Global Automotive Heat Shield Market

Market Size in USD Billion

CAGR :

%

USD

12.50 Billion

USD

13.97 Billion

2024

2032

USD

12.50 Billion

USD

13.97 Billion

2024

2032

| 2025 –2032 | |

| USD 12.50 Billion | |

| USD 13.97 Billion | |

|

|

|

|

Automotive Heat Shield Market Size

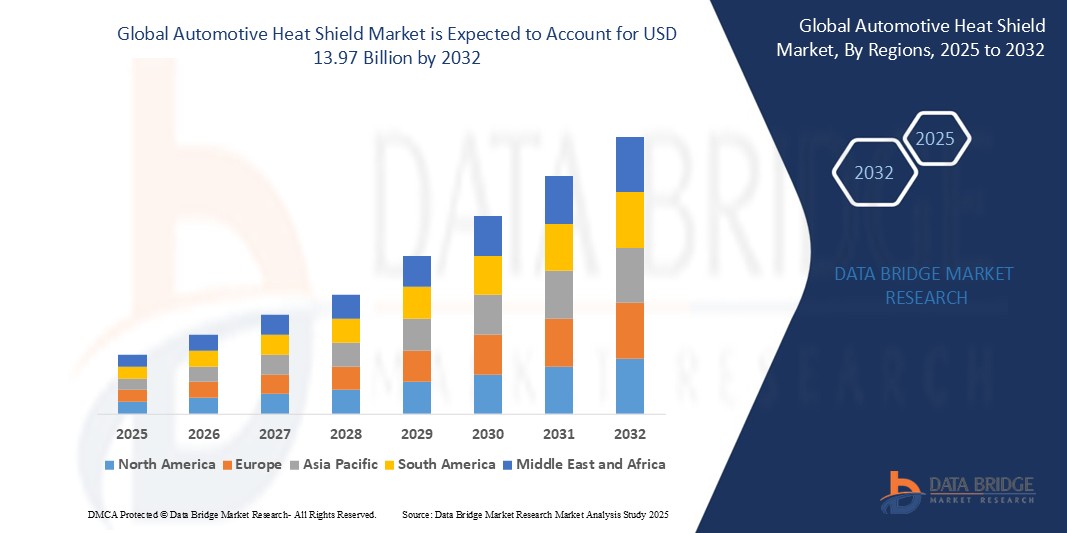

- The global automotive heat shield market size was valued at USD 12.5 billion in 2024 and is expected to reach USD 13.97 billion by 2032, at a CAGR of 1.40% during the forecast period

- This growth is driven by factors such as the increasing demand for lightweight and high-performance thermal insulation solutions to improve fuel efficiency and meet stringent emission regulations

Automotive Heat Shield Market Analysis

- An automotive heat shield is defined as a specially designed sheet that is utilized for protecting various automotive components from excessive heat generated from the exhaust systems and engine

- It has a crucial role in increasing the power output of an engine by maintaining optimal thermal comfort inside the vehicle and controlling the under-bonnet temperature

- Asia-Pacific is expected to dominate the automotive heat shields market with 38.61% due to region's high vehicle production rates, both for domestic consumption and export, significantly boost the demand for heat shields

- North America is expected to be the fastest growing region in the automotive heat shield market during the forecast period due to significant advancements in heat shield materials and designs

- Single shell segment is expected to dominate the market with a market share of 58.1% due to their straightforward design offers a balance between performance and affordability, making them attractive to manufacturers aiming to reduce production costs

Report Scope and Automotive Heat Shield Market Segmentation

|

Attributes |

Automotive Heat Shield Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Heat Shield Market Trends

“Shift Toward Lightweight and High-Performance Materials”

- Advancements in materials science have led to the development of lightweight, high-performance heat shields

- Manufacturers are increasingly adopting materials such as aluminum, ceramics, and composites to enhance thermal protection while reducing vehicle weight

- The incorporation of technologies such as nanomaterials and phase-change materials is enabling the production of heat shields that offer superior thermal management and lightweight design

- With the rise of EVs, there is a growing demand for specialized heat shields that can manage the unique thermal challenges of electric powertrains

- Manufacturers are focusing on sustainability by embracing recyclable materials and energy-efficient production processes to meet eco-conscious consumer preferences

Automotive Heat Shield Market Dynamics

Driver

“Stringent Emission Regulations and Fuel Efficiency Standards”

- Governments worldwide are imposing stringent emission standards to combat climate change, compelling automakers to adopt technologies that reduce vehicle emissions

- In regions such as the EU, Japan, and China, fuel economy standards are becoming more stringent, driving the need for lightweight components such as heat shields to improve vehicle efficiency

- Original Equipment Manufacturers (OEMs) are focusing on light-weighting and engine efficiency to comply with these regulations, thereby increasing the demand for advanced heat shields

- Consumers are increasingly prioritizing fuel-efficient vehicles, prompting automakers to invest in technologies that enhance fuel economy, further driving the demand for heat shields

Opportunity

“Rising Demand for Luxury and High-Performance Vehicles”

- The increasing demand for luxury vehicles, which feature high-end components and powerful engines, is driving the need for advanced heat shields to manage the additional heat generated

- High-performance vehicles require efficient thermal management to maintain optimal engine performance, creating opportunities for specialized heat shield solutions

- Developing economies are witnessing a rise in disposable income, leading to increased sales of luxury vehicles and subsequently boosting the demand for advanced heat shields

- Advancements in heat shield technology are enabling the development of solutions that meet the specific thermal management needs of luxury and high-performance vehicles

Restraint/Challenge

“Challenges in Integrating Heat Shields into Modern Vehicle Designs”

- Modern vehicles are designed with complex architectures and integrated systems, leaving limited space for the installation of heat shields

- The high cost of raw materials such as composites, metals, and ceramics can significantly impact the overall cost of heat shields, posing challenges for manufacturers

- Integrating heat shields into compact and aerodynamically optimized vehicle designs can be challenging, requiring innovative solutions to ensure effective thermal management

- Fluctuating regulatory standards across different regions can complicate the design and manufacturing processes for heat shields, as they must comply with varying requirements

Automotive Heat Shield Market Scope

The market is segmented on the basis of product type, types, material, function, application, and vehicle type.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Types |

|

|

By Material |

|

|

By Function |

|

|

By Application |

|

|

By Vehicle Type |

|

In 2025, the single shell is projected to dominate the market with a largest share in product type segment

The single shell segment is expected to dominate the Automotive Heat Shield market with the largest share of 58.1% in 2025 due their straightforward design offers a balance between performance and affordability, making them attractive to manufacturers aiming to reduce production costs. Typically lighter than multi-layer alternatives, single shell heat shields contribute to improved vehicle fuel efficiency

The metallic is expected to account for the largest share during the forecast period in material market

In 2025, the metallic segment is expected to dominate the market with the largest market share of 85% due to materials such as aluminium and steel offer exceptional thermal conductivity and can withstand high-temperature environments commonly found in automotive engines and exhaust systems.

Automotive Heat Shield Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Automotive Heat Shield Market”

- Asia Pacific accounted for 38.61% of the global automotive heat shield market, making it the largest regional market

- China, India, and Japan are the major contributors to this dominance, driven by their robust automotive manufacturing sectors

- The region's high vehicle production rates, both for domestic consumption and export, significantly boost the demand for heat shields

- Asia Pacific is at the forefront of adopting advanced materials and manufacturing technologies in heat shield production

- The rise in electric vehicle production in countries such as China further propels the need for efficient thermal management solutions, including heat shields

“North America is Projected to Register the Highest CAGR in the Automotive Heat Shield Market”

- North America is expected to exhibit the fastest growth in the automotive heat shield market during the forecast period

- Stringent emissions regulations in the U.S. and Canada are compelling automakers to invest in advanced thermal management solutions

- The region is witnessing significant advancements in heat shield materials and designs, contributing to market growth

- The presence of major automotive manufacturers and suppliers in North America supports the demand for high-quality heat shields

- Increasing adoption of electric vehicles in North America necessitates the development of specialized heat shields for battery and powertrain protection

Automotive Heat Shield Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Dana Limited (U.S.)

- Morgan Advanced Materials (U.K.)

- ElringKlinger AG (Germany)

- Lydall, Inc. (U.S.)

- HAPPICH GmbH (Germany)

- CARCOUSTICS (Germany)

- HKO Group (China)

- Shiloh Industries (U.S.)

- NICHIAS Corporation (Japan)

- Cummins Inc. (U.S.)

- Hyundai Motor Company (South Korea)

- MITSUBISHI HEAVY INDUSTRIES, LTD. (Japan)

- MAHLE GmbH (Germany)

- Scania (Sweden)

- Talbros (India)

- Borgers SE & Co. KGaA (Germany)

- Röchling (Germany)

- Zircotec (U.K.)

- Soundwich (U.S.)

- DuPont (U.S.)

Latest Developments in Global Automotive Heat Shield Market

- In November 2024, Autoneum (Switzerland) opened a new Research & Technology (R&T) Center in Shanghai, China, to focus on New Mobility and expand its presence there. The center will support the development and production of components and materials for e-mobility. A team of 80 R&T employees will work on advancing acoustic and thermal management and shielding technologies

- In October 2024, at The Battery Show North America 2024, ElringKlinger AG (Germany) showcased ElroSafe underbody shielding for battery protection, a thermoplastic cover with integrated electromagnetic shielding (EMI), and ElroShield EV+

- In October 2024, at the International Suppliers Fair (IZB) 2024, ElringKlinger AG (Germany) showcased ElroForm TP-ECO and ElroSafe shielding for battery systems. These solutions protect thermal propagation, prevent short circuits from metallic venting particles, and enhance thermal shielding between the battery case and the environment or passenger compartment

- In April 2024, Alkegen (U.S.) announced that JLR (U.K.) chose its new range of anti-thermal propagation products to improve thermal protection in JLR's next-generation electric vehicles. This product line offered advanced solutions with multiple protection levels for the battery. The products were designed for easy integration into various battery applications, making them adaptable to different EV models

- In April 2023, Autoneum completed the acquisition of Borgers Automotive. This development has led to Autoneum's operational scope now encompassing 67 production facilities across the globe, with a workforce of approximately 16,100 individuals spanning 24 different countries. By integrating the well-established German company into its operations, Autoneum has taken another significant step in fortifying its position as a worldwide leader in sustainable solutions for vehicle acoustic and thermal management

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.