Global Automotive Ignition Systems Market

Market Size in USD Billion

CAGR :

%

USD

9.13 Billion

USD

17.87 Billion

2024

2032

USD

9.13 Billion

USD

17.87 Billion

2024

2032

| 2025 –2032 | |

| USD 9.13 Billion | |

| USD 17.87 Billion | |

|

|

|

|

Automotive Ignition Systems Market Size

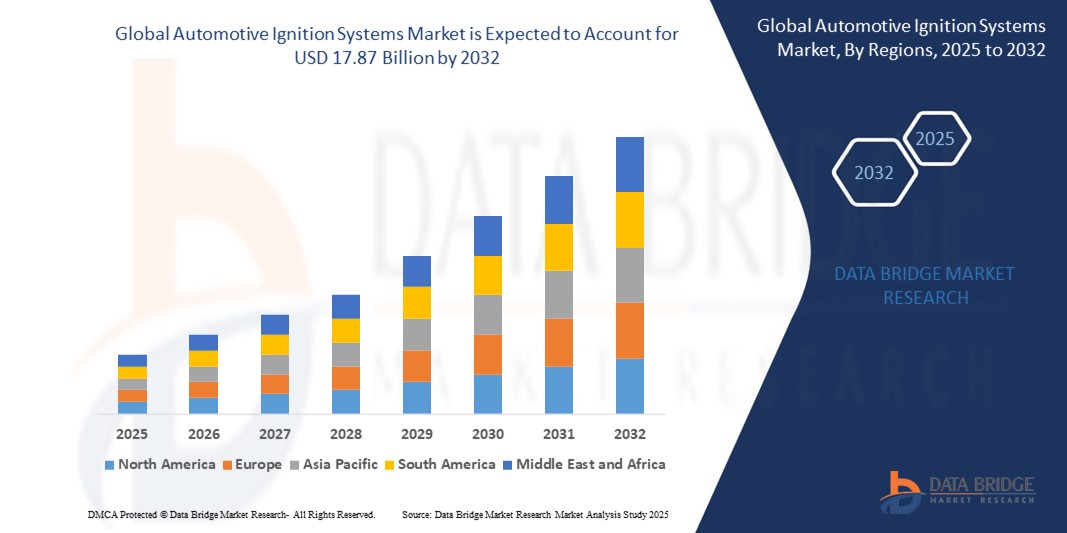

- The global automotive ignition systems market size was valued at USD 9.13 billion in 2024 and is expected to reach USD 17.87 billion by 2032, at a CAGR of 8.75% during the forecast period

- The market growth is primarily driven by the increasing demand for fuel-efficient vehicles, advancements in ignition system technologies, and the rising adoption of electric and hybrid vehicles requiring sophisticated ignition components

- In addition, stringent emission regulations and the growing trend of vehicle electrification are pushing manufacturers to develop advanced ignition systems, further boosting market expansion

Automotive Ignition Systems Market Analysis

- Automotive ignition systems, essential for initiating combustion in internal combustion engines, are critical for vehicle performance, fuel efficiency, and emission control across various vehicle types

- The surge in demand is fueled by the growing production of passenger and commercial vehicles, advancements in electronic and distributor less ignition systems, and the need for enhanced engine efficiency to meet environmental regulations

- Asia-Pacific dominated the automotive ignition systems market with the largest revenue share of 42.5% in 2024, driven by high vehicle production, rapid urbanization, and the presence of major automotive manufacturers in countries such as China, Japan, and India

- North America is expected to be the fastest-growing region during the forecast period due to increasing investments in electric vehicle infrastructure, technological innovations, and rising consumer demand for high-performance vehicles

- The ignition coil segment dominated the largest market revenue share of 38.2% in 2024, driven by its critical role in generating high-voltage current for spark plugs, essential for efficient combustion in gasoline engines

Report Scope and Automotive Ignition Systems Market Segmentation

|

Attributes |

Automotive Ignition Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Ignition Systems Market Trends

“Increasing Integration of Advanced Electronic and Smart Ignition Technologies”

- The global automotive ignition systems market is experiencing a significant trend toward the integration of advanced electronic and smart ignition technologies

- These technologies enable precise ignition timing, improved fuel efficiency, and reduced emissions through enhanced control over the combustion process

- Smart ignition systems, leveraging IoT connectivity and advanced sensors, allow for real-time monitoring and diagnostics, optimizing engine performance and enabling predictive maintenance

- For instance, companies are developing ignition control modules that use data analytics to adjust spark timing based on driving conditions, fuel type, and engine load, enhancing vehicle efficiency

- This trend is increasing the appeal of ignition systems for both manufacturers and consumers, particularly for passenger vehicles and light commercial vehicles, by aligning with demands for sustainability and performance

- Advanced ignition systems, such as coil-on-plug systems, analyze engine parameters such as crankshaft and camshaft position to deliver precise spark delivery, reducing misfires and improving combustion efficiency

Automotive Ignition Systems Market Dynamics

Driver

“Rising Demand for Fuel-Efficient Vehicles and Stringent Emission Regulations”

- The growing consumer and regulatory demand for fuel-efficient vehicles is a key driver for the global automotive ignition systems market

- Ignition systems, such as electronic and distributor-less ignition systems, enhance combustion efficiency, leading to better fuel economy and lower emissions in petrol and diesel engines

- Government regulations, particularly in regions such as Europe and Asia-Pacific, mandating lower CO2 emissions are pushing automakers to adopt advanced ignition technologies, such as coil-on-plug and simultaneous ignition systems

- The proliferation of IoT and advancements in ignition control modules are enabling more sophisticated ignition systems, supporting real-time adjustments for optimal engine performance

- Automakers are increasingly integrating factory-fitted electronic ignition systems as standard features in passenger vehicles and light commercial vehicles to meet consumer expectations and comply with environmental standards

Restraint/Challenge

“High Development Costs and Shift Toward Electric Vehicles”

- The significant costs associated with developing and integrating advanced ignition systems, including components such as ignition coils, spark plugs, and control modules, pose a barrier to adoption, particularly in cost-sensitive emerging markets

- Retrofitting older vehicles with modern ignition systems, such as distributor-less or coil-on-plug systems, can be complex and expensive

- In addition, the rapid shift toward electric vehicles (EVs), which do not require traditional ignition systems, is a major challenge, particularly in regions such as Asia-Pacific and North America where EV adoption is accelerating

- The fragmented regulatory landscape across countries regarding emissions and ignition system standards complicates compliance for manufacturers, increasing operational costs

- These factors may limit market growth, especially in regions with high EV penetration or where cost sensitivity restricts adoption of advanced ignition technologies

Automotive Ignition Systems market Scope

The market is segmented on the basis of components, ignition type, engine type, product type, and vehicle type.

- By Components

On the basis of components, the automotive ignition systems market is segmented into ignition switch, spark plug, glow plug, ignition coil, ignition control module, crankshaft, and camshaft position sensor. The ignition coil segment dominated the largest market revenue share of 38.2% in 2024, driven by its critical role in generating high-voltage current for spark plugs, essential for efficient combustion in gasoline engines. Advancements in ignition coil technology, such as high-energy coils, further enhance fuel efficiency and emissions control.

The spark plug segment is expected to witness the fastest growth rate of 8.9% from 2025 to 2032, fueled by increasing demand for high-performance spark plugs, such as iridium and platinum variants, which improve engine performance and durability. The growing aftermarket demand for spark plug replacements, especially in passenger vehicles, supports this segment’s rapid expansion.

- By Ignition Type

On the basis of ignition type, the automotive ignition systems market is segmented into coil on plug (COP), simultaneous, and compression ignition. The coil on plug (COP) segment dominated with a market revenue share of 45.3% in 2024, owing to its precise ignition timing, improved fuel efficiency, and reduced emissions. COP systems, which eliminate the need for distributors, are increasingly adopted in modern gasoline-powered vehicles for enhanced performance.

The compression ignition segment is anticipated to experience the fastest growth rate of 7.8% from 2025 to 2032, driven by advancements in diesel engine technologies, particularly in heavy-duty commercial vehicles. Innovations in glow plugs and electronic control modules are enhancing cold-start performance and meeting stringent emission standards.

- By Engine Type

On the basis of engine type, the automotive ignition systems market is segmented into petrol, diesel, and others (including hybrid engines). The petrol segment held the largest market revenue share of 52.4% in 2024, attributed to the widespread use of gasoline engines in passenger vehicles and their reliability in spark ignition systems. Despite the rise of electric vehicles, petrol engines remain dominant in regions with established infrastructure.

The diesel segment is expected to witness significant growth from 2025 to 2032, with a CAGR of 6.5%, driven by demand in commercial and off-highway applications. Advancements in glow plug technology and electronic control modules are improving diesel engine efficiency and compliance with emission regulations.

- By Product Type

On the basis of product type, the automotive ignition systems market is segmented into conventional breaker point type ignition system, electronic ignition systems, and distributorless ignition system. The electronic ignition systems segment accounted for the largest market revenue share of 48.7% in 2024, due to their superior efficiency, precise ignition timing, and reduced emissions compared to mechanical systems. These systems are widely adopted in modern vehicles for improved performance and fuel economy.

The distributorless ignition system segment is projected to grow at the fastest rate of 9.2% from 2025 to 2032, driven by its use of multiple ignition coils for direct spark plug firing, eliminating the need for distributors. This system enhances engine performance and reliability, particularly in high-performance vehicles.

- By Vehicle Type

On the basis of vehicle type, the automotive ignition systems market is segmented into light commercial vehicles, heavy commercial vehicles, passenger vehicles, and off-road vehicles. The passenger vehicles segment dominated with a market revenue share of 47.8% in 2024, fueled by the high global production of passenger cars and increasing consumer demand for advanced ignition systems to enhance fuel efficiency and performance.

The heavy commercial vehicles segment is anticipated to witness the fastest growth rate of 7.4% from 2025 to 2032, driven by the adoption of advanced ignition technologies in long-haul trucks and commercial fleets. These systems support fuel efficiency, emissions compliance, and real-time diagnostics for fleet management.

Automotive Ignition Systems Market Regional Analysis

- Asia-Pacific dominated the automotive ignition systems market with the largest revenue share of 42.5% in 2024, driven by high vehicle production, rapid urbanization, and the presence of major automotive manufacturers in countries such as China, Japan, and India

- Consumers prioritize ignition systems for enhanced engine performance, fuel efficiency, and reduced emissions, particularly in regions with stringent environmental regulations

- Growth is supported by advancements in ignition technology, including coil-on-plug systems, electronic ignition systems, and smart ignition systems with IoT connectivity, alongside rising adoption in both OEM and aftermarket segments

Japan Automotive Ignition Systems Market Insight

Japan’s automotive ignition systems market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced ignition systems that enhance engine performance and fuel efficiency. The presence of major automotive manufacturers and integration of advanced ignition systems, such as coil-on-plug and electronic ignition, in OEM vehicles accelerate market penetration. Rising interest in aftermarket performance upgrades also contributes to growth.

China Automotive Ignition Systems Market Insight

China holds the largest share of the Asia-Pacific automotive ignition systems market, propelled by rapid urbanization, rising vehicle ownership, and increasing demand for fuel-efficient and low-emission solutions. The country’s growing middle class and focus on smart mobility support the adoption of advanced ignition systems. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

U.S. Automotive Ignition Systems Market Insight

The U.S. automotive ignition systems market is expected to witness significant growth, fueled by strong aftermarket demand and growing consumer awareness of fuel efficiency and emission reduction benefits. The trend toward vehicle performance optimization and increasing regulations promoting cleaner combustion technologies further boost market expansion. Automakers’ growing incorporation of advanced ignition systems, such as coil-on-plug and electronic ignition, complements aftermarket sales, creating a diverse product ecosystem.

Europe Automotive Ignition Systems Market Insight

The Europe automotive ignition systems market is expected to witness significant growth, supported by regulatory emphasis on emission reduction and vehicle efficiency. Consumers seek ignition systems that optimize combustion while reducing environmental impact. The growth is prominent in both new vehicle installations and aftermarket upgrades, with countries such as Germany and France showing significant uptake due to rising environmental concerns and advanced automotive manufacturing.

U.K. Automotive Ignition Systems Market Insight

The U.K. market for automotive ignition systems is expected to witness rapid growth, driven by demand for improved engine efficiency and emission control in urban and suburban settings. Increased interest in vehicle performance and rising awareness of advanced ignition technologies, such as distributor-less ignition systems, encourage adoption. Evolving environmental regulations influence consumer choices, balancing performance with compliance.

Germany Automotive Ignition Systems Market Insight

Germany is expected to witness rapid growth in automotive ignition systems, attributed to its advanced automotive manufacturing sector and high consumer focus on fuel efficiency and engine performance. German consumers prefer technologically advanced ignition systems, such as coil-on-plug and electronic ignition, that reduce fuel consumption and contribute to lower emissions. The integration of these systems in premium vehicles and aftermarket options supports sustained market growth.

Automotive Ignition Systems Market Share

The automotive ignition systems industry is primarily led by well-established companies, including:

- Robert Bosch GmbH (Germany)

- Hitachi Ltd. (Japan)

- Honeywell International Inc. (U.S.)

- SUN DEVIL AUTO (U.S.)

- Del City (U.S.)

- R.S. Components & Controls (I) Ltd. (U.K.)

- Ozautoelectrics Pty Ltd. (Australia)

- Aptiv (Ireland)

- BorgWarner Inc. (U.S.)

- Yangming Auto Parts (China)

- General Motors (U.S.)

- STRATTEC (U.S.)

- OMRON Corporation (Japan)

- Chaoda USA (U.S.)

What are the Recent Developments in Global Automotive Ignition Systems Market?

- In May 2025, a report by Reanin.com projected robust growth in the Global Automotive Ignition System Market, forecasting an increase from USD 12,063.70 million in 2025 to USD 20,809.44 million by 2032. This represents a Compound Annual Growth Rate (CAGR) of 8.1%, reflecting sustained momentum in vehicle production, technological advancements, and rising demand for fuel-efficient ignition systems. The report highlights how evolving emission regulations and the shift toward hybrid and electric vehicles are driving innovation and investment in ignition technologies, positioning the sector for significant transformation over the forecast period

- In February 2025, IMARC Group released a report stating the global automotive ignition system market size was valued at USD 8.9 Billion in 2024 and is projected to reach USD 15.2 Billion by 2033, exhibiting a CAGR of 6.2% during 2025-2033. The report highlighted the adoption of advanced ignition technologies such as Coil-on-Plug (COP) systems and transistorized ignition modules as a key trend driven by the need for better fuel efficiency and stricter emission regulations

- In December 2024, industry reports highlighted continued progress in electronic ignition technologies, marking a shift away from traditional distributor-based systems. Throughout 2023 and 2024, manufacturers focused on innovations that deliver precise spark timing, improve fuel efficiency, and reduce harmful emissions, while also extending the lifespan of ignition components. These developments are largely driven by rising vehicle production volumes and increasingly stringent environmental regulations worldwide. Enhanced systems—such as high-energy ignition modules, dual-spark configurations, and sensor-integrated control units—are enabling more efficient combustion and supporting the transition to cleaner, smarter mobility

- In August 2024, industry reports and annual disclosures from major automotive technology firms such as Robert Bosch GmbH, Denso Corporation, BorgWarner Inc., Mitsubishi Electric Corporation, and Hitachi Ltd. highlighted their ongoing R&D efforts to enhance ignition systems for modern internal combustion engines, particularly those with turbocharging and direct injection. These initiatives focus on improving spark precision, fuel efficiency, and emissions control, while also extending component durability. A key area of innovation includes advanced sensor integration for real-time monitoring and diagnostics, enabling predictive maintenance and optimized engine performance

- In February 2024, Ericsson completed the deployment of 100,000 Massive MIMO 5G radios for Bharti Airtel across 12 telecom circles in India, marking a major milestone in the country’s digital infrastructure expansion. This achievement reflects broader trends of government-backed investment in advanced technologies, which are increasingly influencing adjacent sectors such as automotive. The rollout of high-speed, low-latency 5G networks lays the foundation for innovations in smart automotive systems, including connected ignition, vehicle-to-everything (V2X) communication, and autonomous driving. Such developments underscore the growing convergence between telecommunications and mobility technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.