Global Automotive E Tailing Market

Market Size in USD Billion

CAGR :

%

USD

51.86 Billion

USD

125.68 Billion

2024

2032

USD

51.86 Billion

USD

125.68 Billion

2024

2032

| 2025 –2032 | |

| USD 51.86 Billion | |

| USD 125.68 Billion | |

|

|

|

|

Automotive E-Tailing Market Size

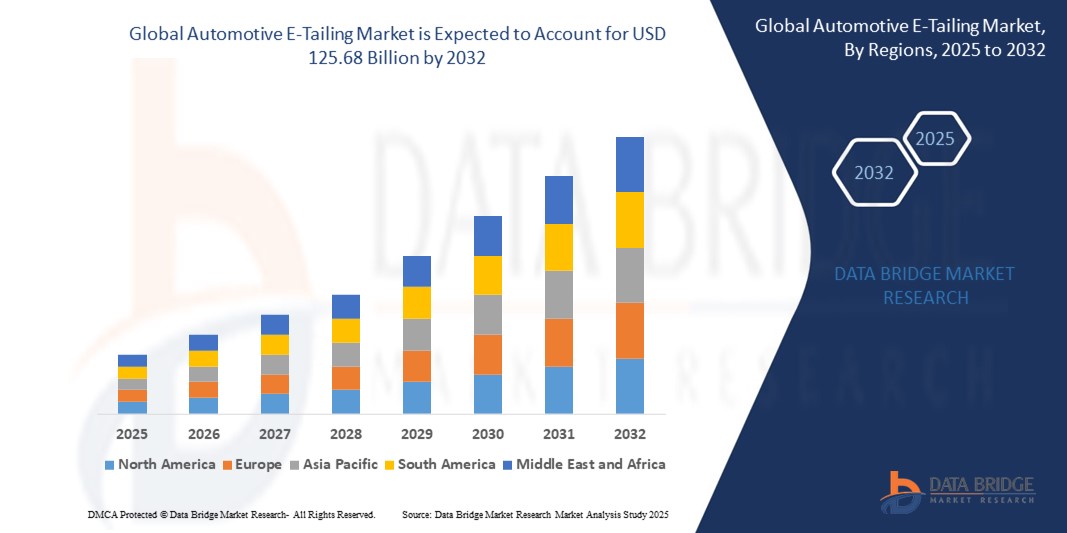

- The global automotive e-tailing market size was valued at USD 51.86 billion in 2024 and is expected to reach USD 125.68 billion by 2032, at a CAGR of 11.7% during the forecast period

- The market growth is primarily driven by the increasing adoption of e-commerce platforms, rising consumer preference for online purchasing of automotive parts, and advancements in digital retail technologies

- In addition, the growing demand for convenience, competitive pricing, and a wide range of automotive products online is positioning e-tailing as a preferred channel for automotive consumers, further accelerating market expansion

Automotive E-Tailing Market Analysis

- Automotive e-tailing involves the online sale of automotive components, accessories, and related products, offering consumers convenience, accessibility, and a broad selection of products for various vehicle types

- The surge in demand for automotive e-tailing is fueled by the growing penetration of internet and smartphone usage, increasing consumer trust in online transactions, and the expansion of logistics and supply chain networks supporting e-commerce

- North America dominated the automotive e-tailing market with the largest revenue share of 42.5% in 2024, driven by advanced e-commerce infrastructure, high consumer spending power, and the presence of major e-tailing platforms and automotive brands in the U.S. and Canada

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, attributed to rapid urbanization, increasing vehicle ownership, and rising disposable incomes in countries such as China, India, and Japan

- The tires and wheels segment dominated the largest market revenue share of 32.5% in 2024, driven by high demand for frequent replacements due to wear and tear, coupled with the presence of major OEM tire manufacturers such as continental, goodyear, and pirelli leveraging e-tailing platforms for direct-to-consumer sales

Report Scope and Automotive E-Tailing Market Segmentation

|

Attributes |

Automotive E-Tailing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive E-Tailing Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global automotive e-tailing market is experiencing a significant trend toward integrating Artificial Intelligence (AI) and Big Data analytics to enhance the online shopping experience.

- These technologies enable advanced data processing, providing personalized product recommendations, optimized pricing strategies, and improved inventory management for e-tailers.

- AI-driven platforms analyze consumer preferences, browsing patterns, and purchase history to offer tailored suggestions for automotive components such as infotainment systems, interior accessories, engine components, tires and wheels, and electrical products.

- For instances, companies are leveraging AI to predict demand for specific parts, streamline supply chains, and offer dynamic pricing based on market trends and consumer behavior.

- Big Data analytics also supports third-party vendors in identifying high-demand products, such as branded tires or counterfeit interior accessories, to cater to diverse vehicle types, including passenger cars, commercial vehicles, and 2-wheelers.

- This trend enhances the value proposition of e-tailing platforms, making them more appealing to both individual consumers and businesses by improving convenience and product relevance.

Automotive E-Tailing Market Dynamics

Driver

“Rising Demand for Online Shopping and Broad Product Availability”

- The growing consumer preference for the convenience of online shopping is a major driver for the global automotive e-tailing market, with platforms offering a wide range of products, including infotainment and multimedia, interior accessories, engine components, tires and wheels, and electrical products.

- E-tailing platforms provide easy access to both OEM and third-party vendor products, catering to passenger cars, commercial vehicles, and 2-wheelers, with options for branded and counterfeit parts.

- The rise of mobile commerce, driven by increased smartphone penetration and user-friendly interfaces, further accelerates market growth, particularly in regions such as Asia-Pacific, where countries such as China and India have large vehicle populations.

- Government initiatives, such as Digital India, and partnerships between brick-and-mortar stores and e-commerce platforms are boosting the adoption of automotive e-tailing.

- The ability to compare products, access customer reviews, and benefit from competitive pricing and discounts enhances consumer trust and drives demand for online automotive purchases.

Restraint/Challenge

“High Operational Costs and Concerns over Counterfeit Products”

- The significant costs associated with logistics, warehousing, and maintaining robust e-commerce platforms can be a barrier to growth, particularly for smaller third-party vendors in emerging markets.

- Integrating advanced technologies such as AI and Big Data analytics requires substantial investment, which may deter smaller players from competing with established e-tailers such as Amazon, Alibaba, or eBay.

- The prevalence of counterfeit products, especially in the interior accessories and electrical products segments, poses a major challenge, as it undermines consumer trust and affects the reputation of e-tailing platforms.

- Data security and privacy concerns related to online transactions, including payment fraud and misuse of consumer data, further complicate market expansion, particularly in regions with stringent data protection regulations.

- The fragmented regulatory landscape across countries, particularly in North America and Asia-Pacific, regarding product authenticity and e-commerce operations creates additional challenges for international vendors, limiting market growth in cost-sensitive or highly regulated regions.

Automotive E-Tailing market Scope

The market is segmented on the basis of component, vendor type, label type, and vehicle type.

- By Component

On the basis of component, the global automotive e-tailing market is segmented into infotainment and multimedia, interior accessories, engine components, tires and wheels, and electrical products. The tires and wheels segment dominated the largest market revenue share of 32.5% in 2024, driven by high demand for frequent replacements due to wear and tear, coupled with the presence of major OEM tire manufacturers such as continental, goodyear, and pirelli leveraging e-tailing platforms for direct-to-consumer sales.

The infotainment and Multimedia segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising consumer demand for advanced in-car entertainment systems, connectivity devices, and AI-powered dashboards. Increasing adoption of connected car technologies and the convenience of online purchasing are key drivers for this segment's growth.

- By Vendor Type

On the basis of vendor type, the global automotive e-tailing market is segmented into oem vendor and third party vendor. The third party vendor segment dominated the market with a revenue share of 62.3% in 2024, attributed to the wide range of products, competitive pricing, and rapid delivery services offered by platforms such as Amazon, Alibaba, and eBay. These vendors cater to diverse consumer needs with both OEM and aftermarket parts.

The OEM vendor segment is anticipated to experience the fastest growth rate of 13.0% from 2025 to 2032, driven by increasing consumer trust in genuine parts that meet manufacturer specifications, enhancing quality assurance and compatibility. Strategic partnerships between OEMs and e-commerce platforms further boost this segment’s growth.

- By Label Type

On the basis of label type, the global automotive e-tailing market is segmented into branded and counterfeit products. The branded segment held the largest market revenue share of 68.7% in 2024, as consumers prefer genuine products for their reliability, longevity, and compatibility with vehicles, particularly for critical components such as engine parts and electrical products.

The counterfeit segment, while smaller, is expected to see moderate growth from 2025 to 2032, particularly in the Interior Accessories segment, due to lower costs and wider availability through third-party vendors. However, concerns over quality and safety, along with increasing regulatory measures, may limit its expansion.

- By Vehicle Type

On the basis of vehicle type, the global automotive e-tailing market is segmented into passenger car, commercial vehicle, and 2-wheeler. The passenger car segment dominated with a revenue share of 70.8% in 2024, driven by the high global volume of passenger vehicles and consumer demand for personalized accessories, infotainment systems, and safety-related components available through e-tailing platforms.

The commercial vehicle segment is expected to witness the fastest growth rate of 14.2% from 2025 to 2032, fueled by the increasing adoption of e-tailing for fleet management needs, including bulk purchases of engine components, tires, and electrical products. Enhanced logistics and competitive pricing on e-commerce platforms further drive this segment’s growth.

Automotive E-Tailing Market Regional Analysis

- North America dominated the automotive e-tailing market with the largest revenue share of 42.5% in 2024, driven by advanced e-commerce infrastructure, high consumer spending power, and the presence of major e-tailing platforms and automotive brands in the U.S. and Canada

- Consumers prioritize e-tailing for its convenience, wide product availability, and competitive pricing, seeking components such as infotainment and multimedia, interior accessories, engine components, tires and wheels, and electrical products across passenger cars, commercial vehicles, and 2-wheelers

- Growth is supported by advancements in e-commerce platforms, increasing internet penetration, and rising adoption in both OEM and third-party vendor segments, despite challenges from counterfeit products

U.S. Automotive E-Tailing Market Insight

The U.S. automotive e-tailing market captured the largest revenue share of 86.4% in 2024 within North America, fueled by strong aftermarket demand and growing consumer awareness of the convenience and cost benefits of online shopping. The trend towards vehicle customization and increasing regulations promoting secure online transactions further boost market expansion. Automakers’ growing integration of OEM vendor platforms complements third-party vendor sales, creating a diverse e-tailing ecosystem.

Europe Automotive E-Tailing Market Insight

The Europe automotive e-tailing market is expected to witness significant growth, supported by regulatory emphasis on secure e-commerce and consumer demand for convenience. Consumers seek components such as infotainment and multimedia, interior accessories, and tires that enhance vehicle performance and aesthetics. The growth is prominent in both B2C and B2B transactions, with countries such as Germany and France showing significant uptake due to rising vehicle ownership and digital adoption.

U.K. Automotive E-Tailing Market Insight

The U.K. market for automotive e-tailing is expected to witness rapid growth, driven by demand for convenient online access to components such as engine parts and interior accessories in urban and suburban settings. Increased interest in vehicle personalization and rising awareness of cost savings through e-tailing encourage adoption. Evolving regulations on online transactions influence consumer choices, balancing product quality with compliance.

Germany Automotive E-Tailing Market Insight

Germany is expected to witness rapid growth in automotive e-tailing, attributed to its advanced automotive manufacturing sector and high consumer focus on vehicle performance and efficiency. German consumers prefer branded components from OEM vendors for reliability, with strong demand for engine components and electrical products. The integration of e-tailing platforms in premium vehicles and aftermarket options supports sustained market growth.

Asia-Pacific Automotive E-Tailing Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding automotive production and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of online shopping convenience, competitive pricing, and vehicle customization is boosting demand for components such as tires and wheels and infotainment systems. Government initiatives promoting digitalization and e-commerce further encourage the adoption of automotive e-tailing.

Japan Automotive E-Tailing Market Insight

Japan’s automotive e-tailing market is expected to witness rapid growth due to strong consumer preference for high-quality, branded components from OEM vendors that enhance vehicle performance and safety. The presence of major automotive manufacturers and integration of e-tailing in OEM platforms accelerate market penetration. Rising interest in aftermarket customization, particularly for passenger cars and 2-wheelers, also contributes to growth.

China Automotive E-Tailing Market Insight

China holds the largest share of the Asia-Pacific automotive e-tailing market, propelled by rapid urbanization, rising vehicle ownership, and increasing demand for affordable components such as interior accessories and electrical products. The country’s growing middle class and focus on digital commerce support the adoption of e-tailing platforms. Strong domestic e-commerce capabilities and competitive pricing enhance market accessibility, despite concerns over counterfeit products.

Automotive E-Tailing Market Share

The automotive e-tailing industry is primarily led by well-established companies, including:

- Advance Auto Parts, Inc. (U.S.)

- Alibaba Group Holding Ltd (China)

- Amazon (U.S.)

- CRUISEMASTER (Australia)

- Competition Motorsport (U.S.)

- RTW Wheels (U.S.)

- Boogey Inc. (U.S.)

- AutoZone, Inc. (U.S.)

- Delticom AG (Germany)

- eBay Inc. (U.S.)

- Flipkart (India)

- O'Reilly Automotive Inc. (U.S.)

- Robert Bosch GmbH (Germany)

- Walmart Stores, Inc. (U.S.)

What are the Recent Developments in Global Automotive E-Tailing Market?

- In June 2024, Boult introduced its latest automotive accessories in India—the X1 GPS Dash Cam and CruiseCam X1. These cutting-edge dash cameras are engineered to enhance road safety with features such as 1080p Full HD recording, 170° ultra-wide field of view, 360° rotation, G-sensor collision detection, and built-in supercapacitors for reliable performance in extreme conditions. Designed specifically for Indian roads, they also offer Wi-Fi connectivity and app control for seamless access to footage

- In April 2024, CATL introduced a revolutionary EV battery tailored for commercial vehicles, developed in partnership with Yutong Bus Co. This advanced battery offers a 15-year warranty and an exceptional lifespan of setting a new benchmark in electric mobility. Engineered for durability, it maintains zero degradation through the first 1,000 cycles, making it ideal for high-mileage applications such as buses and trucks. The battery is now available through various e-commerce platforms, including Alibaba, supporting CATL’s global expansion strategy and commitment to sustainable transportation

- In December 2023, Garrett Motion launched an advanced e-commerce platform called Garrett Marketplace, tailored specifically for racing enthusiasts and performance automotive professionals. This innovative platform offers a wide selection of aftermarket parts, including turbochargers, intercoolers, wastegates, and other high-performance components. Designed to provide direct access to Garrett’s engineering expertise, the marketplace ensures customers can browse, compare, and purchase genuine products with confidence. It also features tools such as wish lists and expert consultations to enhance the shopping experience. Garrett Marketplace is currently available in the U.S., with plans to expand globally

- In October 2023, X-Cart announced a strategic partnership with Turn 14 Distribution, aiming to empower automotive retailers with advanced e-commerce capabilities. This collaboration integrates Turn 14’s real-time inventory, pricing automation, and dropshipping logistics directly into X-Cart’s platform, enabling businesses to boost online sales and streamline auto parts delivery. Retailers benefit from features such as automated catalog management, live shipping rates, and precise order routing, all designed to enhance customer satisfaction and operational efficiency. This move reinforces X-Cart’s position as a leading e-commerce solution for the automotive aftermarket

- In August 2023, Schaeffler India acquired Koovers, a Bengaluru-based B2B e-commerce platform operated by KRSV Innovative Auto Solutions Pvt. Ltd., to accelerate its digital aftermarket strategy. This strategic move enables Schaeffler to expand its footprint in India’s fast-growing automotive spare parts sector by leveraging Koovers’ robust digital infrastructure and last-mile delivery capabilities. With a catalog of over 1.8 million parts and a customer base of 7,000+ workshops, Koovers continues to operate under its brand name while benefiting from Schaeffler’s global expertise. The acquisition was fully funded through internal cash generation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.