Global Automotive Hardware Market

Market Size in USD Billion

CAGR :

%

USD

23.10 Billion

USD

27.87 Billion

2024

2032

USD

23.10 Billion

USD

27.87 Billion

2024

2032

| 2025 –2032 | |

| USD 23.10 Billion | |

| USD 27.87 Billion | |

|

|

|

|

Automotive Hardware Market Size

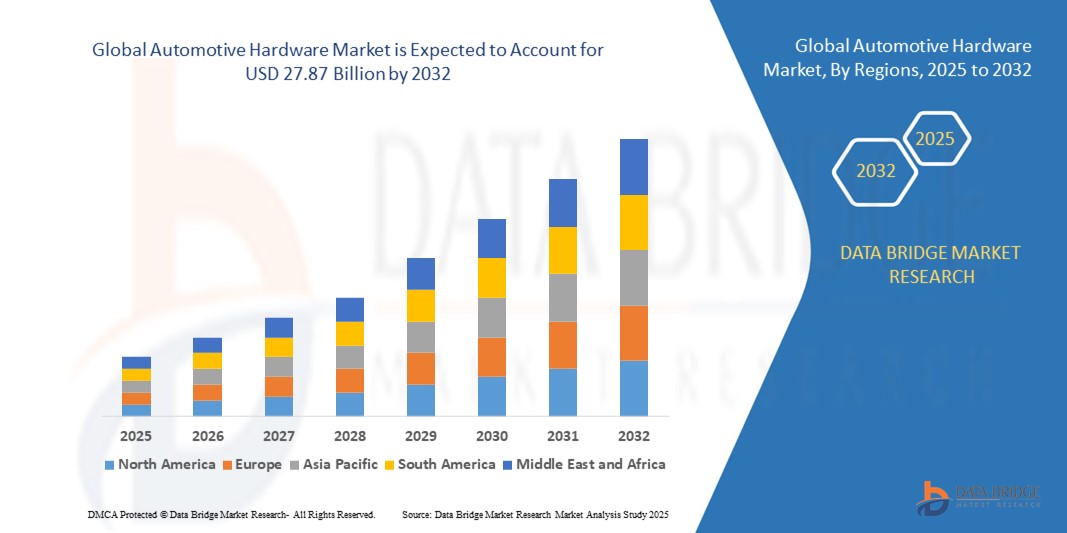

- The global automotive hardware market size was valued at USD 23.10 billion in 2024 and is expected to reach USD 27.87 billion by 2032, at a CAGR of 2.37% during the forecast period

- The market growth is driven by increasing vehicle production, rising demand for lightweight and durable materials, and the growing adoption of advanced technologies such as connected vehicle systems and autonomous driving features

- Growing consumer preference for enhanced vehicle safety, comfort, and aesthetics, along with the rise of electric vehicles (EVs) and smart hardware integration, is further propelling market demand across OEM and aftermarket channels

Automotive Hardware Market Analysis

- The automotive hardware market is experiencing robust growth due to rising consumer demand for vehicle customization, safety enhancements, and advanced technology integration

- The growing popularity of electric vehicles, SUVs, and luxury vehicles is encouraging manufacturers to innovate with lightweight, high-strength materials and smart hardware solutions

- Asia-Pacific dominated the automotive hardware market with the largest revenue share of 32.6% in 2024, driven by high vehicle production, rapid urbanization, and increasing demand for advanced automotive components in countries such as China, Japan, and India

- North America is expected to be the fastest-growing region during the forecast period, fueled by technological advancements, increasing adoption of electric and autonomous vehicles, and strong aftermarket demand for hardware upgrades

- The door latches segment dominated the market with the largest revenue share of 33.4% in 2024, driven by their critical role in ensuring vehicle security and accessibility. Door latches are essential for secure door closure and integration with advanced electronic locking systems, particularly in vehicles with smart entry technologies

Report Scope and Automotive Hardware Market Segmentation

|

Attributes |

Automotive Hardware Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Hardware Market Trends

Increasing Integration of Advanced Materials and Smart Technologies

- The global automotive hardware market is experiencing a significant trend toward the integration of advanced materials and smart technologies

- Lightweight materials such as aluminum, high-strength plastics, and composites are increasingly used in components such as door latches, exterior door handles, and hinges to improve fuel efficiency and reduce emissions

- Smart hardware, including sensor-integrated door latches, electronic locking systems, and connected vehicle technology, enables enhanced functionality such as keyless entry, remote access, and real-time diagnostics

- For instance, companies such as Magna International are developing mechatronic hinge assemblies and smart latches that integrate with electric vehicle (EV) platforms for seamless operation and improved security

- These advancements enhance vehicle performance, safety, and user experience, making smart hardware solutions more appealing to both OEMs and aftermarket consumers

- Connected vehicle technologies are also being embedded in components such as mounting brackets and bonnet support rods, enabling features such as automated liftgates and advanced driver-assistance systems (ADAS)

Automotive Hardware Market Dynamics

Driver

Rising Demand for Lightweight and Safe Vehicle Components

- The increasing consumer demand for fuel-efficient and safe vehicles is a major driver for the global automotive hardware market

- Hardware components such as door seals, gas springs, and chassis components are critical for ensuring vehicle safety, structural integrity, and compliance with stringent safety regulations

- Government mandates, particularly in regions such as Europe and Asia-Pacific, are pushing for lightweight materials and advanced safety features, boosting the adoption of innovative hardware solutions

- The rise of electric vehicles (EVs) and autonomous vehicles is driving demand for specialized hardware, such as battery enclosures, sensor mounts, and electromechanical systems, to support new vehicle architectures

- Automakers are increasingly incorporating factory-fitted smart hardware and connected vehicle technologies as standard or optional features to enhance vehicle value and meet consumer expectations

Restraint/Challenge

High Costs of Advanced Hardware Integration and Regulatory Complexities

- The high initial investment required for developing and integrating advanced hardware components, such as smart latches, connected vehicle systems, and lightweight materials, can be a significant barrier, particularly in cost-sensitive markets

- Retrofitting existing vehicles with advanced hardware, such as electromechanical systems or sensor-integrated components, is complex and costly

- Regulatory complexities surrounding safety standards, emissions, and material usage vary across regions, posing challenges for manufacturers operating in multiple markets, including Asia-Pacific and North America

- Data security concerns arise with connected vehicle technologies, as components such as smart door handles and electronic latches collect and transmit sensitive vehicle data, raising issues about potential breaches and compliance with data protection regulations

- These factors can limit market growth, particularly in regions with stringent regulations or high cost sensitivity, despite Asia-Pacific’s dominance and North America’s rapid growth in the market

Automotive Hardware market Scope

The market is segmented on the basis of product, component type, vehicle type, raw material, technology type, and sales channel.

- By Product

On the basis of product, the global automotive hardware market is segmented into door latches, exterior door handles, door seals, door straps, door hinges, mounting brackets, gas springs, fuel flaps, grab handles, shackles, bonnet support rods, license plates, and others. The door latches segment dominated the market with the largest revenue share of 33.4% in 2024, driven by their critical role in ensuring vehicle security and accessibility. Door latches are essential for secure door closure and integration with advanced electronic locking systems, particularly in vehicles with smart entry technologies. Their importance in safety and functionality, coupled with the shift toward lightweight and electronically actuated designs, has solidified their market dominance.

The gas springs segment is expected to register the fastest growth rate from 2025 to 2032, fueled by increasing demand for lightweight, durable components that enhance vehicle functionality. Gas springs are widely used in tailgates, hoods, and seats, offering smooth operation and improved user experience. The rise in electric vehicle (EV) production and consumer preference for convenience features further accelerate the adoption of gas springs in modern vehicle designs.

- By Component Type

On the basis of component type, the global automotive hardware market is segmented into engine components, transmission components, chassis components, electrical components, body components, and interior components. The electrical components segment held the largest revenue share in 2024, driven by the rapid adoption of advanced driver-assistance systems (ADAS), electric powertrains, and connected vehicle technologies. These components, including sensors, wiring harnesses, and control units, are critical for enabling vehicle electrification and autonomous functionalities, with high demand from both OEMs and aftermarket channels.

The interior components segment is anticipated to grow at the fastest CAGR from 2025 to 2032, propelled by consumer demand for enhanced comfort, aesthetics, and smart cabin technologies. Innovations such as customizable dashboards, ambient lighting, and integrated infotainment systems are driving growth, particularly in premium and electric vehicles. The focus on lightweight materials and sustainable designs further supports the expansion of this segment.

- By Vehicle Type

On the basis of vehicle type, the global automotive hardware market is segmented into passenger cars, light commercial vehicles, luxury vehicles, electric vehicles (EVs), SUVs and crossovers, and motorcycles. The passenger car segment accounted for the largest revenue share in 2024, supported by high global sales volumes and increasing demand for safety and comfort features. Passenger cars require a wide range of hardware, from door latches to electrical systems, to meet consumer expectations for performance and convenience.

The electric vehicle (EV) segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by global efforts to reduce carbon emissions and the rising adoption of EVs. The shift toward EVs necessitates specialized hardware, such as battery management systems and lightweight components, to enhance efficiency and range. Government incentives and advancements in EV technology further accelerate this segment’s growth.

- By Raw Material

On the basis of raw material, the global automotive hardware market is segmented into metals, plastics, composites, glass, and textiles. The metals segment, particularly steel and aluminum, dominated the market in 2024 due to its widespread use in structural and functional components such as chassis, engine parts, and door hinges. Metals offer durability and strength, making them essential for safety-critical applications.

The composites segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by the increasing focus on lightweight materials to improve fuel efficiency and reduce emissions. Composites, such as carbon fiber and fiberglass, are gaining traction in EVs and high-performance vehicles due to their strength-to-weight ratio and corrosion resistance. The push for sustainability and material innovation further supports this segment’s growth.

- By Technology Type

On the basis of technology type, the global automotive hardware market is segmented into traditional hardware, smart hardware, connected vehicle technology, autonomous technology, and electromechanical systems. The traditional hardware segment held the largest revenue share in 2024, as it encompasses essential components such as door latches, hinges, and mounting brackets, which remain integral to all vehicle types.

The connected vehicle technology segment is projected to grow at the fastest CAGR from 2025 to 2032, fueled by the increasing integration of IoT, 5G connectivity, and vehicle-to-everything (V2X) communication systems. These technologies require advanced hardware, such as sensors and communication modules, to enable real-time data exchange, remote diagnostics, and enhanced driver experiences. The rise of autonomous and connected vehicles significantly drives this segment’s growth.

- By Sales Channel

On the basis of sales channel, the global automotive hardware market is segmented into OEM, aftermarket, online sales, brick-and-mortar retail, and direct sales. The OEM segment dominated the market in 2024, driven by strong partnerships between automakers and hardware suppliers, ensuring seamless integration of components into new vehicles. High production volumes and the need for compliance with stringent safety and performance standards bolster this segment.

The online sales segment is anticipated to grow at the fastest CAGR from 2025 to 2032, propelled by the digitalization of aftermarket channels and the growing popularity of e-commerce platforms. Online sales offer convenience, price transparency, and access to a wide range of hardware components, catering to both individual consumers and repair shops. The expansion of digital marketplaces and localized supply chains further accelerates this trend.

Automotive Hardware Market Regional Analysis

- Asia-Pacific dominated the automotive hardware market with the largest revenue share of 32.6% in 2024, driven by high vehicle production, rapid urbanization, and increasing demand for advanced automotive components in countries such as China, Japan, and India

- Consumers prioritize automotive hardware for enhancing vehicle functionality, safety, and aesthetics, particularly in regions with growing vehicle ownership and diverse driving conditions

- Growth is supported by innovations in smart hardware and connected vehicle technologies, alongside rising adoption in both OEM and aftermarket segments

Japan Automotive Hardware Market Insight

Japan’s automotive hardware market is expected to witness significant growth due to strong consumer preference for high-quality, technologically advanced hardware that enhances driving safety and comfort. The presence of major automotive manufacturers and integration of smart hardware in OEM vehicles accelerate market penetration. Rising interest in aftermarket customization also contributes to growth.

China Automotive Hardware Market Insight

China holds the largest share of the Asia-Pacific automotive hardware market, propelled by rapid urbanization, rising vehicle ownership, and increasing demand for advanced hardware solutions. The country’s growing middle class and focus on smart mobility support the adoption of connected vehicle technologies and electromechanical systems. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

U.S. Automotive Hardware Market Insight

The Europe automotive hardware market is expected to witness significant growth, supported by regulatory emphasis on vehicle safety and efficiency. Consumers seek hardware that enhances durability, connectivity, and thermal management. Growth is prominent in both new vehicle installations and retrofit projects, with countries such as Germany and France showing strong adoption due to advanced automotive manufacturing and environmental concerns.

U.K. Automotive Hardware Market Insight

The U.K. market for automotive hardware is expected to witness rapid growth, driven by demand for enhanced vehicle functionality and safety in urban and suburban settings. Increased interest in vehicle aesthetics and rising awareness of smart hardware benefits encourage adoption. Evolving safety regulations influence consumer choices, balancing advanced technology with compliance.

Germany Automotive Hardware Market Insight

Germany is expected to witness significant growth in the automotive hardware market, attributed to its advanced automotive manufacturing sector and high consumer focus on vehicle efficiency and connectivity. German consumers prefer technologically advanced hardware, such as connected vehicle components and electromechanical systems, which contribute to lower fuel consumption and enhanced safety. Integration in premium vehicles and aftermarket options supports sustained market growth.

Automotive Hardware Market Share

The automotive hardware industry is primarily led by well-established companies, including:

- Hansen International (U.S.)

- Kiekert AG (Germany)

- Aisin Seiki (Japan)

- Magna International (Canada)

- Dorman Products (U.S.)

- Mitsui Mining and Smelting (Japan)

- Stahl Holding (Germany)

- STRATTEC (U.S.)

- Smittybilt (U.S.)

- Seatbelt Solutions (U.S.)

- Denso Corporation (Japan)

- ZF Friedrichshafen AG (Germany)

- Continental AG (Germany)

- Aisin Seiki Co., Ltd. (Japan)

- Robert Bosch GmbH (Germany)

What are the Recent Developments in Global Automotive Hardware Market?

- In June 2025, Typhoon HIL, Inc. entered a strategic collaboration with Infineon Technologies AG to deliver cutting-edge tools for automotive engineering teams, focusing on a real-time Hardware-in-the-Loop (HIL) platform. This partnership enables developers working with Infineon’s AURIX™ TC3x/TC4x microcontrollers to access a fully integrated HIL simulation environment for ultra-high fidelity testing of motor drives, battery management systems, on-board chargers, and power electronics. The solution streamlines validation workflows, accelerates design cycles, and reduces development costs—empowering faster, more efficient prototyping and testing of xEV powertrain systems

- In January 2025, dSPACE GmbH announced a strategic partnership with Stellantis to accelerate cloud-based vehicle development. The collaboration integrates dSPACE’s VEOS platform for Software-in-the-Loop (SIL) testing into Stellantis’ Virtual Engineering Workbench (VEW), enabling engineers to develop and test software up to a year before production hardware is available. This initiative supports Stellantis’ broader software strategy—built on platforms such as STLA Brain, SmartCockpit, and AutoDrive—to deliver intelligent, connected vehicles. The partnership aims to streamline development cycles, enhance software innovation, and improve time-to-market for next-generation automotive technologies

- In December 2024, BMW Automotive (Ireland) Limited issued a recall affecting select models of its 5 Series, i5, i7, 7 Series, and M5 Series vehicles. This action was part of a broader global recall campaign addressing multiple hardware-related issues, including defects in seatbelt sensors, armrest brackets, and battery housings. In addition, a critical flaw in the steering spindle’s double universal joint was identified, which could result in stiff or jerky steering, posing safety risks. These recalls highlight the complexity of integrating advanced hardware in modern vehicles and underscore the need for rigorous quality control across global manufacturing operations.

- In September 2024, Continental AG unveiled two new versions of its ContiConnect tire management platform—ContiConnect Lite and ContiConnect Pro—at the IAA Transportation event in Hanover. Designed to support customized fleet management, ContiConnect Lite offers a mobile app-based entry-level solution for quick tire monitoring, while ContiConnect Pro delivers a comprehensive system with predictive maintenance and real-time alerts via a web portal and app. These innovations aim to reduce fleet operating costs, improve safety, and enhance sustainability by optimizing tire usage and minimizing fuel consumption and emissions

- In December 2022, Hyundai unveiled a prototype of its gesture-controlled door handle at the Open Innovation Lounge in Seattle, developed in collaboration with Somalytics, a startup specializing in gesture recognition and nanotechnology. The SomaControl Door Handle features SomaCap™ sensors, a new type of capacitive sensor made from carbon nanotube-infused paper, capable of detecting human presence up to 200 mm away. This innovation enables intuitive left-right hand gestures to open or close vehicle doors, enhancing user experience and advancing human-machine interaction in automotive design.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.