance. Strong demand from OEM testing labs and engineering centers continues to support this segment’s leadership.

The software segment is expected to witness the fastest growth rate from 2026 to 2033 driven by the increasing integration of analytics, cloud compatibility, and automated test workflows. Software platforms enable efficient processing, visualization, and analysis of large vehicle datasets, reducing testing timelines for OEMs and tier-1 suppliers. Growing adoption of over-the-air diagnostics, remote accessibility, and AI-based data interpretation tools further elevates demand. As modern vehicles generate exponentially higher data volumes due to ADAS and autonomous systems, software-centric solutions are becoming indispensable. The shift toward software-defined vehicles strengthens this segment’s future growth trajectory.

- By Connection

On the basis of connection type, the automotive data logger market is segmented into SD card, USB, and Bluetooth/Wi-Fi. The SD card segment dominated the market with the largest share in 2025 due to its cost-effectiveness, high portability, and reliability in capturing long-duration datasets during road tests and endurance evaluations. Engineers prefer SD card-based logging for its ability to handle large files without requiring continuous connectivity and for its strong compatibility with existing in-vehicle testing setups. The ease of extraction and quick transfer of data for post-analysis also supports widespread adoption in fleet and regulatory testing. Its durability and stable performance under variable driving conditions strengthen its position.

The Bluetooth/Wi-Fi segment is projected to witness the fastest growth from 2026 to 2033 due to the growing need for real-time wireless data transfer and remote diagnostics. This segment benefits from rising deployment of connected testing environments where data must be streamed live to cloud platforms or engineering dashboards. Wireless connectivity simplifies logger installation, reduces manual intervention, and enables instant feedback during ADAS, emissions, and calibration tests. As automotive R&D shifts toward digital validation ecosystems, Bluetooth/Wi-Fi-based loggers offer enhanced convenience and improved operational efficiency. This transition supports their rapid market expansion.

- By Application

On the basis of application, the automotive data logger market is segmented into pre-sales and post-sales. The pre-sales segment dominated the market in 2025 owing to extensive use of data loggers during prototype development, performance benchmarking, and regulatory validation. OEMs depend heavily on precise real-time data to evaluate vehicle durability, emissions compliance, and ADAS performance under varying conditions. The need for thorough testing before market launch requires sophisticated logger systems that support multiple communication bus interfaces. The pre-sales phase involves long test cycles, enhancing demand for high-capacity, ruggedized data logging solutions. This segment continues to lead due to its critical role in vehicle development programs.

The post-sales segment is expected to grow at the fastest rate from 2026 to 2033 due to increasing emphasis on predictive maintenance, warranty analytics, and service diagnostics. Data loggers are widely adopted in dealership networks, service centers, and fleet monitoring systems to identify faults quickly and reduce vehicle downtime. Growing complexity of modern electric and autonomous vehicle systems increases the need for continuous health monitoring and remote diagnostics. Post-sales data logging supports proactive issue detection that reduces maintenance costs for OEMs and customers. These advantages support strong future market growth in the segment.

- By Channels

On the basis of channels, the market is segmented into CAN and CAN FD, LIN, FlexRay, and Ethernet. The CAN and CAN FD segment dominated the market with the largest share in 2025 due to its long-standing adoption as the primary communication backbone of automotive electronics. CAN-based logging ensures precise monitoring of ECU messages, diagnostics, and network performance in combustion, hybrid, and electric vehicles. Its reliability, cost-efficiency, and compatibility with almost all testing platforms strengthen its dominance. CAN FD’s high bandwidth further supports the growing volume of data generated by advanced automotive systems. This segment remains essential for validation workflows across OEMs and testing agencies.

The Ethernet segment is anticipated to register the fastest growth from 2026 to 2033 driven by rising adoption of high-speed data networks in ADAS and autonomous vehicles. Ethernet enables gigabit-level bandwidth essential for capturing camera, radar, LiDAR, and sensor-fusion data used in automated driving systems. Its scalability and real-time capabilities make it ideal for complex vehicle architectures evolving toward software-defined models. Engineers prefer Ethernet-based logging for its ability to support high-volume data streams without performance loss. As autonomous testing expands globally, the demand for Ethernet loggers accelerates significantly.

- By End Market

On the basis of end market, the automotive data logger market is segmented into OEMs, service stations, and regulatory bodies. The OEM segment dominated the market in 2025 due to extensive use of data loggers during research, testing, validation, and prototype development across all vehicle classes. Automakers rely on high-quality logging systems for chassis testing, emissions evaluation, ADAS calibration, and EV battery performance assessment. The presence of large-scale test facilities and continuous vehicle innovation maintains strong demand from OEMs. Their requirement for multi-channel, high-speed, and ruggedized loggers ensures dominance of this segment.

The regulatory bodies segment is projected to grow at the fastest pace from 2026 to 2033 due to rising global emphasis on safety, emission standards, and compliance testing. Agencies use data loggers to monitor real-world driving emissions, verify homologation parameters, and evaluate ADAS performance under standardized protocols. Increasing implementation of on-road testing procedures such as RDE strengthens the adoption of precise data logging tools. Regulatory pressures on EVs, autonomous systems, and environmental compliance further elevate demand. This results in rapid expansion of the regulatory segment over the forecast period.

Automotive Data Logger Market Regional Analysis

- North America dominated the automotive data logger market with the largest revenue share of over 44% in 2025, driven by strong adoption of advanced vehicle testing technologies and high investment in connected and autonomous vehicle development

- Automakers and technology providers in the region increasingly rely on data loggers to support ADAS validation, emissions testing, and ECU calibration across both combustion and electric vehicle platforms

- The region’s advanced infrastructure, widespread use of telematics, and growing reliance on digital validation tools strengthen its position as a leader in the automotive data logger landscape

U.S. Automotive Data Logger Market Insight

The U.S. automotive data logger market captured the largest revenue share within North America in 2025, fueled by rapid advancements in EV platforms, autonomous driving programs, and extensive OEM-driven testing activities. The country’s leading automakers and mobility technology firms utilize data loggers for simulation, durability analysis, software calibration, and multi-channel acquisition across complex vehicle architectures. Increasing adoption of cloud-enabled analytics, high-speed Ethernet logging, and connected test environments continues to enhance market growth. Strong investments in R&D facilities, partnerships between automotive and semiconductor companies, and accelerating demand for intelligent mobility solutions further propel the market in the U.S.

Europe Automotive Data Logger Market Insight

Europe is projected to grow at a substantial CAGR during the forecast period, driven by strict safety regulations, emissions standards, and advanced vehicle testing requirements across the region. OEMs and Tier-1 suppliers in Europe heavily depend on data loggers for WLTP, RDE, and ADAS validation, as well as for EV battery and powertrain testing. Rising demand for connected vehicles and software-defined architectures increases the need for precise, high-speed data acquisition systems. The presence of strong engineering capabilities, expanding vehicle digitalization, and increasing investment in automotive innovation contribute to widespread adoption of data loggers across Europe.

U.K. Automotive Data Logger Market Insight

The U.K. automotive data logger market is anticipated to grow at a noteworthy CAGR throughout the forecast period, supported by the country’s strong focus on automotive R&D, EV development, and advanced validation technologies. Engineering and testing centers across the U.K. increasingly deploy data loggers for emissions compliance, ADAS calibration, vehicle diagnostics, and performance benchmarking. Rising adoption of connected vehicle technologies, automated testing frameworks, and digitalized mobility systems enhances the overall demand for data logging solutions. Continuous advancements in automotive engineering and strong support for innovation stimulate sustained market growth in the U.K.

Germany Automotive Data Logger Market Insight

The Germany automotive data logger market is expected to expand at a considerable CAGR, driven by the nation’s position as a global center for automotive manufacturing and engineering excellence. German OEMs and suppliers utilize data loggers extensively for high-precision testing of ADAS, EV systems, autonomous platforms, and powertrain technologies. Strict regulatory standards and a strong emphasis on innovation accelerate the adoption of advanced, multi-protocol data logging solutions. Integration of digital testing methods, simulation technologies, and intelligent validation practices supports the rising demand for robust data acquisition systems across Germany’s automotive ecosystem.

Asia-Pacific Automotive Data Logger Market Insight

The Asia-Pacific automotive data logger market is poised to grow at the fastest CAGR from 2026 to 2033, driven by rapid automotive production, increasing EV penetration, and strong technological advancements in countries such as China, Japan, South Korea, and India. Expanding investments in ADAS development, autonomous vehicle trials, and digital mobility initiatives significantly increase the need for data logging systems across the region. Rising regulatory standards and the growing presence of automotive electronics manufacturers further support widespread adoption. APAC’s emergence as a global manufacturing and R&D hub accelerates growth in both pre-sales and post-sales deployment of data loggers.

Japan Automotive Data Logger Market Insight

The Japan automotive data logger market is gaining momentum due to the country’s advanced automotive ecosystem, strong technological culture, and demand for precise vehicle testing solutions. Japanese automakers depend heavily on data loggers for hybrid, electric, and autonomous vehicle validation, alongside rigorous safety and performance testing. Integration with sensor-rich architectures, IoT-driven diagnostics, and connected testing environments drives continuous adoption. Japan’s focus on engineering precision, intelligent transportation systems, and innovation in mobility technology strengthens the expanding role of high-performance data logging systems.

China Automotive Data Logger Market Insight

The China automotive data logger market accounted for the largest revenue share in Asia-Pacific in 2025, supported by rapid EV production growth, large-scale autonomous vehicle programs, and accelerated development of smart mobility ecosystems. Chinese OEMs and technology companies increasingly rely on data loggers for real-world emissions testing, ADAS validation, and digital vehicle development. Strong manufacturing capabilities, competitive pricing, and wide availability of high-performance logging devices drive widespread usage. Government support for smart cities, intelligent transportation, and advanced automotive electronics continues to strengthen China’s dominance in the regional market.

Automotive Data Logger Market Share

The automotive data logger industry is primarily led by well-established companies, including:

- Aptiv PLC (U.S.)

- Vector Informatik GmbH (Germany)

- Continental AG (Germany)

- ARMAN International (U.S.)

- RACELOGIC Ltd. (U.K.)

- National Instruments Corp. (U.S.)

- TTTech Computertechnik AG (Austria)

- HORIBA Ltd. (Japan)

- Xilinx Inc. (U.S.)

- Intrepid Control Systems Inc. (U.S.)

- Intelligent Technology Corp., Ltd. (China)

- Danlaw Technologies India Limited (India)

- Joomla Templates (U.S.)

- Transtron Inc. (Japan)

- Dewesoft d.o.o. (Slovenia)

- Influx Technology Ltd. (U.K.)

- IPETRONIK GmbH & Co. KG (Germany)

- MadgeTech Inc. (U.S.)

- MyCarma 2 (U.S.)

- Moog Inc. (U.S.)

Latest Developments in Global Automotive Data Logger Market

- In September 2025, Continental (DE) introduced a new series of automotive data loggers designed to elevate vehicle diagnostics and performance monitoring, reinforcing its position as a key innovator in the market. This development strengthens Continental’s competitiveness as modern vehicles demand more sophisticated data capture capabilities to support ADAS, electrification, and software-driven functionalities. By expanding its product portfolio, the company enhances its ability to meet rising OEM and Tier-1 requirements, thereby positively influencing its market share in the rapidly evolving automotive technology landscape

- In August 2025, Honeywell (US) announced a strategic partnership with a leading electric vehicle manufacturer to co-develop specialized data logging systems tailored for EV platforms, marking a significant advancement in its market presence. This collaboration positions Honeywell at the forefront of EV-focused data acquisition technologies, supporting the industry’s accelerating shift toward electrification. By delivering solutions aligned with the unique thermal, battery, and drivetrain requirements of electric vehicles, Honeywell strengthens its competitive edge and expands its influence within the growing EV data logging segment

- In July 2025, Robert Bosch (DE) expanded its technological capabilities by acquiring a software startup specializing in machine learning algorithms for automotive applications, a move that directly enhances its data logging and analytics ecosystem. This acquisition enables Bosch to integrate advanced ML-driven insights into its platforms, improving real-time performance interpretation and safety-critical diagnostics. With vehicle architectures becoming increasingly software-defined, Bosch’s strengthened analytics capability is expected to significantly boost its market appeal and reinforce its leadership in intelligent automotive data solutions

- In March 2025, TTTech Auto launched its next-generation PM-350 data logger, advancing software-defined vehicle verification capabilities through high-speed data capture and improved processing performance. This innovation highlights TTTech Auto’s strategic commitment to supporting SDV architectures, where precise data acquisition is essential for real-time validation and over-the-air software updates. The PM-350’s enhanced capabilities elevate TTTech Auto’s market positioning as automakers transition to centralized computing and high-bandwidth communication systems

- In August 2024, NXP and TTTech Auto formed a partnership to develop the N4 Network Controller integrating S32G2 processors with advanced Ethernet switching, strengthening their collective footprint in automotive networking and data logging infrastructure. This collaboration supports the growing demand for high-performance vehicle networks required for ADAS, centralized zonal architectures, and autonomous driving functions. The integrated controller enhances reliability and bandwidth efficiency, reinforcing both companies’ roles in shaping next-generation automotive communication and data acquisition systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.