Global Automotive Engine Market

Market Size in USD Billion

CAGR :

%

USD

95.95 Billion

USD

115.10 Billion

2024

2032

USD

95.95 Billion

USD

115.10 Billion

2024

2032

| 2025 –2032 | |

| USD 95.95 Billion | |

| USD 115.10 Billion | |

|

|

|

|

Automotive Engine Market Size

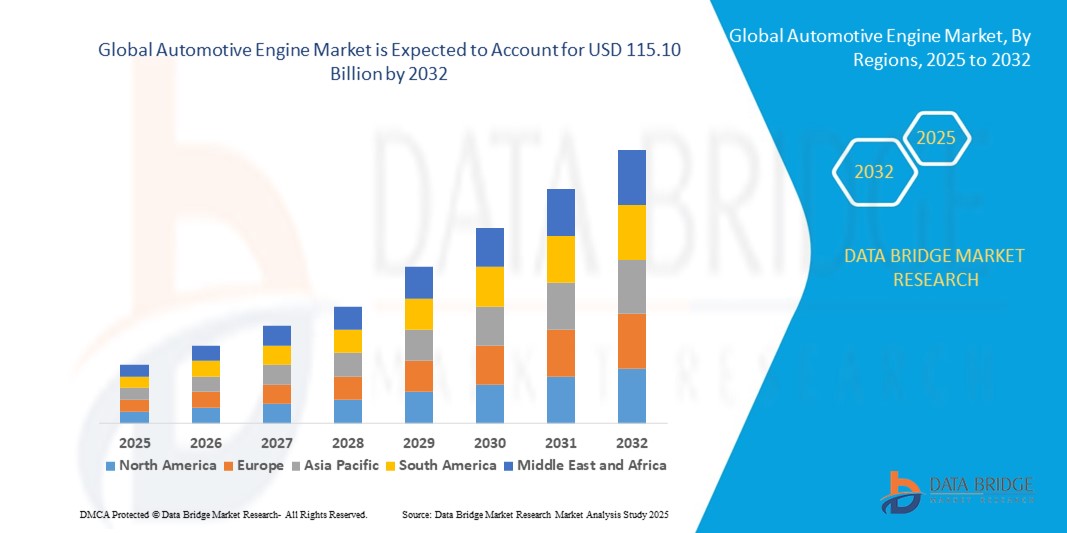

- The global automotive engine market size was valued at USD 95.95 billion in 2024 and is expected to reach USD 115.10 billion by 2032, at a CAGR of 2.30% during the forecast period

- The market growth is largely fuelled by the rising demand for fuel-efficient and low-emission engines supported by stricter environmental regulations worldwide

- Continuous innovation in hybrid and electric-compatible engine technologies is further accelerating adoption, as automakers shift toward meeting sustainability and performance goals

Automotive Engine Market Analysis

- The market is witnessing a transformative shift as manufacturers invest in downsized turbocharged engines that deliver higher power output while reducing fuel consumption

- Hybridization strategies, where conventional engines are paired with electric powertrains, are creating new opportunities in both passenger and commercial vehicle segments

- North America dominated the automotive engine market with the largest revenue share of 36.5% in 2024, driven by strong demand for high-performance vehicles, stringent emission regulations, and continuous technological advancements in engine design

- Asia-Pacific region is expected to witness the highest growth rate in the global automotive engine market, driven by expanding automobile production, rising disposable incomes, and growing demand for passenger cars and commercial vehicles across emerging economies

- The Internal Combustion Engines (ICE) segment held the largest market revenue share in 2024, driven by their widespread use across passenger cars and commercial vehicles. ICE technology remains the backbone of global transportation, supported by well-established infrastructure and continued advancements in fuel efficiency and emission control

Report Scope and Automotive Engine Market Segmentation

|

Attributes |

Automotive Engine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Automotive Engine Market Trends

Shift Toward Hybrid And Electric-Compatible Engines

- The automotive industry is witnessing a steady transition toward hybrid and electric-compatible engines, reshaping the global engine landscape. Automakers are increasingly investing in flexible powertrains that combine fuel efficiency with reduced emissions, aligning with stricter environmental regulations. This shift supports sustainability goals while maintaining performance standards

- The rising consumer demand for greener vehicles is accelerating adoption of engines designed to integrate seamlessly with electric drivetrains. Manufacturers are prioritizing modular platforms that can cater to both conventional and hybrid segments, ensuring adaptability across different markets

- Hybrid-compatible engines also allow automakers to extend vehicle ranges and reduce fuel dependency, making them a strategic bridge toward full electrification. This approach benefits consumers by balancing efficiency, cost-effectiveness, and reliability

- For instance, in 2023, several leading automakers in Europe launched hybrid-engine platforms that delivered improved fuel economy and compliance with Euro 7 emission norms. These innovations not only reduced CO₂ footprints but also positioned manufacturers competitively in global markets

- While the trend toward hybrid and electric engines is accelerating, continued advancements in materials, integration technology, and affordability are crucial. Companies must focus on scalable solutions to ensure widespread adoption and long-term sustainability

Automotive Engine Market Dynamics

Driver

Growing Demand For Fuel-Efficient And Low-Emission Vehicles

- Stricter emission regulations worldwide are pushing manufacturers to design engines that meet high standards for efficiency and sustainability. Governments across major economies are enforcing carbon-neutral roadmaps, creating strong incentives for automakers to prioritize fuel-efficient technologies. These policies are accelerating the adoption of advanced combustion systems and hybrid-ready platforms across global markets

- Consumers are also showing rising awareness of environmental impacts, leading to higher demand for vehicles that offer lower fuel costs and reduced emissions. This has strengthened the case for investment in next-generation engines that support both environmental and financial benefits. Growing eco-consciousness among younger buyers is further pressuring automakers to expand their green vehicle portfolios

- Automakers are heavily investing in R&D for turbocharged, downsized, and hybrid-ready engines. Partnerships with technology providers are also driving innovation, ensuring engines meet future mobility demands. Strategic alliances with battery and software developers are enabling the integration of smart, fuel-efficient features in new-generation powertrains

- For instance, in 2022, Japan implemented advanced emission standards for passenger cars, boosting demand for smaller, fuel-efficient engines with enhanced performance features. This regulatory framework spurred innovation in lightweight designs and hybrid integration. The move also influenced neighboring Asian markets to strengthen their own efficiency and emission policies

- While efficiency-driven adoption is reshaping the market, achieving scalability requires continued collaboration between regulators, automakers, and technology providers to balance performance with affordability. Coordinated policies, incentives, and infrastructure development will be essential to meet future global mobility targets. Without alignment, adoption could remain fragmented across regions

Restraint/Challenge

High Development Costs And Complexity Of Next-Generation Engines

- The high cost associated with developing advanced hybrid and electric-compatible engines is a major challenge for automakers, particularly smaller firms. R&D expenses, testing requirements, and compliance with evolving regulations increase overall production costs. These financial barriers often delay mass-market deployment and limit innovation accessibility

- Complexity in integrating electronic systems, battery management, and software platforms adds additional hurdles. Automakers require specialized expertise and advanced facilities, which are not equally accessible across all regions. The learning curve for hybrid-electric integration also extends product development cycles, slowing time-to-market

- Supply chain issues, including semiconductor shortages and raw material constraints, further limit production scalability. This affects availability and delays market expansion in some economies. Dependence on rare earth materials also creates geopolitical vulnerabilities, increasing risk exposure for manufacturers

- For instance, in 2023, several North American manufacturers reported delays in launching new hybrid-engine models due to rising costs of rare earth materials and limited semiconductor supplies, impacting overall output. These challenges forced companies to reconsider production timelines and adopt alternative sourcing strategies

- While innovation continues, addressing cost and complexity challenges will be vital. Industry stakeholders must focus on collaborative development, scalable designs, and localized production strategies to ensure wider market penetration. Building resilient supply chains and investing in workforce training will be key to overcoming these obstacles

Automotive Engine Market Scope

The market is segmented on the basis of engine type, vehicle type, displacement capacity, and fuel type.

- By Engine Type

On the basis of engine type, the automotive engine market is segmented into Internal Combustion Engines (ICE), Electric Engines, and Alternative Fuel Engines. The Internal Combustion Engines (ICE) segment held the largest market revenue share in 2024, driven by their widespread use across passenger cars and commercial vehicles. ICE technology remains the backbone of global transportation, supported by well-established infrastructure and continued advancements in fuel efficiency and emission control.

The Electric Engines segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the global transition toward sustainable mobility and the rapid expansion of EV infrastructure. Increasing government incentives, consumer demand for zero-emission vehicles, and innovations in battery technologies are accelerating the adoption of electric engines worldwide.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Two-wheelers, and Buses and Coaches. Passenger Cars accounted for the largest revenue share in 2024, driven by high global demand, continuous innovation in powertrain technologies, and regulatory push for cleaner, more efficient engines. Automakers are focusing on compact and hybrid-ready engines to meet diverse consumer preferences.

The Light Commercial Vehicles (LCVs) segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rapid growth of e-commerce, last-mile delivery services, and urban logistics. LCV manufacturers are adopting efficient ICE and hybrid powertrains to balance performance with fuel economy in increasingly congested city environments.

- By Displacement Capacity

On the basis of displacement capacity, the automotive engine market is categorized into Below 1.0L, 1.0L to 2.0L, 2.0L to 3.0L, and Above 3.0L. The 1.0L to 2.0L segment held the largest revenue share in 2024, driven by its dominance in passenger cars and compact SUVs. This range offers the optimal balance of fuel efficiency and power output, making it the preferred choice for both urban and highway driving conditions.

The Below 1.0L segment is expected to witness the fastest growth rate from 2025 to 2032, largely due to rising demand for small, lightweight, and fuel-efficient vehicles in emerging economies. This category is gaining traction in two-wheelers, entry-level cars, and micro-mobility solutions, where affordability and efficiency are key purchase factors.

- By Fuel Type

On the basis of fuel type, the automotive engine market is segmented into Gasoline, Diesel, Electric, Hybrid, and Alternative Fuels. The Gasoline segment accounted for the largest revenue share in 2024, attributed to its strong adoption in passenger cars and wide availability of refueling infrastructure. Continuous innovation in gasoline engine design has further boosted efficiency and reduced emissions, sustaining its market leadership.

The Hybrid segment is expected to witness the fastest growth rate from 2025 to 2032, driven by growing environmental concerns and consumer demand for vehicles offering both efficiency and extended driving range. Hybrid powertrains are emerging as a key transitional technology, combining ICE performance with electric efficiency to support global decarbonization goals.

Automotive Engine Market Regional Analysis

- North America dominated the automotive engine market with the largest revenue share of 36.5% in 2024, driven by strong demand for high-performance vehicles, stringent emission regulations, and continuous technological advancements in engine design

- Consumers in the region prioritize vehicles offering efficiency, durability, and compliance with green standards, creating opportunities for hybrid-ready and turbocharged engines

- This widespread adoption is further supported by high disposable incomes, well-developed infrastructure, and robust automotive manufacturing bases, positioning North America as a leading market for both traditional and next-generation engines

U.S. Automotive Engine Market Insight

The U.S. automotive engine market captured the largest revenue share in 2024 within North America, fueled by rising demand for fuel-efficient passenger cars and light commercial vehicles. Automakers are increasingly investing in downsized, turbocharged, and hybrid-compatible engines to meet consumer expectations and regulatory requirements. The market is further propelled by strong R&D spending, partnerships with technology providers, and the growing trend toward sustainable mobility solutions. In addition, the rising popularity of electric and hybrid powertrains is reshaping competition, boosting adoption across multiple vehicle categories.

Europe Automotive Engine Market Insight

The Europe automotive engine market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by the region’s aggressive emission reduction targets and adoption of hybrid and electric-compatible engines. Increasing urbanization and consumer demand for fuel-efficient vehicles are pushing manufacturers to innovate. Europe also remains a leader in engine technology, supported by strong policy frameworks and established automotive OEMs. The market is witnessing expansion across both passenger and commercial vehicles, with hybrid integration becoming a standard in new model lineups.

U.K. Automotive Engine Market Insight

The U.K. automotive engine market is expected to witness the fastest growth rate from 2025 to 2032, supported by government initiatives to reduce emissions and the rising adoption of hybrid and electric-ready vehicles. Automakers in the U.K. are focusing on cleaner, compact, and technologically advanced engine platforms. Growing consumer interest in sustainable transportation and the country’s well-developed aftermarket services are further boosting demand. In addition, the U.K.’s transition toward carbon-neutral roadmaps is accelerating investments in hybrid-compatible ICE and alternative fuel engines.

Germany Automotive Engine Market Insight

The Germany automotive engine market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country’s strong engineering base and commitment to innovation in engine efficiency. Germany’s leadership in the automotive industry, combined with its focus on sustainability, is driving demand for advanced turbocharged, hybrid, and electric-compatible engines. Automakers are heavily investing in lightweight designs and smart integration with hybrid powertrains. The rising adoption of eco-conscious vehicles across residential and commercial segments further strengthens Germany’s position as a key contributor to the European market.

Asia-Pacific Automotive Engine Market Insight

The Asia-Pacific is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increasing vehicle ownership in countries such as China, India, and Japan. Government policies supporting fuel-efficient vehicles and hybrid adoption are accelerating market expansion. As APAC also serves as a major manufacturing hub for engines and components, affordability and accessibility continue to rise. The market is experiencing significant traction across passenger cars, two-wheelers, and commercial vehicles, supported by ongoing investments in hybrid and electric-compatible designs.

Japan Automotive Engine Market Insight

The Japan automotive engine market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s technological leadership, rapid urbanization, and consumer focus on eco-friendly vehicles. Japan has long emphasized hybrid and alternative fuel adoption, driving growth in innovative engine solutions. The market is supported by integration with electric vehicle systems, compact turbocharged engines, and lightweight designs. Moreover, Japan’s aging population is likely to increase demand for efficient, low-maintenance vehicles, further supporting hybrid and small-capacity engine adoption across the country.

China Automotive Engine Market Insight

The China automotive engine market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by the country’s large-scale automotive production, expanding middle class, and strong demand for both passenger cars and commercial vehicles. China remains one of the largest consumers of hybrid and fuel-efficient vehicles, with government-led initiatives pushing for emission reductions and electrification. Domestic manufacturers are innovating rapidly, producing affordable yet advanced engine platforms. The combination of smart city projects, urban infrastructure growth, and rising adoption of new-energy vehicles continues to boost China’s dominance in the regional market.

Automotive Engine Market Share

The Automotive Engine industry is primarily led by well-established companies, including:

- TOYOTA MOTOR CORPORATION (Japan)

- Ford Motor Company (U.S.)

- Volkswagen AG (Germany)

- General Motors Company (U.S.)

- Honda Motor Co., Ltd. (Japan)

- BMW AG (Germany)

- Daimler AG (Germany)

- Nissan Motor Corporation (Japan)

- Hyundai Motor Company (South Korea)

- Fiat Chrysler Automobiles (now part of Stellantis) (Netherlands)

- Subaru Corporation (Japan)

- Mazda Motor Corporation (Japan)

- Renault SA (France)

- Tata Motors Limited (India)

Latest Developments in Global Automotive Engine Market

- In May 2024, Toyota Motor North America (TMNA) has officially named its California R&D office as the North American Hydrogen Headquarters (H2HQ) to advance its hydrogen fuel cell initiatives. The renovated facility will support research, development, and commercialization of hydrogen-related products, with future plans for a flexible microgrid and a customer education center. President and CEO Ted Ogawa emphasized Toyota's commitment to zero-emission technology

- In May 2021, Ford Motor Company announced a comprehensive plan to invest $22 billion in electrification by 2025, focusing on electrifying iconic models such as the Mustang, F-150, and Transit. The company aims to enhance performance and capability while delivering zero-emission versions of its popular vehicles. Ford is also expanding its electric vehicle infrastructure, boasting North America’s largest public charging network and a dedicated global battery center in Michigan. This strategy aligns with Ford’s commitment to achieving carbon neutrality by 2050 and supporting the transition to electric vehicle ownership

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Automotive Engine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automotive Engine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automotive Engine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.