Global Automotive Ethernet Network Market

Market Size in USD Billion

CAGR :

%

USD

4.12 Billion

USD

19.32 Billion

2024

2032

USD

4.12 Billion

USD

19.32 Billion

2024

2032

| 2025 –2032 | |

| USD 4.12 Billion | |

| USD 19.32 Billion | |

|

|

|

|

Automotive Ethernet Network Market Size

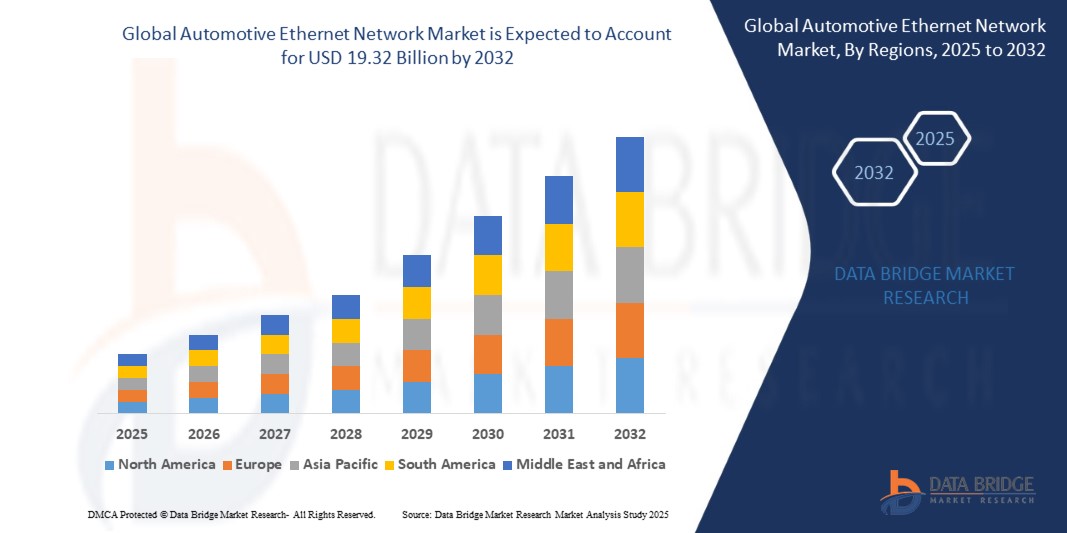

- The global automotive ethernet network market size was valued at USD 4.12 billion in 2024 and is expected to reach USD 19.32 billion by 2032, at a CAGR of 21.3% during the forecast period

- The Automotive Ethernet Network market growth is largely driven by the increasing integration of connected and autonomous vehicle technologies, which demand high-speed, reliable, and scalable in-vehicle communication networks

- Furthermore, the rising need for advanced driver-assistance systems (ADAS), infotainment solutions, and vehicle-to-everything (V2X) connectivity is pushing automakers to adopt Ethernet-based architectures, enhancing data transfer efficiency and overall vehicle performance. These factors are accelerating the adoption of Automotive Ethernet solutions, thereby significantly expanding the market's reach

Automotive Ethernet Network Market Analysis

- Automotive Ethernet networks provide high-speed, low-latency communication between various in-vehicle systems, including sensors, cameras, infotainment modules, and control units. These networks enable scalable data transmission, improved vehicle safety, and enhanced performance in connected and autonomous vehicles

- The increasing deployment of electric vehicles, connected car technologies, and intelligent transportation systems is further propelling the demand for Automotive Ethernet solutions, supported by industry standards and innovations in high-bandwidth in-vehicle networking

- Asia-Pacific dominated the automotive ethernet network market with a share of 48.5% in 2024, due to rapid adoption of connected and autonomous vehicle technologies, strong automotive manufacturing hubs, and rising demand for high-speed in-vehicle data networks

- North America is expected to be the fastest growing region in the automotive ethernet network market during the forecast period due to high demand for connected vehicles, ADAS, and electric mobility solutions

- Passenger cars segment dominated the market with a market share of 52.8% in 2024, due to the increasing integration of advanced infotainment systems, ADAS, and connectivity features in modern cars. Ethernet networks in passenger cars provide high-speed data transmission, supporting real-time applications such as multimedia streaming, navigation, and driver-assistance functionalities. Rising consumer demand for connected and smart vehicles continues to accelerate the deployment of Ethernet-based solutions in passenger vehicles, establishing this segment as the key revenue contributor

Report Scope and Automotive Ethernet Network Market Segmentation

|

Attributes |

Automotive Ethernet Network Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Ethernet Network Market Trends

Increasing Demand for Advanced Driver Assistance Systems (ADAS)

- The rising integration of advanced driver assistance systems is accelerating the adoption of automotive Ethernet networks as vehicles require high-speed, low-latency data transmission to support safety-critical features. Ethernet networks are enabling advanced sensing and decision-making systems that form the backbone of modern driver assistance technologies

- For instance, Broadcom has developed high-speed automotive Ethernet solutions that are increasingly being adopted in vehicles equipped with ADAS features such as lane departure warning, automatic emergency braking, and adaptive cruise control. These technologies require seamless data transfer between cameras, sensors, and control units, making Ethernet networks indispensable

- The growing use of high-resolution cameras, radar, and LiDAR systems is generating large volumes of data that exceed the capacity of legacy communication protocols such as CAN or LIN. Automotive Ethernet networks provide sufficient bandwidth to meet these requirements, supporting real-time decision-making and advanced safety enhancements

- The trend toward automated and autonomous vehicles further strengthens the role of Ethernet, as autonomous driving platforms demand reliable, high-speed connectivity to process data from multiple systems simultaneously with minimal latency

- In addition, standardization efforts such as the development of IEEE 802.3 automotive Ethernet standards are ensuring interoperability and reliability across components, fostering greater adoption by OEMs and Tier 1 suppliers in their ADAS and safety solutions

- The integration of security layers into Ethernet networks is another rising trend as manufacturers strive to prevent cybersecurity risks linked to connected driving features. Secure automotive Ethernet is becoming critical in ensuring the safety and trustworthiness of ADAS applications

Automotive Ethernet Network Market Dynamics

Driver

Demand for In-Vehicle Infotainment (IVI) Systems

- The growing consumer preference for advanced in-vehicle infotainment systems is emerging as one of the strongest drivers for the automotive Ethernet market. Increasing expectations for high-quality audio, video streaming, real-time navigation, and seamless connectivity are placing new demands on vehicle communication bandwidth

- For instance, Marvell Technology has been at the forefront of offering automotive Ethernet switches and transceivers specifically designed to support multiple infotainment features. Their solutions enable high-speed transfers of video and audio while ensuring smooth connectivity for passengers, highlighting how Ethernet meets the need for immersive experiences in modern vehicles

- The rise of connected cars and demand for digital smart cabins further enhances the need for robust Ethernet networks. Infotainment systems integrating voice assistants, internet browsing, and on-demand content require reliable, uncompressed data streams that Ethernet networks can effectively deliver

- Integration with rear-seat entertainment and multi-display dashboards is also contributing to demand. Passengers expect uninterrupted entertainment and real-time content synchronization, which can overwhelm older in-vehicle network systems not designed for such data-intensive applications

- The growing popularity of vehicle-to-cloud connectivity for personalized services, mapping, and real-time software updates pushes infotainment systems to rely more heavily on Ethernet infrastructure, further expanding market growth in this driver segment

Restraint/Challenge

Increasing Service and Maintenance Costs

- The growing complexity of automotive Ethernet networks poses a challenge due to rising service and maintenance costs. Unlike legacy in-vehicle networks, Ethernet systems require advanced diagnostic tools, skilled technicians, and regular software updates, which raises ownership expenses for both manufacturers and consumers

- For instance, industry reports highlight that leading automakers face significant increases in costs related to training and certifying workforce for Ethernet-based architectures. Companies such as Volkswagen and General Motors have invested heavily in upgrading their service networks to handle repairs and updates for Ethernet-enabled vehicles, reflecting the economic challenge for large-scale rollouts

- The integration of advanced cybersecurity protocols to protect Ethernet-connected systems adds costs in both hardware and continuous patching, which impacts OEMs’ profitability and increases consumer service charges

- In addition, frequent technological upgrades in Ethernet standards lead to challenges in backward compatibility. Vehicles equipped with earlier generation Ethernet may face higher maintenance and component replacement costs when systems need updates to meet future requirements

- The limited availability of skilled technicians capable of managing Ethernet-based automotive diagnostics and repairs in smaller markets further raises service costs and delays. This shortage creates a barrier to adoption in regions where technical expertise is scarce, slowing overall market penetration

Automotive Ethernet Network Market Scope

The market is segmented on the basis of component type and vehicle type.

• By Component Type

On the basis of component type, the automotive Ethernet network market is segmented into hardware, software, and services. The hardware segment dominated the largest market revenue share in 2024, driven by the increasing adoption of Ethernet-enabled in-vehicle networking solutions and the need for high-speed data transmission to support advanced driver-assistance systems (ADAS) and infotainment systems. Hardware components, including switches, connectors, and cables, form the backbone of reliable and high-performance automotive Ethernet networks, making them critical for modern vehicles. Automotive manufacturers are investing heavily in robust and scalable hardware solutions to ensure seamless communication across multiple in-vehicle systems, further bolstering the demand for hardware components.

The software segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rising complexity of in-vehicle networks and the need for sophisticated network management, diagnostics, and cybersecurity solutions. Software solutions enable real-time monitoring, optimized data routing, and secure communication across connected vehicle networks. With the growing adoption of autonomous driving features and vehicle-to-everything (V2X) communication, software-driven intelligence in automotive Ethernet networks is becoming indispensable for enhancing safety, performance, and overall vehicle connectivity.

• By Vehicle Type

On the basis of vehicle type, the automotive Ethernet network market is segmented into passenger cars and commercial vehicles. The passenger cars segment dominated the largest market revenue share of 52.8% in 2024, driven by the increasing integration of advanced infotainment systems, ADAS, and connectivity features in modern cars. Ethernet networks in passenger cars provide high-speed data transmission, supporting real-time applications such as multimedia streaming, navigation, and driver-assistance functionalities. Rising consumer demand for connected and smart vehicles continues to accelerate the deployment of Ethernet-based solutions in passenger vehicles, establishing this segment as the key revenue contributor.

The commercial vehicles segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by the growing adoption of connected logistics, telematics, and fleet management solutions. Commercial vehicles increasingly rely on Ethernet networks to enable efficient data communication between engine control units, sensors, and telematics platforms, enhancing operational efficiency, safety, and remote monitoring capabilities. The push toward electrification and autonomous commercial vehicles further reinforces the demand for high-speed, reliable Ethernet networks in this segment.

Automotive Ethernet Network Market Regional Analysis

- Asia-Pacific dominated the automotive ethernet network market with the largest revenue share of 48.5% in 2024, driven by rapid adoption of connected and autonomous vehicle technologies, strong automotive manufacturing hubs, and rising demand for high-speed in-vehicle data networks

- The region’s cost-effective vehicle production landscape, growing investments in electric and smart vehicle development, and expanding exports of automotive electronics are accelerating market expansion

- Availability of skilled labor, supportive government policies for automotive innovation, and increasing focus on next-generation mobility solutions are contributing to heightened adoption of automotive Ethernet networks across passenger and commercial vehicles

China Automotive Ethernet Network Market Insight

China held the largest share in the Asia-Pacific automotive Ethernet network market in 2024, owing to its status as the largest automotive producer globally and strong push toward smart and connected vehicles. Government initiatives supporting intelligent mobility, extensive industrial base for automotive electronics, and increasing exports of connected vehicles are key growth drivers. Continuous investments in ADAS, infotainment systems, and autonomous vehicle technologies are further strengthening demand for Ethernet-based in-vehicle networks.

India Automotive Ethernet Network Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising vehicle production, expanding adoption of connected car technologies, and growing focus on electric and hybrid vehicles. Government initiatives promoting "Make in India" and development of smart mobility infrastructure are encouraging deployment of high-speed automotive networks. Increasing local manufacturing of automotive electronics, rising R&D in advanced driver-assistance systems, and growing export opportunities are accelerating market expansion.

Europe Automotive Ethernet Network Market Insight

The European market is expanding steadily, supported by stringent vehicle safety and connectivity regulations, rising integration of advanced infotainment and ADAS, and investments in sustainable automotive technologies. The region emphasizes high-quality network standards, cybersecurity, and robust in-vehicle communication protocols. Adoption of Ethernet networks in premium and electric vehicles, along with collaboration between automotive OEMs and technology providers, is driving growth.

Germany Automotive Ethernet Network Market Insight

Germany’s market is driven by its strong automotive manufacturing ecosystem, focus on advanced mobility solutions, and high penetration of premium and electric vehicles. Extensive R&D networks and partnerships between automakers and tech firms are fostering innovation in in-vehicle networking. High demand for Ethernet-based solutions in connected, autonomous, and electric vehicles is reinforcing Germany’s market leadership.

U.K. Automotive Ethernet Network Market Insight

The U.K. market is supported by a mature automotive industry, increasing localization of vehicle electronics production, and growing adoption of connected vehicle technologies. Investments in electric vehicle platforms, smart mobility solutions, and advanced driver-assistance systems are driving Ethernet network integration. Collaboration between automotive OEMs and software providers enhances market growth in the region.

North America Automotive Ethernet Network Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by high demand for connected vehicles, ADAS, and electric mobility solutions. Rising investments in autonomous driving technologies, vehicle electrification, and robust automotive R&D infrastructure are boosting adoption of Ethernet networks. Government support for smart transportation systems and collaboration between automakers and tech firms further accelerate market expansion.

U.S. Automotive Ethernet Network Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its strong automotive electronics industry, advanced R&D capabilities, and leadership in connected and autonomous vehicle technologies. The country’s focus on innovation, vehicle safety, and high-speed in-vehicle communication networks is driving adoption of Ethernet solutions. Presence of key OEMs and technology providers further solidifies the U.S.'s dominant position in the region.

Automotive Ethernet Network Market Share

The automotive ethernet network industry is primarily led by well-established companies, including:

- Broadcom Inc. (U.S.)

- NXP Semiconductors NV (Netherlands)

- Marvell Technology Group Ltd. (Bermuda)

- Microchip Technology Inc. (U.S.)

- Texas Instruments Inc. (U.S.)

- Vector Informatik GmbH (Germany)

- Keysight Technologies (U.S.)

- Cadence Design Systems (U.S.)

- Aukua Systems Inc. (U.S.)

- Texas Instruments Inc. (U.S.)

Latest Developments in Global Automotive Ethernet Network Market

- In March 2024, ENNOVI introduced an automotive 10Gbps+ Ethernet Connector Solution featuring a standardized USCAR interface and press-fit pins, eliminating the need for soldering. This innovation enhances the flexibility and efficiency of in-vehicle Ethernet integration, allowing OEMs and suppliers to customize board- and connector-interface positioning, thereby accelerating adoption of high-speed Ethernet solutions in automotive applications

- In March 2024, Analog Devices, Inc. (ADI) and the BMW Group announced their collaboration on the early adoption of ADI’s E²B technology, utilizing 10BASE-T1S Ethernet to the Edge bus. This development supports the implementation of new zonal architectures and software-defined vehicle designs, positioning BMW as a pioneer in advanced Ethernet deployment and driving demand for high-speed, scalable in-vehicle networking solutions

- In February 2024, AVIVA Links, Inc. launched the industry’s first family of multi-gigabit asymmetrical Ethernet devices based on the ASA-MLE draft specification, including Ethernet PHYs, switches, CSI-2 bridge ICs, and zonal aggregators. These products address ultra-high bandwidth requirements for video and control links, supporting the growing trend of advanced driver-assistance systems (ADAS) and infotainment applications, thereby accelerating adoption of asymmetric high-speed Ethernet networks in the automotive market

- In November 2023, Broadcom completed the acquisition of VMware, Inc. for around USD 61.0 billion, enabling enhanced innovation in connected vehicle solutions. The acquisition provides expanded capabilities to build, manage, and protect large-scale automotive applications, fostering the integration of advanced software-defined networking and connectivity solutions within vehicles

- In October 2023, Microchip Technology Inc. announced the expansion of its Detroit Automotive Technology Center in Novi, Michigan, adding a 24,000-square-foot facility with high-voltage and E-mobility labs. This expansion strengthens technical training and development capabilities, supporting faster innovation and deployment of automotive Ethernet and other in-vehicle networking solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.