Global Automotive Gear Oil Market

Market Size in USD Billion

CAGR :

%

USD

3.28 Billion

USD

5.94 Billion

2024

2032

USD

3.28 Billion

USD

5.94 Billion

2024

2032

| 2025 –2032 | |

| USD 3.28 Billion | |

| USD 5.94 Billion | |

|

|

|

|

Automotive Gear Oil Market Size

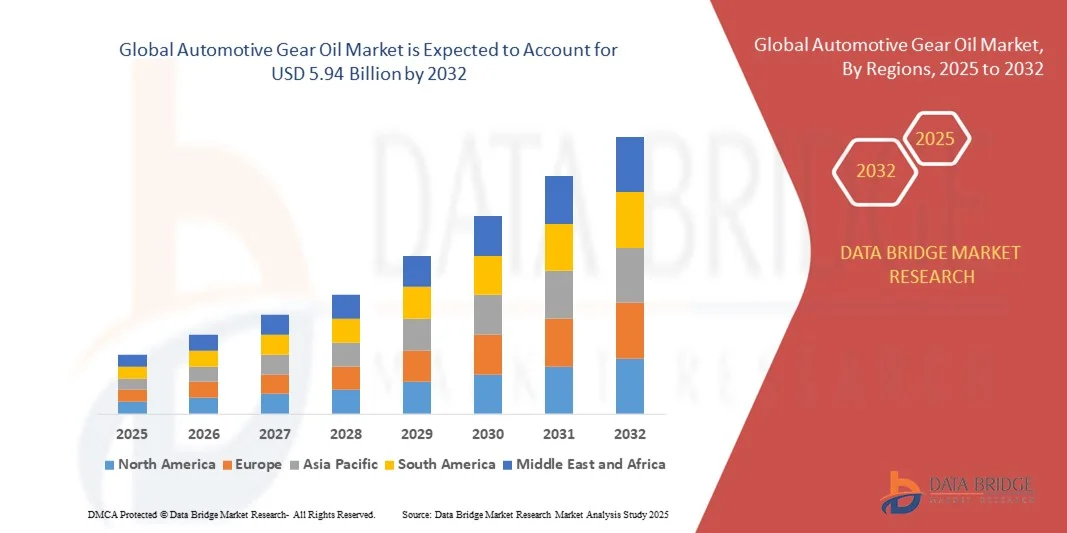

- The global automotive gear oil market size was valued at USD 3.28 billion in 2024 and is expected to reach USD 5.94 billion by 2032, at a CAGR of 7.72% during the forecast period

- The market growth is largely fueled by the rising adoption of advanced vehicles, increasing production of passenger cars and commercial vehicles, and growing awareness about the importance of high-performance lubricants for engine and transmission longevity

- Furthermore, increasing consumer and fleet operator demand for fuel-efficient, long-lasting, and performance-optimized gear oils is establishing synthetic and specialized lubricants as the preferred choice for modern vehicles. These converging factors are accelerating the uptake of high-quality gear oils, thereby significantly boosting the industry's growth

Automotive Gear Oil Market Analysis

- Automotive gear oils, providing essential lubrication for engines, transmissions, and differentials, are increasingly vital components for both passenger and commercial vehicles due to their role in enhancing fuel efficiency, reducing wear, and extending service life

- The escalating demand for automotive gear oils is primarily driven by rising vehicle production, growing fleet sizes, adoption of high-performance and electric vehicles, and increasing awareness of OEM-recommended lubricants for optimal vehicle performance

- North America dominated the automotive gear oil market in 2024, due to the high adoption of vehicles, increasing focus on vehicle maintenance, and awareness of advanced lubricants

- Asia-Pacific is expected to be the fastest growing region in the automotive gear oil market during the forecast period due to rapid vehicle production, urbanization, and rising disposable incomes in countries such as China, India, and Japan

- Synthetic gear oil segment dominated the market with a market share of 49% in 2024, due to its superior performance characteristics, including higher thermal stability, better oxidation resistance, and longer service life. Vehicle owners and fleet operators often prefer synthetic gear oils for their ability to enhance fuel efficiency, reduce wear and tear, and maintain viscosity under extreme operating conditions. The segment also benefits from increasing awareness about the importance of engine protection and reduced maintenance costs. Moreover, synthetic gear oils are widely recommended by OEMs for modern vehicles with high-performance and turbocharged engines, further solidifying their dominance in the market

Report Scope and Automotive Gear Oil Market Segmentation

|

Attributes |

Automotive Gear Oil Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Gear Oil Market Trends

Rising Use of Synthetic Gear Oils for Better Efficiency and Drivetrain Protection

- The automotive gear oil market is witnessing a strong transition toward synthetic formulations as manufacturers and consumers seek enhanced performance, longer oil life, and superior drivetrain protection. Synthetic gear oils provide excellent resistance to oxidation, temperature fluctuations, and shear breakdown, enhancing the operational efficiency of modern transmissions and axles under demanding conditions

- For instance, ExxonMobil Corporation and Royal Dutch Shell plc have expanded their synthetic gear oil product lines with advanced formulations designed for extreme performance and fuel efficiency. Products such as Mobil Delvac Syn Gear Oil and Shell Spirax S6 GXME 75W-80 are engineered to reduce frictional losses and protect critical gear components in commercial vehicles and passenger cars alike

- The adoption of synthetic gear oils is improving lubrication stability and performance across a wide temperature range, minimizing wear, corrosion, and sludge formation. Such oils maintain consistent viscosity and offer extended drain intervals, reducing maintenance frequency and total ownership costs for vehicle owners and fleet operators

- In addition, synthetic formulations are playing a critical role in improving energy efficiency and supporting OEM requirements for low-viscosity lubricants compatible with modern drivetrain systems. Their advanced properties also contribute to better fuel economy and reduced emissions by optimizing mechanical efficiency

- The ongoing push for electrification and lightweight vehicle design is creating demand for high-performance lubricants that can handle higher torque densities and thermal stress in compact drivetrain configurations. Synthetic gear oils offer the stability and thermal control needed for these evolving mechanical designs

- As automotive performance requirements and environmental standards continue to evolve, the widespread adoption of synthetic gear oils represents a fundamental shift toward durable, efficient, and eco-compliant lubrication solutions across global vehicle segments

Automotive Gear Oil Market Dynamics

Driver

Growing Vehicle Production and Fleet Expansion

- The expansion of global vehicle production and the rising number of commercial and passenger fleets are primary drivers for the automotive gear oil market. Increasing vehicle ownership, coupled with growing transportation and logistics activity, is boosting demand for high-performance gear oils that ensure smooth operation and long-term reliability of drivetrains

- For instance, Castrol Limited and TotalEnergies SE have increased their gear oil production capacities to support OEMs and large fleet maintenance operations in Asia-Pacific and North America. Their specialized formulations are designed to improve drivetrain efficiency, helping meet the operational and durability needs of expanding automotive fleets

- The growing popularity of automatic and dual-clutch transmissions is further fueling the requirement for premium-grade gear oils that can withstand higher pressures and thermal load. Gear oils play a vital role in reducing frictional wear, promoting seamless gear shifting, and extending the lifespan of transmission components in vehicles of all classes

- In addition, the rapid growth of industrial logistics and public transportation is generating continued aftermarket demand for gear lubricants used in heavy-duty trucks, buses, and off-highway vehicles. This consistent usage pattern secures a steady replacement cycle that supports long-term market sustainability

- The combined effects of expanding vehicle populations, ongoing infrastructure growth, and heightened performance expectations are reinforcing the essential role of gear oils in achieving drivetrain efficiency and reliability. These factors collectively underpin the continuous revenue growth across the global automotive lubrication market

Restraint/Challenge

Compliance with Strict Environmental and Emission Regulations

- Stricter environmental and emission standards are posing notable challenges for the automotive gear oil market. Regulations mandating reduced carbon emissions and eco-friendly lubricants require significant reformulation of traditional oil compositions to ensure compliance with evolving global sustainability goals

- For instance, FUCHS PETROLUB SE and Valvoline Inc. have invested in developing low-toxicity and recyclable lubricant technologies to meet the European Union’s REACH and U.S. EPA emission guidelines. Despite these advancements, the continuous evolution of standards often necessitates costly R&D efforts and reformulation of lubricant additives to maintain regulatory compliance

- Restrictions on sulfur, phosphorus, and zinc content in lubricants designed for modern engines can affect product stability and performance. Modifying formulations to adhere to these regulations while maintaining thermal resistance and wear protection remains a key challenge for manufacturers

- In addition, waste oil recycling and disposal laws in various regions increase operational costs for producers and service workshops managing used lubricants. Ensuring proper biodegradability and minimizing environmental impact during the product lifecycle are further complicating compliance measures

- Addressing these regulatory constraints through eco-friendly additive development, sustainable production methods, and advanced chemical testing will be critical for the long-term viability of gear oil manufacturers operating in increasingly regulated markets

Automotive Gear Oil Market Scope

The market is segmented on the basis of product type and vehicle type.

- By Product Type

On the basis of product type, the automotive gear oil market is segmented into mineral gear oil, synthetic gear oil, and others. The synthetic gear oil segment dominated the market with the largest revenue share of 49% in 2024, driven by its superior performance characteristics, including higher thermal stability, better oxidation resistance, and longer service life. Vehicle owners and fleet operators often prefer synthetic gear oils for their ability to enhance fuel efficiency, reduce wear and tear, and maintain viscosity under extreme operating conditions. The segment also benefits from increasing awareness about the importance of engine protection and reduced maintenance costs. Moreover, synthetic gear oils are widely recommended by OEMs for modern vehicles with high-performance and turbocharged engines, further solidifying their dominance in the market.

The mineral gear oil segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its cost-effectiveness and continued use in older vehicles and budget commercial fleets. Mineral gear oils offer acceptable lubrication performance for conventional transmissions and differential systems, making them a popular choice in developing regions. The growing retrofit demand and gradual modernization of fleet maintenance practices are expected to boost its adoption. Its availability in various viscosity grades and compatibility with different gearbox configurations also support consistent market growth.

- By Vehicle Type

On the basis of vehicle type, the automotive gear oil market is segmented into off-road vehicles, heavy commercial vehicles, light commercial vehicles, and passenger cars. The passenger cars segment dominated the market with the largest revenue share in 2024, driven by the rising production of private vehicles, increasing disposable income, and a strong focus on vehicle maintenance and longevity. Gear oils for passenger cars are increasingly optimized for performance, fuel efficiency, and reduced emissions, making them essential for modern vehicles. The popularity of synthetic oils in this segment further strengthens market dominance, as they provide superior protection under stop-and-go urban traffic conditions and varying climate scenarios. OEM recommendations and aftermarket replacement trends also contribute to the sustained preference for high-quality gear oils in passenger cars.

The heavy commercial vehicle segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by rapid growth in logistics, mining, and construction sectors that rely on high-capacity trucks and buses. These vehicles operate under heavy loads and harsh conditions, making advanced gear oils critical for reducing downtime and extending transmission life. Increased awareness among fleet operators about vehicle efficiency, cost optimization, and maintenance reliability is driving adoption. In addition, the development of specialized gear oils for heavy-duty applications ensures better protection and operational performance, supporting rapid segment growth.

Automotive Gear Oil Market Regional Analysis

- North America dominated the automotive gear oil market with the largest revenue share in 2024, driven by the high adoption of vehicles, increasing focus on vehicle maintenance, and awareness of advanced lubricants

- Consumers and fleet operators in the region prioritize high-performance gear oils that enhance fuel efficiency, reduce wear and tear, and extend transmission life

- This widespread adoption is further supported by high disposable incomes, stringent vehicle maintenance standards, and growing awareness about environmental compliance, establishing synthetic and premium gear oils as preferred solutions for passenger cars and commercial fleets

U.S. Automotive Gear Oil Market Insight

The U.S. automotive gear oil market captured the largest revenue share in 2024 within North America, fueled by rising vehicle ownership and the strong preference for synthetic gear oils in modern vehicles. Fleet operators and individual consumers increasingly prioritize gear oils that improve engine performance and reduce long-term maintenance costs. The growing trend of preventive maintenance, coupled with awareness of OEM-recommended lubricants, further propels the market. In addition, the integration of advanced lubricants in commercial and passenger vehicles, including off-road and heavy-duty trucks, significantly contributes to market expansion.

Europe Automotive Gear Oil Market Insight

The Europe automotive gear oil market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strict vehicle emission norms, regulatory mandates on lubricant quality, and rising demand for fuel-efficient solutions. Increased urbanization and growing adoption of high-performance vehicles are fostering gear oil consumption across passenger and commercial vehicles. European consumers and fleet operators are also drawn to long-life synthetic oils that reduce maintenance intervals. The region is witnessing notable growth across passenger cars, light commercial vehicles, and heavy-duty trucks, with premium lubricants increasingly incorporated in new vehicles and replacement applications.

U.K. Automotive Gear Oil Market Insight

The U.K. automotive gear oil market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing vehicle production, rising safety and performance expectations, and the growing preference for synthetic gear oils. Concerns regarding transmission longevity and fuel efficiency are encouraging both individual vehicle owners and commercial fleet operators to choose high-performance lubricants. The U.K.’s strong automotive aftermarket, combined with increasing awareness of OEM recommendations, is expected to continue stimulating market growth.

Germany Automotive Gear Oil Market Insight

The Germany automotive gear oil market is expected to expand at a considerable CAGR during the forecast period, fueled by stringent environmental regulations, technological advancements in lubricants, and a high focus on vehicle efficiency. Germany’s well-established automotive industry and emphasis on innovation support the adoption of synthetic and specialized gear oils. Integration of advanced gear oils in both passenger and commercial vehicles, along with increasing fleet modernization, is promoting market growth. Moreover, the demand for eco-friendly and performance-optimized lubricants aligns with German consumers’ sustainability and efficiency priorities.

Asia-Pacific Automotive Gear Oil Market Insight

The Asia-Pacific automotive gear oil market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid vehicle production, urbanization, and rising disposable incomes in countries such as China, India, and Japan. The region's growing automotive sector, supported by government policies promoting industrial growth and modernization of commercial fleets, is boosting gear oil demand. In addition, the increasing adoption of synthetic and high-performance gear oils in passenger cars and commercial vehicles is expanding the market. APAC’s role as a manufacturing hub for automotive lubricants and the availability of cost-effective options further enhance accessibility for a broader consumer base.

Japan Automotive Gear Oil Market Insight

The Japan automotive gear oil market is gaining momentum due to high technological adoption in vehicles, an aging population demanding reliable vehicle maintenance, and a preference for synthetic lubricants. The market growth is driven by the increasing number of high-performance passenger cars, hybrid vehicles, and connected commercial fleets. Japanese consumers prioritize gear oils that improve fuel efficiency, reduce maintenance intervals, and offer superior transmission protection. Integration of advanced lubricants in modern vehicles and government regulations on emission reduction are supporting sustained demand.

China Automotive Gear Oil Market Insight

The China automotive gear oil market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, a growing middle-class population, and expansion of the passenger car and commercial vehicle segments. Synthetic and high-performance gear oils are increasingly preferred due to their ability to enhance vehicle efficiency, reduce wear, and extend service intervals. Government initiatives promoting fleet modernization, combined with the presence of strong domestic lubricant manufacturers, are key factors propelling the market. China’s growing automotive aftermarket and increasing awareness of OEM-recommended lubricants further support market expansion.

Automotive Gear Oil Market Share

The automotive gear oil industry is primarily led by well-established companies, including:

- Lubrication Engineers (U.S.)

- FUCHS (Germany)

- BP P.L.C. (U.K.)

- Total (France)

- ZF Friedrichshafen AG (Germany)

- Valvoline LLC (U.S.)

- Chevron U.S.A. Inc. (U.S.)

- Exxon Mobil Corporation (U.S.)

- Apar Industries Ltd. (India)

- LUKOIL Marine Lubricants DMCC (U.A.E.)

- Idemitsu Kosan (Japan)

- Phillips 66 Company (U.S.)

- Peak Lubricants Pty Ltd (Australia)

- Carl Bechem Lubricants India Private Limited (India)

- Calumet Branded Products, LLC (U.S.)

- Saudi Arabian Oil Co. (Saudi Arabia)

- Penrite Oil (Australia)

- The Lubrizol Corporation (U.S.)

- HP Lubricants (U.K.)

- China Petroleum & Chemical Corporation (China)

Latest Developments in Global Automotive Gear Oil Market

- In October 2025, RAVENOL launched a dedicated EV‑gear‑oil product line under its EV‑SYNTO range, specifically designed for electric vehicle drivetrains that operate under low‑viscosity, high‑torque, and thermal‑management conditions. This development directly addresses the unique lubrication requirements of electric vehicles, supporting the shift toward electrification in the automotive sector. By offering products tailored for EVs, RAVENOL strengthens its position in a rapidly growing segment of the automotive gear oil market and enhances its potential to capture market share among manufacturers and fleet operators transitioning to electric mobility

- In September 2025, Royal Dutch Shell announced a strategic partnership with a leading technology firm to develop AI‑driven solutions for lubricant formulation. The collaboration aims to optimize the performance of gear oils while minimizing their environmental footprint, reflecting the market’s increasing focus on sustainability. By integrating artificial intelligence into product development, Shell is positioned to accelerate innovation, improve efficiency in formulation, and meet growing consumer demand for high-performance and environmentally responsible lubricants, thereby enhancing its competitive edge in the automotive gear oil market

- In August 2025, ExxonMobil (U.S.) unveiled a new line of synthetic gear oils specifically engineered for electric vehicles. This strategic move aligns with the industry’s growing trend toward electrification and positions ExxonMobil as a market leader in providing specialized products for emerging vehicle technologies. The launch is expected to enhance drivetrain efficiency, reduce wear, and cater to the evolving requirements of EV owners, signaling the company’s commitment to supporting next-generation mobility solutions and strengthening its presence in the automotive gear oil sector

- In July 2025, BP (U.K.) expanded its manufacturing capabilities in Asia by investing in a new facility dedicated to producing high-performance gear oils. This expansion addresses the rising demand in the Asia-Pacific region, which is witnessing rapid growth in passenger cars and commercial vehicles. By increasing production capacity, BP is enhancing supply chain reliability and ensuring timely delivery of advanced lubricants to meet regional market needs. This move reinforces BP’s strategic focus on operational efficiency, market responsiveness, and long-term growth in a highly competitive automotive gear oil landscape

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Automotive Gear Oil Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automotive Gear Oil Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automotive Gear Oil Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.