Global Automotive Grade Inductors Market

Market Size in USD Billion

CAGR :

%

USD

2.49 Billion

USD

3.21 Billion

2025

2033

USD

2.49 Billion

USD

3.21 Billion

2025

2033

| 2026 –2033 | |

| USD 2.49 Billion | |

| USD 3.21 Billion | |

|

|

|

|

Automotive Grade Inductors Market Size

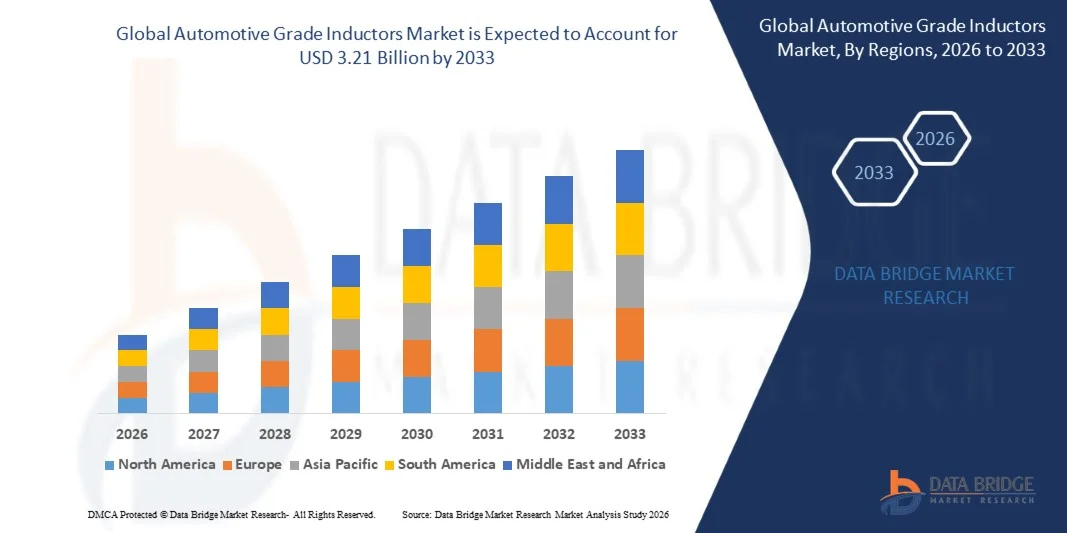

- The global automotive grade inductors market size was valued at USD 2.49 billion in 2025 and is expected to reach USD 3.21 billion by 2033, at a CAGR of 3.20% during the forecast period

- The market growth is largely fueled by the increasing adoption of electric and hybrid vehicles, rising integration of electronic control units (ECUs), and the growing complexity of automotive electronics requiring efficient power management and signal conditioning

- Furthermore, escalating demand for energy-efficient, high-performance, and thermally stable inductors in powertrain systems, infotainment modules, and ADAS applications is driving manufacturers to adopt advanced automotive-grade inductors. These converging factors are accelerating the adoption of inductors across passenger and commercial vehicles, thereby significantly boosting the industry's growth

Automotive Grade Inductors Market Analysis

- Automotive-grade inductors, essential for voltage regulation, EMI suppression, and power conversion in vehicle electronic systems, are becoming increasingly critical components due to the rise of electrified powertrains, connected vehicles, and advanced driver-assistance systems

- The escalating demand for automotive-grade inductors is primarily fueled by growing EV penetration, increasing complexity of in-vehicle electronics, rising safety and efficiency requirements, and the need for reliable, compact, and high-current handling components

- Asia-Pacific dominated the automotive grade inductors market with a share of 47.7% in 2025, due to expanding automotive production, rising deployment of electronic control units (ECUs), and the rapid shift toward electric mobility across major economies

- North America is expected to be the fastest growing region in the automotive grade inductors market during the forecast period due to rising adoption of electric and hybrid vehicles, increasing integration of ADAS and infotainment systems, and strong investments in automotive semiconductor manufacturing

- SMD power inductors segment dominated the market with a market share of 62.5% in 2025, due to their compact size, surface-mount compatibility, and strong adoption across ECUs, infotainment units, and powertrain electronics. Automakers prefer SMD inductors as they support high-frequency operations and efficient power regulation in modern automotive circuitry. Their ability to withstand thermal stress and vibration makes them suitable for under-the-hood environments in EVs and hybrid vehicles. Frequent integration in ADAS modules and battery management systems further accelerates their market leadership. Manufacturers continue to invest in high-current and low-loss SMD designs, reinforcing the dominance of this segment

Report Scope and Automotive Grade Inductors Market Segmentation

|

Attributes |

Automotive Grade Inductors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Grade Inductors Market Trends

“Growing Use of Inductors in Electric and Hybrid Vehicles”

- A significant trend in the automotive grade inductors market is the increasing deployment of inductors in electric and hybrid vehicles, driven by rising electrification and the need for efficient power management across powertrains and onboard electronics. This trend is reinforcing the role of automotive-grade inductors as essential components in energy-efficient and high-performance vehicle systems

- For instance, Murata Manufacturing and TDK Corporation supply high-performance inductors for EV power converters and battery management systems. These components support stable voltage regulation, reduce energy losses, and enhance the reliability of electrified vehicle systems

- The adoption of advanced inductors in hybrid and plug-in hybrid vehicles is growing rapidly as these components enable effective DC-DC conversion, EMI suppression, and current handling in compact electronic modules. This is positioning automotive-grade inductors as critical elements for next-generation mobility platforms

- Increasing integration of inductors in electronic control units and powertrain modules is accelerating innovation in high-current, thermally stable designs that ensure efficient operation under demanding automotive conditions

- Manufacturers are also expanding the use of inductors in ADAS, infotainment, and autonomous driving systems, highlighting their importance in enhancing overall vehicle functionality and energy efficiency

- The market is witnessing strong growth in high-voltage and high-current automotive electronics, where advanced inductors contribute to improved system performance, reliability, and energy conservation. This rising incorporation is reinforcing the overall transition toward electrified and digitally connected vehicles

Automotive Grade Inductors Market Dynamics

Driver

“Rising Integration of Advanced Vehicle Electronics”

- The growing complexity of automotive electronics is driving demand for high-performance inductors capable of supporting power conversion, EMI suppression, and voltage regulation in ECUs, inverters, and infotainment systems. These components are crucial for maintaining stable operation in electrified and connected vehicles

- For instance, Vishay Intertechnology and Coilcraft provide automotive-grade inductors designed for hybrid and EV powertrains, enabling efficient energy transfer and reliable current handling. Such components strengthen system durability and ensure consistent performance under variable automotive operating conditions

- Increasing adoption of connected vehicle systems, ADAS, and autonomous technologies is further fueling demand for precision inductors. These components support rapid signal processing, energy-efficient power distribution, and reliable system integration

- The rising deployment of electric vehicles and high-power electronics modules is creating a need for compact, high-efficiency inductors that can withstand thermal stress and vibration. This trend reinforces their role as critical enablers of modern vehicle electronics

- Growing OEM investments in EV and hybrid technologies, combined with regulatory pressures for energy efficiency, are strengthening market expansion. The demand for advanced inductors is becoming a key factor in enabling safer, more efficient, and technologically sophisticated automotive systems

Restraint/Challenge

“High Production Costs and Strict Quality Standards”

- The automotive grade inductors market faces challenges due to high manufacturing costs, stringent AEC-Q200 compliance requirements, and the need for precision in high-current, thermally stable components. These factors increase overall production complexity and elevate cost structures for manufacturers

- For instance, Bourns and Murata deploy advanced fabrication techniques and rigorous quality inspections to meet automotive reliability standards. These procedures demand specialized equipment, skilled labor, and precise material handling, raising operational expenses

- Producing high-performance automotive inductors requires adherence to strict tolerance and durability standards to ensure safe and reliable operation in harsh automotive environments. These quality controls extend production timelines and contribute to higher unit costs

- The reliance on advanced materials and high-precision assembly processes increases supply chain complexity and impacts cost efficiency. Manufacturers face difficulties balancing performance, reliability, and economic feasibility

- The market continues to encounter constraints in scaling production of compact, high-efficiency inductors while maintaining cost-effectiveness. These challenges collectively pressure manufacturers to innovate in process optimization and materials engineering to meet growing demand

Automotive Grade Inductors Market Scope

The market is segmented on the basis of product type, inductance range, vehicle type, distribution channel, and application.

• By Product Type

On the basis of product type, the automotive grade inductors market is segmented into SMD power inductors and plug-in power inductors. The SMD power inductors segment dominated the market with the largest share of 62.5% in 2025 due to their compact size, surface-mount compatibility, and strong adoption across ECUs, infotainment units, and powertrain electronics. Automakers prefer SMD inductors as they support high-frequency operations and efficient power regulation in modern automotive circuitry. Their ability to withstand thermal stress and vibration makes them suitable for under-the-hood environments in EVs and hybrid vehicles. Frequent integration in ADAS modules and battery management systems further accelerates their market leadership. Manufacturers continue to invest in high-current and low-loss SMD designs, reinforcing the dominance of this segment.

The plug-in power inductors segment is projected to witness the fastest growth from 2026 to 2033, driven by increasing use in high-power automotive applications. These inductors offer stronger mechanical stability and higher saturation current levels, making them suitable for heavy-duty vehicle electronics. Growth in electric SUVs, trucks, and commercial vehicles strengthens demand due to the need for robust inductors in DC-DC converters and inverters. Their through-hole mounting ensures enhanced durability under harsh operating conditions. Expansion of high-power LED lighting and safety systems also supports adoption. With rising demand for stable, high-current components, plug-in inductors are set to grow rapidly across next-generation vehicle platforms.

• By Inductance Range

On the basis of inductance range, the market includes less than 1 micro Henry, 1–10 micro Henry, 10–20 micro Henry, 20–30 micro Henry, 30–40 micro Henry, and above 40 micro Henry categories. The 1 to 10 micro Henry segment dominated the market in 2025 due to its extensive use in power regulation circuits across ECUs, ignition systems, and infotainment electronics. These inductors balance optimal current handling with compact size, making them suitable for high-frequency switching applications. Automakers prefer this range because it supports stable voltage regulation in electronic control units operating across diverse vehicle functions. Their reliability under fluctuating load conditions strengthens adoption in mass-market and premium vehicles. Integration into EV onboard chargers and DC-DC converters further reinforces their market dominance.

The more than 40 micro Henry segment is projected to experience the fastest growth from 2026 to 2033 due to rising demand in high-power automotive systems. These inductors support higher energy storage, making them ideal for electric drivetrain components, regenerative braking systems, and traction inverters. The shift toward high-voltage EV architectures significantly boosts demand for larger inductance values. Heavy commercial vehicles and electric buses increasingly rely on such inductors for stable power transfer. Their ability to manage thermal stress and high current loads supports accelerated deployment across next-generation EV platforms. Growing investments in advanced power electronics drive rapid adoption of this segment.

• By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger cars, compact, mid-size, luxury, SUV, light commercial vehicles, and heavy commercial vehicles. Passenger cars dominated the market in 2025 due to substantial integration of electronic control units, infotainment systems, LED lighting, and driver assistance technologies. Growth in hybrid and fully electric passenger cars further increases the need for efficient power inductors in battery management and inverter systems. Automakers prioritize inductors with high stability and low EMI performance, strengthening demand across mass-market models. Rising consumer expectations for enhanced connectivity and safety features also fuel adoption. Continuous electronic innovation in passenger vehicles reinforces the strong position of this segment.

The SUV segment is expected to record the fastest growth from 2026 to 2033 due to rising global production and increasing adoption of premium in-vehicle electronics. SUVs typically incorporate larger entertainment systems, advanced climate control, and multi-sensor ADAS configurations, which require multiple inductors for stable power delivery. Growth in electric SUVs accelerates demand for inductors in high-power electrical subsystems such as DC-DC converters and drive units. The segment also benefits from consumer preference toward high-performance and safety-rich models. As OEMs expand SUV electrification programs, the demand for reliable automotive inductors continues to surge rapidly. Enhanced powertrain complexity drives sustained growth in this category.

• By Distribution Channel

On the basis of distribution channel, the OEM segment dominated the market in 2025 due to strong integration of advanced inductors during vehicle manufacturing. Automakers rely on OEM-supplied inductors to ensure consistency, quality, and compatibility across complex electronic systems. Rising production of EVs and premium vehicles boosts direct procurement from OEMs for critical components such as converters and control modules. OEMs maintain long-term partnerships with inductor manufacturers to streamline supply chains and guarantee high-performance parts. Stringent automotive quality standards further encourage reliance on OEM channels. Expansion of integrated electronics across new vehicle platforms reinforces the dominance of this segment.

The aftermarket segment is projected to grow fastest from 2026 to 2033 due to rising replacement needs for inductors in aging vehicle fleets. Increased lifespan of vehicles globally results in more frequent maintenance and component upgrades. Demand also rises due to retrofitting of LED lighting systems, audio systems, and performance enhancements that require high-grade inductors. Growth in EV aftermarket services boosts the need for replacing power electronics components exposed to thermal and electrical stress. Small-scale repair shops and service centers increasingly source inductors independently, driving aftermarket expansion. The shift toward DIY automotive electronics further accelerates growth in this channel.

• By Application

On the basis of application, the market includes transmission control units, LED drivers, HID lighting, and noise suppression. Transmission control units dominated the market in 2025 due to increasing electrification of powertrains and adoption of advanced automatic transmission systems. These units rely heavily on inductors for voltage stabilization, electromagnetic noise filtering, and high-frequency signal processing. EVs and hybrids use more sophisticated control units, enhancing demand for power inductors that support rapid switching cycles. Their requirement for precise and stable electronic control reinforces widespread adoption. Continuous upgrades in vehicle transmission technologies strengthen this segment’s leading position.

The LED drivers segment is expected to witness the fastest growth from 2026 to 2033 due to rapid expansion of automotive LED lighting systems. LED headlights, daytime running lamps, and cabin illumination require inductors to regulate current and support efficient power conversion. Automakers increasingly adopt LED lighting for energy efficiency, durability, and premium aesthetics, boosting demand for driver circuits using high-performance inductors. Growth in EVs and luxury vehicles accelerates the shift toward full-LED architectures. Rising adoption of adaptive lighting systems enhances need for higher-grade inductors. Expansion of smart lighting modules ensures rapid growth of this application segment.

Automotive Grade Inductors Market Regional Analysis

- Asia-Pacific dominated the automotive grade inductors market with the largest revenue share of 47.7% in 2025, driven by expanding automotive production, rising deployment of electronic control units (ECUs), and the rapid shift toward electric mobility across major economies

- The region’s strong manufacturing ecosystem, increasing investments in automotive electronics, and large-scale adoption of power management components are accelerating market growth

- The availability of skilled labor, supportive government policies, and rapid industrialization across emerging countries are contributing to heightened demand for automotive inductors in EVs, hybrid vehicles, and advanced safety systems

China Automotive Grade Inductors Market Insight

China held the largest share in the Asia-Pacific automotive grade inductors market in 2025, supported by its position as a global hub for automotive manufacturing and electronic component production. The country’s robust supply chain for semiconductors, rapid EV adoption, and large-scale production of ECUs and powertrain electronics are key growth factors. Policies promoting new energy vehicles and continuous expansion in battery and inverter technologies strengthen the domestic demand for automotive-grade inductors. Growing export capabilities for automotive electronics further reinforce China’s leading position.

India Automotive Grade Inductors Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising automotive production, expansion of EV manufacturing, and increasing use of in-vehicle electronics across mass-market models. Government initiatives such as FAME II and Make in India are driving investments in automotive electronics and component localization. The country’s growing ecosystem for semiconductor packaging and power electronics assembly supports higher demand for inductors. Expanding production of two-wheelers, compact cars, and electric three-wheelers is contributing to rapid market expansion.

Europe Automotive Grade Inductors Market Insight

The Europe automotive grade inductors market is expanding steadily, supported by strong demand for high-reliability components in premium vehicles, increasing adoption of ADAS features, and the region’s leadership in automotive engineering. Stringent safety and emission regulations are accelerating investments in electronic control systems and electrified powertrains. The presence of advanced automotive suppliers and a strong push toward sustainable mobility enhance the demand for high-performance inductors. Growth in electric and hybrid vehicle production continues to drive uptake of specialized inductive components.

Germany Automotive Grade Inductors Market Insight

Germany’s automotive grade inductors market is driven by its established leadership in precision automotive manufacturing, high adoption of electronic control units, and a strong focus on engineering excellence. The country’s automotive OEMs prioritize advanced power electronics for efficient power management, boosting demand for high-quality inductors. Strong R&D networks and collaborations between automotive suppliers and technology providers support continuous innovation. Demand is reinforced by Germany’s rapid expansion of EV models and premium vehicle platforms requiring complex electronic architectures.

U.K. Automotive Grade Inductors Market Insight

The U.K. market is supported by a technologically advanced automotive sector, growing focus on electric vehicle development, and rising demand for power electronics in next-generation mobility platforms. Efforts to strengthen domestic supply chains and increased investments in R&D contribute to the adoption of high-performance inductors. Academic–industry collaborations and advancements in EV battery systems and drivetrain electronics further stimulate market growth. The country continues to maintain a strong presence in high-value automotive electronics and power management solutions.

North America Automotive Grade Inductors Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising adoption of electric and hybrid vehicles, increasing integration of ADAS and infotainment systems, and strong investments in automotive semiconductor manufacturing. Robust developments in power electronics, advanced battery systems, and connected vehicle technologies are boosting demand for automotive-grade inductors. Expanding reshoring efforts and growing partnerships between OEMs and electronic component manufacturers further support regional market expansion.

U.S. Automotive Grade Inductors Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its strong automotive innovation ecosystem, extensive EV production capacity, and high adoption of advanced vehicle electronics. Significant investment in semiconductor development and power management technologies enhances the demand for inductors across ECUs, traction inverters, and onboard chargers. The country’s emphasis on safety compliance, technological advancement, and electrification strategies strengthens its market position. A mature supplier base and leading automotive OEMs reinforce the U.S. leadership in the regional automotive inductors market.

Automotive Grade Inductors Market Share

The automotive grade inductors industry is primarily led by well-established companies, including:

- Laird (U.S.)

- TDK Corporation (Japan)

- Abracon (U.S.)

- TTI, Inc. (U.S.)

- Avnet, Inc. (U.S.)

- Vishay Intertechnology, Inc. (U.S.)

- Bourns, Inc. (U.S.)

- TAIYO YUDEN CO., LTD. (Japan)

- NIC Components Corp (U.S.)

- Coilmaster Electronics Co., Ltd. (China)

- Murata Manufacturing Co., Ltd. (Japan)

- BEC Distribution Ltd (U.K.)

- Panasonic Corporation (Japan)

- Texas Instruments Incorporated (U.S.)

- Pulse Electronics (U.S.)

- Coilcraft, Inc. (U.S.)

- Tokin Corporation (Japan)

- Chilisin (Taiwan)

- SUMIDA CORPORATION (Japan)

- KEMET Corporation (U.S.)

- Viking Tech Corporation (Taiwan)

Latest Developments in Global Automotive Grade Inductors Market

- In September 2025, TDK Corporation (Japan) entered into a strategic partnership with a leading automotive OEM to jointly develop advanced inductor technologies tailored for autonomous vehicle platforms. This collaboration reinforces TDK’s position as a forward-looking supplier that is closely aligned with the future demands of the mobility sector. By integrating its design capabilities directly into the OEM’s AV architecture, TDK strengthens its role in high-precision power management, signal conditioning, and sensor-driven electronics used in autonomous systems. The partnership is expected to boost TDK’s long-term component pipeline, expand its influence in ADAS and autonomy projects, and accelerate adoption of its inductors in next-generation automotive platforms

- In August 2025, Murata Manufacturing Co., Ltd. (Japan) announced the launch of a new series of automotive-grade inductors engineered to meet stringent EV performance standards, especially related to efficiency, thermal stability, and compact design. This product introduction underscores Murata’s commitment to innovation and solidifies its competitive standing in the rapidly electrifying automotive market. By focusing on high-efficiency components that enhance power conversion and battery management systems, Murata positions itself to capture accelerating demand from EV manufacturers seeking reliable, space-efficient inductors. The launch is expected to support Murata’s market expansion by addressing critical needs in inverter modules, onboard chargers, and DC-DC converters

- In July 2025, Vishay Intertechnology, Inc. (U.S.) expanded its operational capabilities through the establishment of a dedicated manufacturing facility for automotive-grade inductors, underscoring its strategy to scale production in response to rising global demand. This investment enhances Vishay’s ability to deliver higher-volume output, reduce lead times, and ensure consistent supply for automakers and Tier-1 suppliers. The new facility strengthens Vishay’s competitive position by improving production efficiency, advancing automation capabilities, and supporting the development of next-generation inductors for EV powertrains and advanced electronic systems. This move positions the company to meet growing demand from both traditional and electric vehicle segments

- In August 2023, CODACA introduced the VSRU27 automotive-grade inductor series, offering high current capability, low-temperature rise, and minimized losses across eight inductance values ranging from 0.1 to 15 µH. This development addresses the increasing need for durable and thermally stable inductors in high-current automotive applications such as powertrain electronics and ECUs. By enhancing performance while maintaining compact design, CODACA strengthens its competitiveness among OEMs and Tier-1 suppliers seeking reliable inductive components that support energy efficiency and system stability. The series positions CODACA as a capable supplier for demanding automotive environments where electrical precision and thermal reliability are critical

- In June 2023, Bourns Inc. launched the AEC-Q200 compliant SRN8040HA semi-shielded power inductor series capable of operating in extreme temperature conditions from –40°C to 150°C. This introduction enhances Bourns’ portfolio of rugged inductors engineered for harsh automotive environments, including engine compartments and thermal-intensive electronic modules. The integration of silicon-based magnetic shielding improves durability, reduces electromagnetic interference, and supports stable performance under continuous load. The launch reinforces Bourns’ presence in the automotive-grade inductor market by addressing OEM demand for components that combine reliability, high-temperature endurance, and compliance with strict automotive standards

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.