Global Automotive Fuse Block Market

Market Size in USD Billion

CAGR :

%

USD

26.60 Billion

USD

45.36 Billion

2025

2033

USD

26.60 Billion

USD

45.36 Billion

2025

2033

| 2026 –2033 | |

| USD 26.60 Billion | |

| USD 45.36 Billion | |

|

|

|

|

Automotive Fuse Block Market Size

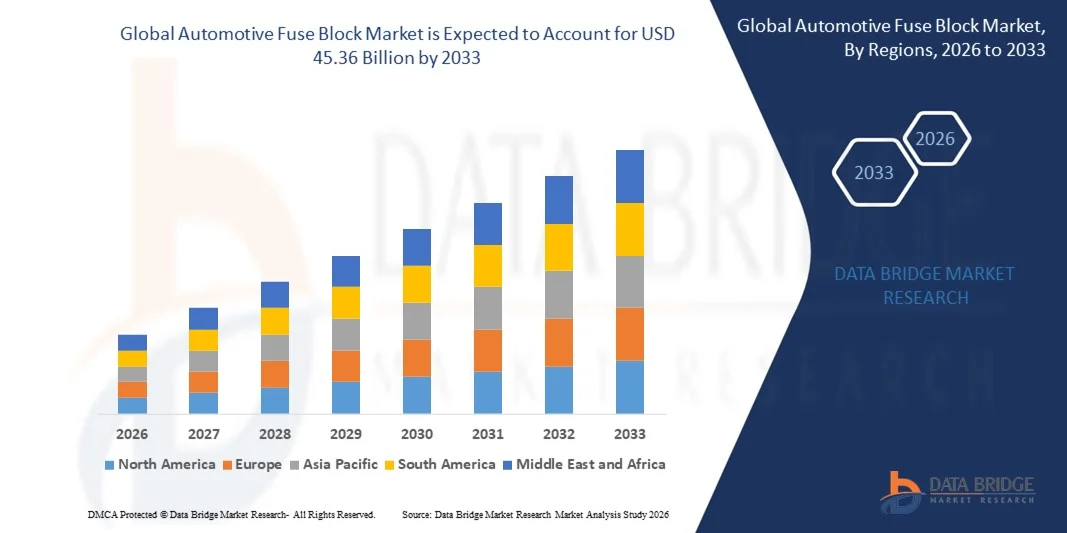

- The global automotive fuse block market size was valued at USD 26.6 billion in 2025 and is expected to reach USD 45.36 billion by 2033, at a CAGR of 6.90% during the forecast period

- The market growth is largely fuelled by the increasing demand for advanced electrical systems in vehicles and the rising production of electric and hybrid vehicles

- Growing adoption of connected and smart vehicle technologies is further contributing to market expansion

Automotive Fuse Block Market Analysis

- The market is witnessing steady growth due to the integration of complex electrical systems in modern vehicles, including infotainment, safety, and power management systems

- Continuous innovation in fuse block design, including compact and modular solutions, is enhancing vehicle efficiency and reliability

- North America dominated the automotive fuse block market with the largest revenue share in 2025, driven by high vehicle production volumes, increasing demand for passenger and commercial vehicles, and the widespread adoption of advanced electrical systems in automobiles

- Asia-Pacific region is expected to witness the highest growth rate in the global automotive fuse block market, driven by increasing automotive production, rising disposable incomes, and government initiatives supporting electric and hybrid vehicle adoption

- The blade segment held the largest market revenue share in 2025, driven by its widespread use in passenger vehicles and compatibility with standard electrical systems. Blade fuses are highly favored for their ease of replacement, reliability, and cost-effectiveness across various automotive applications

Report Scope and Automotive Fuse Block Market Segmentation

|

Attributes |

Automotive Fuse Block Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Fuse Block Market Trends

Advancements in Electrical Systems Driving Fuse Block Adoption

- The increasing integration of advanced electrical and electronic systems in vehicles is transforming the automotive fuse block landscape by enabling safer and more reliable power distribution. Modern vehicles with infotainment systems, ADAS, and electric drivetrains rely heavily on fuse blocks to protect circuits, reducing failure risks and enhancing overall vehicle safety

- The growing demand for electric and hybrid vehicles is accelerating the adoption of high-capacity, modular, and compact fuse blocks. These solutions are particularly effective in managing complex electrical architectures and ensuring consistent performance across automotive platforms. The trend is further supported by OEMs focusing on innovative vehicle designs

- The affordability and ease of installation of modern fuse blocks are making them attractive for both OEMs and aftermarket suppliers, leading to more widespread adoption in passenger and commercial vehicles. Manufacturers benefit from reduced assembly complexity and improved electrical system reliability, which enhances customer satisfaction and reduces warranty costs

- For instance, in 2023, several European automakers reported improved vehicle reliability and reduced electrical failures after implementing modular fuse block systems across their EV and hybrid fleets. These implementations allowed faster assembly, simplified maintenance, and enhanced protection for high-voltage circuits

- While fuse block innovations are enhancing vehicle safety and reliability, their impact depends on continued technological advancement, standardization, and supplier partnerships. Manufacturers must prioritize modular, scalable, and compact solutions to fully capitalize on growing vehicle electrification

Automotive Fuse Block Market Dynamics

Driver

Rising Demand for Electric Vehicles and Advanced Automotive Electronics

- The surge in electric and hybrid vehicle production is pushing automakers to adopt advanced fuse blocks as a critical component for power management and circuit protection. Vehicles with higher electrical loads require robust solutions to prevent short circuits and ensure passenger safety

- OEMs are increasingly aware of the operational and financial risks associated with electrical failures, including recalls, warranty claims, and brand reputation damage. This awareness is driving the widespread adoption of modular and compact fuse block systems across global vehicle platforms

- Government regulations and safety standards focusing on electrical system reliability and vehicle safety are further supporting the market. Mandates for circuit protection and compliance testing encourage automakers to deploy standardized and high-performance fuse block solutions

- For instance, in 2022, the U.S. National Highway Traffic Safety Administration (NHTSA) updated safety guidelines emphasizing robust electrical circuit protection, boosting demand for advanced fuse block systems across passenger and commercial vehicles

- While rising EV adoption and regulatory compliance are driving growth, automakers must continue to innovate in fuse block design, reduce system complexity, and ensure compatibility with evolving vehicle architectures to sustain market expansion

Restraint/Challenge

High Cost of Advanced Fuse Blocks and Complex Integration Requirements

- The high price point of advanced modular and compact fuse blocks, especially those designed for electric vehicles and high-voltage systems, limits adoption among small-scale manufacturers and aftermarket suppliers. Cost remains a significant barrier to widespread usage

- Many automotive facilities face challenges in integrating advanced fuse blocks into existing vehicle platforms due to complexity in assembly, wiring harness compatibility, and electrical system design. This slows adoption and increases engineering costs

- Market penetration is also restricted by supply chain limitations, including the availability of high-quality components and specialized materials required for advanced fuse blocks. Delays in sourcing can impact production schedules and vehicle delivery timelines

- For instance, in 2023, several Asian automotive plants reported delays in EV assembly due to the limited availability of high-voltage fuse blocks, affecting production and delivery timelines for hybrid and electric models

- While automotive fuse block technologies continue to evolve, addressing cost, integration complexity, and supply chain challenges remains crucial. Market stakeholders must focus on modular, scalable, and cost-effective solutions to unlock long-term growth potential

Automotive Fuse Block Market Scope

The automotive fuse block market is segmented on the basis of fuse type, circuit type, voltage, material, vehicle type, sales channel, and application

- By Fuse Type

On the basis of fuse type, the market is segmented into blade, semiconductor, and glass tube. The blade segment held the largest market revenue share in 2025, driven by its widespread use in passenger vehicles and compatibility with standard electrical systems. Blade fuses are highly favored for their ease of replacement, reliability, and cost-effectiveness across various automotive applications.

The semiconductor segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising adoption of electric and hybrid vehicles requiring advanced electrical protection. Semiconductor fuses provide rapid response to overcurrent conditions and enhanced safety for high-voltage automotive systems, making them ideal for modern vehicle architectures.

- By Circuit Type

On the basis of circuit type, the market is segmented into 2-4 circuit, 4-8 circuit, 8-12 circuit, and more than 12 circuit. The 4-8 circuit segment accounted for the largest share in 2025 due to its common usage in standard passenger cars and light commercial vehicles.

The more than 12 circuit segment is expected to witness the fastest growth from 2026 to 2033, driven by the increasing complexity of vehicle electrical systems and the integration of multiple electronic control units (ECUs).

- By Voltage

On the basis of voltage, the market is segmented into 12 volt, 24 volt, 48 volt, and more than 48 volt. The 12-volt segment held the largest revenue share in 2025, owing to its dominant presence in conventional vehicles and compatibility with standard automotive electrical systems.

The 48-volt segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the rising demand for mild hybrid and electric vehicles, which utilize higher-voltage systems for improved efficiency and performance.

- By Material

On the basis of material, the market is segmented into steel and alloy material. Steel-based fuse blocks accounted for the largest share in 2025, driven by their durability, strength, and widespread adoption in automotive manufacturing.

Alloy material fuse blocks are expected to witness the fastest growth during the forecast period, owing to their lightweight properties and enhanced performance in high-voltage applications, particularly in electric and hybrid vehicles.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger car, light commercial vehicle (LCV), heavy commercial vehicle (HCV), two-wheeler, battery electric vehicle, hybrid electric vehicle, and plug-in hybrid vehicle. Passenger cars held the largest market share in 2025 due to their high production volumes and extensive use of automotive fuses for electrical safety.

Battery electric vehicles are expected to witness the fastest growth from 2026 to 2033, driven by the global push toward electric mobility, stricter emission regulations, and increasing consumer adoption of EVs.

- By Sales Channel

On the basis of sales channel, the market is segmented into original equipment manufacturer (OEM) and aftermarket. The OEM segment accounted for the largest share in 2025, supported by automakers’ preference for factory-fitted fuse blocks ensuring quality, reliability, and compliance with safety standards.

The aftermarket segment is expected to witness the fastest growth during the forecast period, fueled by rising vehicle maintenance needs, replacement demand, and increasing awareness of aftermarket electrical safety solutions.

- By Application

On the basis of application, the market is segmented into auxiliary, charge inlet, battery, PCU, onboard, and traction motor. The battery application segment held the largest share in 2025, owing to its critical role in vehicle power distribution and electrical protection.

The traction motor application segment is expected to witness the fastest growth from 2026 to 2033, driven by the rapid adoption of electric vehicles and the increasing complexity of high-power EV drive systems requiring advanced fuse protection.

Automotive Fuse Block Market Regional Analysis

- North America dominated the automotive fuse block market with the largest revenue share in 2025, driven by high vehicle production volumes, increasing demand for passenger and commercial vehicles, and the widespread adoption of advanced electrical systems in automobiles

- Consumers and manufacturers in the region highly value the reliability, safety, and ease of integration offered by modern fuse blocks, which protect critical vehicle electronics and enhance operational efficiency

- This widespread adoption is further supported by stringent automotive safety regulations, high disposable incomes, and the growing trend of electric and hybrid vehicle deployment, establishing automotive fuse blocks as essential components across vehicle types

U.S. Automotive Fuse Block Market Insight

The U.S. automotive fuse block market captured the largest revenue share in North America in 2025, driven by rapid vehicle production, increasing adoption of electric vehicles, and technological advancements in automotive electrical systems. OEMs are increasingly prioritizing factory-fitted fuse blocks to ensure safety, reliability, and compliance with regulatory standards. Moreover, growing aftermarket demand for replacement and upgrade solutions further propels market growth.

Europe Automotive Fuse Block Market Insight

The Europe automotive fuse block market is expected to witness the fastest growth rate from 2026 to 2033, fueled by stringent vehicle safety regulations and the rising adoption of electric and hybrid vehicles. Increasing urbanization, government incentives for EV adoption, and a strong focus on emission reduction are fostering the integration of advanced fuse systems. Europe is also witnessing growth in both OEM and aftermarket segments due to vehicle modernization and retrofitting.

U.K. Automotive Fuse Block Market Insight

The U.K. automotive fuse block market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing vehicle electrification and demand for enhanced safety and reliability in automotive electrical systems. Government policies promoting EV adoption, coupled with the growing aftermarket for automotive electrical components, are boosting market expansion

Germany Automotive Fuse Block Market Insight

The Germany automotive fuse block market is expected to witness the fastest growth rate from 2026 to 2033, owing to the country’s focus on automotive innovation, electrification, and eco-friendly vehicle technologies. High production volumes, advanced infrastructure, and a preference for technologically robust and durable components are driving the adoption of modern fuse blocks across passenger and commercial vehicles.

Asia-Pacific Automotive Fuse Block Market Insight

The Asia-Pacific automotive fuse block market is expected to witness the fastest growth rate from 2026 to 2033, propelled by rapid urbanization, increasing vehicle production, and rising EV adoption in countries such as China, Japan, and India. The region’s expanding middle class, government initiatives supporting electric mobility, and APAC’s emergence as a major automotive manufacturing hub are boosting demand for advanced fuse block solutions.

Japan Automotive Fuse Block Market Insight

The Japan automotive fuse block market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high focus on automotive technology, electrification, and vehicle safety. Integration of fuse blocks in hybrid and electric vehicles, along with increasing adoption of smart vehicle electrical systems, is driving market expansion. In addition, Japan’s aging population and emphasis on vehicle reliability further support demand.

China Automotive Fuse Block Market Insight

The China automotive fuse block market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid vehicle production, growing EV adoption, and rising demand for reliable and high-performance automotive electrical components. Government incentives for electric mobility, strong domestic manufacturers, and expanding aftermarket services are key factors propelling market growth in China

Automotive Fuse Block Market Share

The Automotive Fuse Block industry is primarily led by well-established companies, including:

- Littelfuse, Inc. (U.S.)

- HELLA New Zealand Limited (New Zealand)

- Prakant Electronics Pvt. Ltd (India)

- Eaton (U.S.)

- Hinew International Company Limited (China)

- Omega Fusibili S.p.A. (Italy)

- Anupam Industries (India)

- MUD-UK (U.K.)

- MTA S.p.A. (Italy)

- MERSEN USA (U.S.)

- Apolo Industrial Corporation (U.S.)

- Blue Sea Systems (U.S.)

- Pacific Engineering Corporation (Japan)

- LEONI Bordnetz-Systeme GmbH (Germany)

- Semiconductor Components Industries, LLC (U.S.)

- Sensata Technologies, Inc. (U.S.)

- SCHURTER (Switzerland)

- OptiFuse (U.S.)

- AEM Components (USA), Inc. (U.S.)

- Fuzetec Technology Co., Ltd. (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.