Global Automotive Key Blanks Market

Market Size in USD Billion

CAGR :

%

USD

9.13 Billion

USD

21.19 Billion

2024

2032

USD

9.13 Billion

USD

21.19 Billion

2024

2032

| 2025 –2032 | |

| USD 9.13 Billion | |

| USD 21.19 Billion | |

|

|

|

|

Automotive Key Blanks Market Size

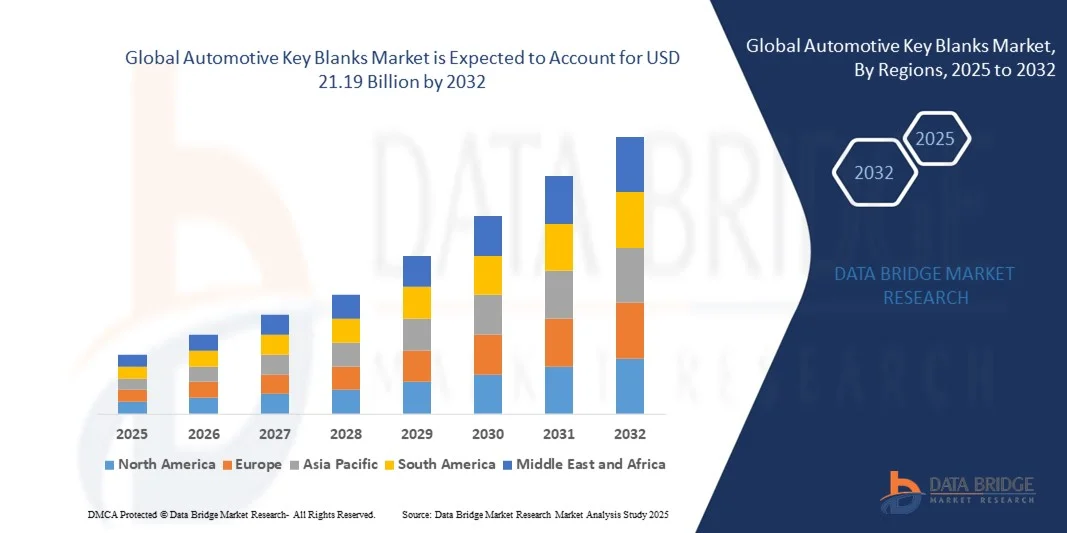

- The global automotive key blanks market size was valued at USD 9.13 billion in 2024 and is expected to reach USD 21.19 billion by 2032, at a CAGR of 11.1% during the forecast period

- The market growth is largely fuelled by the increasing automotive production, rising demand for vehicle security solutions, and technological advancements in key design and manufacturing

- In addition, the growing adoption of smart and high-security keys, combined with the expansion of aftermarket services for vehicle key replacements and upgrades, is further driving market demand

Automotive Key Blanks Market Analysis

- The market is witnessing significant growth due to rising vehicle sales globally, increasing replacement frequency of automotive keys, and higher consumer awareness about vehicle security and anti-theft solutions

- In addition, advancements in materials and manufacturing processes, such as laser-cut keys and remote key fobs, are enhancing product reliability and functionality, further contributing to market expansion

- North America dominated the automotive key blanks market with the largest revenue share in 2024, driven by increasing vehicle production, rising demand for high-security keys, and growing awareness of vehicle safety and anti-theft technologies

- Asia-Pacific region is expected to witness the highest growth rate in the global automotive key blanks market, driven by urbanization, rising vehicle sales, and the adoption of smart and high-security key systems across passenger and commercial vehicles

- The transponder segment held the largest market revenue share in 2024 driven by enhanced vehicle security features and widespread adoption across new vehicle models. Transponder keys often provide anti-theft protection, immobilizer integration, and compatibility with keyless entry systems, making them a preferred choice for modern vehicles

Report Scope and Automotive Key Blanks Market Segmentation

|

Attributes |

Automotive Key Blanks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Key Blanks Market Trends

Increasing Adoption of High-Security And Smart Keys

- The growing shift toward high-security and smart automotive keys is transforming the vehicle access landscape by enabling enhanced security and convenience. Advanced keys such as laser-cut and transponder keys allow for anti-theft protection, reducing vehicle theft and unauthorized access. These keys also integrate with vehicle immobilizer systems and smart entry technology, ensuring comprehensive security and improved user experience across modern vehicles

- The high demand for smart keys with remote and keyless entry capabilities is accelerating the adoption of electronic key systems and key blanks compatible with modern vehicles. These solutions are particularly effective for new car models and luxury vehicles, supporting secure and convenient access. Integration with mobile apps and keyless start systems is further driving consumer preference and enhancing the aftermarket opportunitie

- The affordability and ease of duplication of conventional key blanks are maintaining steady demand in the aftermarket segment. Automotive service providers benefit from supplying a range of key blanks for different car models, enabling rapid replacements without excessive costs. The availability of pre-cut blanks and universal key options is also supporting small-scale locksmiths and enhancing service efficiency

- For instance, in 2023, several automotive service centers in North America reported improved customer satisfaction and faster service times after implementing laser-cut and transponder key replacement programs, reducing wait times and enhancing security. The programs also allowed technicians to serve multiple vehicle brands efficiently, increasing operational throughput and business profitability

- While high-security and smart key adoption is accelerating vehicle access management, the impact depends on ongoing technological innovation, standardization across vehicle models, and training of locksmiths and service providers. Continuous updates to key programming protocols and compatibility with evolving vehicle electronics are essential to maintain system reliability and user trust

Automotive Key Blanks Market Dynamics

Driver

Increasing Vehicle Production And Growing Focus On Vehicle Security

- The rise in global vehicle production is pushing manufacturers and aftermarket service providers to prioritize key blanks and high-security solutions. Vehicles such as sedans, SUVs, and commercial fleets require reliable key systems for safety and convenience. Expanding automotive markets in developing regions are also creating new opportunities for key blank manufacturers

- Consumers are increasingly aware of security risks associated with vehicle theft and tampering, prompting higher adoption of advanced key blanks and electronic key systems. This awareness is driving consistent demand across passenger and commercial vehicles. Insurance companies are also offering incentives for vehicles equipped with high-security keys, further motivating adoption

- In addition, government regulations and safety standards are encouraging automakers to equip vehicles with tamper-resistant and programmable keys, further boosting market demand for key blanks and related technologies. Compliance with international safety standards is accelerating innovation in key design and enhancing the durability and reliability of key systems

- For instance, in 2022, several automotive manufacturers in Europe implemented standardized transponder key systems across new vehicle models, driving the demand for compatible key blanks and enhancing overall vehicle security. This initiative also promoted streamlined production and simplified after-sales support, improving efficiency across the value chain

- While vehicle production and security awareness are driving market growth, challenges such as compatibility issues and technological complexity require continued innovation and aftermarket support. Collaboration between manufacturers, locksmith associations, and training institutions is critical to address these challenges and maintain growth momentum

Restraint/Challenge

High Cost Of Smart Key Systems And Complexity Of Duplication

- The high price of smart keys and electronic key blanks, including transponder and laser-cut variants, limits accessibility for low-cost vehicle segments and small-scale service providers. Cost remains a key barrier for widespread adoption. Fluctuating material costs and proprietary technology licensing fees further impact affordability

- In addition, duplicating advanced keys requires specialized machines, software, and trained personnel, restricting availability in remote or underdeveloped regions. This limits market penetration for high-security key solutions. Lack of standardized duplication protocols across different vehicle brands further complicates replication and service delivery

- Supply chain and manufacturing challenges for electronic key components, such as transponders and chips, can delay production and distribution, affecting service centers and dealerships. Dependence on specific suppliers for microchips and encryption modules also introduces risks of delays during peak demand periods

- For instance, in 2023, several automotive locksmiths in Asia reported delays in providing replacement smart keys due to limited availability of electronic components and lack of trained personnel. These delays impacted customer satisfaction and highlighted the need for robust inventory management and training programs

- While conventional key blanks continue to evolve, addressing cost, complexity, and accessibility challenges remains critical. Stakeholders must focus on scalable solutions, training programs, and efficient distribution channels to expand market reach and ensure long-term growth. Investment in automated key cutting and programming systems can also enhance service efficiency and reduce operational costs

Automotive Key Blanks Market Scope

The market is segmented on the basis of product type, material type, vehicle type, application, and distribution channel

- By Product Type

On the basis of product type, the automotive key blanks market is segmented into plastic and metal head keys, transponder technology keys, laser-cut keys, and remote key fobs. The transponder segment held the largest market revenue share in 2024 driven by enhanced vehicle security features and widespread adoption across new vehicle models. Transponder keys often provide anti-theft protection, immobilizer integration, and compatibility with keyless entry systems, making them a preferred choice for modern vehicles.

The plastic and metal head key segment is expected to witness the fastest growth rate from 2025 to 2032, driven by their affordability, ease of duplication, and compatibility with a wide range of vehicles. Laser-cut keys and remote key fobs are gaining traction in premium and luxury vehicles due to advanced security features and integration with smart vehicle systems.

- By Material Type

On the basis of material type, the market is segmented into brass, nickel silver, steel, aluminum, and others. Brass keys held the largest share due to their durability, corrosion resistance, and wide usage in both OEM and aftermarket applications.

The nickel silver segment is expected to witness the fastest growth rate from 2025 to 2032 owing to its high strength, resistance to wear, and increasing use in high-security and smart key applications. Steel and aluminum keys are also gaining adoption in light commercial and industrial vehicles due to cost efficiency and robustness.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger vehicles, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), two-wheelers, and electric vehicles (EVs). Passenger vehicles held the largest share due to high production volumes and frequent replacement demand.

The LCV, HCV, and EV segments is expected to witness the fastest growth rate from 2025 to 2032 owing to rising commercial fleet expansion, electrification of vehicles, and increasing focus on vehicle security in logistics and transport sectors. Two-wheelers are also driving demand in emerging markets due to affordability and replacement needs.

- By Application

On the basis of application, the market is segmented into compact cars, mid-size cars, SUVs, luxury cars, and commercial vehicles. Luxury and mid-size cars are driving demand for transponder and high-security keys due to advanced security systems and consumer preference for convenience.

Compact cars is expected to witness the fastest growth rate from 2025 to 2032 owing to increasing vehicle sales in emerging economies, while commercial vehicles continue to drive replacement demand in logistics, transportation, and fleet management.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into original equipment manufacturers (OEMs), aftermarket, automotive service centers, locksmiths, and online retail. OEMs held the largest market share in 2024 as they supply keys directly with new vehicles and ensure compatibility with vehicle security systems.

The aftermarket segment is expected to witness the fastest growth rate from 2025 to 2032 driven by rising demand for key replacement services, increasing vehicle age, and expansion of automotive service centers globally. Online retail and specialized locksmiths are also contributing to growth by providing convenient access to replacement keys and programming services.

Automotive Key Blanks Market Regional Analysis

- North America dominated the automotive key blanks market with the largest revenue share in 2024, driven by increasing vehicle production, rising demand for high-security keys, and growing awareness of vehicle safety and anti-theft technologies

- Consumers in the region increasingly value advanced key solutions such as transponder and laser-cut keys, which provide enhanced security, convenience, and compatibility with modern vehicles

- This widespread adoption is further supported by the presence of major automotive manufacturers, a robust aftermarket network, and growing demand for replacement keys in both passenger and commercial vehicles

U.S. Automotive Key Blanks Market Insight

The U.S. automotive key blanks market captured the largest revenue share in 2024 within North America, fueled by high vehicle production, growing fleet sales, and strong adoption of high-security and smart key systems. Consumers are prioritizing vehicle safety and keyless entry solutions, driving demand for transponder and electronic key blanks. The presence of OEMs, aftermarket service providers, and locksmith networks further supports market growth and accessibility

Europe Automotive Key Blanks Market Insight

The Europe automotive key blanks market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent vehicle safety regulations, rising demand for advanced key systems, and growing vehicle production. European consumers are adopting transponder and smart key solutions for both new and existing vehicles. The region is witnessing significant growth across passenger cars, SUVs, and commercial vehicles

U.K. Automotive Key Blanks Market Insight

The U.K. automotive key blanks market is expected to witness rapid growth from 2025 to 2032, driven by increasing vehicle sales, the rising trend of smart key adoption, and growing concerns over vehicle theft. The presence of well-established automotive service centers and locksmith networks supports replacement demand and aftermarket sales. In addition, the increasing integration of keyless entry and transponder systems in new vehicles is boosting market expansion

Germany Automotive Key Blanks Market Insight

The Germany automotive key blanks market is expected to witness significant growth from 2025 to 2032, fueled by strong automotive manufacturing, rising demand for smart and high-security keys, and advanced vehicle technologies. German consumers and commercial fleet operators are increasingly adopting transponder, laser-cut, and electronic key systems. OEM partnerships and a robust aftermarket infrastructure further enhance market accessibility

Asia-Pacific Automotive Key Blanks Market Insight

The Asia-Pacific automotive key blanks market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising vehicle production, urbanization, and growing adoption of smart and high-security keys in countries such as China, India, and Japan. Increasing vehicle sales, expanding commercial fleets, and rising awareness of vehicle safety are supporting the market. Furthermore, the growth of automotive service networks and affordable replacement key options are driving adoption across passenger and commercial vehicles

Japan Automotive Key Blanks Market Insight

The Japan automotive key blanks market is expected to witness strong growth from 2025 to 2032 due to high vehicle production, advanced automotive technologies, and growing consumer preference for keyless entry and transponder systems. Japanese consumers prioritize vehicle security and convenience, boosting demand for smart key solutions. OEMs and aftermarket service providers are playing a crucial role in ensuring availability and support for high-security key blanks

China Automotive Key Blanks Market Insight

The China automotive key blanks market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid vehicle production, expanding middle-class consumers, and high adoption of smart and high-security keys. Replacement demand for conventional and transponder keys, along with growing commercial fleets and urbanization, is driving market growth. The presence of OEMs, aftermarket networks, and domestic manufacturers further accelerates adoption

Automotive Key Blanks Market Share

The Automotive Key Blanks industry is primarily led by well-established companies, including:

• Kaba Ilco Corp. (U.S.)

• Goto Manufacturing Co. Ltd. (Japan)

• Jet Hardware Manufacturing Co. (U.S.)

• Brockhage Corporation (U.K.)

• Hudson Lock, LLC (U.S.)

• Altuna Group (Spain)

• Keyline Creative Services (Italy)

• Xuanhua Hardware Products Co Ltd. (China)

• Others

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.