Global Automotive Filters Oe Market

Market Size in USD Billion

CAGR :

%

USD

2.45 Billion

USD

4.38 Billion

2024

2032

USD

2.45 Billion

USD

4.38 Billion

2024

2032

| 2025 –2032 | |

| USD 2.45 Billion | |

| USD 4.38 Billion | |

|

|

|

|

Automotive Filters OE Market Size

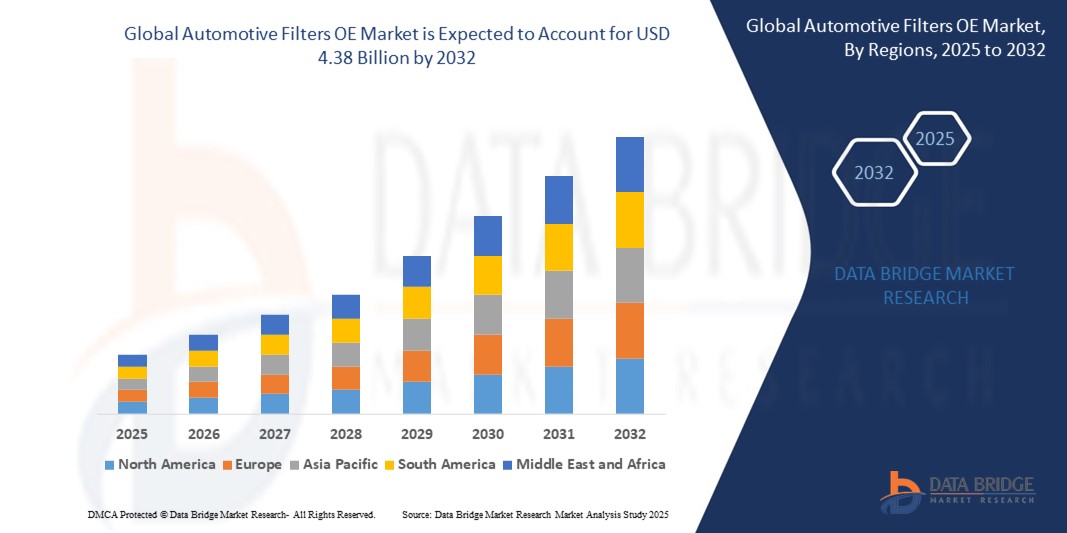

- The Global Automotive Filters OE Market size was valued at USD 2.45 billion in 2024 and is expected to reach USD 4.38 billion by 2032, at a CAGR of 7.52% during the forecast period

- The market growth is largely fueled by need for efficient filtration and adherence to stringent emissions standards.

Automotive Filters OE Market Analysis

- Automotive filters are essential components in Original Equipment (OE) manufacturing, playing a critical role in enhancing vehicle performance, protecting engine components, and improving air and fluid quality. These filters—engine oil, air, cabin air, fuel, and transmission help ensure cleaner combustion, better air circulation in cabins, and longer engine life, directly impacting vehicle efficiency, emissions, and safety.

- Market growth is driven by stricter emission regulations, rising production of ICE (internal combustion engine) vehicles, and increasing demand for high-performance, fuel-efficient automobiles. Automotive OEMs are integrating advanced multi-layered filtration systems to comply with Euro 6, BS-VI, and other global standards.

- Europe is expected to dominate the global Automotive Filters OE Market with 52.45% in 2024 backed by its stringent emission norms, high automotive production levels in Germany, France, and the UK, and growing emphasis on sustainable mobility. Leading OEMs are increasingly collaborating with filter manufacturers to deliver custom-engineered solutions to meet evolving powertrain technologies.

- Asia-Pacific is projected to witness the fastest market growth, supported by a surge in passenger and commercial vehicle manufacturing, especially in China and India. Rapid urbanization, improved road infrastructure, and increasing consumer demand for fuel-efficient vehicles are pushing OEMs to equip new vehicles with advanced filtration systems.

- The air filter segment accounted for the largest revenue with 54.12% market share in 2024 , driven by its critical role in maintaining engine efficiency and reducing emissions. With increased consumer demand for cleaner emissions and improved fuel economy, OEMs continue to invest in high-efficiency air filtration systems for combustion engines. The widespread application of air filters across all vehicle segments, including passenger cars, trucks, and buses, supports the segment’s dominance.

Report Scope and Automotive Filters OE Market Segmentation

|

Attributes |

Automotive Filters OE Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Filters OE Market Trends

“Integration of Advanced Filtration Technologies for Emissions and Cabin Air Quality”

- A key trend shaping the global automotive filters OE market is the integration of advanced multi-layer filtration systems that improve engine performance, enhance fuel efficiency, and significantly reduce harmful emissions. In particular, the adoption of activated carbon and electrostatic cabin filters is rising to meet both regulatory demands and consumer expectations for in-cabin air quality.

- Automakers are also embracing next-generation brake dust and oil separator filters to align with stringent Euro 7 and similar emissions norms globally, particularly in Europe and Asia.

For instance,

- In February 2024, leading German OEMs began integrating dual-stage cabin filters with activated carbon and electrostatic layers into new vehicle models to combat rising concerns over particulate matter and allergens. These filters not only protect HVAC systems but also improve passenger comfort, aligning with growing health-conscious consumer preferences.

- Additionally, the trend toward modular filter designs and synthetic media is gaining traction due to their longer lifespan, recyclability, and performance consistency across various environmental conditions.

Automotive Filters OE Market Dynamics

Driver

“Rising Vehicle Production and Stringent Emissions Regulations”

- Increasing global vehicle production, especially in emerging markets like India, China, and Brazil, is a primary driver of the automotive filters OE market. As internal combustion engine (ICE) vehicles continue to dominate the vehicle mix, the demand for OEM-installed air, fuel, oil, and cabin filters remains strong.

- Furthermore, stringent government regulations such as BS-VI (India), Euro 6/7 (Europe), and EPA Tier 3 (U.S.) are compelling OEMs to adopt high-efficiency filtration systems that reduce greenhouse gas emissions and airborne pollutants.

For instance,

- In May 2024, automakers in India were mandated to equip all petrol and diesel passenger vehicles with advanced fuel and oil filtration systems to comply with BS-VI Phase 2 norms. This regulation led to a 15% rise in OE filter demand across domestic manufacturers, fueling significant short-term market growth.

- The growing demand for cabin air filters is also driven by heightened awareness of in-cabin air quality post-COVID, particularly in urban markets with high levels of air pollution.

Restraint/Challenge

“Market Volatility Due to Fluctuating Raw Material Prices and Electrification Shift”

- A significant challenge faced by the automotive filters OE market is the price volatility of raw materials such as synthetic fibers, rubber, and steel mesh, which impacts production costs and supply chain stability. Supply disruptions stemming from geopolitical tensions and inflationary pressures further strain OEM budgets and timelines.

For instance,

- In late 2024, European OEMs reported a 12–18% increase in procurement costs for synthetic filtration media due to petrochemical price hikes and logistics delays. These rising input costs led to renegotiations in OEM-supplier contracts and minor production delays for several vehicle models.

- Moreover, the accelerating transition to electric vehicles (EVs) poses a long-term structural challenge, as EVs eliminate the need for traditional fuel and oil filters. While cabin and brake dust filters remain relevant, the decline in ICE production could reduce demand in certain filter categories over time.

- Navigating this transformation requires filter manufacturers to diversify product portfolios and invest in EV-compatible filter solutions, which may involve high R&D costs and uncertain returns.

Automotive Filters OE Market Scope

The market is segmented on the basis of filter type, media type, and material composition.

- By Filter Type

On the basis of Filter Type, the Automotive Filters OE Market is segmented into air filter, fuel filter, oil filter, cabin filter, brake dust filter, transmission filter, coolant filter, oil separator, and steering filter. The air filter segment accounted for the largest revenue with 54.12% market share in 2024 , driven by its critical role in maintaining engine efficiency and reducing emissions. With increased consumer demand for cleaner emissions and improved fuel economy, OEMs continue to invest in high-efficiency air filtration systems for combustion engines. The widespread application of air filters across all vehicle segments, including passenger cars, trucks, and buses, supports the segment’s dominance.

The cabin filter segment is projected to witness the fastest CAGR growth rate 13.67% from 2025 to 2032, propelled by heightened health awareness and growing demand for enhanced in-cabin air quality. Rising concerns over urban air pollution and allergens have made advanced cabin filters a priority for automakers, especially in premium and electric vehicle lines. Innovations such as HEPA and PM2.5 particle filters are further expanding the segment's growth potential.

- By Media Type

On the basis of media type, the Automotive Filters OE Market is segmented cellulose media and synthetic media. The cellulose media segment held the highest market share in 2024, attributed to its cost-effectiveness and widespread use in traditional fuel, air, and oil filters. Cellulose fibers offer sufficient filtration efficiency for conventional vehicle designs and are easily integrated into mass production processes by OEMs.

The synthetic media segment is expected to grow at the fastest rate during the forecast period, owing to its superior durability, filtration precision, and moisture resistance. Synthetic media are increasingly adopted in high-performance and luxury vehicles due to their ability to support extended service intervals and withstand extreme operating conditions, such as high temperatures and heavy particulate environments.

- By Material Type

On the basis of material used in cabin filters, the market is segmented into particle cabin filters, activated carbon cabin filters, and electrostatic cabin filters. The particle cabin filter segment currently leads the market in terms of revenue share in 2024, as it provides a basic and cost-efficient solution for blocking dust, pollen, and other particulate matter. Widely adopted in entry-level and mid-range vehicles, these filters represent a standard offering across most OEM lines.

The activated carbon cabin filter segment is forecast to experience the highest CAGR from 2025 to 2032, driven by its ability to neutralize odors, harmful gases, and volatile organic compounds (VOCs). Consumer preferences for premium in-vehicle air quality and odor control have accelerated adoption across the luxury vehicle segment and EVs. Additionally, the rising trend toward wellness-oriented interiors is pushing OEMs to integrate activated carbon filters as a value-added feature.

Automotive Filters OE Market Regional Analysis

Europe is expected to dominate the global Automotive Filters OE Market with 52.45% in 2024 backed by its stringent emission norms, high automotive production levels in Germany, France, and the UK, and growing emphasis on sustainable mobility.

Leading OEMs are increasingly collaborating with filter manufacturers to deliver custom-engineered solutions to meet evolving powertrain technologies.

Increasing urbanization and consumer awareness of air quality are accelerating the uptake of cabin filters with activated carbon and electrostatic media.

Germany Automotive Filters OE Market Insight

The Germany Automotive Filters OE Market captured the largest revenue share of 81.06% in 2024 within Europe, due to significant demand from luxury vehicle manufacturers focusing on advanced filtration solutions to meet high-performance and emission standards. The country’s push for cleaner mobility and government incentives for eco-friendly vehicles are driving innovations in synthetic media and oil separator filters. Additionally, integration of filters in emerging hybrid and mild-hybrid vehicles supports growth.

North America Automotive Filters OE Market Insight

The North America Automotive Filters OE Market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent emissions regulations, high vehicle production, and the increasing demand for advanced filtration technologies. The region’s focus on vehicle safety, passenger comfort, and engine efficiency is boosting demand for cabin air filters and synthetic media filters. Additionally, growing aftermarket replacements and OEM upgrades in the U.S. and Canada further support market growth.

U.S. Automotive Filters OE Market Insight

The U.S. Automotive Filters OE Market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by fueled by the rapid adoption of lightweight vehicles and stricter EPA emissions standards. Increasing production of SUVs and electric vehicles (EVs) equipped with advanced filtration systems is driving the demand for oil and fuel filters. Consumer preferences for cleaner cabin air and enhanced engine performance are also encouraging OEMs to innovate in filter materials and designs. Strong automotive manufacturing infrastructure and technological advancements in filtration media contribute to market expansion.

Asia-Pacific Automotive Filters OE Market Insight

The Asia-Pacific Automotive Filters OE Market is poised to grow at the fastest CAGR of 20.42% during the forecast period of 2025 to 2032, driven by rapid industrialization, increasing vehicle production, and expanding automotive OEM activities in countries like China, India, and Japan. Rising environmental regulations and consumer demand for cleaner air inside vehicles are fueling the demand for premium cabin filters. The region’s expanding middle class and growing preference for passenger cars and SUVs drive the need for air, fuel, and oil filters.

India Automotive Filters OE Market Insight

India’s automotive filters market is growing rapidly, supported by increasing vehicle ownership, stricter BS-VI emission norms, and expanding production of passenger and commercial vehicles. Rising awareness about air pollution and demand for cabin air quality improvement drive the adoption of activated carbon and electrostatic cabin filters. The growing replacement market and affordable filter options from local manufacturers further propel growth.

China Automotive Filters OE Market Insight

China holds the largest market revenue share in Asia-Pacific in 2024, propelled by the world’s largest automotive production volume and a surge in new vehicle sales. Government initiatives promoting emission reductions and clean vehicle technologies encourage the use of high-efficiency filters. Domestic manufacturers are investing in research and development to produce advanced filtration media, boosting local and export markets.

Automotive Filters OE Market Share

The Automotive Filters OE industry is primarily led by well-established companies, including:

- ACEA (Belgium)

- Japan Automobile Manufacturers Association, Inc. (Japan)

- ACMA India (India)

- Mahindra & Mahindra Ltd. (India)

- Tata Motors (India)

- TOYOTA MOTOR CORPORATION (Japan)

- HYUNDAI MOTOR GROUP (South Korea)

- Ford Motor Company (US)

- Daimler AG (Germany)

- Volkswagen AG (Germany)

- K&N Engineering, Inc. (US)

- Hengst SE (Germany)

- WHI Solutions, Inc. (US)

- Ahlstrom-Munksjö (Finland)

- DENSO CORPORATION (Japan)

- Sogefi SpA (Italy)

- Robert Bosch GmbH (Germany)

- Donaldson Company, Inc. (US)

- MANN+HUMMEL (Germany)

- Kavo Parts (Netherlands)

Latest Developments in Global Automotive Filters OE Market

- In April 2025, Mann+Hummel introduced its latest cabin air filter designed specifically for electric vehicles (EVs). This advanced filter features a multi-layer design with activated carbon and HEPA technology, targeting the increasing demand for high-efficiency filtration to improve air quality inside EVs. The product launch addresses growing consumer concerns over cabin air pollution and allergen protection, helping automakers meet stricter interior air quality standards worldwide.

- In March 2025, Donaldson Company completed the acquisition of FS Filters, a European filtration specialist focused on high-performance engine and hydraulic filters. This strategic acquisition expands Donaldson’s OE portfolio and strengthens its footprint in the European automotive market. The move aims to accelerate innovation in filtration technologies, enabling Donaldson to better serve OEMs with comprehensive filter solutions tailored for internal combustion and hybrid vehicles.

- In January 2025, Honeywell unveiled a new nano-fiber oil filter media designed to improve filtration efficiency and extend oil change intervals for heavy-duty vehicles. The innovation uses advanced nanotechnology to capture smaller particles and contaminants, enhancing engine protection and reducing maintenance costs for commercial vehicle OEMs. Honeywell’s nano-fiber media is gaining rapid interest from global truck manufacturers looking to improve vehicle durability and sustainability.

- In February 2025, Mahle announced a collaboration with Bosch to co-develop next-generation particulate filters with improved soot capturing capabilities for gasoline direct injection engines. The partnership focuses on combining Mahle’s filter manufacturing expertise with Bosch’s sensor and control technology to enhance real-time filter monitoring and performance. This joint effort is expected to set new benchmarks for emission control systems in passenger vehicles.

- In April 2025, Tenneco launched an eco-friendly cabin air filter under its Global OE product line in North America. The filter uses sustainable materials and biodegradable components without compromising filtration efficiency. This product launch responds to increasing regulatory pressure and consumer demand for environmentally responsible automotive components. Tenneco expects this innovation to boost its OE market share in passenger vehicles by aligning with green manufacturing trends.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.