Global Automotive Grille Market

Market Size in USD Billion

CAGR :

%

USD

4.12 Billion

USD

4.91 Billion

2024

2032

USD

4.12 Billion

USD

4.91 Billion

2024

2032

| 2025 –2032 | |

| USD 4.12 Billion | |

| USD 4.91 Billion | |

|

|

|

Automotive Grille Market Analysis

The automotive grille market is experiencing steady growth, driven by rising vehicle production, increasing demand for aesthetic vehicle enhancements, and advancements in lightweight materials. Grilles play a crucial role in vehicle design, aerodynamics, and engine cooling, making them an essential component for both performance and visual appeal. The growing adoption of electric vehicles (EVs) has led to the development of active grille shutters (AGS), which improve aerodynamics and energy efficiency by regulating airflow. In addition, manufacturers are focusing on advanced materials such as carbon fiber, aluminum, and high-strength plastics to enhance durability and fuel efficiency. The expansion of the luxury vehicle segment, along with consumer preferences for customized and premium vehicle aesthetics, is also fueling market growth. Moreover, technological advancements such as smart grilles with integrated sensors and LED lighting are becoming increasingly popular, particularly in high-end vehicles. The presence of leading automotive grille manufacturers in regions such as Asia-Pacific, North America, and Europe is further contributing to the expansion of the market. However, challenges such as fluctuating raw material prices and stringent environmental regulations could impact market growth. Despite these challenges, the increasing shift towards sustainable and energy-efficient automotive components is expected to create new opportunities in the market.

Advancements in the automotive grille market are primarily centered on design innovations, material improvements, and smart technology integration. The introduction of active grille shutters (AGS) has significantly improved vehicle aerodynamics, reducing drag and enhancing fuel efficiency. With the rise of electric vehicles (EVs), the demand for closed and partially closed grilles has increased to maintain the vehicle's thermal efficiency while enhancing visual appeal. Manufacturers are utilizing lightweight materials such as ABS plastic, stainless steel, and aluminum to reduce vehicle weight and improve fuel economy. In addition, 3D printing technology is being employed for custom grille designs, allowing automakers to develop unique and intricate patterns that align with brand identity. The integration of LED lighting, sensors, and adaptive grille technologies is becoming more common in premium and luxury vehicles, enhancing both aesthetics and functionality. Companies are also focusing on sustainable manufacturing practices, including recyclable materials and eco-friendly coatings, to comply with environmental regulations. As automotive design continues to evolve, the grille market is expected to witness further technological advancements, making vehicles more efficient, stylish, and sustainable.

Automotive Grille Market Size

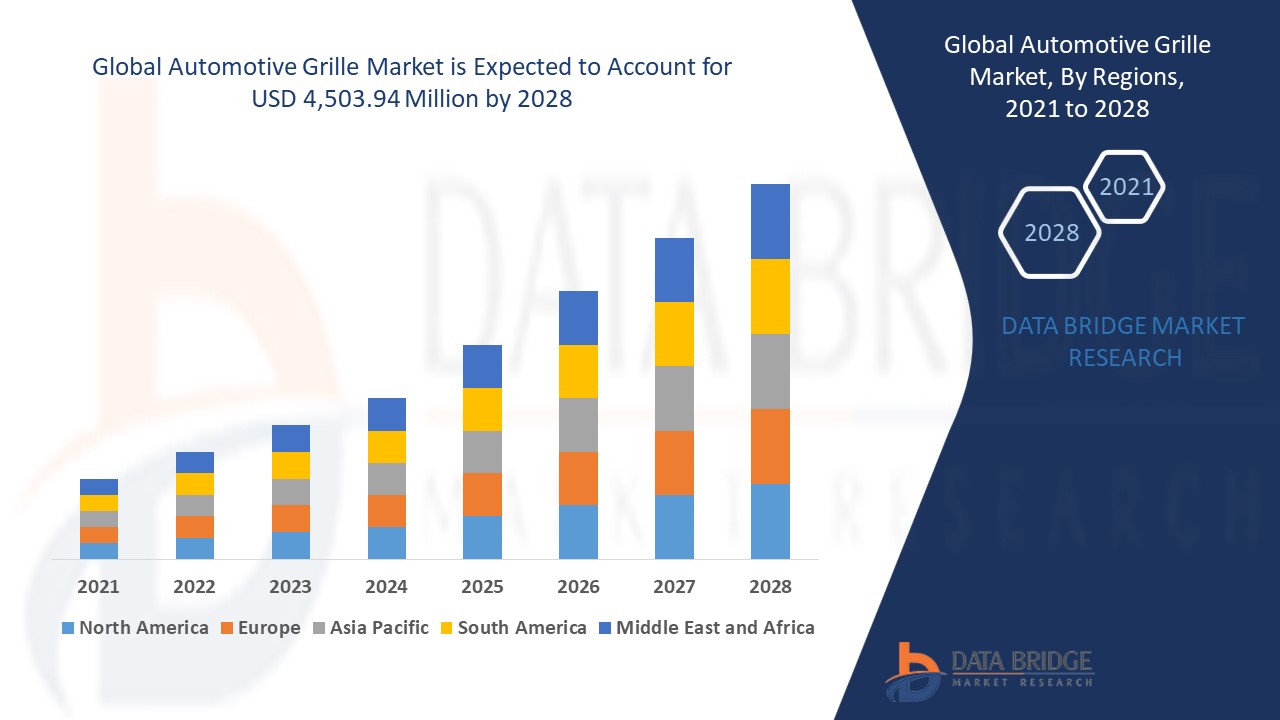

The global automotive drive shaft market size was valued at USD 4.12 billion in 2024 and is projected to reach USD 4.91 billion by 2032, with a CAGR of 2.20% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Automotive Grille Market Trends

“Increasing Adoption of Active Grille Shutters (AGS)”

One of the key trends in the automotive grille market is the increasing adoption of active grille shutters (AGS) to enhance fuel efficiency and aerodynamics. These smart grilles automatically open and close based on the vehicle's cooling needs, reducing drag and improving overall energy efficiency. This trend is particularly prominent in electric vehicles (EVs) and hybrid cars, where optimizing airflow plays a crucial role in extending battery range. For instance, the Ford F-150 Hybrid and Tesla Model 3 utilize AGS technology to regulate airflow and enhance vehicle performance. In addition, luxury automakers such as BMW and Mercedes-Benz are integrating adaptive grille designs with LED lighting and embedded sensors, adding a premium aesthetic while supporting advanced driver-assistance systems (ADAS). As automakers focus on lightweight materials, sustainability, and smart technologies, the adoption of active and intelligent grille systems is expected to grow, driving innovation in vehicle design.

Report Scope and Automotive Grille Market Segmentation

|

Attributes |

Automotive Grille Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

T-Rex Truck Products (U.S.), Westin Automotive Products, Inc. (U.S.), Putco (U.S.), TOYODA GOSEI Co., Ltd. (Japan), Dorman Products (U.S.), OPmobility SE (France), SRG Global (U.S.), Roush Performance Products, Inc. (U.S.), TWP INC. (U.S.), Sakae Riken Kogyo Co., Ltd. (Japan), Tata AutoComp Systems (India), GALIO INDIA (India), Röchling SE & Co. KG (Germany), Batz Group (Spain), Valeo (France), Karthigeya Group (India), and Magna International Inc. (Canada) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Grille Market Definition

An automotive grille is a structural component located at the front of a vehicle, designed to allow airflow to the engine compartment while protecting it from debris and external elements. It serves both functional and aesthetic purposes, enhancing engine cooling, aerodynamics, and vehicle styling.

Automotive Grille Market Dynamics

Drivers

- Rising Vehicle Production

The continuous rise in global vehicle production is a major force propelling the automotive grille market forward. As passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs) see increasing demand, automakers are investing in innovative grille designs to enhance aerodynamics, engine cooling, and vehicle aesthetics. For instance, Volkswagen's latest SUV lineup incorporates honeycomb-patterned grilles made from lightweight yet durable materials, improving both airflow efficiency and design appeal. In addition, the emergence of electric vehicles (EVs) has further driven grille innovations. Unlike internal combustion engine (ICE) vehicles, which require large openings for engine cooling, EVs such as the Tesla Model S and Lucid Air feature minimalist, closed-off grille designs to enhance battery cooling and aerodynamics. As vehicle production continues to rise, the demand for customized, functional, and high-performance grilles is expected to escalate, making grille manufacturing a vital component of the automotive industry.

- Growing Demand for Aesthetic and Customizable Grilles

Consumers today are increasingly prioritizing unique and stylish grilles as a key design element in their vehicles. This demand is pushing automakers to offer customizable grille options that cater to diverse consumer preferences and brand differentiation. For instance, BMW's illuminated kidney grille, introduced in the i7 and other luxury models, reinforces the brand's identity and integrates LED lighting and smart sensors for advanced functionality. Similarly, Mercedes-Benz's Panamericana grille, featured in its AMG lineup, provides a bold, aggressive look while optimizing air intake for high-performance engines. Beyond OEM offerings, the automotive aftermarket industry is witnessing a surge in demand for premium grille replacements, with consumers opting for chrome-finished, carbon fiber, and sport mesh grilles to personalize their vehicles. This increasing inclination towards customization and enhanced aesthetics is further accelerating the growth of the automotive grille market, making it a crucial segment within the broader automotive design landscape.

Opportunities

- Advancements in Materials and Manufacturing Technologies

The automotive grille market is witnessing a significant transformation with the adoption of lightweight and high-performance materials such as ABS plastic, aluminum, and carbon fiber. These materials enhance the durability and aesthetics of grilles and contribute to fuel efficiency by reducing overall vehicle weight. In addition, cutting-edge manufacturing technologies such as 3D printing and laser cutting are revolutionizing grille production by enabling intricate designs, reducing material waste, and optimizing production efficiency. For instance, Ford and General Motors have incorporated precision engineering in their grille designs, allowing for better aerodynamics and cooling efficiency. This helps ICE vehicles meet stringent emission regulations, while also optimizing battery performance in EVs. As the industry shifts toward eco-friendly and cost-effective solutions, the adoption of advanced materials and innovative manufacturing processes presents a lucrative growth opportunity for grille manufacturers in both OEM and aftermarket segments.

- Growth of Electric and Hybrid Vehicles

The rapid growth of the electric vehicle (EV) and hybrid vehicle market has created a demand for innovative grille solutions that prioritize efficiency and aerodynamics. Unlike traditional internal combustion engine (ICE) vehicles, which require large grilles for engine cooling, EVs and hybrids benefit from closed-off or active grille designs to minimize air resistance and improve range. Automakers such as Tesla, Lucid Motors, and Rivian have embraced flush-mounted, minimalist grilles that enhance both aesthetics and energy efficiency. Furthermore, the increasing adoption of Active Grille Shutters (AGS)—which automatically adjust airflow based on cooling needs—has become a key feature in many hybrid and fuel-efficient vehicles. This technology is already being implemented in models such as the Ford Escape Hybrid and BMW X5 xDrive45e, helping optimize battery cooling and aerodynamic performance. As EV adoption accelerates, grille manufacturers have a unique opportunity to develop next-generation grille systems that cater to the evolving demands of the sustainable automotive industry.

Restraints/Challenges

- High Manufacturing Costs

The production of automotive grilles involves the use of advanced materials such as aluminum, stainless steel, and ABS plastic, which require precision engineering and specialized manufacturing processes. The costs associated with material procurement, molding, machining, and finishing significantly impact the final price of the product. In addition, integrating modern design elements such as aerodynamic features and active grille shutters further escalates production expenses. For instance, premium brands such as BMW and Audi incorporate active grille systems in their high-end models to improve aerodynamics and fuel efficiency, but this innovation adds to the overall manufacturing cost. As a market challenge, these high costs can lead to increased vehicle prices, limiting consumer affordability and impacting sales, especially in price-sensitive regions.

- Stringent Regulatory Standards

Automotive grilles must comply with strict safety and environmental regulations set by authorities such as the National Highway Traffic Safety Administration (NHTSA) in the U.S. and the European Union’s automotive safety standards. These regulations ensure that grilles do not compromise pedestrian safety, crash performance, or vehicle aerodynamics. In addition, environmental concerns push manufacturers toward sustainable materials and eco-friendly coatings, further increasing compliance costs. For instance, the shift towards recyclable ABS plastic and corrosion-resistant stainless steel to meet sustainability goals has added cost pressures on grille manufacturers. As a market challenge, these regulations create a financial burden for both OEMs and aftermarket suppliers, potentially slowing down production and limiting design flexibility.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Automotive Grille Market Scope

The market is segmented on the basis of product type, type, material type, vehicle type, and distribution channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Mesh Automotive Grille

- CNC Automotive Grille

- Billet Automotive Grille

Type

- Radiator Grille

- Roof or Trunk Grilles

- Bumper Skirt Grilles

- Fender Grilles

- Hood Scoop Grille

Material Type

- Aluminum

- Stainless Steel

- ABS Plastic

Vehicle Type

- Passenger Cars

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Distribution Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

Automotive Grille Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product type, type, material type, vehicle type, and distribution channel as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates the automotive grille market due to the rising vehicle production, rapid industrialization, and strong presence of leading automakers in the region. Countries such as China, India, and Japan are witnessing significant growth in automobile manufacturing, driven by increasing consumer demand and expanding infrastructure. In addition, government initiatives promoting electric vehicles (EVs) and fuel-efficient technologies are further boosting the adoption of lightweight and aerodynamic grilles. The presence of key automotive component manufacturers and continuous advancements in design and materials contribute to the region's market leadership.

North America is expected to witness fastest growth in the automotive grille market from 2025 to 2035, driven by the rising demand for automobiles and increasing consumer spending power. As disposable incomes grow, consumers are seeking innovative, stylish, and performance-oriented vehicle components, including customized and high-quality grilles. In addition, the expansion of luxury and electric vehicle segments, along with advancements in aerodynamic and lightweight grille designs, is further fueling market growth. The presence of leading automakers and aftermarket customization trends also contributes to the region's strong market expansion.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Automotive Grille Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Automotive Grille Market Leaders Operating in the Market Are:

- T-Rex Truck Products (U.S.)

- Westin Automotive Products, Inc. (U.S.)

- Putco (U.S.)

- TOYODA GOSEI Co., Ltd. (Japan)

- Dorman Products (U.S.)

- OPmobility SE (France)

- SRG Global (U.S.)

- Roush Performance Products, Inc. (U.S.)

- TWP INC. (U.S.)

- Sakae Riken Kogyo Co., Ltd. (Japan)

- Tata AutoComp Systems (India)

- GALIO INDIA (India)

- Röchling SE & Co. KG (Germany)

- Batz Group (Spain)

- Valeo (France)

- Karthigeya Group (India)

- Magna International Inc. (Canada)

Latest Developments in Automotive Grille Market

- In May 2024, the new-generation Swift's mid-spec VXi variant was spotted testing in India. It features an all-black grille, LED DRLs, LED taillamps, and rear parking sensors. However, it lacks several features, including a shark fin antenna, fog lights, alloy wheels, a rear wiper, and a rear parking camera.

- In August 2021, Magna International Inc., a leading automotive parts supplier, announced the construction of a new liftgate module manufacturing plant for Nissan Qashqai in Sunderland, England. The thermoplastic liftgate is lighter than its steel predecessor, reflecting the industry's trend toward mass reduction for improved fuel efficiency and lower emissions. This development will support Magna's AGS system in catering to new OEM demands

- In March 2021, Magna International Inc., a leading automotive component supplier, introduced two advanced electrified propulsion systems, successfully testing them on ice and snow-filled tracks to evaluate their performance and efficiency

- In December 2020, Dorman Products acquired Dayton Parts, a company offering a comprehensive range of undercarriage and related products for commercial vehicles in the U.S. and Canada. This acquisition strengthens Dorman’s position in the independent commercial vehicle aftermarket, providing one of the largest single-source product offerings available

- In December 2020, Westin Automotive Products, Inc. acquired Hint Mounts, a company specializing in the public safety vehicle and electronics market. Hint Mounts’ product line includes computers, tablets, keyboards, monitors, specialty mounts, consoles, rear organizers, and electronic solutions for cars, trucks, and specialty applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.