Global Automotive Hud Market

Market Size in

CAGR :

%

1.74

6.10

2024

2032

1.74

6.10

2024

2032

| 2025 –2032 | |

| USD 1.74 | |

| USD 6.10 | |

|

|

|

|

Automotive HUD Market Size

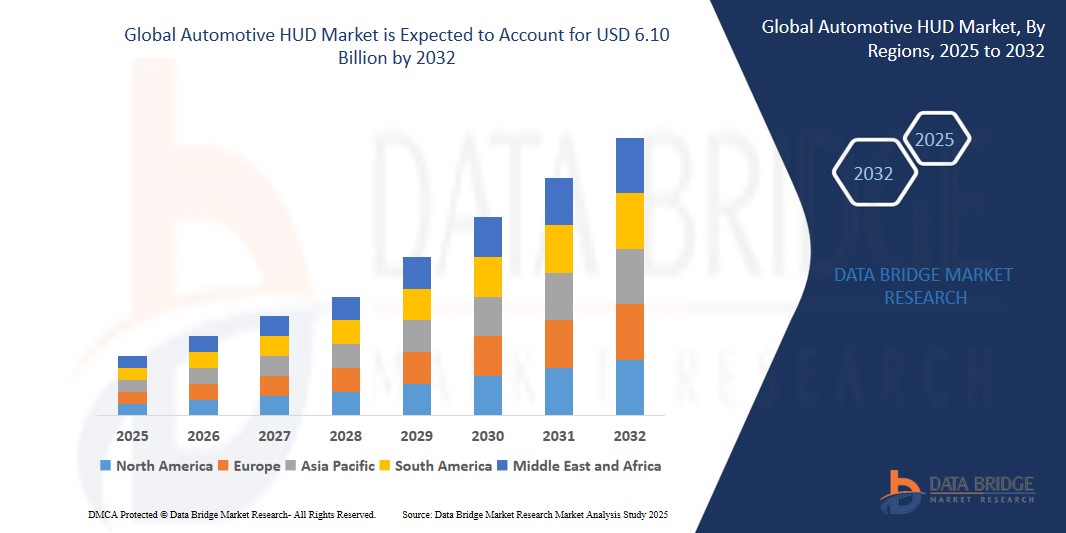

- The Global Automotive HUD Market size was valued at USD 1.74 billion in 2024 and is expected to reach USD 6.10 billion by 2032, at a CAGR of 19.9% during the forecast period

- This growth is driven by factors such as the increasing demand for driver safety, immersive driving experiences, and cockpit digitalization, particularly in premium and tech-integrated vehicles

Automotive HUD Market Analysis

- The GPS segment holds the largest market share of 56.81% due to its widespread adoption across various commercial, industrial, and consumer applications.

- Automotive Head-Up Displays (HUDs) are becoming a critical component in modern vehicles, enhancing driving safety and user experience by projecting key information such as speed, navigation, and warnings onto the windshield or a separate screen in the driver’s line of sight. These systems help reduce driver distraction, improve situational awareness, and support the integration of advanced driver assistance systems (ADAS).

- Market growth is driven by increasing consumer demand for in vehicle safety features, the rapid advancement of AR/AI technologies, and the rising penetration of premium and midrange vehicles with built in digital cockpit systems. Automakers are also integrating HUDs as part of their transition toward connected and semi-autonomous vehicles.

- North America is expected to dominate the global Automotive HUD market due to strong demand for high end vehicles, robust innovation from OEMs, and favorable regulations promoting driver safety technologies. The U.S. market, in particular, is seeing widespread adoption of HUDs in luxury and electric vehicles.

- The Asia-Pacific region is projected to register the fastest growth during the forecast period, supported by rising disposable incomes, a growing automotive production base, and increasing demand for advanced infotainment and driver safety systems in countries such as China, Japan, and South Korea. Rapid urbanization and the adoption of EVs and ADAS platforms are further fueling demand in this region.

- The windshield segment holds the largest market share of 60.80% due to its ability to seamlessly project vital information (such as speed, navigation, and alerts) onto the windshield within the driver’s line of sight.

Report Scope and Automotive HUD Market Segmentation

|

Attributes |

Navigation Satellite System (NSS) Chip Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive HUD Market Trends

“Rise of Augmented Reality (AR) and 3D Displays in Automotive HUDs”

- A major trend transforming the automotive HUD market is the integration of augmented reality (AR) and 3D projection technology to create immersive, intuitive driving experiences. These systems project real time navigation, object recognition, and driver assistance data directly onto the windshield.

- Automakers are adopting AR HUDs to enhance situational awareness and reduce driver distraction by overlaying crucial information on the driver's view of the road.

- For instance, In January 2025, BMW rolled out its Panoramic Vision AR HUD across its Neue Klasse electric vehicle lineup, offering real-time hazard alerts, navigation cues, and lane guidance projected across the windshield. The launch marked a shift toward immersive HUDs tailored for next generation EVs.

- The combination of AI, computer vision, and AR in HUDs is driving innovation, particularly in premium and electric vehicle (EV) segments, as consumers demand smarter, safer, and more connected in-cabin experiences.

Automotive HUD Market Dynamics

Driver

“Increasing Demand for Driver Safety and Advanced Driver Assistance Systems (ADAS)”

- Rising concerns over road safety and driver distraction are key drivers accelerating the adoption of automotive HUDs worldwide.

- HUDs play a critical role in minimizing distraction by displaying essential information (speed, navigation, warnings) in the driver’s line of sight, thus enhancing reaction time and reducing accidents.

- With global regulations pushing for greater vehicle safety standards, OEMs are integrating HUDs as part of broader ADAS solutions.

- For instance, In March 2024, Volvo integrated HUDs with its Level 2 ADAS suite in its XC60 models, offering drivers speed limits, collision alerts, and adaptive cruise control status directly on the windshield. This move is aimed at enhancing both safety and user experience.

- The growing popularity of semi-autonomous vehicles and safety-first design strategies among automakers is expected to sustain demand for HUDs over the long term.

Opportunity

“Growing Integration of HUDs in Mid-Range and Electric Vehicles”

- The widespread adoption of GNSS technology in mobile devices, wearables, and smart city infrastructure continues to support long-term growth of the market

- Initially limited to luxury models, HUD technology is now expanding into mid segment and EV vehicles, creating a massive market opportunity for HUD component manufacturers and software vendors.

- Declining component costs, coupled with modular HUD platforms, have made it feasible for OEMs to offer HUDs as optional or standard features in mid-range vehicles.

- For instance, In June 2024, Hyundai launched its IONIQ 6 electric sedan with a standard windshield HUD in select global markets. The model targets younger, tech savvy buyers looking for futuristic driving experiences at accessible prices.

- As the global EV market continues to boom and OEMs compete on digital cockpit innovation, HUD adoption is expected to rise sharply, especially in regions like Asia-Pacific and Europe where EV penetration is accelerating.

Restraint/Challenge

“High Cost of Advanced HUD Systems and Integration Complexity”

- One of the key challenges in the automotive HUD market is the high cost associated with AR and large-field-of-view HUDs, which restricts mass-market adoption, particularly in developing economies.

- Integration into the vehicle dashboard or windshield requires design customization, optical alignment, and compatibility with other in-car systems, adding to the complexity and cost.

- For Instance, In early 2024, a leading Japanese automaker delayed the rollout of AR HUDs in its compact car lineup due to the high system costs and the need for structural dashboard redesigns, leading to longer product development cycles.

- While costs are gradually declining, the price sensitivity of mass-market buyers and the complexity of retrofitting HUDs in existing vehicle architectures remain significant barriers, particularly in cost-competitive segments.

Automotive HUD Market Scope

The market is segmented on the basis, product and industry.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Technology |

|

|

By Vehicle Type |

|

|

By Dimension |

|

In 2025, windshield HUD are projected to dominate the market, holding the largest share

In 2025, the windshield HUD segment is expected to lead the automotive HUD market due to its ability to seamlessly project vital information (such as speed, navigation, and alerts) onto the windshield within the driver’s line of sight. This enhances driving safety and comfort. Major OEMs are integrating windshield HUDs into mid-size and premium vehicles, driving demand amid growing consumer preference for safer and more tech-enhanced vehicles.

The Augmented Reality (AR) is expected to account for the largest share during the forecast period.

The augmented reality HUD segment is anticipated to grow at the highest rate during the forecast period. This growth is driven by rising adoption in high-end vehicles and increasing investments in AR-based driving assistance systems. AR HUDs project contextual, real-world information like lane guidance and hazard detection, making them vital for autonomous and semi-autonomous vehicle development.

Automotive HUD Market Regional Analysis

“North America Holds the Largest Share in the Automotive HUD Market”

- North America dominates the global automotive HUD market due to its early adoption of advanced driver assistance systems (ADAS), high consumer demand for luxury vehicles, and strong presence of key automotive OEMs and technology suppliers.

- The U.S. leads the region, driven by robust R&D investments and a growing ecosystem of AR and automotive electronics startups contributing to HUD innovation.

“Asia-Pacific is Projected to Register the Highest CAGR in the Automotive HUD Market”

- The Asia-Pacific region is expected to witness the fastest growth in the global automotive HUD market, driven by rapid urbanization, increasing vehicle ownership, and rising demand for safety-enhancing technologies in countries like China, Japan, South Korea, and India.

- China, the world’s largest automotive market, is a major growth driver due to strong domestic manufacturing capabilities, a booming EV sector, and government initiatives supporting smart and connected mobility. Major Chinese OEMs are integrating AR-based HUDs in mid to high end vehicles to appeal to tech conscious consumers.

Automotive HUD Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Continental AG (Germany)

- Bosch Mobility Solutions (Germany)

- Pioneer Corporation (Japan)

- Yazaki Corporation (Japan)

- Denso Corporation (Japan)

- Nippon Seiki (Japan)

- Hyundai Mobis (South Korea)

- BAE Systems plc (UK)

- MicroVision, Inc. (US)

Latest Developments in Global Automotive HUD Market

- In January 2025, Hyundai Mobis introduced its full windshield holographic head-up display at CES 2025. This advanced system uses augmented reality to project key driving data such as navigation and safety alerts across the entire windshield. The display enhances driver safety and awareness by integrating real-time visual information directly into the driver's line of sight, reducing distraction and supporting intuitive decision making.

- In March 2025, Panasonic announced new partnerships with global automotive OEMs to co-develop next generation HUD systems. These solutions focus on integrating AR-based navigation, driver monitoring, and real time traffic data to enhance vehicle intelligence and safety. The collaborations aim to accelerate the adoption of HUDs in mid range and premium vehicle segments by combining Panasonic’s display expertise with automaker innovation.

- In April 2025, multiple automotive suppliers began integrating Mini LED backlighting into HUD systems to improve image quality and adaptability to varying light conditions. Mini LED provides higher brightness, sharper contrast, and improved energy efficiency. These advancements are being adopted particularly in luxury vehicles, enhancing the clarity of navigation prompts and safety information under both daytime and nighttime driving conditions.

- In May 2025, Visteon Corporation announced a strategic partnership with Nvidia to develop AI-powered head-up displays for next-generation vehicles. The collaboration will combine Visteon’s automotive grade display technology with Nvidia’s DRIVE platform to deliver AR-enhanced visuals, including dynamic lane guidance, object detection alerts, and real time traffic overlays. This partnership is expected to accelerate the rollout of intelligent HUD solutions in autonomous and semi-autonomous vehicles, reinforcing the trend toward safer, more connected driving experiences.

- In February 2025, Continental AG unveiled progress on its augmented reality HUD platform, capable of projecting context aware symbols aligned precisely with the road. The company’s latest version integrates with ADAS systems to provide real time hazard alerts and adaptive cruise visuals. This innovation supports Continental’s mission to improve driver comfort and reduce accidents by making digital guidance more intuitive and lifelike.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.