Global Automotive Interior Materials Market

Market Size in USD Billion

CAGR :

%

USD

64.47 Billion

USD

111.18 Billion

2024

2032

USD

64.47 Billion

USD

111.18 Billion

2024

2032

| 2025 –2032 | |

| USD 64.47 Billion | |

| USD 111.18 Billion | |

|

|

|

|

Automotive Interior Materials Market Size

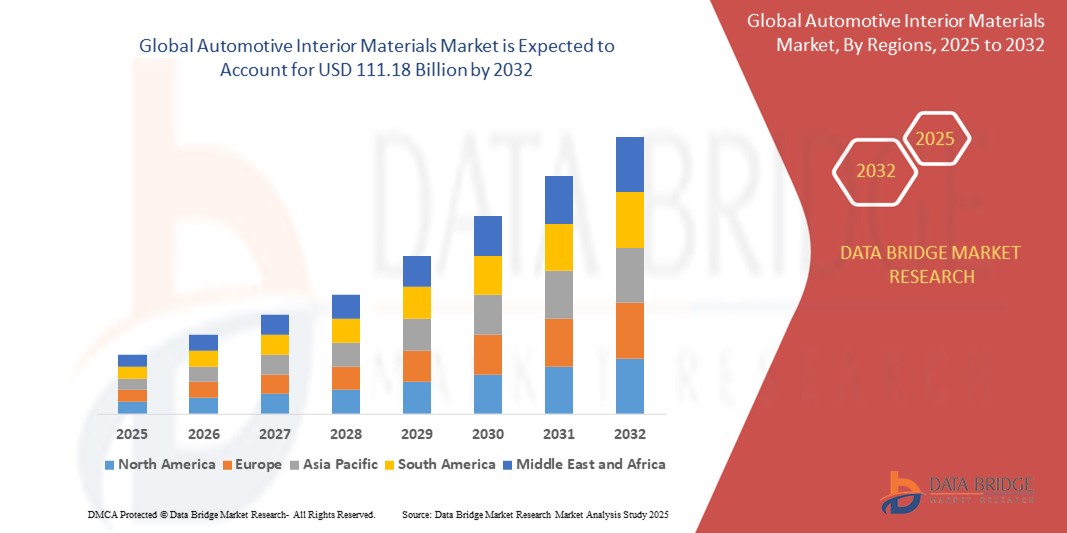

- The global automotive interior materials market size was valued at USD 64.47 billion in 2024 and is expected to reach USD 111.18 billion by 2032, at a CAGR of 7.05% during the forecast period

- This growth is driven by factors such as rising vehicle production, growing demand for comfort and luxury, advancements in lightweight and sustainable materials, stricter emission regulations, and increased EV adoption

Automotive Interior Materials Market Analysis

- Automotive interior materials include fabrics, polymers, leather, and composites used in vehicle cabins to enhance comfort, aesthetics, and functionality. These materials are designed to meet standards for durability, weight reduction, and environmental compliance across various vehicle segments

- The automotive interior materials market is growing steadily due to rising vehicle production, increased consumer demand for premium and comfortable interiors, stricter emission regulations encouraging lightweight materials, expansion of the electric vehicle segment, and ongoing innovations in sustainable and high-performance interior solutions

- Asia-Pacific is expected to dominate the automotive interior materials market with a share of 56.1%, due to the region's rapid industrialization, significant government support through subsidies, and favorable policies that encourage automotive manufacturing investment

- Europe is expected to be the fastest growing region in the automotive interior materials market during the forecast period due to the demand for advanced, luxurious, and eco-friendly interior solutions

- Passenger segment is expected to dominate the market with a market share of 78.4% due to increasing demand for enhanced comfort, luxury, and aesthetics in consumer vehicles. Rising consumer preferences for premium interiors, along with advancements in materials such as leather, fabric, and synthetic alternatives, are driving growth. In addition, the adoption of innovative technologies, including smart features and sustainable materials, is contributing to the segment's expansion. The shift towards electric vehicles (EVs) further fuels the demand for high-quality interior materials to improve both functionality and sustainability

Report Scope and Automotive Interior Materials Market Segmentation

|

Attributes |

Automotive Interior Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Interior Materials Market Trends

“Rising Adoption of Bioplastics & Veganism”

- One prominent trend in the global automotive interior materials market is the rising adoption of bioplastics & veganism

- This trend is driven by the increasing environmental concerns, stricter sustainability regulations, and growing consumer demand for cruelty-free and eco-friendly vehicle components

- For instance, companies such as BMW and Tesla are incorporating plant-based leathers and recycled plastics in their interiors to reduce carbon footprints and appeal to ethically conscious buyers

- The demand for these materials is gaining traction across both luxury and mass-market segments as automakers prioritize green innovation and responsible sourcing

- As sustainability becomes a key differentiator in automotive design, this trend is expected to drive material innovation and shape the future of interior component manufacturing

Automotive Interior Materials Market Dynamics

Driver

“Growing Trend of Autonomous Vehicle Interiors”

- The growing trend of autonomous vehicle interiors is a key driver of growth in the automotive interior materials market, as the shift toward self-driving technology transforms vehicle cabins into multifunctional living spaces

- This shift is particularly impactful in premium and concept vehicle segments, where interiors are being redesigned for relaxation, entertainment, and work purposes rather than just driving

- As the focus moves from driver control to passenger experience, the demand is rising for advanced materials that offer enhanced comfort, modularity, and acoustic performance

- Automakers are responding by integrating smart surfaces, high-quality textiles, and adaptive seating systems made from innovative materials that support new interior layouts

- The push to create lounge-like environments and improve in-vehicle experience is accelerating the adoption of premium and tech-integrated materials

For instance,

- Companies such as Volvo and Mercedes-Benz are showcasing concept interiors with swiveling seats, touch-sensitive panels, and sustainable fabrics to align with autonomous mobility trends

- Material suppliers are also collaborating with OEMs to develop solutions tailored for flexible and connected interior spaces

- As autonomous driving continues to evolve, this driver is expected to significantly influence material development and long-term demand in the automotive interior materials market

Opportunity

“Expansion of the Automotive Industry in Emerging Markets”

- The expansion of the automotive industry in emerging markets presents a significant opportunity for the automotive interior materials market, enabling suppliers to tap into growing vehicle demand and increasing consumer expectations for upgraded interiors

- As income levels rise and urbanization accelerates, consumers in regions such as Asia-Pacific, Latin America, and the Middle East are seeking vehicles that offer enhanced comfort, style, and functionality

- This opportunity aligns with the surge in local vehicle production, investments by global automakers, and the growing adoption of passenger vehicles in these economies

For instance,

- In countries such as India, Vietnam, and Brazil, automakers are launching new models with improved interior designs using higher-quality materials to attract first-time buyers and retain market competitiveness

- Chinese automakers, including BYD and Geely, are increasing the use of advanced materials in their electric vehicle interiors, driving demand for sustainable and high-performance components

- As the automotive market continues to grow in emerging economies, the interior materials segment is well-positioned to benefit from increased production volumes and the shift toward value-added features

Restraint/Challenge

“Competition from Alternative Interior Solutions”

- Competition from alternative interior solutions presents a significant challenge for the automotive interior materials market, as new technologies and innovative materials threaten to displace traditional materials such as plastics, leather, and fabric

- The increasing adoption of alternative solutions such as 3D-printed parts, lightweight composites, and biodegradable materials creates pressure for manufacturers to invest in new production methods and technologies, driving up development costs

- This challenge is particularly significant for established players in the market, as they need to balance traditional material offerings with emerging alternatives while maintaining product quality and performance standards

For instance,

- Companies such as Tesla and Rivian are incorporating sustainable materials such as hemp-based composites and recycled fabrics, which may reduce their reliance on conventional automotive interior materials

- Without continued innovation and adaptation to these new material trends, traditional interior material manufacturers may struggle to maintain competitive advantage in the face of cost-effective and environmentally friendly alternatives

Automotive Interior Materials Market Scope

The market is segmented on the basis of product, application, and vehicle type.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Application |

|

|

By Vehicle Type |

|

In 2025, the passenger is projected to dominate the market with a largest share in vehicle type segment

The passenger segment is expected to dominate the automotive interior materials market with the largest share of 78.4% in 2025 due to increasing demand for enhanced comfort, luxury, and aesthetics in consumer vehicles. Rising consumer preferences for premium interiors, along with advancements in materials such as leather, fabric, and synthetic alternatives, are driving growth. In addition, the adoption of innovative technologies, including smart features and sustainable materials, is contributing to the segment's expansion. The shift towards electric vehicles (EVs) further fuels the demand for high-quality interior materials to improve both functionality and sustainability.

The plastic is expected to account for the largest share during the forecast period in product segment

In 2025, the plastic segment is expected to dominate the market with the largest market share of 47.1% due to its lightweight nature, cost-efficiency, and design flexibility. Plastics are widely used for dashboards, door panels, and trims as they help reduce vehicle weight, improving fuel efficiency and supporting emission regulations. In addition, advancements in polymer technologies allow for enhanced durability, aesthetic appeal, and recyclability, making plastics a preferred choice for both conventional and electric vehicles.

Automotive Interior Materials Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Automotive interior materials Market”

- Asia-Pacific dominates the automotive interior materials market with a share of 56.1%, driven by the region's rapid industrialization, significant government support through subsidies, and favorable policies that encourage automotive manufacturing investment

- China holds a significant share of 42.6% due to its dominance in the automotive industry, rapid urbanization, and increasing demand for both electric vehicles (EVs) and conventional vehicles with high-quality interiors

- The region’s growth is further bolstered by a booming middle-class population, rising disposable incomes, and an increasing focus on sustainability, which leads to the demand for eco-friendly and innovative materials

- The region is anticipated to maintain its dominance through 2032, largely due to significant investments in automotive interior material development and the shift toward advanced technology and green materials

“Europe is Projected to Register the Highest CAGR in the Automotive interior materials Market”

- Europe is expected to witness the highest growth rate in the automotive interior materials market, driven by the demand for advanced, luxurious, and eco-friendly interior solutions

- Germany holds a significant share due to its robust automotive manufacturing sector, with leading brands such as Volkswagen, BMW, and Mercedes-Benz focusing on high-end materials to cater to the growing consumer desire for premium in-car experiences

- The region’s growth is also supported by the increasing trend toward electric vehicles and autonomous driving, where interior materials need to be highly adaptable, lightweight, and sustainable

- Europe is expected to experience strong growth through 2032, with key automotive hubs such as Germany, France, and Italy driving the adoption of advanced, sustainable interior materials in both traditional and electric vehicles

Automotive Interior Materials Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Stahl Holdings B.V. (Netherlands)

- Lear (U.S.)

- Toyota Boshoku Corporation (Japan)

- Technical Textile Services Ltd., (U.K.)

- ZF Friedrichshafen AG (Germany)

- FORVIA Faurecia FORVIA Faurecia (France)

- Grammer AG (Germany)

- Johnson Controls (Ireland)

- Antolin (Spain)

- Henkel Corporation (Germany)

- Auto textile S.A. (Greece)

- Suminoe Textile Co., Ltd. (Japan)

- Magna International Inc (Canada)

- Celanese Corporation (U.S.)

- Toyoda Gosei Co., Ltd. (Japan)

Latest Developments in Global Automotive Interior Materials Market

- In July 2024, Antolin partnered with MIT ADT University to collaborate on automotive interior design projects. This partnership combines Antolin's industry expertise with MIT ADT University's academic research to develop innovative solutions, including new materials, technologies, and design concepts aimed at enhancing the passenger experience. The collaboration positions Antolin to lead in automotive interior innovation, potentially driving advancements that meet evolving consumer demands and strengthening its competitive edge in the market

- In May 2024, Yanfeng and Trinseo entered a partnership to advance the development of circular materials for automotive interiors. The focus on creating materials that comply with 2030 End-of-life vehicle requirements and support the circular economy will likely propel both companies to the forefront of sustainability in the automotive interior materials market. Their efforts to enhance recycling technologies and produce high-quality recycled materials will address growing environmental concerns and align with industry trends toward eco-friendly, sustainable solutions, boosting their market presence

- In October 2023, Asahi Kasei invested in the U.S. startup NFW, which specializes in producing non-petroleum-based leather alternatives for automotive interiors. This collaboration, driven by Asahi Kasei's "Care for Earth" initiative, positions the company as a key player in the push for sustainable materials in the automotive market. NFW’s MIRUM, a 100% biobased product, is expected to accelerate the adoption of eco-friendly materials among automakers, enhancing Asahi Kasei’s market position as a leader in environmentally responsible automotive interior solutions

- In May 2022, Faurecia introduced their plans to invest USD 147 million in constructing a new facility in Nuevo Leon, Mexico. This state-of-the-art factory will cater to both the Interiors and Seating Business Groups of the company. Of the total investment, USD 75 million will be allocated to enhancing production capacity for the Interiors Business Group, primarily for the development and installation of instrument panels and other interior modules. It enhances production capacity, fostering growth and innovation in the automotive interior materials market

- In May 2022, Faurecia and Veolia entered an agreement to jointly develop innovative compounds for automotive interior modules, including instrument panels and door panels, in Europe. This collaboration aims to expedite the adoption of sustainable interior solutions, contributing to the market's evolution towards eco-friendly automotive materials and practices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Automotive Interior Materials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automotive Interior Materials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automotive Interior Materials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.