Global Automotive Lead Acid Batteries Market

Market Size in USD Billion

CAGR :

%

USD

49.01 Billion

USD

70.83 Billion

2024

2032

USD

49.01 Billion

USD

70.83 Billion

2024

2032

| 2025 –2032 | |

| USD 49.01 Billion | |

| USD 70.83 Billion | |

|

|

|

|

Automotive Lead Acid Batteries Market Size

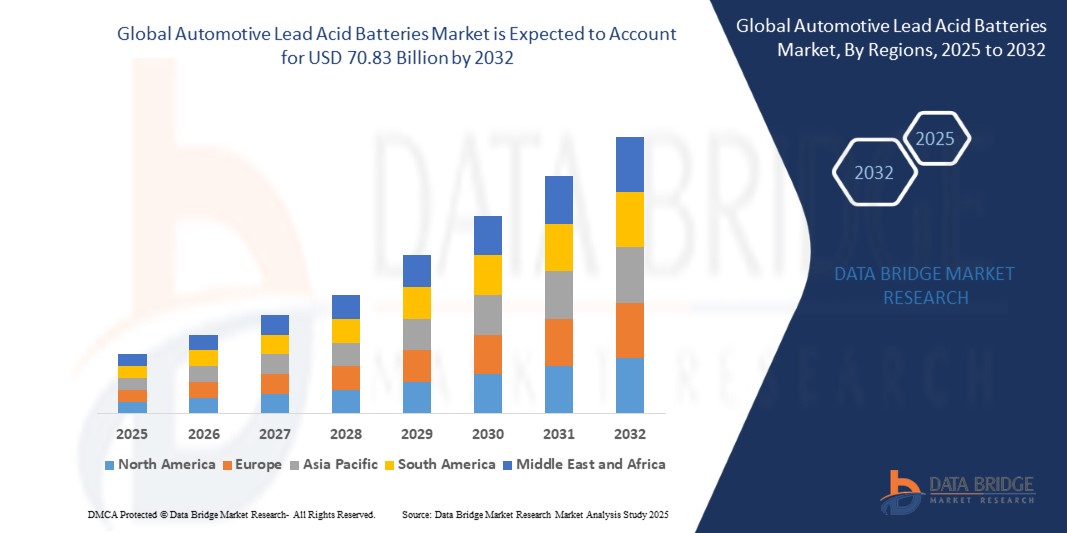

- The global Automotive lead acid batteries market size was valued at USD 49.01 billion in 2024 and is expected to reach USD 70.83 billion by 2032, at a CAGR of 4.6% during the forecast period

- This growth is driven by the increasing demand for cost-effective energy storage solutions in conventional and start-stop vehicles, rising vehicle production, and the expansion of aftermarket services in emerging economies.

Automotive Lead Acid Batteries Market Analysis

- Lead acid batteries are widely used in automotive applications due to their affordability, reliability, and ability to deliver high surge currents for starting internal combustion engine (ICE) vehicles.

- The demand for automotive lead acid batteries is significantly driven by the continued dominance of ICE vehicles, the adoption of start-stop technology, and the growing need for reliable power in commercial and two-wheeler applications.

- Asia-Pacific is expected to dominate the automotive lead acid batteries market due to high vehicle production, robust aftermarket demand, and rapid urbanization in countries like China and India.

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, fueled by increasing automotive sales, infrastructure development, and government support for electric two-wheeler adoption.

- The flooded battery segment is expected to dominate the market with a market share of approximately 45% in 2025, driven by its low cost and widespread use in passenger cars and commercial vehicles.

Report Scope and Automotive lead acid batteries Market Segmentation

|

Attributes |

Automotive lead acid batteries Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive lead acid batteries Market Trends

“Advancements in Battery Technology for Enhanced Performance and Sustainability”

- A prominent trend in the automotive lead acid batteries market is the development of advanced battery technologies, such as Enhanced Flooded Batteries (EFB) and Absorbent Glass Mat (AGM) batteries, which offer improved performance, durability, and efficiency for start-stop and hybrid vehicles.

- These innovations enhance battery life, charge acceptance, and resistance to deep cycling, addressing the growing demand for reliable power in modern vehicles with high electrical loads.

- For instance, EFBs are increasingly adopted in start-stop vehicles due to their ability to handle frequent cycling, offering a cost-effective alternative to AGM batteries while meeting stringent emission regulations.

- By integrating advanced materials and recycling innovations, the automotive lead acid battery industry is addressing environmental concerns and enhancing performance, ensuring continued relevance in the evolving automotive landscape.

Automotive lead acid batteries Market Dynamics

Driver

“Sustained Demand for Cost-Effective Energy Storage in ICE and Start-Stop Vehicles”

- The persistent dominance of internal combustion engine (ICE) vehicles, coupled with the widespread adoption of start-stop technology, is a key driver of the automotive lead acid batteries market. These batteries provide a cost-effective and reliable solution for delivering high surge currents required for vehicle starting and powering auxiliary systems.

- Lead acid batteries are critical in passenger cars, commercial vehicles, and two-wheelers, particularly in emerging markets where affordability is a priority.

- Government regulations promoting fuel efficiency and emission reductions, such as Euro 6 standards in Europe, are increasing the adoption of start-stop systems, further boosting demand for EFB and AGM batteries.

For instance,

- The growing sales of start-stop vehicles in India, supported by government incentives for fuel-efficient technologies, have driven demand for EFB batteries, which offer enhanced durability and performance at a lower cost than lithium-ion alternatives.

The sustained demand for cost-effective energy storage solutions in ICE and start-stop vehicles, driven by their affordability and compatibility with modern automotive technologies, ensures the continued growth of the automotive lead acid batteries market, positioning it as a vital component.

Opportunity

“Development of Advanced Lead Acid Batteries for Emerging Automotive Applications”

- Innovate by developing next-generation lead acid batteries, such as EFB and AGM variants, tailored for hybrid vehicles, start-stop systems, and electric two-wheelers, offering improved charge acceptance and cycle life.

- Explore lightweight lead acid battery designs to enhance fuel efficiency in commercial vehicles and two-wheelers, addressing the needs of emerging markets.

- Invest in recycling technologies to improve the sustainability of lead acid batteries, creating a competitive edge in environmentally conscious markets.

For instance,

- In September 2024, a leading battery manufacturer introduced an advanced EFB battery for electric two-wheelers in Southeast Asia, offering 20% longer cycle life and improved charge retention. This innovation targets the booming e-scooter market, providing a cost-effective alternative to lithium-ion batteries and supporting regional sustainability goals.

- The opportunity to develop advanced lead acid batteries for emerging automotive applications, such as hybrid vehicles and electric two-wheelers, enables manufacturers to capture high-growth market segments, enhance sustainability through recycling innovations, and maintain a competitive edge in the evolving automotive industry.

Restraint/Challenge

“Competition from Lithium-Ion Batteries and Environmental Concerns”

- The growing adoption of lithium-ion batteries in electric vehicles (EVs) and hybrid applications poses a significant challenge to the lead acid batteries market, as lithium-ion batteries offer higher energy density and longer lifespans.

- Environmental concerns related to lead toxicity and battery disposal require stringent recycling regulations, increasing operational costs for manufacturers.

For instance,

- an automotive OEM planning to transition to lithium-ion batteries for its hybrid vehicle lineup may reduce its reliance on lead acid batteries due to their lower energy density. Additionally, stricter regulations in the EU on lead disposal could increase recycling costs, impacting profit margins for lead acid battery manufacturers.

The competition from lithium-ion batteries and the environmental challenges associated with lead acid battery production and disposal necessitate ongoing innovation and robust recycling strategies to sustain market growth.

Automotive lead acid batteries Market Scope

The global automotive lead acid batteries market is segmented into three notable segments based on battery type, vehicle type, and sales channel.

|

Segmentation |

Sub-Segmentation |

|

By Battery Type |

|

|

By Vehicle Type |

|

|

By Sales Channel |

|

In 2025, the flooded battery segment is projected to dominate the market with the largest share in the battery type segment.

The flooded battery segment is expected to dominate the automotive lead acid batteries market with a share of approximately 45.02% in 2025, driven by its low cost, widespread availability, and suitability for conventional ICE vehicles and two-wheelers.

The aftermarket segment is expected to account for the largest share during the forecast period.

In 2025, the aftermarket segment is projected to dominate with a market share of approximately 55.99%, owing to the high replacement rate of lead acid batteries, particularly in emerging markets with large vehicle fleets and limited access to OEM channels.

Automotive lead acid batteries Market Regional Analysis

“Asia Pacific Holds the Largest Share in the Automotive lead acid batteries Market”

- Asia-Pacific dominates the automotive lead acid batteries market, driven by high vehicle production, robust aftermarket demand, and rapid urbanization in countries like China, India, and Thailand.

- China holds a significant share due to its massive automotive manufacturing base, growing two-wheeler market, and increasing adoption of start-stop technology.

- Government initiatives promoting vehicle electrification and fuel efficiency, such as India’s FAME scheme, further strengthen the market.

“Asia-Pacific is Projected to Register the Highest CAGR in the Automotive lead acid batteries Market”

- The Asia-Pacific region is expected to witness the highest growth rate, with a CAGR of over 5%, driven by rising vehicle sales, infrastructure development, and the expansion of the two-wheeler market.

- China and India are key markets due to their large vehicle populations, increasing demand for affordable batteries, and investments in automotive manufacturing.

- Japan’s focus on advanced battery technologies, such as EFB and AGM, drives demand for high-performance lead acid batteries in start-stop and hybrid vehicles.

Automotive lead acid batteries Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Exide Technologies (U.S.)

- EnerSys (U.S.)

- Clarios (U.S.)

- GS Yuasa Corporation (Japan)

- East Penn Manufacturing Co., Inc. (U.S.)

- Amara Raja Batteries Ltd. (India)

- Leoch International Technology Limited (China)

- FIAMM Energy Technology S.p.A. (Italy)

- HBL Power Systems Limited (India)

- C&D Technologies, Inc. (U.S.)

Latest Developments in Global Automotive lead acid batteries Market

- In October 2024, Kinetic Green Energy and Power Solutions Limited launched a limited-edition Safar Smart electric three-wheeler in India, available with both lead-acid and lithium-ion battery variants. The lead-acid battery option, featuring a 150 Ah capacity, was introduced to cater to cost-conscious consumers in urban and rural markets. The vehicle includes enhanced features like a music system and floor mats, with financing options through partnerships with Cholamandalam Finance and ReVfin Finance, driving demand for affordable lead-acid batteries in the electric three-wheeler segment. This launch highlights the continued relevance of lead-acid batteries in emerging markets for last-mile mobility solutions.

- In August 2024, Mahindra Last Mile Mobility Limited introduced the e-Alfa Plus, an electric three-wheeler designed for both urban and rural transportation in India. The vehicle is equipped with a 150 Ah lead-acid battery, delivering a peak power of 1.95 kW and a real-world range of over 100 km per charge. This launch targets the growing demand for cost-effective electric vehicles in India’s commercial transportation sector, reinforcing the role of lead-acid batteries in providing reliable and affordable energy storage for electric three-wheelers, particularly in price-sensitive markets.

- In July 2024, Exide Industries Ltd., a leading Indian battery manufacturer, launched an advanced Absorbent Glass Mat (AGM) battery specifically designed for automotive starting, lighting, and ignition (SLI) applications. This new AGM battery offers improved charge acceptance and durability, catering to the increasing adoption of start-stop technology in passenger cars and hybrid vehicles. The launch strengthens Exide’s position in the global market by addressing the demand for high-performance lead-acid batteries that meet stringent fuel efficiency and emission standards, particularly in Asia-Pacific and Europe.

- In May 2023, Infineon Technologies AG, a global semiconductor leader, launched the PSoC 4 HVPA-144K microcontroller, designed for automotive battery management systems (BMS). This microcontroller integrates high-precision analog and high-voltage subsystems on a single chip, enabling accurate monitoring of 12V lead-acid batteries used in conventional and start-stop vehicles. The technology enhances battery performance and lifespan, supporting the growing need for advanced battery management in internal combustion engine (ICE) vehicles, particularly in North America and Europe, where lead-acid batteries remain dominant.

- In April 2024, Hyundai Motor Company and Kia Corporation announced a strategic partnership with Exide Energy Solutions Ltd. to localize electric vehicle (EV) battery production in India. While the collaboration primarily focuses on lithium-iron-phosphate (LFP) cells, Exide Industries, traditionally known for lead-acid batteries, is leveraging this partnership to expand its expertise in battery manufacturing. The initiative includes plans to continue supplying lead-acid batteries for auxiliary functions in hybrid and ICE vehicles, reinforcing their importance in India’s automotive market, which is a key growth region for lead-acid battery demand.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.