Global Automotive Door Guards Market

Market Size in USD Billion

CAGR :

%

USD

32.76 Billion

USD

45.88 Billion

2025

2033

USD

32.76 Billion

USD

45.88 Billion

2025

2033

| 2026 –2033 | |

| USD 32.76 Billion | |

| USD 45.88 Billion | |

|

|

|

|

Global Automotive Door Guards Market Size

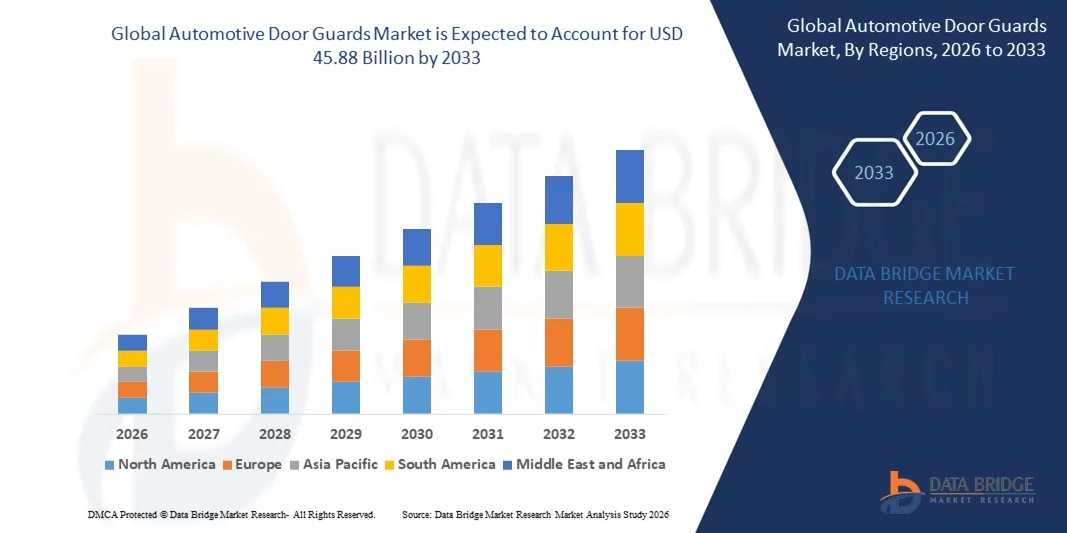

- The global Automotive Door Guards Market size was valued at USD 32.76 billion in 2025 and is expected to reach USD 45.88 billion by 2033, at a CAGR of 4.30% during the forecast period.

- The market growth is largely driven by the increasing adoption of premium and luxury vehicles, along with rising consumer awareness about vehicle protection and safety, which is boosting demand for high-quality door guard solutions.

- Furthermore, technological advancements in materials, design, and installation methods, combined with the growing focus on enhancing vehicle aesthetics and durability, are encouraging consumers to invest in automotive door guards. These converging factors are accelerating market expansion and significantly supporting the industry's growth.

Global Automotive Door Guards Market Analysis

- Automotive door guards, designed to protect vehicle doors from scratches, dents, and minor collisions, are increasingly essential accessories for both personal and commercial vehicles due to their convenience, durability, and contribution to maintaining vehicle aesthetics and resale value.

- The rising demand for automotive door guards is primarily driven by the growing vehicle ownership, increased consumer awareness regarding vehicle protection, and the preference for long-lasting and cost-effective solutions to prevent door damage.

- North America dominated the Global Automotive Door Guards Market with the largest revenue share of 32% in 2025, supported by high vehicle ownership rates, strong consumer spending, and a well-established automotive aftermarket, with the U.S. witnessing significant adoption of premium and customizable door guards across personal and fleet vehicles.

- Asia-Pacific is expected to be the fastest-growing region in the Global Automotive Door Guards Market during the forecast period due to rapid urbanization, rising disposable incomes, and increased demand for vehicle protection in densely populated cities.

- The steel segment dominated the market with the largest revenue share of 45.6% in 2025, driven by its high strength, durability, and superior resistance to impacts and scratches.

Report Scope and Global Automotive Door Guards Market Segmentation

|

Attributes |

Automotive Door Guards Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• 3M (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Global Automotive Door Guards Market Trends

Enhanced Protection Through Advanced Materials and Design

- A significant and accelerating trend in the global Automotive Door Guards Market is the adoption of advanced materials and innovative designs that enhance vehicle protection while maintaining aesthetic appeal. These developments are significantly improving durability, impact resistance, and ease of installation for consumers.

- For instance, 3M’s Scotchgard Automotive Door Guards use high-strength polymer coatings to prevent scratches and minor dents, while WeatherTech’s stainless steel and rubber-based guards offer robust protection without compromising the vehicle’s look.

- Material innovation in door guards enables features such as self-healing coatings, scratch resistance, and reinforced edges that reduce damage from minor collisions. Similarly, flexible yet strong guard designs, such as those from Auto Ventshade (AVS), allow easy installation and removal while offering maximum coverage.

- The integration of advanced designs with vehicle-specific customization options ensures that consumers can protect their cars without affecting overall styling. Through precise fit and finish, users can safeguard doors, bumpers, and side panels while maintaining the original look of their vehicles.

- This trend toward more durable, functional, and visually appealing door guards is reshaping consumer expectations for automotive protection accessories. Consequently, companies such as Husky Liners and Clazzio are developing premium door guards with features like reinforced edges, customizable finishes, and impact-absorbing materials.

- The demand for automotive door guards with advanced protection and stylish designs is growing rapidly across personal and commercial vehicle segments, as consumers increasingly prioritize vehicle longevity, aesthetics, and ease of use.

Global Automotive Door Guards Market Dynamics

Driver

Growing Need Due to Rising Vehicle Ownership and Awareness of Vehicle Protection

- The increasing number of vehicle owners worldwide, coupled with heightened consumer awareness about vehicle maintenance and protection, is a significant driver for the growing demand for automotive door guards.

- For instance, in 2025, WeatherTech expanded its line of door guards with customizable, impact-resistant models designed for SUVs and trucks, addressing both aesthetic and protective needs. Strategies like these by key companies are expected to drive market growth during the forecast period.

- As consumers become more conscious of minor vehicle damages caused by parking, collisions, or urban congestion, automotive door guards offer practical protection by preventing scratches, dents, and paint damage, making them an essential aftermarket accessory.

- Furthermore, the increasing focus on maintaining vehicle resale value and enhancing overall vehicle aesthetics is driving demand for premium and customizable door guards. Consumers are opting for solutions that blend protection with style and fit seamlessly with their vehicles.

- The convenience of easy installation, low maintenance, and long-lasting durability are key factors propelling the adoption of automotive door guards in both personal and commercial vehicle segments. The trend towards DIY installation and the availability of versatile guard designs further contribute to market growth.

Restraint/Challenge

Concerns Regarding Quality, Fitment, and Premium Pricing

- Concerns surrounding the quality, fitment, and durability of some automotive door guards pose a significant challenge to broader market penetration. Poorly designed or low-quality products can fail to provide adequate protection, reducing consumer confidence.

- For instance, reports of scratches caused by ill-fitting or low-grade door guards have made some vehicle owners hesitant to invest in aftermarket protection solutions.

- Ensuring high-quality materials, precision fit, and robust design is crucial for building consumer trust. Companies such as 3M, Husky Liners, and Clazzio emphasize premium materials, precise engineering, and easy installation to reassure potential buyers. Additionally, the relatively high cost of some advanced door guard systems compared to basic or generic options can be a barrier to adoption, especially for budget-conscious consumers or in developing markets.

- While prices are gradually becoming more competitive, the perceived premium for high-quality, durable, and vehicle-specific door guards can still hinder widespread adoption among price-sensitive buyers.

- Overcoming these challenges through product quality assurance, consumer education on installation and benefits, and offering a range of affordable yet durable options will be vital for sustained market growth.

Global Automotive Door Guards Market Scope

Automotive door guards market is segmented on the basis of material type, application, and vehicle type.

- By Material Type

On the basis of material type, the Global Automotive Door Guards Market is segmented into steel, aluminum, and plastic composites. The steel segment dominated the market with the largest revenue share of 45.6% in 2025, driven by its high strength, durability, and superior resistance to impacts and scratches. Steel door guards are widely preferred for premium vehicles and commercial fleets, where long-term protection and robustness are prioritized. Their ability to absorb minor collisions and prevent dents contributes to the high adoption rate among safety-conscious consumers.

The aluminum segment is expected to witness the fastest CAGR of 19.8% from 2026 to 2033. Aluminum door guards are lightweight yet strong, offering enhanced fuel efficiency benefits in addition to protection, making them increasingly popular in passenger cars, electric vehicles, and hybrid vehicles where weight reduction is a critical consideration. The growing focus on combining durability with lightweight design is fueling the rapid adoption of aluminum door guards globally.

- By Application

On the basis of application, the Global Automotive Door Guards Market is segmented into front side doors and rear side doors. The front side door segment held the largest market revenue share of 52.4% in 2025, as these doors are more prone to accidental impacts, parking lot scratches, and urban wear and tear. Consumers often prioritize protecting front doors to maintain vehicle aesthetics, especially in high-end cars and SUVs.

The rear side door segment is anticipated to witness the fastest CAGR of 18.7% from 2026 to 2033, driven by the increasing adoption of family vehicles, SUVs, and multi-purpose vehicles (MPVs) where rear door protection is critical due to frequent passenger usage. Additionally, rising awareness about protecting rear doors from minor collisions, especially in commercial fleets and ride-sharing vehicles, is contributing to the accelerating demand for rear side door guards across both developed and emerging markets.

- By Vehicle Type

On the basis of vehicle type, the Global Automotive Door Guards Market is segmented into conventional vehicles, passenger cars, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), battery electric vehicles (BEVs), and hybrid electric vehicles (HEVs). The passenger car segment dominated the market with the largest revenue share of 48.3% in 2025, reflecting the high volume of passenger cars on the roads and the strong consumer focus on preserving vehicle aesthetics and resale value. Door guards for passenger cars offer a combination of style, protection, and ease of installation, making them a preferred aftermarket accessory.

The battery electric vehicles (BEVs) segment is expected to witness the fastest CAGR of 20.4% from 2026 to 2033, driven by the growing adoption of EVs globally, higher vehicle valuations, and the demand for lightweight, high-durability materials. Increasing investments in EV infrastructure and rising consumer awareness about protecting these premium vehicles are further fueling the rapid adoption of door guards in the BEV segment.

Global Automotive Door Guards Market Regional Analysis

- North America dominated the Global Automotive Door Guards Market with the largest revenue share of 32% in 2025, driven by the high vehicle ownership rate, strong consumer focus on vehicle protection, and growing awareness of aftermarket accessories.

- Consumers in the region highly value the durability, aesthetic appeal, and ease of installation offered by automotive door guards, which help prevent scratches, dents, and minor collisions while maintaining vehicle resale value.

- This widespread adoption is further supported by high disposable incomes, a preference for premium vehicle accessories, and increasing awareness about protecting personal and commercial vehicles, establishing automotive door guards as a favored solution for both individual car owners and fleet operators.

U.S. Automotive Door Guards Market Insight

The U.S. automotive door guards market captured the largest revenue share of 81% in 2025 within North America, driven by high vehicle ownership, rising awareness about vehicle protection, and growing demand for premium aftermarket accessories. Vehicle owners increasingly prioritize safeguarding their cars against scratches, dents, and minor collisions, particularly in urban areas and densely populated cities. The growing preference for stylish, durable, and easy-to-install door guards, along with the expansion of online automotive accessory retail channels, further supports market growth. Moreover, the trend of customizing vehicles and protecting high-value cars is significantly contributing to the market’s expansion.

Europe Automotive Door Guards Market Insight

The Europe automotive door guards market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing urbanization, rising vehicle ownership, and the growing focus on vehicle maintenance. Stringent regulations around vehicle safety and the popularity of high-end cars are encouraging consumers to adopt door guards to protect their vehicles from minor damages. Strong demand is seen across both passenger cars and light commercial vehicles, with the aftermarket segment benefiting from easy availability and customization options.

U.K. Automotive Door Guards Market Insight

The U.K. automotive door guards market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by increasing awareness of vehicle protection and the rising number of urban vehicles. Consumers are opting for easy-to-install and aesthetically appealing door guards to maintain their vehicles’ value and prevent dents and scratches. The country’s well-established automotive aftermarket, combined with e-commerce platforms for vehicle accessories, continues to stimulate market growth across both passenger and commercial vehicles.

Germany Automotive Door Guards Market Insight

The Germany automotive door guards market is expected to expand at a considerable CAGR during the forecast period, supported by high vehicle ownership rates and increasing focus on vehicle longevity. German consumers show strong preference for premium-quality door guards that provide durability, corrosion resistance, and easy installation. Growing adoption in both private and commercial fleets, coupled with a strong automotive manufacturing ecosystem, promotes market growth. Furthermore, the integration of customized door protection solutions for luxury and electric vehicles is contributing to increased demand.

Asia-Pacific Automotive Door Guards Market Insight

The Asia-Pacific automotive door guards market is poised to grow at the fastest CAGR of 24% during the forecast period of 2026 to 2033, driven by rapid urbanization, increasing disposable incomes, and rising vehicle ownership in countries such as China, India, and Japan. The growing awareness about vehicle maintenance, combined with the popularity of SUVs, MPVs, and electric vehicles, is boosting adoption. Furthermore, APAC’s emergence as a manufacturing hub for automotive accessories, along with the availability of cost-effective and durable door guards, is expanding the market to a wider consumer base.

Japan Automotive Door Guards Market Insight

The Japan automotive door guards market is gaining momentum due to the country’s high vehicle density, urban living conditions, and strong focus on vehicle aesthetics and protection. Japanese consumers increasingly invest in easy-to-install, durable, and stylish door guards to prevent minor scratches and dents. The rising popularity of compact cars, EVs, and premium vehicles, along with the growing trend of vehicle customization, is driving market growth in both residential and commercial segments.

China Automotive Door Guards Market Insight

The China automotive door guards market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s growing middle class, rapid urbanization, and high vehicle sales. Door guards are becoming increasingly popular for passenger cars, SUVs, and electric vehicles in residential and commercial settings. The focus on vehicle protection in congested urban areas, along with the availability of affordable and high-quality domestic options, is significantly propelling market growth in China.

Global Automotive Door Guards Market Share

The Automotive Door Guards industry is primarily led by well-established companies, including:

• 3M (U.S.)

• WeatherTech (U.S.)

• Auto Ventshade (AVS) (U.S.)

• Husky Liners (U.S.)

• Clazzio (Japan)

• Mopar (U.S.)

• OXFORD Products (U.K.)

• Revi Accessories (U.S.)

• Proti Auto Accessories (India)

• Luxury Auto Accessories (U.S.)

• Forte Automotive (South Korea)

• Topfit Automotive (China)

• Samurai Auto Accessories (Japan)

• CarDoorGuard (Germany)

• AutoTrim Design (U.K.)

• Royal Guard Automotive (U.S.)

• Glomex Automotive (Italy)

• GuardTech Automotive (China)

• AUTOANY (China)

• Armadillo Automotive (U.S.)

What are the Recent Developments in Global Automotive Door Guards Market?

- In April 2024, 3M, a global leader in automotive protection solutions, launched a strategic initiative in South Africa to expand its range of high-performance automotive door guards. This initiative focuses on providing durable, impact-resistant, and aesthetically appealing door guards for both residential and commercial vehicle owners. By leveraging its global expertise in materials and protective technologies, 3M aims to address regional vehicle protection challenges while strengthening its presence in the rapidly growing Global Automotive Door Guards Market.

- In March 2024, WeatherTech, a U.S.-based manufacturer of premium automotive accessories, introduced its new customizable Front & Rear Door Guard kit designed for SUVs and light commercial vehicles. The innovative design offers enhanced protection against scratches, dents, and minor collisions, emphasizing WeatherTech’s commitment to combining functionality with style. This launch highlights the company’s dedication to delivering practical, user-friendly solutions for vehicle owners across various market segments.

- In March 2024, Husky Liners successfully rolled out its Heavy-Duty Door Guard Series in India as part of the Smart Vehicle Protection Initiative. This project aims to protect high-value vehicles in congested urban areas by deploying durable, impact-absorbing door guards. Husky Liners’ efforts underscore the growing importance of vehicle protection accessories in emerging markets, contributing to safer, better-maintained automotive fleets.

- In February 2024, Auto Ventshade (AVS) announced a strategic partnership with a leading car rental association in the U.S. to supply premium door guards for rental fleets. The collaboration is designed to minimize vehicle damage and streamline fleet maintenance, offering cost-effective solutions for commercial operators. This initiative reinforces AVS’s commitment to innovation and operational efficiency in the automotive accessories market.

- In January 2024, Clazzio, a Japan-based automotive aftermarket company, unveiled its new EcoShield Door Guard Series at the Tokyo Auto Show 2024. The series features lightweight, high-durability materials designed for passenger cars and hybrid vehicles, combining protection with style. The launch demonstrates Clazzio’s focus on integrating advanced materials and design innovation into vehicle protection solutions, providing customers with both convenience and enhanced vehicle safety.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.