Global Automotive Films Market

Market Size in USD Million

CAGR :

%

USD

6.48 Million

USD

9.68 Million

2024

2032

USD

6.48 Million

USD

9.68 Million

2024

2032

| 2025 –2032 | |

| USD 6.48 Million | |

| USD 9.68 Million | |

|

|

|

|

Automotive Films Market Size

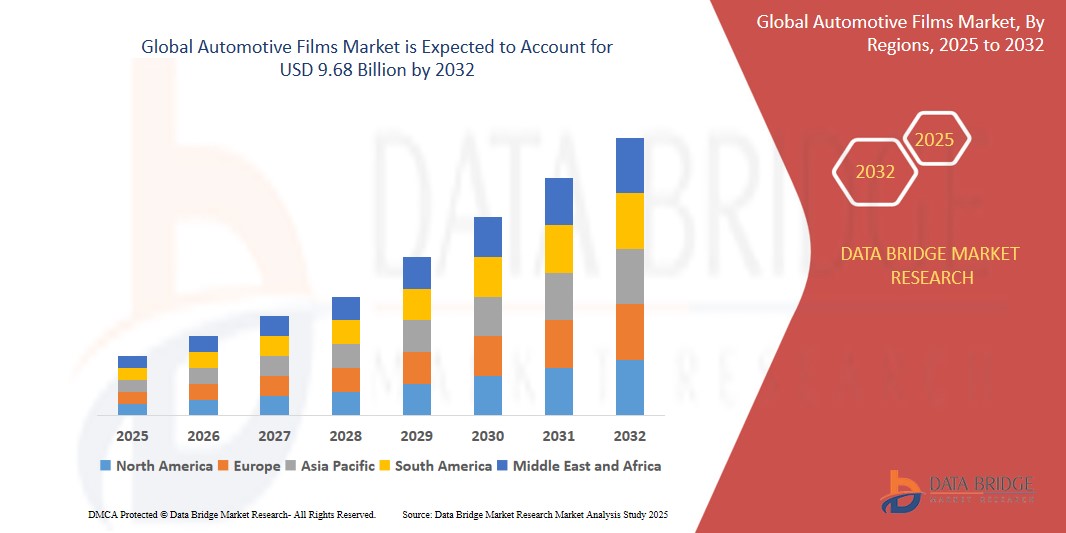

- The global automotive films market was valued at USD 6.48 billion in 2024 and is expected to reach USD 9.68 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.15%, primarily driven by rising vehicle production, demand for UV protection, aesthetic enhancements, privacy concerns, and stricter environmental regulations are driving market growth.

- This growth is driven by factors such as rising automotive sales, increasing demand for comfort, heat control, UV protection, and growing vehicle customization trends

Automotive Films Market Analysis

- Automotive films are utilized in advanced applications across automotive, advertising, and energy-saving industries to enhance vehicle security, privacy, UV protection, and visual appeal. These films enable improved passenger comfort and foster collaborations among raw material suppliers, adhesive manufacturers, and OEMs to drive innovation and meet evolving safety and aesthetic standards

- The demand for automotive films is significantly driven by the rising need for glare reduction, protection against harmful solar radiation, energy efficiency, and vehicle durability. Increased focus on privacy, safety, and cost-effective maintenance solutions propels adoption. Additionally, advancements in film materials such as polyester, polystyrene, and polycarbonate improve performance and affordability. Government initiatives promoting industrialization, consumer safety, and energy conservation further stimulate market growth, alongside rising investments in sustainable automotive technologies

- The Asia-Pacific region stands out as one of the dominant regions for automotive films, driven by its booming automotive production, rising consumer awareness, and growing focus on vehicle customization and energy efficiency

- For instance, China leads in automotive films adoption. Major automotive companies leverage cutting-edge film technologies, supported by government urbanization initiatives, pollution control policies, and automotive sector incentives, to enhance vehicle safety, comfort, and aesthetic value.

- Globally, the automotive films market ranks as a critical segment within the automotive accessories and materials space, playing a pivotal role in improving vehicle performance, occupant comfort, energy efficiency, and aesthetic appeal across both commercial and passenger vehicles.

Report Scope and Automotive films Market Segmentation

|

Attributes |

Automotive Films Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive films Market Trends

“Increasing Vehicle Production and Sales”

- One prominent trend in the advancement of Automotive films is the rising vehicle production and sales across both passenger and commercial vehicle segments, which is directly boosting demand for these films

- Automotive films provide functional and aesthetic benefits such as UV protection, thermal insulation, and enhanced vehicle appearance, making them increasingly essential as vehicle volumes grow worldwide

- For instance, with the surge in global automotive sales, manufacturers are incorporating high-performance films for window tinting, paint protection, and surface enhancements, supporting both consumer demand for customization and regulatory requirements for safety and efficiency

- The widespread adoption of these films improves vehicle durability, enhances energy efficiency by reducing air conditioning load, and contributes to greater overall vehicle performance

- These developments are transforming the automotive sector, driving material innovations, and aligning with global trends toward smarter, more sustainable, and consumer-oriented mobility solutions

Automotive Films Market Dynamics

Driver

“Rising Demand for UV Protection and Heat Control”

- The rising consumer demand for enhanced UV protection and heat control is significantly driving the growth of the Automotive films market

- As awareness about the harmful effects of solar radiation and the need for greater in-cabin comfort grows, manufacturers are increasingly focusing on developing advanced film technologies that offer superior heat rejection and UV blocking capabilities

- Automotive films are extensively used in vehicle windows and windshields due to their ability to minimize solar heat gain, protect interiors from UV damage, and improve overall driving comfort

- These films not only enhance passenger well-being but also contribute to improved vehicle energy efficiency by reducing the load on air conditioning systems, thus lowering fuel consumption and emissions

- As consumer expectations for safer, more comfortable, and energy-efficient vehicles continue to rise, the demand for innovative Automotive films is poised to expand, supporting the evolution of smarter and more sustainable automotive technologies

- For instance, Premium UV-blocking films are increasingly being incorporated in modern vehicles to shield occupants from over 99% of harmful UV rays while also reducing interior temperatures by up to 60%, thereby significantly enhancing driving comfort and preserving vehicle interiors

- Advanced heat control films are finding application in electric vehicles (EVs) where managing thermal comfort without compromising battery range is critical, showcasing the growing role of high-performance films in supporting energy efficiency and sustainability goals in the automotive sector

Opportunity

“Growing Demand for Smart Films”

- The growing demand for smart films, such as electrochromic and photochromic technologies, is driven by their ability to provide dynamic privacy control, heat management, and enhanced comfort in vehicles

- These advanced films improve vehicle efficiency by automatically adjusting tint levels based on external light conditions, reducing the reliance on air conditioning systems and thereby lowering energy consumption

- Additionally, the adoption of smart films aligns with trends toward connected, energy-efficient, and user-centric vehicle designs, supporting the automotive industry's shift toward smarter, greener mobility solutions

- For instance, Electrochromic films, like those used in luxury vehicles such as the Mercedes-Benz S-Class and Boeing 787 Dreamliner windows, offer adjustable tinting at the touch of a button, enhancing passenger comfort, reducing glare, and improving thermal efficiency. These innovations are creating new revenue streams in the automotive sector by offering premium personalization and energy savings features

Restraint/Challenge

“High Installation Costs”

- While there is growing demand for premium automotive films, the high installation costs of advanced films, such as those with ceramic coatings or self-healing properties, remain a significant challenge for wider adoption

- These films, while offering superior performance and durability, come with significant installation expenses due to their specialized materials and installation techniques

- The high cost of installation can deter price-sensitive consumers, particularly in emerging markets, limiting the broader acceptance of premium automotive films and hindering their overall market growth

Automotive Films Market Scope

The market is segmented on the basis of film type, vehicle type, application, function, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Film Type |

|

|

By Vehicle Type |

|

|

By Application |

|

|

By Function

|

|

|

By Distribution Channel |

|

Automotive Films Market Regional Analysis

“North America is the Dominant Region in the Automotive Films Market”

- North America dominates the Automotive films market, driven by a rise in vehicle personalization trends, technological advancements, and the strong presence of key industry players

- The U.S. holds a significant share of the market due to the increasing adoption of automotive wraps for customization, with consumers seeking more personalized and unique vehicle appearances

- The region's well-developed automotive industry, coupled with the growing demand for vehicle aesthetics and protection solutions, creates a favorable environment for the growth of the Automotive films market

- Furthermore, the presence of major automotive manufacturers, strong consumer interest in innovative vehicle features, and rising demand for films that provide both functional and aesthetic benefits continue to propel the expansion of the Automotive films market across North America

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the Automotive films market, driven by increasing consumer awareness of the benefits these films offer and rising demand for automotive customization

- Countries such as China, India, and Japan are emerging as key markets, propelled by growing awareness of the advantages of automotive films, including UV protection, heat control, and enhanced privacy

- Japan, with its advanced automotive technology infrastructure and focus on innovation, remains a pivotal market for high-performance automotive films. The country continues to lead in integrating smart vehicle solutions and promoting eco-friendly materials

- China and India, with their rapidly expanding automotive sectors and rising middle-class consumer base, are seeing increased investments in automotive film solutions. The growing emphasis on vehicle customization and the adoption of premium features further accelerate market growth in the region

Automotive films Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- 3M (U.S.)

- Madico Inc (U.S.)

- Solar Screen (U.S.)

- Geoshield (U.S.)

- NEXFIL (South Korea)

- LINTEC Corporation (Japan)

- Eastman Chemical Company (U.S.)

- Zeofilms (South Africa)

- Ergis (Poland)

- AVERY DENNISON CORPORATION (U.S.)

- Johnson Window Films Inc. (U.S.)

Latest Developments in Global Automotive films Market

- In March 2024, Renault announced its partnership with India’s renowned DPIFF as the Powered by Partner for 2024. This collaboration symbolizes the fusion of automotive excellence with cinematic brilliance.

- In February 2024, INEOS Automotive and BASF's Coatings division formed an agreement focused on advancing global automotive refinish body and paint technologies. This partnership marks the beginning of a long-term strategic collaboration aimed at surpassing industry standards in vehicle body repair and paint restoration. It includes the supply of sustainable resurfacing solutions, expertise, cutting-edge color matching technologies, and training

- In January 2024, China further solidified its commitment to electric vehicles (EVs) as BYD positioned itself to surpass Tesla as the leading global EV manufacturer.

- In June 2023, Toray Industries, Inc. introduced PICASUS, a high heat-insulating solar control film designed for advanced mobility applications. This film leverages the company’s innovative nano-multilayer technology to provide transparency comparable to glass, while offering exceptional thermal insulation by blocking the sun’s infrared rays.

- In February 2023, Eastman Chemical Company acquired Ai-Red Technology (Dalian) Co., Ltd., a leading manufacturer and supplier of paint protection and window films for the automotive and architectural markets in the Asia Pacific. This acquisition strengthened Eastman’s presence in China and boosted its earning potential.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Automotive Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automotive Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automotive Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.