Global Automotive Electric Hvac Compressor Market

Market Size in USD Billion

CAGR :

%

USD

14.76 Billion

USD

83.57 Billion

2024

2032

USD

14.76 Billion

USD

83.57 Billion

2024

2032

| 2025 –2032 | |

| USD 14.76 Billion | |

| USD 83.57 Billion | |

|

|

|

|

Automotive Electric HVAC Compressor Market Size

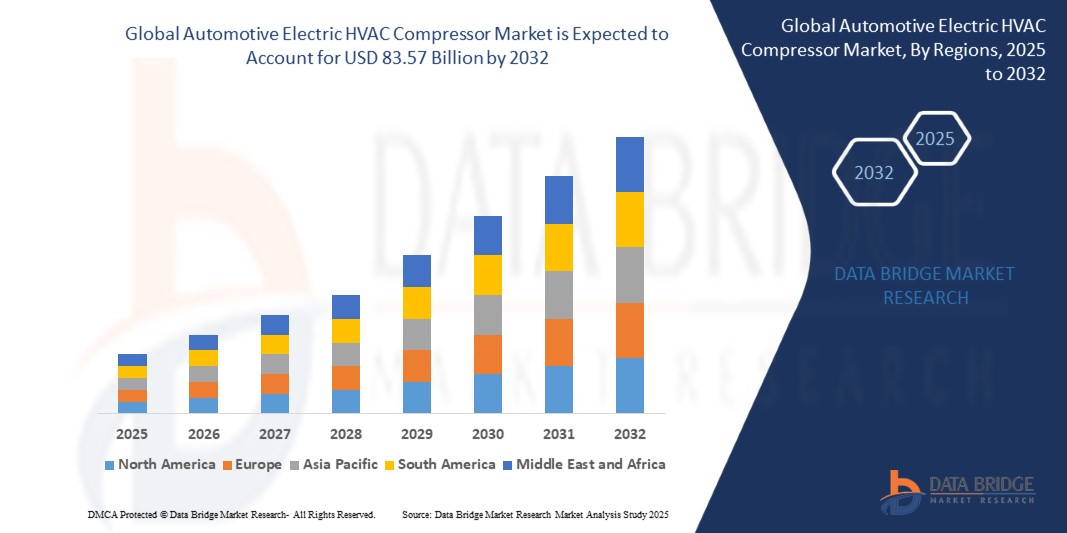

- The global automotive electric HVAC compressor market was valued at USD 14.76 billion in 2024 and is expected to reach USD 83.57 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 24.20%, primarily driven by the electrification of vehicles and the demand for energy-efficient thermal management systems

- This growth is driven by factors such as the rising adoption of electric vehicles (EVs), stringent environmental regulations, and technological advancements in compressor design for improved energy efficiency and compactness

Automotive Electric HVAC Compressor Market Analysis

- Automotive electric HVAC compressors are vital components in electric and hybrid vehicles, responsible for regulating cabin temperature using electrical energy instead of traditional engine power. They enable climate control while reducing emissions and improving overall energy efficiency

- The demand for electric HVAC compressors is significantly driven by the rapid adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs), as well as growing consumer expectations for comfort and sustainability. Increasing regulatory pressure to reduce vehicle emissions is further accelerating the shift toward electric HVAC solutions

- The Asia-Pacific region stands out as one of the dominant markets for automotive electric HVAC compressors, fueled by the high volume of EV production in countries like China, Japan, and South Korea, along with supportive government incentives and investments in green mobility infrastructure

- For instance, China, which leads the world in EV sales, is witnessing a sharp rise in demand for high-efficiency HVAC systems, pushing domestic and international automakers to adopt advanced electric compressor technologies in their latest models

- Globally, automotive electric HVAC compressors are now considered a core component in the thermal management systems of electric vehicles. Their role extends beyond passenger comfort, impacting battery performance, vehicle range, and compliance with environmental regulations, making them an indispensable part of next-generation vehicle design

Report Scope and Automotive Electric HVAC Compressor Market Segmentation

|

Attributes |

Automotive Electric HVAC Compressor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Electric HVAC Compressor Market Trends

“Integration of Smart Sensors and Thermal Management Systems”

- One prominent trend in the global automotive electric HVAC compressor market is the increasing integration of smart sensors and advanced thermal management technologies

- These innovations enhance compressor efficiency and enable real-time monitoring and adaptive control of cabin and battery temperatures, which is essential for the performance and longevity of electric vehicles (EVs)

- For instance, modern electric HVAC compressors are being equipped with intelligent control units that automatically adjust operation based on ambient conditions, vehicle load, and battery status — optimizing energy use and extending driving range

- Smart thermal management also supports the efficient operation of battery packs, especially in high-performance EVs, where precise temperature regulation is critical to prevent overheating and performance degradation

- This trend is reshaping the landscape of vehicle climate control systems, driving the demand for compact, high-efficiency, and digitally integrated HVAC compressors across the automotive industry, particularly in electric and hybrid vehicle segments

Automotive Electric HVAC Compressor Market Dynamics

Driver

“Growing Demand Due to Rising Electric Vehicle (EV) Adoption”

- The rapid global adoption of electric and hybrid vehicles is significantly driving the demand for automotive electric HVAC compressors, which are essential for maintaining cabin comfort and regulating battery temperatures using electric power rather than engine-driven systems

- As governments worldwide enforce stricter emissions regulations and offer incentives to promote electric mobility, the EV market continues to expand—creating a direct need for efficient, compact, and high-performance HVAC solutions

- Electric HVAC compressors are particularly vital in EVs, where traditional belt-driven systems are incompatible. These electric compressors ensure optimal thermal performance without compromising the vehicle’s energy efficiency or driving range

- Technological advancements have led to the development of variable-speed compressors that provide improved energy management and thermal efficiency, meeting consumer expectations for both comfort and sustainability

- The increasing production of EVs across key regions—including Asia-Pacific, Europe, and North America—continues to accelerate market growth for electric HVAC compressors, making them a critical component of next-gen automotive design

For instance,

- In September 2023, MAHLE announced its expansion in high-voltage electric compressor production, citing a surge in demand from global EV manufacturers. These compressors are designed to optimize thermal comfort while supporting high-efficiency electric drive systems

- As EV adoption increases, the demand for advanced electric HVAC compressors continues to rise, supporting enhanced passenger comfort, improved battery longevity, and vehicle energy optimization—solidifying their role as a key growth driver in the automotive industry

Opportunity

““Enhancing Vehicle Efficiency Through Integration with Smart Thermal Management Systems”

- The integration of electric HVAC compressors with smart thermal management systems presents a significant growth opportunity in the global automotive industry, especially within electric and hybrid vehicle platforms. These advanced systems help maintain battery health, optimize energy use, and improve overall vehicle performance

- Smart thermal systems enable real-time adjustments in compressor operation based on vehicle conditions—such as battery temperature, ambient climate, and driving behavior—ensuring maximum energy efficiency and system longevity

- In addition, these compressors contribute to reducing the energy burden on electric drivetrains by intelligently modulating cooling and heating loads. This not only enhances passenger comfort but also extends vehicle driving range, addressing one of the key concerns among EV consumers

For instance,

- In February 2024, Denso Corporation unveiled a new generation of integrated electric compressors with embedded sensors and control units designed to support predictive thermal management in electric vehicles. This innovation supports vehicle electrification by ensuring precise battery cooling under varying load conditions

- As automakers strive to improve energy efficiency and range in their electric models, the demand for intelligent, integrated HVAC solutions is poised to grow rapidly. The integration of smart thermal management with electric HVAC compressors presents a lucrative opportunity for manufacturers to meet sustainability goals and enhance EV performance—offering a competitive edge in a fast-evolving market

Restraint/Challenge

“High Production and Integration Costs Hindering Market Penetration”

- The high production cost of automotive electric HVAC compressors presents a significant challenge, especially for mid- and entry-level vehicle segments and manufacturers operating in price-sensitive markets. These compressors require advanced materials, precision engineering, and integration with vehicle electronics, all of which drive up costs

- Compared to traditional belt-driven compressors, electric HVAC compressors involve complex electronic control systems and must meet stringent safety and efficiency standards—factors that increase manufacturing and integration expenses

- As a result, automakers may hesitate to implement advanced HVAC compressor technologies across their full product line, limiting adoption primarily to premium or high-end electric models and slowing market penetration

For instance,

- In June 2024, according to an analysis published by Sanden Holdings Corporation, one of the key barriers to widespread adoption of electric HVAC compressors is the high cost of variable-speed compressor technology and inverter modules. These components contribute to higher vehicle manufacturing costs, especially in compact EVs and hybrids where affordability is critical

- Consequently, high equipment and integration costs can restrict the ability of OEMs to scale deployment across all vehicle segments, creating disparities in thermal comfort and efficiency offerings. This cost barrier is a critical restraint on market growth, especially in regions where affordability remains a primary consumer concern

Automotive Electric HVAC Compressor Market Scope

The market is segmented on the basis cooling capacity, product, vehicle, drivetrain, type, refrigerant type, drive type and voltage.

|

Segmentation |

Sub-Segmentation |

|

By Cooling Capacity |

|

|

By Product |

|

|

By Vehicle |

|

|

By Drivetrain |

|

|

By Type |

|

|

By Refrigerant Type |

|

|

By Drive Type |

|

|

By Voltage |

|

Automotive Electric HVAC Compressor Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Automotive Electric HVAC Compressor Market”

- Asia-Pacific dominates the automotive electric HVAC compressor market with 66.3% market share, driven by the region’s leadership in electric vehicle (EV) production, strong manufacturing infrastructure, and the presence of key automotive and component suppliers

- China, in particular, holds a significant share due to its expansive EV ecosystem, government incentives promoting green mobility, and rapid urbanization driving demand for climate-controlled transport solutions

- The region also benefits from large-scale investments in automotive R&D and thermal management technologies, as well as favorable policies aimed at reducing vehicle emissions and increasing energy efficiency

- In addition, Japan and South Korea contribute significantly to regional dominance through advanced automotive engineering, technological innovation, and partnerships between OEMs and HVAC system providers

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the automotive electric HVAC compressor market, driven by the rapid expansion of electric vehicle (EV) production, government support for clean mobility, and growing demand for energy-efficient automotive technologies

- Countries such as China, India, South Korea, and Japan are emerging as key growth markets due to rising EV adoption, urbanization, and consumer awareness around climate control and battery efficiency in vehicles

- China leads the regional market with its aggressive EV deployment strategies, extensive supply chain ecosystem, and major domestic manufacturers like BYD and SAIC integrating advanced HVAC systems into their electric fleets

- Japan and South Korea, known for automotive innovation and strong R&D, continue to invest in high-performance compressor technologies to meet evolving consumer expectations in EV performance and passenger comfort

- India, with its growing EV policy initiatives and increasing domestic manufacturing capabilities, is also expected to witness substantial growth in electric HVAC compressor demand, especially in two-wheelers and compact electric cars

- The region’s rising investment in EV infrastructure, favorable regulatory frameworks, and strategic partnerships between OEMs and component manufacturers contribute to the strong projected growth of the automotive electric HVAC compressor market in Asia-Pacific

Automotive Electric HVAC Compressor Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Denso Corporation (Japan)

- Sanden Holdings Corporation (Japan)

- Nidec Corporation (Japan)

- Hitachi Automotive Systems (Japan)

- Lumax (India)

- TKM Electric (China)

- Hanon Systems (South Korea)

- Delphi Technologies (U.K.)

- Koushun Electric Company (Japan)

- Mahle GmbH (Germany)

- Calsonic Kansei Corporation (Japan)

- Sunway Automotive (China)

- Mitsubishi Electric Corporation (Japan)

- LG Magna ePowertrain (South Korea / Canada)

- Valeo (France)

Latest Developments in Global Automotive Electric HVAC Compressor Market

- In June 2021, Hisense Group acquired Sanden Corporation for USD 195.6 million. This strategic acquisition expanded Hisense's presence in the automotive compressor market and enhanced its capabilities in electric vehicle HVAC solutions

- In January 2022, TCCI Manufacturing launched an 850V electric compressor tailored for commercial transport applications. This advanced compressor provides efficient cabin and battery cooling for electric vehicles, supporting the shift toward sustainable mobility

- In February 2024, Hanon Systems celebrated the opening of a state-of-the-art engineering center in Palmela, Portugal. Strategically located within its compressor manufacturing campus, operational since 1998, the facility is dedicated to advancing electric scroll compressor technology for European markets. Spanning 2,488 square meters, the center consolidates testing operations, prototype assembly, and engineering workspaces. It features capabilities such as inverter software development, compressor design, and environmental performance testing. Nearly 100 specialists are employed, with plans for expansion to meet future demands. This initiative underscores Hanon Systems' commitment to innovation and sustainability

- In April 2024, Astute Analytica forecasted that the automotive electric HVAC compressor market would grow to USD 66.52 billion by 2032. This growth is attributed to the rising adoption of electric vehicles and the increasing demand for efficient climate control systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.